Global Butadiene Market By Product Type(Butadiene Rubber, Styrene Butadiene Rubber, Acrylonitrile Butadiene Rubber, Nitrile Butadiene Rubber, Styrene Butadiene Latex, Others), By Production Process(C4 Hydrocarbon Extraction, n-butane Dehydrogenation, From Ethanol, From Futenes), By Purity(Below 99%, Above 99%), By End-Use(Tire Manufacturing, Automotive, Plastics and Polymers, Building and Construction, Consumer Products, Healthcare, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 116535

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

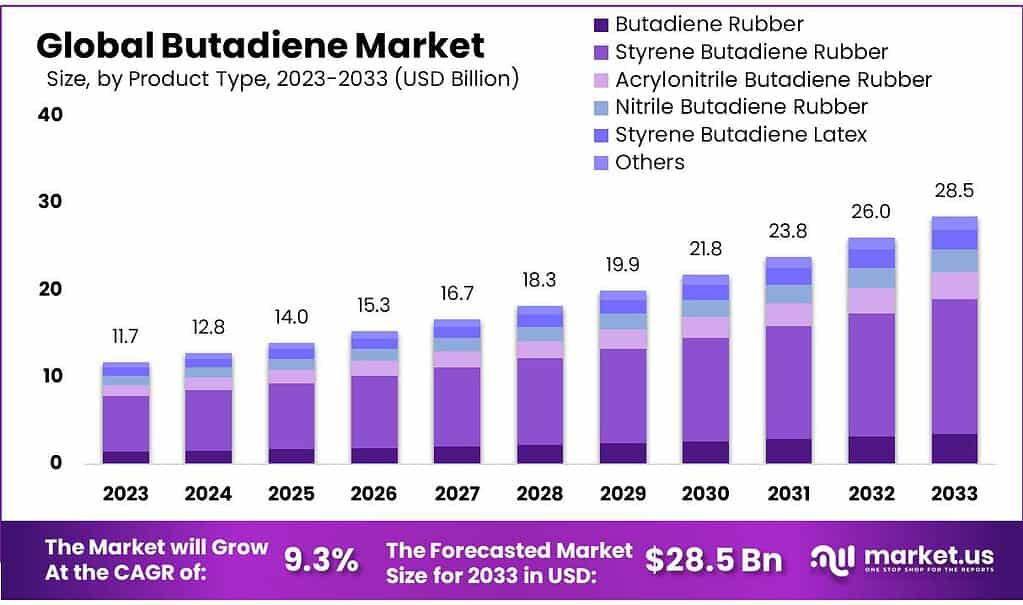

The global Butadiene Market size is expected to be worth around USD 28.5 billion by 2033, from USD 11.7 billion in 2023, growing at a CAGR of 9.3% during the forecast period from 2023 to 2033.

The Butadiene Market refers to the global economic sector centered around the production, distribution, and consumption of butadiene, a chemical compound that is a colorless, highly flammable gas. Butadiene (C4H6) plays a critical role in the chemical industry due to its use as a monomer in the production of synthetic rubbers and polymers. These materials are essential components in a wide range of applications, including automotive tires, plastics, footwear, and other consumer goods.

Butadiene is predominantly produced through the process of steam cracking of naphtha or ethane and propane in the production of ethylene, a key building block in the petrochemical industry. It can also be produced through the dehydrogenation of butane or butenes, processes that contribute to its availability for industrial use.

The demand for butadiene is closely linked to the automotive industry, given its significant use in the manufacture of styrene-butadiene rubber (SBR) and polybutadiene rubber (PBR), both of which are crucial for making tires and other automotive components. Additionally, butadiene is used in the production of acrylonitrile butadiene styrene (ABS) and nitrile rubber, which find applications in consumer electronics, appliances, and a variety of industrial products.

Key Takeaways

- Market Size Projection: The Butadiene Market is to reach USD 28.5 billion by 2033, with a 9.3% CAGR from 2023.

- Dominant Product Types: Styrene Butadiene Rubber leads, capturing 54.7% market share, followed by Butadiene Rubber and others.

- Production Processes: Ethanol-based production holds 56.4% market share, with C4 Hydrocarbon Extraction and other processes contributing.

- Purity Segmentation: Below 99% purity dominates due to cost-effectiveness, while above 99% purity commands a premium for specialized applications.

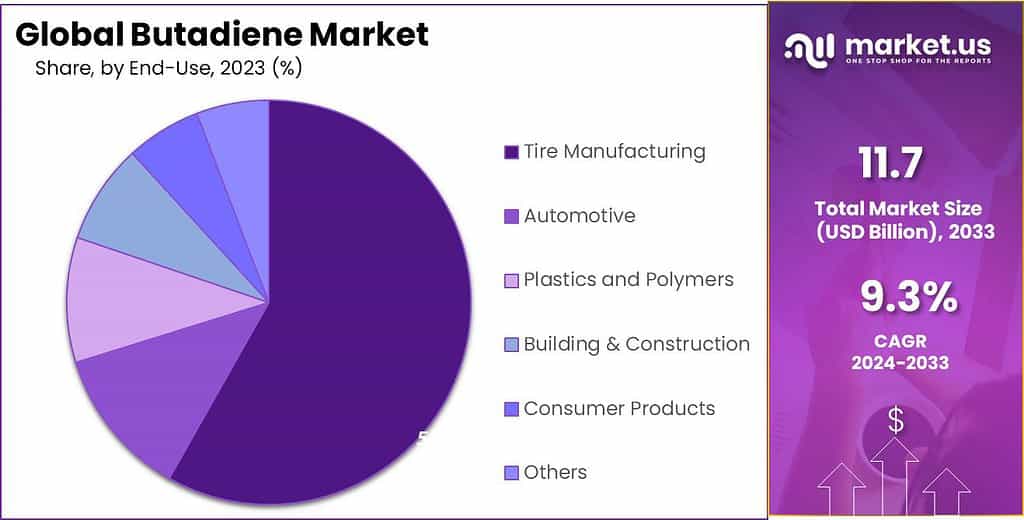

- End-Use Applications: Tire manufacturing holds over 58.2% market share, followed by Automotive, Plastics, and others.

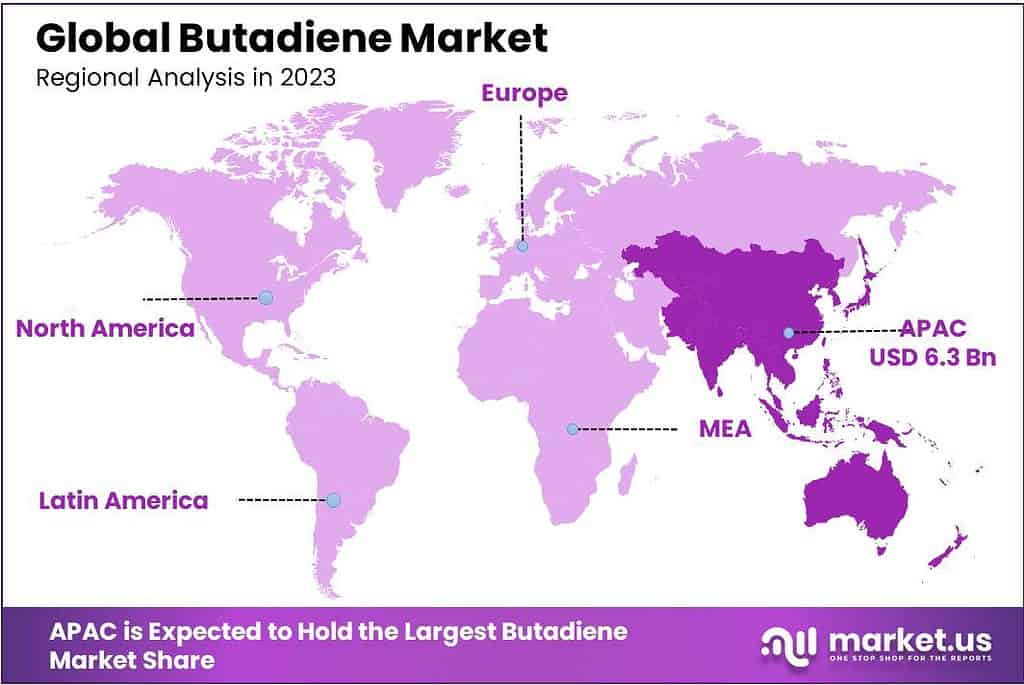

- Regional Analysis: Asia Pacific, particularly China, emerges as a key player, capturing a substantial 54.6% share of the Butadiene Market.

- The United States is expected to increase its butadiene production capacity by approximately 300,000 tons by 2024, driven by investments in new crackers and dehydrogenation units.

- Europe’s butadiene demand is projected to grow at a CAGR of 2.8% from 2023 to 2028, supported by the recovery of the automotive and construction sectors.

By Product Type

Styrene Butadiene Rubber held a dominant market position, capturing more than a 54.7% share. This segment’s prominence is attributed to its extensive use in the automotive industry, especially for manufacturing tires, due to its excellent abrasion resistance and aging stability. The demand in this segment is driven by the global automotive sector’s growth, pushing the need for high-quality rubber.

Butadiene Rubber, also known as polybutadiene rubber, is notable for its high resilience and resistance to wear, making it another critical material for tire manufacturing and industrial rubber products. Its properties of low-temperature flexibility and high abrasion resistance contribute to its use in challenging environments.

Acrylonitrile Butadiene Rubber, recognized for its superior resistance to oils, fuels, and other chemicals, finds its application in the automotive and oil industries for making hoses, seals, and gaskets. The demand in this segment benefits from the increasing requirements for durable and reliable materials in harsh chemical environments.

Nitrile Butadiene Rubber is favored for applications requiring excellent oil, fuel, and chemical resistance. Its use in the automotive, oil and gas, and aerospace industries for producing o-rings, seals, and gaskets underpins the steady demand within this segment.

Styrene Butadiene Latex stands out for its applications in paper coatings, adhesives, and foams, owing to its good bonding properties and durability. This segment caters to the construction, paper, and consumer goods sectors, where the demand for quality adhesives and coatings drives market growth.

By Production Process

From Ethanol emerged as the leading segment, capturing more than a 56.4% share. This dominance is due to the sustainability aspect and the relatively lower environmental impact of ethanol-based processes. The method’s efficiency and the growing emphasis on greener chemical processes have made it particularly attractive, driving its substantial market share.

C4 Hydrocarbon Extraction follows, characterized by its role in extracting butadiene from mixed C4 streams derived from steam crackers and refineries. This process is pivotal for its ability to supply butadiene alongside the production of other valuable chemicals, although it faces challenges from fluctuating crude oil prices and the demand for alternative, more sustainable sources.

N-butane dehydrogenation presents a method of directly converting n-butane into butadiene. This process gains attention for its potential to utilize shale gas resources, offering a strategic advantage in regions rich in natural gas. However, its market share is moderated by technological and economic considerations, including the cost of butane and the investment in dehydrogenation facilities.

Futenes involve the dimerization of isobutylene or the dehydrogenation of isopentane. This niche segment caters to specific market needs, leveraging the availability of feedstocks and targeting applications where specific butadiene isomers are desired. Although smaller in market share, this segment highlights the diversity of production methods catering to the butadiene market’s nuanced demands.

By Purity

Below 99% held a dominant market position, reflecting the broad utility and demand for butadiene in applications where ultra-high purity is not a critical requirement. This segment caters to a wide range of industrial uses, including the production of synthetic rubbers and polymers, where slightly lower purity levels do not compromise the performance of the end products. The dominance of this segment is attributed to its cost-effectiveness and sufficient quality for large-volume applications.

Above 99% purity butadiene, although a smaller segment, is crucial for specialized applications that demand the highest purity levels. This includes specific types of rubber and plastics, as well as certain chemical synthesis processes where the presence of impurities can significantly affect the quality and characteristics of the final product. Despite its smaller market share, this segment commands a premium due to the stringent production controls and purification processes required to achieve such high purity levels.

By End-Use

Tire Manufacturing held a dominant market position, capturing more than a 58.2% share. This significant portion is due to the critical role butadiene plays in producing synthetic rubber, a fundamental material for tires. The demand in this segment is driven by the global automotive industry’s growth, emphasizing the need for durable and high-performance tires.

Automotive beyond tire manufacturing, the automotive sector relies on butadiene for parts like hoses, seals, and gaskets. This segment benefits from the industry’s continuous evolution, requiring more advanced and reliable materials to meet safety and performance standards.

Plastics and Polymers utilize butadiene in creating products with enhanced flexibility, toughness, and heat resistance. This segment caters to a wide array of applications, from household items to industrial components, underscoring the material’s versatility.

Building & Construction finds butadiene-based materials crucial for producing adhesives, sealants, and coatings. The durability and resistance properties of these materials support the sector’s demand, reflecting the construction industry’s ongoing development.

Consumer Products segment includes everyday items ranging from toys to appliances, where butadiene’s role in plastics and rubber contributes to the quality and functionality of these products. The diversity of consumer goods underscores the widespread application of butadiene-derived materials.

Healthcare utilizes butadiene in manufacturing medical devices, equipment, and packaging. This segment values the material for its safety, flexibility, and durability, essential attributes for healthcare products.

Key Market Segmentation

By Product Type

- Butadiene Rubber

- Styrene Butadiene Rubber

- Acrylonitrile Butadiene Rubber

- Nitrile Butadiene Rubber

- Styrene Butadiene Latex

- Others

By Production Process

- C4 Hydrocarbon Extraction

- n-butane Dehydrogenation

- From Ethanol

- From Futenes

By Purity

- Below 99%

- Above 99%

By End-Use

- Tire Manufacturing

- Automotive

- Plastics and Polymers

- Building & Construction

- Consumer Products

- Healthcare

- Others

Driving Factors

Growing Demand in Automotive and Tire Industries

The automotive sector, particularly tire manufacturing, remains the cornerstone of butadiene demand. According to the World Economic Forum, the global automotive industry is expected to grow, further propelled by emerging markets in Asia and Africa. Butadiene-based synthetic rubbers, such as Styrene-Butadiene Rubber (SBR), are essential for producing tires that offer improved performance and durability. This demand is reinforced by the increasing vehicle production and sales globally, driving the butadiene market forward.

Advances in Polymer Science and Material Engineering

Innovation in polymer science and material engineering has expanded the application range of butadiene-derived products. New formulations of butadiene rubbers are being developed to meet the specific needs of various industries, including construction, footwear, and healthcare. These advances not only enhance the properties of existing products but also open up new markets for butadiene applications.

Economic Growth in Emerging Markets

Rapid industrialization and economic growth in emerging markets are significant drivers for the butadiene market. As countries such as China, India, and Brazil continue to grow, their demand for consumer goods, automotive, and construction materials increases. This growth translates into a higher demand for butadiene and its derivatives, providing a substantial market opportunity.

Restraining Factors

Feedstock Price Volatility

The butadiene market is susceptible to the volatility of crude oil and natural gas prices, as these are primary feedstocks for its production. The U.S. Energy Information Administration (EIA) regularly reports on these fluctuations, which can significantly affect production costs and market prices for butadiene.

Regulatory and Environmental Constraints

Strict environmental regulations globally, such as the U.S. Environmental Protection Agency’s (EPA) regulations on toxic emissions, impose significant compliance costs on butadiene producers. These regulations also restrict the use of butadiene in certain applications, impacting market growth.

Competition from Alternatives

The development of alternative materials that can substitute butadiene in various applications poses a challenge. Innovations in material science often lead to the creation of products that offer similar or superior properties without the associated environmental or health risks, potentially diminishing butadiene’s market share.

Growth Opportunities

Bio-based Butadiene Production

The drive towards sustainability has opened avenues for bio-based butadiene, using renewable resources as feedstock. This not only addresses environmental concerns but also provides an opportunity to tap into markets with stringent sustainability criteria.

Market Expansion

The versatility of butadiene makes it suitable for a wide range of applications, presenting opportunities for market expansion into new sectors. Continuous research and development can lead to innovations that leverage butadiene’s unique properties for use in advanced technologies, such as energy storage and medical devices.

Strategic Collaborations

Partnerships between butadiene producers, end-users, and research institutions can foster innovation and market expansion. These collaborations can accelerate the development of new technologies and applications, enabling stakeholders to quickly adapt to market changes and explore untapped markets.

Latest Trends

The Market Is Poised To Be Led By the Dominance Of Tire And Rubber Products

The dominance of tire and rubber production in the market can be attributed to the significant utilization of butadiene, a key component in the manufacturing of synthetic rubbers and elastomers. Among these elastomers are polybutadiene rubber (PBR), styrene-butadiene rubber (SBR), nitrile rubber (NR), and polychloroprene (Neoprene). These materials serve as essential inputs for a wide range of goods and products.

Polybutadiene rubber (PBR) and styrene-butadiene rubber (SBR) play crucial roles in tire manufacturing, contributing to the production of high-quality and durable tires. On the other hand, neoprene and nitrile rubber find application in the production of various items such as gloves, seals, gaskets, hoses, wetsuits, foams, and water-related products. Additionally, styrene-butadiene (SB) latex proves valuable for the creation of carpets and paper coatings.

Polybutadiene rubber, known as BR or PBR, stands out as a synthetic general-purpose elastomer often employed as an alternative to natural rubber due to its cost-effectiveness and large production volume. The synthesis of polybutadiene rubber in a non-polar solvent involves either anionic polymerization or coordination polymerization of 1,3-butadiene. This method is preferred for its ability to tightly control molecular weight (MW) and achieve high stereoregularity in the final product.

Geopolitics and Recession Impact Analysis

The geopolitical landscape and economic fluctuations have significantly influenced the global butadiene market, affecting its operations and prospects. The tensions among major nations have disrupted the path to economic stabilization post-COVID-19 pandemic, leading to economic sanctions, increased commodity prices, and interruptions in global supply chains.

These geopolitical events have a direct impact on the butadiene market due to the implementation of trade policies and sanctions that can restrict access to crucial feedstocks or limit export opportunities for butadiene and its derivatives. For instance, sanctions on countries that are key players in the butadiene supply chain can create gaps in supply, affecting prices and availability on a global scale. Economic downturns generally lead to a decrease in manufacturing and industrial activities.

Given butadiene’s significant use in manufacturing synthetic rubbers and polymers for automotive tires, consumer goods, and construction materials, a recession could lead to a reduced demand for these products, thereby decreasing the need for butadiene. The geopolitical tensions have also caused supply chain disruptions, impacting the procurement of essential raw materials for butadiene production. The consequent rise in commodity prices and the challenges posed by economic sanctions can increase production costs, leading to pricing pressures within the butadiene market.

Moreover, the uncertainty and instability resulting from geopolitical conflicts can make investors and market participants cautious, potentially delaying or scaling down investment in market expansion or innovation within the butadiene sector.

Despite these obstacles, the butadiene market is poised for growth, driven by the sustained demand in its primary application areas, such as the automotive industry, construction, and consumer products. This growth is supported by the critical role butadiene plays in the development of products essential for everyday use and industrial applications, highlighting the market’s capacity to adapt and thrive even in challenging economic and geopolitical climates. The resilience of the butadiene market is a testament to the indispensable nature of its applications across various industries, ensuring its continued relevance and demand in the global market landscape.

Regional Analysis

In 2023, the Asia Pacific region emerged as a pivotal player in the global butadiene market, capturing a substantial share of 54.6%, propelled by the exponential growth of the chemical and consumer goods industries within the region. The burgeoning expansion of sectors such as electronics and automotive in Asia Pacific has significantly spurred the demand for butadiene, which is crucial in the production of synthetic rubbers and polymers.

China, standing as a central figure in the Asia Pacific market, has notably influenced the region’s dominance in the butadiene industry. The country’s extensive industrial activities and advancements in manufacturing capabilities have bolstered the production and supply of butadiene-based products. This growth is closely tied to the heightened demand for synthetic rubber in tire manufacturing, automotive components, and various consumer goods, underlining the integral role of butadiene in these industries.

The region’s substantial demand for butadiene is further amplified by its applications in creating plastics and polymers, which are essential in a wide array of industrial and consumer applications. With China at the forefront, Asia Pacific benefits from an efficient supply chain and robust production infrastructure, facilitating the widespread use of butadiene-derived products in construction, healthcare, and electronics, among others.

Additionally, the strategic focus on expanding automotive and manufacturing industries across the region has led to an increased requirement for high-performance materials, including butadiene rubber, further cementing the Asia Pacific’s leadership in the global butadiene market. This scenario is indicative of the region’s dynamic industrial landscape, where the availability of resources and the push toward technological advancements drive the continuous growth and demand for butadiene and its derivatives.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- India

- Japan

- South Korea

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Key Players Analysis

The butadiene market is characterized by a competitive landscape with several key players who play crucial roles in shaping the industry dynamics. These companies are actively involved in the production, supply, and innovation of butadiene and its derivatives, catering to a wide range of industrial applications. Among the notable companies in this market are Sinopec, LyondellBasell, TPC Group, Ineos, and BASF, each bringing their own strengths and strategic focuses to the forefront.

Sinopec, one of the largest petrochemical manufacturers globally, has a significant presence in the butadiene market, particularly in the Asia-Pacific region, which is a key market due to its rapid industrial growth and demand for synthetic rubbers and polymers. LyondellBasell is another major player, known for its advanced technology and extensive production capabilities, which enable it to meet the growing demand for butadiene across various sectors including automotive, construction, and consumer goods.

Market Key Players

- BASF SE

- Sinopec

- LyondellBasell Industries

- The Dow Chemical Company (Dow)

- Royal Dutch Shell

- ExxonMobil Corporation

- INEOS Group

- Reliance Industries Limited

- Lanxess AG

- TPC Group

- Eni S.p.A.

- JSR Corporation

- Evonik Industries AG

- Repsol

- Formosa Plastics Corporation

Recent Developments

In July 2022, Sinopec and INEOS Group unveiled plans for three joint ventures to bolster petrochemical production in response to growing demand in China. As part of the collaboration, INEOS acquired a 50% stake in Sinopec subsidiary SECCO Petrochemical Co. Ltd., a major butadiene producer.

BASF, in June 2022, extended its Licity anode binders for Li-ion battery manufacturing, introducing the second-generation styrene-butadiene rubber (SBR) binder Licity 2698 X F. This binder facilitates the use of silicon contents exceeding 20%, offering higher capacity, increased charge/discharge cycles, and reduced charging times.

Report Scope

Report Features Description Market Value (2023) US$ 11.7 Bn Forecast Revenue (2033) US$ 28.5 Bn CAGR (2024-2033) 9.3 % Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type(Butadiene Rubber, Styrene Butadiene Rubber, Acrylonitrile Butadiene Rubber, Nitrile Butadiene Rubber, Styrene Butadiene Latex, Others), By Production Process(C4 Hydrocarbon Extraction, n-butane Dehydrogenation, From Ethanol, From Futenes), By Purity(Below 99%, Above 99%), By End-Use(Tire Manufacturing, Automotive, Plastics and Polymers, Building and Construction, Consumer Products, Healthcare, Others) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, India, Japan, South Korea, ASEAN, and the Rest of APAC; Latin America: Brazil, Mexico, and Rest of Latin America; Middle East & Africa: GCC, South Africa, and Rest of Middle East & Africa. Competitive Landscape BASF SE, Sinopec, LyondellBasell Industries, The Dow Chemical Company (Dow), Royal Dutch Shell, ExxonMobil Corporation, INEOS Group, Reliance Industries Limited, Lanxess AG, TPC Group, Eni S.p.A., JSR Corporation, Evonik Industries AG, Repsol, Formosa Plastics Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Butadiene Market?Butadiene Market size is expected to be worth around USD 28.5 billion by 2033, from USD 11.7 billion in 2023

What CAGR is projected for the Butadiene Market?The Butadiene Market is expected to grow at 9.3% CAGR (2024-2033).Name the major industry players in the Butadiene Market?BASF SE, Sinopec, LyondellBasell Industries, The Dow Chemical Company (Dow), Royal Dutch Shell, ExxonMobil Corporation, INEOS Group, Reliance Industries Limited, Lanxess AG, TPC Group, Eni S.p.A., JSR Corporation, Evonik Industries AG, Repsol, Formosa Plastics Corporation

-

-

- BASF SE

- Sinopec

- LyondellBasell Industries

- The Dow Chemical Company (Dow)

- Royal Dutch Shell

- ExxonMobil Corporation

- INEOS Group

- Reliance Industries Limited

- Lanxess AG

- TPC Group

- Eni S.p.A.

- JSR Corporation

- Evonik Industries AG

- Repsol

- Formosa Plastics Corporation