Global Carbon Nanotubes Market By Type (Single-Walled Carbon Nanotubes (SWCNTs) and Multi-Walled Carbon Nanotubes (MWCNTs)) By Production Method (Chemical Vapor Deposition (CVD), Arc Discharge, Laser Ablation) By End-Use Industry (Electronics and Semiconductor, Aerospace and Defense, Automotive, Energy and Power, Chemicals and Polymers) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Sep 2023

- Report ID: 106702

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

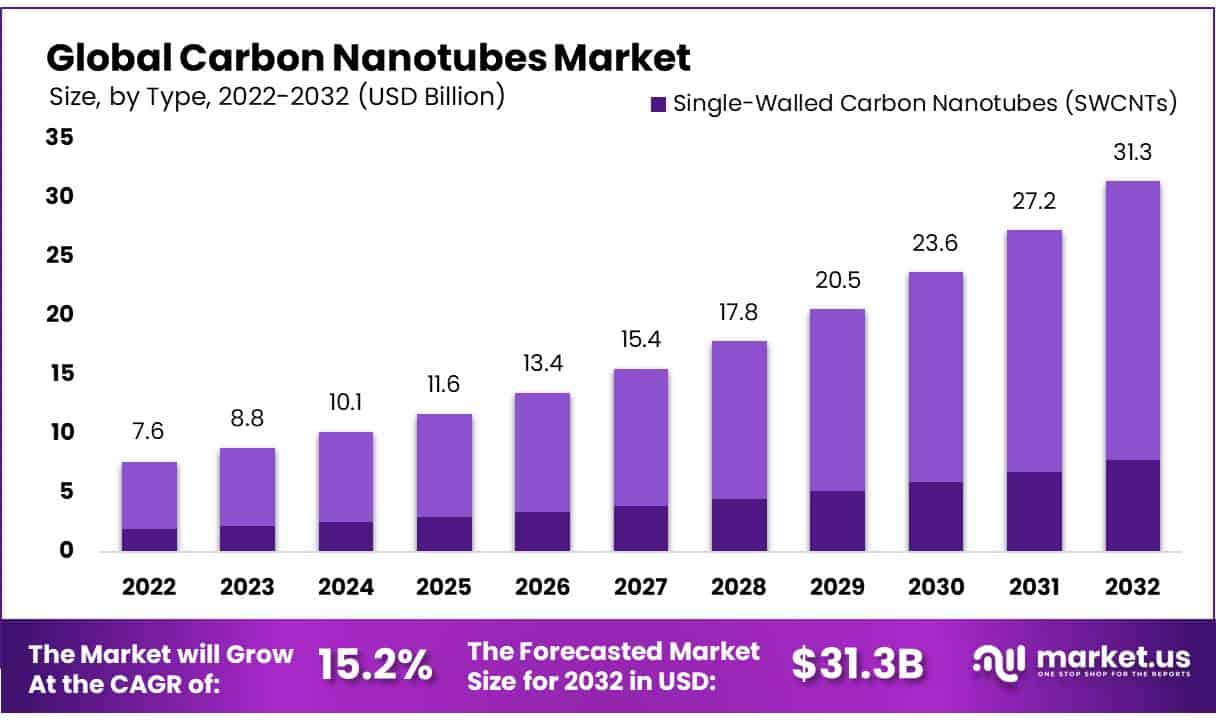

In 2022, the Global Carbon Nanotubes Market was valued at USD 7.6 Billion, and is expected to reach USD 31.3 Billion in 2032 Between 2023 and 2032, this market is estimated to register a CAGR of 15.2%.

Introduction

Carbon nanotubes, also known as buckytubes, are nano cylindrical structures composed of carbon atoms, covalently bonded in hexagonal shape. They usually resemble rolled-up graphene sheets. They are incredibly small and have diameters on the nanoscale ranging from micrometers to millimeters.

Carbon nanotubes possess outstanding mechanical, thermal, and electrical properties, which make them immensely useful in a wide range of industries. In recent years, they have been a promising material for research and development with a new ray of hope for various applications.

Their exceptional light weight, stiffness, and high strength are the remarkable properties in which many industries have started investing in them. This combination of strength and low weight makes them highly desirable in industries where weight reduction while maintaining structure integrity is important.

Industries such as aerospace & defense, automotive, and electronics are particularly interested in carbon nanotubes to enhance the overall performance of their respective product portfolios.

Key Takeaways

- The Global Carbon Nanotubes Market is valued at USD 7.6 Billion in 2022.

- By Type, the Multi-Walled Carbon Nanotubes (MWCNTs) segment dominated the global carbon nanotubes market with a market share of 75.6% in 2022.

- By Production Method, the Chemical Vapor Deposition segment dominated the global carbon nanotubes market with more than 28.9% market share in 2022.

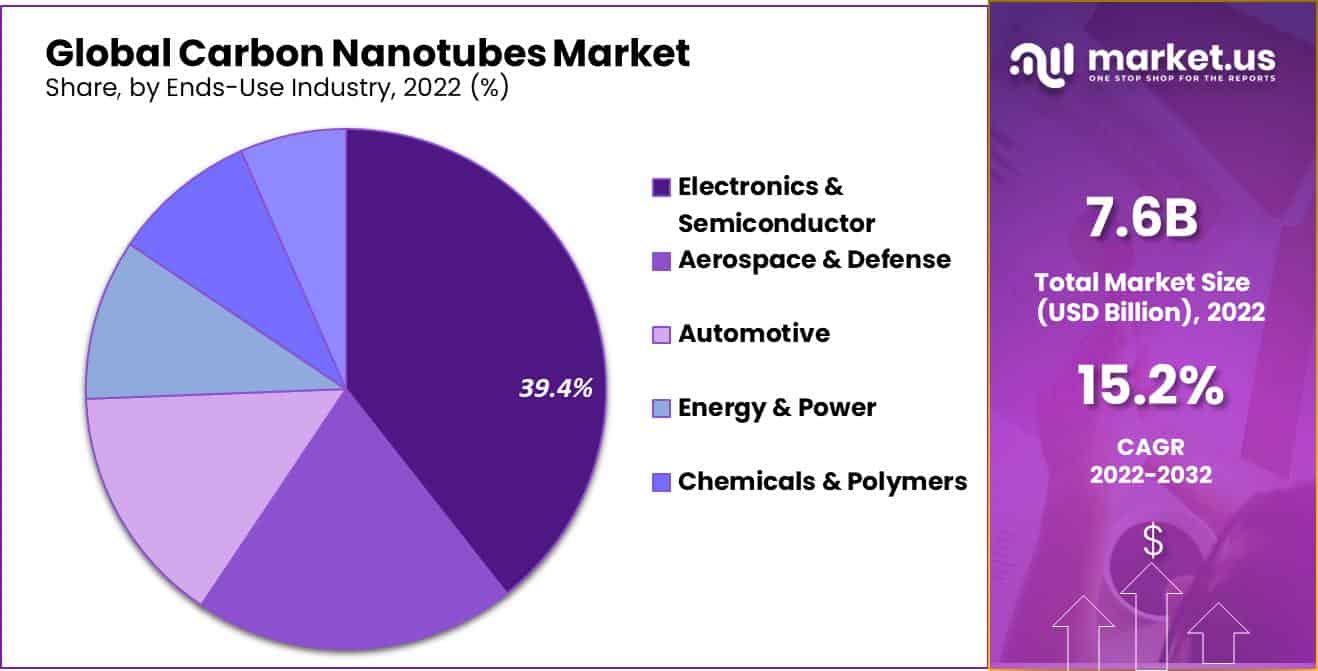

- By End-Use Industry, the Electronics and semiconductor segment led the global carbon nanotubes market in 2022 with a market share of 39.4%.

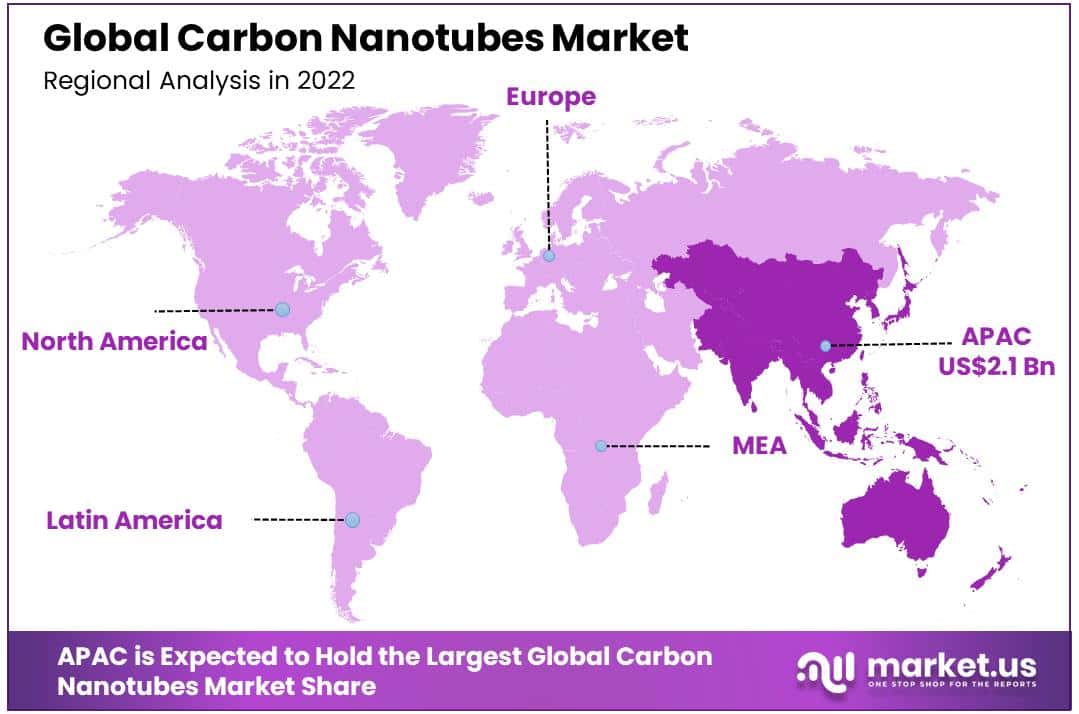

- In 2022, the Asia-Pacific region was the dominant region in the global carbon nanotubes market, with a market share of 42.5% of global revenue.

- United States and China are the top producers of carbon nanotubes in the world, with a share of 34% and 32%, respectively.

- China is the largest consumer of carbon nanotubes in the Asia-Pacific region and the third-largest consumer globally.

Actual Numbers Might Vary in the Final Report.

Driving Factors

Growing Demand in Electronics and Semiconductors

One of the primary drivers for carbon nanotubes market growth is an increasing demand in the electronics and semiconductor industries. Carbon nanotubes possess exceptional electrical and thermal conductivity properties that make them perfect for various applications in these sectors, including creating smaller electronic components with faster processing speed or greater energy efficiency.

Their use has become more prominent with miniaturization trends as demand for higher performance continues, making carbon nanotubes indispensable when producing transistors, interconnects, or any other electronic component.

Expanding Aerospace and Defense Applications

Carbon nanotubes market growth is also driven by their widespread adoption by aerospace and defense sectors, where carbon nanotubes’ lightweight yet highly strong structural properties make them ideal for use in aircraft and defense equipment.

Carbon nanotubes are often utilized as lightweight composite materials which increase strength, durability, and while decreasing overall weight; furthermore, they’ve recently been explored for use as electromagnetic interference (EMI) shielding capabilities within military equipment that is crucial in modern warfare environments.

Restraining Factors

High Production Costs

One significant restraint in the global carbon nanotubes market is the high production costs associated with manufacturing these nanomaterials. Carbon nanotubes require precise and controlled processes, often involving specialized equipment and expertise.

The cost of raw materials, such as high-purity carbon sources, catalysts, and energy-intensive production methods, contributes to the overall high production expenses. These elevated costs can limit the widespread adoption of carbon nanotubes in various industries, particularly in price-sensitive applications.

Regulatory Hurdles and Safety Concerns

The global carbon nanotubes market faces considerable restraints due to stringent regulatory requirements and safety concerns associated with their production and usage. Global regulatory agencies are particularly wary of potential health and environmental risks posed by carbon nanotubes in industries like healthcare and electronics.

Compliance with these regulations requires considerable investments in R&D for safe manufacturing processes and handling protocols, with long-term health effects of exposure continuing to create uncertainty that prevents widespread adoption in various applications.

Growth Opportunity

Advancements in Energy Storage Systems

The Carbon nanotubes market is expected to witness significant expansion due to advancements in energy storage systems. Carbon nanotubes due to their impressive mechanical strength and unique structural properties have received immense recognition, making them suitable components for improving energy storage devices such as batteries and supercapacitors.

This provides one of the greatest opportunities to increase both their energy density and longevity. CNTs can help enhance electrode materials to increase storage capacity, charging times, cycle life, and safety concerns associated with battery technology and reduce risks such as overheating or fire incidents.

As demand for high-capacity long-lasting batteries continues to increase in sectors like electric vehicles and renewable energy storage, CNTs play an integral role in meeting this demand and driving the transition toward cleaner sources of energy.

Latest Trends

Healthcare Applications

The global carbon nanotubes market is currently witnessing a significant transformation driven by growing applications in the healthcare industry. CNTs are being explored as carriers for drug delivery systems. Their high surface area and ability to encapsulate therapeutic agents with precision make them ideal candidates for targeted drug delivery, minimizing side effects.

Also, in the field of regenerative medicine, CNTs are used to improve scaffold materials for tissue engineering. Their mechanical strength and biocompatibility facilitate the creation of artificial organs and tissues. Moreover, CNT-based wound dressings have shown promise in accelerating wound healing processes by promoting cell growth and tissue regeneration.

Furthermore, they are also used in the development of contrast agents for medical imaging techniques like MRI and CT scans, improving image quality and diagnostic accuracy.

By Type Analysis

The Multi-Walled Carbon Nanotubes (MWCNTs) Segment Held the Largest Market Share in 2022 Due to Their Cost-Effectiveness, Versatility, and Structural Stability

Based on type, the global carbon nanotubes market is segmented into Single-Walled Carbon Nanotubes (SWCNTs) and Multi-Walled Carbon Nanotubes (MWCNTs). Among them, the multi-walled carbon nanotubes (MWCNTs) segment was the most lucrative in the global carbon nanotubes market, with a market share of 75.6% in 2022.

MWCNTs are versatile for use and can be tailored for various applications by adjusting their length and diameter. Moreover, the production of MWCNTs is generally more cost-effective compared to SWCNTs. This cost advantage has made MWCNTs more accessible to various industries and has contributed to their dominance in the market. Furthermore, MWCNTs have a higher resistance to structural defects and damage due to their multiple walls.

This structural stability makes them more robust and less prone to breakage during handling and incorporation into various applications. In some industries like healthcare and aerospace, MWCNTs have gained regulatory approvals and certifications for specific applications.

Production Method Analysis

The Chemical Vapor Deposition Segment Held the Largest Market Share in 2022 Due to Precise Control Over Growth Conditions, Minimized Downtime, and Cost Efficiency.

Based on the production method, the global carbon nanotubes market is segmented into Chemical Vapor Deposition (CVD), Arc Discharge, Laser Ablation, and Other Production Methods. Among these production methods, the chemical vapor deposition segment was the most lucrative in the global carbon nanotubes market with a market share of 28.9, in 2022.

CVD has been a well-established and researched production method for carbon nanotubes, with a substantial body of knowledge and expertise available in the scientific and industrial communities. This familiarity contributes to its dominance in the market. CVD provides precise control over the growth conditions, such as temperature, pressure, and catalyst composition.

It also minimizes downtime and ensures a consistent supply of carbon nanotubes. While CVD equipment can be initially expensive to set up, it offers cost advantages in the long run due to its efficiency and ability to produce high-quality carbon nanotubes.

The arc discharge method has emerged as the fastest-growing segment in the global carbon nanotubes market. First, arc discharge is a well-established and mature production technique that has been used for a considerable period, leading to refined processes and better scalability.

This results in consistent and reproducible nanotube quality, which is crucial for industrial applications. Additionally, arc discharge produces carbon nanotubes with excellent structural properties, such as high aspect ratios and narrow diameter distributions. Despite its strengths, arc discharge does have limitations, including the need for controlled environments and skilled operators.

End-Use Industry Analysis

The Electronics and semiconductor Segment Held the Largest Market Share in 2022 Due to Carbon nanotubes’s Outstanding Electrical Conductivity, Thermal Properties, and Effectiveness in Enhancing Device Performance

Based on the end-use industry, the global carbon nanotubes market is segmented into Electronics and semiconductors, Aerospace and Defense, Automotive, Energy and Power, Chemicals and polymers, and Other End-Use Industries. Among these end-use industries, the electronics & semiconductor segment was the most lucrative in the global carbon nanotubes market, with a market share of 39.4% in 2022.

Carbon nanotube’s dominance within the electronics and semiconductor industries is attributable to several key elements. First, their outstanding electrical conductivity and thermal properties make them highly desirable in enhancing electronic components and semiconductors’ performance. Furthermore, carbon nanotubes enable faster, smaller devices that meet industry-wide drives towards innovation and miniaturization.

Carbon nanotubes have also proven highly successful at solving heat dissipation challenges faced by electronic devices. As more compact and powerful electronic components enter the market, managing heat becomes a critical consideration, but carbon nanotubes’ exceptional heat dissipation properties enable them to efficiently disperse, prolonging and improving reliability for electronics of all sorts.

Aerospace and defense have emerged as the fastest growing segment in the global carbon nanotubes market. Aerospace and defense applications often require advanced materials that offer exceptional strength-to-weight ratios and other unique properties. Carbon nanotubes fit these requirements perfectly, as they are known for their lightweight yet robust characteristics.

Moreover, they can significantly enhance the structural integrity of various aerospace components, such as aircraft frames and rocket casings. Their exceptional strength and stiffness make them invaluable in ensuring the reliability and safety of aerospace equipment.

Many governments worldwide allocate substantial funding to research and development in the aerospace and defense sectors. This funding often extends to the development and utilization of advanced materials like carbon nanotubes, further driving their demand in these industries.

Actual Numbers Might Vary in the Final Report.

Market Key Segmentation

Based on the Type

- Single-Walled Carbon Nanotubes (SWCNTs)

- Multi-Walled Carbon Nanotubes (MWCNTs)

Based on the Production Method

- Chemical Vapor Deposition (CVD)

- Arc Discharge

- Laser Ablation

- Other Production Methods

Based on the End-Use Industry

- Electronics & Semiconductor

- Aerospace & Defense

- Automotive

- Energy & Power

- Chemicals & Polymers

- Other End-Use Industries

Geopolitics and Recession Impact Analysis

Geopolitical Factors:

Trade Policies and Tariffs: Geopolitical tensions can lead to changes in trade policies and tariffs. Export restrictions or tariffs on CNTs can disrupt the global supply chain, affecting both producers and consumers. Companies may need to diversify their supply sources to mitigate risks.

- The U.S. government implemented a significant new use rule (SNUR) under the Toxic Substances Control Act (TSCA) for multi-walled carbon nanotubes (MWCNTs) in 2011

- In 2018, the United States imposed tariffs on a range of Chinese goods as part of an ongoing trade dispute. These tariffs included certain types of carbon nanotubes imported from China. The U.S. imposed tariffs of 10% on $200 billion worth of Chinese imports, which included carbon nanotubes

Export Controls: Some countries may impose export controls on advanced materials like CNTs due to their potential dual-use nature in military applications. This can limit the availability of CNTs in certain markets, impacting demand and pricing.

- The US government has placed controls on the physical export of certain manufactured items, including technical data related to CNTs

Intellectual Property and Technology Transfer: Geopolitical disputes can affect intellectual property rights and technology transfer agreements. Companies operating in multiple regions must navigate legal complexities, which can impact market access and competitiveness.

Sanctions: Global sanctions on certain countries can restrict trade and collaboration in the CNT industry. Companies must be aware of sanctions regimes and ensure compliance to avoid legal consequences.

Recession Impact:

Demand Volatility: During a recession, demand for CNTs may decline in industries like automotive, electronics, and aerospace. Reduced consumer spending can lead to decreased production of products that incorporate CNTs, affecting suppliers.

Cost Pressure: Companies may face increased cost pressures due to economic downturns. Managing production costs becomes crucial to maintain competitiveness, potentially leading to cost-cutting measures.

Research and Development: Economic recessions can impact investment in research and development. Innovations in CNT applications may slow down, affecting long-term market growth potential.

Supply Chain Disruptions: Economic downturns can disrupt supply chains, affecting the availability and cost of raw materials required for CNT production. Supply chain resilience becomes a key consideration.

Regional Analysis

APAC is the Dominant Region in the Global Carbon Nanotubes Market in 2022 Due to its Advanced Manufacturing Infrastructure, Abundant Resources, and Government Support.

In 2022, APAC held the leading position in the global carbon nanotubes market, with a significant market share of 42.5%. The APAC region boasts a well-established manufacturing infrastructure, with advanced facilities and technologies. This infrastructure enables efficient production of carbon nanotubes at a competitive cost, making it an attractive destination for both domestic and international manufacturers.

APAC countries, particularly China and Japan, have heavily invested in manufacturing infrastructure for carbon nanotubes. Moreover, they have access to abundant resources required for carbon nanotube production. This includes a steady supply of carbon feedstock and catalyst materials, essential for the synthesis of nanotubes. Many APAC governments have recognized the potential of nanotechnology and carbon nanotubes in particular.

They have implemented supportive policies, research grants, and incentives to encourage the growth of the carbon nanotube industry. The region hosts numerous research institutions, universities, and laboratories dedicated to nanotechnology research. This ecosystem fosters innovation and facilitates collaboration between academia and industry.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key players in the global carbon nanotubes market include Arkema Group, Showa Denko K.K., Nanocyl S.A., JiangSu Cnano Technology Ltd., LG Chem, Timesnano, and more. Key players are focusing on research and development efforts to innovate new applications and production techniques for carbon nanotubes, aiming to expand their market reach.

Additionally, partnerships and collaborations have become commonplace, allowing companies to access complementary technologies and markets. Some players have also pursued mergers and acquisitions to consolidate their positions and diversify product portfolios.

Market leaders have emphasized sustainability by developing environmentally friendly production methods and promoting green applications of carbon nanotubes. Furthermore, cost-efficiency and scalability have been at the forefront, with companies optimizing manufacturing processes and investing in large-scale production facilities.

Market Key Players

- Arkema Group

- Showa Denko K.K.

- Nanocyl S.A.

- JiangSu Cnano Technology Ltd.

- LG Chem

- Timesnano

- Hyperion Catalysis International

- OCSiAl Group

- Qingdao Haoxin

- Zeon Corporation

- Nanotech Labs Inc.

- Carbon Solutions, Inc.

- MSE Supplies LLC

- Raymor Industries Inc.

- Other Key Players

Recent Developments

In August 2022, LG Chem is expanding its investment in carbon nanotubes (CNT) with the construction of the world’s largest single-line CNT manufacturing plant.

In January 2022, OCSiAl Launched a New Graphene Nanotube Concentrate.

Report Scope

Report Features Description Market Value (2022) USD 7.6 Bn Forecast Revenue (2032) USD 31.3 Bn CAGR (2023-2032) 15.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Single-Walled Carbon Nanotubes (SWCNTs) and Multi-Walled Carbon Nanotubes (MWCNTs)), By Production Method (Chemical Vapor Deposition (CVD), Arc Discharge, Laser Ablation, and Other Production Methods), By End-Use Industry (Electronics & Semiconductor, Aerospace & Defense, Automotive, Energy & Power, Chemicals & Polymers, and Other End-Use Industries) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape Arkema Group, Showa Denko K.K., Nanocyl S.A., JiangSu Cnano Technology Ltd., LG Chem, Timesnano, Hyperion Catalysis International, OCSiAl Group, Qingdao Haoxin, Zeon Corporation, Nanotech Labs Inc., Carbon Solutions, Inc., MSE Supplies LLC, Raymor Industries Inc., and Other Key Players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are carbon nanotubes (CNTs) market?Carbon nanotubes (CNTs) are cylindrical nanostructures made of carbon atoms arranged in a hexagonal pattern. They exhibit extraordinary mechanical, electrical, and thermal properties, making them valuable in various industrial applications.

How is the carbon nanotubes market expected to grow in the coming years?The carbon nanotubes market is anticipated to grow due to increased demand for advanced materials in various industries, such as electronics, aerospace, and healthcare. The market growth is driven by technological advancements, research and development activities, and the expanding range of applications.

What factors influence the pricing of carbon nanotubes market?The pricing of carbon nanotubes is influenced by factors such as production methods, purity, diameter, length, functionalization, and market demand. Improved production techniques and increased economies of scale may also impact pricing.

-

-

- Arkema Group

- Showa Denko K.K.

- Nanocyl S.A.

- JiangSu Cnano Technology Ltd.

- LG Chem

- Timesnano

- Hyperion Catalysis International

- OCSiAl Group

- Qingdao Haoxin

- Zeon Corporation

- Nanotech Labs Inc.

- Carbon Solutions, Inc.

- MSE Supplies LLC

- Raymor Industries Inc.

- Other Key Players