1,2-Propanediol Market Size, Share, And Strategic Business Review By Product Type (Industrial Grade, Food Grade, Pharmaceutical Grade), By Application (Unsaturated Polyester Resins, Functional Fluids, Food and Flavor, Others), By End-User Industry (Automotive, Building and Construction, Pharmaceuticals, Food and Beverage, Cosmetics and Personal Care, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: December 2024

- Report ID: 135719

- Number of Pages: 282

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Strategic Business Review of 1,2-Propanediol

- By Product Type Analysis

- By Application Analysis

- By End-User Industry Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

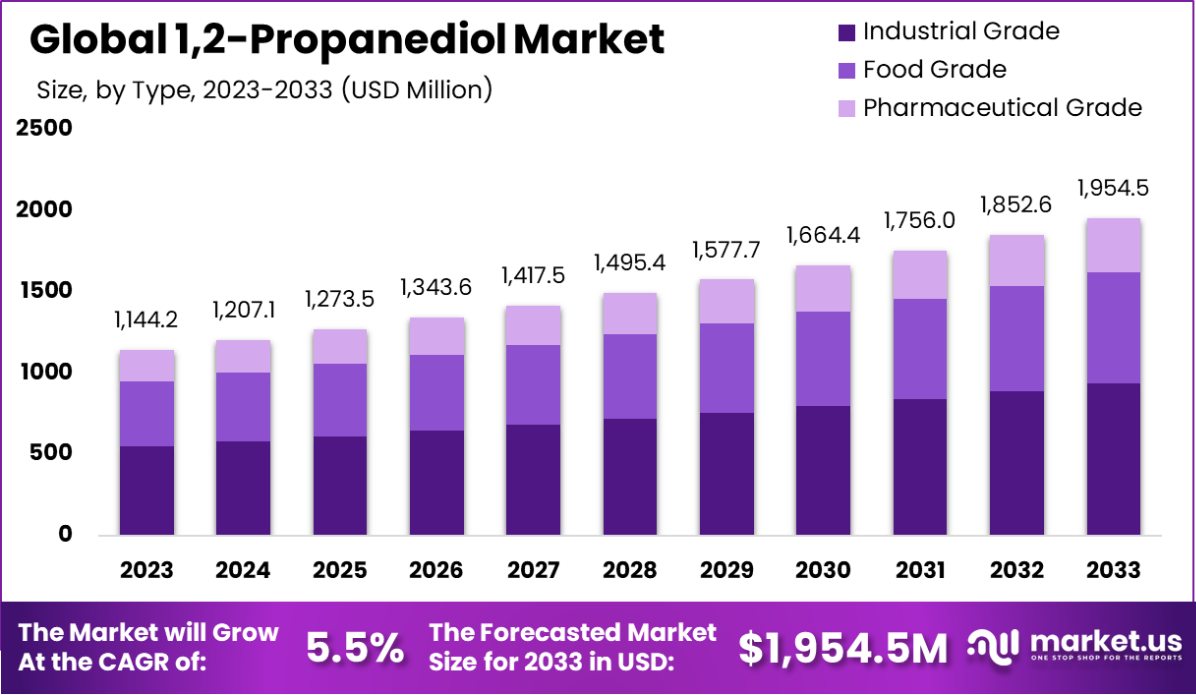

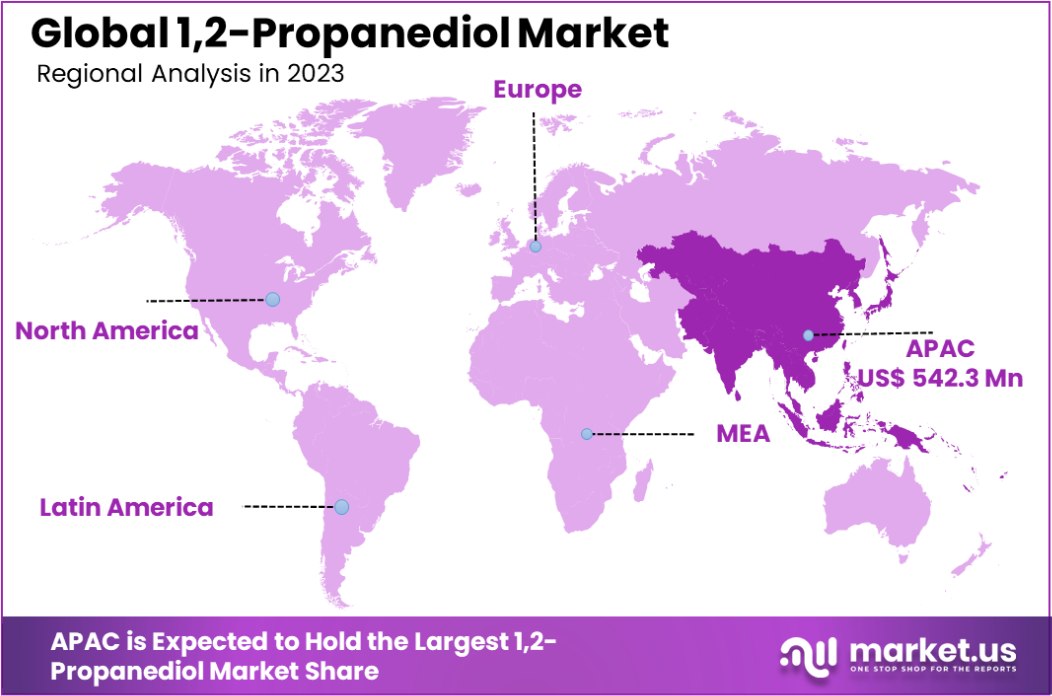

The Global 1,2-Propanediol Market is expected to be worth around USD 1,954.5 Million by 2033, up from USD 1144.2 Million in 2023, and grow at a CAGR of 5.5% from 2024 to 2033. The Asia-Pacific 1,2-Propanediol market holds a 44.8% share, valued at USD 542.3 million.

1,2-Propanediol, commonly known as propylene glycol, is an organic compound with a wide range of uses in the pharmaceutical, food, and chemical industries due to its properties as a solvent and moisture-preserving agent. It is colorless, odorless, and possesses a syrup-like consistency, making it ideal for use in cosmetics, food flavorings, and as an ingredient in antifreeze formulations.

The 1,2-propanediol market is experiencing growth driven by increasing demand in industries such as food and beverage, pharmaceuticals, and cosmetics. The shift towards more natural and less toxic products is propelling the use of 1,2-Propanediol in eco-friendly antifreeze and coolant applications, offering significant market opportunities.

Innovations in biochemical pathways for sustainable production are also expected to boost market growth by appealing to environmentally conscious consumers and companies.

The 1,2-propanediol market, commonly referred to as propylene glycol, exhibits robust growth prospects driven by both traditional applications and innovative production methods. In 1998, the United States reported a significant production capacity, totaling approximately 596 thousand tonnes (1.312 billion pounds), underscoring its critical role in industrial and consumer product manufacturing. This capacity highlights the substantial scale and the established presence of 1,2-propanediol in the chemical sector.

In recent years, the industry has seen a pivot towards sustainability, marked by advancements in the conversion of glycerol to 1,2-propanediol. Recent studies underscore the efficiency of this transition, achieving selectivities as high as 93.4%. This is particularly notable as glycerol, a byproduct of biodiesel production, presents a renewable feedstock that aligns with global sustainability goals.

The process involves the introduction of glycerol with less than 3% water content by weight, along with hydrogen, into a reactor. This reaction occurs in the presence of a copper-based catalyst at conditions ranging from 20-150 bar and temperatures between 150-400°C. Moreover, the process is finely tuned to maintain the water content in the resulting solution below 5% by weight, optimizing the reaction efficiency and product purity.

This shift towards greener production methods not only enhances the environmental profile of 1,2-propanediol but also offers potential cost benefits and aligns with regulatory trends favoring sustainable industrial practices.

As industries continue to demand more eco-friendly and efficient solutions, the 1,2-Propanediol market is poised to expand its reach and impact, driven by both innovation and an enduring demand across various sectors including pharmaceuticals, cosmetics, and food production.

Key Takeaways

- The Global 1,2-Propanediol Market is expected to be worth around USD 1,954.5 Million by 2033, up from USD 1144.2 Million in 2023, and grow at a CAGR of 5.5% from 2024 to 2033.

- In the 1,2-Propanediol market, industrial-grade products dominate with a 48.4% market share.

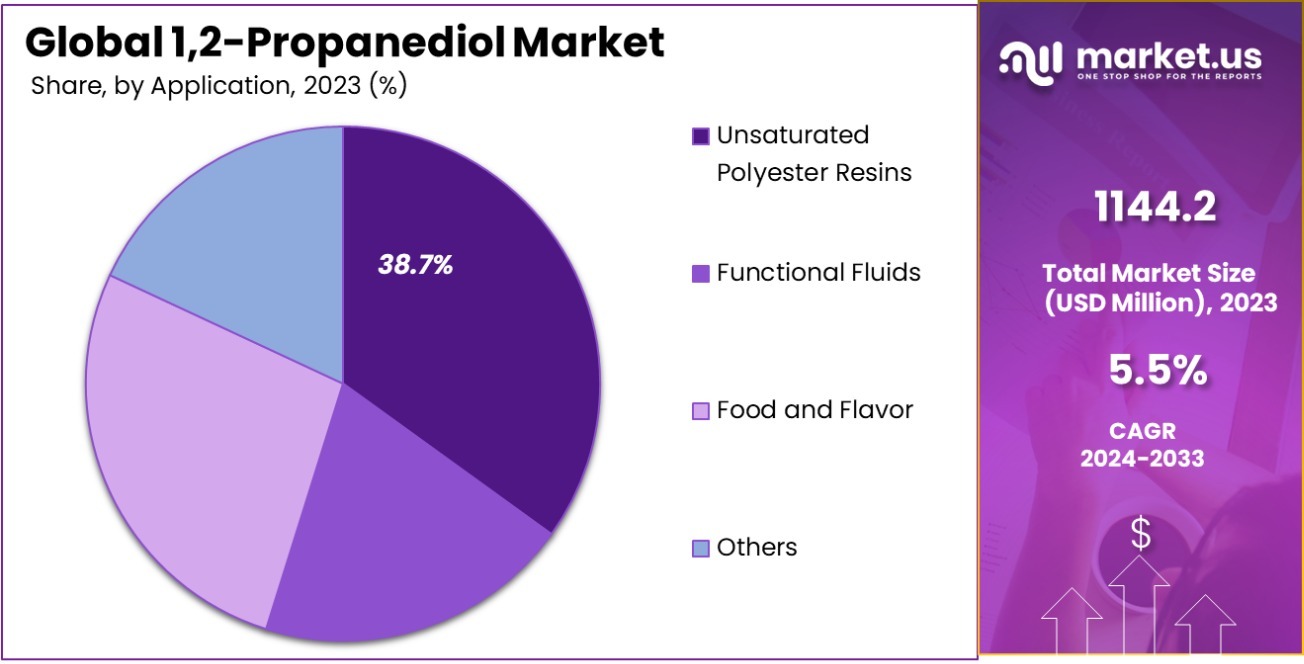

- Unsaturated polyester resins are a major application, accounting for 38.7% of the market use.

- The automotive industry is a significant end-user, comprising 29.3% of the market demand.

- In Asia-Pacific, the 1,2-propanediol market holds a 44.8% share, valued at USD 542.3 million.

Strategic Business Review of 1,2-Propanediol

1,2-Propanediol, commonly known as propylene glycol, is a versatile chemical used in a variety of industries, including pharmaceuticals, food processing, and cosmetics. It serves as an antifreeze component, a solvent, and a substance that can hold and dissolve other substances.

The synthesis of 1,2-propanediol has been industrially significant since the 1930s, derived from propylene oxide and water, leading to the production of both di- and tripropylene glycol. As of 2017, the global production capacity for 1,2-propanediol was estimated at over 2.5 million tons.

In addition to its industrial and commercial uses, propylene glycol is utilized in organic farming, particularly for treating ketosis in ruminants under specific conditions outlined by the USDA’s organic standards.

Ketosis is a metabolic disorder that can occur in pregnant or lactating ruminants when their energy demands exceed the glucose supply, leading to the breakdown of body fats to ketones for energy. Propylene glycol provides a direct source of glucose to correct this imbalance.

The safety and health profiles of propylene glycol have been thoroughly evaluated, revealing that it is generally recognized as safe for use in foods and drugs when used according to established guidelines. However, it must be handled with care to avoid occupational exposure risks, especially in industrial settings where high volumes are used.

By Product Type Analysis

The 1,2-propanediol market is predominantly characterized by its industrial-grade products, accounting for 48.4% of the market share.

In 2023, Industrial Grade held a dominant market position in the “By Product Type” segment of the 1,2-Propanediol Market, with a 48.4% share. This substantial market share is attributed to the widespread application of 1,2-Propanediol in industries such as automotive, paints and coatings, and plastics, where it is primarily used as an antifreeze and coolant.

Industrial Grade 1,2-Propanediol’s properties such as low toxicity and excellent viscosity control make it indispensable in manufacturing processes.

Following Industrial Grade, the Food Grade segment accounted for a 32.1% share of the market. This grade of 1,2-Propanediol is crucial in food processing industries because it serves as a solvent for food colors and flavors, and is also used in the production of moisture-stabilizing agents. Its non-toxic nature and compatibility with food ingredients drive its demand in this segment.

Lastly, the Pharmaceutical Grade segment made up 19.5% of the market. This grade is essential in pharmaceutical applications due to its role in the formulation of various medicinal products such as injectables, ointments, and syrups. Its function as a carrier of active ingredients and as a solvent enhances its utility in medical formulations, supporting its steady market share.

By Application Analysis

In terms of application, unsaturated polyester resins dominate the usage of 1,2-Propanediol, holding a substantial 38.7% share.

In 2023, Unsaturated Polyester Resins held a dominant market position in the “By Application” segment of the 1,2-Propanediol Market, with a 38.7% share. This dominance is primarily due to the extensive use of 1,2-Propanediol in the production of resins, which are key components in fiberglass-reinforced plastics.

These materials are crucial in various industries, including automotive, construction, and marine, for their durability and lightweight properties. The growth in these sectors directly influences the demand for Unsaturated Polyester Resins, reinforcing their leading position in the market.

Following closely, Functional Fluids accounted for 33.6% of the market share. 1,2-Propanediol’s role as a base for functional fluids in applications such as antifreeze, hydraulic and brake fluids, and heat transfer fluids highlights its versatility and importance in maintaining machinery and automotive performance. Its non-corrosive and effective thermal properties drive its utility across these applications.

Lastly, the Food and Flavor segment captured 27.7% of the market. In this segment, 1,2-Propanediol is utilized as a solvent for food colorings and flavorings, and as a humectant in food and tobacco products. Its approval by food safety regulations for use in consumable products underpins its significant share in this market.

By End-User Industry Analysis

The automotive sector emerges as a significant end-user of 1,2-Propanediol, comprising 29.3% of the market’s demand.

In 2023, Automotive held a dominant market position in the “By End-User Industry” segment of the 1,2-Propanediol Market, with a 29.3% share. The significant demand within this sector is driven by the use of 1,2-Propanediol in manufacturing engine coolants and antifreeze formulations, which are essential for vehicle maintenance and performance.

The growth in the automotive industry, particularly with increasing production and maintenance of vehicles, has bolstered the demand for these chemicals, solidifying the segment’s leadership in the market.

Following Automotive, the Building and Construction sector accounted for 22.8% of the market. 1,2-Propanediol is utilized in this sector for the production of unsaturated polyester resins, which are crucial in creating composites used in construction materials for their durability and resistance properties.

The pharmaceutical industry held an 18.9% market share, using 1,2-propanediol predominantly as a solvent and carrier in various medicinal formulations. Meanwhile, the Food and Beverage industry captured 17.1% of the market, with 1,2-Propanediol being used as a humectant and preservative in numerous food products.

Key Market Segments

By Product Type

- Industrial Grade

- Food Grade

- Pharmaceutical Grade

By Application

- Unsaturated Polyester Resins

- Functional Fluids

- Food and Flavor

- Others

By End-User Industry

- Automotive

- Building and Construction

- Pharmaceuticals

- Food and Beverage

- Cosmetics and Personal Care

- Others

Driving Factors

Expanding Uses in Cosmetics and Personal Care Products

The 1,2-propanediol market is experiencing significant growth due to its increasing utilization in the cosmetics and personal care industry. As a safe and effective humectant and solvent, 1,2-propanediol enhances product stability and texture, making it a valuable ingredient in formulations for skincare, haircare, and makeup products.

This expansion is driven by rising consumer demand for high-quality cosmetic products that offer both efficacy and safety, leading to greater investment and development in versatile, biocompatible ingredients like 1,2-propanediol.

Growing Demand for Environmentally Friendly Antifreeze

Environmental sustainability concerns are driving the demand for eco-friendly antifreeze solutions, where 1,2-propanediol plays a crucial role. As an effective, less toxic alternative to ethylene glycol, 1,2-propanediol is preferred in applications requiring low toxicity and biodegradability, such as in automotive and HVAC systems.

This shift is supported by tightening regulations on environmental protection and an increase in the production of sustainable and safe chemicals, which are expected to propel the adoption of 1,2-propanediol in various industrial applications.

Advancements in Bio-based Production Techniques

Significant advancements in bio-based production methods for 1,2-propanediol are key drivers of its market growth. These sustainable production techniques are gaining traction as they reduce reliance on petroleum-based feedstocks and decrease environmental impact.

The development of genetically modified organisms (GMOs) that can efficiently convert glucose to 1,2-propanediol is a promising area of research that could substantially lower production costs and enhance market supply, thus meeting the increasing demand for greener chemical processes and materials.

Restraining Factors

Volatility in Raw Material Prices Affects Market Stability

The market for 1,2-propanediol is notably impacted by the volatility of raw material prices. As it is primarily derived from petroleum products, fluctuations in oil prices directly influence production costs. This instability can lead to unpredictable expenses for manufacturers, affecting overall profitability.

Companies in the sector must navigate these economic uncertainties, which can restrain market growth as they struggle to maintain consistent pricing and cost efficiency in their production processes.

Regulatory and Environmental Compliance Challenges

The production and use of 1,2-propanediol are subject to stringent regulatory standards aimed at protecting health and the environment. Compliance with these regulations can be costly and time-consuming, involving significant investment in safety, handling, and disposal practices.

This aspect can act as a barrier to entry for new players and limit the expansion of existing companies within the market. The need to adhere to these regulations can thus restrain market growth as companies weigh the benefits against the potential compliance costs.

Competition from Alternative Products and Technologies

1,2-propanediol faces substantial competition from alternative products that can perform similar functions in various applications, such as propylene glycol and glycerol. These alternatives are often more established in the market and may be preferred due to cost-effectiveness or specific performance characteristics.

The presence of these competitive products can limit the growth potential of 1,2-propanediol, particularly in price-sensitive markets where manufacturers opt for less expensive or more readily available substitutes. This competition poses a significant restraint on the expansion and penetration of 1,2-propanediol in various industrial segments.

Growth Opportunity

Expansion into Emerging Markets Boosts Growth Potential

The 1,2-propanediol market holds significant growth opportunities in emerging economies, driven by industrialization and the growing middle class. These regions present a rising demand for consumer goods, automotive products, and pharmaceuticals, all of which utilize 1,2-propanediol.

By establishing a presence in these markets, manufacturers can tap into new consumer bases and benefit from lower production costs, potentially leading to increased sales volumes and market share. This strategic expansion can serve as a catalyst for sustained growth as companies leverage emerging market dynamics.

Innovation in Green Chemistry Opens New Avenues

Innovation in green chemistry presents a substantial growth opportunity for the 1,2-propanediol market. As industries and consumers increasingly prioritize sustainability, the development of bio-based 1,2-propanediol offers an eco-friendly alternative to traditional petroleum-based products.

This shift not only aligns with global sustainability trends but also meets regulatory requirements for lower environmental impact. Companies investing in the research and development of sustainable production processes are likely to see enhanced market acceptance and competitive advantage, opening up new business opportunities and revenue streams.

Integration in Advanced Pharmaceutical Applications

The pharmaceutical industry offers a lucrative growth avenue for 1,2-propanediol through its integration into novel drug formulations. Its properties as a solvent and carrier enhance the efficacy and stability of pharmaceutical products. As drug manufacturers seek to improve product performance and patient outcomes, the demand for specialized excipients like 1,2-propanediol is expected to rise.

Capitalizing on this trend involves continuous innovation and compliance with stringent health standards, positioning companies that can meet these requirements for substantial growth in this high-value sector.

Latest Trends

Increased Adoption of Biodegradable Products Drives Demand

The trend towards environmentally friendly and biodegradable products is increasingly influencing the 1,2-propanediol market. As global awareness of environmental issues grows, industries are seeking sustainable alternatives to conventional chemicals. 1,2-propanediol, particularly bio-based variants, offers an effective solution that aligns with these eco-friendly initiatives.

This shift is particularly evident in industries such as cosmetics, pharmaceuticals, and food production, where the demand for non-toxic and renewable ingredients is rising rapidly. Companies that adapt to this trend by producing or incorporating biodegradable 1,2-propanediol are likely to experience enhanced market growth and customer loyalty.

Technological Advancements in Production Processes

Recent technological advancements in production processes for 1,2-propanediol are revolutionizing the market. Innovations in catalysis and fermentation technology have made it possible to produce 1,2-propanediol more efficiently and from a wider range of feedstocks, including glucose derived from agricultural waste.

These advancements not only improve the sustainability of production but also reduce costs, making 1,2-propanediol more competitive against traditional petrochemical-derived products. As these technologies continue to evolve, they provide a significant growth opportunity for manufacturers to increase their production capacity and market reach.

Rise in Demand from the Automotive Sector

The automotive sector is emerging as a significant consumer of 1,2-propanediol, particularly in the production of environmentally friendly antifreeze and coolant formulations. As automotive manufacturers commit to more sustainable production practices, the demand for eco-friendly and biodegradable chemicals has surged.

1,2-propanediol’s low toxicity and excellent performance characteristics make it a preferred choice over traditional options. This trend is supported by increasing regulations focusing on vehicle emissions and chemical safety, prompting automotive companies to seek out green chemicals like 1,2-propanediol as part of their sustainability strategies.

Regional Analysis

In Asia-Pacific, the 1,2-propanediol market holds a 44.8% share, valued at USD 542.3 million.

The 1,2-propanediol market exhibits varied growth dynamics across different geographical regions, influenced by local industrial activities, regulatory frameworks, and technological advancements.

In Asia-Pacific, the market is the most dominant, accounting for 44.8% with a value of USD 542.3 million. This region benefits from rapid industrialization, especially in countries like China and India, where there is significant expansion in pharmaceuticals, cosmetics, and automotive industries, all major consumers of 1,2-propanediol. The region’s large population and increasing middle-class consumer base also drive demand for personal care and consumer products, further bolstering the market.

North America follows with robust growth, driven by stringent environmental regulations that favor the adoption of bio-based and sustainable chemicals. The region’s advanced technological landscape facilitates innovative production processes, enhancing the efficiency and sustainability of 1,2-propanediol manufacturing.

Europe mirrors North America’s trends, with additional support from governmental initiatives promoting green chemistry. The presence of major automotive manufacturers who are incorporating eco-friendly antifreeze solutions contributes significantly to the regional market demand.

Conversely, the Middle East & Africa and Latin America are emerging markets with slower growth. These regions are gradually recognizing the potential of 1,2-propanediol, especially in applications like antifreeze and personal care products, driven by urbanization and regulatory changes towards safer, more sustainable chemicals.

Each of these markets presents unique opportunities and challenges, reflecting their specific economic, environmental, and industrial conditions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global 1,2-propanediol market for 2023 is marked by the presence of both longstanding and emerging players, each contributing to the market’s dynamic growth through strategic innovations and expansions.

ADM and BASF SE remain pivotal due to their expansive production capacities and significant R&D investments. These companies focus on enhancing the sustainability of their operations and optimizing the eco-friendliness of their 1,2-propanediol offerings, thereby meeting the stringent regulatory standards across various regions.

BASF SE has been particularly active in developing bio-based 1,2-propanediol, catering to the growing demand for sustainable chemical solutions.

Huntsman International LLC and LyondellBasell Industries N.V. continue to leverage their integrated supply chains and global presence to maintain a competitive edge. Their focus on cost-efficient manufacturing processes and high-purity products allows them to effectively serve critical end-use industries like pharmaceuticals and cosmetics.

Emerging players like Arham Petrochem Pvt. Ltd. and Shandong Shida Shenghua Chemical are distinguishing themselves through niche market penetration and regional dominance, particularly in Asia-Pacific, the market’s largest region. These companies benefit from localized market understanding, cost advantages, and agility in production adjustments based on market demands.

INEOS AG and Dow, with their diversified chemical portfolios, are also key contributors, innovating in production technologies to offer products that are safer and more environmentally friendly.

Lastly, Merck KGaA and Repsol SA stand out for their strategic focus on high-grade pharmaceutical and industrial applications, pushing the boundaries in high-performance uses of 1,2-propanediol.

Together, these companies set the competitive landscape in 2023, driving forward with technological advancements, geographic expansions, and a strong focus on sustainability, ensuring their positions as leaders in the evolving global 1,2-propanediol market.

Top Key Players in the Market

- ADM

- Arham Petrochem Pvt. Ltd.

- Asahi Kasei

- Avril SCA

- BASF SE

- CNOOC and Shell Petrochemicals

- Daze Group

- Dow

- Dow Chemical Co.

- Global Bio chem Technology Group Co. Ltd.

- HELM AG

- Hi-tech Spring Chemical

- Huntsman

- Huntsman International LLC

- INEOS AG

- LyondellBasell Industries N.V.

- Manali Petrochemicals Ltd.

- Merck KGaA

- Repsol SA

- Shandong Shida Shenghua Chemical

- Shell plc

- Sisco Research Laboratories Pvt. Ltd.

- SKC

- Sumitomo Chemical (Nihon Oxirane)

- Tokyo Chemical Industry Co. Ltd.

- Tongling Jintai Chemical

- Toronto Research Chemicals Inc.

- Vizag Chemical International

Recent Developments

- In 2023, Avril SCA posted €7.9 billion in revenue, a 12.7% decline due to normalizing commodity prices. Despite economic pressures, the firm’s robust financial maneuvers ensured a stable net leverage ratio of 2.4x and strong liquidity.

- In 2023, BASF SE improved the use of 1,2-Propanediol in animal feed, particularly for dairy cattle, enhancing energy metabolism and milk production. They also developed sustainable bio-based propylene glycol from glycerin, reinforcing their commitment to environmental sustainability.

Report Scope

Report Features Description Market Value (2023) USD 1144.2 Million Forecast Revenue (2033) USD 1,954.5 Million CAGR (2024-2033) 5.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Industrial Grade, Food Grade, Pharmaceutical Grade), By Application (Unsaturated Polyester Resins, Functional Fluids, Food and Flavor, Others), By End-User Industry (Automotive, Building and Construction, Pharmaceuticals, Food and Beverage, Cosmetics and Personal Care, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ADM, Arham Petrochem Pvt. Ltd., Asahi Kasei, Avril SCA, BASF SE, CNOOC and Shell Petrochemicals, Daze Group, Dow, Dow Chemical Co., Global Bio chem Technology Group Co. Ltd., HELM AG, Hi-tech Spring Chemical, Huntsman, Huntsman International LLC, INEOS AG, LyondellBasell Industries N.V., Manali Petrochemicals Ltd., Merck KGaA, Repsol SA, Shandong Shida Shenghua Chemical, Shell plc, Sisco Research Laboratories Pvt. Ltd., SKC, Sumitomo Chemical (Nihon Oxirane), Tokyo Chemical Industry Co. Ltd., Tongling Jintai Chemical, Toronto Research Chemicals Inc., Vizag Chemical International Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  1,2-Propanediol MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

1,2-Propanediol MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ADM

- Arham Petrochem Pvt. Ltd.

- Asahi Kasei

- Avril SCA

- BASF SE

- CNOOC and Shell Petrochemicals

- Daze Group

- Dow

- Dow Chemical Co.

- Global Bio chem Technology Group Co. Ltd.

- HELM AG

- Hi-tech Spring Chemical

- Huntsman

- Huntsman International LLC

- INEOS AG

- LyondellBasell Industries N.V.

- Manali Petrochemicals Ltd.

- Merck KGaA

- Repsol SA

- Shandong Shida Shenghua Chemical

- Shell plc

- Sisco Research Laboratories Pvt. Ltd.

- SKC

- Sumitomo Chemical (Nihon Oxirane)

- Tokyo Chemical Industry Co. Ltd.

- Tongling Jintai Chemical

- Toronto Research Chemicals Inc.

- Vizag Chemical International