Global Tuna Peptides Market By Source (Sea Tuna, Farmed Tuna), By Application (Dietary Supplement, Functional Foods and Beverages, Pharmaceutical and Nutraceutical Products, Personal Care and Cosmetics Products), By Form (Powder, Liquid, By Extraction Process, Enzymatic Hydrolysis, Fermentation, Chemical Hydrolysis), By End Use (Food And Beverage Industry, Pharmaceutical Industry, Cosmetic And Personal Care Industry, Animal Feed And Pet Food, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140625

- Number of Pages: 370

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

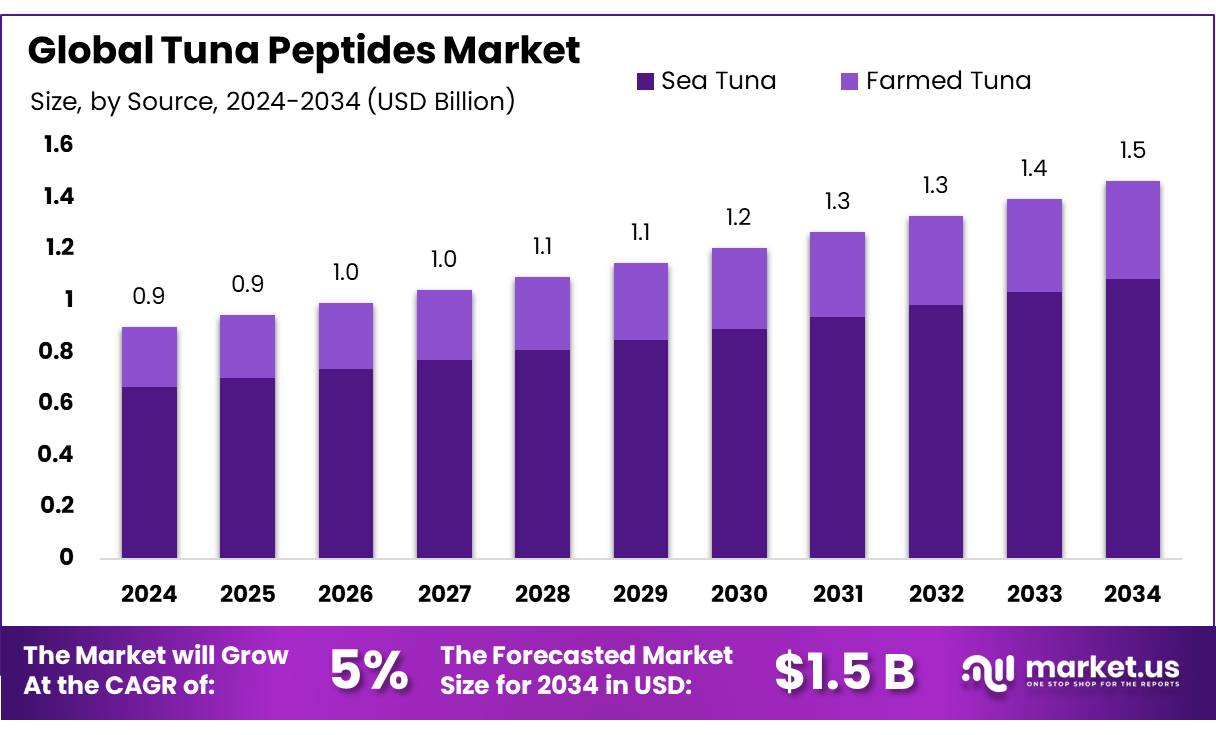

The Global Tuna Peptides Market size is expected to be worth around USD 1.5 Bn by 2034, from USD 0.9 Bn in 2024, growing at a CAGR of 5.0% during the forecast period from 2025 to 2034.

Tuna peptides, derived from the hydrolysis of tuna proteins, are gaining recognition for their potential health benefits and diverse applications across various industries, particularly in the food, dietary supplement, and cosmetic sectors.

These bioactive peptides, known for their high bioavailability and functional properties, offer various benefits such as antioxidant effects, immune system enhancement, skin elasticity improvement, and muscle recovery. The increasing demand for natural and functional ingredients is propelling the growth of the tuna peptides market, positioning it as a key player in the global health and wellness trends.

The World Health Organization (WHO) reports that non-communicable diseases are responsible for 71% of all deaths in the area, with diabetes, cancer, and cardiovascular disease being the leading causes.

Key driving factors for the tuna peptides market include the rising global trend of health-conscious consumers seeking products that promote overall wellness, enhance muscle recovery, and slow down the aging process. The growing popularity of functional foods, which are enhanced with bioactive ingredients like peptides, is also contributing to market expansion. For example, in the dietary supplement industry, tuna peptides are widely used to formulate products that support joint health, cardiovascular wellness, and anti-aging benefits.

Future growth opportunities in the tuna peptides market are significant, particularly in the expanding dietary supplement sector. The segment is poised to see continued growth, driven by increasing consumer interest in preventive health and personalized nutrition.

Key Takeaways

- Tuna Peptides Market size is expected to be worth around USD 1.5 Bn by 2034, from USD 0.9 Bn in 2024, growing at a CAGR of 5.0%.

- Sea Tuna held a dominant market position, capturing more than a 74.4% share.

- Dietary Supplement segment held a dominant market position, capturing more than a 42.2% share.

- Powder held a dominant market position, capturing more than an 82.3% share.

- Enzymatic Hydrolysis held a dominant market position, capturing more than a 56.3% share.

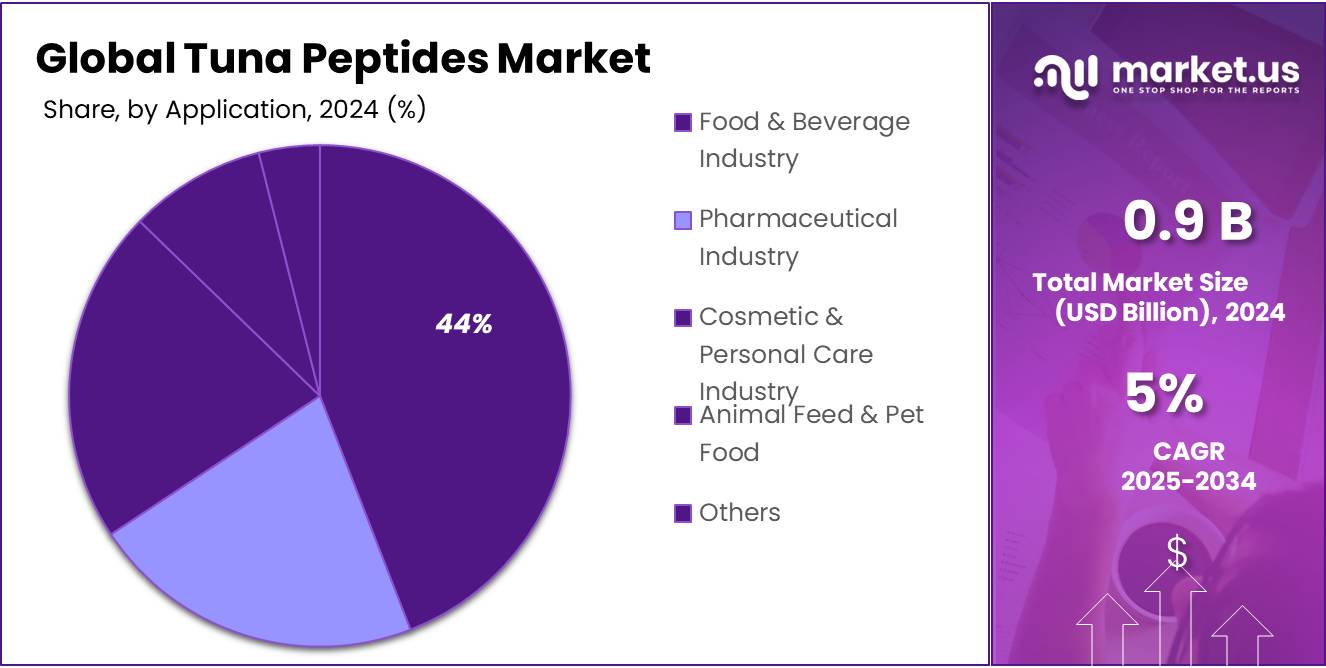

- Food & Beverage Industry held a dominant market position, capturing more than a 45.4% share.

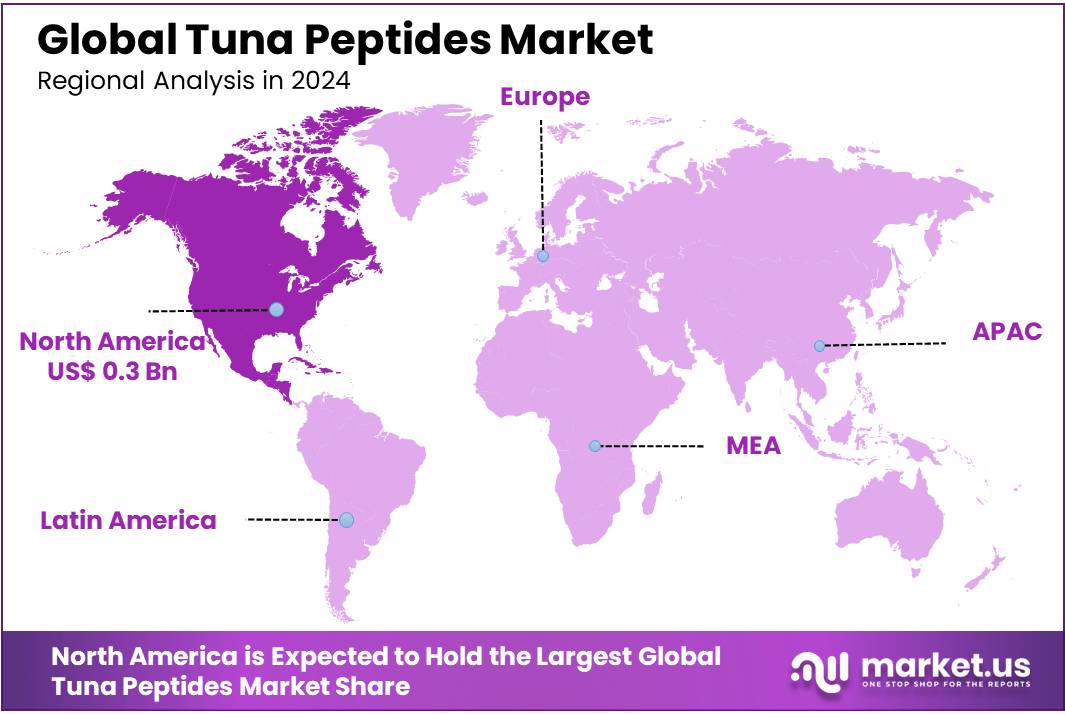

- North America held a dominant position in the global tuna peptides market, capturing more than 42.1% of the market share, valued at approximately USD 0.6 billion.

By Source

In 2024, Sea Tuna held a dominant market position, capturing more than a 74.4% share of the global tuna peptides market. This significant share can be attributed to the high demand for tuna peptides, which are widely used across various industries due to their beneficial health properties and high-quality amino acid profile. Sea Tuna peptides, extracted primarily from wild-caught tuna species, are highly valued for their superior nutritional content, including their ability to promote muscle growth and recovery, boost immune function, and support joint health.

The demand for Sea Tuna peptides is also expected to rise in the coming years, driven by increased consumer preference for natural and sustainable health supplements. The fish’s rich peptide composition, including various bioactive compounds, continues to make it a popular choice among health-conscious individuals looking to enhance their well-being.

By Application

In 2024, the Dietary Supplement segment held a dominant market position, capturing more than a 42.2% share of the Tuna Peptides market. This significant share can be attributed to the growing consumer awareness of health and wellness, which has fueled the demand for functional ingredients in dietary supplements. Tuna peptides, known for their high bioavailability and potential health benefits, such as improving skin elasticity, supporting muscle recovery, and boosting overall immune function, are increasingly being incorporated into supplement formulations.

The expansion of the dietary supplement market is also supported by increased marketing efforts by supplement manufacturers, who are highlighting the scientific backing and proven health benefits of tuna peptides. With the continued focus on personalized nutrition, tuna peptides are gaining traction in targeted supplements designed to address specific health concerns, such as joint health, cardiovascular support, and overall vitality.

By Form

In 2024, Powder held a dominant market position, capturing more than an 82.3% share of the global tuna peptides market. This substantial share can be attributed to the increasing popularity of powdered peptide supplements due to their convenience, versatility, and ease of use. Tuna peptides in powder form are favored by consumers because they can be easily incorporated into various food and beverage products, such as smoothies, protein shakes, and dietary supplements, making it easier for individuals to access the nutritional benefits of tuna peptides.

The demand for powdered tuna peptides is also driven by the growing trend of fitness and wellness, where powdered supplements are widely used to enhance muscle recovery, improve skin health, and boost overall energy levels. The format is especially popular among athletes, gym-goers, and health-conscious consumers seeking natural, high-quality protein sources.

By Extraction Process

In 2024, Enzymatic Hydrolysis held a dominant market position, capturing more than a 56.3% share of the global tuna peptides market. This extraction process is preferred due to its efficiency in breaking down proteins into smaller, bioactive peptides, making them more readily absorbed by the body. Enzymatic Hydrolysis is a highly effective and sustainable method that preserves the nutritional value of tuna peptides while enhancing their functionality. This process allows for the creation of peptides that are not only bioavailable but also have improved taste and solubility, making them ideal for use in a wide range of food and supplement applications.

The popularity of Enzymatic Hydrolysis is also driven by its ability to produce peptides with specific health benefits, such as improved skin health, joint support, and muscle recovery. As more consumers become aware of the advantages of bioactive peptides, particularly in the wellness and sports nutrition sectors, the demand for enzymatically hydrolyzed tuna peptides has grown significantly. The increasing interest in natural, non-chemical processes has further solidified Enzymatic Hydrolysis as the leading extraction method.

By End Use

In 2024, the Food & Beverage Industry held a dominant market position, capturing more than a 45.4% share of the global tuna peptides market. This significant share reflects the growing use of tuna peptides in various food and drink products, driven by rising consumer demand for functional ingredients that promote health and well-being. Tuna peptides are increasingly being incorporated into a wide range of products, including protein bars, energy drinks, smoothies, and other health-conscious food options due to their high-quality amino acid profile and health benefits.

The Food & Beverage sector’s dominance in the tuna peptides market can be attributed to the growing trend of clean-label and natural ingredients, as well as the increasing consumer interest in protein-rich foods. As more consumers seek convenient, nutrient-dense options to support their active lifestyles, the demand for tuna peptides as a functional ingredient in food products is expected to rise. This sector also benefits from the versatility of tuna peptides, which can be easily integrated into both sweet and savory products without altering taste or texture significantly.

Key Market Segments

By Source

- Sea Tuna

- Farmed Tuna

By Application

- Dietary Supplement

- Functional Foods and Beverages

- Pharmaceutical and Nutraceutical Products

- Personal Care and Cosmetics Products

By Form

- Powder

- Liquid

By Extraction Process

- Enzymatic Hydrolysis

- Fermentation

- Chemical Hydrolysis

By End Use

- Food & Beverage Industry

- Pharmaceutical Industry

- Cosmetic & Personal Care Industry

- Animal Feed & Pet Food

- Others

Drivers

Increasing Demand for Protein-Rich Functional Foods

One of the major driving factors behind the growth of the tuna peptides market is the increasing global demand for protein-rich functional foods. As consumers become more health-conscious and seek alternatives to traditional protein sources, the popularity of peptides—especially those derived from tuna—continues to rise. Tuna peptides offer a high-quality, bioavailable source of protein, rich in essential amino acids that support muscle growth, recovery, and overall well-being. This trend is particularly prominent in the growing fitness and wellness sectors.

According to a report by the Food and Agriculture Organization (FAO), global demand for protein, especially animal-based protein, is expected to rise significantly over the next decade. Tuna, being one of the most popular and widely consumed fish species, is a key player in meeting this demand.

In addition, governments around the world are supporting the growth of the functional food industry. For instance, the European Commission has recognized the potential of the functional food market as part of its Farm to Fork Strategy, which aims to promote healthier diets and more sustainable food systems. As part of this initiative, protein-rich foods, including those derived from seafood, are encouraged as part of a balanced, sustainable diet.

Restraints

Sustainability Concerns and Overfishing

One of the major restraining factors for the growth of the tuna peptides market is the increasing concern about sustainability and overfishing of tuna species. While tuna peptides are highly valued for their nutritional benefits, the sustainability of tuna fishing practices has come under scrutiny in recent years. Overfishing, driven by the rising global demand for tuna, has led to significant depletion of certain tuna species, raising environmental and ethical concerns.

According to the World Wildlife Fund (WWF), many tuna populations are currently overexploited, with some species like the Atlantic bluefin tuna facing critical levels of depletion. The International Union for Conservation of Nature (IUCN) reports that Atlantic bluefin tuna is classified as “endangered,” with stocks continuing to decline despite management efforts. This poses a challenge to the tuna peptides market, as consumers and manufacturers increasingly prioritize sustainability in their sourcing practices.

In response to these concerns, governments and international organizations have introduced regulations to promote sustainable fishing practices. For example, the United Nations has implemented the “2030 Agenda for Sustainable Development,” which includes targets to reduce the depletion of fish stocks and promote responsible seafood sourcing. However, the effectiveness of these measures remains uncertain, and the market for tuna peptides may face continued pressure from consumers demanding ethically sourced, sustainable products.

Opportunity

Expansion of Plant-Based and Sustainable Protein Alternatives

A major growth opportunity for the tuna peptides market lies in the increasing consumer demand for plant-based and sustainable protein alternatives. As the global shift toward plant-based diets continues, there is also a parallel rise in the demand for sustainable, animal-based proteins like tuna peptides that offer similar nutritional benefits but with a smaller environmental footprint.

According to the Food and Agriculture Organization (FAO), plant-based protein consumption is expected to grow significantly, with global markets projected to expand by 6-8% annually through 2030. However, consumers seeking more sustainable sources of animal protein are increasingly turning to seafood like tuna due to its lower carbon footprint compared to other animal products, such as beef and poultry. This makes tuna peptides a compelling option for the growing segment of environmentally-conscious consumers who are looking for protein that is both nutritious and responsibly sourced.

Government initiatives also support the growth of sustainable protein markets. For instance, the European Commission’s “Farm to Fork Strategy” emphasizes the need for sustainable food production, promoting seafood as a source of environmentally friendly protein. This strategy encourages sustainable fishing practices and the use of seafood-based ingredients, including tuna peptides, in functional foods and supplements. As consumers increasingly seek both ethical and healthy dietary options, the opportunity for tuna peptides to serve as a sustainable, high-quality protein source will continue to grow.

Trends

Rise in Functional Foods and Nutraceuticals

One of the latest trends driving the growth of the tuna peptides market is the increasing popularity of functional foods and nutraceuticals. As more consumers turn to foods that offer additional health benefits beyond basic nutrition, tuna peptides are becoming a key ingredient in a variety of products designed to support specific health goals, such as muscle recovery, skin health, and joint function.

This surge in demand is being fueled by consumers’ increasing awareness of the importance of health and wellness. Tuna peptides, rich in bioactive compounds, have become highly sought after in this space due to their ability to enhance the nutritional profile of functional foods without compromising taste or texture. These peptides are often used in protein supplements, smoothies, and even fortified snacks, appealing to health-conscious individuals.

Government initiatives are also helping to fuel this trend. For example, the U.S. Food and Drug Administration (FDA) has supported the growth of functional foods through its recognition of health claims related to bioactive ingredients. This regulatory framework encourages manufacturers to innovate and incorporate peptides like those derived from tuna into new food products. Similarly, the European Commission’s “Farm to Fork Strategy” aims to make the food system more sustainable, promoting healthier food options, including nutrient-dense seafood products like tuna peptides.

Regional Analysis

In 2024, North America held a dominant position in the global tuna peptides market, capturing more than 42.1% of the market share, valued at approximately USD 0.6 billion. This substantial market share is driven by the growing consumer demand for protein-rich supplements and functional foods, particularly among health-conscious individuals and athletes.

The region’s focus on fitness, wellness, and sports nutrition has significantly boosted the consumption of peptide-based products, including those derived from tuna. North America’s well-established supplement industry, with a strong presence of both domestic and international brands, continues to be a key driver in the market’s expansion.

The United States is the primary contributor to North America’s tuna peptides market, benefiting from the increasing popularity of natural and clean-label ingredients in the food and beverage sector. According to the Council for Responsible Nutrition, more than 77% of U.S. adults regularly take dietary supplements, further underscoring the demand for high-quality protein sources like tuna peptides. Additionally, the rise in sports nutrition and the growing trend of plant-based and sustainable protein sources are driving manufacturers to incorporate tuna peptides into protein bars, shakes, and other functional foods.

In 2025, North America is expected to maintain its leadership in the market, with projections indicating continued growth, driven by increasing consumer awareness of the health benefits associated with tuna peptides. As the demand for clean, sustainable, and functional ingredients rises, North America will remain a dominating region, further solidifying its significant role in the global tuna peptides market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The tuna peptides market features several key players who have established themselves as leaders in the production and supply of high-quality peptide-based products. Aker BioMarine Antarctic AS and Biomega Group are prominent companies in this space, focusing on the extraction of marine peptides, including those from tuna, leveraging their expertise in sustainable sourcing and cutting-edge extraction technologies.

These companies are well-positioned to meet the increasing demand for clean-label and functional ingredients, with a strong emphasis on sustainability and bioactive properties. Similarly, Bolognani Srl, Cargill, Incorporated, and Copalis Sea Solutions play key roles in offering tuna peptides for various applications, including supplements and nutraceuticals, by capitalizing on their extensive distribution networks and established industry reputations.

Other notable players such as Glanbia Nutritionals, Hofseth BioCare ASA, and Lonza Group also contribute significantly to the market. Glanbia Nutritionals, known for its wide range of health and wellness products, uses tuna peptides in its functional food and beverage offerings.

Hofseth BioCare ASA and Lonza Group focus on leveraging their advanced bioengineering capabilities to offer highly bioavailable peptides with added health benefits, making them popular choices for both manufacturers and consumers alike. Norvik Trawl AS, Seagarden AS, and Symrise AG also feature prominently, utilizing their strong presence in the seafood and natural ingredient sectors to deliver sustainably sourced peptides to a broad market.

Top Key Players

- Aker BioMarine Antarctic AS

- Biomega Group

- Bolognani Srl

- Cargill, Incorporated

- Copalis Sea Solutions

- Glanbia Nutritionals

- Hofseth BioCare ASA

- Lonza Group

- Norvik Trawl AS

- Seagarden AS

- Sopropeche

- Symrise AG

- Vital Proteins LLC

- Waitaki Biosciences

Recent Developments

In 2024, Biomega’s revenue from marine peptides is expected to grow by around 9%, driven by the increasing popularity of functional foods, dietary supplements, and natural protein sources.

In 2024, Bolognani’s market share in the tuna peptides sector is projected to grow by approximately 7%, driven by the rising trend of functional foods and natural protein sources.

Report Scope

Report Features Description Market Value (2024) USD 0.9 Bn Forecast Revenue (2034) USD 1.5 Bn CAGR (2025-2034) 5.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Sea Tuna, Farmed Tuna), By Application (Dietary Supplement, Functional Foods and Beverages, Pharmaceutical and Nutraceutical Products, Personal Care and Cosmetics Products), By Form (Powder, Liquid, By Extraction Process, Enzymatic Hydrolysis, Fermentation, Chemical Hydrolysis), By End Use (Food And Beverage Industry, Pharmaceutical Industry, Cosmetic And Personal Care Industry, Animal Feed And Pet Food, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Aker BioMarine Antarctic AS, Biomega Group, Bolognani Srl, Cargill, Incorporated, Copalis Sea Solutions, Glanbia Nutritionals, Hofseth BioCare ASA, Lonza Group, Norvik Trawl AS, Seagarden AS, Sopropeche, Symrise AG, Vital Proteins LLC, Waitaki Biosciences Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Aker BioMarine Antarctic AS

- Biomega Group

- Bolognani Srl

- Cargill, Incorporated

- Copalis Sea Solutions

- Glanbia Nutritionals

- Hofseth BioCare ASA

- Lonza Group

- Norvik Trawl AS

- Seagarden AS

- Sopropeche

- Symrise AG

- Vital Proteins LLC

- Waitaki Biosciences