Global Traffic Road Marking Coatings Market By Product Type (Paint, Thermoplastic, Preformed Polymer Tape, Epoxy, Others), By Type (Permanent and Removable), By Type of Marking (Flat Marking and Extruded Marking), By Application (Road and Highway Marking, Pavement Marking, Parking Lot Marking, Factory Marking, Airport Marking, Field Marking and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 128697

- Number of Pages: 271

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

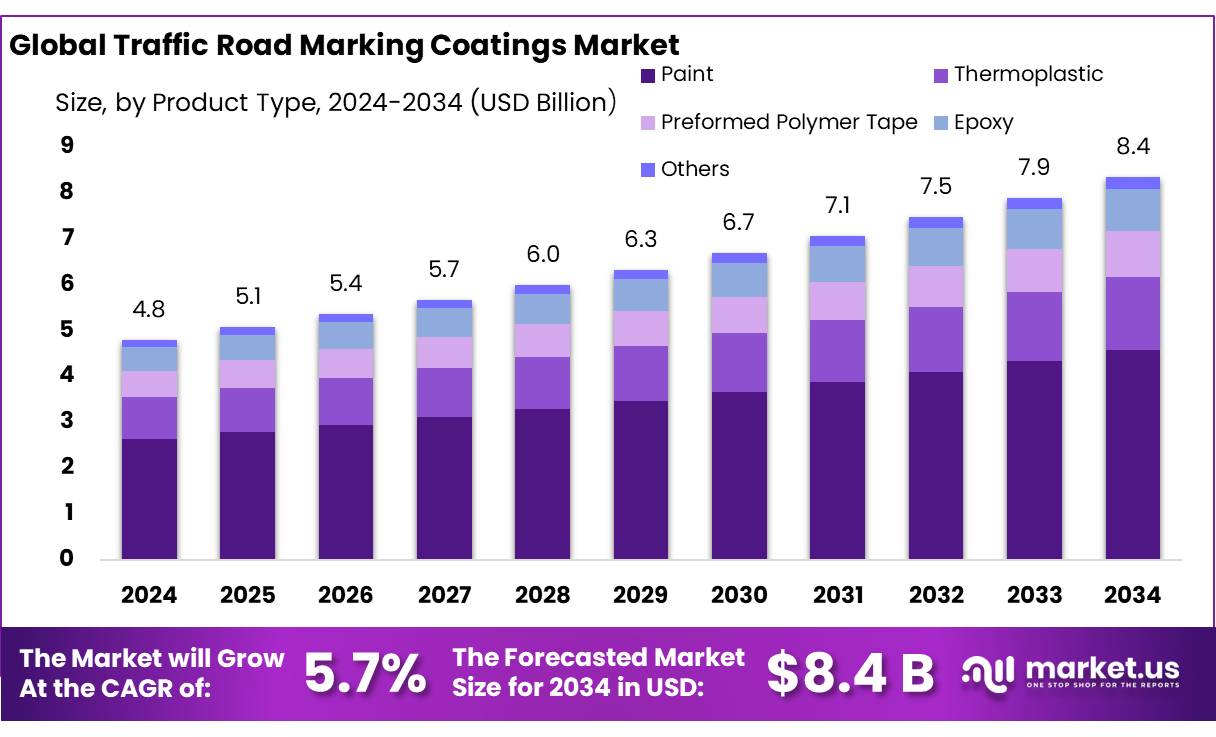

The Global Traffic Road Marking Coatings Market size is expected to be worth around USD 8.3 Billion by 2034, from USD 4.8 Billion in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034.

Road markings defined as lines, patterns, or symbols applied directly on road surfaces or kerbs to control, guide, inform, or warn road users serve as a visual language essential for efficient traffic management. These coatings are primarily composed of materials such as thermoplastics, waterborne paints, solvent-based paints, and cold plastics, each suited for specific road types, climate conditions, and durability requirements.

The expansion of global road infrastructure, rising urbanization, and increasing vehicle density are key forces driving demand for advanced road marking solutions. The global traffic road marking coatings market plays a vital role in ensuring road safety, guiding traffic flow, and reducing accident risks across urban and rural transportation systems.

Coating materials are expected to not only withstand heavy traffic but also endure diverse weather conditions such as high UV exposure, rainfall, and freeze-thaw cycles. This has led to growing adoption of durable materials such as thermoplastic and cold plastic coatings which offer high reflectivity, skid resistance, and longer service life. Particularly, thermoplastic coatings are widely used in high-traffic areas due to their durability and fast-drying characteristics, especially in countries with extreme weather patterns. Technological innovation is reshaping the market dynamics.

Key Takeaways

- The global traffic road marking coatings market was valued at USD 4.8 billion in 2024.

- The global traffic road marking coatings market is projected to grow at a CAGR of 5.7% and is estimated to reach USD 8.3 billion by 2034.

- Among product types, paint accounted for the largest market share of 54.8%.

- Among types, permanent traffic road marking coatings led the market with a largest share of 65.3%.

- Among type of markings, flat marking traffic road marking coatings led the market with a largest share of 63.4%.

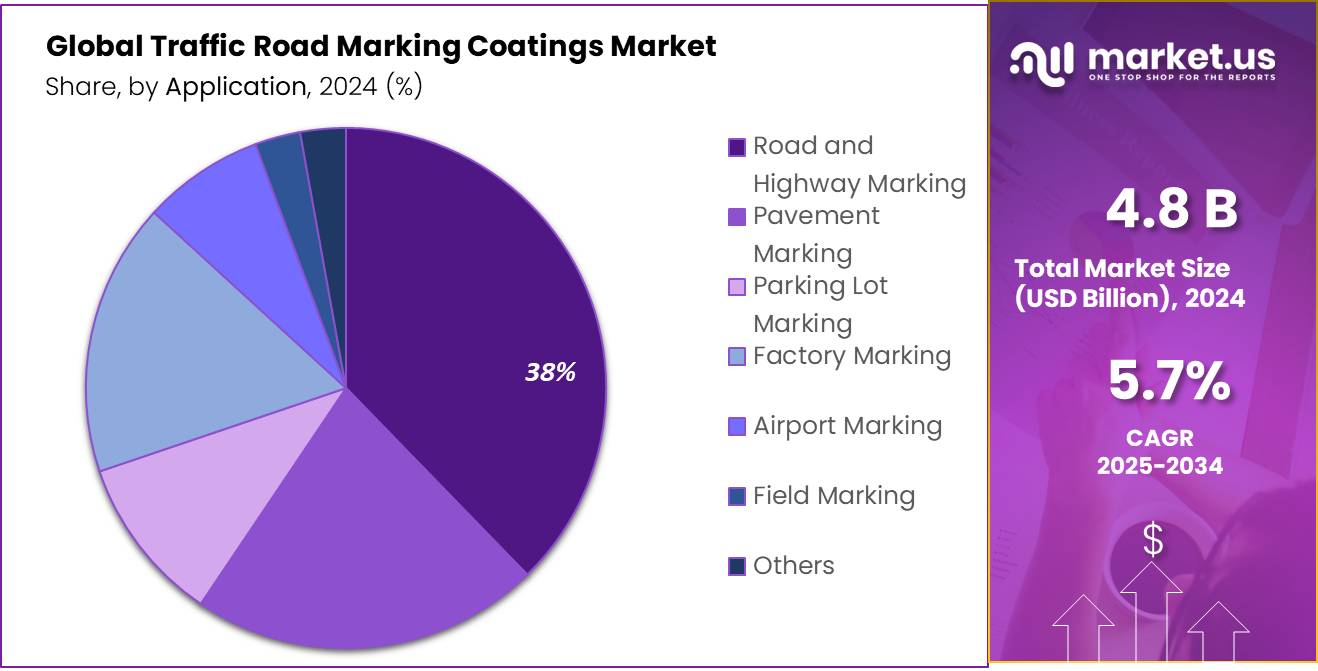

- Based on application, road and highway marking accounted for the majority of the market share 38.6%.

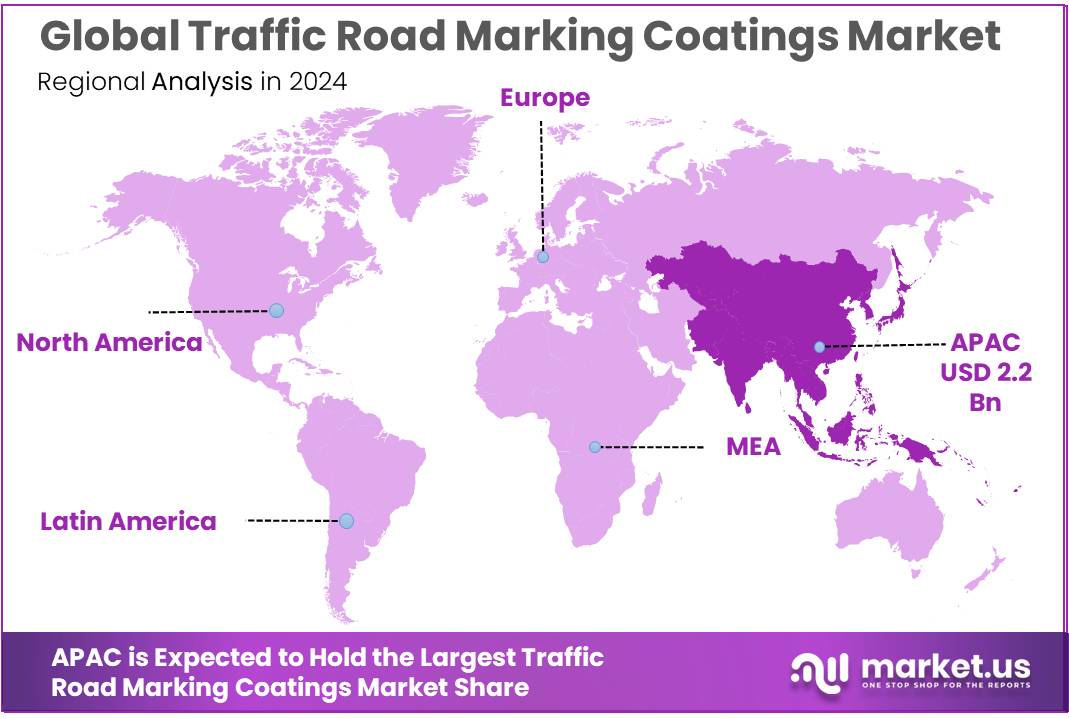

- Asia-Pacific is estimated as the largest market for traffic road marking coatings with a share of 47.7% of the market share and is anticipated to register the highest CAGR of 6.1%.

- Europe with a revenue share of 21.4% in 2024 and expected to register a CAGR of 5.2%.

Product Type Analysis

Paints Dominated the Market, Owing to Its Cost-Effectiveness, and Ease of Application

The traffic road marking coatings market is segmented based on product type as paint, thermoplastic, preformed polymer tape, epoxy & others. In 2024, the paint segment held a significant revenue share of 54.8% in the global traffic road marking coatings market due to its cost-effectiveness, ease of application, and widespread use for standard road marking needs across both developed and developing regions. Paint-based markings are widely adopted for their quick-drying properties, compatibility with various road surfaces, and suitability for both urban and rural infrastructures. They require minimal specialized equipment, making them ideal for maintenance and short-term road marking projects, particularly in regions with budget constraints.

Moreover, governments and municipal bodies often prefer paint due to its lower upfront cost and the ability to reapply it frequently, ensuring visibility and safety compliance. In contrast, other alternatives like thermoplastics or epoxy may offer higher durability but come at a higher cost and require more complex installation processes. The paint segment also benefits from regulatory support, as many road safety guidelines around the world continue to approve waterborne and solvent-based paints for highways and city streets. This combination of affordability, flexibility, and regulatory acceptance solidified its dominant share the global market in 2024.

Global Traffic Road Marking Coatings Market, By Product Type, 2020-2024 (USD Mn)

Product Type 2020 2021 2022 2023 2024 Paint 2,164.5 2,275.4 2,384.2 2,504.6 2,636.6 Water-Based 1,586.3 1,667.9 1,747.9 1,835.8 1,934.4 Solvent-Based 578.3 607.5 636.3 668.8 702.2 Thermoplastic 1,052.3 1,098.0 1,145.4 1,202.3 1,267.1 Preformed Polymer Tape 367.8 383.9 400.2 419.8 442.2 Epoxy 300.5 309.6 318.3 329.1 341.6 Others 109.9 112.5 114.8 117.5 120.4 Type Analysis

Permanent Traffic Road Marking Coatings Dominates Global Market.

Based on type, the market is further divided into permanent and removable. In 2024, the permanent type accounted for the largest share of 65.3% the global traffic road marking coatings market, due to its critical role in long-term traffic regulation and infrastructure planning. Permanent road markings are essential for highways, expressways, and city roads where consistent and durable lane guidance, pedestrian crossings, and traffic symbols are required for daily safety and efficient traffic flow.

These markings are designed to withstand harsh weather, heavy traffic loads, and UV exposure, making them the preferred choice for authorities focused on reducing maintenance frequency and ensuring long-term visibility. Governments and municipal agencies across regions continue to prioritize investments in long-lasting road safety infrastructure to minimize recurring costs and disruptions. Permanent markings also align with broader urban development goals, especially in smart cities and expanding metropolitan areas where traffic volume and regulatory demands are higher.

Additionally, the widespread use of thermoplastic coatings, epoxy-based materials, and durable paints—all predominantly used for permanent applications—further supported the segment’s dominance. In contrast, removable markings are typically used for temporary construction zones or detours, representing a smaller share due to limited use cases. The reliability, durability, and regulatory demand for fixed traffic guidance made permanent markings the leading type in 2024, securing of the global market share.

Global Traffic Road Marking Coatings Market, By Type, 2020-2024 (USD Mn)

Type 2020 2021 2022 2023 2024 Permanent 2,586.7 2,714.1 2,840.4 2,981.9 3,139.3 Removable 1,408.4 1,465.3 1,522.6 1,591.4 1,668.7 Type of Marking Analysis

The flat marking segment held the largest share of 63.4% in the global traffic road marking coatings market due to its widespread use, cost efficiency, and compatibility with a wide range of road types. Flat markings, typically applied using spray or roller techniques, are extensively used for lane lines, edge markings, pedestrian crossings, and basic traffic symbols across highways, city roads, and parking lots. Their quick application process and lower material consumption make them a preferred choice for both new projects and routine maintenance.

Flat markings are also highly adaptable to various coating types such as paint, thermoplastic, and cold plastic, and can be used on both asphalt and concrete surfaces. Additionally, they provide sufficient visibility and durability for standard traffic conditions, making them suitable for the majority of public road systems worldwide. Since most road infrastructure does not require the higher build or tactile features of extruded markings, flat markings continue to dominate due to their functionality, ease of application, and economic value.

Global Traffic Road Marking Coatings Market, By Type of Marking, 2020-2024 (USD Mn)

Type of Marking 2020 2021 2022 2023 2024 Flat Marking 2,546.7 2,664.3 2,778.4 2,905.8 3,046.1 Extruded Marking 1,448.4 1,515.1 1,584.6 1,667.5 1,761.8 Application Analysis

Based on type of markings, the market is further divided into road & highway marking, pavement marking, parking lot marking, factory marking, airport marking, field marking & others. In 2024, the road and highway marking segment accounted for the largest share of 38.6% in the global traffic road marking coatings market due to the sheer scale, critical safety role, and continuous demand for maintenance and upgrades in global transportation infrastructure.

Road and highway networks are the backbone of mobility in every country, requiring clearly visible markings to ensure lane discipline, vehicle flow, pedestrian safety, and traffic regulation. These markings—such as centerlines, edge lines, arrows, and pedestrian crossings are mandatory across virtually all road categories, from city streets to national highways.

Governments consistently allocate significant budgets for highway expansion, repair, and smart transportation initiatives, which drive recurring demand for durable and high-visibility coatings. Unlike temporary or indoor markings, road and highway applications face constant exposure to heavy traffic loads, rain, sunlight, and wear, necessitating frequent reapplication and use of high-performance materials such as thermoplastics, epoxy, or long-lasting paint.

Emerging economies are also rapidly investing in road infrastructure under national development programs, further boosting this segment. The essential nature of road safety, coupled with increasing vehicle volumes globally, solidified the dominance of road and highway markings.

Global Traffic Road Marking Coatings Market, By Application, 2020-2024 (USD Mn)

Application 2020 2021 2022 2023 2024 Road and Highway Marking 1,504.3 1,587.2 1,669.0 1,758.6 1,857.0 Pavement Marking 881.7 924.1 967.5 1,018.6 1,075.9 Parking Lot Marking 456.7 472.5 488.1 507.5 529.8 Factory Marking 336.6 350.2 363.7 379.6 397.9 Airport Marking 379.8 396.0 412.9 433.2 456.3 Field Marking 247.2 255.2 262.7 271.0 280.2 Others 188.7 194.2 199.1 204.7 210.8 Key Market Segments

By Product Type

- Paint

- Water-Based

- Solvent-Based

- Thermoplastic

- Preformed Polymer Tape

- Epoxy

- Others

By Type

- Permanent

- Removable

By Type of Marking

- Flat Marking

- Extruded Marking

By Application

- Road & Highway Marking

- Pavement Marking

- Parking Lot Marking

- Factory Marking

- Airport Marking

- Field Marking

- Others

Drivers

Increasing Investment in Public Infrastructure Across Developing and Developed Nations Expected to Boost the Traffic Road Marking Coatings Market.

The rising investment in public infrastructure across both developing and developed nations is a major driver fueling demand in the global traffic road marking coatings market. Countries are increasingly prioritizing road and transport development to support economic growth, urbanization, logistics, and public safety each of which depends heavily on road marking systems to function effectively. For instance, the United States Infrastructure Investment and Jobs Act (IIJA) signed into law in November 2021 allocated over $1.2 trillion for infrastructure, of which $110 billion was designated for roads, bridges, and highway improvements.

- Global infrastructure spending is projected to grow significantly, from $4 trillion per year in 2012 to over $9 trillion per year by 2025. Cumulatively, close to $78 trillion is expected to be invested globally between 2014 and 2025.

- India’s infrastructure spending has grown rapidly, with budget allocations reaching ₹10 lakh crore (about $120 billion) in 2023–24.

Smart city programs in nations such as Saudi Arabia (NEOM), Singapore (Land Transport Master Plan), and South Korea (U-City) further encourage investment in advanced road coating solutions, such as glow-in-the-dark lines and machine-readable patterns for autonomous vehicles. In conclusion, rising global investment in road, highway, and urban infrastructure—driven by economic stimulus, urbanization, and global connectivity—has led to a sustained increase in demand for traffic road marking coatings.

These coatings play a foundational role in enabling road functionality, safety, and smart transportation ecosystems. With billions in confirmed government and multilateral funding committed across multiple continents, the market is poised for long-term growth rooted in real infrastructure development rather than speculative demand.

Restraints

Higher Plastic Pollution From Road Markings Paints May Hamper The Growth Of the Market

Plastic pollution originating from road marking paints is emerging as a significant environmental concern and an increasingly important restraint on the global traffic road marking coatings market. Thermoplastic paints widely used worldwide due to their high durability and retro reflectivity are among the largest contributors to micro plastic leakage into the environment. Although thermoplastics have relatively lower leakage rates compared to solvent- and water-based coatings, their widespread use amplifies their overall impact.

According to an analysis, thermoplastics account for a 73% leakage rate, while solvent- and water-based paints exhibit leakage rates of around 78%. This slight performance advantage is attributed to thermoplastics being three to four times more durable, requiring less frequent reapplication. However, the wear and tear from vehicle movement, weather exposure, and road maintenance still leads to substantial plastic shedding. Globally, the total plastic leakage from road markings is estimated at 143,000 metric tons per year, with 82% of this leakage caused by abrasion during regular use a form of gradual micro plastic release that is difficult to collect or monitor.

- Approximately 74% of all paint used in the road marking sector ultimately enters the environment, contributing around 173 kilotons of plastic waste. Out of this, nearly 91 kilotons are estimated to leak into oceans and waterways. Particularly, 99% of this leakage occurs in the form of micro plastics.

- In 2019, a total of 234 kilotons of plastic were utilized in the production of road marking paints.

Opportunity

Green Road Marking Technology Development Is Anticipated To Create More Opportunities For Emerging Players

The development of green road marking technologies represents both a significant driver and a transformative opportunity for the global traffic road marking coatings market. As countries enforce stricter environmental regulations and pursue net-zero emission goals, there is growing pressure on public infrastructure systems to adopt sustainable and low-emission materials. Traditional solvent-based traffic paints often contain high levels of volatile organic compounds (VOCs), which contribute to air pollution and worker exposure risks.

Regulatory agencies such as the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) have already placed VOC limits on coatings used in outdoor applications, including traffic markings. In California, for instance, the California Air Resources Board (CARB) mandates VOC content in traffic paints to be under 100 grams per liter, leading to a shift toward waterborne and high-solid coatings. This transition has spurred innovation in eco-friendly marking solutions, such as cold-applied plastics (CAP), water-based acrylic paints, and bio-based binders, which reduce emissions and improve sustainability.

The European Union’s Green Deal and Sustainable Procurement Guidelines have further driven adoption by requiring government-funded road projects to prioritize low-emission, recyclable, and longer-lasting marking systems. Additionally, Japan’s Ministry of the Environment has supported R&D into energy-efficient, long-life coatings through its Low Carbon Technology Plan, while Germany’s Federal Environment Agency (UBA) promotes the use of thermoplastic coatings that meet Blue Angel eco-label standards.

These advancements are not only regulatory responses but also market opportunities, as cities and transport authorities seek products that meet environmental certification requirements and reduce maintenance cycles. For example, reflective thermoplastics with embedded glass beads offer both durability and lower carbon footprints due to fewer reapplications over time.

Trends

3D Marking and High-speed Construction

The growing adoption of 3D marking and high-speed construction technologies is reshaping the global traffic road marking coatings market by addressing critical needs for road safety, visual effectiveness, and operational efficiency. 3D road marking technology uses advanced visual illusion designs that create a three-dimensional appearance on flat surfaces.

These optical effects significantly enhance driver awareness and instinctively prompt a reduction in speed—by approximately 30–40%—without relying on physical speed breakers. This makes 3D markings particularly valuable in high-risk zones such as school crossings, pedestrian-heavy areas, and accident-prone intersections.

The technology employs special composite materials engineered with a controlled surface friction coefficient to maintain safety during wet or high-speed conditions, while also offering increased durability to withstand high traffic volumes and environmental wear. Additionally, dynamic display features—such as active light-emitting lines using LEDs—enhance visibility at night or during adverse weather, further contributing to traffic safety.

Geopolitical Impact Analysis

Trade Tariff Policies Have Impacted Import/Export and Disrupted The Global Supply Chain Activities.

The United States has imposed a range of tariffs over the past years that have significantly affected the global flow of coating materials, including those used in traffic road marking. As of 2024, coatings, paints, and related chemical products are subject to various import duties under depending on composition. For instance, acrylic-based waterborne paints used for road markings face duties up to 6.5% on imports from developed nations, as listed by U.S. International Trade Commission (USITC).

However, since the U.S.-China tariff escalation beginning in 2018, especially under Section 301 targeting Chinese imports, have raised the cost of key raw materials for traffic coating products—including titanium dioxide, epoxy resins, and specialty additives—by 12% to 28% for U.S. manufacturers. The impact of these tariffs has been particularly acute in the traffic marking sector, which heavily relies on Chinese exports of titanium dioxide, resins, and glass beads key inputs in thermoplastic and reflective paints.

The result is a noticeable rise in input costs for U.S.-based manufacturers and contractors. This has also triggered downstream cost pressures in road construction projects managed by departments of transportation (e.g., FHWA), which must rebid or revise procurement budgets to account for the rise in material costs.

Regional Analysis

Asia-Pacific Held the Largest Share of the Global Traffic Road Marking Coatings Market

In 2024, Asia-Pacific dominated the global traffic road marking coatings market with a 47.7% share, driven by a combination of large-scale infrastructure development, rapid urbanization, increasing vehicle ownership, and strong government investment in road safety initiatives. The region, home to some of the world’s fastest-growing economies like China, India, Indonesia, and Vietnam, has been witnessing an unprecedented expansion of road networks to support economic growth and urban mobility.

National programs such as India’s Bharatmala Pariyojana, China’s Belt and Road Initiative (BRI), and Indonesia’s National Strategic Projects have prioritized the construction and maintenance of highways, expressways, and smart urban roadways. These massive road-building efforts generate continuous demand for traffic marking coatings to guide vehicles, manage traffic flow, and improve commuter safety.

Additionally, Asia-Pacific has seen a sharp rise in vehicle ownership and traffic density over the past decade, leading to a heightened need for effective lane markings, pedestrian crossings, warning signs, and directional guidance. This surge in traffic volume requires frequent maintenance and re-application of durable coatings such as thermoplastics and cold-applied plastics to ensure visibility and longevity under heavy wear. Governments across the region are also enforcing stricter road safety standards in response to high accident rates, further fueling demand for high-performance road marking solutions.

Global Traffic Road Marking Coatings Market, By Region, 2020-2024 (USD Mn)

Region 2020 2021 2022 2023 2024 North America 699.1 732.6 768.7 806.9 849.6 Europe 882.9 919.3 943.1 984.0 1,029.6 Asia Pacific 1,869.7 1,963.3 2,064.4 2,171.8 2,291.6 Middle East & Africa 255.7 265.8 276.8 288.3 301.2 Latin America 287.6 298.4 310.0 322.2 335.9 Key Regions and Countries Covered

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In the Traffic Road Marking Coatings Market, Companies Sustain Their Competitive Edge By Leveraging A Mix Of Innovation, Regulatory Compliance, Cost-Efficiency, And Regional Presence.

In the Traffic Road Marking Coatings Market, companies sustain their competitive edge through a blend of innovation, regulatory compliance, and strategic positioning. Continuous investment in R&D allows them to develop high-performance, durable, and eco-friendly coatings that meet stringent environmental standards, such as low-VOC and lead-free formulations.

Firms that offer waterborne, thermoplastic, and cold plastic coatings are gaining preference, especially in regions with harsh climates or heavy traffic. Cost competitiveness is maintained by optimizing production, integrating supply chains, and establishing regional manufacturing hubs to reduce logistics expenses.

The following are some of the major players in the industry

- The Sherwin-Williams Company

- The 3M Company

- ATS Traffic

- AutoMark Technologies (India) Pvt. Ltd.

- Berger Paints

- Crown

- Dow Inc.

- Dulux Protective Coatings

- PPG Industries, Inc.

- Geveko Markings

- Kansai Paint Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- Pidilite Industries

- SealMaster

- Other Key Players

Key Development

- In April 2022, Sherwin-Williams Company announced the successful completion of its acquisition of Sika AG’s European industrial coatings business. The newly acquired operations will be integrated into Sherwin-Williams’ Performance Coatings Group segment.

- In July 2023, PPG is set to construct a new 250,000-square-foot paint and coatings manufacturing facility in Loudon County, Tennessee. This will be the company’s first new manufacturing plant in the U.S. in over 15 years. Initially, the plant will focus on producing paint and coating products specifically for automotive manufacturers and parts suppliers.

Report Scope

Report Features Description Market Value (2024) US$ 4.8 Bn Forecast Revenue (2034) US$ 8.3 Bn CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Paint, Thermoplastic, Preformed Polymer Tape, Epoxy, Others), By Type (Permanent and Removable), By Type of Marking (Flat Marking and Extruded Marking), By Application (Road and Highway Marking, Pavement Marking, Parking Lot Marking, Factory Marking, Airport Marking, Field Marking & Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape The Sherwin-Williams Company, The 3M Company, ATS Traffic, AutoMark Technologies (India) Pvt. Ltd., Berger Paints, Crown, Dow Inc., Dulux Protective Coatings, PPG Industries, Inc., Geveko Markings, Kansai Paint Co., Ltd., Nippon Paint Holdings Co., Ltd., Pidilite Industries, SealMaster, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Traffic Road Marking Coatings MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Traffic Road Marking Coatings MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- The Sherwin-Williams Company

- The 3M Company

- ATS Traffic

- AutoMark Technologies (India) Pvt. Ltd.

- Berger Paints

- Crown

- Dow Inc.

- Dulux Protective Coatings

- PPG Industries, Inc.

- Geveko Markings

- Kansai Paint Co., Ltd.

- Nippon Paint Holdings Co., Ltd.

- Pidilite Industries

- SealMaster

- Other Key Players