Global Iron Powder Market By Product Type(Reduced Iron Powder, Atomized Iron Powder, Electrolytic Iron Powder), By Type(Unalloyed, Alloyed, Insulated Iron Powder), By Manufacturing Process(Physical, Chemical, Mechanical), By Purity(High Purity, Standard Purity), By End Use(Automotive, Aerospace and defence, Oil and Gas, Medical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Sep 2024

- Report ID: 128550

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

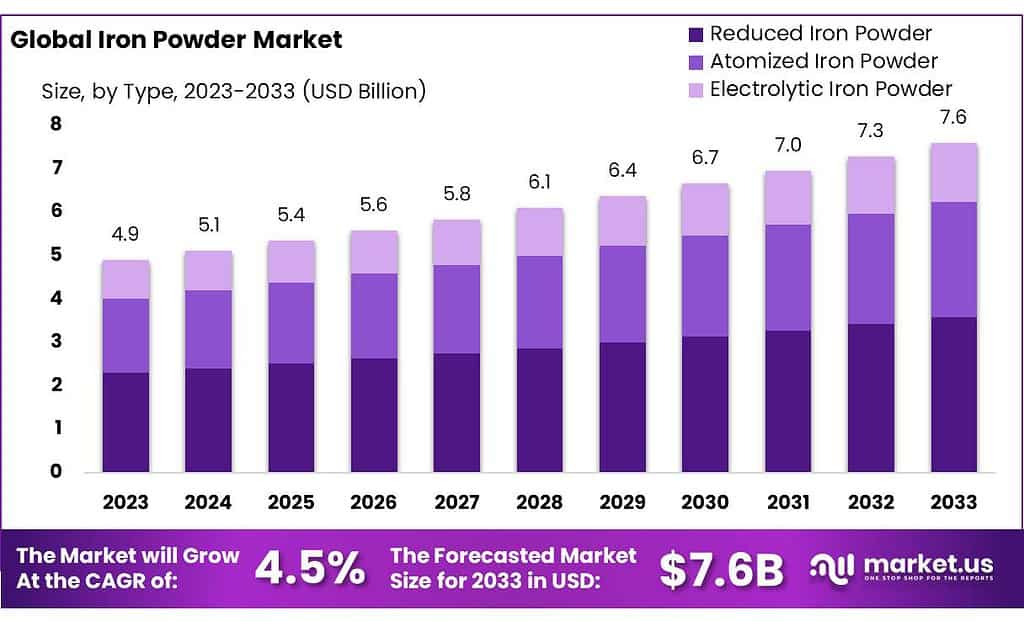

The global Iron Powder Market size is expected to be worth around USD 7.6 billion by 2033, from USD 4.9 billion in 2023, growing at a CAGR of 4.5% during the forecast period from 2023 to 2033.

The iron powder market is a significant sector in global manufacturing, valued at approximately $3.5 billion in 2023, due to its extensive applications across diverse industries. Iron powder is primarily used in metallurgy, electronics, automotive manufacturing, and construction. Its magnetic and conductive properties make it essential for producing sintered components, magnetic products, and welding electrodes, as well as in various chemical processes.

In the automotive industry, iron powder plays a crucial role by being used in the production of components like gears and bearings. This sector alone accounted for around 1 million tons of the global iron powder demand in 2023, according to the International Iron Metallics Association. The construction and electronics sectors also heavily utilize iron powder; in construction for structural components and heavy machinery, and electronics for fabricating magnetic and electronic devices.

Regulatory oversight is critical in this market, especially concerning environmental and safety standards. In Europe, the REACH framework ensures that iron powders minimize environmental and health risks. Similarly, the U.S. Environmental Protection Agency (EPA) monitors and controls emissions from iron powder production facilities, ensuring compliance with safety regulations.

The iron powder market experiences dynamic global trade, with major exporters including the United States, China, and Germany. These countries leverage their advanced metallurgical industries to meet international demand, which is also shaped by regional market fluctuations and trade policies. In 2022, global trade in iron powder was valued at around $2 billion, indicating its significant international movement and economic impact.

Innovation drives growth in the iron powder market, with recent developments like atomized iron powders enhancing properties for high-density applications in industries such as automotive and heavy machinery. Strategic acquisitions also play a role in expanding market reach and enhancing technological capabilities, as seen with Höganäs AB’s recent acquisition in India.

Government initiatives further support this sector, with programs like the U.S. Department of Energy funding projects to improve metal powder production processes. The European Union’s Horizon 2020 program also contributes by funding research aimed at advancing the sustainability and efficiency of iron powder technologies.

By Product Type

In 2023, Reduced Iron Powder held a dominant market position, capturing more than a 47.4% share. This product type is preferred for its cost-effectiveness and versatility in applications such as welding, powder metallurgy, and various chemical processes. The strong demand in sectors such as automotive and construction, where high-strength materials are crucial, supports its significant market share.

Atomized Iron Powder follows, known for its high purity and uniform particle size, which make it indispensable in high-performance applications including advanced electronics and specialized machining. This segment benefits from the growing precision manufacturing industry, which requires components with exacting specifications.

Lastly, Electrolytic Iron Powder, recognized for its exceptional purity and chemical properties, is essential in the food and pharmaceutical sectors. It plays a critical role in the production of iron supplements and nutritional additives, with its market growth driven by increasing health awareness and regulatory support for fortified foods.

By Type

In 2023, Unalloyed Iron Powder held a dominant market position, capturing more than a 56.7% share. Its wide usage in applications like sintered parts and magnetic materials underpins its strong market presence. The simplicity and cost-effectiveness of unalloyed iron make it a popular choice across various industries.

Alloyed Iron Powder follows, valued for its enhanced mechanical properties and resistance to wear and corrosion. This type is critical in high-performance applications such as automotive parts and industrial machinery, where durability and strength are key.

Insulated Iron Powder, while a smaller segment, is important for specialized applications. It is primarily used in electronics and electromagnetic devices due to its insulation properties, which prevent electrical interference and improve performance in these high-tech areas.

By Manufacturing Process

In 2023, Physical Iron Powder held a dominant market position, capturing more than a 56.5% share. This method is favored for its efficiency and cost-effectiveness, making it ideal for applications in automotive parts and construction materials. The physical process, involving methods such as grinding and crushing, produces highly versatile iron powders.

Chemical Iron Powder follows, appreciated for its high purity and fine particle size. It is widely used in specialized applications such as catalysts and high-tech manufacturing. The chemical process, which involves reducing iron compounds, ensures consistent quality and performance in demanding environments.

Mechanical Iron Powder, though a smaller segment, is valued for its unique properties. This method involves techniques like atomization and milling to create powders with specific characteristics needed for advanced manufacturing processes and precision components.

By Purity

In 2023, Standard Purity Iron Powder held a dominant market position, capturing more than a 68.9% share. This segment is widely utilized for its affordability and adequacy in general industrial applications, such as welding and manufacturing sintered products. Its broad applicability across diverse sectors underpins its substantial market share.

High Purity Iron Powder, although a smaller portion of the market, is critical for applications requiring exceptional material properties, such as in electronics and pharmaceuticals. Its superior purity levels make it essential for processes where contamination must be minimized, supporting its importance in high-tech and health-related industries.

By End Use

In 2023, Automotive held a dominant market position, capturing more than a 43.2% share. Iron powder is extensively used in automotive parts, including components made via powder metallurgy. The automotive industry’s continuous growth drives the high demand for durable and cost-effective iron powder solutions.

Aerospace & Defence follows, with significant use of iron powder in high-performance components and materials. This segment benefits from the need for reliable and strong materials in aircraft and defense equipment, reflecting its substantial share in the market.

Oil & Gas, though smaller, remains crucial. Iron powder is used in applications such as catalysts and drilling equipment, driven by the sector’s need for efficient and robust materials under extreme conditions.

Medical applications also contribute to market demand. High-purity iron powder is employed in supplements and diagnostic devices, where purity and precision are paramount. The growing focus on health and wellness supports this segment’s steady growth.

Key Market Segments

By Product Type

- Reduced Iron Powder

- Atomized Iron Powder

- Electrolytic Iron Powder

By Type

- Unalloyed

- Alloyed

- Insulated Iron Powder

By Manufacturing Process

- Physical

- Chemical

- Mechanical

By Purity

- High Purity

- Standard Purity

By End Use

- Automotive

- Aerospace & defence

- Oil & Gas

- Medical

- Others

Driving Factors

Increasing Demand in Powder Metallurgy: One of the major driving factors for the iron powder market is the increasing demand from the powder metallurgy sector. Powder metallurgy is a process that involves the pressing and sintering of powdered metals to create precise and complex mechanical components, which are widely used in various industries, including automotive, aerospace, and machinery.

Growth in Automotive and Aerospace Sectors: The automotive and aerospace industries are significant consumers of components made through powder metallurgy, owing to their need for high-strength, durable, and lightweight parts. As these sectors continue to expand and innovate, the demand for iron powder, a key ingredient in this manufacturing process, also increases.

For instance, the global automotive industry, which extensively uses iron powder for producing gears, bearings, and other engine components, is projected to grow at a compound annual growth rate (CAGR) of 3.5% from 2023 to 2028, according to a report by the International Organization of Motor Vehicle Manufacturers.

Technological Advancements: Technological advancements in powder metallurgy, such as the development of new forming and sintering techniques, have also contributed to the growth of the iron powder market. These advancements help in improving the efficiency and capabilities of powder metallurgy, making it possible to produce more complex and high-performance parts. This not only enhances the application scope of iron powder but also its market demand.

Government and Industry Initiatives: Government initiatives and industry collaborations play a crucial role in driving the iron powder market. For example, several national governments, along with major industry players, are investing in research and development projects to enhance the efficiency and sustainability of powder metallurgy. These initiatives often focus on reducing energy consumption and minimizing waste, aligning with global sustainability goals.

Global Infrastructure Development: The ongoing global infrastructure development, particularly in emerging economies, is another driving factor for the iron powder market. Iron powder is used in the construction industry, especially in the production of high-performance cement and concrete products. The increasing urbanization and industrialization in regions such as Asia-Pacific and the Middle East have led to a rise in construction activities, thereby boosting the demand for iron powder.

Restraining Factors

Volatility in Raw Material Prices: One of the major restraining factors affecting the iron powder market is the volatility in raw material prices. Iron powder production heavily relies on the availability and cost of raw materials, primarily iron ore. Fluctuations in iron ore prices can significantly impact the production costs of iron powder, affecting the overall market stability and profitability.

Impact of Iron Ore Price Fluctuations: The price of iron ore is influenced by various global factors, including mining production levels, international demand, trade policies, and economic conditions. For example, according to the World Steel Association, iron ore prices have seen substantial fluctuations in recent years due to changes in production outputs from major suppliers and shifts in demand from key markets like China. Such volatility makes it challenging for iron powder manufacturers to maintain consistent pricing and supply chains, potentially leading to reduced market growth.

Economic Conditions and Industry Demand: Economic downturns can also exacerbate the impact of raw material price volatility. During periods of economic slowdown, industries such as automotive and construction, which are major consumers of iron powder, may reduce their production, leading to decreased demand for iron powder. This decrease in demand, combined with high raw material costs, can squeeze margins and deter investment in new technologies and capacity expansion.

Regulatory and Environmental Challenges: Additionally, regulatory and environmental challenges related to mining and metal production can further complicate the supply of raw materials. For instance, stricter environmental regulations in key iron ore-producing countries can reduce mining outputs or increase production costs, as mining companies are required to implement more sustainable but cost-intensive mining practices. According to a report by the International Energy Agency, these regulations are becoming more prevalent as governments worldwide push for more environmentally friendly industrial processes.

Strategies to Mitigate Impact: To mitigate the impact of raw material price volatility, companies in the iron powder market are exploring various strategies. These include long-term contracts with raw material suppliers to stabilize prices, investments in recycling technologies to reduce dependency on virgin raw materials, and diversification of supply chains to minimize risks associated with geopolitical issues or trade disputes.

Growth Opportunity

Expansion into Additive Manufacturing: One significant growth opportunity for the iron powder market is its expanding application in additive manufacturing, commonly known as 3D printing. This technology has rapidly evolved and is being increasingly adopted across various industries for its ability to create complex, high-precision components efficiently and cost-effectively.

Growth in Additive Manufacturing: Additive manufacturing has transformed from a niche technology to a mainstream manufacturing process, particularly in sectors like aerospace, automotive, and healthcare. According to the International Data Corporation (IDC), the global market for 3D printing, including materials like iron powder, was expected to grow to $23 billion by 2023. Iron powder is crucial in this context due to its suitability for creating dense, strong metallic parts, which are essential in high-stress applications.

Demand in Aerospace and Automotive Industries: The aerospace and automotive industries present particularly lucrative markets for iron powder used in additive manufacturing. In aerospace, 3D-printed parts can significantly reduce aircraft weight, thereby improving fuel efficiency and performance.

For instance, a report by the Aerospace Industries Association noted that additive manufacturing could potentially reduce aircraft weight by up to 55%, emphasizing the role of iron powder in this reduction. In the automotive sector, the ability to produce complex parts quickly and in a customized manner is driving the adoption of iron powder in 3D printing processes.

Government and Industrial Support: Governments and industry consortia worldwide are increasingly supporting the development of additive manufacturing. Programs such as America Makes in the USA and the Fraunhofer Project Center for Advanced Manufacturing in Europe focus on advancing 3D printing technologies and materials, including iron powder. These initiatives often come with significant funding and research support, aiming to enhance the capabilities and applications of additive manufacturing technologies.

Innovation and Material Development: Innovation in the processing and application of iron powder is key to its growth in the additive manufacturing sector. Enhanced powder characteristics, such as improved particle size distribution and purity, are critical for achieving better printing accuracy and mechanical properties. Companies are investing in R&D to develop new types of iron powders that are optimized for 3D printing applications, which promise to open new markets and applications.

Latest Trends

Sustainability and Recycling in Iron Powder Production: One of the latest significant trends in the iron powder market is the increasing focus on sustainability and recycling efforts within the production process. This shift is driven by global environmental concerns, stricter regulatory standards, and a growing industry commitment to reducing carbon footprints and improving energy efficiency.

Increasing Regulatory Pressure and Environmental Standards: Environmental regulations are becoming stricter worldwide, with governments and international organizations imposing more rigorous standards on the production and disposal of industrial materials, including iron powder. For instance, the European Union’s Circular Economy Action Plan promotes recycling and sustainable resource usage, which directly impacts how iron powders are produced and utilized. Companies are now mandated to not only minimize waste but also enhance recycling processes to meet these standards.

Rising Demand for Recycled and Eco-Friendly Materials: There is a growing demand from end-use industries for more sustainable materials. In sectors like automotive and construction, where iron powder is heavily used, companies are increasingly seeking recycled materials to improve their environmental sustainability profiles. According to a report from the World Steel Association, the use of recycled steel (from which iron powder can be derived) in manufacturing is seeing a notable increase as industries aim to reduce their ecological impacts.

Advancements in Recycling Technologies: Technological advancements in recycling processes are enabling more efficient recovery and reuse of iron from various waste streams. Innovations in magnetic separation, enhanced filtration systems, and energy-efficient smelting processes are improving the yield and quality of recycled iron powder. These technologies not only help in reducing the environmental impact but also lower the costs associated with raw material procurement.

Government and Industry Initiatives: Several government and industry initiatives are supporting these sustainability trends. For example, the U.S. Department of Energy has funded projects aimed at improving energy efficiency and reducing the emissions of metal powder production processes. Similarly, major industry players are forming alliances, such as the Responsible Steel initiative, which aims to increase the use of recycled materials and promote transparency in production practices.

Regional Analysis

The Iron Powder Market demonstrates significant growth across multiple regions, with Asia-Pacific (APAC) emerging as the dominant region, accounting for 38.6% of the total market share, valued at USD 1.9 billion in 2023. The region’s dominance can be attributed to the rapid industrialization and growth in automotive and construction industries in countries like China, India, and Japan. The increased demand for iron powder in manufacturing automotive parts and advanced machinery fuels this growth. The presence of key manufacturers and the region’s expanding metalworking sector further contribute to its market leadership.

In North America, the iron powder market shows steady growth due to the region’s developed automotive and manufacturing sectors, particularly in the United States and Canada. The rising demand for additive manufacturing and metal injection molding (MIM) technologies in industrial applications supports market expansion in this region.

Europe follows closely, driven by the growing demand for iron powder in powder metallurgy for the automotive sector, especially in countries like Germany, France, and Italy. Strict regulations aimed at reducing CO2 emissions have led to increased adoption of lightweight automotive components produced through iron powder metallurgy.

The Middle East & Africa and Latin America represent smaller market shares but are showing potential for future growth due to increasing industrialization and infrastructure development. The growth of construction and energy sectors in Brazil and South Africa further drives the demand for iron powder in these regions. While APAC leads the market, North America and Europe continue to play critical roles in sustaining global growth in the iron powder market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Iron Powder Market is highly competitive, with key players such as Saint-Gobain, Imerys, and RHI Magnesita leading the market through their extensive product portfolios and global presence. These companies focus on supplying high-quality iron powder for various applications, particularly in metallurgy, automotive parts, and industrial machinery.

POSCO Future M Co., Ltd., a key player in the Asia-Pacific region, leverages its strong position in steel production to support iron powder manufacturing. Similarly, Vesuvius and Magnezit Group contribute significantly to the market with their specialized iron powder offerings for high-temperature applications, particularly in the refractory industry.

Other notable companies include KEFER SE & Co. KG, Beijing Lier High-Temperature Materials Co., Ltd., and HarbisonWalker International, which focuses on providing advanced iron powder solutions for niche applications such as metal injection molding and powder metallurgy. Refratechnik Holding GmbH and Puyang Refractories Group Co., Ltd. are prominent players in Europe and Asia, respectively, with a strong emphasis on innovation and sustainability in their iron powder products.

Companies like Ruitai Materials Technology Co., Ltd. and Plibrico Company, LLC continue to strengthen their market positions by expanding production capacities and enhancing R&D efforts to develop new iron powder technologies. The overall market is characterized by significant mergers, acquisitions, and collaborations aimed at increasing production efficiency and expanding market reach, making competition in the iron powder market increasingly robust.

Market Key Players

- JFE Steel Corporation

- Höganäs AB

- Reade International Corporation

- Industrial Metal Powders

- American Elements

- ATI

- Ashland

- BASF

- CNPC Powder

- Rio Tinto Metal Powders

- Reade

- SAGWELL USA INC.

- Serena Nutrition

- Belmont Metal

Recent Developers

In 2023, JFE introduced Denjiro™, an insulation-coated pure iron powder, which is particularly important for soft magnetic composites used in electronic and automotive industries.

In 2023 Reade International Corporation, the company continued to expand its product offerings, including electrolytic iron powder, which is highly sought after in industries such as food, pharmaceuticals, and steel production.

Report Scope

Report Features Description Market Value (2023) US$ 4.9 Bn Forecast Revenue (2033) US$ 7.6 Bn CAGR (2024-2033) 4.5% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type(Reduced Iron Powder, Atomized Iron Powder, Electrolytic Iron Powder), By Type(Unalloyed, Alloyed, Insulated Iron Powder), By Manufacturing Process(Physical, Chemical, Mechanical), By Purity(High Purity, Standard Purity), By End Use(Automotive, Aerospace and defence, Oil and Gas, Medical, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, &Rest of MEA Competitive Landscape JFE Steel Corporation, Höganäs AB, Reade International Corporation, Industrial Metal Powders, American Elements, ATI, Ashland, BASF, CNPC Powder, Rio Tinto Metal Powders, Reade, SAGWELL USA INC., Serena Nutrition, Belmont Metal Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- JFE Steel Corporation

- Höganäs AB

- Reade International Corporation

- Industrial Metal Powders

- American Elements

- ATI

- Ashland

- BASF

- CNPC Powder

- Rio Tinto Metal Powders

- Reade

- SAGWELL USA INC.

- Serena Nutrition

- Belmont Metal