Global 3-Cyanopyridine Market By Purity (High Purity, Low Purity), By End-User(Pharmaceutical Industry, Chemical Industry, Agricultural Industry, Others), By Distribution Channel (Direct Sales, Distributors And Wholesalers, Online Platforms, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 138648

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

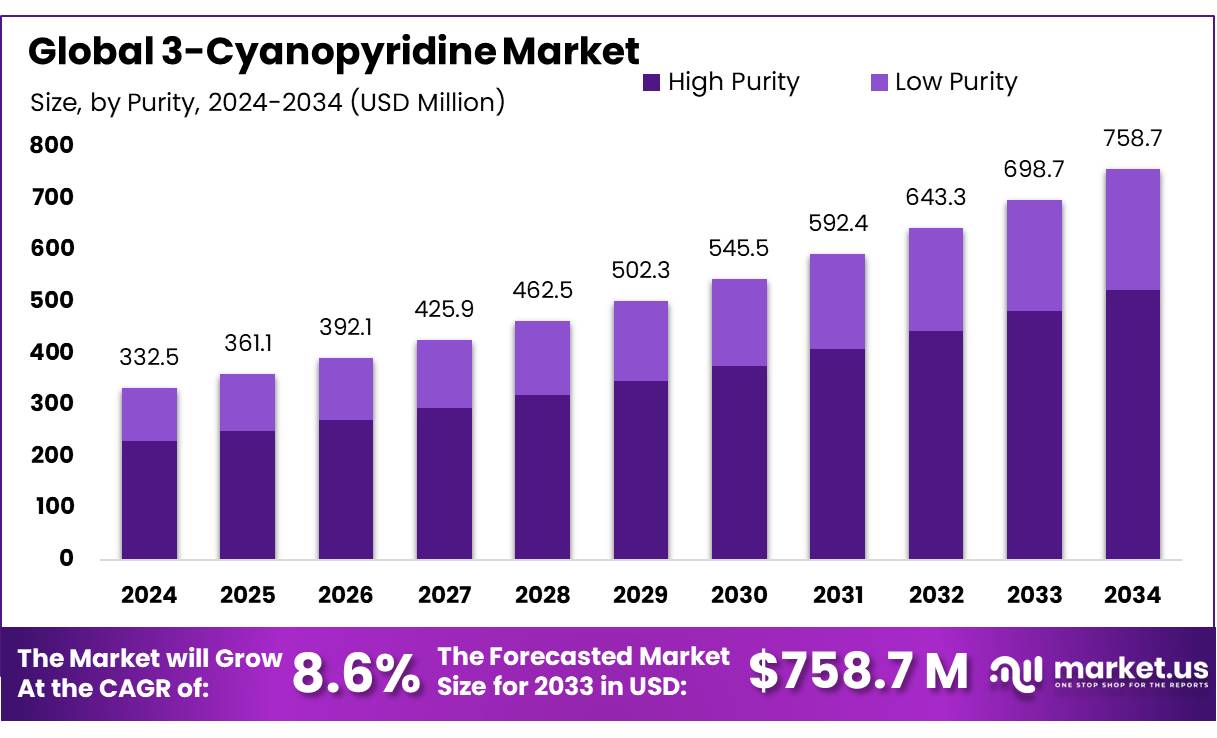

The Global 3-Cyanopyridine Market size is expected to be worth around USD 758.7 Mn by 2034, from USD 332.5 Mn in 2024, growing at a CAGR of 8.6% during the forecast period from 2025 to 2034.

The global 3-Cyanopyridine market is witnessing steady growth, driven by its increasing demand across industries such as pharmaceuticals, agrochemicals, and specialty chemicals. 3-Cyanopyridine, an organic compound with the chemical formula C6H4N2, serves as a crucial intermediate in the synthesis of several bioactive compounds. Notably, it is used in the production of nicotinic acid (niacin) and its derivatives, essential for vitamin B3 production, and in the synthesis of pyridine derivatives used in various applications.

The growing global demand for vitamins, especially vitamin B3 (niacin), has resulted in a significant rise in 3-Cyanopyridine production. Niacin, derived from 3-Cyanopyridine, is commonly used as a dietary supplement and in treating cholesterol-related conditions. Moreover, in the agrochemical sector, 3-Cyanopyridine is utilized for producing herbicides and fungicides, further driving market growth.

The 3-Cyanopyridine market is largely driven by its application in the pharmaceutical industry, where it is crucial in producing niacin, an important vitamin. The rising global demand for vitamin B3 supplements, especially in emerging markets, has contributed significantly to the expansion of this market. Additionally, the increasing prevalence of cholesterol-related health issues is boosting niacin’s demand, indirectly driving 3-Cyanopyridine consumption.

The agrochemical industry’s growth, fueled by the rising global demand for food production, is also a major driver. 3-Cyanopyridine is used in the synthesis of various herbicides and insecticides essential for agricultural productivity. The Asia-Pacific region, particularly China and India, holds the largest share of the market, driven by robust pharmaceutical and agrochemical manufacturing in these countries and the presence of cost-effective production facilities.

Key Takeaways

- 3-Cyanopyridine Market size is expected to be worth around USD 758.7 Mn by 2034, from USD 332.5 Mn in 2024, growing at a CAGR of 8.6%.

- High Purity held a dominant market position, capturing more than a 69.1% shar.

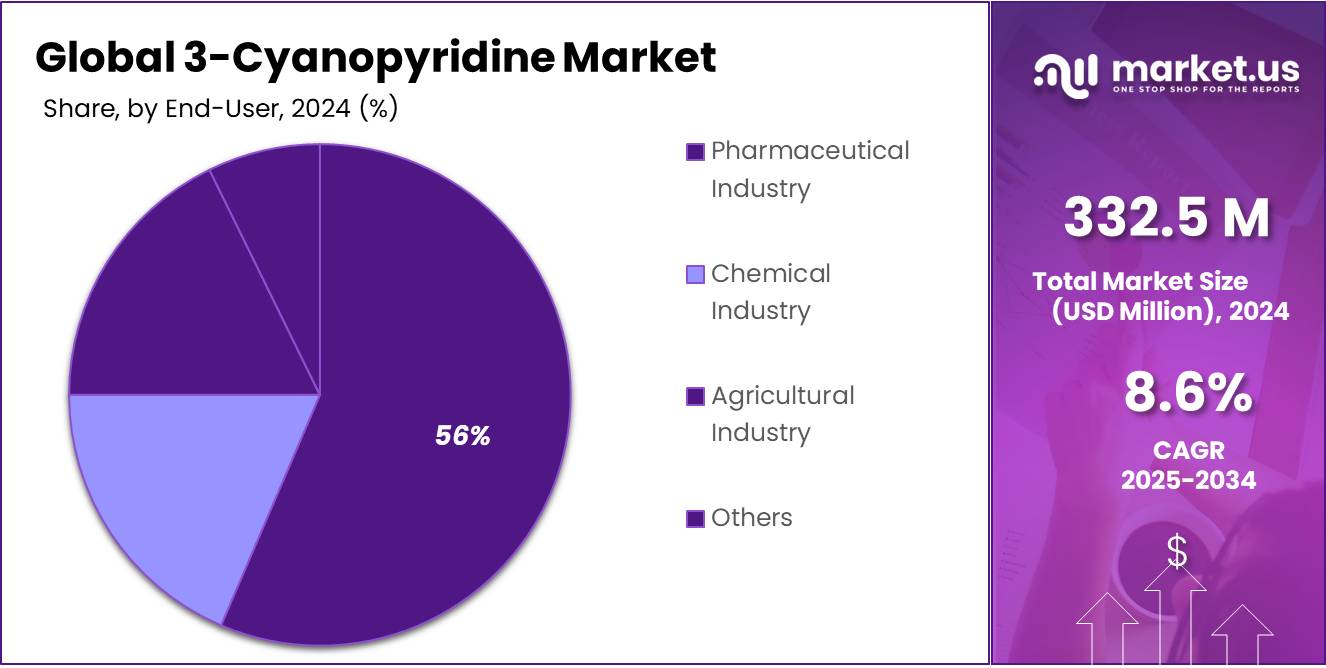

- Pharmaceutical Industry held a dominant market position, capturing more than a 57.1% share.

- Direct Sales held a dominant market position, capturing more than a 46.1% share of the 3-Cyanopyridine market.

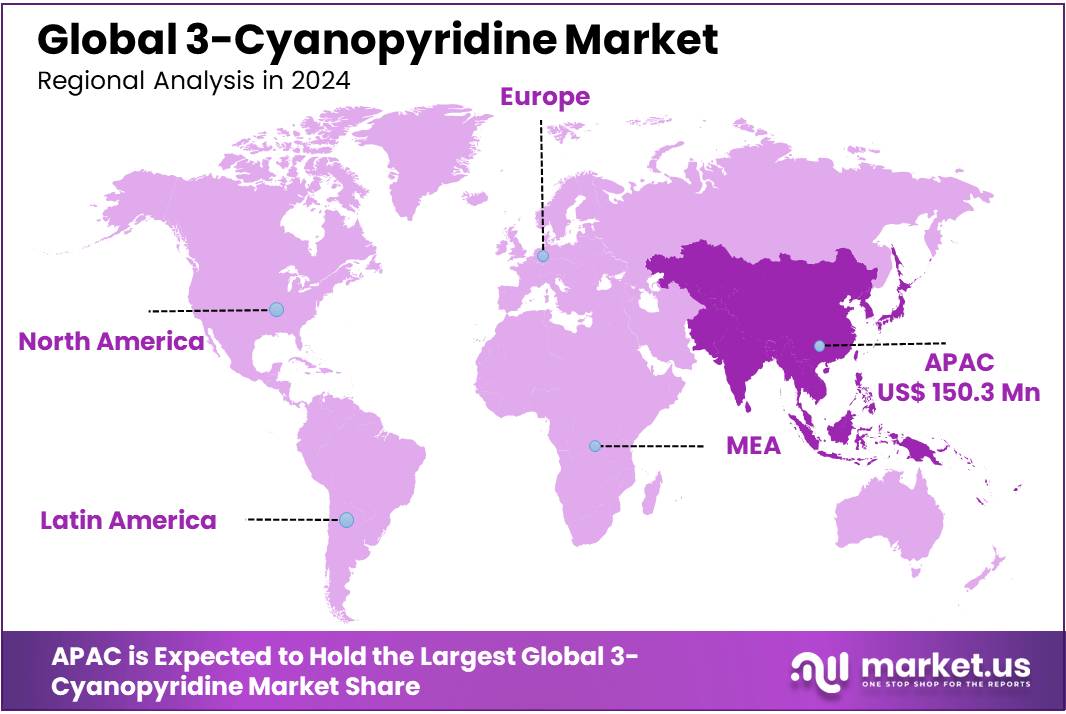

- Asia Pacific (APAC) held a dominant position in the 3-Cyanopyridine market, capturing more than a 45.2% share, valued at approximately USD 150.29 million.

By Purity

In 2024, High Purity held a dominant market position, capturing more than a 69.1% share of the 3-Cyanopyridine market. This segment is largely driven by its applications in pharmaceuticals, agrochemicals, and specialty chemicals, where higher purity levels are required for more precise and effective formulations. The increasing demand for high-purity 3-Cyanopyridine in the production of active pharmaceutical ingredients (APIs) and high-quality agrochemicals has contributed significantly to its growth.

The Low Purity segment held a smaller share of the market, accounting for the remaining portion. While its applications are still relevant, primarily in industrial uses and for manufacturing lower-grade products, the demand for low-purity 3-Cyanopyridine is not growing as rapidly as the high-purity segment. The Low Purity segment has been largely stable in recent years, with manufacturers focusing on cost-efficient production methods, which helps keep this segment competitive in terms of pricing.

By End-User

In 2024, the Pharmaceutical Industry held a dominant market position, capturing more than a 57.1% share of the 3-Cyanopyridine market. This significant share is attributed to the increasing demand for 3-Cyanopyridine in the production of key pharmaceutical intermediates and active ingredients. Its role in the synthesis of various drugs, particularly those related to anti-inflammatory, anti-viral, and anti-cancer treatments, has positioned the pharmaceutical sector as the largest consumer of 3-Cyanopyridine.

The Chemical Industry, while holding a smaller portion of the market, still plays an important role, driven by the use of 3-Cyanopyridine in producing various chemical compounds and intermediates. This segment accounted for a notable share in 2024, as chemical manufacturers utilize 3-Cyanopyridine in applications such as solvents, adhesives, and polymer production. The Chemical Industry is expected to experience steady growth, supported by ongoing innovations in chemical processes and materials.

In the Agricultural Industry, 3-Cyanopyridine is increasingly being used in the development of pesticides and herbicides, contributing to its steady demand in this segment. Though it held a smaller market share compared to the pharmaceutical industry, the Agricultural Industry’s use of 3-Cyanopyridine is poised to grow modestly as the need for more effective crop protection solutions rises globally.

By Distribution Channel

In 2024, Direct Sales held a dominant market position, capturing more than a 46.1% share of the 3-Cyanopyridine market. This method of distribution is favored by many manufacturers and suppliers due to its direct connection with large-scale clients, particularly in the pharmaceutical and chemical industries. Direct sales allow for better control over pricing, customer relationships, and product availability, which is crucial for businesses dealing with high-value, specialized chemicals like 3-Cyanopyridine. As these industries demand more tailored solutions and large volumes, the direct sales model is expected to maintain its strong position in the coming years.

Distributors & Wholesalers represent another significant portion of the market, holding a notable share in 2024. This segment benefits from its wide reach and established networks, particularly in regions with a diverse industrial base. Distributors and wholesalers serve as intermediaries between manufacturers and smaller businesses or regional customers, making 3-Cyanopyridine more accessible to a broader market.

Online Platforms, although currently holding a smaller market share, are growing rapidly, especially in regions with a robust e-commerce infrastructure. The increasing trend of digital transformation across industries has led to a rise in online sales of chemicals, including 3-Cyanopyridine. In 2024, this channel’s share was modest, but it is expected to see significant growth in the coming years as more customers, especially smaller businesses and startups, prefer the convenience of online purchasing.

Hospitals & Healthcare Providers also hold a share of the market, though they are more focused on the pharmaceutical applications of 3-Cyanopyridine. These institutions purchase the chemical primarily for its role in drug production and medical applications. Their share of the market in 2024 is relatively small compared to other distribution channels, but with the continuous growth in healthcare and medical research, their demand for specialized chemicals like 3-Cyanopyridine may see gradual growth.

Key Market Segments

By Purity

- High Purity

- Low Purity

By End-User

- Pharmaceutical Industry

- Chemical Industry

- Agricultural Industry

- Others

By Distribution Channel

- Direct Sales

- Distributors & Wholesalers

- Online Platforms

- Others

Drivers

Increasing Demand for Pharmaceutical Intermediates

One of the major driving factors behind the growth of the 3-Cyanopyridine market is the increasing demand for pharmaceutical intermediates, especially in the production of critical drugs and active pharmaceutical ingredients (APIs). 3-Cyanopyridine is an essential building block for various drugs, including those used in the treatment of central nervous system disorders, infections, and other therapeutic areas.

According to the World Health Organization (WHO), the global pharmaceutical market size was valued at approximately 1.48 trillion USD in 2021 and is expected to reach 2.3 trillion USD by 2025, growing at a compound annual growth rate (CAGR) of 7.4%. This expansion directly correlates with the growing demand for pharmaceutical intermediates, such as 3-Cyanopyridine. The increasing need for more complex and targeted medications has made high-quality chemical intermediates a critical component of drug development and manufacturing.

The U.S. Food and Drug Administration (FDA) reports that the pharmaceutical sector in North America continues to drive innovation in drug development. As pharmaceutical companies invest heavily in R&D for new drugs, the demand for specialty chemicals like 3-Cyanopyridine is expected to remain strong. Additionally, 3-Cyanopyridine plays a pivotal role in the production of certain nicotine receptor antagonists and anti-inflammatory agents, which have seen increased demand in both developed and emerging markets.

According to a report by India Brand Equity Foundation (IBEF), the Indian pharmaceutical market alone is expected to reach 65 billion USD by 2024. The government’s focus on enhancing domestic pharmaceutical manufacturing capabilities also plays a significant role in this growth, further driving the demand for intermediates.

Restraints

Regulatory Challenges and Environmental Concerns

In the European Union, for example, the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulations impose strict requirements on the chemical industry. Companies must prove that their products meet safety standards to be marketed, and 3-Cyanopyridine, being a key component in the production of several drugs, falls under such scrutiny.

The European Chemicals Agency (ECHA) reports that around 70% of industrial chemicals face significant barriers in meeting REACH compliance, which often results in high production costs, delays, and added financial burdens for manufacturers. This regulatory burden increases operational costs, which can be a significant challenge, especially for small and medium-sized enterprises (SMEs) looking to enter or expand in the market.

In the U.S., the Environmental Protection Agency (EPA) has increasingly focused on the environmental impact of manufacturing processes, especially chemicals that could pose health risks. For instance, there are regulations regarding the release of hazardous substances during production, as well as emissions control for volatile organic compounds (VOCs) that are associated with the use of certain chemicals like 3-Cyanopyridine. Companies that fail to comply with these standards may face substantial penalties or even bans on certain practices, which directly affects the overall availability and cost of 3-Cyanopyridine in the market.

Beyond strict regulations, there are growing concerns about the environmental sustainability of manufacturing processes for chemicals like 3-Cyanopyridine. The chemical industry is under increasing pressure to adopt greener and more sustainable production methods to reduce its carbon footprint and minimize waste.

According to a report from the International Energy Agency (IEA), the chemical industry accounts for nearly 20% of global energy consumption and 30% of industrial carbon dioxide emissions. This has led to increased interest in environmentally friendly alternatives and manufacturing technologies. However, transitioning to these greener technologies can be expensive and time-consuming, further impacting the cost-effectiveness of producing 3-Cyanopyridine.

Government initiatives to improve environmental standards are contributing to the overall restructuring of the chemical industry. For example, the Green Chemistry Initiative, which aims to design chemical products and processes that reduce or eliminate the use and generation of hazardous substances, is pushing for changes in how chemicals like 3-Cyanopyridine are produced. While this is positive for the long-term sustainability of the industry, it also means that companies must invest heavily in new technologies and processes to remain compliant with evolving environmental standards.

Opportunity

Expanding Pharmaceutical and Agricultural Applications

In the pharmaceutical sector, 3-Cyanopyridine is primarily used in the synthesis of nicotinic acid derivatives, which are crucial for developing medications that treat cardiovascular diseases and neurodegenerative disorders. With an aging global population, the demand for drugs to manage conditions like Alzheimer’s disease, Parkinson’s disease, and even certain forms of cancer is rising. According to the World Health Organization (WHO), the number of people aged 60 years and older is expected to double by 2050, which directly increases the need for pharmaceutical solutions, including those derived from 3-Cyanopyridine.

The pharmaceutical industry is seeing a marked rise in drug development focusing on nicotinic receptor modulators, for which 3-Cyanopyridine is a key building block. For example, Varenicline, a medication used to help people stop smoking, and various other treatments for neurological diseases use 3-Cyanopyridine derivatives. As the global market for neurological treatments is expected to grow at a compound annual growth rate (CAGR) of 7.6% from 2020 to 2027, this creates significant opportunities for the 3-Cyanopyridine market.

According to the Food and Agriculture Organization (FAO), global food production will need to increase by 70% by 2050 to meet the demands of a growing population. This, in turn, will fuel demand for more efficient agricultural chemicals, including those based on 3-Cyanopyridine. Furthermore, the growing interest in sustainable farming and integrated pest management (IPM) will likely drive demand for safer and more effective agrochemicals, boosting the role of 3-Cyanopyridine in this sector.

Government Initiatives and Policy Support also play a significant role in supporting this growth. In the pharmaceutical sector, the FDA and regulatory bodies worldwide are increasingly focusing on the approval of drugs that target neurodegenerative diseases, offering incentives such as fast-track approval processes and extended patent protections to companies that bring innovative treatments to market. This policy shift is likely to encourage more investments in research and development of pharmaceuticals involving 3-Cyanopyridine derivatives.

In agriculture, government initiatives focusing on food security and sustainable agricultural practices are likely to boost demand for crop protection chemicals, including those that incorporate 3-Cyanopyridine. For instance, the European Union’s Green Deal and the Farm to Fork Strategy have placed strong emphasis on sustainable agriculture, which could lead to more demand for safer pesticides and crop protection solutions based on innovative chemical intermediates like 3-Cyanopyridine.

Trends

Rising Demand for 3-Cyanopyridine in Sustainable Agrochemicals

One of the latest trends in the 3-Cyanopyridine market is the growing demand for sustainable agrochemicals. As the global population continues to increase, the need for efficient, environmentally friendly agricultural solutions becomes more urgent. 3-Cyanopyridine is gaining popularity in the development of new agrochemical products, especially in the production of pesticides, herbicides, and fungicides. The increased demand for sustainable farming practices and integrated pest management (IPM) is driving innovation in the agrochemical sector, with 3-Cyanopyridine playing a crucial role as a key intermediate in the production of eco-friendly crop protection chemicals.

The rise of sustainable agriculture is not just a passing trend; it is becoming a central focus globally. According to the Food and Agriculture Organization (FAO), agriculture is a key sector in tackling the challenges of climate change, and by 2050, the global agricultural output must increase by 70% to meet the food demand of an additional 2.3 billion people. As a result, there is increasing pressure on the agricultural industry to reduce the environmental impact of farming while improving productivity.

3-Cyanopyridine is an essential intermediate in the production of pyridine-based agrochemicals, which are known for their efficiency in controlling pests, fungi, and weeds. These chemicals are gaining traction because they tend to be less toxic to humans and animals, making them a safer alternative to traditional agrochemicals. With sustainable farming gaining policy support worldwide, particularly through government initiatives like the European Union’s Green Deal, demand for safer, effective, and environmentally-friendly agrochemicals is expected to rise significantly in the coming years.

Governments worldwide are investing in sustainable agricultural technologies. For example, the European Commission has made it a priority to reduce pesticide use by 50% by 2030 through its Farm to Fork Strategy, part of the EU Green Deal. This is expected to significantly boost the demand for more sustainable and bio-based agrochemicals, in which 3-Cyanopyridine-based products are becoming increasingly prominent. The shift towards sustainable agrochemicals is not only driven by policy but also by consumer preferences for organic and eco-friendly products. With consumer demand for sustainably farmed produce increasing, manufacturers are increasingly looking for alternatives to traditional chemicals, turning to advanced compounds like 3-Cyanopyridine to meet these requirements.

Regional Analysis

In 2024, Asia Pacific (APAC) held a dominant position in the 3-Cyanopyridine market, capturing more than a 45.2% share, valued at approximately USD 150.29 million. This region’s dominance is primarily driven by the strong demand from China, India, and Japan, where the agrochemical and pharmaceutical industries are expanding rapidly. The increasing adoption of advanced agricultural practices, coupled with rising pesticide demand, particularly in China (the world’s largest producer and consumer of agrochemicals), significantly contributes to the market growth in the APAC region.

North America is the second-largest market for 3-Cyanopyridine, holding a substantial share of the market. The demand here is driven by high-end pharmaceutical applications, where 3-Cyanopyridine plays a vital role in the synthesis of nicotinamide and other bioactive compounds. The United States and Canada have seen a rise in pharmaceutical manufacturing, with an increasing focus on sustainable farming practices, which fuels the demand for high-purity chemicals used in agrochemical formulations.

Europe follows closely as a significant market player, with Germany and the UK being major contributors. The growing trend toward eco-friendly agrochemicals, driven by EU policies like the Farm to Fork Strategy, is propelling demand for sustainable chemicals such as 3-Cyanopyridine in agricultural applications.

In Latin America and Middle East & Africa, the market remains comparatively smaller but is poised for growth, especially as agricultural productivity and pharmaceutical industries in countries like Brazil and South Africa continue to expand.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The 3-Cyanopyridine market is characterized by the presence of several key players that dominate various segments, ranging from agrochemicals to pharmaceuticals. BASF SE, one of the global leaders in chemicals, is heavily involved in producing high-quality 3-Cyanopyridine for use in both agricultural and pharmaceutical industries.

Evonik Industries AG is another prominent player that brings a significant presence in the market, focusing on developing sustainable and high-purity chemicals for agricultural purposes. Similarly, Jubilant Life Sciences Limited, through its subsidiary Jubilant Ingrevia, is one of the major contributors to the market, specializing in the production of 3-Cyanopyridine derivatives for various applications, particularly in pharmaceuticals.

Companies like Jiangsu Huachang Chemical Co., Ltd., Hubei Sanonda Co., Ltd., and Shandong Luba Chemical Co., Ltd. are actively expanding their footprint in the APAC region, where demand for 3-Cyanopyridine is growing rapidly.

These companies are mainly involved in supplying 3-Cyanopyridine for agrochemical formulations and other industrial uses, especially in China and India. Koninklijke DSM N.V., Lonza Group AG, and Nanjing Guangtong Pharmaceutical Co., Ltd. also play key roles in the pharmaceutical segment by providing high-quality intermediates for the production of nicotinamide and other bioactive compounds. Furthermore, companies like Vertellus Holdings LLC and Lasons India Pvt. Ltd. are gaining traction by offering customized solutions for various end-users, focusing on innovation and high standards in production processes.

Top Key Players

- BASF SE

- Evonik Industries AG

- Hubei Sanonda Co., Ltd.

- Jiangsu Huachang Chemical Co., Ltd.

- Jubilant Ingrevia Limited

- Jubilant Life Sciences Limited

- Koei Chemical Co. Ltd.

- Koninklijke DSM N.V.

- Lasons India Pvt. Ltd.

- Lonza Group AG

- Nanjing Guangtong Pharmaceutical Co. Ltd.

- Nantong Acetic Acid Chemical Co. Ltd.

- Ningxia Huayi Chemical Industry Co., Ltd.

- Shandong Luba Chemical Co., Ltd.

- Vertellus Holdings LLC

Recent Developments

In 2024, BASF’s revenue from its specialty chemicals division is projected to exceed $23 billion, with a significant portion derived from its agrochemical and pharmaceutical products, including 3-Cyanopyridine derivatives.

In 2024, Evonik continues to expand its reach within the market, with a significant share expected in Europe and North America due to its well-established distribution networks. The company’s annual revenue from specialty chemicals, including 3-Cyanopyridine derivatives, is projected to be around €6.5 billion in 2024, contributing to its overall growth in the global market.

In 2024, Hubei Sanonda is projected to achieve annual revenues of $250 million, with 3-Cyanopyridine being a key contributor to this growth. The company’s strong market presence in China and Southeast Asia allows it to cater to the increasing demand for vitamin B3 (niacin) and other pharmaceutical applications.

Report Scope

Report Features Description Market Value (2024) USD 332.5 Mn Forecast Revenue (2034) USD 758.7 Mn CAGR (2025-2034) 8.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (High Purity, Low Purity), By End-User(Pharmaceutical Industry, Chemical Industry, Agricultural Industry, Others), By Distribution Channel (Direct Sales, Distributors And Wholesalers, Online Platforms, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape BASF SE, Evonik Industries AG, Hubei Sanonda Co., Ltd., Jiangsu Huachang Chemical Co., Ltd., Jubilant Ingrevia Limited, Jubilant Life Sciences Limited, Koei Chemical Co. Ltd., Koninklijke DSM N.V., Lasons India Pvt. Ltd., Lonza Group AG, Nanjing Guangtong Pharmaceutical Co. Ltd., Nantong Acetic Acid Chemical Co. Ltd., Ningxia Huayi Chemical Industry Co., Ltd., Shandong Luba Chemical Co., Ltd., Vertellus Holdings LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Evonik Industries AG

- Hubei Sanonda Co., Ltd.

- Jiangsu Huachang Chemical Co., Ltd.

- Jubilant Ingrevia Limited

- Jubilant Life Sciences Limited

- Koei Chemical Co. Ltd.

- Koninklijke DSM N.V.

- Lasons India Pvt. Ltd.

- Lonza Group AG

- Nanjing Guangtong Pharmaceutical Co. Ltd.

- Nantong Acetic Acid Chemical Co. Ltd.

- Ningxia Huayi Chemical Industry Co., Ltd.

- Shandong Luba Chemical Co., Ltd.

- Vertellus Holdings LLC