Global High-Performance Polymers Market Size, Share, And Business Benefits By Type (Fluoropolymers, Polyamides, Polyphenylene Sulfide (PPS), Sulfone Polymers (SP), Liquid Crystal Polymers (LCP), Others), By End-use Industry (Transportation, Electrical and Electronics, Industrial, Medical, Packaging, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142015

- Number of Pages: 264

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

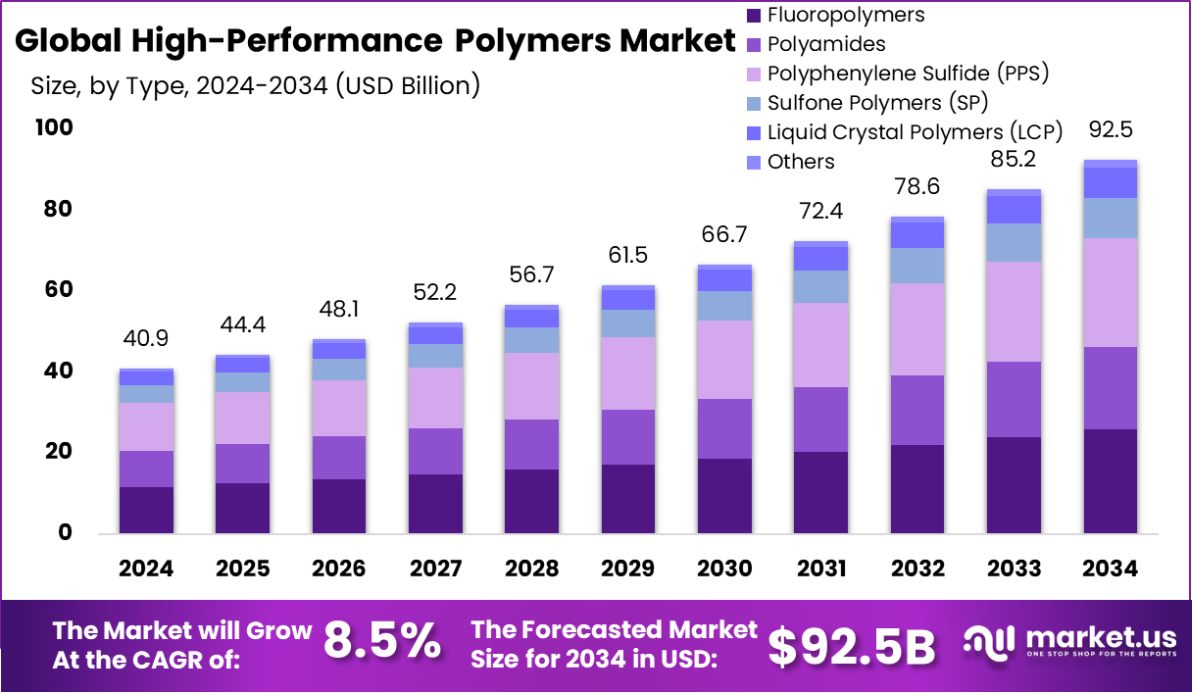

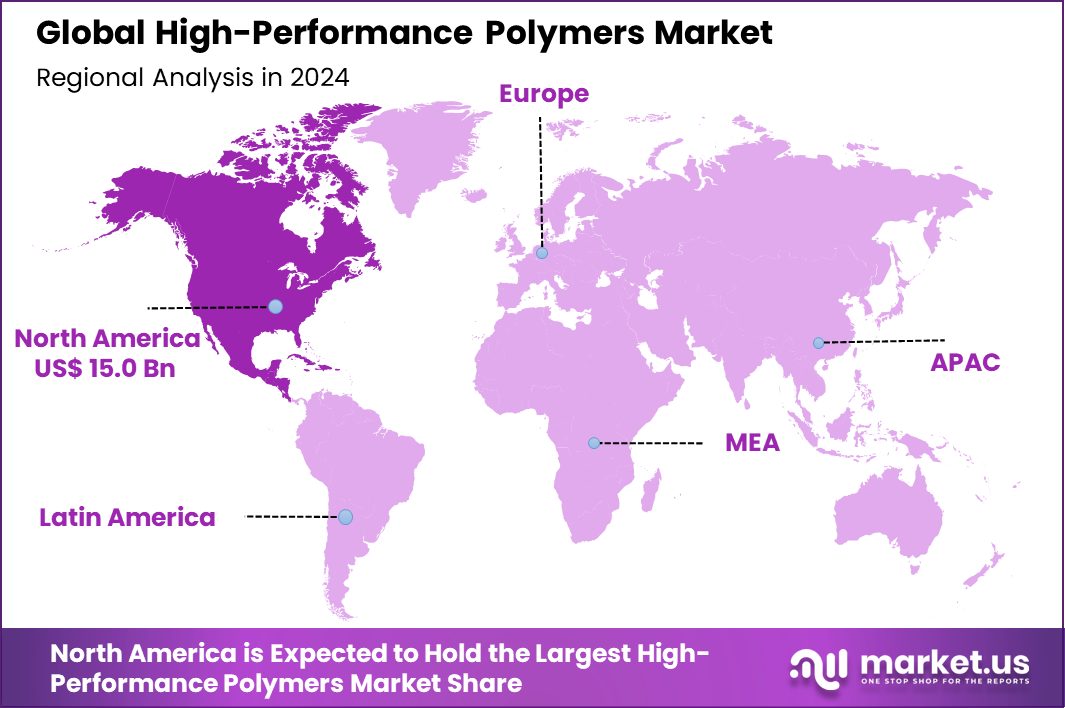

Global High-Performance Polymers Market is expected to be worth around USD 92.5 billion by 2034, up from USD 40.9 billion in 2024, and grow at a CAGR of 8.5% from 2025 to 2034. With a 36.8% market share, North America dominates the High-Performance Polymers sector, reaching a total of USD 15.0 billion.

High-performance polymers are a class of specialized materials known for their superior properties, including resistance to high temperatures, chemicals, and wear. They are widely used in industries such as aerospace, automotive, and medical devices due to their ability to maintain performance under extreme conditions. These polymers are essential in applications where ordinary plastics would fail, making them critical for advancing technological and engineering capabilities.

The High-Performance Polymers Market is experiencing robust growth driven by increasing demands across several high-tech industries. As sectors like aerospace and automotive push for lighter, more durable materials to enhance efficiency and performance, high-performance polymers are becoming indispensable. Their unique properties, such as heat resistance and mechanical strength, align perfectly with the requirements of these industries, propelling market expansion.

One significant growth factor for the high-performance polymers market is the continuous advancement in material science, which enhances their properties and expands their application range. The U.S. Department of Energy’s $4 million investment in supercomputers to address manufacturing challenges is a testament to the technological advancements aiming to optimize polymer performance and efficiency.

The market is also seeing increased demand due to the rising emphasis on sustainability and performance in manufacturing. The automotive industry, for example, is rapidly adopting these polymers to reduce vehicle weight, which directly contributes to fuel efficiency and lower carbon emissions. This demand is supported by initiatives like the High-Performance Computing for Energy Innovation (HPC4EI) program, which received an additional $3.4 million funding opportunity to innovate and enhance materials like high-performance polymers.

Opportunities in the high-performance polymers market are vast, particularly in developing economies where industrialization and modernization efforts are increasing. The Ohio Department of Development’s allocation of $850,000 for polymer industry governance in 2022/2023 highlights the regional focus on fostering industry growth, supporting R&D, and potentially leading to new applications and market expansions in high-performance polymers.

Key Takeaways

- Global High-Performance Polymers Market is expected to be worth around USD 92.5 billion by 2034, up from USD 40.9 billion in 2024, and grow at a CAGR of 8.5% from 2025 to 2034.

- By type, fluoropolymers hold a significant 28.1% share in the High-Performance Polymers Market, reflecting robust demand.

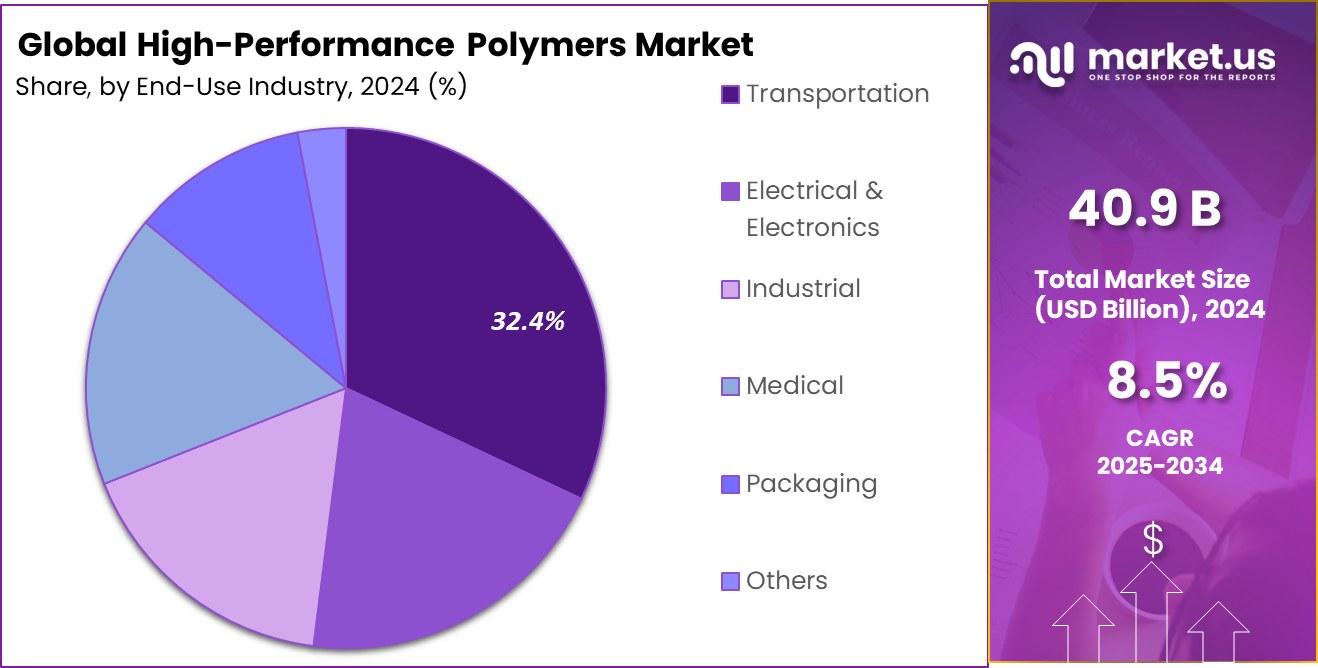

- In the High-Performance Polymers Market, the transportation sector dominates with a 32.4% share, driven by advanced material needs.

- The High-Performance Polymers Market in North America is robust, with a market value of USD 15.0 billion and a 36.8% share.

By Type Analysis

Fluoropolymers hold a 28.1% share in the High-Performance Polymers Market by type.

In 2024, Fluoropolymers held a dominant market position in the “By Type” segment of the High-Performance Polymers Market, with a 28.1% share. This significant market share underscores the critical role fluoropolymers play in various high-stake industries due to their exceptional resistance to solvents, acids, and bases. The automotive and electronics sectors, in particular, have heavily relied on fluoropolymers for their ability to perform under extreme conditions, contributing to the material’s prominence in the market.

The demand for fluoropolymers is primarily driven by their use in applications such as fuel hoses, gaskets, and seals, where high performance is non-negotiable. Additionally, the rise in the manufacturing of electric vehicles has further propelled the demand for fluoropolymers, as they are essential in battery solutions and insulation materials that require high chemical stability and thermal resistance.

Looking ahead, the market is poised for continued growth, fueled by technological advancements and increasing demand for performance-efficient materials in critical applications. As industries continue to push the boundaries of what’s possible in engineering and manufacturing, fluoropolymers are expected to play an even more integral role in driving innovation and efficiency across multiple sectors.

By End-Use Industry Analysis

Transportation leads with 32.4% in market usage of High-Performance Polymers by industry.

In 2024, Transportation held a dominant market position in the “By End-Use Industry” segment of the High-Performance Polymers Market, with a 32.4% share. This leading position highlights the pivotal role of high-performance polymers in the transportation sector, driven by the automotive and aerospace industries’ ongoing pursuit of lighter, more durable, and more efficient materials.

These industries are particularly focused on reducing vehicle and aircraft weight to improve fuel efficiency and reduce emissions, making high-performance polymers such as PEEK and fluoropolymers highly valuable for their exceptional strength-to-weight ratios.

The substantial market share of the transportation sector is further bolstered by the increasing production of electric vehicles (EVs), which rely extensively on high-performance polymers for electrical insulation, thermal management, and structural components. As regulatory demands for lower emissions continue to rise globally, the demand within this segment is expected to grow, fueled by advancements in material science that enhance the performance attributes of these polymers.

The future of high-performance polymers in transportation looks promising, with ongoing research and development aimed at improving the cost-effectiveness and performance characteristics of these materials. This is likely to expand their applications within the sector and further solidify their market position.

Key Market Segments

By Type

- Fluoropolymers

- Polyamides

- Polyphenylene Sulfide (PPS)

- Sulfone Polymers (SP)

- Liquid Crystal Polymers (LCP)

- Others

By End-use Industry

- Transportation

- Electrical and Electronics

- Industrial

- Medical

- Packaging

- Others

Driving Factors

Rising Demand for Lightweight Automotive Materials

One of the top driving factors in the High-Performance Polymers Market is the increasing demand for lightweight materials within the automotive industry. As global regulations on fuel efficiency and emissions become stricter, automotive manufacturers are turning to materials that can reduce overall vehicle weight without compromising on performance or safety.

High-performance polymers, known for their exceptional strength-to-weight ratios, are ideally suited to meet these requirements. They are extensively used in the production of components like fuel systems, electrical insulation, and under-the-hood parts. The lightweight nature of these polymers not only enhances fuel efficiency but also improves the vehicle’s handling and acceleration, making them a key component in modern automotive design.

Restraining Factors

High Cost Limits High-Performance Polymers Market Growth

A significant restraining factor in the High-Performance Polymers Market is the high cost associated with these materials. High-performance polymers are engineered to provide superior properties such as high temperature resistance, chemical stability, and mechanical strength, which typically make them more expensive than conventional polymers.

This cost factor can be a substantial barrier to widespread adoption, particularly in cost-sensitive markets and applications where budget constraints are tight. Industries such as automotive and consumer electronics, which operate on low-margin, high-volume business models, often find the high initial costs challenging. As a result, the high expense of these polymers can limit their market penetration and slow down the growth of the High-Performance Polymers Market.

Growth Opportunity

Expanding Applications in Electric Vehicle Market

A prominent growth opportunity for the High-Performance Polymers Market lies in the expanding electric vehicle (EV) sector. As the global shift towards electric mobility accelerates, the demand for materials that can withstand the unique challenges of EVs—such as high temperatures and chemical exposures in battery packs and power systems—increases. High-performance polymers are ideal for these applications due to their excellent thermal stability, electrical insulation properties, and chemical resistance.

Their ability to perform in harsh environments makes them indispensable in the production of EV components, which are critical for safety and efficiency. As the EV market continues to grow, driven by environmental concerns and supportive government policies, the demand for high-performance polymers is expected to surge, presenting significant market expansion opportunities.

Latest Trends

Adoption of 3D Printing Technology Drives Innovation

One of the latest trends in the High-Performance Polymers Market is the increased adoption of 3D printing technology. This trend is revolutionizing how high-performance polymers are used, particularly in the aerospace, healthcare, and automotive industries. With 3D printing, complex parts can be manufactured more efficiently and with greater design flexibility than traditional methods allow.

High-performance polymers are particularly suited for 3D printing applications due to their high strength, thermal stability, and chemical resistance, which are essential for producing durable and functional components. This trend not only enhances product customization but also reduces waste and shortens the product development cycle, opening new pathways for innovation and efficiency in manufacturing processes across various industries.

Regional Analysis

North America holds a commanding 36.8% share of the High-Performance Polymers Market, valued at USD 15.0 billion.

In the High-Performance Polymers Market, regional dynamics play a critical role in shaping market trends and opportunities. North America dominates the market with a significant 36.8% share, amounting to USD 15.0 billion. This dominance is driven by advanced manufacturing capabilities and a strong presence of leading aerospace, automotive, and electronics companies that demand high-performance materials. The region benefits from robust R&D investments and a strong push towards technological innovations in material science.

Europe follows, with a focus on sustainability and stringent environmental regulations driving the adoption of high-performance polymers in automotive and aerospace sectors. The region’s commitment to reducing carbon footprints and enhancing energy efficiency presents a fertile ground for market growth.

Asia Pacific is rapidly emerging as a key player due to its expanding manufacturing sector and increasing investments in automotive, electronics, and construction. The region’s market is propelled by economic growth in China and India, alongside advancements in manufacturing technologies.

Meanwhile, the Middle East & Africa, and Latin America are experiencing gradual growth, with increasing industrial activities and rising awareness about the benefits of high-performance polymers. These regions present untapped potential with growing demands in sectors such as oil & gas and automotive, which require advanced materials for enhanced performance and durability.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global High-Performance Polymers Market was significantly shaped by the strategic initiatives and innovative breakthroughs of key players like Arkema, BASF SE, Celanese, Daikin, DIC, and DowDuPont. Each of these companies has contributed uniquely to the industry, driving forward the applications and accessibility of high-performance polymers.

Arkema stood out for its focus on bio-based high-performance polymers, catering to the growing demand for sustainable and environmentally friendly materials. This strategic direction not only enhanced Arkema’s market position but also aligned with global sustainability trends, appealing to industries seeking green alternatives.

BASF SE, a giant in the chemical industry, leveraged its extensive R&D capabilities to enhance the functionality and performance of polymers used in harsh and demanding environments. BASF’s innovations in polymer chemistry have been pivotal in advancing the automotive and aerospace sectors, where high-performance materials are increasingly vital.

Celanese concentrated on the production of engineering thermoplastics and specialty materials, introducing products with superior mechanical properties suitable for high-temperature applications. This focus has secured Celanese a critical role in electronics and automotive manufacturing.

Daikin, known for its expertise in fluoropolymers, expanded its portfolio to include advanced polymer solutions that offer exceptional chemical and heat resistance, vital for applications in electronics and coatings.

DIC has capitalized on its capabilities in creating high-performance pigments and resins that enhance the aesthetic and functional properties of polymers used in consumer goods and automotive industries.

Lastly, DowDuPont has made significant strides in market expansion through the development of multi-functional polymers that provide high strength, durability, and thermal stability. These materials are crucial for applications across various industrial sectors, including construction and electronics.

Top Key Players in the Market

- Arkema

- BASF SE

- Celanese

- Daikin

- DIC

- DowDuPont

- DSM

- DuPont

- Evonik Industries

- Kuraray

- RTP

- SABIC

- Saint-Gobain Performance Plastics

- Solvay

- Sumitomo Chemical

- Unitika

- Victrex plc

Recent Developments

- In January 2025, Arkema presented its portfolio of advanced bio-circular materials for eyewear at MIDO 2025. The company introduced Rilsan® Clear G820 Rnew®, a 62% bio-based transparent polyamide, and 100% bio-based Rilsan® PA11 Fine powders for 3D printing.

- In May 2024, BASF announced a 40% increase in production capacity for Ultramid® polyamide and Ultradur® polybutylene terephthalate at its plants in Panoli and Thane, India. The company also opened a new Polyurethane Technical Development Center in Mumbai.

Report Scope

Report Features Description Market Value (2024) USD 40.9 Billion Forecast Revenue (2034) USD 92.5 Billion CAGR (2025-2034) 8.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Fluoropolymers, Polyamides, Polyphenylene Sulfide (PPS), Sulfone Polymers (SP), Liquid Crystal Polymers (LCP), Others), By End-use Industry (Transportation, Electrical and Electronics, Industrial, Medical, Packaging, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Arkema, BASF SE, Celanese, Daikin, DIC, DowDuPont, DSM , DuPont, Evonik Industries, Kuraray, RTP, SABIC, Saint-Gobain Performance Plastics, Solvay, Sumitomo Chemical, Unitika, Victrex plc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  High-Performance Polymers MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

High-Performance Polymers MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Arkema

- BASF SE

- Celanese

- Daikin

- DIC

- DowDuPont

- DSM

- DuPont

- Evonik Industries

- Kuraray

- RTP

- SABIC

- Saint-Gobain Performance Plastics

- Solvay

- Sumitomo Chemical

- Unitika

- Victrex plc