Global Energy Balls Market Size, Share, And Business Benefits By Nature (Conventional, Organic), By Flavour (Nut-based, Chocolate-based, Fruit-based, Others), By Distribution Channel (Hypermarket/Supermarket, Specialty Stores, Online Retail, Convenience Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144283

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

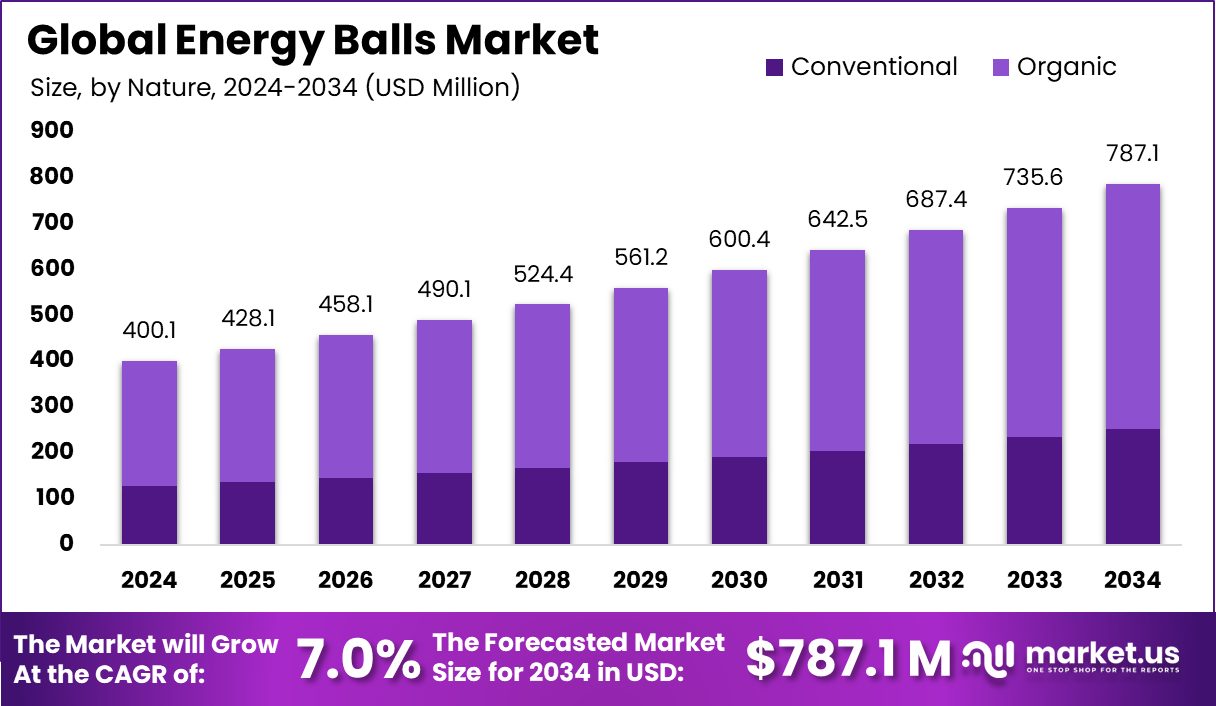

Global Energy Balls Market is expected to be worth around USD 787.1 million by 2034, up from USD 400.1 million in 2024, and grow at a CAGR of 7.0% from 2025 to 2034. Health-conscious consumers in North America continue driving demand, contributing to its USD 164.8 million market share.

Energy balls are small, bite-sized snacks made from a blend of ingredients like nuts, dried fruits, seeds, and various binders such as honey or peanut butter. These nutritious snacks are designed to provide a quick boost of energy, making them popular among health-conscious consumers, athletes, and busy professionals seeking a healthy, portable snack option.

The energy balls market is experiencing growth due to increasing awareness of health and wellness, where consumers are looking for nutritious and convenient eating options. As lifestyles become busier, the demand for quick, healthful foods like energy balls is on the rise, particularly among those looking to maintain a healthy diet without spending much time on meal preparation.

One of the key growth factors for the energy balls market is the rising trend of fitness and wellness. People are increasingly adopting healthier eating habits as part of their fitness regimes, and energy balls serve as an ideal, healthful snack. They are often packed with protein, fiber, and essential nutrients, which are attractive to fitness enthusiasts who need sustained energy for workouts and daily activities.

Demand for energy balls is also driven by the convenience they offer. These snacks are portable and require no preparation, making them a perfect choice for on-the-go consumption. Whether it’s a quick breakfast, a mid-day snack, or a post-workout replenishment, energy balls fit various daily scenarios, appealing to a wide demographic including busy professionals, students, and active families.

There is a significant opportunity in the market for innovations in flavors and ingredients. As consumers continue to seek variety and new taste experiences, introducing unique flavor combinations or functional ingredients like superfoods can attract more customers.

Key Takeaways

- Global Energy Balls Market is expected to be worth around USD 787.1 million by 2034, up from USD 400.1 million in 2024, and grow at a CAGR of 7.0% from 2025 to 2034.

- In the energy balls market, conventional products dominate with a significant 68.20% market share.

- Nut-based flavors are preferred in the energy balls market, accounting for 34.20% of the segment.

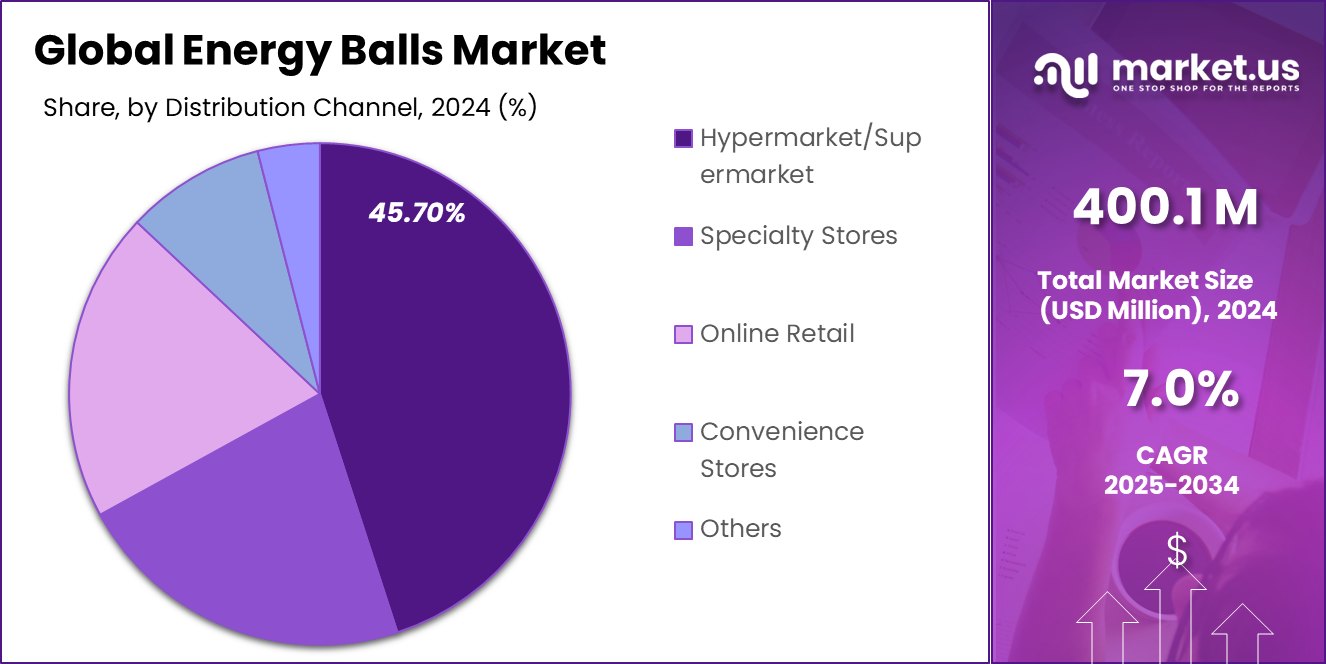

- Hypermarkets and supermarkets are the leading distribution channels, holding 45.70% of the energy balls market.

- The North American energy balls market reached a value of USD 164.8 million in recent analysis.

By Nature Analysis

Conventional energy balls hold a 68.20% share in the market.

In 2024, the “By Nature” segment of the Energy Balls Market was predominantly led by the conventional category, which captured a substantial 68.20% market share. This dominance illustrates the strong consumer preference for traditionally produced energy balls, which are typically more accessible and often priced more competitively than their organic counterparts.

The conventional segment benefits from well-established distribution channels and extensive product availability across various retail formats, from supermarkets to convenience stores.

This significant market share indicates that, despite a growing interest in organic and natural products, conventional energy balls remain a staple in consumer diets. They appeal to a broad demographic, including budget-conscious consumers who prioritize cost over organic labeling.

However, the robust position of conventional energy balls also suggests that there is a substantial market yet to be tapped into for organic variants, which could see growth as consumer awareness and income levels increase. This could potentially lead to a shift in market dynamics over the coming years as more consumers seek healthier, sustainably produced snack options.

By Flavour Analysis

Nut-based flavors account for 34.20% of the energy balls market.

In 2024, the Nut-based category led the “By Flavour” segment of the Energy Balls Market, securing a dominant market share of 34.20%. This leadership underscores the strong consumer inclination toward nut flavors, reflecting a preference for tastes that offer both nutritional benefits and satisfying textures.

Nut-based energy balls are especially popular due to their rich protein content, essential fats, and the sustained energy they provide, making them a favored choice among health-conscious consumers and fitness enthusiasts.

This significant market share highlights the nut-based category’s appeal across various consumer segments, from busy professionals seeking quick, nutritious snacks to athletes and casual gym-goers looking for portable energy sources. The popularity of nut flavors in energy balls can also be attributed to their versatility in blending with other ingredients.

Such as fruits and spices, which enhance their appeal by offering a variety of taste profiles within the same health-focused snack category. As the market evolves, the demand for nut-based energy balls is expected to continue growing, driven by increasing health awareness and the rising trend of clean eating.

By Distribution Channel Analysis

Hypermarkets, supermarkets distribute 45.70% of energy balls market-wide.

In 2024, the Hypermarket/Supermarket channel maintained a dominant position in the “By Distribution Channel” segment of the Energy Balls Market, boasting a 45.70% share. This significant market share underscores the pivotal role that these large retail formats play in the consumer goods sector, particularly in the distribution of energy balls.

Hypermarkets and supermarkets are preferred by consumers for their convenience, variety, and the ability to compare products and prices in one location. The dominance of hypermarkets and supermarkets is supported by their widespread presence and accessibility, making them key destinations for shoppers looking to purchase a range of groceries and snack items, including energy balls.

These outlets also benefit from strong supply chain efficiencies, which ensure a consistent availability of a diverse array of products. As these retail giants continue to expand their reach and enhance customer shopping experiences through promotions and discounts, they are likely to retain their market dominance.

This trend indicates that while online and specialty stores are growing, the physical store experience provided by hypermarkets and supermarkets remains integral to consumer shopping habits, particularly for food and snack purchases like energy balls.

Key Market Segments

By Nature

- Conventional

- Organic

By Flavour

- Nut-based

- Chocolate-based

- Fruit-based

- Others

By Distribution Channel

- Hypermarket/Supermarket

- Specialty Stores

- Online Retail

- Convenience Stores

- Others

Driving Factors

Rising Demand for Healthy On-the-Go Snacks

One big reason the energy balls market is growing fast is that people want quick, healthy snacks. Many consumers today are very focused on fitness, weight control, and balanced diets. Energy balls offer a smart solution—they’re packed with protein, fiber, and natural ingredients like oats, nuts, and dates. Busy professionals, students, and even travelers prefer these snacks because they are easy to carry and don’t require refrigeration.

They also work well as pre- or post-workout fuel. With rising awareness about artificial additives and sugar levels in traditional snacks, more people are switching to natural options like energy balls. This change in consumer lifestyle and eating habits is helping the market grow across all age groups.

Restraining Factors

High Product Cost Limits Mass Market Reach

A key challenge for the energy balls market is their high price compared to regular snacks. Many energy balls are made with premium ingredients like organic oats, chia seeds, almond butter, and dates. These ingredients cost more, especially when they’re sourced sustainably or labeled as non-GMO, gluten-free, or vegan.

While health-conscious buyers in urban areas may afford them, people in rural regions or with tight budgets might not buy them regularly. This price gap slows down the market’s growth in developing economies. To expand reach, brands need to find ways to reduce production costs without compromising quality or nutrition.

Growth Opportunity

Expanding Online Sales Channels Boosts Market Reach

One big opportunity for the energy balls market is the rapid growth of online shopping. More people now prefer to buy snacks through e-commerce platforms like Amazon, Walmart, and brand websites. This shift in buying behavior is opening new doors for both small and big brands.

Online stores let companies reach customers in remote areas without needing physical shops. They can also offer variety packs, trial sizes, and subscription boxes to attract new buyers. Social media and influencer marketing help spread the word about healthy snacking trends.

With smart digital strategies, brands can build loyal communities and grow faster. This online push makes it easier to educate customers about product benefits and drive steady demand across regions.

Latest Trends

Launch of Functional Energy Balls Gains Attention

A major trend in the energy balls market is the launch of functional energy balls. These are not just snacks—they now serve extra purposes like boosting immunity, aiding digestion, or supporting brain health. Brands are adding ingredients such as probiotics, adaptogens, collagen, and superfoods like spirulina or turmeric.

Consumers love these added health benefits, especially after the pandemic made wellness a top priority. Functional energy balls appeal to people looking for snacks that do more than just fill their stomachs.

This trend is catching on fast, especially among fitness enthusiasts and health-conscious shoppers. As awareness of functional nutrition grows, more brands are expected to innovate and expand product lines with new ingredients and health claims to match demand.

Regional Analysis

North America holds the largest energy balls market share at 41.20%, showing strong regional dominance.

The global energy balls market exhibits notable regional variations, with North America emerging as the dominating region. Holding the largest share, North America accounts for 41.20% of the total market, translating to a value of USD 164.8 million.

This strong regional performance is largely driven by the increasing preference for healthy, on-the-go snacking options among health-conscious consumers in the United States and Canada. Europe follows closely, supported by rising awareness of plant-based nutrition and a growing inclination toward clean-label products.

Asia Pacific is experiencing steady growth, attributed to the expanding urban population, changing dietary habits, and increasing adoption of Western-style health snacks, particularly in countries like Japan, China, and India. In the Middle East & Africa, the market remains relatively niche but is gradually expanding due to the influence of fitness trends and premium retail distribution.

Latin America also shows early-stage development, with a growing demand for organic and nutrient-rich snacks in urban centers. While North America leads in both value and volume, other regions present emerging opportunities that reflect shifting consumer preferences toward convenient and nutritious snacking options.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global energy balls market continues to evolve, with players like Betty Lou’s Inc., Boostball, and Bounce Foods Ltd. strategically strengthening their positions. Each company brings a unique approach, enabling them to capture consumer interest and market share in a highly competitive health snack landscape.

Betty Lou’s Inc., based in the U.S., remains a strong force in North America, leveraging its long-standing presence in the natural snacks segment. With a focus on gluten-free, non-GMO, and organic ingredients, the brand caters well to health-conscious consumers. Their energy balls align perfectly with evolving consumer preferences for clean-label and allergen-free products.

Boostball, headquartered in the U.K., stands out for its functional, high-protein energy balls and innovative flavor combinations. The company has effectively expanded its footprint across Europe by appealing to fitness-focused and vegan consumers. Their clean ingredient labels and strong online presence give them a competitive edge, especially among millennials and Gen Z buyers.

Bounce Foods Ltd, also based in the U.K., remains a notable player with a well-established portfolio of energy-based snacks. The brand emphasizes energy-boosting formulations and natural ingredients, making it popular in both retail and gym-based channels. Bounce’s global expansion, particularly into Australia and selected Asian markets, indicates a robust growth strategy.

Top Key Players in the Market

- Betty Lou’s Inc.

- Boostball

- Bounce Foods ltd

- DELICIOUSLY ELLA LTD.

- Koa Natural Foods

- Made in Nature, Inc.

- Nomz

- Nutri-Brex

- Nutrilicious Food Products

- The Protein Ball Co

- Fairnatural GmbH

- Just Wholefoods Ltd

- Nuttree SARL

- OVERSTIM.s

Recent Developments

- In September 2024, Deliciously Ella was acquired by the Swiss multinational Hero Group. The acquisition aims to expand Deliciously Ella’s plant-based food products globally, including launching oat bars in the US through Whole Foods Market

Report Scope

Report Features Description Market Value (2024) USD 400.1 Million Forecast Revenue (2034) USD 787.1 Million CAGR (2025-2034) 7.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Conventional, Organic), By Flavour (Nut-based, Chocolate-based, Fruit-based, Others), By Distribution Channel (Hypermarket/Supermarket, Specialty Stores, Online Retail, Convenience Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Betty Lou’s Inc., Boostball, Bounce Foods ltd, DELICIOUSLY ELLA LTD., Koa Natural Foods, Made in Nature, Inc., Nomz, Nutri-Brex, Nutrilicious Food Products, The Protein Ball Co, Fairnatural GmbH, Just Wholefoods Ltd, Nuttree SARL, OVERSTIM.s Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Betty Lou's Inc.

- Boostball

- Bounce Foods ltd

- DELICIOUSLY ELLA LTD.

- Koa Natural Foods

- Made in Nature, Inc.

- Nomz

- Nutri-Brex

- Nutrilicious Food Products

- The Protein Ball Co

- Fairnatural GmbH

- Just Wholefoods Ltd

- Nuttree SARL

- OVERSTIM.s