Global Fuel Cell Balance of Plant (BOP) Market Size, Share, And Business Benefits By Material (Structural Plastics, Elastomers, Coolants, Assembly Aids, Metals, Others), By Type (PEMFC BOP, SOFC BOP, Alkaline FC BOP, MCFC BOP, Anion Exchange Membrane Fuel Cell BOP), By Power Output (Below 50 KW, 50-250 kW, 250-1000 kW, Above 1000 kW), By Application (Cooling, Power Supply, Water Circulation, Hydrogen Processing, Heat Stabilizers, Others), By End User (Power Plants, Transportation Companies, Industrial Facilities, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2025

- Report ID: 141118

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

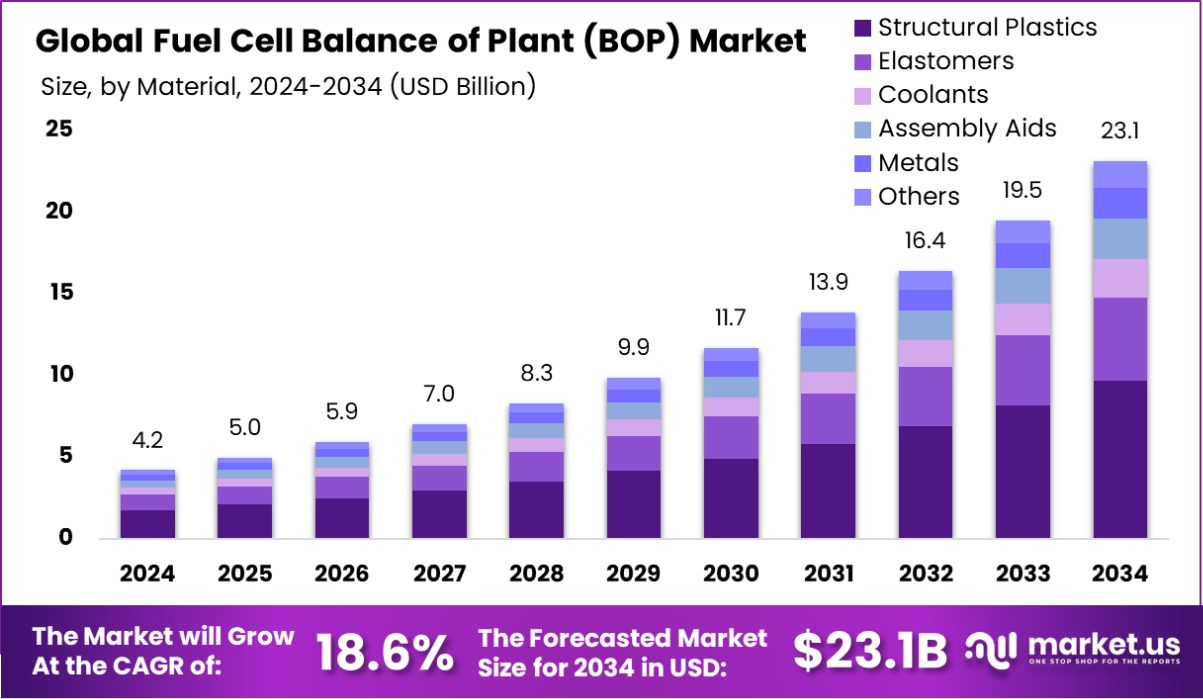

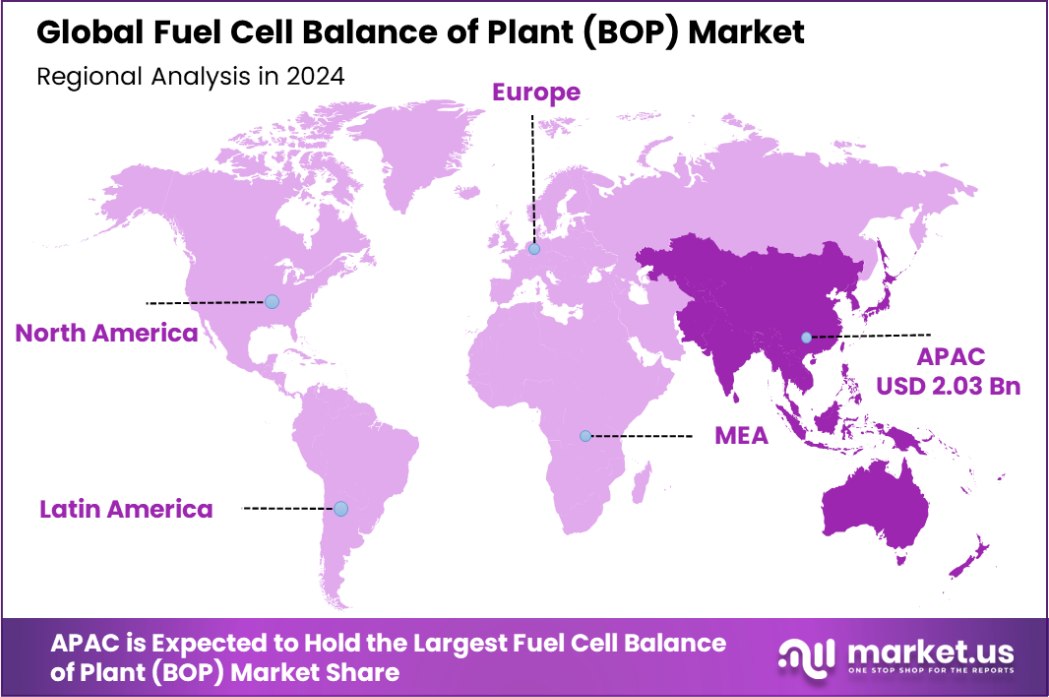

Global Fuel Cell Balance of Plant (BOP) Market is expected to be worth around USD 23.1 Billion by 2034, up from USD 4.2 Billion in 2024, and grow at a CAGR of 18.6% from 2025 to 2034. Asia-Pacific holds a 48.8% share of the Fuel Cell BOP market valued at USD 2.03 billion.

Fuel Cell Balance of Plant (BOP) refers to the peripheral components and systems required for the operation of a fuel cell beyond the fuel cell stack itself. These include systems like air compressors, pumps, heat exchangers, and control units, among others, that ensure efficient energy production and safety in fuel cell systems.

The BOP works in tandem with the fuel cell stack to manage fuel supply, heat, and water, which are critical to the fuel cell’s performance. It essentially supports the stack to convert chemical energy into electrical energy while maintaining operational stability and safety.

The growth of the Fuel Cell BOP market is largely driven by the increasing demand for sustainable and clean energy solutions. As governments around the world push for carbon neutrality and the reduction of fossil fuel dependency, fuel cell technology has gained significant attention due to its ability to generate clean power. Additionally, the rising investments in the renewable energy sector, coupled with advancements in hydrogen fuel cell technologies, have further accelerated the market’s growth.

The demand for Fuel Cell BOP is expanding, particularly in industries such as transportation (e.g., fuel cell electric vehicles), stationary power generation, and portable power applications. The growing shift toward zero-emission vehicles and green energy sources is increasing the need for efficient and cost-effective fuel cell systems. Furthermore, as fuel cells become more reliable and cost-competitive, the adoption rate across multiple sectors is rising.

The Fuel Cell BOP market presents significant opportunities, especially in the development of advanced, low-cost, and highly efficient BOP systems. As fuel cells continue to evolve, the opportunity to innovate in supporting technologies, such as more durable pumps, heat exchangers, and advanced control systems, will grow.

In February 2025, Ceres Power Holdings reported a record order intake exceeding £110 million in 2024, securing two new manufacturing partners and an electrolyzer system partner. In November 2024, Doosan Fuel Cell Co., Ltd. captured 72% of the market share (approximately 125MW) in the general hydrogen bidding market. In April 2024, Nel Hydrogen reported a 14% revenue increase compared to Q1 2023, with a 20% growth in the Alkaline electrolyzer segment, further boosting its position in the Fuel Cell Balance of Plant (BOP) market.

Key Takeaways

- Global Fuel Cell Balance of Plant (BOP) Market is expected to be worth around USD 23.1 Billion by 2034, up from USD 4.2 Billion in 2024, and grow at a CAGR of 18.6% from 2025 to 2034.

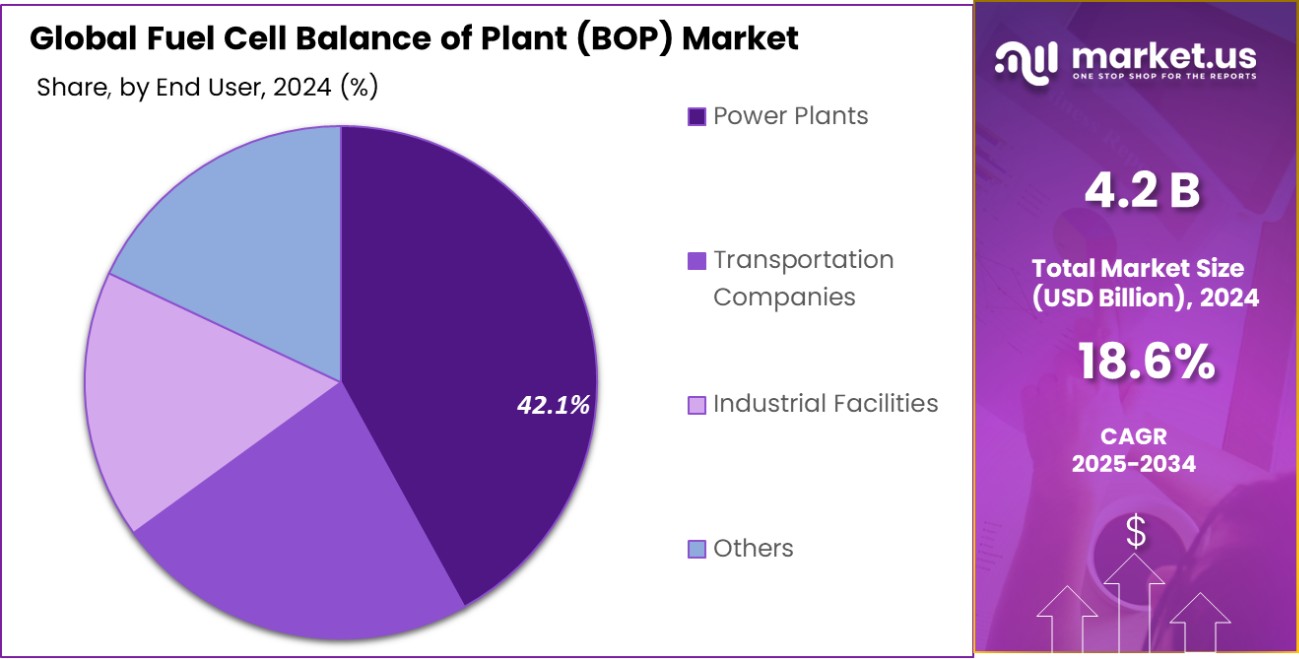

- Structural plastics account for 42.1% of the Fuel Cell BOP market.

- PEMFC BOP represents 48.5% of the overall Fuel Cell BOP market.

- Fuel Cell BOP in the 50-250 kW range is 38.4%.

- Power supply applications make up 34.2% of the Fuel Cell BOP market.

- Power plants are the dominant end-user, comprising 42.1% market share.

- In 2024, Asia-Pacific accounted for 48.8% of the Fuel Cell BOP Market, valued at USD 2.03 billion.

By Material Analysis

Structural plastics make up 42.1% of the Fuel Cell BOP market, offering lightweight and durable solutions.

In 2024, Structural Plastics held a dominant market position in the By Material segment of the Fuel Cell Balance of Plant (BOP) Market, with a 42.1% share. Structural plastics are widely used in the BOP due to their superior lightweight properties, resistance to corrosion, and cost-effectiveness.

These materials play a crucial role in the construction of various components such as manifolds, enclosures, and supports, which are integral to the functioning of fuel cell systems. Their ability to withstand harsh operating conditions while offering durability has significantly contributed to their widespread adoption in fuel cell applications.

The segment’s growth is also attributed to advancements in plastic technology, which have led to the development of more advanced, high-performance polymers. These polymers not only enhance the efficiency of fuel cell systems but also help reduce overall system weight, a critical factor in applications such as fuel cell electric vehicles (FCEVs). The ongoing research and development in materials science are expected to further strengthen the position of structural plastics in the market.

Additionally, the increasing shift toward clean energy solutions and the adoption of hydrogen-powered fuel cell systems have driven the demand for materials that can efficiently support these technologies. As the market for fuel cell technologies expands, structural plastics are anticipated to maintain their dominant position, providing manufacturers with a reliable, cost-effective material choice.

Looking ahead, further innovations in composite materials, particularly those that combine the benefits of plastics with advanced carbon or glass fibers, are expected to drive further market growth. These innovations promise to enhance the performance, sustainability, and cost-effectiveness of the fuel cell BOP system.

By Type Analysis

PEMFC BOP accounts for 48.5% of the market, optimizing performance and reliability in hydrogen fuel cell systems.

In 2024, PEMFC (Proton Exchange Membrane Fuel Cell) BOP held a dominant market position in the By Type segment of the Fuel Cell Balance of Plant (BOP) Market, with a 48.5% share. This growth can be attributed to the widespread adoption of PEMFC technology, which is widely recognized for its high efficiency, fast start-up times, and suitability for both stationary and mobile applications. The PEMFC BOP is critical in ensuring the seamless integration of fuel cells by providing essential components such as compressors, humidifiers, and cooling systems.

The dominance of PEMFC BOP is further supported by the rising demand for clean energy solutions across multiple industries, particularly in the automotive and power generation sectors. PEMFCs are considered a promising option for zero-emission vehicles, especially fuel cell electric vehicles (FCEVs), which are gaining traction as governments implement stricter emission regulations. This has significantly boosted the demand for PEMFC-based fuel cell systems and, by extension, the BOP components that support their operation.

Additionally, the continuous advancements in PEMFC technology, such as improvements in durability and energy density, have made these systems more competitive with other fuel cell types. As the adoption of hydrogen infrastructure grows, the role of PEMFC BOP components in enhancing performance and reducing costs is expected to solidify their leading position in the market.

The increasing investment in renewable energy projects and the growing focus on decarbonizing industries like transportation and manufacturing are also driving the demand for PEMFC BOP systems. Looking ahead, continued technological innovations and cost reductions are expected to further cement the dominance of PEMFC BOP in the fuel cell market.

By Power Output Analysis

Fuel cells with 50-250 kW power output represent 38.4%, catering to medium-scale industrial power generation applications.

In 2024, the 50-250 kW power output range held a dominant market position in the By Power Output segment of the Fuel Cell Balance of Plant (BOP) Market, with a 38.4% share. This power output range is particularly well-suited for medium-scale applications, including commercial buildings, small industrial operations, and municipal power generation. Fuel cells within this range offer an optimal balance between energy efficiency, system size, and cost, making them a preferred choice for a variety of stationary applications.

The growth in demand for 50-250 kW fuel cells is driven by the increasing need for distributed energy generation systems that can provide reliable, on-site power without relying on the grid. These systems are particularly attractive in regions where grid stability is a concern or in off-grid locations that require a self-sufficient energy solution. Furthermore, this power output range is ideal for integrating with renewable energy sources like solar or wind, where fuel cells can provide backup power during periods of low generation.

As hydrogen infrastructure continues to develop and the cost of fuel cell systems decreases, the adoption of 50-250 kW fuel cell systems is expected to expand. This segment also benefits from the growing trend of decarbonizing industrial processes and commercial applications, where medium-scale fuel cells are increasingly seen as a viable, low-emission alternative to conventional power sources.

By Application Analysis

Power supply applications hold 34.2% of the market, driven by increasing demand for clean energy solutions.

In 2024, Power Supply held a dominant market position in the By Application segment of the Fuel Cell Balance of Plant (BOP) Market, with a 34.2% share. This segment includes the use of fuel cell systems for stationary power generation, where they are employed as a reliable source of electricity for commercial, industrial, and residential applications. Fuel cells in the power supply application provide clean, efficient, and sustainable energy, making them increasingly attractive in the context of the global push toward decarbonization and the reduction of fossil fuel dependency.

The growth of this segment is primarily driven by the increasing demand for off-grid and backup power systems. Fuel cells are seen as an ideal solution for areas where grid reliability is an issue or in remote locations that require independent power generation. Additionally, fuel cells provide high efficiency and low emissions, making them a preferred choice for applications looking to meet environmental regulations and sustainability goals.

As renewable energy adoption grows, fuel cells are increasingly used in hybrid systems alongside solar and wind power to provide an uninterrupted energy supply. This trend is particularly prominent in areas with intermittent renewable energy generation, where fuel cells can serve as a backup when natural sources are unavailable.

The continued advancements in fuel cell technology, including improvements in efficiency, cost reduction, and durability, are expected to drive further growth in the power supply segment. As hydrogen infrastructure improves, fuel cells are likely to play an even more significant role in powering communities, industries, and critical infrastructure in the future.

By End User Analysis

Power plants make up 42.1% of the Fuel Cell BOP market, focusing on large-scale energy production.

In 2024, Power Plants held a dominant market position in the By End User segment of the Fuel Cell Balance of Plant (BOP) Market, with a 42.1% share. Power plants utilizing fuel cell technology are increasingly seen as a viable solution for large-scale, efficient, and low-emission electricity generation.

Fuel cells provide a steady, reliable source of power with minimal environmental impact, making them an attractive option for meeting the growing demand for clean energy and helping power plants transition away from fossil fuel dependence.

The dominance of power plants in this segment is largely driven by the growing global emphasis on reducing carbon emissions and the need to replace traditional coal or gas-fired power generation systems with more sustainable alternatives. Fuel cell-based power plants, particularly those powered by hydrogen, offer high efficiency and can provide baseload power generation, which is essential for grid stability.

As energy demand increases and governments implement stricter regulations around carbon emissions, the adoption of fuel cells in power plants is expected to continue to grow. Fuel cells can also integrate well with renewable energy sources, providing backup power when wind or solar generation is low, making them a key player in the push for more resilient and flexible energy systems.

Looking forward, further technological advancements in fuel cell efficiency, coupled with improvements in hydrogen storage and distribution infrastructure, will likely drive the expansion of fuel cell-based power plants. These innovations promise to make fuel cells even more competitive with traditional power generation methods, solidifying their role in the future energy landscape.

Key Market Segments

By Material

- Structural Plastics

- Elastomers

- Coolants

- Assembly Aids

- Metals

- Others

By Type

- PEMFC BOP

- SOFC BOP

- Alkaline FC BOP

- MCFC BOP

- Anion Exchange Membrane Fuel Cell BOP

By Power Output

- Below 50 KW

- 50-250 kW

- 250-1000 kW

- Above 1000 kW

By Application

- Cooling

- Power Supply

- Water Circulation

- Hydrogen Processing

- Heat Stabilizers

- Others

By End User

- Power Plants

- Transportation Companies

- Industrial Facilities

- Others

Driving Factors

Growing Demand for Clean and Sustainable Energy

One of the primary driving factors for the Fuel Cell Balance of Plant (BOP) market is the increasing global demand for clean and sustainable energy solutions. As the world focuses on reducing carbon emissions and addressing climate change, governments and industries are investing heavily in renewable energy technologies, with hydrogen fuel cells being at the forefront of these efforts.

Fuel cell systems are considered a viable, low-emission alternative to traditional fossil fuel-based power generation. The BOP components, which ensure the efficient operation of fuel cells, are critical in making this technology commercially viable. As industries look for greener energy sources, the demand for fuel cell BOP systems is expected to continue growing, driving market expansion.

Restraining Factors

High Initial Costs and Limited Infrastructure Development

A key restraining factor for the Fuel Cell Balance of Plant (BOP) market is the high initial cost of fuel cell systems and the limited development of hydrogen infrastructure. Fuel cells, along with their BOP components, require significant investment in both research and manufacturing, making them expensive compared to traditional energy solutions.

Additionally, the lack of widespread hydrogen fueling stations and infrastructure for hydrogen production and distribution presents a major challenge for the adoption of fuel cell technologies. This limits the practical deployment of fuel cells, particularly in transportation and large-scale power generation. Until infrastructure improves and costs decrease through technological advancements, these factors may slow the growth of the BOP market.

Growth Opportunity

Expanding Hydrogen Infrastructure and Technological Advancements

A significant growth opportunity for the Fuel Cell Balance of Plant (BOP) market lies in the expansion of hydrogen infrastructure and ongoing technological advancements. As governments and industries ramp up efforts to establish hydrogen refueling stations and improve hydrogen production and distribution systems, the demand for fuel cell-based technologies, including their BOP components, is expected to rise.

Enhanced infrastructure will allow fuel cells to become a more practical and widely adopted energy solution, particularly in transportation and large-scale power generation. Additionally, continued improvements in fuel cell technology—such as increased efficiency, longer lifespan, and reduced costs—will make BOP systems more attractive to end-users. As these advancements unfold, the market for fuel cell BOP components is poised for significant growth.

Latest Trends

Integration of Fuel Cells with Renewable Energy

One of the latest trends in the Fuel Cell Balance of Plant (BOP) market is the growing integration of fuel cells with renewable energy sources like solar and wind. As the world shifts toward greener energy solutions, combining fuel cells with renewables helps address energy intermittency issues. Fuel cells provide reliable backup power when renewable energy generation is low, such as during cloudy days for solar or calm periods for wind.

This hybrid approach not only enhances the stability and reliability of power supply systems but also makes renewable energy more feasible as a primary power source. As the trend towards decarbonization intensifies, this integration is expected to become a key driver of growth in the fuel cell BOP market.

Regional Analysis

In 2024, Asia-Pacific held a dominant 48.8% share of the Fuel Cell BOP Market, valued at USD 2.03 billion.

In 2024, the Asia-Pacific region dominated the Fuel Cell Balance of Plant (BOP) Market, accounting for 48.8% of the total market share, valued at approximately USD 2.03 billion. This leadership is driven by the region’s strong commitment to clean energy technologies and significant investments in hydrogen fuel cell infrastructure.

Countries like Japan, South Korea, and China have heavily invested in hydrogen-based energy solutions, with Japan aiming to become a global leader in hydrogen energy by 2030. The high adoption of fuel cell electric vehicles (FCEVs) and the ongoing development of hydrogen refueling stations further contribute to the market’s expansion in this region.

Europe follows as a prominent market, with a focus on reducing carbon emissions and increasing renewable energy use. The European Union has implemented stringent environmental policies and incentives to promote fuel cell technologies, particularly in transportation and stationary power generation. Germany, France, and the UK are key players, driving demand for fuel cell systems in commercial and industrial applications.

North America, particularly the United States, is experiencing steady growth due to government initiatives promoting clean energy, such as tax credits and grants for hydrogen fuel cell development. While the market is growing, it remains smaller compared to Asia-Pacific and Europe.

The Middle East & Africa and Latin America have slower market growth, largely due to limited infrastructure and lower investment in hydrogen technologies. However, there are emerging opportunities as these regions explore cleaner energy solutions and seek to diversify their energy mix.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Fuel Cell Balance of Plant (BOP) market is expected to witness significant contributions from several key players, each playing a pivotal role in advancing fuel cell technologies and expanding their market footprint.

Ballard Power Systems, a leader in proton exchange membrane fuel cells, continues to expand its presence in transportation and stationary power sectors. Bloom Energy and FuelCell Energy are focusing on stationary power generation solutions, leveraging their expertise in solid oxide fuel cell technology to offer high-efficiency, low-emission energy systems for industrial and commercial applications.

Ceres Power Holdings and Solid Power are making strides with their innovative technologies in fuel cell design, targeting high-performance and scalable solutions. Cummins, Inc. and Dana Limited are also enhancing their portfolios with fuel cell technologies, focusing on both automotive and stationary applications, and strengthening their presence in the clean energy transition.

Meanwhile, Doosan Fuel Cell Co., Ltd. and Doosan Heavy Industries & Construction continue to dominate South Korea’s energy sector, capitalizing on the country’s aggressive hydrogen strategy. Linde AG, Nel Hydrogen, and Hydrogenics Corporation are making significant strides in hydrogen production and distribution, ensuring the availability of clean hydrogen fuel to power the fuel cell systems globally.

Notably, Plug Power and Toyota Motor Corporation have invested heavily in advancing fuel cell electric vehicles (FCEVs) and hydrogen infrastructure, while Siemens, Johnson Matthey, and SFC Energy AG focus on innovation in industrial and utility-scale applications. With continuous technological advancements and increasing adoption across multiple sectors, these companies will be crucial in driving the growth of the fuel cell BOP market in the coming years.

Top Key Players in the Market

- Ballard Power Systems

- Bloom Energy

- Ceres Power Holdings

- Cummins, Inc.

- Dana Limited

- Doosan Fuel Cell Co., Ltd.

- Doosan Heavy Industries Construction

- Elcogen AS

- ElringKlinger

- FuelCell Energy

- HORIBA FuelCon GmbH

- Hydrogenics Corporation

- INN Balance

- Johnson Matthey

- Linde AG

- Nel Hydrogen

- Plug Power

- SFC Energy AG

- Siemens

- Solid Power

- Sunfire

- Toyota Motor Corporation

Recent Developments

- In November 2024, Ballard Power Systems Announced plans to invest approximately $110 million from 2024 through 2027 to build a new manufacturing facility with an annual production capacity of 8 million membrane electrode assemblies, 8 million bipolar plates, 20,000 fuel cell stacks, and up to 20,000 fuel cell engines.

- In July 2024, Cummins Inc. Awarded $75 million from the Department of Energy to convert approximately 360,000 sq. ft. of existing manufacturing space for zero-emissions components and electric powertrain systems.

Report Scope

Report Features Description Market Value (2024) USD 4.2 Billion Forecast Revenue (2034) USD 23.1 Billion CAGR (2025-2034) 18.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Structural Plastics, Elastomers, Coolants, Assembly Aids, Metals, Others), By Type (PEMFC BOP, SOFC BOP, Alkaline FC BOP, MCFC BOP, Anion Exchange Membrane Fuel Cell BOP), By Power Output (Below 50 KW, 50-250 kW, 250-1000 kW, Above 1000 kW), By Application (Cooling, Power Supply, Water Circulation, Hydrogen Processing, Heat Stabilizers, Others), By End User (Power Plants, Transportation Companies, Industrial Facilities, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ballard Power Systems, Bloom Energy, Ceres Power Holdings, Cummins, Inc., Dana Limited, Doosan Fuel Cell Co., Ltd., Doosan Heavy Industries Construction, Elcogen AS, ElringKlinger, FuelCell Energy, HORIBA FuelCon GmbH, Hydrogenics Corporation, INN Balance, Johnson Matthey, Linde AG, Nel Hydrogen, Plug Power, SFC Energy AG, Siemens, Solid Power, Sunfire, Toyota Motor Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fuel Cell Balance of Plant (BOP) MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

Fuel Cell Balance of Plant (BOP) MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ballard Power Systems

- Bloom Energy

- Ceres Power Holdings

- Cummins, Inc.

- Dana Limited

- Doosan Fuel Cell Co., Ltd.

- Doosan Heavy Industries Construction

- Elcogen AS

- ElringKlinger

- FuelCell Energy

- HORIBA FuelCon GmbH

- Hydrogenics Corporation

- INN Balance

- Johnson Matthey

- Linde AG

- Nel Hydrogen

- Plug Power

- SFC Energy AG

- Siemens

- Solid Power

- Sunfire

- Toyota Motor Corporation