Global Electronic Lab Notebook Market Size, Share, Statistics Analysis Report By Product (Cross-disciplinary and Specific), By License (Proprietary and Open), By Delivery Mode (On-premise and Cloud-based), By End-User (Life Sciences, Food and Beverages & Agriculture Industries, CRO’s, Academic Research, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Nov. 2024

- Report ID: 48988

- Number of Pages: 361

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

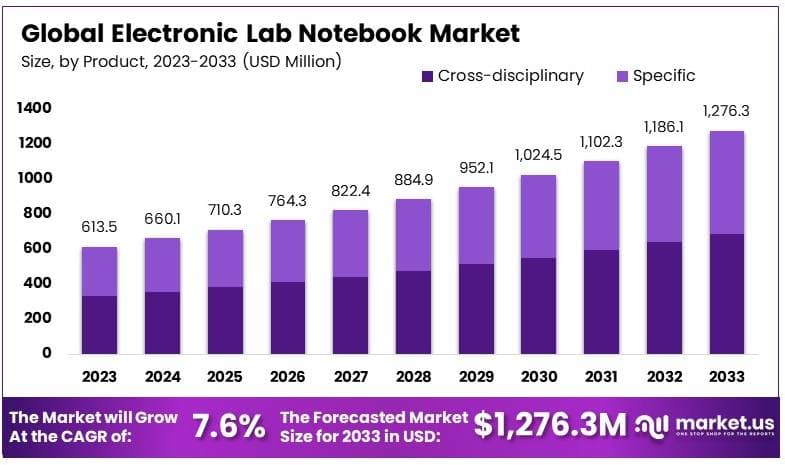

The Global Electronic Lab Notebook Market size is expected to be worth around USD 1,276.3 Million by 2033, from USD 613.5 Million in 2023, growing at a CAGR of 7.6% during the forecast period from 2024 to 2033.

An Electronic Lab Notebook (ELN) is a software solution designed to replace traditional paper laboratory notebooks. This technology is utilized by researchers and scientists to document experiments, store data, and manage research activities digitally. The versatility of ELNs allows for the inclusion of text, images, graphs, and direct data feeds from laboratory equipment, enhancing the efficiency of record-keeping in scientific research.

The ELN market is positioned within a rapidly evolving sector where technology plays a pivotal role in streamlining research operations. This market is influenced by the growing need for data accuracy, ease of access to research data, and stringent regulatory requirements in industries like pharmaceuticals and biotechnology. As laboratories seek to enhance productivity and maintain compliance with regulatory standards, the demand for sophisticated solutions like ELNs that can integrate with other lab systems continues to rise.

The primary driving factors for the adoption of ELNs include the need for enhanced data integrity, the reduction of manual errors, and the ability to quickly access and retrieve information. The shift from manual to digital record-keeping helps in ensuring that data is not only stored securely but is also easily shareable and traceable across different stages of research. This traceability is crucial for meeting compliance with standards such as FDA regulations and ISO guidelines, which demand meticulous record maintenance and audit trails.

There is a significant demand in the ELN market to cater to the complexities of modern scientific research which generates vast amounts of data. Research facilities are continuously looking for solutions that can handle large datasets with efficiency and accuracy. The integration capabilities of ELNs with other technological tools like LIMS (Laboratory Information Management Systems) and SDMS (Scientific Data Management Systems) present substantial market opportunities.

Technological advancements in ELN software are centered around improving user interfaces, increasing the flexibility of data entry, and enhancing the security features that protect intellectual property and ensure compliance with legal standards. Cloud-based ELNs are becoming more prevalent, offering researchers the ability to access and share data remotely, which is particularly advantageous for multi-site collaborations.

The development of features like audit logs, which provide tamper-evident records, and the integration of advanced data analytics tools are also pivotal in increasing the adoption and utility of ELNs in the scientific community. Locally, the impact of ELNs extends to improving the operational capabilities of labs, fostering faster innovation cycles, and supporting the broader adoption of digital technologies in research settings.

According to a 2024 report by Technology Networks, approximately 77% of laboratory leaders indicated that the COVID-19 pandemic accelerated their digital transformation plans, underscoring the pivotal role of digital tools like ELNs in modern laboratory environments.

Government regulations have a profound impact on the adoption and development of ELNs. Compliance with stringent regulatory frameworks ensures that laboratories maintain high standards of data integrity and security. On a broader scale, ELNs facilitate significant advancements in research and development activities across various industries by enabling more precise and accessible data management.

Key Takeaways

- The Electronic Lab Notebook Market was valued at USD 613.5 million in 2023 and is expected to reach USD 1,276.3 million by 2033, with a CAGR of 7.6%.

- In 2023, Cross-disciplinary products dominated with 53.8%, offering versatility across various scientific and research fields.

- In 2023, Proprietary licenses led the market, providing security and tailored features for users.

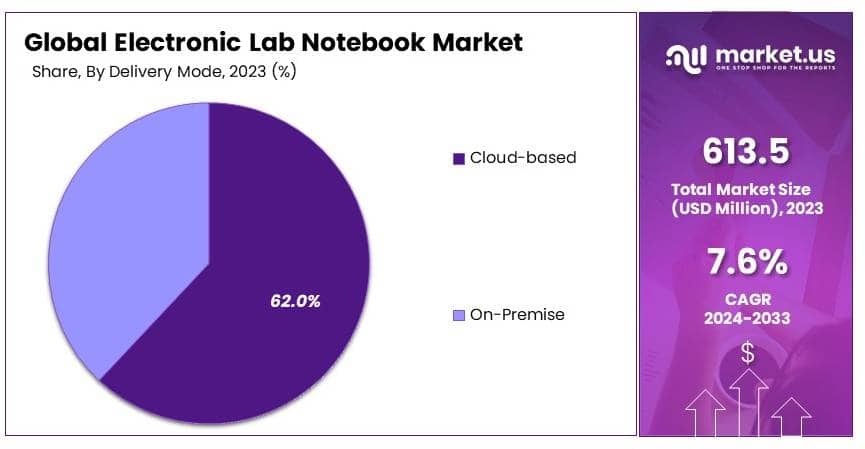

- In 2023, Cloud-based delivery mode led with 62%, offering flexibility and scalability for users.

- In 2023, Pharmaceutical end-users dominated with 38.5%, highlighting the importance of digital solutions in drug development.

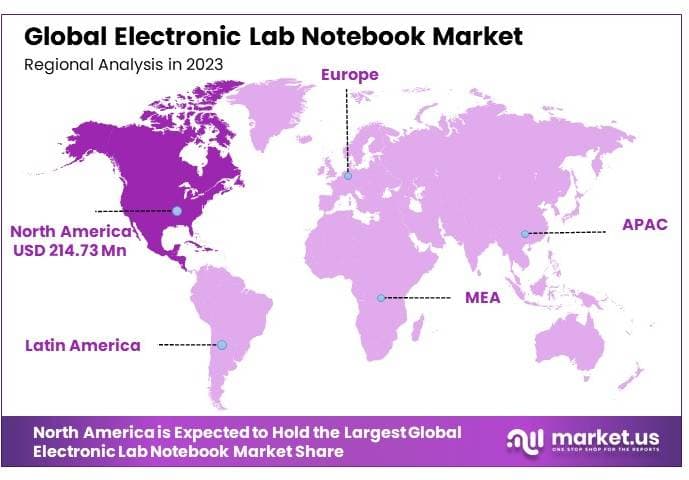

- In 2023, North America dominated the market with 35.0%, driven by advanced research infrastructure.

Product Analysis

Cross-disciplinary electronic lab notebooks (ELNs) dominate the product segment with 53.8% due to their flexibility in supporting various scientific disciplines.

The electronic lab notebook (ELN) market is segmented by product into cross-disciplinary and specific ELNs. Cross-disciplinary ELNs hold the largest market share, as they offer versatility and are designed to be used across various scientific fields.

This flexibility makes them highly desirable in environments where research spans multiple disciplines or where organizations want to standardize on a single platform to streamline operations. The ability to integrate with multiple types of scientific equipment and data systems further enhances their utility and adoption.

Specific ELNs, tailored for particular fields such as chemistry or biology, meet the unique needs of specialized researchers. They often include features and templates specific to those fields, enhancing functionality and user experience for dedicated applications. However, their specialized nature can limit their applicability across other scientific disciplines, making them less prevalent than cross-disciplinary systems.

License Analysis

Proprietary licenses dominate the licensing segment as they offer comprehensive support and advanced features that meet the diverse needs of modern laboratories.

In the licensing segment of the ELN market, proprietary licenses prevail over open licenses. Proprietary ELNs are preferred by many organizations due to the robust support, continuous updates, and enhanced security features they typically offer.

These systems are developed and maintained by companies that ensure the software remains compatible with evolving technologies and compliant with stringent regulatory standards. The investment in proprietary systems is often justified by the advanced functionalities and integration capabilities that these platforms provide.

Open license ELNs, while less common, are favored by some academic and non-profit research entities for their affordability and adaptability. Users can modify the software to fit their specific needs without the cost barriers associated with proprietary software.

Despite these benefits, the lack of dedicated support and the requirement for in-house technical expertise can make open systems less appealing to larger organizations or those with extensive compliance requirements.

Delivery Mode Analysis

Cloud-based delivery dominates with 62% due to its scalability, accessibility, and lower upfront cost.

Delivery modes for ELNs include on-premise and cloud-based systems. Cloud-based ELNs have gained significant traction, commanding a dominant market share due to their scalability and ease of access. Researchers can access cloud-based ELNs from any location, facilitating collaboration across geographical boundaries.

Additionally, cloud systems reduce the IT burden on an organization as the service provider manages system maintenance, updates, and data storage. The subscription-based pricing of cloud ELNs also makes them attractive to organizations looking for lower initial investments and predictable operating expenses.

On-premise ELNs are preferred by organizations that require full control over their data and systems due to regulatory or network security concerns. These systems are installed on the organization’s own servers, giving them complete control over the data security measures and system customization.

However, the higher upfront costs and ongoing maintenance responsibilities make on-premise solutions less appealing to many smaller or mid-sized organizations.

End-User Analysis

Pharmaceutical companies are the dominant end-users with 38.5%, as ELNs are crucial for managing complex research data and maintaining compliance with regulatory standards.

In the end-user segment, pharmaceutical companies lead the adoption of ELNs, driven by the industry’s need to efficiently manage vast amounts of research data and adhere to strict regulatory requirements. ELNs help streamline the documentation and sharing of experimental data, supporting compliance with FDA regulations and intellectual property protection needs.

The ability to quickly retrieve and audit trial data significantly enhances operational efficiencies in pharmaceutical research and development.

Other significant end-users include life sciences, academic research institutions, contract research organizations (CROs), and food and beverage & agriculture industries.

Each of these sectors relies on ELNs to various extents to enhance research efficiency, data security, and collaboration. Life sciences and academic institutions often focus on the collaborative features of ELNs, while CROs value the ability to securely share data with sponsors and regulatory bodies.

The electronic lab notebook market continues to expand as more organizations recognize the value of digital data management in enhancing research productivity, collaboration, and compliance. Innovations in cloud computing, data analytics, and integration capabilities are likely to further drive the adoption and evolution of ELNs across all segments of scientific research.

Key Market Segments

By Product

- Cross-disciplinary

- Specific

By License

- Proprietary

- Open

By Delivery Mode

- On-Premise

- Cloud-based

By End-User

- Lifesciences

- Food and Beverages & Agriculture Industries

- CRO’s

- Academic Research

- Pharmaceutical

- Other End-Users

Drivers

Digital Solutions and Data Accuracy Drive Market Growth

The Electronic Lab Notebook (ELN) Market is primarily driven by the increasing adoption of digital solutions in laboratories. As more labs transition from traditional paper-based systems to digital platforms, the demand for ELNs continues to grow.

Furthermore, the growing demand for laboratory automation is another driving factor. Automation in labs not only improves efficiency but also reduces human errors, making ELNs an integral part of modern lab operations. Laboratories, particularly in pharmaceuticals and biotechnology, are turning to ELNs to streamline workflows and enhance productivity.

Advancements in cloud-based technologies have further fueled market growth. Cloud-enabled ELNs provide flexibility, allowing researchers to access and share data in real-time from anywhere, improving collaboration across teams and organizations. This trend toward digital transformation is reshaping the future of laboratory operations and contributing to the growth of the ELN market.

Restraints

High Costs and Data Security Restraints Market Growth

Several factors restrain the growth of the Electronic Lab Notebook Market. One of the primary challenges is the high initial implementation costs. Transitioning from paper-based systems to digital platforms requires significant investment in software, hardware, and staff training, which can be a deterrent for smaller labs or institutions with limited budgets.

Data security and privacy concerns are another key restraint. ELNs store sensitive research data, and any breach or unauthorized access can lead to serious consequences. This makes organizations cautious about adopting ELNs, particularly those operating in highly regulated industries such as pharmaceuticals.

Additionally, the lack of standardized formats across different ELN platforms poses a challenge. Researchers often face difficulties when trying to integrate or transfer data between systems. Resistance to change from traditional paper-based methods also slows down the adoption of ELNs, especially in labs that are hesitant to disrupt their existing workflows.

Opportunity

AI Integration and Emerging Markets Provide Opportunities

The integration of artificial intelligence (AI) and machine learning in ELNs presents a significant growth opportunity. These technologies can enhance data analysis, automate repetitive tasks, and offer predictive insights, making ELNs even more valuable tools for researchers. Companies that invest in AI-powered ELN solutions are likely to gain a competitive edge.

Expansion into emerging markets offers another opportunity. As research activities increase in regions such as Asia-Pacific and Latin America, the demand for ELNs is expected to rise, driven by the growing need for advanced laboratory management systems.

There is also increasing demand from the pharmaceutical and biotech industries. These industries require robust data management tools for compliance, regulatory submissions, and drug discovery processes, making ELNs indispensable.

Furthermore, collaborations between ELN providers and research institutions can open new avenues for growth, as partnerships drive innovation and customized solutions tailored to specific research needs.

Challenges

Integration Complexity Challenges Market Growth

The integration of ELNs with existing laboratory systems presents a significant challenge. Many laboratories use a range of legacy systems and software, and ensuring seamless interoperability between these systems can be complex and costly.

Interoperability issues between different software platforms further complicate the landscape. Laboratories often struggle to integrate data from various sources, leading to inefficiencies and potential data silos. This challenge can slow down the widespread adoption of ELNs, especially in multi-disciplinary research environments.

Additionally, the high training requirements for end-users create a barrier. ELNs require researchers and lab personnel to familiarize themselves with new interfaces and processes, which can be time-consuming and reduce productivity during the transition period.

The rapidly evolving technological landscape means that ELN providers must continuously innovate to stay ahead, which can be challenging for companies to manage sustainably.

Growth Factors

Life Sciences Research and Data-Driven Decision Making Are Growth Factors

The increase in research activities within the life sciences tools is a key growth factor for the Electronic Lab Notebook Market. As more research institutions and pharmaceutical companies focus on innovation and drug development, the demand for efficient data management systems like ELNs is rising.

The growing emphasis on data-driven decision-making in research and development is also driving the market. ELNs allow for better organization and analysis of large datasets, enabling researchers to make more informed decisions, which improves the overall efficiency and effectiveness of the R&D process.

Rising investments in the digital transformation of laboratories further contribute to market growth. As laboratories seek to modernize their operations, ELNs play a central role in this transition.

The increased collaboration between academia and industry is driving the adoption of ELNs, as these platforms facilitate better coordination and data sharing across research teams, accelerating innovation.

Emerging Trends

Cloud-Based Solutions and Mobile Compatibility Are Latest Trending Factor

The increasing adoption of cloud-based ELNs is a key trend shaping the market. Cloud-based solutions offer flexibility, scalability, and ease of access, making them highly attractive to laboratories looking for efficient data management tools. This trend is expected to continue as more labs transition to digital platforms.

Real-time data sharing and collaboration are also trending. As research becomes more global, the need for platforms that enable seamless collaboration across geographic boundaries grows. ELNs that offer real-time data sharing capabilities are gaining traction in this evolving landscape.

The growing use of mobile-compatible ELN solutions is another trend to watch. With mobile devices becoming integral to modern workflows, ELN providers are increasingly developing solutions that can be accessed via smartphones and tablets, enhancing the accessibility and convenience of lab operations.

There is a rising emphasis on compliance with regulatory standards. As industries become more regulated, ELNs that facilitate compliance and audit trails are in high demand, particularly in sectors such as pharmaceuticals, biotechnology, and healthcare.

Regional Analysis

North America Dominates with 35.0% Market Share

North America leads the Electronic Lab Notebook (ELN) Market with a 35.0% share, valued at USD 214.73 million. This dominance is driven by the presence of advanced research institutions, major pharmaceutical companies, and extensive government funding for scientific research. High adoption rates of digital technologies in laboratories also contribute to the region’s leadership.

The region benefits from a strong focus on innovation and regulatory compliance, particularly in sectors like life sciences and pharmaceuticals. North America’s robust infrastructure supports the integration of ELNs, making research more efficient and data management more streamlined. The region’s push for digitization and automation in research laboratories plays a crucial role in its high market performance.

North America’s dominance in the ELN market is expected to grow. Increasing investment in R&D, particularly in biotechnology and pharmaceuticals, will drive further adoption of ELNs. The region’s focus on data accuracy, security, and compliance with stringent regulations will continue to support its leadership in this sector.

Regional Mentions:

- Europe: Europe is characterized by strong regulatory frameworks and advanced research programs. The region’s focus on compliance with data protection and intellectual property laws boosts the adoption of ELNs in pharmaceutical and academic sectors.

- Asia Pacific: Asia Pacific is rapidly growing in the ELN market due to increasing R&D activities in countries like China and Japan. The region’s push for scientific advancements and cost-effective solutions is fueling ELN adoption in both academic and commercial research labs.

- Middle East & Africa: The Middle East & Africa are gradually adopting ELNs, driven by growing investments in healthcare and academic research. The region’s focus on modernizing its research infrastructure is expected to support market growth.

- Latin America: Latin America is embracing ELNs as part of broader efforts to enhance scientific research and pharmaceutical manufacturing. Government initiatives to improve research facilities and data management are driving adoption in key countries like Brazil and Mexico.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Electronic Lab Notebook (ELN) Market is highly competitive, with key players such as Bruker Corporation, PerkinElmer, Inc., and Thermo Fisher Scientific Inc. leading the industry. These companies cater primarily to scientific research institutions, pharmaceutical companies, and healthcare organizations, offering digital solutions for data management and laboratory workflows.

Their product and service offerings include cloud-based and on-premise ELN systems, integrated lab data management tools, and software that supports collaboration in scientific research. Companies like LabWare and Core Informatics focus on providing customizable platforms to enhance data accuracy and efficiency in labs.

In terms of market strategies, these players focus on building long-term partnerships with research organizations and expanding their product portfolios through acquisitions and collaborations. Pricing strategies vary, with some companies offering flexible subscription-based models and others providing more premium, feature-rich solutions.

Geographically, these companies have a strong presence in North America and Europe, with growing interest in Asia-Pacific markets due to the rising demand for digitalization in laboratories.

Innovation is key, with a focus on improving ELN functionalities such as real-time data sharing, AI integration, and regulatory compliance.

Their competitive edge lies in providing comprehensive, integrated solutions that streamline lab processes and ensure data integrity. By continuously improving their offerings and leveraging global networks, these companies maintain their leadership in the ELN market.

Top Key Players in the Market

- Bruker Corporation

- PerkinElmer, Inc.

- Accelrys, Inc.

- Agilent Technologies, Inc.

- Waters Corporation

- Core Informatics, LLC

- Abbott

- Danaher Corporation

- Thermo Fisher Scientific Inc.

- LabWare

- Other Key Players

Recent Developments

- Lab Logs: In July 2024, Wilmington-based startup Lab Logs raised nearly $3 million, with a $2 million lead investment from Rockmont Partners. The funding, part of a Series A round, will help expand the company’s staff and enhance their digital platform for tracking laboratory maintenance and compliance. Lab Logs aims to replace traditional paper logs with a digital solution, serving over 150 customers and leveraging the new investment to further its market reach and product offerings.

- eLabNext: In August 2024, eLabNext, part of the Eppendorf Group, announced the integration of the Thermo Scientific VisionMate HSX High-Speed Barcode Reader with its digital lab platform. This integration aims to improve sample tracking and logging in life science laboratories, reducing identification errors and streamlining workflows. The VisionMate HSX reader can decode barcodes quickly and is compatible with various lab formats, supporting automated and large-scale sample management.

Report Scope

Report Features Description Market Value (2023) USD 613.5 Million Forecast Revenue (2033) USD 1,276.3 Million CAGR (2024-2033) 7.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Cross-disciplinary, Specific), By License (Proprietary, Open), By Delivery Mode (On-Premise, Cloud-based), By End-User (Lifesciences, Food and Beverages & Agriculture Industries, CRO’s, Academic Research, Pharmaceutical, Other End-Users) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bruker Corporation, PerkinElmer, Inc., Accelrys, Inc., Agilent Technologies, Inc., Waters Corporation, Core Informatics, LLC, Abbott, Danaher Corporation, Thermo Fisher Scientific Inc., LabWare, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Electronic Lab Notebook MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample

Electronic Lab Notebook MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Bruker Corporation

- PerkinElmer, Inc.

- Accelrys, Inc.

- Agilent Technologies, Inc.

- Waters Corporation

- Core Informatics, LLC

- Abbott

- Danaher Corporation

- Thermo Fisher Scientific Inc.

- LabWare

- Other Key Players