Dairy Products Market Size, Share And Growth Analysis By Product (Milk, Cheese, Yogurt, Butter, Others), By Category (Lactose, Lactose-Free, By Nature, Conventional, Organic), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 141759

- Number of Pages: 376

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

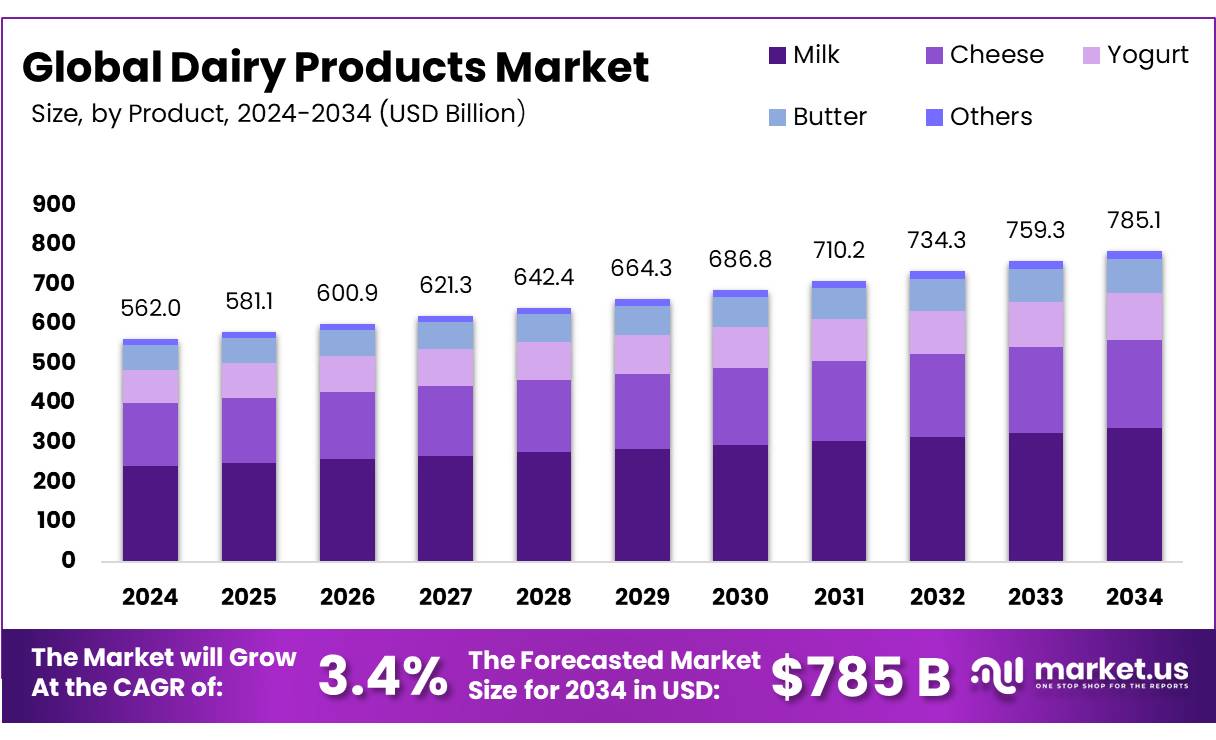

The Global Dairy Products Market size is expected to be worth around USD 785.1 Billion by 2034, from USD 562.0 Billion in 2024, growing at a CAGR of 3.4% during the forecast period from 2025 to 2034.

The Dairy Products Market is experiencing substantial growth, driven by a complex interplay of socio-economic, health, and technological factors. At its core, the industry is supported by the universal recognition of dairy products as essential components of dietary nutrition, offering vital nutrients such as calcium, protein, and vitamins.

The dairy products, such as milk, cheese, and yogurt, alongside a notable surge in preference for value-added dairy products. These include lactose-free, organic, and fortified dairy products, which cater to a growing segment of health-conscious consumers.

The trend towards healthier lifestyles has led to innovations such as probiotic dairy products, which are gaining popularity due to their benefits to digestive health and immune system support. Dairy products are the kinds of foods that are obtained primarily from or contain milk of mammals such as cattle, goats, sheep, etc. Dairy products include a variety of foods such as cheese, butter, yogurt, and many more. They are consumed throughout the world, excluding some parts of central Africa and some countries in East and Southeast Asia.

Key Takeaways

- The Dairy Products Market is projected to grow from USD 562.0 billion in 2024 to USD 785.1 billion by 2034, at a CAGR of 3.4% from 2025 to 2034.

- In 2024, milk held a dominant market share of over 43.4%, driven by its nutritional benefits (high calcium and protein) and its role as a staple in daily diets.

- Lactose captured more than 66.7% of the market share in 2024, fueled by its use in food, pharmaceuticals, and lactose-free products catering to lactose-intolerant consumers.

- Conventional dairy products accounted for over 78.3% of the market in 2024, supported by affordability, established supply chains, and consumer trust in traditional methods.

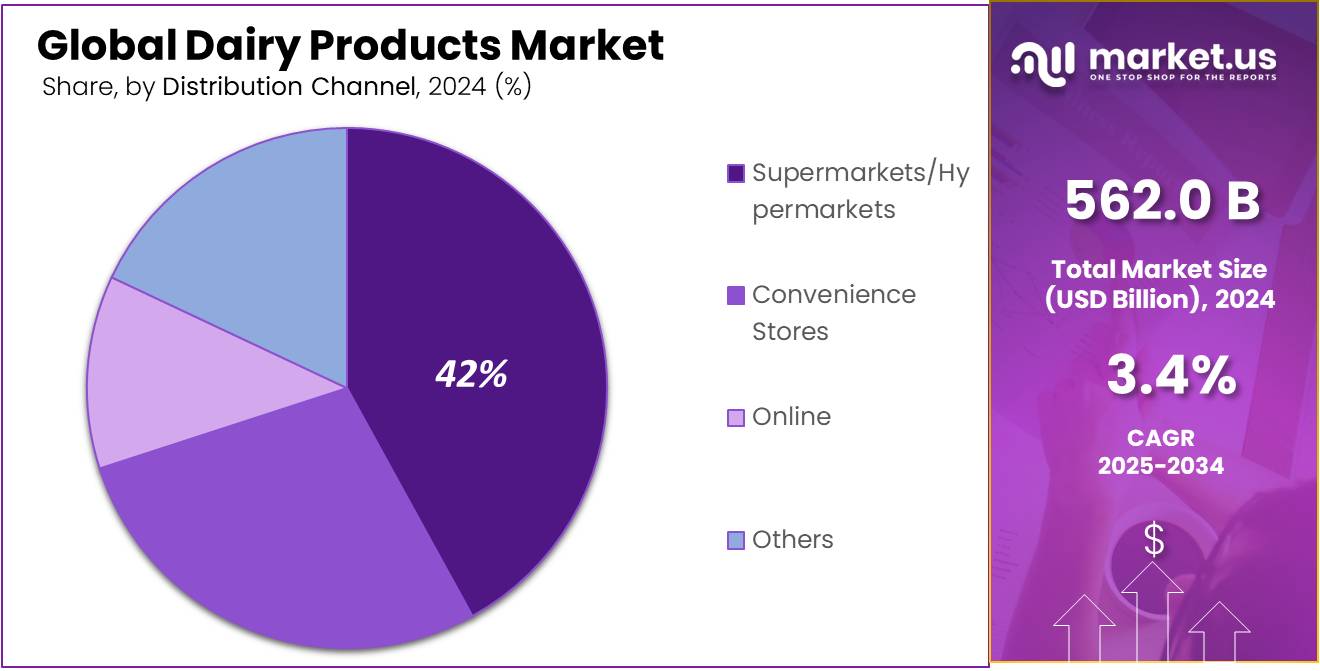

- Supermarkets and hypermarkets led distribution channels with a 42.2% share in 2024, offering convenience and a wide variety of dairy products.

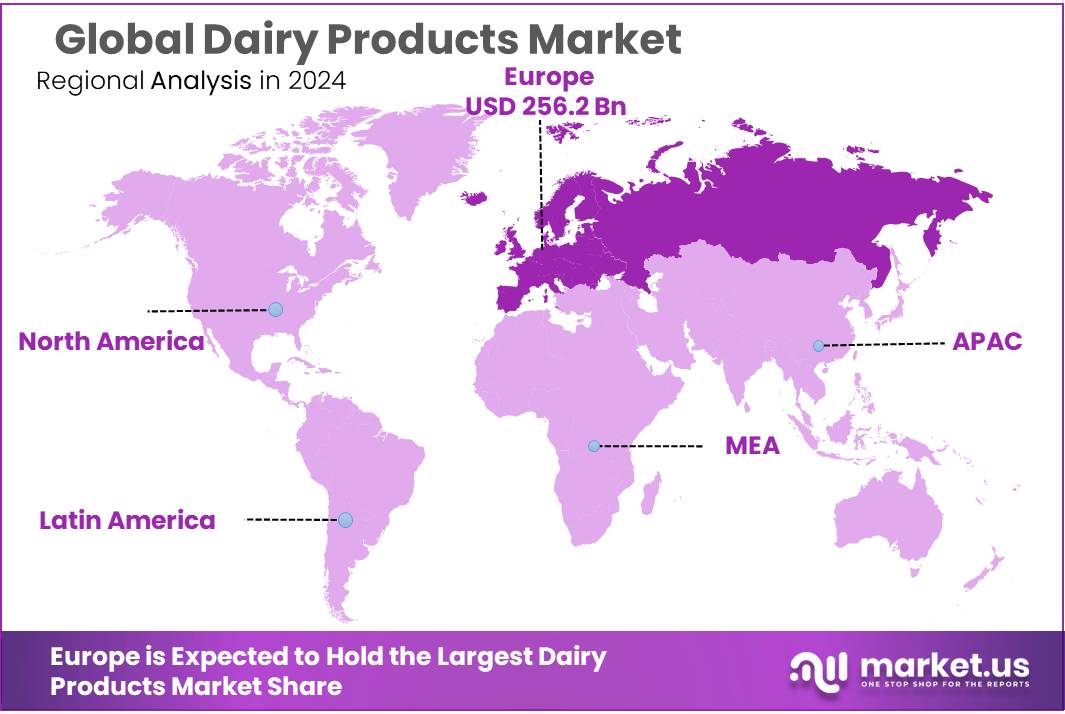

- Europe dominated the market with a 45.6% share (USD 256.2 billion) in 2024, driven by strong dairy traditions and demand for diverse products like milk, cheese, and yogurt.

By Product

In 2024, Milk held a dominant market position, capturing more than a 43.4% share in the dairy products market. This segment’s robust performance is primarily due to increasing consumer preferences for traditional dairy beverages, coupled with growing awareness about the health benefits associated with milk consumption, such as high calcium and protein content.

Throughout the year, the market saw a steady increase in demand for organic and grass-fed milk varieties, reflecting a broader shift toward more sustainable and health-conscious consumption patterns. Innovations in packaging and the expansion of distribution channels, including online grocery delivery services, also played a crucial role in making milk more accessible to a wider audience.

By Category

In 2024, Lactose held a dominant market position, capturing more than a 66.7% share in the dairy products category. This substantial market share is largely attributed to the widespread use of lactose in various food products, pharmaceuticals, and in the preparation of lactose-free food items, which are gaining popularity among lactose-intolerant consumers.

The increasing awareness and diagnosis of lactose intolerance have spurred the demand for lactose as a crucial ingredient in dairy alternatives, which mimics the taste and texture of dairy while providing digestibility.

The year also observed a surge in demand for lactose in the confectionery and bakery sectors, where it is prized for its ability to enhance flavor, browning, and texture of baked goods. As manufacturers continue to innovate in these areas, the role of lactose in new product development has become more significant.

By Nature

In 2024, Conventional dairy products held a dominant market position, capturing more than a 78.3% share. This significant market share reflects the ongoing consumer reliance on traditionally produced dairy items, which are generally available and typically priced more competitively than their organic counterparts.

The strong performance of conventional dairy products is supported by well-established supply chains and high consumer trust in traditional dairy processing methods. Despite the growing interest in organic and sustainable products, conventional dairy remains preferred due to its wide availability and varied product offerings, from milk and cheese to yogurt and butter.

By Distribution Channel

In 2024, Supermarkets and Hypermarkets held a dominant market position in the distribution of dairy products, capturing more than a 42.2% share. This channel’s success can be attributed to the convenience it offers, allowing consumers to access a wide range of dairy products under one roof.

The popularity of supermarkets and hypermarkets is also bolstered by their ability to stock a variety of brands and product types, catering to the diverse preferences of shoppers. These outlets are particularly favored for their regular promotions and discounts, which attract budget-conscious consumers looking for value in their purchases.

Key Market Segments

By Product

- Milk

- Cheese

- Yogurt

- Butter

- Others

By Category

- Lactose

- Lactose-Free

By Nature

- Conventional

- Organic

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

Drivers

Rising Health Awareness Among Consumers

One major driving factor for the growth in the dairy products market is the rising health awareness among consumers. As people become more conscious of their dietary choices, there is a noticeable shift toward products that offer health benefits, including dairy items rich in essential nutrients like calcium, protein, and vitamins.

According to the Food and Agriculture Organization (FAO), dairy products are recognized as important components of a balanced diet, providing essential nutrients that are crucial for bone health and the prevention of chronic diseases. In recent years, there has been a surge in consumer demand for functional foods, a category in which dairy products play a significant role.

For instance, probiotic yogurts and fortified milk varieties have seen increased popularity due to their health benefits, including improved digestive health and enhanced immune response. The International Dairy Foods Association (IDFA) reports that sales of these functional dairy products have climbed, reflecting a broader trend of health-centric consumption.

Restraints

Rising Concerns About Lactose Intolerance and Dairy Allergies

A significant restraint in the dairy products market is the increasing prevalence of lactose intolerance and dairy allergies among the global population. Lactose intolerance affects a substantial number of individuals, preventing them from consuming traditional dairy products without experiencing discomfort or adverse health effects.

According to data from the National Institutes of Health (NIH), it is estimated that approximately 65% of the global population has a reduced ability to digest lactose after infancy. The impact of lactose intolerance is particularly noticeable in regions such as Asia and Africa, where the prevalence is higher compared to Western countries.

Opportunity

Innovation in Dairy Product Varieties

A significant growth factor in the dairy products market is the ongoing innovation in dairy product varieties, which has dramatically expanded consumer choices and appealed to a broader demographic. Innovations such as the introduction of flavored milk, high-protein yogurts, and specialty cheeses are catering to a more diverse consumer base with varying tastes and dietary requirements.

According to the International Dairy Federation, the introduction of these innovative products is not only meeting the demand for variety but also boosting consumption rates across different age groups. For instance, the availability of lactose-free and high-protein dairy options has made it possible for people with specific dietary restrictions, such as those with lactose intolerance or athletes seeking protein-rich foods, to include dairy in their diets.

Trends

Plant-Based Dairy Alternatives Gain Momentum

A major emerging factor in the dairy products market is the rapid rise in popularity of plant-based dairy alternatives. This trend is driven by a combination of health consciousness, ethical concerns regarding animal welfare, and environmental sustainability.

According to the Food and Agriculture Organization (FAO), the demand for plant-based alternatives to milk, such as almond milk, soy milk, and oat milk, has seen significant growth in recent years. These alternatives are not only appealing to vegans and vegetarians but also to lactose-intolerant consumers and those seeking to reduce their dairy intake.

The innovation in plant-based dairy products has expanded beyond milk to include alternatives for cheese, yogurt, and even ice cream. This expansion is largely due to advancements in food technology that improve the taste and texture of plant-based products to more closely mimic their dairy counterparts. Consumer acceptance has increased as these products become more available and familiar on supermarket shelves.

Regional Analysis

In the Dairy Products Market, Europe stands out as a dominating region, capturing a substantial 45.6% share, which translates to approximately USD 256.2 billion in market value. This significant presence is largely attributed to the region’s deep-rooted dairy traditions and sophisticated consumer preferences that demand a wide array of dairy products, from basic milk to artisan cheeses and yogurts.

Europe’s leadership in the dairy market is supported by robust dairy industries in countries like Germany, France, and the Netherlands, where dairy farming and processing are highly advanced. These countries not only satisfy domestic demands but are also key players in the global dairy export market.

The European market is characterized by high standards of quality and safety, reinforced by stringent EU regulations and a strong focus on sustainable and ethical production practices. Innovation within the European dairy sector also drives its market dominance. There is a growing trend towards organic and free-from dairy products, catering to an increasingly health-conscious consumer base.

The European dairy industry benefits from governmental support in terms of agricultural subsidies and promotional campaigns aimed at boosting consumption of dairy products. These factors collectively ensure that Europe not only retains a substantial market share but also sets trends within the global dairy industry.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

- Amul (Gujarat Cooperative Milk Marketing Federation)

- Arla Foods amba

- Dairy Farmers of America, Inc.

- Danone S.A.

- Dean Foods Company

- DMK Group

- Fonterra Co-operative Group

- FrieslandCampina

- GCMMF

- Groupe Lactalis

- Kerry Group plc

- Meiji Holdings Co., Ltd.

- Mengniu Dairy

- Murray Goulburn Co-operative Co. Limited

- Nestle S.A.

- Parmalat S.p.A.

- Royal FrieslandCampina

- Saputo Inc.

- Savencia Fromage & Dairy

- Sodiaal

- The Kraft Heinz Company

- Unilever N.V.

- Vinamilk

- Yili Group

Top Key Players in the Market

- Amul (Gujarat Cooperative Milk Marketing Federation), based in India, is a leading dairy cooperative known for its wide range of milk products. Established in 1946, it revolutionized India’s dairy industry through the White Revolution. Amul operates on a cooperative model, empowering millions of farmers. The brand offers products like milk, butter, cheese, ice cream, and more, catering to both domestic and international markets.

- Arla Foods, a Danish multinational, is one of the largest dairy companies globally. Founded in 1881, it operates as a cooperative owned by farmers. Arla is renowned for its high-quality dairy products, including milk, cheese, butter, and yogurt. Arla is known for brands like Lurpak and Castello, delivering nutritious and sustainable dairy options to consumers worldwide.

- Dairy Farmers of America (DFA) is a major U.S. dairy cooperative, founded in 1998. Representing thousands of family farms, DFA focuses on milk production, processing, and marketing. The cooperative produces a variety of dairy products, including cheese, butter, and ice cream, under brands like Borden and Kemps. DFA plays a crucial role in the U.S. dairy industry, ensuring high-quality dairy products reach consumers nationwide.

Recent Developments

- In 2024, Amul achieved a substantial turnover of approximately USD 7.3 billion, reflecting its robust market presence and broad consumer base. The cooperative is renowned for its diverse product range, including milk, butter, cheese, ice cream, and other dairy products, catering to a wide array of consumer preferences.

- In 2024, Arla Foods amba continued to strengthen its position in the dairy products sector, achieving significant financial and strategic success. The company reported a revenue of EUR 13.8 billion, marking a stable performance in comparison to the previous year.

Report Scope

Report Features Description Market Value (2024) USD 562.0 Billion Forecast Revenue (2034) USD 785.1 Billion CAGR (2025-2034) 3.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Milk, Cheese, Yogurt, Butter, Others), By Category (Lactose, Lactose-Free, By Nature, Conventional, Organic), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Amul (Gujarat Cooperative Milk Marketing Federation), Arla Foods amba, Dairy Farmers of America, Inc., Danone S.A., Dean Foods Company, DMK Group, Fonterra Co-operative Group, FrieslandCampina, GCMMF, Groupe Lactalis, Kerry Group plc, Meiji Holdings Co., Ltd., Mengniu Dairy, Murray Goulburn Co-operative Co. Limited, Nestle S.A., Parmalat S.p.A., Royal FrieslandCampina, Saputo Inc., Savencia Fromage & Dairy, Sodiaal, The Kraft Heinz Company, Unilever N.V., Vinamilk, Yili Group Customization Scope Customization for segments the region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Amul (Gujarat Cooperative Milk Marketing Federation)

- Arla Foods amba

- Dairy Farmers of America, Inc.

- Danone S.A.

- Dean Foods Company

- DMK Group

- Fonterra Co-operative Group

- FrieslandCampina

- GCMMF

- Groupe Lactalis

- Kerry Group plc

- Meiji Holdings Co., Ltd.

- Mengniu Dairy

- Murray Goulburn Co-operative Co. Limited

- Nestle S.A.

- Parmalat S.p.A.

- Royal FrieslandCampina

- Saputo Inc.

- Savencia Fromage & Dairy

- Sodiaal

- The Kraft Heinz Company

- Unilever N.V.

- Vinamilk

- Yili Group