Global Texture Paints Market Size, Share, And Business Benefits By Type (Smooth Texture Paint, Sand Texture Paint, Popcorn Texture Paint, Knockdown Texture Paint, Others), By Resin Type (Acrylic, Epoxy, Alkyd, Others), By Technology (Water-based, Solvent-based, Powder Coatings), By Method (Roller, Brush, Spray, Trowel, Others), By Application (Interior, Exterior), By End-use (Residential, Commercial, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146661

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Type Analysis

- By Resin Type Analysis

- By Technology Analysis

- By Method Analysis

- By Application Analysis

- By End-use Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

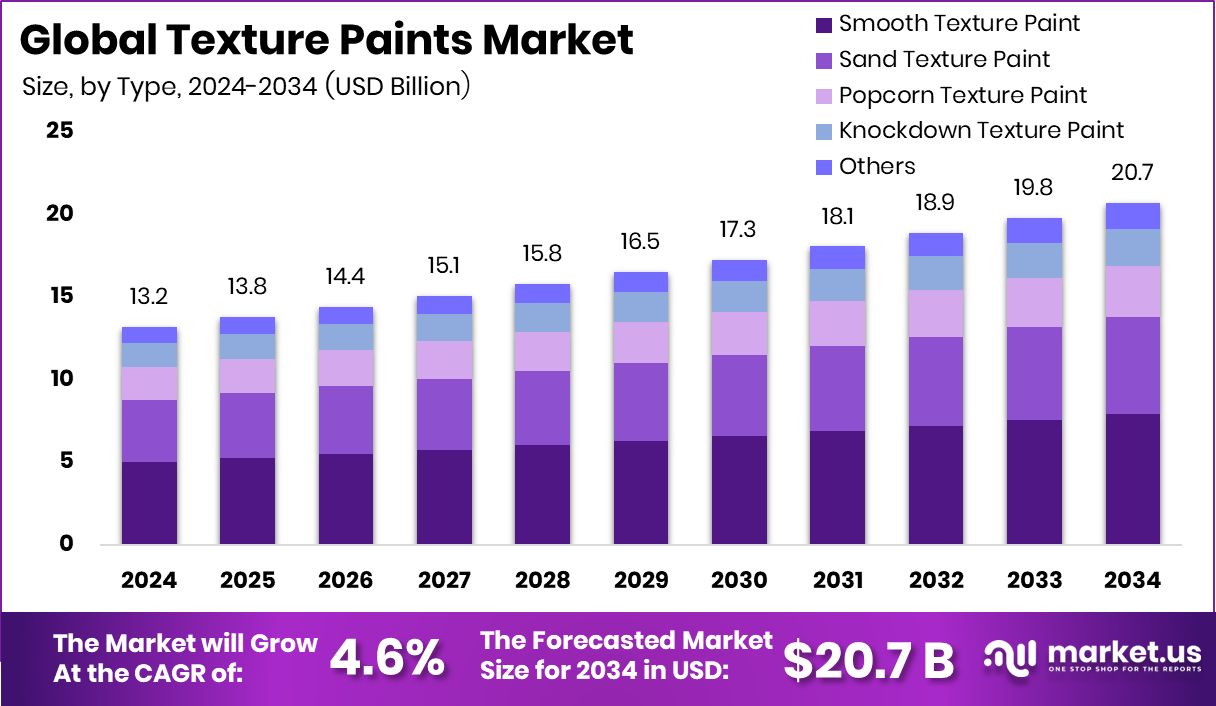

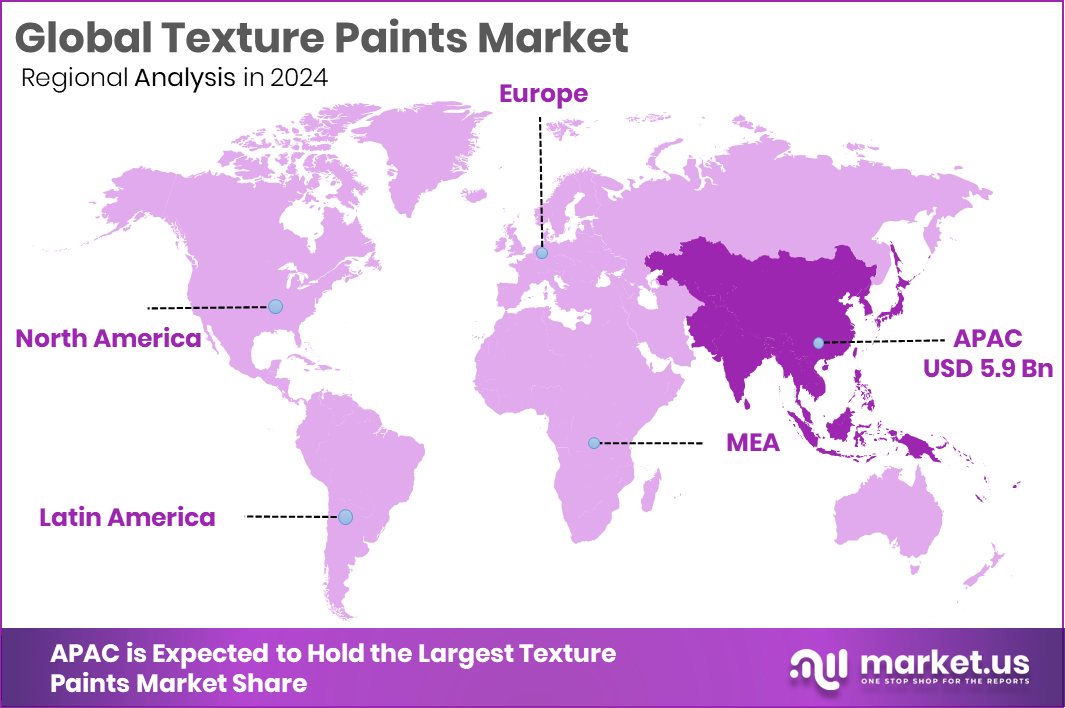

Global Texture Paints Market is expected to be worth around USD 20.7 billion by 2034, up from USD 13.2 billion in 2024, and grow at a CAGR of 4.6% from 2025 to 2034. Asia-Pacific leads regional growth in Texture Paints, valued at USD 5.9 billion.

Texture paints are specially formulated decorative coatings applied to walls and ceilings to create tactile and visual surface effects. These paints come with added coarse particles like sand, quartz, or synthetic polymers, allowing them to produce patterns such as sand swirl, popcorn, or stucco finishes. They not only enhance the aesthetic appeal of spaces but also help hide surface imperfections.

The texture paints market includes all products and solutions associated with textured coatings used across construction, real estate, infrastructure, and renovation projects. It spans product types like acrylic, emulsion, and spray-based textures. The market is shaped by consumer preferences for premium wall finishes, urban construction growth, and evolving interior design trends.

Urbanization and smart city developments are driving large-scale construction projects, increasing the use of decorative and protective paints. Governments investing in housing schemes and infrastructure push demand for textured paints. Additionally, rising disposable incomes are shifting consumer preferences toward high-end wall finishes, boosting growth.

India’s chemical industry, which forms the backbone of paint manufacturing, is a significant contributor to the nation’s economy. According to the Department of Scientific and Industrial Research (DSIR), the chemical industry accounts for approximately 14% of the country’s total manufacturing output, with a turnover of about USD 30.8 billion. Within this framework, the paints and coatings sector has witnessed substantial growth, driven by increasing urbanization, rising disposable incomes, and a surge in infrastructure development.

Key Takeaways

- Global Texture Paints Market is expected to be worth around USD 20.7 billion by 2034, up from USD 13.2 billion in 2024, and grow at a CAGR of 4.6% from 2025 to 2034.

- In Texture Paints Market, smooth texture paint held a 38.2% share by type in 2024.

- Acrylic-based texture paints led by a 56.3% share, dominating the resin type segment in global applications.

- The water-based texture paints secured a 63.4% share, showing eco-preference and growing environmental awareness globally.

- In application methods, the roller method was dominant with 38.5% usage across commercial and residential interiors.

- Interior applications accounted for 59.1% market share, driven by demand in decorative and protective wall coatings.

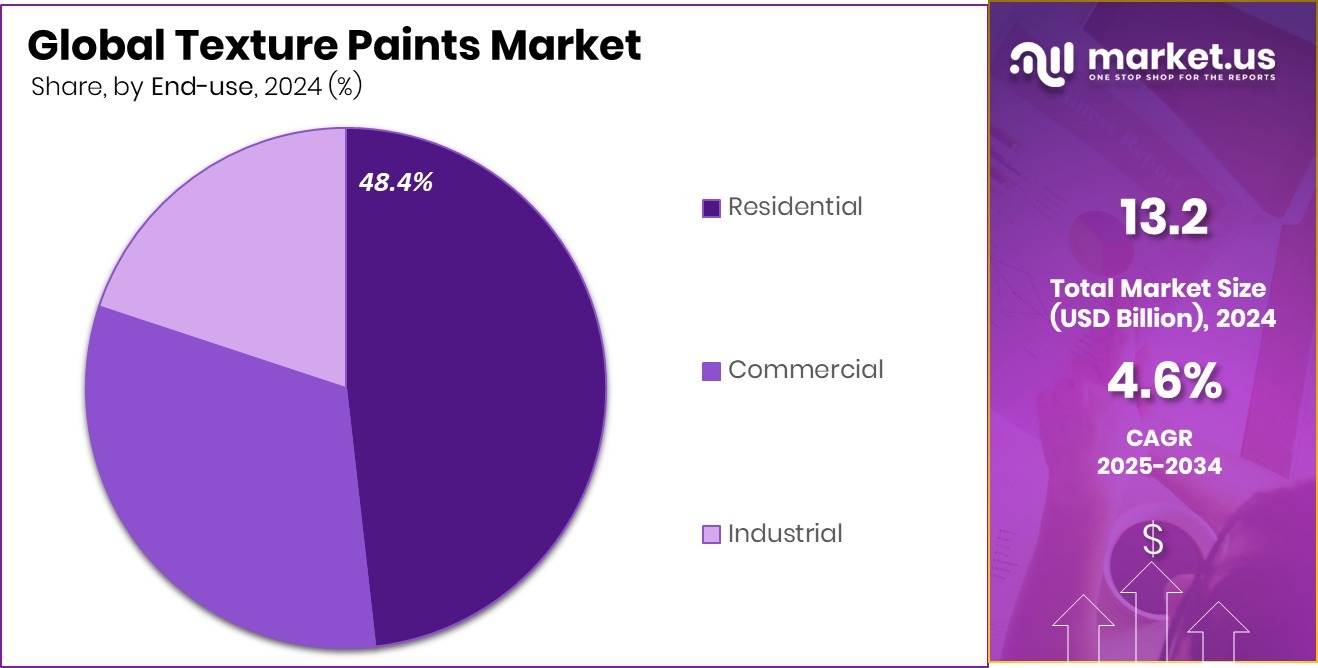

- The residential sector dominated end-use with a 48.4% share, showing a rising preference for textured finishes in homes.

- Strong urbanization in Asia-Pacific boosts Texture Paints’ demand, holding 45.3% market share.

By Type Analysis

Smooth texture paint holds 38.2% market share by type in 2024.

In 2024, Smooth Texture Paint held a dominant market position in the By Type segment of the Texture Paints Market, with a 38.2% share. This leading stance reflects the increasing preference among consumers and contractors for finishes that offer both aesthetic appeal and durability.

The popularity of Smooth Texture Paint can be attributed to its versatile application across various substrates, making it ideal for both interior and exterior use. Additionally, its ease of application, coupled with a growing demand for renovation and new construction projects, has significantly driven its market penetration.

The texture paint segment further benefited from advancements in formulation technology, enhancing the paint’s performance against environmental factors and wear. Market trends also indicate a rising inclination towards eco-friendly and low-VOC paint products, which Smooth Texture Paint manufacturers have capitalized on to fortify their market position.

By Resin Type Analysis

Acrylic resin type dominates texture paints with a 56.3% market share globally.

In 2024, Acrylic held a dominant market position in the By Resin Type segment of the Texture Paints Market, with a 56.3% share. This leadership is primarily driven by acrylic’s superior properties, including excellent durability, color retention, and resistance to weathering, which make it highly suitable for both indoor and outdoor applications.

Acrylic texture paints have been increasingly favored for their quick-drying characteristics and their ability to adhere to a variety of surfaces, ranging from wood and plaster to concrete and metal.

The segment’s growth is also supported by the rising trend of DIY home renovations and the expansion of residential and commercial construction sectors globally. As environmental regulations become stricter, the demand for water-based acrylic paints, known for their low volatile organic compound (VOC) levels, has surged.

By Technology Analysis

Water-based technology leads the segment with a 63.4% share in 2024 globally.

In 2024, Water-based technology held a dominant market position in the By Technology segment of the Texture Paints Market, with a 63.4% share. This significant market share is largely attributed to the growing environmental awareness and stringent regulations regarding VOC emissions, which have driven both consumers and industries toward safer, more sustainable painting solutions.

The robust growth of this segment is also supported by technological advancements that have improved the performance of water-based paints, rivaling that of their solvent-based counterparts. These paints now offer enhanced durability, quicker drying times, and resistance to cracking and fading, making them suitable for a wide range of applications, from residential projects to large-scale commercial buildings.

Furthermore, the ease of cleanup and maintenance, combined with health benefits due to fewer harmful emissions, continue to boost the popularity of water-based texture paints.

By Method Analysis

Roller application method captures 38.5% share in the texture paints market.

In 2024, Roller held a dominant market position in the By Method segment of the Texture Paints Market, with a 38.5% share. This predominance stems from the roller method’s widespread adoption due to its efficiency, ease of use, and ability to provide consistent texture finishes quickly over large surface areas. Rollers are particularly favored in both residential and commercial painting projects for their ability to evenly distribute paint, which is crucial for achieving uniform texture effects.

The preference for rollers is also influenced by the growing DIY trend, as rollers require less skill and preparation compared to more specialized techniques like spraying or troweling. This accessibility makes them a popular choice among homeowners looking to undertake home improvement projects themselves.

Additionally, the development of advanced roller designs and materials has enhanced their effectiveness in applying various types of textured paints, further boosting their market share.

By Application Analysis

Interior applications contribute 59.1% to the total texture paints market size.

In 2024, Interior held a dominant market position in the By Application segment of the Texture Paints Market, with a 59.1% share. This significant market dominance is driven by the increasing consumer inclination towards enhancing indoor aesthetics and the continuous innovation in interior design trends. Texture paints for interiors are highly valued for their ability to add depth and dimension to walls, making spaces more vibrant and personalized.

The demand for interior texture paints is bolstered by the booming residential construction sector and the renovation industry, where individuals are looking to modernize their living spaces. These paints are particularly popular in urban areas, where design differentiation and aesthetic appeal are key factors in property valuations.

Texture paints are also preferred for their practical benefits, such as hiding imperfections on walls and offering durable finishes that are easy to maintain. The advancement in paint technology has further improved their environmental sustainability, a critical factor as consumers increasingly prefer eco-friendly home decor options.

By End-use Analysis

Residential end-use accounts for 48.4% share in the texture paints market growth.

In 2024, Residential held a dominant market position in the By End-use segment of the Texture Paints Market, with a 59.1% share. This prominence is primarily driven by the escalating demand for personalized and aesthetically appealing home interiors among homeowners. Texture paints, offering varied finishes such as smooth, sand, and popcorn, have become a popular choice for adding character and style to residential spaces.

The residential sector’s preference for textured paints is further influenced by their functional benefits, including durability and the ability to mask imperfections on walls and ceilings. These paints are especially favored in new construction and home renovation projects, where both appearance and longevity are key considerations.

Market trends also show a growing interest in DIY home improvement projects, which has significantly contributed to the increased use of textured paints in residential settings. Homeowners are drawn to the ease of application and the transformative impact these paints have on living spaces.

Key Market Segments

By Type

- Smooth Texture Paint

- Sand Texture Paint

- Popcorn Texture Paint

- Knockdown Texture Paint

- Others

By Resin Type

- Acrylic

- Epoxy

- Alkyd

- Others

By Technology

- Water-based

- Solvent-based

- Powder Coatings

By Method

- Roller

- Brush

- Spray

- Trowel

- Others

By Application

- Interior

- Exterior

By End-use

- Residential

- Commercial

- Industrial

Driving Factors

Growing Construction Projects Fuel Texture Paint Demand

One major reason driving the texture paints market is the rapid rise in construction activities. Cities are expanding, and new buildings—both homes and offices—are being built across urban and semi-urban areas. People want attractive walls with unique finishes, and textured paints offer just that. They make walls look stylish while also protecting them from weather damage.

As a result, texture paints are being used more for interiors and exteriors alike. The demand is also rising due to housing projects and smart city developments. Supporting this growth, the total installed capacity of organized paint manufacturers reached about 4.3 billion litres per annum at the end of FY24, enabling supply to match rising demand.

Restraining Factors

High Competition from New Entrants Slows Growth

One major factor holding back the Texture Paints Market is the rising competition. Over 1 billion litres per annum of additional capacity, mostly from new entrants, is expected to come online during FY25–FY26. This represents a planned capacity addition of about 70% over the next 3–4 years. Such a massive increase in supply will crowd the market, making it harder for existing brands to maintain pricing power.

As a result, profit margins may drop, especially for smaller or regional players. This flood of new supply might also lead to overcapacity, reducing the incentive for established firms to expand further. It creates pricing pressure and limits overall market stability, making growth a challenge in the short term.

Growth Opportunity

Rising Organized Sector Drives Market Growth Ahead

One of the biggest growth opportunities in the texture paints market is the rising dominance of organized players. The share of organized players is set to rise to 80% in the medium term, driven by significant capacity expansions and regulatory shifts like GST implementation. These changes are simplifying the tax structure and encouraging smaller players to integrate into the organized sector.

With organized companies offering better product quality, stronger distribution networks, and branding, they’re likely to grab more market share. This shift benefits consumers through consistent product quality and also boosts formal sector revenues.

Latest Trends

Eco-Friendly Texture Paints Leading Market Growth

In 2025, the texture paint market is experiencing a significant shift towards eco-friendly options. Consumers are increasingly seeking paints that are safe for both their health and the environment.

This demand has led to the development of texture paints with low or zero volatile organic compounds (VOCs), which reduce harmful emissions. Manufacturers are also incorporating natural and recycled materials into their products, such as bio-based binders and mineral additives.

These sustainable paints not only minimize environmental impact but also offer benefits like improved indoor air quality and durability. The trend is further supported by government regulations promoting green building practices and the growing awareness of sustainable living among consumers.

Regional Analysis

Asia-Pacific dominates the Texture Paints Market with a 45.3% share, worth USD 5.9 Bn.

In 2024, the Asia-Pacific region held a dominant position in the global texture paints market, accounting for 45.3% of the total market share and reaching a value of USD 5.9 billion. This leadership is supported by rapid urban infrastructure development, rising housing demand, and increasing renovation activities across countries like China, India, and Southeast Asia.

The growing preference for decorative interior and exterior finishes among middle-income populations has further driven demand for textured paints in the region.

In North America, the market is influenced by steady residential and commercial construction activities, with demand driven by aesthetic upgrades and modern textured wall trends. Europe follows closely, with rising eco-friendly and sustainable paint preferences pushing the market forward, especially in Germany, France, and the UK.

The Middle East & Africa region is witnessing moderate growth, backed by new construction projects and climate-resistant texture paint demand in countries like the UAE and Saudi Arabia. Latin America presents steady potential, with Brazil and Mexico leading in residential paint adoption.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Akzo Nobel N.V. continues to solidify its position as a global leader in the texture paints market. The company’s emphasis on sustainable product development and innovation in decorative coatings helps it retain a strong competitive edge. With its Dulux brand being a well-known name in both developed and emerging markets, Akzo Nobel focuses on expanding its eco-friendly texture paint lines to meet rising demand for low-VOC products.

Asian Paints remains a dominant force, especially in Asia-Pacific, where it leverages its strong brand presence and widespread dealer network. The company focuses on customer-centric innovations, such as offering texture painting solutions with personalized design consultation services. In 2024, Asian Paints strengthened its product portfolio by introducing a series of texture finishes tailored for modern interior and exterior themes.

PPG Industries, Inc. holds a significant presence in North America and Europe, backed by its extensive R&D and durable coating technologies. In 2024, PPG emphasized advanced surface texture finishes catering to architectural and commercial sectors. The company invests in smart manufacturing and digital tools that help streamline color-matching and texture applications, making it a preferred brand among professionals.

Top Key Players in the Market

- Akzo Nobel N.V.

- Asian Paints

- PPG Industries, Inc.

- Kansai Paint Co. Ltd.

- Nippon Paint Holdings Co., Ltd.

- Berger Paints India

- The Sherwin-Williams Company

- Hempel A/S

- Jotun A/S

- SKK

- Axalta Coating Systems

- Tikkurila Oyj

- Crown Paints

- Indigo Paints

- JSW Paints

- Other Key Players

Recent Developments

- In November 2024, AkzoNobel’s Coil and Extrusion Coatings division launched the CERAM-A-STAR® Expressions Standard Color Palette. This high-performance textured coating offers wood grain aesthetics with enhanced durability, suitable for applications like lap siding and board and batten.

- In September 2024, PPG announced “Purple Basil” as its 2025 Color of the Year. This deep, dramatic purple hue, a blend of red and blue, resonates with consumers’ increasing confidence in using bold colors. Purple Basil’s versatility allows it to evoke different moods based on lighting and context, making it suitable for various interior and exterior design needs

- In July 2024, Asian Paints expanded its Mysuru manufacturing facility, doubling its capacity from 300,000 KL to 600,000 KL. This expansion aims to meet the growing demand for decorative paints, including textured finishes.

Report Scope

Report Features Description Market Value (2024) USD 13.2 Billion Forecast Revenue (2034) USD 20.7 Billion CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Smooth Texture Paint, Sand Texture Paint, Popcorn Texture Paint, Knockdown Texture Paint, Others), By Resin Type (Acrylic, Epoxy, Alkyd, Others), By Technology (Water-based, Solvent-based, Powder Coatings), By Method (Roller, Brush, Spray, Trowel, Others), By Application (Interior, Exterior), By End-use (Residential, Commercial, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Akzo Nobel N.V., Asian Paints, PPG Industries, Inc., Kansai Paint Co. Ltd., Nippon Paint Holdings Co., Ltd., Berger Paints India, The Sherwin-Williams Company, Hempel A/S, Jotun A/S, SKK, Axalta Coating Systems, Tikkurila Oyj, Crown Paints, Indigo Paints, JSW Paints, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Akzo Nobel N.V.

- Asian Paints

- PPG Industries, Inc.

- Kansai Paint Co. Ltd.

- Nippon Paint Holdings Co., Ltd.

- Berger Paints India

- The Sherwin-Williams Company

- Hempel A/S

- Jotun A/S

- SKK

- Axalta Coating Systems

- Tikkurila Oyj

- Crown Paints

- Indigo Paints

- JSW Paints

- Other Key Players