Global Industrial Wastewater Treatment Technology Market Size, Share, And Business Benefits By Type (Corrosion Inhibitors, Scale Inhibitors, Coagulants and Flocculants, Anti-foaming Agents, Chelating Agents, pH Adjusters and stabilizers, Biocides and Disinfectants), By Technology (Biological Treatment, Membrane Bioreactor, Activated Sludge, Reverse Osmosis, Membrane Filtration, Sludge Treatment, Others), By Application (Boiler Feed Water, Chemical Production, Cooling Towers, Closed Loop Chillers, Air Compressors, Air Washers, Pharmaceutical Production, Others), By End Use Industry (Oil and Gas, Food and Beverage, Chemical, Mining, Power, Pharmaceutical, Pulp and Paper, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2025

- Report ID: 141183

- Number of Pages: 345

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

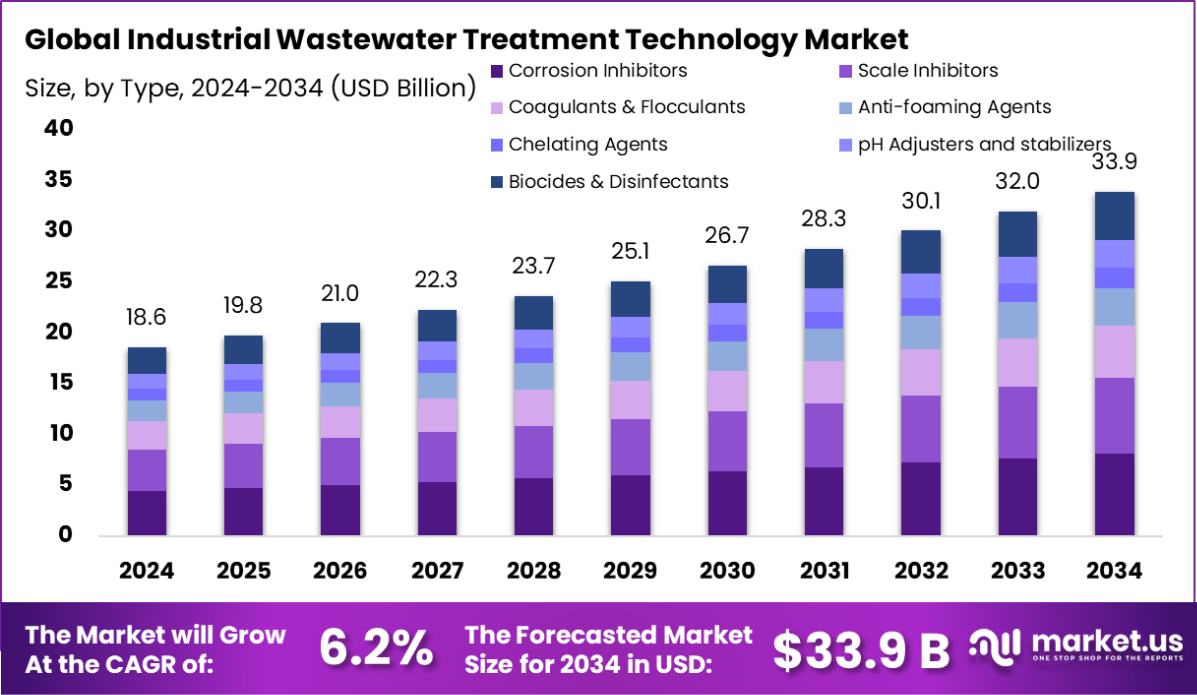

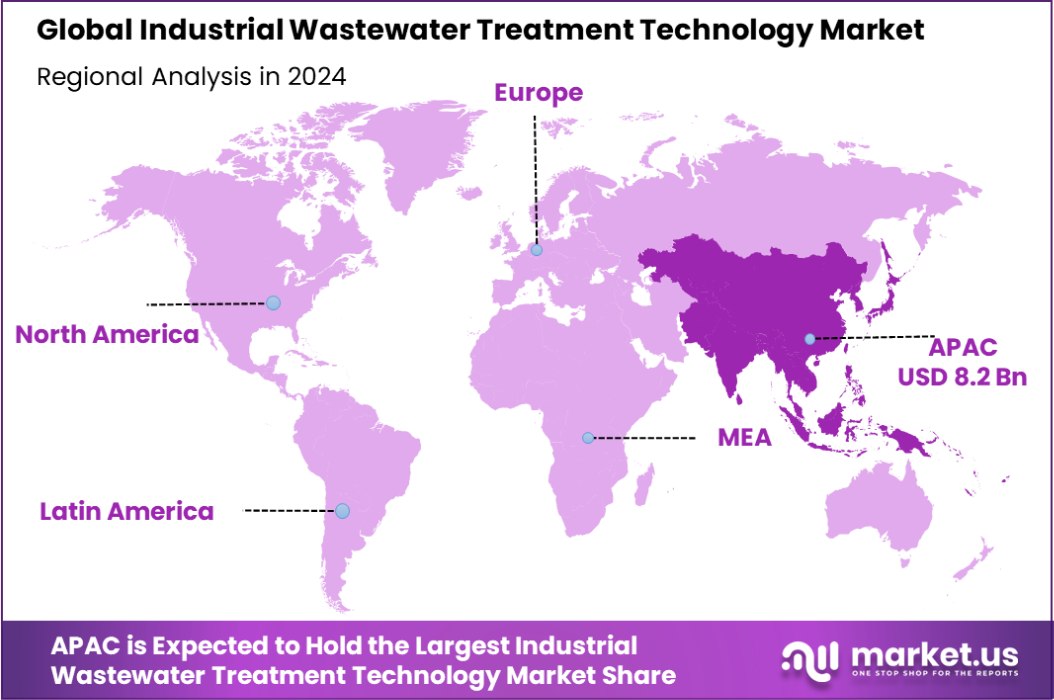

Global Industrial Wastewater Treatment Technology Market is expected to be worth around USD 33.9 billion by 2034, up from USD 18.6 billion in 2024, and grow at a CAGR of 6.2% from 2025 to 2034. With a market value of USD 8.2 billion, Asia-Pacific holds a 44.5% share in industrial wastewater treatment technology.

Industrial Wastewater Treatment Technology refers to the systems and processes used to treat and manage wastewater generated by industrial activities. This wastewater, which may contain chemicals, metals, or other hazardous substances, must be purified before it can be safely released into the environment or reused. Technologies used in industrial wastewater treatment include physical, chemical, and biological processes designed to remove contaminants, such as filtration, chemical precipitation, biological treatment, and advanced oxidation.

A key element in the treatment process is sludge management. Conventional sludge treatment typically involves thickening, anaerobic digestion, and dewatering. During thickening, the solid content of sludge can be increased from 2-4% to 16-18% by weight, making it easier to handle and treat.

In addition, Membrane Bioreactor (MBR) systems combine suspended growth biological treatment (usually activated sludge) with membrane filtration. These systems have gained popularity due to their ability to reduce the facility footprint by 30-50% compared to conventional treatment systems. This compactness, coupled with their effectiveness, makes MBR systems an attractive solution for industries seeking efficient and space-saving technologies.

Another widely used technology is Reverse Osmosis (RO), which is essential in industrial applications such as water purification and desalination. RO systems can remove up to 99% of contaminants, including salts, chemicals, and bacteria, ensuring high-quality treated water for reuse or safe discharge into the environment.

The Industrial Wastewater Treatment Technology Market is growing as industries across the globe face increasing pressure to comply with stricter environmental regulations. These advanced treatment technologies, including thickening, MBR, and RO, play a crucial role in helping industries manage wastewater effectively and sustainably.

Key Takeaways

- Global Industrial Wastewater Treatment Technology Market is expected to be worth around USD 33.9 billion by 2034, up from USD 18.6 billion in 2024, and grow at a CAGR of 6.2% from 2025 to 2034.

- Corrosion inhibitors hold a 23.4% share in the industrial wastewater treatment market.

- Biological treatment technology leads with a 34.3% market share for industrial wastewater management solutions.

- Boiler feed water treatment accounts for 29.2% of the industrial wastewater treatment market.

- The oil and gas industry represents the largest share, with 43.2% market demand.

- The Asia-Pacific market for industrial wastewater treatment technology reached USD 8.2 billion, capturing a 44.5% share.

By Type Analysis

Corrosion inhibitors make up 23.4% of the industrial wastewater treatment technology market, improving equipment lifespan.

In 2024, Corrosion Inhibitors held a dominant market position in the By Type segment of the Industrial Wastewater Treatment Technology Market, with a 23.4% share. Corrosion inhibitors are widely used in industrial wastewater treatment to prevent the degradation of metal surfaces in equipment, pipelines, and storage tanks.

Their ability to prolong the lifespan of industrial machinery and minimize maintenance costs has contributed to their significant market share. These chemicals play a crucial role in managing the potential corrosion caused by aggressive wastewater components, which is particularly critical in industries such as petrochemicals, power generation, and manufacturing.

The increasing demand for efficient and cost-effective treatment solutions in industries dealing with high volumes of wastewater has further solidified the role of corrosion inhibitors. Their widespread adoption is driven by the rising need for equipment protection, operational efficiency, and compliance with environmental regulations regarding wastewater discharge.

As industrial facilities continue to expand and seek sustainable solutions, corrosion inhibitors are expected to maintain their strong position in the market. The growing emphasis on reducing operational downtime and enhancing the durability of wastewater treatment infrastructure continues to drive the demand for these essential chemical additives.

By Technology Analysis

Biological treatment holds the largest share at 34.3%, utilizing microorganisms to break down organic pollutants effectively.

In 2024, Biological Treatment held a dominant market position in the By Technology segment of the Industrial Wastewater Treatment Technology Market, with a 34.3% share. Biological treatment processes utilize microorganisms to break down organic contaminants in wastewater, making them one of the most cost-effective and widely adopted methods in industrial wastewater management. This technology is especially prevalent in industries such as food and beverage, pharmaceuticals, and textiles, where large quantities of organic waste are generated.

The significant market share of biological treatment can be attributed to its effectiveness in treating high-strength organic wastewater, its relatively low operational costs, and its environmentally friendly nature. As industries increasingly focus on sustainability and regulatory compliance, biological treatment technologies are preferred due to their ability to offer high-efficiency treatment without the need for complex or expensive chemicals.

With the growing demand for eco-friendly solutions and the rising emphasis on water reuse and recycling, biological treatment technologies are expected to maintain their dominant position. Their ability to meet environmental standards while minimizing operational costs continues to drive their widespread adoption across diverse industrial sectors.

By Application Analysis

Boiler feed water treatment accounts for 29.2%, ensuring safe, efficient operation in industrial boilers and systems.

In 2024, Boiler Feed Water held a dominant market position in the By Application segment of the Industrial Wastewater Treatment Technology Market, with a 29.2% share. Boiler feed water treatment is essential in industries such as power generation, oil & gas, and chemicals, where water is used in steam boilers for heating and energy production. The quality of water used in these systems is critical to ensure operational efficiency, prevent scaling, and corrosion, and ensure the longevity of equipment.

The high market share of boiler feed water treatment solutions can be attributed to the critical need for maintaining water purity and system efficiency in steam boilers. Contaminants such as dissolved salts, minerals, and organic materials can lead to scaling, corrosion, and reduced heat transfer efficiency, significantly impacting operational costs and safety. As industries focus on reducing energy consumption and increasing the lifespan of their equipment, proper treatment of boiler feed water has become a priority.

Furthermore, increasing industrial activities and stringent water quality regulations have further driven the demand for efficient boiler-feed water treatment technologies. The growing need for sustainable practices and water reuse is also supporting the expansion of this application, making it a key focus in the industrial wastewater treatment market.

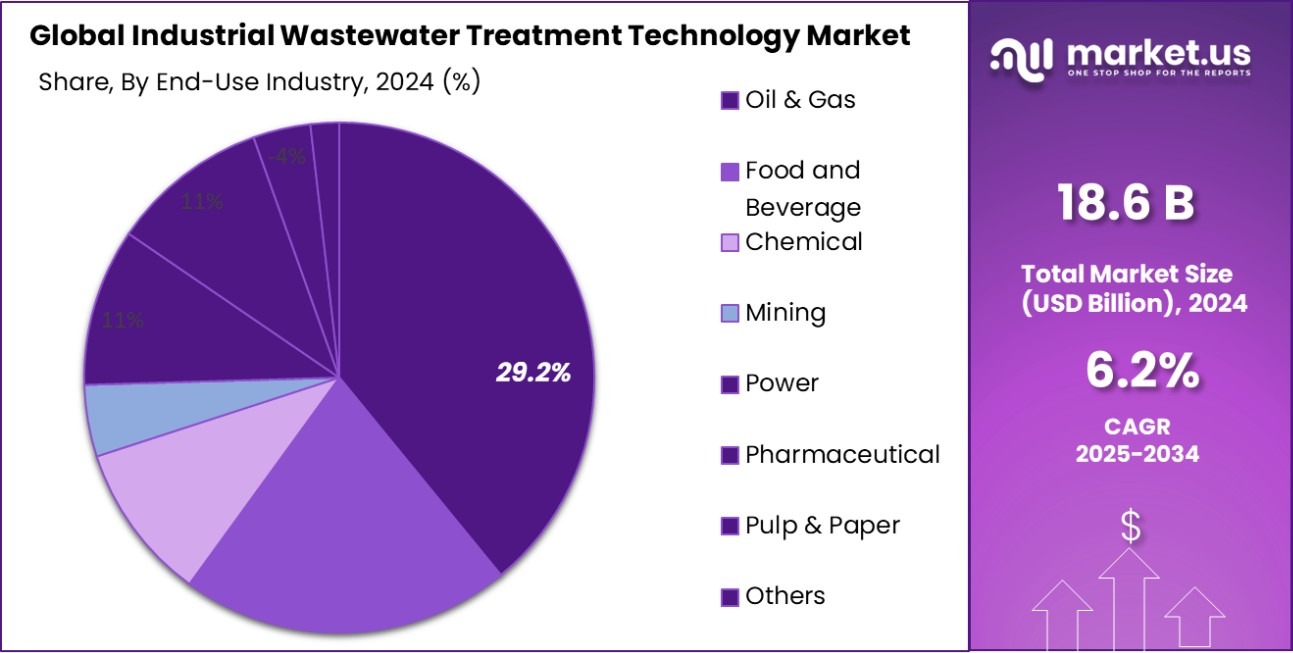

By End Use Industry Analysis

The oil and gas sector dominates the market, contributing 43.2% due to wastewater management needs.

In 2024, Oil and Gas held a dominant market position in the By End Use Industry segment of the Industrial Wastewater Treatment Technology Market, with a 29.2% share. The oil and gas industry generates significant volumes of wastewater due to exploration, drilling, production, and refining activities. These wastewater streams often contain a mixture of oil, chemicals, and other contaminants that require effective treatment to meet environmental standards and enable safe disposal or reuse.

The substantial market share of the oil and gas sector is driven by the increasing demand for efficient and sustainable wastewater management practices. As environmental regulations become stricter globally, the need for advanced wastewater treatment technologies in this industry has grown. Effective treatment solutions help mitigate the environmental impact of oil and gas operations, protect natural water resources, and reduce operational costs related to water disposal.

Additionally, the rise in shale oil production and offshore drilling activities has further contributed to the growth of the market in this sector. Oil and gas companies are increasingly adopting advanced technologies, such as membrane filtration and chemical treatment, to improve water recovery and minimize environmental risks. As the industry continues to focus on sustainability and regulatory compliance, the demand for industrial wastewater treatment technologies in the oil and gas sector is expected to remain robust.

Key Market Segments

By Type

- Corrosion Inhibitors

- Scale Inhibitors

- Coagulants and Flocculants

- Anti-foaming Agents

- Chelating Agents

- pH Adjusters and stabilizers

- Biocides and Disinfectants

By Technology

- Biological Treatment

- Membrane Bioreactor

- Activated Sludge

- Reverse Osmosis

- Membrane Filtration

- Sludge Treatment

- Others

By Application

- Boiler Feed Water

- Chemical Production

- Cooling Towers

- Closed Loop Chillers

- Air Compressors

- Air Washers

- Pharmaceutical Production

- Others

By End Use Industry

- Oil and Gas

- Food and Beverage

- Chemical

- Mining

- Power

- Pharmaceutical

- Pulp and Paper

- Others

Driving Factors

Stringent Environmental Regulations Drive Market Growth

One of the primary driving factors for the Industrial Wastewater Treatment Technology Market is the increasing stringency of environmental regulations. Governments worldwide are implementing stricter rules to manage wastewater disposal, aiming to protect water resources and prevent contamination of natural ecosystems.

Industries, particularly those in sectors such as chemicals, pharmaceuticals, and food processing, are required to adopt advanced wastewater treatment technologies to comply with these regulations. Non-compliance can lead to hefty fines, legal consequences, and reputational damage.

As a result, businesses are increasingly investing in efficient treatment solutions that ensure their wastewater meets environmental standards. The growing pressure to mitigate the environmental impact of industrial operations is expected to continue driving demand for these technologies.

Restraining Factors

High Capital and Operational Costs Limit Adoption

A significant restraining factor in the Industrial Wastewater Treatment Technology Market is the high capital investment and operational costs associated with advanced treatment systems. While effective, technologies such as membrane filtration, reverse osmosis, and chemical treatment can be expensive to install, maintain, and operate.

For many industries, particularly small and medium-sized enterprises, these high costs can be a significant barrier to adopting state-of-the-art wastewater treatment solutions. Additionally, ongoing maintenance and the need for skilled labor to operate these systems add to the overall expenses.

As a result, companies in cost-sensitive sectors may opt for less efficient, lower-cost treatment methods that may not meet all environmental regulations. This economic challenge is expected to limit the widespread adoption of advanced wastewater treatment technologies in some markets.

Growth Opportunity

Increasing Demand for Water Reuse and Recycling

A key growth opportunity in the Industrial Wastewater Treatment Technology Market lies in the increasing demand for water reuse and recycling across industries. As water scarcity becomes a more pressing global issue, companies are seeking ways to reduce their water consumption by reusing treated wastewater within their operations. This trend is particularly prominent in water-intensive industries like oil and gas, chemicals, and power generation, where water is a critical resource.

Advanced treatment technologies that enable the purification and reuse of industrial wastewater are gaining traction, as they help companies reduce their water footprint and comply with environmental regulations. As sustainability becomes a priority, this growing demand for water reuse and recycling presents a significant opportunity for market expansion and technological innovation.

Latest Trends

Adoption of Membrane Technologies for Efficient Treatment

One of the latest trends in the Industrial Wastewater Treatment Technology Market is the increased adoption of membrane technologies, such as reverse osmosis and ultrafiltration. These technologies are gaining popularity due to their ability to efficiently remove contaminants from wastewater, producing high-quality treated water suitable for reuse or safe discharge.

Membrane filtration systems are highly effective in removing suspended solids, dissolved salts, and organic compounds, making them ideal for industries with complex wastewater streams like oil and gas, food processing, and textiles.

The demand for membrane technologies is driven by their ability to deliver high treatment efficiency, reduce operational costs, and support sustainability goals. As industries strive to meet stricter environmental regulations and focus on water conservation, membrane technologies are becoming an essential part of modern wastewater treatment systems.

Regional Analysis

In 2024, the Asia-Pacific region accounted for 44.5% of the Industrial Wastewater Treatment Technology Market, valued at USD 8.2 billion.’

In 2024, the Asia-Pacific region dominated the Industrial Wastewater Treatment Technology Market, accounting for 44.5% of the global share, valued at USD 8.2 billion. The region’s dominance is driven by rapid industrialization, population growth, and rising concerns about water scarcity. Key industries such as oil and gas, chemicals, and textiles are pushing for advanced wastewater treatment solutions, further fueling market growth.

North America follows as a significant player, holding a notable market share with a strong focus on stringent environmental regulations. The growing adoption of sustainable technologies in the U.S. and Canada is driving the demand for advanced wastewater treatment solutions in industries like power generation and food processing.

Europe also holds a considerable market share, benefiting from robust regulations and a shift towards water recycling initiatives. The region’s emphasis on environmental sustainability and the circular economy boosts the market for wastewater treatment technologies in industrial sectors.

In Latin America, the market is expanding slowly but steadily due to growing awareness of wastewater treatment and sustainability, though it remains a smaller segment compared to other regions.

The Middle East & Africa face water scarcity challenges, driving demand for wastewater treatment technologies in industries like oil and gas, although the market remains limited in size.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, key players in the global Industrial Wastewater Treatment Technology Market, such as 3M Company, Veolia Environnement, Siemens AG, and Suez S.A., continue to lead with innovative solutions and strategic expansions. These companies are driving the market with advanced technologies like membrane filtration, chemical treatment, and biological processes that offer high-efficiency solutions for wastewater management across diverse industries.

Veolia Environnement and Suez S.A. maintain strong market positions due to their comprehensive global presence and established portfolios in water treatment. Their solutions cater to a wide range of sectors, including oil and gas, chemicals, and manufacturing, and are particularly focused on sustainability and water reuse. Siemens AG is heavily investing in automation and digitalization technologies, enhancing wastewater treatment system efficiency and operational optimization.

3M Company and A. O. Smith Corporation continue to innovate with filtration solutions and corrosion inhibitors that are critical to maintaining system longevity and performance. Their advanced technologies cater to industries where efficient wastewater treatment is essential, such as power generation and chemical processing.

Aquatech International LLC and Culligan are carving out a niche in water treatment solutions for both municipal and industrial applications, with a focus on providing customized, cost-effective solutions. Similarly, Xylem Inc. and Danaher Corporation are expanding their offerings to include cutting-edge water management systems and sensor technologies, which are gaining traction in highly regulated sectors.

Top Key Players in the Market

- 3M Company

- A. O. Smith Corporation

- AECOM

- ALFA LAVAL

- Aquatech International LLC WaterProfessionals

- Calgon Carbon Corporation (A Kuraray Company)

- Creative Water Solutions

- Culligan

- Danaher Corporation

- DuPont de Nemours, Inc.

- Ecolab Inc.

- GEA Group Aktiengesellschaft

- Honeywell International Inc.

- Kemira Oyj

- Kurita Water Industries Ltd.

- M. W. Watermark

- Minerals Technologies Inc

- MIOX

- PURONICS

- Sapphire Water

- Siemens AG

- Suez S.A.

- Thermo Fisher Scientific Inc.

- Veolia Environnement S.A.

- Xylem Inc.

Recent Developments

- In January 2025, DuPont received the 2025 BIG Innovation Award for advancements in water purification and reuse technologies. They launched the Water Solutions Sustainability Navigator, a digital tool helping water producers compare sustainability indicators across different treatment technologies.

- In March 2024, Ecolab opened a new wastewater treatment plant on Shell Jurong Island, Singapore. The facility can treat and reuse up to 24,000 cubic meters of wastewater monthly, using ultrafiltration and reverse osmosis membrane systems.

Report Scope

Report Features Description Market Value (2024) USD 18.6 Billion Forecast Revenue (2034) USD 33.9 Billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Corrosion Inhibitors, Scale Inhibitors, Coagulants and Flocculants, Anti-foaming Agents, Chelating Agents, pH Adjusters and stabilizers, Biocides and Disinfectants), By Technology (Biological Treatment, Membrane Bioreactor, Activated Sludge, Reverse Osmosis, Membrane Filtration, Sludge Treatment, Others), By Application (Boiler Feed Water, Chemical Production, Cooling Towers, Closed Loop Chillers, Air Compressors, Air Washers, Pharmaceutical Production, Others), By End Use Industry (Oil and Gas, Food and Beverage, Chemical, Mining, Power, Pharmaceutical, Pulp and Paper, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape 3M Company, A. O. Smith Corporation, AECOM, ALFA LAVAL, Aquatech International LLC WaterProfessionals, Calgon Carbon Corporation (A Kuraray Company), Creative Water Solutions, Culligan, Danaher Corporation, DuPont de Nemours, Inc., Ecolab Inc., GEA Group Aktiengesellschaft, Honeywell International Inc., Kemira Oyj, Kurita Water Industries Ltd., M. W. Watermark, Minerals Technologies Inc, MIOX, PURONICS, Sapphire Water, Siemens AG, Suez S.A., Thermo Fisher Scientific Inc., Veolia Environnement S.A., Xylem Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Industrial Wastewater Treatment Technology MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

Industrial Wastewater Treatment Technology MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M Company

- A. O. Smith Corporation

- AECOM

- ALFA LAVAL

- Aquatech International LLC WaterProfessionals

- Calgon Carbon Corporation (A Kuraray Company)

- Creative Water Solutions

- Culligan

- Danaher Corporation

- DuPont de Nemours, Inc.

- Ecolab Inc.

- GEA Group Aktiengesellschaft

- Honeywell International Inc.

- Kemira Oyj

- Kurita Water Industries Ltd.

- M. W. Watermark

- Minerals Technologies Inc

- MIOX

- PURONICS

- Sapphire Water

- Siemens AG

- Suez S.A.

- Thermo Fisher Scientific Inc.

- Veolia Environnement S.A.

- Xylem Inc.