Global 1,3 butadiene Market Size, Share, And Strategic Business Review By Grade (Refined Butadiene, Polymer Grade Butadiene), By Application (Synthetic Rubber Production, Chemical Intermediates, Fuel Additives, Others), By Manufacturing Process (Steam Cracking, Butane Dehydrogenation, Others), By End-use (Automotive, Construction, Consumer Goods, Packaging, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: December 2024

- Report ID: 135623

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Strategic Business Review of 1,3 butadiene

- By Grade Analysis

- By Application Analysis

- By Manufacturing Process Analysis

- By End-Use Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

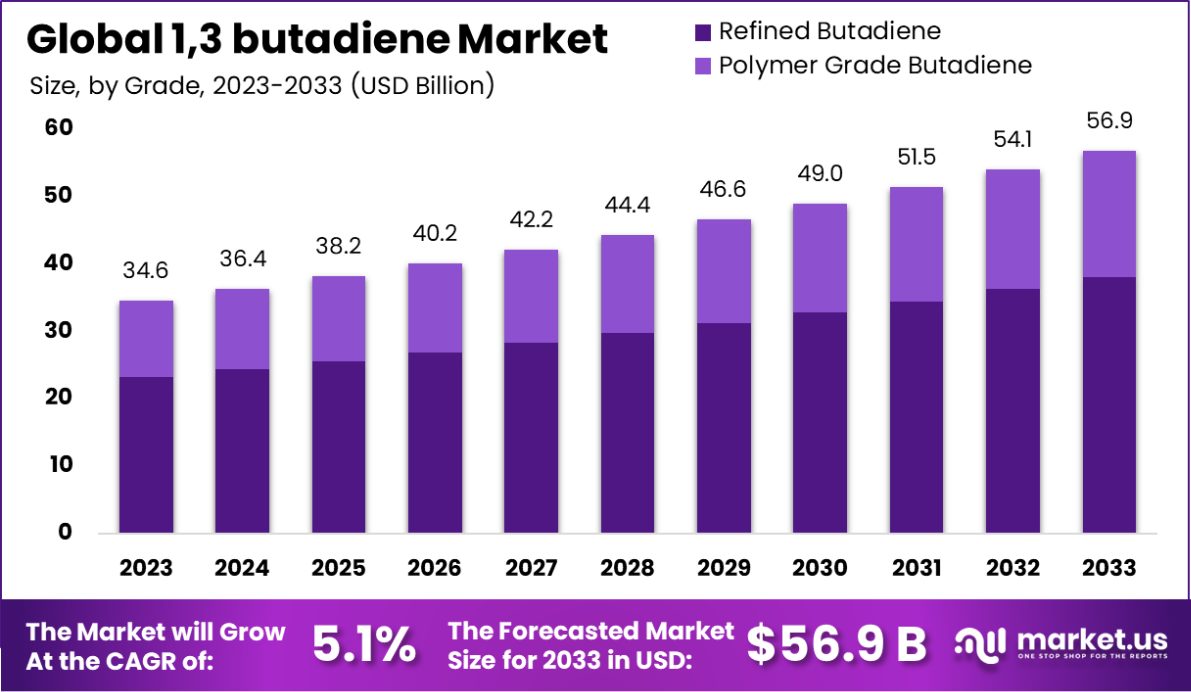

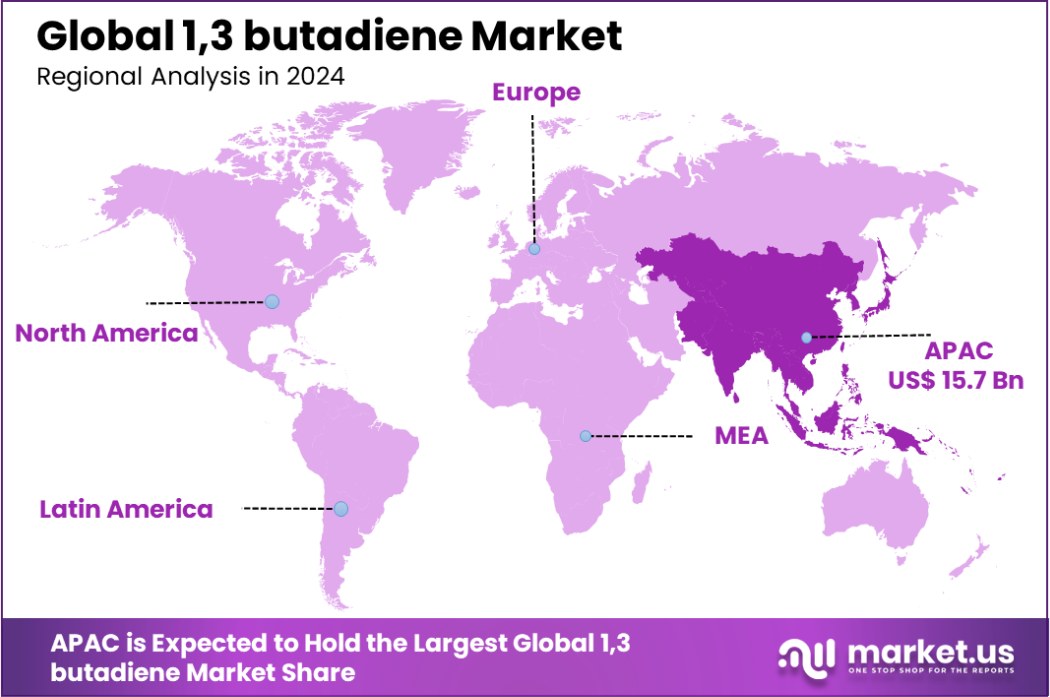

The Global 1,3 butadiene Market is expected to be worth around USD 56.9 Billion by 2033, up from USD 34.6 Billion in 2023, and grow at a CAGR of 5.1% from 2024 to 2033. Asia-Pacific dominates the 1,3 butadiene market with 45.4%, valued at USD 15.7 billion.

1,3-Butadiene is a colorless, highly reactive gas used primarily as a monomer to manufacture synthetic rubber, specifically styrene-butadiene rubber and polybutadiene rubber. It’s also used in the production of plastics, including acrylonitrile butadiene styrene and nitrile rubber, which are essential for automotive, appliance, and consumer goods industries.

The 1,3-butadiene market is experiencing growth due to increasing demand from the automotive industry for synthetic rubber in tires and various components. Additionally, rising global automotive production, particularly in developing countries, is boosting the consumption of 1,3-butadiene.

Growth factors for the 1,3-butadiene market include technological advancements in rubber production and increased investment in infrastructure development. The expanding global automotive industry and rising demand for high-performance rubber in tires and automotive parts drive this growth.

Opportunities in the 1,3-butadiene market lie in the development of eco-friendly production processes and the exploration of new applications in biodegradable materials. As industries seek more sustainable materials, 1,3-butadiene suppliers have the potential to innovate and capture new markets focused on environmental sustainability.

The 1,3-butadiene market presents a complex landscape influenced by robust production volumes, regulatory scrutiny, and ongoing research into sustainable production methods. Annually, the United States produces between 1 and 5 billion pounds of 1,3-butadiene, highlighting its significant role in the chemical industry.

The safety and environmental impact of 1,3-butadiene is noteworthy, with the substance being immediately dangerous to life or health at concentrations of 2,000 ppm. Furthermore, lethal concentration tests reveal that mice and rats can withstand extremely high levels of exposure, with LC50 values at 122,000 and 129,000 ppm, respectively, for durations between 2 and 4 hours. Such data is crucial for regulatory bodies and industries to establish safe handling and exposure guidelines.

Key Takeaways

- The Global 1,3 butadiene Market is expected to be worth around USD 56.9 Billion by 2033, up from USD 34.6 Billion in 2023, and grow at a CAGR of 5.1% from 2024 to 2033.

- Refined butadiene, essential for synthetic products, captures 67.5% of the market by grade.

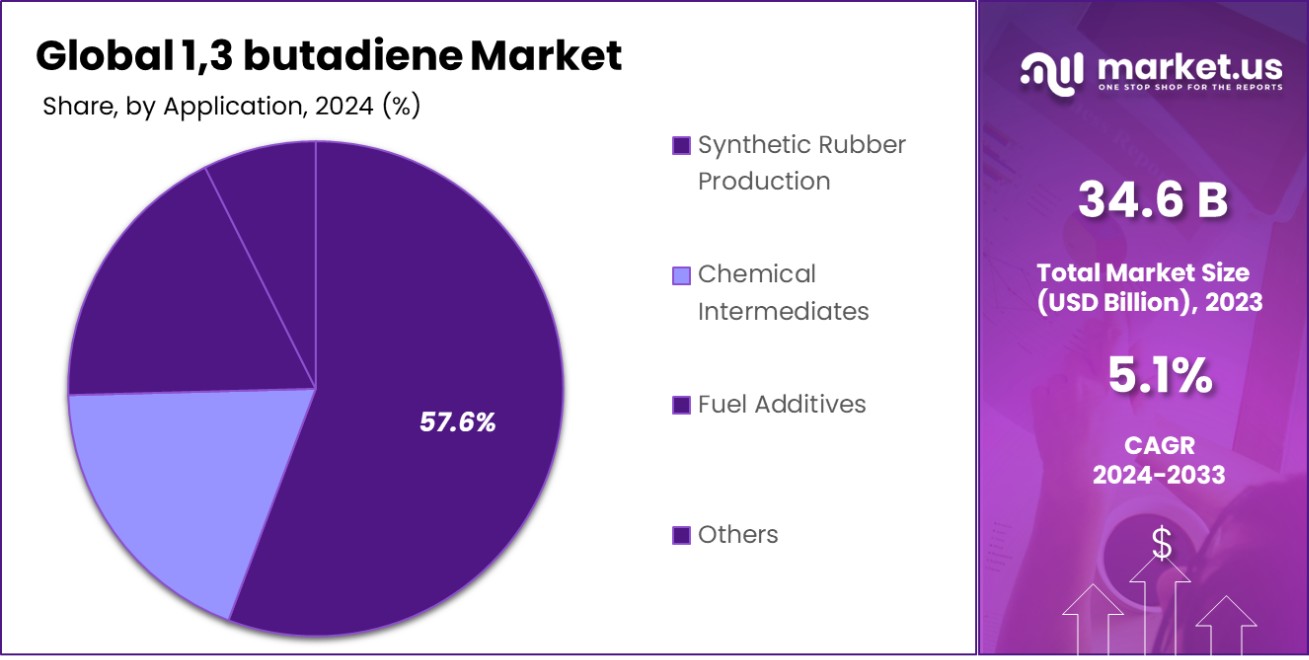

- Predominantly used in synthetic rubber production, butadiene satisfies 57.6% of the market by application.

- Steam cracking leads the butadiene manufacturing processes, holding a substantial 78.5% market share.

- The automotive sector remains a major butadiene end-user, accounting for 48.5% of market consumption.

- Asia-Pacific dominates the 1,3 butadiene market with 45.4% share, valued at USD 15.7 billion.

Strategic Business Review of 1,3 butadiene

The strategic business review for 1,3-butadiene highlights several important factors affecting the market and industry dynamics. The production and use of 1,3-butadiene, a crucial chemical in the manufacture of synthetic rubber and plastics, has significant implications for both economic and environmental aspects.

In recent years, the 1,3-butadiene market has demonstrated varied growth, particularly influenced by its applications in high-performance polymers and the demand for greener and environmentally friendly alternatives. For instance, the synthetic rubber industry, a major consumer of 1,3-butadiene, has seen growth due to its applications in automotive and industrial uses.

The industry’s revenue and growth metrics, such as those observed in companies like Kraton, indicate a market size of approximately $3.3 billion, with significant contributions from advanced materials and coatings that utilize 1,3-butadiene.

Environmental and safety regulations also play a critical role in shaping the market. The U.S. Environmental Protection Agency (EPA) has been actively evaluating the risks associated with 1,3-butadiene, particularly concerning its potential health impacts on workers and the general population.

Preliminary findings suggest that while consumer uses of 1,3-butadiene do not significantly contribute to environmental or health risks, industrial applications warrant closer scrutiny due to their higher exposure levels.

By Grade Analysis

Refined butadiene, a crucial chemical component, holds a significant 67.5% share in its market grade category.

In 2023, Refined Butadiene held a dominant market position in the By Grade segment of the 1,3 Butadiene Market, securing a 67.5% share. This notable market presence underscores the robust demand and pivotal role of Refined Butadiene in various industrial applications. On the other hand, polymer-grade butadiene also carved out a significant niche, reflecting the diverse needs and specifications demanded by manufacturers across the globe.

The prominence of Refined Butadiene can be attributed to its critical applications in the production of synthetic rubbers and plastics, which are integral to the automotive, construction, and consumer goods industries. The high purity level of Refined Butadiene makes it a preferred choice for manufacturers seeking optimal performance and quality in their end products.

As industries continue to evolve and new technologies emerge, the demand patterns for both grades of Butadiene are expected to shift. Innovations in product formulations and the increasing emphasis on sustainable manufacturing practices are likely to influence future market dynamics.

By Application Analysis

In the butadiene market, synthetic rubber production dominates applications, capturing a substantial 57.6%.

In 2023, Synthetic Rubber Production held a dominant market position in the By Application segment of the 1,3 Butadiene Market, with a 57.6% share. This leading position reflects the extensive use of 1,3 Butadiene in manufacturing various types of synthetic rubbers, which are crucial components in automotive tires, industrial belts, and hoses.

The rest of the market was distributed among uses in Chemical Intermediates and Fuel Additives, indicating a diverse range of applications that leverage the chemical properties of 1,3 Butadiene.

The strong foothold of Synthetic Rubber Production is driven by the global automotive industry’s demand for high-performance rubber products that can meet stringent safety and environmental standards. This segment’s growth is supported by increasing vehicle production and sales, particularly in emerging markets where economic growth is boosting consumer purchasing power.

Looking forward, the market dynamics may be influenced by advancements in rubber manufacturing technology and shifts in consumer preferences toward more sustainable materials.

As manufacturers continue to innovate and regulatory pressures increase, the role of 1,3 Butadiene in Chemical Intermediates and as Fuel Additives is also expected to evolve, potentially expanding its market reach and opening new opportunities for industry stakeholders.

By Manufacturing Process Analysis

Steam cracking, a primary manufacturing process, is pivotal, accounting for 78.5% of the butadiene sector.

In 2023, Steam Cracking held a dominant market position in the By Manufacturing Process segment of the 1,3 Butadiene Market, with a 78.5% share. This method outpaced Butane Dehydrogenation, highlighting its pivotal role in the industry. The preference for Steam Cracking stems from its efficiency in breaking down heavier hydrocarbon molecules into simpler ones, including 1,3 Butadiene, which is essential for producing synthetic rubber and other polymers.

The predominance of Steam Cracking can be linked to its established infrastructure and the scalability it offers to large chemical producers. This method is favored not only for its economic viability but also for its adaptability to various feedstocks, making it a versatile choice in diverse market conditions.

As the market continues to evolve, the efficiency of Steam Cracking and its integration with emerging technologies is expected to maintain its leading position. However, environmental concerns and the push for more sustainable production methods might boost interest in Butane Dehydrogenation, which could see advancements in its technology and possibly an increase in market share.

By End-Use Analysis

The automotive industry, a major end-user, utilizes 48.5% of butadiene, influencing its market dynamics significantly.

In 2023, the Automotive sector held a dominant market position in the By End-Use segment of the 1,3 Butadiene Market, with a 48.5% share. This significant portion underscores the critical role of 1,3 Butadiene in producing synthetic rubbers and plastics used extensively in vehicles.

Other notable segments included Construction, Consumer Goods, and Packaging, each leveraging 1,3 Butadiene for various applications, from building materials to everyday product packaging.

The Automotive industry’s reliance on 1,3 Butadiene is driven by its need for durable, high-performance materials that meet stringent safety and environmental regulations. As vehicle production increases globally, particularly with a push towards more fuel-efficient and electric models, the demand for these materials is expected to remain robust.

Moving forward, shifts in consumer preferences towards more sustainable and environmentally friendly products could reshape the demand dynamics across all sectors, including construction and smart packaging.

Key Market Segments

By Grade

- Refined Butadiene

- Polymer Grade Butadiene

By Application

- Synthetic Rubber Production

- Chemical Intermediates

- Fuel Additives

- Others

By Manufacturing Process

- Steam Cracking

- Butane Dehydrogenation

- Others

By End-use

- Automotive

- Construction

- Consumer Goods

- Packaging

- Others

Driving Factors

Increasing Demand from Automotive Industry

The 1,3 butadiene market is significantly driven by its demand in the automotive sector. This chemical is primarily used to produce synthetic rubber, which is essential for manufacturing tires, hoses, and gaskets.

As global automotive production continues to grow, with millions of vehicles being manufactured each year, the need for synthetic rubber rises, boosting the 1,3 butadiene market. This trend is reinforced by the expanding automotive markets in developing countries, where vehicle sales and production have been showing robust growth.

Growth in Construction and Home Improvement Sectors

1,3 butadiene is a key component in producing plastics and rubber used in construction and home improvement products. With the global construction industry expected to expand by approximately 3.5% annually, there is a heightened demand for these materials.

Products like pipes, cables, flooring, and sealants rely on the properties provided by butadiene-based products, supporting market growth. The surge in home renovation projects, particularly in regions with growing middle-class populations, also contributes significantly to the demand.

Innovations in Butadiene Extraction Technologies

Technological advancements in the extraction and production processes of 1,3 butadiene present a major driving factor for the market. New methods that allow for more efficient, cost-effective, and environmentally friendly production are being developed.

These innovations not only reduce production costs but also align with the global shift towards sustainable manufacturing practices. As industries continue to adopt these advanced technologies, the production of 1,3 butadiene becomes more feasible, supporting its market growth across various sectors.

Restraining Factors

Environmental Regulations Tightening Globally

The 1,3 butadiene market faces significant challenges due to stricter environmental regulations worldwide. Governments are increasingly focused on reducing pollution and controlling the use of chemicals that can harm the environment. 1,3 butadiene, used in various industrial applications, is under scrutiny for its potential environmental and health impacts.

These regulations not only increase the costs associated with compliance but also limit the production capacities of companies. This regulatory pressure is particularly strong in Europe and North America, where environmental standards are very stringent.

Volatility in Raw Material Prices

One of the major hurdles for the 1,3 butadiene market is the volatility in raw material prices. Butadiene is derived from the processing of crude oil, which has highly unpredictable price patterns. Fluctuations in crude oil prices can have a direct impact on the production costs of butadiene, affecting profitability and planning stability for manufacturers.

This volatility discourages long-term planning and could deter new entrants or investments in the market, potentially stifling growth and innovation.

Competition from Bio-based Alternatives

As the global push towards sustainability gains momentum, bio-based alternatives to traditional petrochemicals like 1,3 butadiene are gaining traction. These eco-friendly alternatives are increasingly preferred by industries looking to reduce their carbon footprint and appeal to environmentally conscious consumers.

This shift not only impacts the demand for traditional butadiene but also diverts investments toward developing and scaling bio-based technologies. The competition from these sustainable alternatives is expected to intensify, posing a challenge to the growth of the conventional 1,3 butadiene market.

Growth Opportunity

Expanding Market in the Asia-Pacific Region

The Asia-Pacific region presents a significant growth opportunity for the 1,3 butadiene market. This area is experiencing rapid industrialization and urbanization, leading to increased demand for automotive and construction products that use butadiene.

Countries like China and India are seeing a surge in their middle-class populations, which boosts consumer spending on vehicles and housing. These trends are expected to drive the demand for butadiene-based products substantially in the coming years, providing a lucrative market for producers looking to expand their presence in Asia-Pacific.

Advancements in Recycling and Green Chemistry

There is a growing opportunity to improve the sustainability of 1,3 butadiene production through advancements in recycling technologies and green chemistry. Innovations that enable the efficient recycling of butadiene-containing products or that minimize the environmental impact of butadiene production are increasingly in demand.

This shift not only helps companies meet stricter environmental regulations but also appeals to consumers and businesses looking to reduce their ecological footprints. Companies that invest in these technologies can gain a competitive edge and access new markets focused on sustainable practices.

Development of Synthetic Rubber for Specialty Applications

The development of synthetic rubbers using 1,3 butadiene for specialty applications offers a promising growth avenue. As technology advances, there is an increasing need for high-performance materials in industries such as aerospace, defense, and healthcare.

Synthetic rubber products tailored for extreme conditions or specific performance requirements present a high-value market. Companies that can innovate and develop new butadiene-based rubber compounds for these specialized applications are likely to see substantial growth, tapping into new industry segments and expanding their market share.

Latest Trends

Shift Toward Sustainable and Renewable Feedstocks

A noticeable trend in the 1,3 butadiene market is the shift toward using sustainable and renewable feedstocks. As environmental concerns mount, industries are actively seeking alternatives to traditional petroleum-based butadiene. This trend is not only driven by regulatory pressures but also by consumer demand for more sustainable products.

Companies are exploring the use of bio-based materials that can be converted into butadiene, potentially reducing dependence on crude oil and decreasing the environmental footprint of their operations. This green shift is expected to continue growing as technology advances and becomes more economically viable.

Increased Focus on Butadiene for High-Performance Plastics

The demand for high-performance plastics is another trend shaping the 1,3 butadiene market. These plastics are utilized in various high-end applications, from automotive parts to consumer electronics, where durability and performance under extreme conditions are crucial.

Butadiene is a key component in producing these plastics, providing the properties needed for tough, heat-resistant, and flexible materials. As industries push for more advanced materials to meet new technical and environmental standards, the use of butadiene in high-performance plastics is expected to expand significantly.

Rising Adoption of Butadiene in Medical Applications

Lastly, the rising use of butadiene in medical applications presents a growing trend. Synthetic rubbers derived from butadiene are becoming increasingly important in the healthcare sector for manufacturing gloves, tubing, and various medical devices that require flexibility and durability.

The ongoing global health challenges have spurred demand for these products, driving significant growth in this segment of the market. As the medical industry continues to grow and evolve, the role of butadiene in producing high-quality, safe, and reliable medical supplies is becoming more critical.

Regional Analysis

The Asia-Pacific region dominates the 1,3 butadiene market with a 45.4% share, valued at USD 15.7 billion.

The 1,3 Butadiene market exhibits distinct regional dynamics influenced by industrial activities, regulatory landscapes, and technological advancements. Asia-Pacific is the market leader, commanding 45.4% of the global share, with revenues reaching USD 15.7 billion.

This dominance is primarily due to robust manufacturing sectors in countries like China, India, and South Korea, where there is significant production of automotive and consumer goods requiring synthetic rubber and plastics, which are key derivatives of 1,3 Butadiene.

North America follows, with a steady demand linked to its mature automotive industry and burgeoning demand in the construction sector. Innovations in biodegradable plastics and increased shale gas extraction, which provides a cheaper raw material base, are significant growth factors in this region.

In Europe, the market is driven by stringent environmental regulations that push for more sustainable materials, affecting the production and consumption patterns of 1,3 Butadiene. The region is seeing a shift towards green tires and bio-based polymers, which utilize butadiene as a critical component.

The Middle East & Africa and Latin America regions show promising growth potential, albeit from a smaller base. These areas are focusing on expanding their petrochemical industries and are potential export hubs for 1,3 Butadiene, given their rising capacities and strategic global positioning.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global 1,3 Butadiene market sees strong contributions from leading companies like Braskem, LyondellBasell, and Sinopec, which are pivotal in shaping industry dynamics through strategic expansions and technological innovations.

Companies like LyondellBasell and SABIC, with their robust supply chains and integrated production systems, are enhancing their operational efficiencies and sustainability measures. These improvements are crucial in maintaining competitiveness in a market pressured by both environmental regulations and fluctuating raw material costs.

Braskem and Repsol are focusing on the development of sustainable solutions, aiming to meet the growing demand for eco-friendly products. This is particularly relevant as the industry shifts towards reducing carbon footprints and enhancing the biodegradability of synthetic rubbers and plastics.

Meanwhile, ExxonMobil and Chevron Phillips Chemical are leveraging their technological prowess to improve yield processes and reduce energy consumption, which is vital for sustaining profitability in the volatile petrochemical sector.

Asian giants like Sinopec and PetroChina are capitalizing on regional growth opportunities by expanding their production capacities. The rapid development of automotive and manufacturing industries in Asia-Pacific directly correlates with increased demand for 1,3 Butadiene derivatives.

Top Key Players

- Braskem

- LyondellBasell

- Repsol

- BASF

- Shell

- ExxonMobil

- TPC Group

- TotalEnergies

- Formosa Plastics Group

- Chevron Phillips Chemical

- PetroChina

- Dow

- Sinopec

- SIBUR

- SABIC

- China National Petroleum Corporation

Recent Developments

- In 2023, Braskem is enhancing its 1,3 Butadiene market presence through strategic initiatives focused on sustainable practices and innovative product development, aiming to meet global synthetic rubber demands efficiently.

- In 2023, LyondellBasell continues to be a significant producer in the 1,3-butadiene market, known for its broad application in rubber and nylon products. Their commitment to sustainable production techniques aligns with market demands for environmentally friendly manufacturing practices.

Report Scope

Report Features Description Market Value (2023) USD 34.6 Billion Forecast Revenue (2033) USD 56.9 Billion CAGR (2024-2033) 5.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Refined Butadiene, Polymer Grade Butadiene), By Application (Synthetic Rubber Production, Chemical Intermediates, Fuel Additives, Others), By Manufacturing Process (Steam Cracking, Butane Dehydrogenation, Others), By End-use (Automotive, Construction, Consumer Goods, Packaging, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Braskem, LyondellBasell, Repsol, BASF, Shell, ExxonMobil, TPC Group, TotalEnergies, Formosa Plastics Group, Chevron Phillips Chemical, PetroChina, Dow, Sinopec, SIBUR, SABIC, China National Petroleum Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Braskem

- LyondellBasell

- Repsol

- BASF

- Shell

- ExxonMobil

- TPC Group

- TotalEnergies

- Formosa Plastics Group

- Chevron Phillips Chemical

- PetroChina

- Dow

- Sinopec

- SIBUR

- SABIC

- China National Petroleum Corporation