Global Plant-based Yogurt Market By Naturen (Conventional, Organic), By Product Type (Soy Yogurt, Coconut Yogurt, Almond Yogurt, Rice Yogurt, Others), By Flavor (Chocolate, Strawberry, Banana, Pineapple, Mango, Lemonade, Peach, Others), By End Use (HORECA, Household), By Sales Channel (Offline, Online) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 134913

- Number of Pages: 217

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

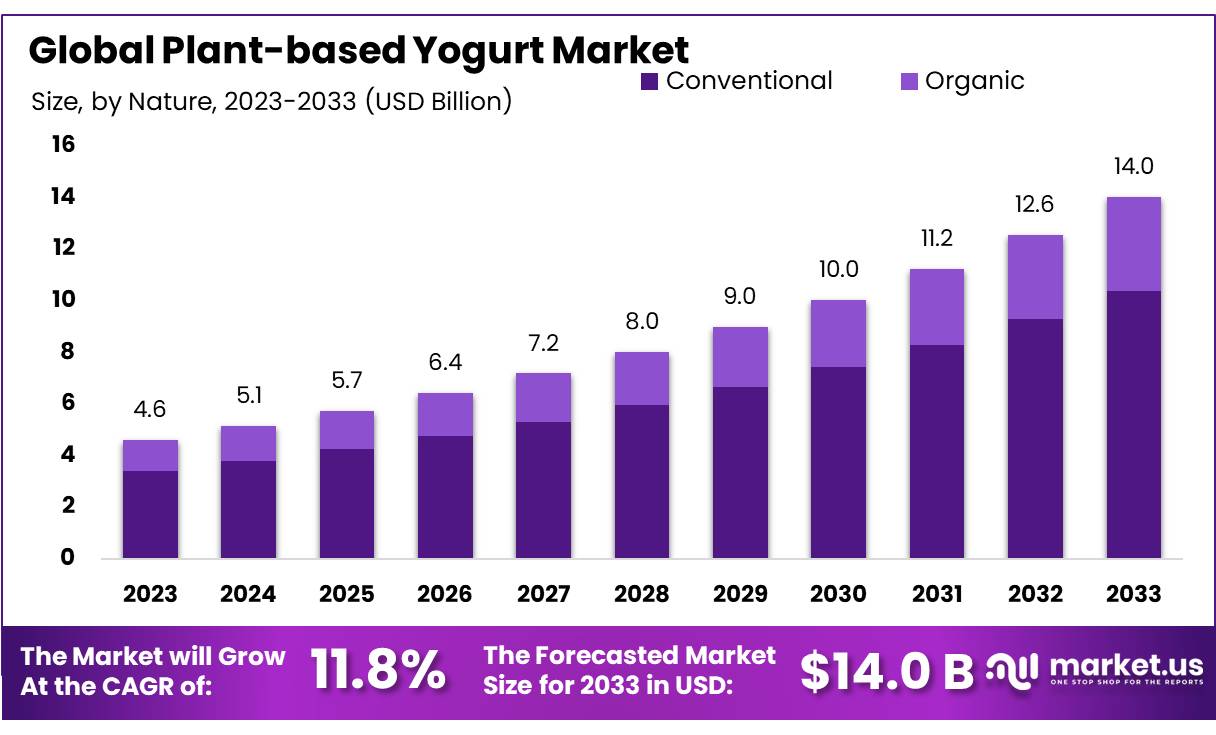

The Global Plant-based Yogurt Market size is expected to be worth around USD 14.0 Bn by 2033, from USD 4.6 Bn in 2023, growing at a CAGR of 11.8% during the forecast period from 2024 to 2033.

Plant-based Yogurt refers to yogurt alternatives made from plant-based ingredients rather than dairy. The growing availability of diverse flavors from nuts, soy, coconut, oats, or other plant-derived sources. Plant-based yogurts are designed to mimic the creamy texture and tangy flavor of traditional dairy yogurt while catering to those who follow vegan, lactose-free, or dairy-free diets.

The demand for plant-based yogurt is not just driven by health considerations, but also by increasing consumer awareness of the environmental footprint of traditional dairy production. This shift is particularly noticeable in Europe, where plant-based diets are becoming more mainstream, and in North America, where health-conscious consumers are seeking out alternatives to dairy products.

The growing availability of diverse flavors, such as coconut, almond, and oat, has broadened the appeal of plant-based yogurt, making it an attractive option for a wider demographic. As these trends continue to evolve, the plant-based yogurt market is expected to further solidify its position within the global food industry.

In North America, where the demand for dairy alternatives has been rapidly increasing, plant-based yogurt is projected to reach USD 2.1 billion by 2026. This growth is a direct result of rising health concerns, environmental sustainability efforts, and an overall shift in consumer dietary preferences.

North American consumers are increasingly avoiding traditional dairy due to concerns over lactose intolerance, dairy-related allergies, and ethical considerations related to animal farming. The growing recognition of plant-based foods as healthier, more sustainable options has made plant-based yogurt a staple in many households.

Similarly, in Europe, where consumers are highly attuned to environmental issues, the plant-based yogurt market is forecast to grow at a CAGR of 8.6% between 2024 and 2030. The European market is being driven by a combination of factors, including a growing interest in vegan and plant-based diets, environmental concerns, and stricter regulations surrounding the food industry’s carbon footprint.

Governments and environmental organizations are promoting plant-based products, recognizing their lower carbon emissions compared to dairy. As a result, plant-based yogurt has seen increased demand not only in supermarkets but also in foodservice and institutional channels, further driving market growth.

Rising concerns about lactose intolerance, dairy allergies, and the desire to lower cholesterol have led consumers to seek healthier alternatives to traditional dairy products. The National Institutes of Health reports that approximately 65% of people worldwide experience reduced lactose digestion after infancy, underscoring the growing demand for lactose-free options.

Key Takeaways

- Plant-based Yogurt Market size is expected to be worth around USD 14.0 Bn by 2033, from USD 4.6 Bn in 2023, growing at a CAGR of 11.8%.

- Conventional plant-based yogurt held a dominant market position, capturing more than a 74.3% share of the market.

- Soy Yogurt held a dominant market position, capturing more than a 38.5% share.

- Chocolate held a dominant market position, capturing more than a 19.3% share.

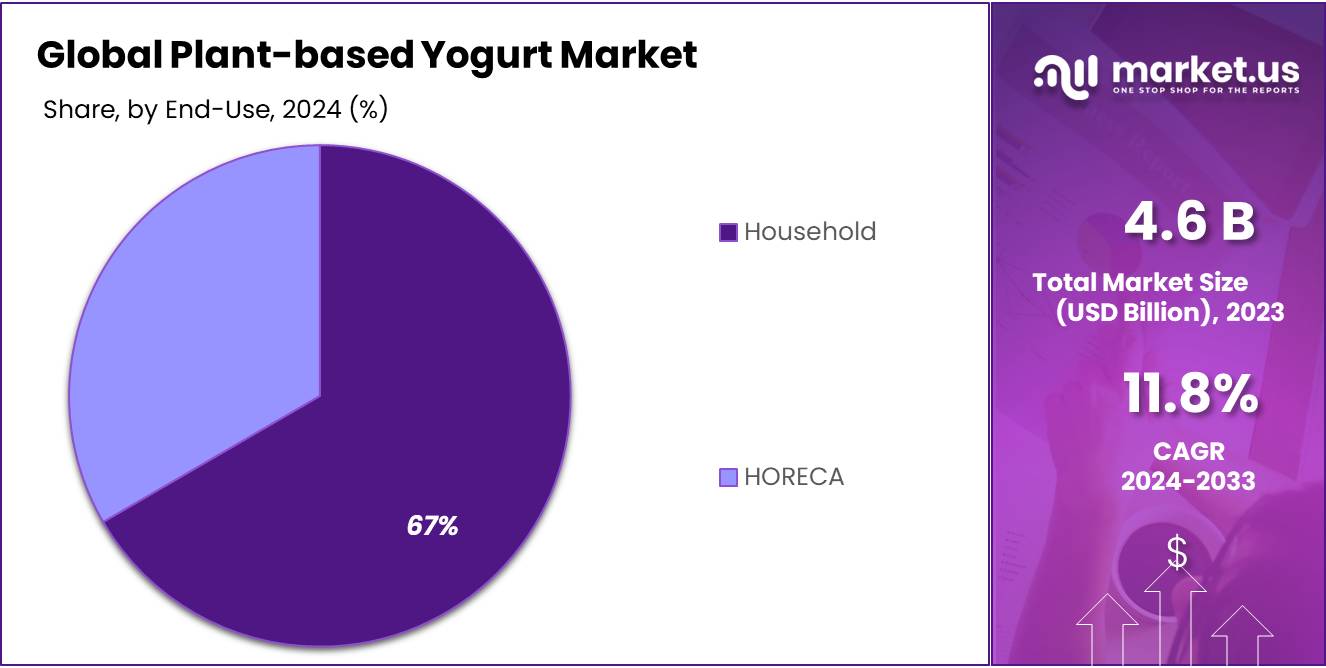

- Household held a dominant market position, capturing more than a 64.4% share.

- Offline held a dominant market position, capturing more than a 79.1% share.

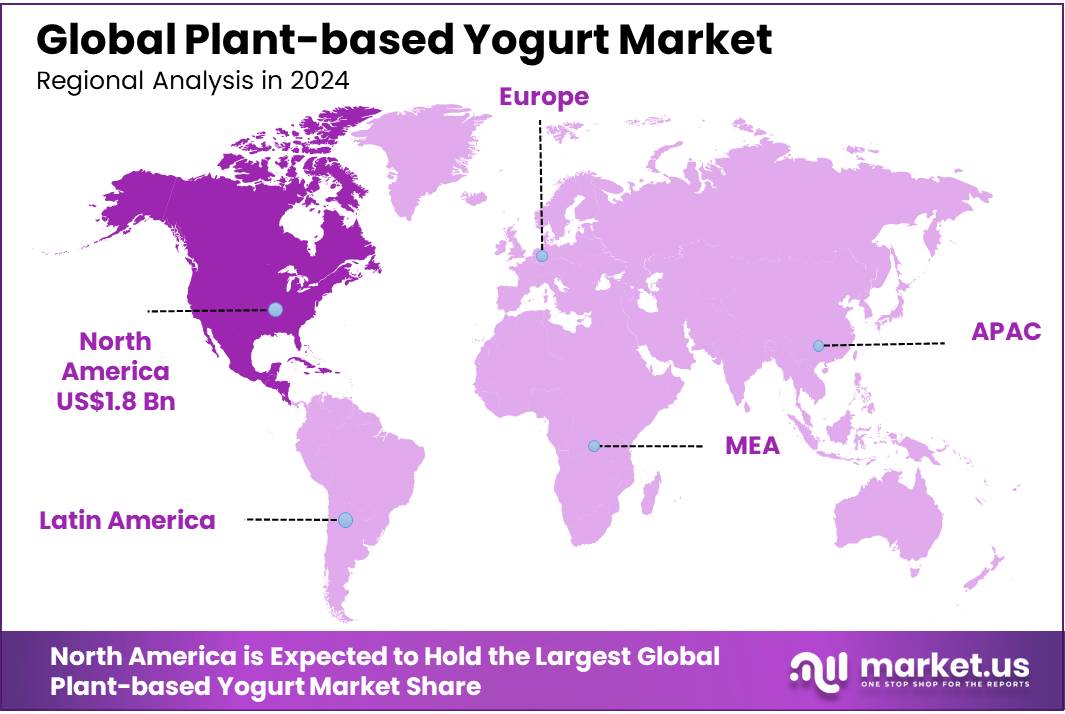

- North America dominated the global plant-based yogurt market, accounting for 31.7% of the market share, valued at USD 1.8 billion.

By Nature

In 2023, Conventional plant-based yogurt held a dominant market position, capturing more than a 74.3% share of the market. This segment continues to lead due to its wide availability, affordability, and established presence in supermarkets. Conventional plant-based yogurts are typically made with ingredients such as soy, almond, and coconut, which are cost-effective and well-accepted by consumers.

The Organic segment, while smaller in comparison, is growing steadily. Organic plant-based yogurt accounted for the remaining share, as more consumers seek products made from non-GMO ingredients and grown without synthetic pesticides or fertilizers. This shift towards organic options is driven by increased health awareness and environmental concerns, though organic products often come at a premium price point.

By Product Type

In 2023, Soy Yogurt held a dominant market position, capturing more than a 38.5% share of the market. Soy yogurt remains the leader due to its nutritional profile, including high protein content, and its long-standing popularity among plant-based yogurt consumers. It also offers a texture and taste similar to traditional dairy yogurt, making it a preferred choice for many.

Coconut Yogurt is another popular product, accounting for a significant share of the market. Known for its creamy texture and tropical flavor, coconut yogurt appeals to consumers seeking a rich, dairy-free alternative. It is especially favored in regions with high coconut consumption and among those seeking a dairy-free, plant-based option.

Almond Yogurt is also gaining traction, driven by its light taste and nutritional benefits, such as being a good source of vitamins and minerals. While it holds a smaller share compared to soy and coconut, almond yogurt is increasingly becoming a go-to choice for health-conscious consumers and those with dietary restrictions.

Rice Yogurt is a niche product but is growing steadily. It is often chosen by individuals with soy or nut allergies. The product’s mild flavor and smooth texture make it an appealing option for those seeking a hypoallergenic plant-based yogurt alternative.

By Flavor

In 2023, Chocolate held a dominant market position, capturing more than a 19.3% share. Chocolate flavor remains a consumer favorite due to its rich and indulgent taste, appealing to both adults and children. It is widely available and often positioned as a dessert alternative, making it one of the top choices in the plant-based yogurt market.

Strawberry flavor is another strong contender, capturing a significant market share. With its sweet, fruity taste, strawberry plant-based yogurt continues to attract health-conscious consumers looking for a familiar, classic flavor. It is popular across a wide range of demographics, from young children to adults.

Banana flavor, while not as dominant as chocolate or strawberry, is growing in popularity. Its smooth, creamy taste offers a mild alternative to more intense fruit flavors, and it appeals to those seeking a natural, light flavor profile. Banana-flavored plant-based yogurt is often marketed as a healthy snack option.

Pineapple and Mango flavors are also gaining traction, particularly in tropical and warmer climates. These flavors are favored for their refreshing, bold taste, and they cater to consumers who prefer more exotic or vibrant fruit profiles in their yogurt.

Lemonade and Peach flavors are smaller but growing segments. Lemonade offers a zesty, tangy option for those seeking something different, while peach is appreciated for its sweet and slightly tart flavor. Both cater to niche consumer preferences, expanding the flavor choices available in the market.

By End Use

In 2023, Household held a dominant market position, capturing more than a 64.4% share. This segment leads due to the growing demand for plant-based products among individual consumers. Households are increasingly adopting plant-based yogurt as part of their daily diet, driven by health trends, dietary restrictions, and environmental concerns. Convenience, along with the availability of a wide variety of flavors, makes plant-based yogurt a popular choice for home consumption.

The HORECA (Hotels, Restaurants, and Cafés) segment, while smaller, is also seeing growth. As more foodservice establishments cater to plant-based diets, demand for plant-based yogurt in this space is rising. Restaurants and cafés use plant-based yogurt in smoothies, desserts, and bowls, offering a dairy-free alternative to their customers. The segment benefits from the increasing popularity of plant-based diets and the growing number of health-conscious consumers dining out. However, it remains a niche compared to the household market, which drives the majority of sales.

By Sales Channel

In 2023, Offline held a dominant market position, capturing more than a 79.1% share. This segment is led by traditional retail channels, including supermarkets, hypermarkets, departmental stores, and convenience stores. Consumers continue to prefer in-store shopping for plant-based yogurt due to the immediate availability and the ability to compare different brands and flavors. Supermarkets and hypermarkets are the largest contributors to offline sales, offering a wide range of options at competitive prices.

Among offline channels, supermarkets and hypermarkets dominate, followed by departmental and convenience stores. The wide distribution network and the physical presence of these stores make plant-based yogurt easily accessible to a broad customer base.

The Online segment is steadily growing, although it still holds a smaller share. Sales through company websites and e-commerce platforms like Amazon are increasing as more consumers seek the convenience of online shopping. The growth of the online segment is driven by the rising popularity of home delivery services and the ease of purchasing plant-based products from the comfort of home. This shift is particularly prominent among younger, tech-savvy consumers who prefer the convenience and variety offered by online platforms.

Key Market Segments

By Nature

- Conventional

- Organic

By Product Type

- Soy Yogurt

- Coconut Yogurt

- Almond Yogurt

- Rice Yogurt

- Others

By Flavor

- Chocolate

- Strawberry

- Banana

- Pineapple

- Mango

- Lemonade

- Peach

- Others

By End Use

- HORECA

- Household

By Sales Channel

- Offline

- Supermarkets/Hypermarkets

- Departmental Stores

- Convenience Stores

- Others

- Online

- Company Website

- e-Commerce Platforms

Drivers

Rising Consumer Health Awareness

One of the major driving factors for the growth of the plant-based yogurt market is the increasing consumer health awareness. As consumers become more educated about the potential health risks associated with dairy products, many are shifting toward plant-based alternatives like yogurt made from soy, almond, coconut, and other plant-based ingredients.

According to a survey by the International Food Information Council (IFIC), 46% of U.S. consumers have reduced their consumption of dairy products due to concerns about lactose intolerance, allergies, and digestive issues. This trend is particularly strong among millennials and Gen Z consumers, who are more inclined to adopt plant-based diets for both health and environmental reasons.

In addition, plant-based yogurt is seen as a healthier option because it is typically lower in saturated fats and cholesterol compared to dairy yogurt. The American Heart Association (AHA) reports that high intake of saturated fats is linked to an increased risk of heart disease, prompting many to explore plant-based alternatives that offer heart-health benefits.

Environmental Sustainability and Ethical Concerns

Environmental sustainability is another key driver of the plant-based yogurt market’s growth. With the increasing awareness of climate change and its impact, consumers are becoming more conscious of their carbon footprint and the environmental consequences of their food choices.

According to the World Economic Forum, the dairy industry is responsible for 4% of global greenhouse gas emissions, with a large portion of those emissions coming from methane produced by dairy cows. As such, many consumers are opting for plant-based alternatives that have a lower environmental impact.

The shift toward plant-based diets is supported by governments and environmental organizations worldwide. For example, in the European Union, the Green Deal and Farm to Fork strategy aim to reduce the environmental impact of food production, including cutting emissions from livestock farming. The plant-based food market, including yogurt, is expected to benefit from these government initiatives aimed at making food production more sustainable.

Government Support and Policy Initiatives

Government initiatives are also playing a crucial role in the growth of the plant-based yogurt market. In many countries, governments are actively supporting plant-based food production and consumption to promote health and sustainability.

For instance, the U.S. government’s Dietary Guidelines for Americans 2020-2025 highlight the benefits of plant-based foods, encouraging individuals to consider plant-based alternatives to dairy products. This guidance aligns with the growing trend of plant-based diets and provides a foundation for policies supporting plant-based food innovation and accessibility.

In addition to this, several countries have introduced subsidies and incentives for plant-based food producers. In the UK, the government has supported plant-based food manufacturers through the Green Finance Institute’s financing initiatives, which aim to boost sustainable food production.

Restraints

Higher Price Compared to Dairy Yogurt

One of the key restraining factors for the growth of the plant-based yogurt market is its higher price compared to traditional dairy yogurt. Plant-based yogurts are typically more expensive due to the cost of sourcing high-quality plant-based ingredients, specialized manufacturing processes, and the lack of economies of scale that larger dairy producers benefit from.

According to the U.S. Department of Agriculture (USDA), the average price of plant-based yogurt is around 30% to 50% higher than that of dairy yogurt. In 2022, a standard 32-ounce container of dairy yogurt cost between $3.50 and $4.00, while a similar-sized container of plant-based yogurt was priced between $5.00 and $6.00.

A survey by the Food Industry Association (FIA) revealed that 63% of consumers consider price to be one of the most important factors when choosing yogurt. As a result, the higher cost of plant-based yogurt often limits its accessibility to a niche market of affluent, health-conscious, or environmentally aware consumers.

Limited Consumer Familiarity and Taste Preferences

Another factor restricting the growth of plant-based yogurt is limited consumer familiarity and taste preferences. Although awareness of plant-based alternatives has increased, many consumers still find plant-based yogurts to be inferior in taste and texture compared to traditional dairy yogurts.

The U.S. Food and Drug Administration (FDA) reports that many consumers feel plant-based yogurt lacks the creamy texture and flavor consistency of dairy yogurt, making it less appealing, especially among those who are long-time yogurt consumers.

In a 2023 study published in the Journal of Food Science, 41% of participants expressed dissatisfaction with the taste and mouthfeel of plant-based yogurt. Additionally, 52% of consumers indicated that they would prefer plant-based yogurts to have a more similar taste and texture to dairy products.

This indicates that even though the health and environmental benefits of plant-based yogurt are clear, the sensory qualities of these products remain a major obstacle to consumer acceptance.

Limited Availability and Distribution Channels

The limited availability and distribution channels for plant-based yogurt also pose a challenge to market expansion. While plant-based alternatives are increasingly available in urban areas, rural regions still have limited access to such products.

According to the National Restaurant Association (NRA), 61% of restaurants in the U.S. offer some form of plant-based alternatives, but availability in smaller stores and rural supermarkets remains relatively low. Many consumers in these areas may have limited access to plant-based yogurt options, which restricts market growth and consumer adoption.

Opportunity

Expansion of Product Variety and Flavors

A significant growth opportunity for the plant-based yogurt market lies in the expansion of product variety and flavors. As consumer demand for plant-based foods continues to rise, manufacturers are introducing innovative flavors and product lines to cater to diverse tastes and dietary preferences. The plant-based yogurt market has seen a steady increase in flavor variety, with products such as coconut, almond, soy, and oat-based yogurts gaining traction.

According to the Plant-Based Foods Association (PBFA), sales of plant-based yogurt in the U.S. grew by 20% from 2020 to 2021, with the growth driven largely by the introduction of new flavors and formulations.

A report from the Specialty Food Association (SFA) also highlighted that in 2023, flavored plant-based yogurt products accounted for more than 40% of the total sales within the category, with fruit-based flavors like strawberry, blueberry, and mango being particularly popular. These flavored varieties appeal to a wider audience, including those who may not be initially interested in plain plant-based yogurt but are more likely to try products with familiar, enjoyable tastes.

For example, a study by the Food and Agriculture Organization (FAO) found that global probiotic yogurt consumption is expected to grow by 6.8% annually through 2027, as consumers look for products that improve gut health and boost immunity. This demand for functional and fortified yogurt presents a significant opportunity for growth in the plant-based yogurt market, as more consumers seek healthier and more diverse product options.

Rising Demand for Dairy-Free and Lactose-Free Alternatives

According to the U.S. National Institutes of Health (NIH), approximately 68% of the global population experiences some form of lactose intolerance, with symptoms including bloating, gas, and diarrhea when consuming dairy products. This has led many consumers to seek alternatives, with plant-based yogurt offering an attractive solution.

The trend toward lactose-free diets has been particularly evident in markets like North America and Europe. In 2021, it was reported that 37% of Americans were actively trying to reduce or eliminate dairy products from their diet, with many turning to plant-based alternatives.

A study by the European Food Safety Authority (EFSA) revealed that 23% of European consumers consider themselves flexitarians, seeking to reduce their animal product consumption. Plant-based yogurt, with its dairy-free composition, caters to this growing segment of consumers, offering a unique opportunity for brands to expand their market reach and develop new, innovative products.

Government Support and Initiatives for Plant-Based Foods

Government initiatives and growing support for plant-based diets offer another key growth opportunity for the plant-based yogurt market. In recent years, several countries have introduced policies and subsidies to encourage the adoption of plant-based foods, driven by concerns about health, climate change, and sustainability.

For instance, in 2021, the European Union launched the “Farm to Fork” strategy, aiming to make food systems fair, healthy, and environmentally-friendly. This strategy encourages the consumption of plant-based foods, including plant-based dairy products like yogurt, to reduce the environmental impact of the food sector.

Similarly, the U.S. Department of Agriculture (USDA) has recognized the importance of plant-based alternatives, recommending them as part of a balanced diet in the U.S. Dietary Guidelines. In 2022, the USDA’s MyPlate guidelines included plant-based dairy alternatives as part of their recommended food choices, encouraging consumers to opt for more sustainable and health-conscious alternatives.

Trends

Rise of Probiotic and Functional Plant-based Yogurts

One of the latest trends in the plant-based yogurt market is the increased incorporation of probiotics and functional ingredients. As consumers become more focused on gut health and immunity, plant-based yogurt brands are capitalizing on this trend by adding probiotics, prebiotics, and other functional ingredients to their products.

According to a 2023 report from the International Dairy Foods Association (IDFA), the functional food market, which includes plant-based yogurt, is expected to grow by 8.5% annually from 2023 to 2030, driven by consumer demand for products that offer additional health benefits beyond basic nutrition.

Probiotic-enriched plant-based yogurt is gaining popularity due to its potential to support digestive health and immunity. Probiotics are live bacteria that promote a healthy gut microbiome and are known to reduce the risk of certain digestive issues, such as irritable bowel syndrome (IBS).

According to the Specialty Food Association, plant-based foods grew 27% in 2021, and functional foods are a major contributor to this growth, as more people seek products that align with both their dietary preferences and wellness goals.

Plant-based Yogurts Targeting Allergen-Free Diets

A 2022 survey by the Food Allergy Research & Education (FARE) organization revealed that approximately 32 million Americans suffer from food allergies, including to common ingredients like soy, nuts, and dairy. As a result, allergen-free diets are becoming a major driver of plant-based yogurt sales.

Brands are responding by formulating yogurt products without soy, nuts, or gluten, while also ensuring that these options are fortified with essential nutrients, such as calcium and vitamin D, which are typically found in dairy products.

For instance, companies like Oatly and Ripple have gained significant market share by offering allergen-free plant-based yogurt alternatives made from oats and peas. According to data from the Food and Drug Administration (FDA), the oat milk market alone saw a 50% growth in 2021, indicating that consumers are increasingly choosing non-dairy options that cater to specific allergies or sensitivities.

Sustainability Focus Driving Market Growth

The Food and Agriculture Organization (FAO) reported that the global dairy sector contributes to 2.7 billion metric tons of greenhouse gas emissions annually, which is a significant factor behind the growing consumer preference for plant-based products.

In response, plant-based yogurt brands are emphasizing their sustainability practices, such as using organic, non-GMO ingredients and packaging made from recyclable materials. According to the Plant-Based Foods Association (PBFA), 38% of U.S. consumers reported that they are willing to pay more for sustainably sourced products.

Regional Analysis

In 2023, North America dominated the global plant-based yogurt market, accounting for 31.7% of the market share, valued at USD 1.8 billion. The region’s strong growth is driven by rising health-conscious consumers, increasing lactose intolerance awareness, and the growing popularity of plant-based diets.

The U.S. leads the market in North America, with plant-based food sales, including yogurt, rising steadily due to the shift towards vegan and flexitarian diets. According to the Plant-Based Foods Association (PBFA), the U.S. plant-based yogurt market alone grew by 20% in 2022.

Europe follows closely as a key player, capturing a significant share of the global market. The region’s preference for dairy alternatives is primarily driven by health trends and environmental awareness.

The European market is valued at USD 1.5 billion in 2023, with Germany, the UK, and France being the largest markets. The European Food Safety Authority (EFSA) has supported the shift towards plant-based products by introducing more stringent regulations that favor non-dairy alternatives, further boosting growth.

Asia Pacific is witnessing a rapid increase in plant-based yogurt adoption, particularly in countries like China and India, driven by a large lactose-intolerant population and increasing awareness of the health benefits of plant-based diets. The region is expected to grow at the highest CAGR over the next decade, with a market size projected to exceed USD 1 billion by 2025.

Latin America and the Middle East & Africa regions are emerging markets, with moderate growth in demand driven by urbanization, rising disposable incomes, and increasing interest in plant-based alternatives. However, these regions still represent a smaller portion of the global market compared to North America and Europe.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Top Key Players in the Market

- Callifia

- Chobani

- COYO Pty Ltd.

- Daiya Foods Inc.

- Danone

- Forager

- General Mills Inc.

- Good Karma

- Good Plants

- Hain Celestial

- Hudson River Foods

- Kite Hill

- LAVVA

- NANCY’S

- Silk

- So Delicious

- Stonyfield Farm Inc.

- The Hain Celestial Group Inc.

Recent Developments

In 2023, Callifia launched its Almond Milk Yogurt line, which has quickly gained popularity in the U.S. due to its creamy texture, clean label, and nutritional benefits. Callifia’s growth has been impressive, with the company reporting a 15% increase in sales of its dairy-free products.

In 2024, Chobani’s total annual revenue is estimated at USD 2.5 billion, with its plant-based yogurt offerings expected to grow rapidly, driven by the continued shift towards plant-based eating in North America.

Report Scope

Report Features Description Market Value (2023) USD 4.6 Bn Forecast Revenue (2033) USD 14.0 Bn CAGR (2024-2033) 11.8% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Naturen(Conventional, Organic), By Product Type (Soy Yogurt, Coconut Yogurt, Almond Yogurt, Rice Yogurt, Others), By Flavor (Chocolate, Strawberry, Banana, Pineapple, Mango, Lemonade, Peach, Others), By End Use (HORECA, Household), By Sales Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Callifia, Chobani, COYO Pty Ltd., Daiya Foods Inc., Danone, Forager, General Mills Inc., Good Karma, Good Plants, Hain Celestial, Hudson River Foods, Kite Hill, LAVVA, NANCY’S, Silk, So Delicious, Stonyfield Farm Inc., The Hain Celestial Group Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Callifia

- Chobani

- COYO Pty Ltd.

- Daiya Foods Inc.

- Danone

- Forager

- General Mills Inc.

- Good Karma

- Good Plants

- Hain Celestial

- Hudson River Foods

- Kite Hill

- LAVVA

- NANCY’S

- Silk

- So Delicious

- Stonyfield Farm Inc.

- The Hain Celestial Group Inc.