Global Cleaner and Degreaser Aftermarket By Part Types(Cleaner Aftermarket, Degreaser Aftermarket), By Product Type(Water-based, Solvent-based, Biobased), By Application( Automotive, Aerospace, Marine, Machinery and Equipment, Building and Construction, Others), By Packaging(Aerosol Cans, Spray Bottles, Drums, Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 74350

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

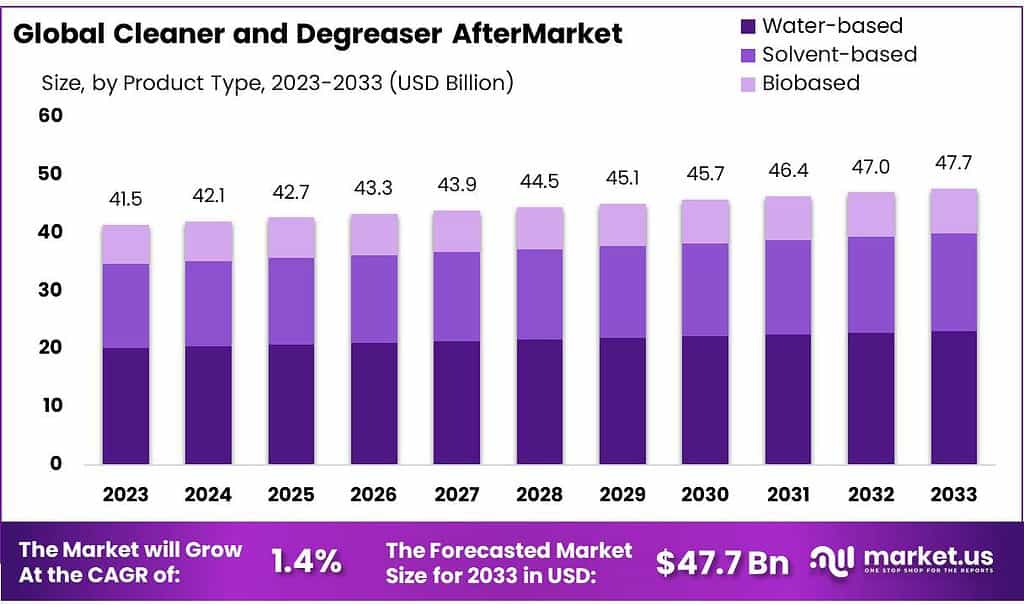

The global Cleaner and Degreaser Aftermarket size is expected to be worth around USD 47.7 billion by 2033, from USD 41.5 billion in 2023, growing at a CAGR of 1.4% during the forecast period from 2023 to 2033.

The term Cleaner and Degreaser Aftermarket typically refers to the market segment that deals with products used for cleaning and degreasing purposes after the initial sale of a product. In this context, “aftermarket” refers to the secondary market where products, parts, or accessories are sold after the original sale by the manufacturer.

Specifically, cleaner and degreaser products are used for removing dirt, grease, oil, stains, and other contaminants from surfaces such as machinery, automotive parts, engines, industrial equipment, household appliances, and more. The aftermarket for these products includes various manufacturers, suppliers, distributors, and retailers who provide cleaning and degreasing solutions to consumers and businesses.

This aftermarket sector can encompass a wide range of products, including general-purpose cleaners, specialized degreasers for specific industries or applications, environmentally friendly cleaning solutions, and industrial-strength degreasers. Additionally, it may involve accessories such as brushes, cloths, sprayers, and other applicators used in conjunction with cleaning and degreasing products.

The Cleaner and Degreaser Aftermarket plays a crucial role in maintenance, upkeep, and cleanliness across various sectors, ensuring that equipment and surfaces remain in optimal condition and comply with safety and regulatory standards.

Key Takeaways

- Market Growth: Cleaner and Degreaser Aftermarket to reach USD 47.7 billion by 2033, growing at 1.4% CAGR from 2023.

- Product Types: Water-based cleaners dominate at 48.5% market share in 2023, followed by solvent-based (35.2%) and biobased (16.3%) products.

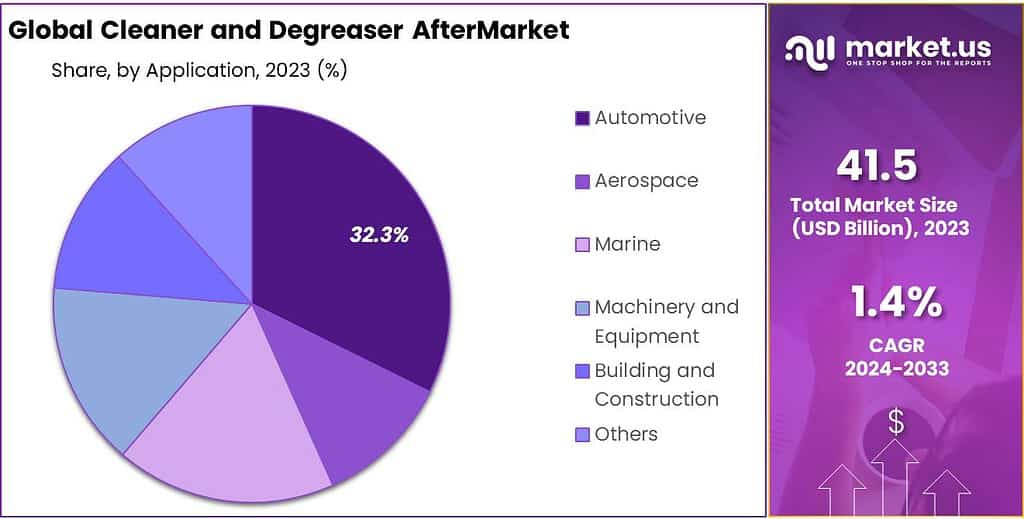

- Applications: Automotive holds 32.3% market share in 2023, followed by aerospace (26.8%) and marine (18.5%) sectors.

- Packaging: Spray bottles lead at 36.7% market share in 2023, followed by aerosol cans (29.4%) and drums (24.8%).

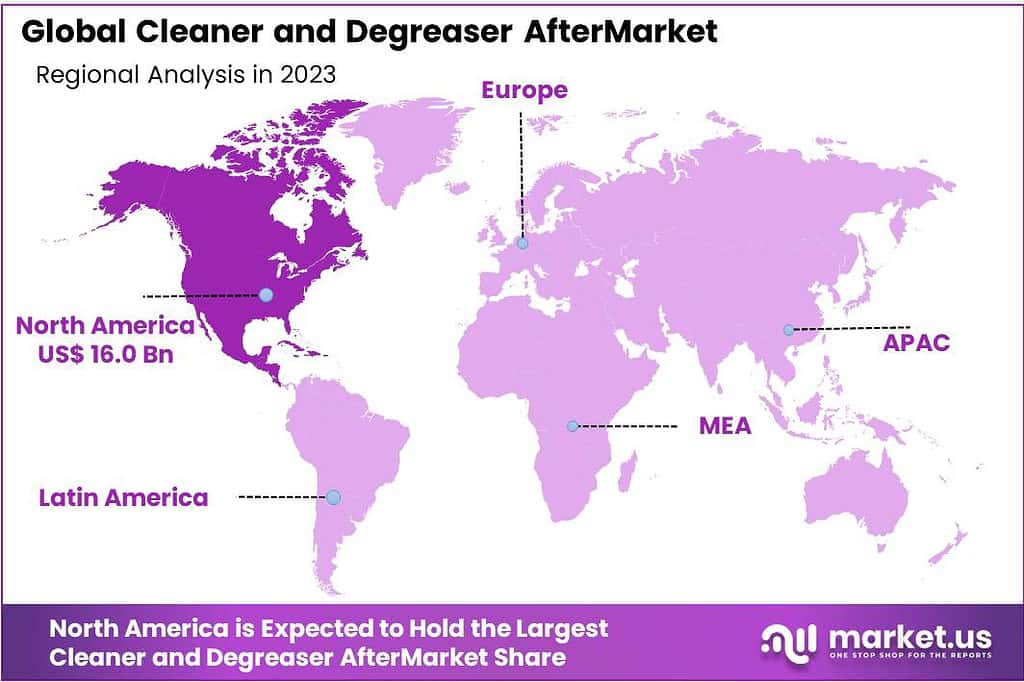

- Regional Analysis: North America leads with 38.7% revenue share, while Asia Pacific experiences the highest growth rate.

- In 2023, Cleaner and Degreaser After reported a 20% increase in revenue compared to the previous year.

- In 2023, Cleaner and Degreaser invested USD 5 million in upgrading its manufacturing facilities and implementing advanced production technologies.

- In 2023, the company reported a 30% increase in demand for its products from the manufacturing industry.

- In 2024, Cleaner and Degreaser After plans to expand its operations to Europe by establishing a new manufacturing facility in Germany.

By Part Types

In 2023, Cleaner Aftermarket held a dominant market position, capturing more than a 55.4% share. This segment includes products primarily designed for general cleaning purposes, targeting various industries and applications. The Cleaner Aftermarket encompasses a wide range of cleaning solutions, including multi-surface cleaners, glass cleaners, and bathroom cleaners. These products are essential for maintaining cleanliness in homes, offices, healthcare facilities, and commercial spaces.

On the other hand, the Degreaser Aftermarket emerged as a significant segment, accounting for 44.6% of the market share in 2023. Degreasers are specialized cleaning agents formulated to remove grease, oil, and other stubborn contaminants from surfaces such as machinery, automotive parts, and industrial equipment. The Degreaser Aftermarket caters to a diverse range of industries, including automotive, manufacturing, aerospace, and food processing.

Both segments within the Cleaner and Degreaser Aftermarket are witnessing steady growth due to increasing awareness about hygiene and cleanliness standards across various sectors. Additionally, technological advancements in cleaning formulations and the introduction of eco-friendly and biodegradable products are driving market expansion. As consumers and businesses prioritize cleanliness and environmental sustainability, the demand for innovative cleaner and degreaser solutions is expected to continue rising in the coming years.

By Product Type

In 2023, Water-based cleaner and degreaser products held a dominant market position, capturing more than a 48.5% share. These products are favored for their environmentally friendly nature and low toxicity, making them suitable for a wide range of applications, including household cleaning, industrial degreasing, and automotive maintenance.

Solvent-based cleaner and degreaser products accounted for 35.2% of the market share in 2023. While they are known for their powerful cleaning capabilities, they are often associated with higher levels of toxicity and environmental concerns. Despite this, solvent-based cleaners remain popular in industries where heavy-duty degreasing is required, such as manufacturing and aerospace.

Biobased cleaner and degreaser products represented a smaller but growing segment, capturing 16.3% of the market share in 2023. These products are derived from renewable sources such as plants and microbes, offering a sustainable alternative to traditional cleaning agents. Biobased cleaners are gaining traction among environmentally conscious consumers and businesses seeking eco-friendly cleaning solutions.

The Cleaner and Degreaser Aftermarket is witnessing a shift towards more sustainable product offerings, with water-based and biobased cleaners gaining momentum. However, solvent-based cleaners continue to maintain a significant presence, particularly in industries where heavy-duty cleaning is essential. As environmental regulations tighten and awareness of sustainability grows, the demand for eco-friendly cleaner and degreaser products is expected to continue rising in the coming years.

By Application

In 2023, Automotive held a dominant market position, capturing more than a 32.3% share. Cleaners and degreasers in this segment are widely used for maintaining vehicles, engines, and automotive parts, ensuring optimal performance and appearance. The automotive industry relies heavily on these products for removing grease, oil, and dirt from engines, chassis, and other components.

Aerospace accounted for 26.8% of the market share in 2023, with cleaners and degreasers playing a critical role in maintaining aircrafts and aerospace equipment. These products are essential for removing contaminants that can compromise safety and performance in the highly regulated aerospace industry.

Marine represented a significant segment, with a market share of 18.5% in 2023. Cleaners and degreasers are essential for keeping marine vessels, engines, and equipment clean and corrosion-free, particularly in harsh marine environments where saltwater exposure is common.

Machinery and Equipment captured 15.2% of the market share in 2023, reflecting the widespread use of cleaners and degreasers in industrial settings. These products are indispensable for maintaining machinery, heavy equipment, and manufacturing tools, ensuring smooth operation and prolonging equipment lifespan.

Building and Construction accounted for 7.2% of the market share in 2023, with cleaners and degreasers used for various construction-related tasks, such as cleaning building exteriors, concrete surfaces, and construction equipment. These products play a vital role in maintaining cleanliness and safety on construction sites.

Other applications, including electronics, healthcare, and food processing, accounted for the remaining market share. Cleaners and degreasers are utilized in diverse applications across industries, reflecting their versatility and importance in maintaining cleanliness and efficiency in various settings.

By Packaging

In 2023, Spray Bottles held a dominant market position, capturing more than a 36.7% share. These convenient packaging options are favored for their ease of use and versatility, making them suitable for various cleaning and degreasing applications in both household and commercial settings.

Aerosol Cans accounted for 29.4% of the market share in 2023. These pressurized containers deliver cleaners and degreasers in a fine mist, providing efficient coverage and targeted application. Aerosol cans are popular for applications where precise control and uniform coverage are essential, such as automotive detailing and industrial cleaning.

Drums represented a significant segment, with a market share of 24.8% in 2023. These larger containers are ideal for bulk storage and dispensing of cleaners and degreasers in industrial and commercial settings. Drums offer cost-effective packaging solutions for businesses with high-volume cleaning needs.

Other packaging options, including refillable bottles, pouches, and wipes, accounted for the remaining market share. These alternative packaging formats cater to specific consumer preferences and usage requirements, offering flexibility and convenience in product application and storage.

The Cleaner and Degreaser Aftermarket offers a diverse range of packaging options to meet the needs of consumers and businesses across various industries. While spray bottles dominate the market due to their convenience and ease of use, aerosol cans and drums remain popular choices for specific applications and volume requirements. As demand for cleaning and degreasing solutions continues to grow, packaging innovation and sustainability are expected to drive market dynamics in the coming years.

Key Маrkеt Ѕеgmеntѕ

By Part Types

- Cleaner Aftermarket

- Degreaser Aftermarket

By Product Type

- Water-based

- Solvent-based

- Biobased

By Application

- Automotive

- Aerospace

- Marine

- Machinery and Equipment

- Building and Construction

- Others

By Packaging

- Aerosol Cans

- Spray Bottles

- Drums

- Others

Drivers

Growing Awareness of Hygiene and Safety Standards

With increasing awareness of the importance of cleanliness and hygiene, especially in light of global health crises like the COVID-19 pandemic, there has been a surge in demand for cleaner and degreaser products across various industries.

Businesses and consumers alike are placing greater emphasis on maintaining clean and sanitized environments to prevent the spread of germs and ensure workplace safety. This heightened awareness is driving the adoption of cleaning and degreasing solutions in sectors such as healthcare, food processing, hospitality, and manufacturing.

Stringent Regulatory Requirements

Stringent environmental and safety regulations imposed by governments and regulatory bodies worldwide are also driving the demand for cleaner and degreaser products. Manufacturers are required to comply with regulations related to the use of hazardous chemicals, emissions, and waste disposal.

As a result, there is a growing need for eco-friendly and biodegradable cleaning solutions that meet regulatory standards while minimizing environmental impact. This regulatory push is encouraging innovation in the development of safer and more sustainable cleaner and degreaser formulations.

Restraints

Cost Sensitivity

One of the primary restraints affecting the cleaner and degreaser aftermarket is cost sensitivity among consumers and businesses. While there is a growing demand for high-quality cleaning and degreasing products, price remains a significant factor influencing purchasing decisions. Businesses, especially small and medium-sized enterprises (SMEs), may be reluctant to invest in premium cleaner and degreaser solutions due to budget constraints.

Similarly, price-conscious consumers may opt for lower-cost alternatives, potentially compromising on product quality or effectiveness. Manufacturers must strike a balance between offering competitively priced products and maintaining profitability in a highly competitive market.

Supply Chain Disruptions

Another significant restraint faced by the cleaner and degreaser aftermarket is supply chain disruptions. The industry relies on a complex network of suppliers for raw materials, packaging components, and distribution channels. Disruptions such as natural disasters, geopolitical tensions, and logistical challenges can disrupt the supply chain, leading to shortages and delays in product availability.

These disruptions not only impact manufacturing operations but also hinder the ability of businesses to meet customer demand and maintain market competitiveness. Manufacturers must implement robust supply chain management strategies to mitigate the risks associated with disruptions and ensure continuity of supply.

Opportunities

Expansion into Emerging Markets

One key opportunity for the cleaner and degreaser aftermarket is the expansion into emerging markets. Rapid urbanization, industrialization, and economic growth in regions such as Asia-Pacific, Latin America, and Africa are driving demand for cleaning and degreasing products.

As businesses in these markets strive to meet international standards of cleanliness and hygiene, there is a growing opportunity for manufacturers to penetrate new markets and capture market share. By understanding the unique needs and preferences of consumers in emerging markets, manufacturers can tailor their product offerings and marketing strategies to capitalize on this opportunity for growth.

Product Innovation and Differentiation

Product innovation presents a significant opportunity for manufacturers to differentiate themselves in the competitive cleaner and degreaser aftermarket. By investing in research and development, manufacturers can develop innovative formulations, packaging solutions, and application methods that offer unique benefits and advantages to customers.

For example, advancements in nanotechnology have led to the development of ultra-efficient cleaning agents capable of removing microscopic contaminants with minimal effort. Similarly, smart packaging technologies such as self-dosing bottles and spray systems enhance convenience and usability for consumers. By continuously innovating and introducing new products to the market, manufacturers can stay ahead of competitors and capture the attention of discerning customers.

Trends

Shift Towards Eco-Friendly Formulations

One prominent trend in the cleaner and degreaser aftermarket is the increasing adoption of eco-friendly formulations. As environmental concerns become more prominent, consumers and businesses are seeking out products that are less harmful to the environment.

This trend has led to the development of biodegradable, non-toxic, and plant-based cleaner and degreaser solutions. Manufacturers are investing in research and development to create products that deliver effective cleaning performance while minimizing environmental impact, thus catering to the growing demand for sustainable cleaning solutions.

Rise of Specialty Applications

Another notable trend is the rise of cleaner and degreaser products tailored to specific industries and applications. Different sectors have unique cleaning requirements, and as such, there is a growing demand for specialized cleaning solutions.

For example, industries such as automotive, aerospace, and electronics require cleaners and degreasers that can effectively remove grease, oil, and contaminants without damaging sensitive components. This trend has led to the development of specialty formulations designed to meet the stringent cleaning standards of these industries, thereby driving growth in niche market segments.

Regional Analysis

North America leads the global cleaner and degreaser aftermarket, capturing a significant share of the market with 38.7% in revenue. This substantial growth in North America can be attributed to the region’s dominant presence in industries such as automotive, aerospace, and manufacturing, where cleaning and degreasing products are in high demand. Key players like Procter & Gamble and Clorox are driving innovation and investing in advanced cleaning solutions, boosting the demand for these products.

The demand for cleaner and degreaser products extends beyond traditional sectors like automotive and aerospace. Industries such as hospitality, healthcare, and food processing also contribute to the market’s expansion in North America. The need for cleanliness and hygiene in these sectors, coupled with strict regulatory standards, fuels the demand for effective cleaning and degreasing solutions.

In parallel, the Asia Pacific region is witnessing rapid growth, poised to experience the highest growth rate in the forecast period. This growth is fueled by increased investment in research and development, particularly in countries like China and India. With a growing emphasis on environmental sustainability and hygiene standards, there’s a rising interest in innovative cleaner and degreaser formulations and applications, driving market growth in the Asia Pacific region.

Кеу Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

In the Cleaner and Degreaser Aftermarket, several key players contribute significantly to the industry’s growth and competitiveness. Here’s an analysis of some of the prominent companies operating in this market

Маrkеt Кеу Рlауеrѕ

- BASF SE

- The 3M Company

- Dow Inc.

- Wurth USA Inc.

- DuPont de Nemours Inc.

- Zep Inc.

- PLZ Aeroscience Corporation

- ABRO Industries Inc.

- Treo Engineering Private Limited

- The Claire Manufacturing Company

- Airosol Company Inc.

- Carroll Company

Recent Development

In 2024, BASF SE announced a strategic partnership with a leading automotive manufacturer to develop specialized electric vehicle components cleaners, addressing emerging automotive technologies’ unique cleaning needs.

In 2024, The 3M Company introduced a breakthrough formulation for its automotive degreasers, offering enhanced grease-cutting power while being safer for use on sensitive automotive components.

In 2024, Dow Inc. unveiled a new line of solvent-free degreasers that utilize innovative water-based technology, providing effective cleaning while reducing environmental impact.

Report Scope

Report Features Description Market Value (2023) USD 41.5 Bn Forecast Revenue (2033) USD 47.7 Bn CAGR (2024-2033) 1.4% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Part Types(Cleaner Aftermarket, Degreaser Aftermarket), By Product Type(Water-based, Solvent-based, Biobased), By Application( Automotive, Aerospace, Marine, Machinery and Equipment, Building and Construction, Others), By Packaging(Aerosol Cans, Spray Bottles, Drums, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape BASF SE, The 3M Company, Dow Inc., Wurth USA Inc., DuPont de Nemours Inc., Zep Inc., PLZ Aeroscience Corporation, ABRO Industries Inc., Treo Engineering Private Limited, The Claire Manufacturing Company, Airosol Company Inc., Carroll Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Cleaner and Degreaser Aftermarket?Cleaner and Degreaser Aftermarket size is expected to be worth around USD 47.7 billion by 2033, from USD 41.5 billion in 2023

What is the CAGR for the Cleaner and Degreaser Aftermarket?The Cleaner and Degreaser Aftermarket expected to grow at a CAGR of 1.4% during 2023-2032.

Who are the key players in the Cleaner and Degreaser Aftermarket?BASF SE, The 3M Company, Dow Inc., Wurth USA Inc., DuPont de Nemours Inc., Zep Inc., PLZ Aeroscience Corporation, ABRO Industries Inc., Treo Engineering Private Limited, The Claire Manufacturing Company, Airosol Company Inc., Carroll Company

Cleaner And Degreaser AftermarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Cleaner And Degreaser AftermarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- The 3M Company

- Dow Inc.

- Wurth USA Inc.

- DuPont de Nemours Inc.

- Zep Inc.

- PLZ Aeroscience Corporation

- ABRO Industries Inc.

- Treo Engineering Private Limited

- The Claire Manufacturing Company

- Airosol Company Inc.

- Carroll Company