Global Asphalt Mixing Plant Market Size, Share, Analysis Report By Product (Portable, Stationary), By Product Type (Batch Mix, Drum Mix, Continuous Mix), By Production Capacity (Below 240t/h, 240t/h-320t/h, Above 320t/h), By Application (Road Construction, Parking Lots, Pedestrian Paths, Bridge, Others), By End User (Residential, Non-residential), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: December 2024

- Report ID: 135146

- Number of Pages: 243

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Product Analysis

- By Product Type Analysis

- By Production Capacity Analysis

- By Application Analysis

- By End User Analysis

- Key Market Segments

- Driving factors

- Restraining Factors

- Growth Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

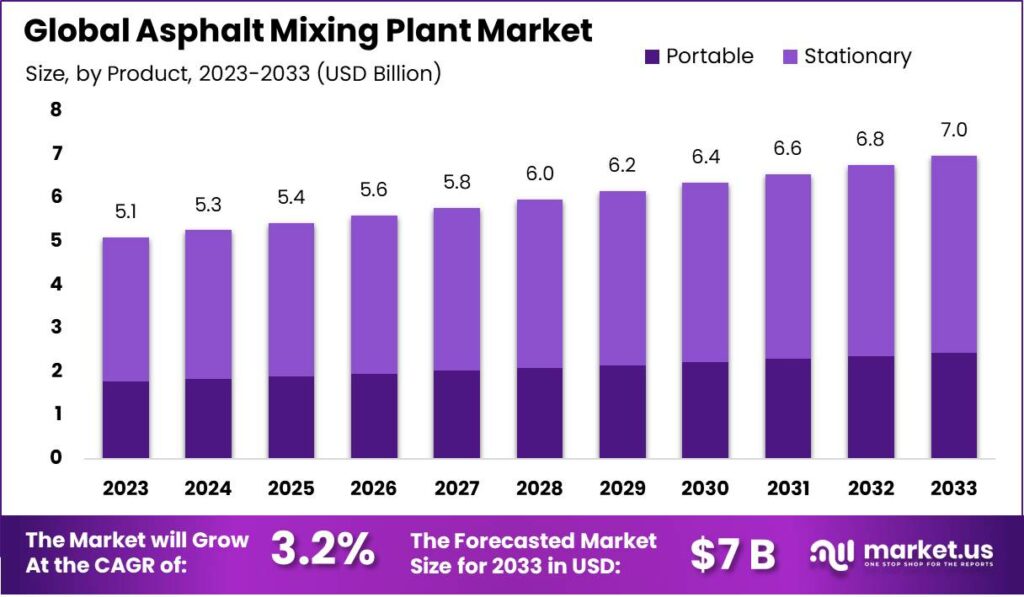

The Global Asphalt Mixing Plant Market size is expected to be worth around USD 7.0 Billion by 2033, from USD 5.1 Billion in 2023, growing at a CAGR of 3.2% during the forecast period from 2024 to 2033.

The asphalt mixing plant market is crucial in the construction industry, particularly in road building and maintenance. These plants are designed to combine various ingredients, such as bitumen, aggregates, and fillers, to produce high-quality asphalt.

As the demand for infrastructure development rises globally, the market for asphalt mixing plants has witnessed significant growth, fueled by the expansion of urban areas and the increasing need for improved road networks. The technology behind these plants continues to evolve, with innovations aimed at reducing energy consumption and increasing efficiency.

Governments across the globe are increasingly enforcing stringent environmental standards on asphalt production due to concerns over emissions. For instance, in the European Union, new regulations set by the EU Emissions Trading System (ETS) are expected to reduce carbon emissions by 43% by 2030 compared to 2005 levels.

These regulations are prompting manufacturers to innovate, adopting technologies that minimize emissions and improve energy efficiency. Additionally, the US Department of Transportation (USDOT) has earmarked $350 billion in federal funds for road infrastructure improvement under the Infrastructure Investment and Jobs Act (IIJA).

The trade of asphalt and components for mixing plants shows significant growth, especially in regions like Asia-Pacific and North America. For example, in 2023, the US exported asphalt products worth around $1.5 billion globally, with the largest markets being Mexico and Canada. On the import side, the EU remains a major importer, with Germany and Italy being leading importers of asphalt materials, primarily used in construction projects.

The asphalt industry is supported by various market initiatives, such as the global push for sustainable infrastructure. According to the report, the use of recycled materials in asphalt production, such as reclaimed asphalt pavement (RAP), has led to a 25% reduction in asphalt production costs and a 15% reduction in carbon emissions.

This has spurred investments into new technology for asphalt recycling and plant automation. The US asphalt market alone uses over 60 million tons of RAP annually, a figure expected to grow as new recycling technologies emerge.

Governments are also directly investing in the development of asphalt mixing plants. For instance, the Indian Government launched the National Infrastructure Pipeline (NIP), with an estimated investment of $1.4 trillion by 2025, which includes funding for modernizing road infrastructure and expanding asphalt production capacity. Similarly, the Chinese government allocated $70 billion for the development of roads and highways under its Belt and Road Initiative (BRI), significantly boosting the demand for asphalt mixing plants in the region.

Expansion activities are also visible, such as Lintec & Linnhoff opening a new plant in India to cater to the growing demand for sustainable construction technologies in the country, with an expected capacity increase of 15% by 2025.

Key Takeaways

- The Global Asphalt Mixing Plant Market size is expected to be worth around USD 7.0 Billion by 2033, from USD 5.1 Billion in 2023, growing at a CAGR of 3.2% during the forecast period from 2024 to 2033.

- Stationary plants dominated the Asphalt Mixing Plant Market with a 65.4% share, excelling in large-scale projects.

- Batch Mix dominated Asphalt Mixing with a 48.2% market share, prized for mix precision.

- The 240t/h-320t/h Asphalt Mixing Plants dominated the market with a 48.4% share, ideal for large-scale projects.

- Road Construction dominated the Asphalt Mixing Plant Market with a significant share, essential for infrastructure.

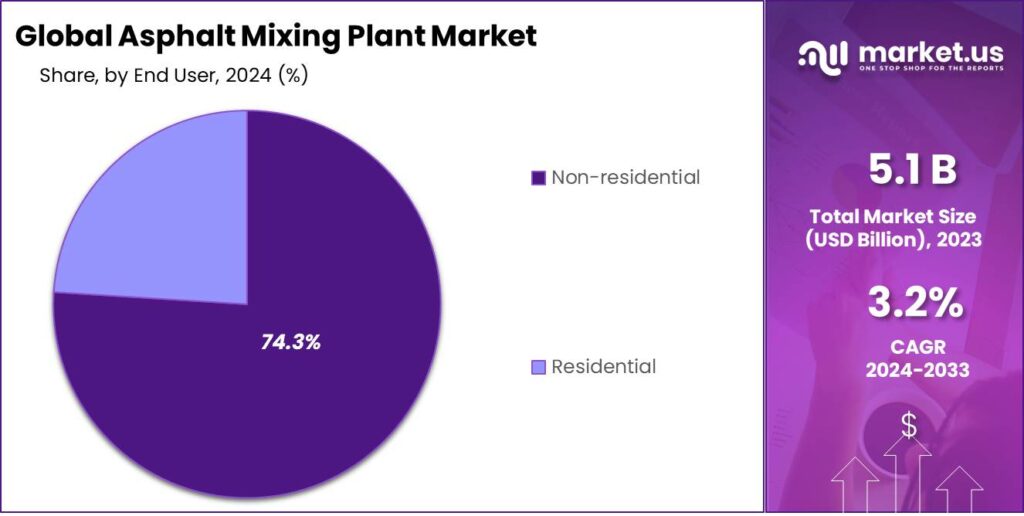

- Non-residential projects dominated the Asphalt Mixing Plant Market with a 74.3% share, spurred by large-scale infrastructure demands.

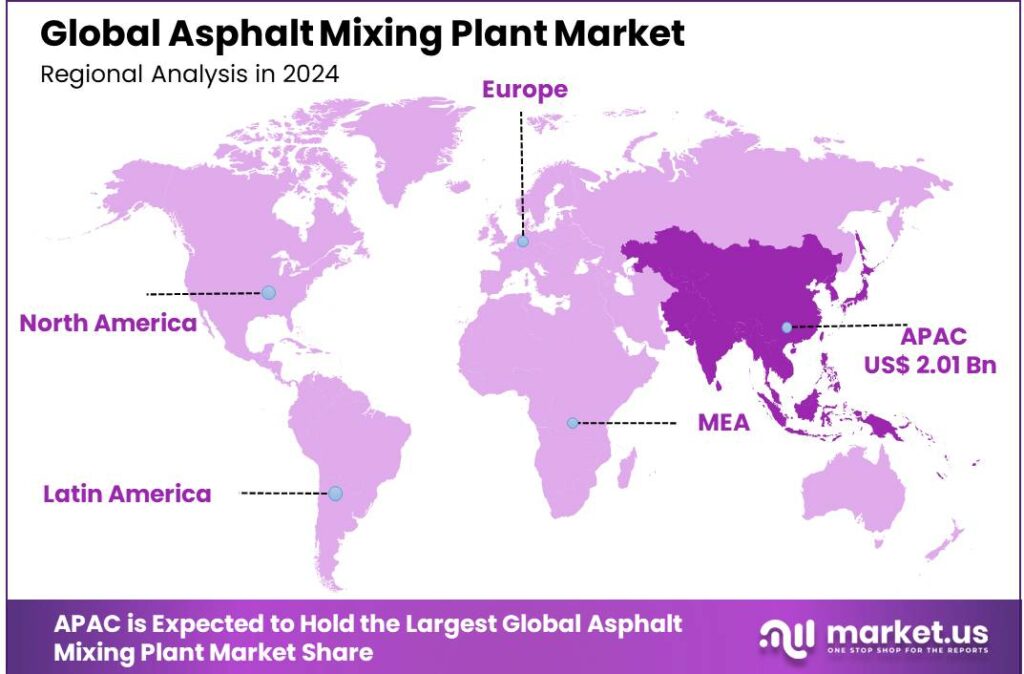

- Asia Pacific dominated the asphalt mixing plant market with a 39.4% share, generating USD 2.01 billion.

By Product Analysis

In 2023, Stationary held a dominant market position in the by-product segment of the Asphalt Mixing Plant Market, capturing more than a 65.4% share. The Stationary segment’s substantial market share can be attributed to its advantages in large-scale construction projects, where high volume and consistent asphalt production are critical. These stationary plants are often preferred for their durability and efficiency, providing a reliable production capacity that portable units typically cannot match.

The Portable segment caters to smaller, more flexible projects that require frequent relocation of equipment, allowing contractors to move their operations close to job sites, thus reducing transportation costs and time. Despite its smaller share, the Portable segment is vital for projects with less production demand or in locations that are temporarily accessible.

By Product Type Analysis

In 2023, Batch Mix held a dominant market position in the By Product Type segment of the Asphalt Mixing Plant Market, capturing more than a 48.2% share. The market is categorized into three types: Batch Mix, Drum Mix, and Continuous Mix.

Batch Mix plants lead due to their ability to produce high-quality asphalt mix with precise ingredient control, making them ideal for critical and high-specification projects. These plants allow for flexible adjustments between batches, catering to various asphalt recipes, which is essential for projects requiring specific performance standards.

Drum Mix plants, on the other hand, are favored for their simplicity and continuous production capabilities, making them suitable for long-term projects with a constant demand for asphalt. These plants typically have lower operational costs and are easier to operate, but they offer less flexibility in changing mix designs during operation.

Continuous Mix plants are the least common and are used in specific conditions where there is a demand for large volumes of low-specification asphalt. These plants operate continuously, with a non-stop mix production process that can deliver asphalt at high rates, but with limited flexibility in mix adjustment.

By Production Capacity Analysis

In 2023, The 240t/h-320t/h range held a dominant market position in the By Production Capacity segment of the Asphalt Mixing Plant Market, capturing more than a 48.4% share. This segment includes three categories: Below 240t/h, 240t/h-320t/h, and Above 320t/h.

The 240t/h-320t/h category leads the market, primarily because it strikes a balance between capacity and flexibility, making it suitable for a wide range of large-scale infrastructure projects without the extensive space and investment requirements of higher capacity plants.

Plants with capacities Below 240t/h are typically utilized for smaller, regional projects or in areas where logistical constraints prevent larger setups. These plants benefit from lower initial costs and greater mobility, appealing to contractors handling smaller projects or those needing occasional asphalt production.

Conversely, plants with capacities Above 320t/h are designed for substantial, long-term projects such as major highways and urban development projects that demand continuous, high-volume asphalt production. These high-capacity plants are the most cost-intensive and require significant setup space and investment, limiting their use to major construction firms and public infrastructure projects.

By Application Analysis

In 2023, Road Construction held a dominant market position in the By Application segment of the Asphalt Mixing Plant Market, capturing more than an impressive share. The segment is diversified into several categories, including Road Construction, Parking Lots, Pedestrian Paths, Bridges, and Others.

Road Construction leads the market due to the substantial and ongoing investments in infrastructure development across the globe. This sector demands high-quality, durable asphalt that can withstand varying traffic loads and environmental conditions, which is why it consistently consumes the bulk of asphalt production.

Parking Lots represents a smaller, though significant portion of the market. These projects require specialized asphalt mixes to endure the stationary loads of parked vehicles and the chemical impacts of leaked automotive fluids, requiring durable and resistant asphalt formulations.

Pedestrian Paths, while holding a minor share, are essential in urban and suburban planning. These paths need smoother and more aesthetically pleasing asphalt mixes, tailored for safety and comfort.

Bridges, similar to road construction, require highly durable and specialized asphalt to support heavy loads and resist environmental elements like moisture and temperature fluctuations, making it a critical but niche market within the industry.

By End User Analysis

In 2023, Non-residential held a dominant market position in the By End User segment of the Asphalt Mixing Plant Market, capturing more than a 74.3% share. This segment is categorized into two primary end-user types: Residential and Non-residential.

The Non-residential segment leads prominently due to widespread investments in commercial, industrial, and public infrastructure projects. These projects typically require larger quantities of asphalt for the construction of roads, airports, and commercial premises, driving significant demand for asphalt mixing plants.

The Residential segment, while smaller, focuses on housing developments and urban expansion projects that require asphalt for roadways and other small-scale infrastructure. Although this market is less intensive in its asphalt usage compared to non-residential projects, it remains essential for supporting residential construction and suburban development.

The substantial share held by the Non-residential segment reflects the broader economic focus on enhancing and expanding infrastructure as a means to support economic growth and community development.

Key Market Segments

By Product

- Portable

- Stationary

By Product Type

- Batch Mix

- Drum Mix

- Continuous Mix

By Production Capacity

- Below 240t/h

- 240t/h-320t/h

- Above 320t/h

By Application

- Road Construction

- Parking Lots

- Pedestrian Paths

- Bridge

- Others

By End User

- Residential

- Non-residential

Driving factors

Growing Demand for Infrastructure Development

The increasing demand for infrastructure development worldwide is one of the primary drivers for the asphalt mixing plant market. As countries invest in the construction of roads, highways, bridges, and other infrastructure projects, the need for asphalt as a key construction material rises. Asphalt mixing plants play a crucial role in ensuring a steady supply of asphalt, which is essential for paving and resurfacing roads.

The growing urbanization and industrialization in both developed and developing countries further fuel this demand, with governments prioritizing road expansion and maintenance projects. According to various sources, global infrastructure investment is expected to grow, particularly in emerging economies like India and China, leading to a heightened requirement for efficient and reliable asphalt mixing plants.

Additionally, the shift towards sustainable and energy-efficient plants, which can reduce emissions and improve production capacity, is further enhancing the attractiveness of these plants for construction companies. These trends reflect a positive outlook for the asphalt mixing plant market in the coming years, as it supports the increasing demand for road infrastructure worldwide.

Restraining Factors

Environmental Concerns and Regulatory Pressures

Environmental concerns and strict regulatory requirements are significant restraints for the asphalt mixing plant market. Asphalt plants emit various pollutants, including volatile organic compounds (VOCs), nitrogen oxides (NOx), and particulate matter. As environmental awareness increases globally, governments have implemented stricter emission norms to reduce air and noise pollution.

For instance, the European Union has stringent regulations on the emission standards of asphalt mixing plants, compelling manufacturers to invest in technologies that reduce emissions.

However, the implementation of these advanced technologies often leads to higher upfront costs and maintenance, which can deter smaller companies from adopting them. This creates a challenge for plant operators to comply with environmental standards while maintaining profitability.

In addition to stricter regulations, communities near asphalt plants often voice concerns about the health impacts of emissions, leading to potential delays or rejections in plant permits. Therefore, while environmental policies are crucial for public health, they pose a challenge for the growth of the asphalt mixing plant market, particularly in regions with highly regulated environmental frameworks.

Growth Opportunity

Technological Advancements in Plant Automation

Technological advancements, particularly in automation and smart technologies, present significant opportunities for the asphalt mixing plant market. Modern plants are increasingly being equipped with automated systems that streamline production, reduce labor costs, and enhance precision in the mixing process.

Automation allows for better monitoring of materials, temperature control, and efficient energy management, leading to improved plant performance and reduced wastage.

In addition, innovations such as IoT (Internet of Things) integration enable real-time data tracking, predictive maintenance, and performance optimization. These improvements contribute to more sustainable and cost-effective operations.

Furthermore, the integration of artificial intelligence (AI) and machine learning algorithms is making plants more adaptive to fluctuating production demands. For example, AI can predict when specific equipment is likely to fail, reducing downtime and maintenance costs.

The growing trend of smart cities and sustainable infrastructure also opens up new avenues for the use of eco-friendly asphalt produced by advanced mixing plants. As the construction industry looks for ways to enhance productivity and reduce environmental impact, companies that invest in these technological advancements stand to gain a competitive edge and tap into new markets.

Challenge

High Initial Investment Costs

One of the primary challenges facing the asphalt mixing plant market is the high initial investment required for plant setup. Purchasing and installing an asphalt mixing plant is a significant capital expenditure, particularly for smaller construction companies or contractors who may have limited financial resources.

The cost of the plant depends on factors such as its production capacity, technological features, and regulatory compliance standards. While modern plants with automation and advanced environmental controls offer long-term cost savings, their initial costs can be prohibitive for many companies. In addition, the need for skilled personnel to operate and maintain these advanced systems further increases the overall cost of ownership.

Small and medium-sized enterprises (SMEs) in the construction sector often struggle with these high upfront expenses, limiting their ability to adopt the latest technologies. This is especially true in regions with lower levels of infrastructure development, where construction projects may not justify such a large investment in equipment.

As a result, the high initial investment acts as a barrier to entry for many players in the asphalt mixing plant market, limiting the overall growth potential, particularly in emerging economies.

Emerging Trends

Asphalt mixing plants are rapidly evolving, driven by technological advancements and the need for more sustainable construction practices. One major trend is the increasing adoption of batch-mixing plants over traditional drum-mixing plants. Batch mixing provides better control over the final product, ensuring consistent quality, which is crucial for high-performance roads and highways.

As projects become more complex, contractors are opting for more precise and reliable mixes. Alongside this, mobile asphalt mixing plants are gaining traction. These plants are compact, easy to transport, and set up, making them ideal for smaller or remote construction projects where site mobility is crucial.

Another notable trend is the integration of automation and smart technology. Modern asphalt plants are incorporating IoT (Internet of Things) systems, allowing plant operators to monitor real-time performance, temperature levels, and even material consumption from remote locations. This shift enhances productivity, reduces human error, and allows for predictive maintenance, cutting down on downtime.

Moreover, energy efficiency is becoming a top priority, with many plants now using reclaimed asphalt pavement (RAP) to reduce the need for virgin materials. This not only lowers costs but also addresses environmental concerns by recycling existing materials, contributing to a more sustainable construction industry. The drive for eco-friendly technologies, such as low-emission plants and reduced energy consumption, reflects the growing importance of sustainability in the sector.

Business Benefits

Asphalt mixing plants offer a range of business benefits, particularly in terms of improving operational efficiency and profitability. One of the most significant advantages is cost savings through the use of recycled materials like RAP (Reclaimed Asphalt Pavement). By reusing asphalt from previous projects, businesses can reduce the amount of virgin materials required, lowering production costs while supporting sustainability goals. This also helps companies maintain competitiveness in a price-sensitive market.

In addition, asphalt mixing plants equipped with automation and smart technologies help improve the consistency and quality of the end product. Automation ensures that the right mix of materials is used at optimal temperatures, reducing wastage and errors. This leads to fewer rejects and rework, which translates into lower operational costs and better project timelines.

The integration of real-time monitoring systems also enhances decision-making, allowing operators to make adjustments and track progress remotely, improving overall productivity.

The long-term return on investment (ROI) for businesses can also be substantial. Although the initial cost of purchasing and setting up an asphalt mixing plant may be high, the improved efficiency, better-quality output, and potential for cost savings on materials typically outweigh the initial investment.

Moreover, as demand for infrastructure continues to rise globally, owning an asphalt mixing plant provides businesses with the flexibility to capitalize on growing opportunities in both public and private sector construction projects.

Lastly, with the increasing emphasis on environmental sustainability, businesses operating eco-friendly asphalt mixing plants can position themselves as leaders in green construction practices, enhancing their market reputation and attracting clients who prioritize environmental responsibility.

Regional Analysis

In 2023, Asia Pacific dominated the asphalt mixing plant market with a 39.4% share, generating USD 2.01 billion.

In 2023, Asia Pacific held a dominant market position in the asphalt mixing plant market, capturing more than 39.4% of the total share with a revenue of USD 2.01 billion. This region’s supremacy can largely be attributed to the rapid industrialization and urbanization seen across key economies such as China, India, and Southeast Asian nations.

The growing infrastructure development, fueled by government-backed initiatives such as China’s Belt and Road Initiative and India’s push for rural infrastructure, is driving substantial demand for asphalt mixing plants. With expanding road construction and large-scale public works projects, Asia Pacific’s market continues to thrive as a result of these long-term investments.

Additionally, the region benefits from a relatively low-cost labor force, enhancing the affordability and scalability of asphalt mixing plant production. The increasing demand for high-quality asphalt in countries like China, India, and Japan, where road infrastructure needs upgrading and expansion, is also a key factor contributing to the region’s market dominance.

In 2023, China alone accounted for over 28% of the regional market share, with a significant number of manufacturers and suppliers catering to both domestic and export demands.

The region’s strong growth in construction activities, particularly in emerging economies, is further supported by robust economic recovery post-pandemic, as well as government incentives and policies promoting infrastructure investments. The availability of affordable raw materials, coupled with the growth of manufacturing capabilities, continues to drive the production of asphalt mixing plants, ensuring consistent market growth in Asia Pacific.

In contrast, regions like North America and Europe exhibit more moderate growth rates, driven primarily by replacement demand and infrastructure renewal. While these regions maintain significant technological advancements in asphalt mixing plant design, their overall market share remains smaller compared to the rapidly expanding infrastructure sector in the Asia Pacific.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In the 2024 global Asphalt Mixing Plant Market, several key players are poised to make significant impacts, each bringing unique strengths to the sector. Among them, Ammann Group Holding AG, ASTEC, Marini S.p.A, and Nikko Company Limited stand out due to their technological advancements, global reach, and product offerings.

Ammann Group Holding AG is known for its innovation and sustainability in the construction equipment sector. The company has consistently focused on integrating new technologies that reduce energy consumption and emissions, a critical factor as the industry moves towards greener construction practices. Ammann’s ability to adapt to regulatory environments and customer needs worldwide makes it a formidable player in the market.

ASTEC plays a pivotal role in the asphalt mixing plant market through its extensive range of equipment, including portable, relocatable, and stationary asphalt plants. Known for durability and reliability, ASTEC’s products are designed to meet both large and small project requirements. The company’s continuous focus on research and development is likely to drive further innovations, enhancing its market position in 2024.

Marini S.p.A is distinguished by its global footprint and advanced solutions in asphalt production. Marini’s emphasis on customizability and performance allows it to cater to diverse customer needs, making it a go-to choice for contractors seeking efficiency and high-quality output. The company’s expansive service network and strong after-sales support also enhance its competitive edge.

Nikko Company Limited is recognized for its commitment to safety and environmental standards. The company’s asphalt mixing plants are engineered to minimize dust emissions and noise, promoting a healthier worksite and community environment. Nikko’s focus on compact and energy-efficient designs appeals to firms looking to reduce operational costs and ecological footprints, aligning with global trends toward sustainability.

Market Key Players

- 4B Construction Corporation

- Ammann Group Holding AG

- Arky Construction

- ASTEC

- Atlas industries

- Aztec Industries Inc.

- Benninghoven

- Capious Roadtech Pvt. Ltd.

- GP Gunter Papenburg AG

- Lintec & Linnhoff Germany GmbH

- Marini S.p.A

- Nikko Company Limited

- Solmec Earthmovers Pvt. Ltd

- Speed Crafts

Recent Development

- In April 2024, Aggregate Industries opened a new asphalt plant in Staffordshire, UK, as part of an $11.46 million investment. This plant features an Ammann ABP 240 universal asphalt mixing plant capable of producing 240 tonnes of asphalt per hour.

- In August 2022, Construction Partners, Inc. acquired Southern Asphalt, Inc., adding two hot-mix asphalt plants and over 200 employees in the Myrtle Beach area, South Carolina. This acquisition expands their operational footprint in the southeastern United States.

- In March 2022, Astec Industries agreed to acquire MINDS Automation Group, a leader in plant automation control systems for the asphalt industry. This acquisition is expected to enhance Astec’s technological capabilities and market reach.

Report Scope

Report Features Description Market Value (2023) USD 5.1 Billion Forecast Revenue (2033) USD 7.0 Billion CAGR (2024-2032) 3.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Portable, Stationary), By Product Type (Batch Mix, Drum Mix, Continuous Mix), By Production Capacity (Below 240t/h, 240t/h-320t/h, Above 320t/h), By Application (Road Construction, Parking Lots, Pedestrian Paths, Bridge, Others), By End User (Residential, Non-residential) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape 4B Construction Corporation, Ammann Group Holding AG, Arky Construction, ASTEC, Atlas Industries, Aztec Industries Inc., Benninghoven, Capious Roadtech Pvt. Ltd., GP Gunter Papenburg AG, Lintec & Linnhoff Germany GmbH, Marini S.p.A, Nikko Company Limited, Solmec Earthmovers Pvt. Ltd, Speed Crafts Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Asphalt Mixing Plant MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

Asphalt Mixing Plant MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- 4B Construction Corporation

- Ammann Group Holding AG

- Arky Construction

- ASTEC

- Atlas industries

- Aztec Industries Inc.

- Benninghoven

- Capious Roadtech Pvt. Ltd.

- GP Gunter Papenburg AG

- Lintec & Linnhoff Germany GmbH

- Marini S.p.A

- Nikko Company Limited

- Solmec Earthmovers Pvt. Ltd

- Speed Crafts