Global Stationery Products Market By Product (Paper Products, Writing Instruments, Art and Craft, Others), By Application (Educational Institutes, Corporates, Others), By Price Range (Economy, Mid-Range, Premium), By Distribution Channel (Offline, Online), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 50450

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

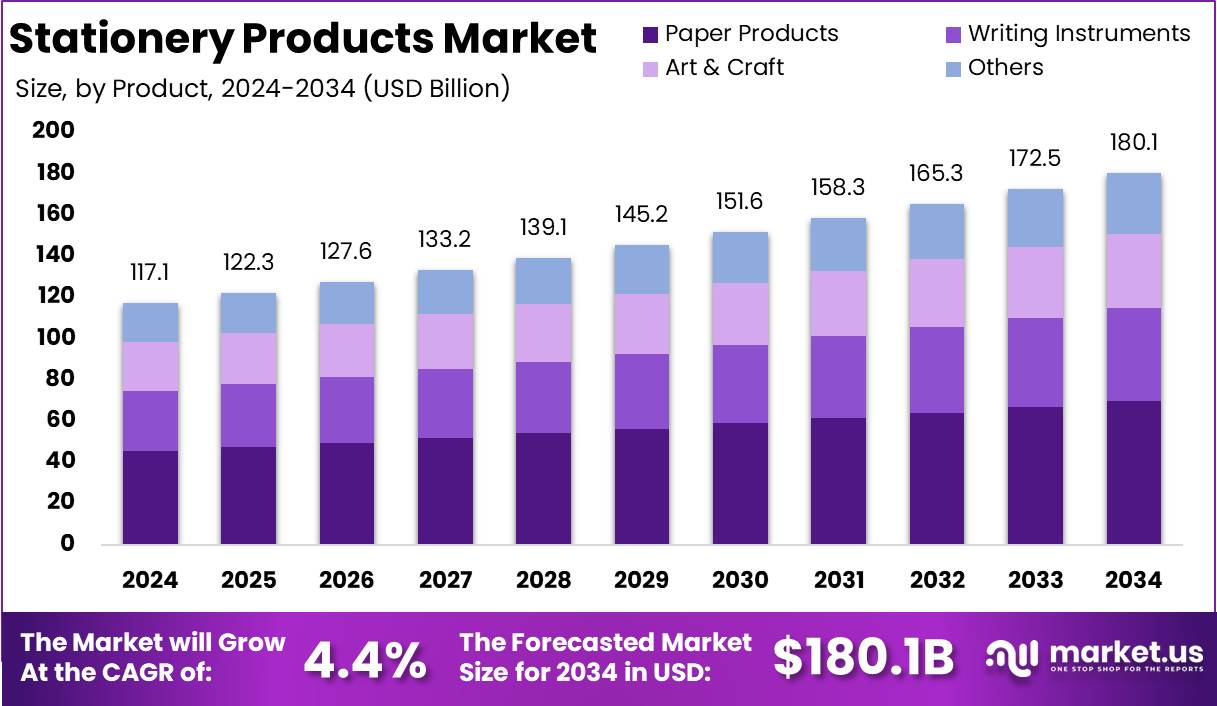

The Global Stationery Products Market size is expected to be worth around USD 180.1 Billion by 2034 from USD 117.1 Billion in 2024, growing at a CAGR of 4.4% during the forecast period from 2025 to 2034.

Stationery products encompass a broad category of materials used for writing, office tasks, and organizational purposes. This includes items such as paper, pens, pencils, markers, notebooks, binders, and other related tools.

Stationery items are typically essential for educational, professional, and personal use, spanning both traditional forms (paper-based products) and digital innovations such as smart notebooks and stylus-based writing tools. The market for stationery products is both dynamic and diversified, catering to a wide range of consumers from individual users to large enterprises.

The stationery products market refers to the industry that involves the production, distribution, and consumption of various stationery items. It includes both the manufacturing of physical goods such as paper, writing instruments, and filing systems, as well as digital alternatives designed to enhance productivity and communication.

This market is influenced by various factors, including technological innovations, educational trends, and the evolving needs of corporate offices and households. As of recent years, the sector has experienced shifts driven by sustainability concerns, the rise of digital tools, and changing consumer preferences for eco-friendly or premium products.

The growth of the stationery products market can be attributed to several key factors. Firstly, the continued expansion of the educational sector globally, particularly in developing regions, has driven consistent demand for basic stationery items.

The demand for stationery products is influenced by demographic factors, economic conditions, and technological trends. In particular, regions with a large student population and a growing middle class tend to exhibit high demand for basic stationery products, including notebooks, writing tools, and educational supplies.

The stationery products market presents several growth opportunities driven by evolving consumer preferences and emerging trends. One key opportunity lies in the sustainability trend, as manufacturers focus on producing eco-friendly products made from recycled materials, reducing the environmental footprint of the industry.

Another opportunity is the increasing popularity of digital stationery, such as smart pens and digital notebooks, which bridge the gap between traditional and modern office tools.

According to Stargel, yellow fluorescent highlighters represent around 80% of total sales in the stationery products market, with their popularity driven by their visibility for colorblind individuals. Additionally, BIC pens, known for their longevity, can write up to 2 kilometers. 3M’s adhesive innovation, initially designed for stronger bonds, was later adapted to create non-damaging, temporary adhesives, further influencing product design and consumer preferences in the stationery sector.

Early 70% of Britons rarely shop for stationery, with most purchases occurring during special occasions. Additionally, 42% shop online, and most limit their monthly spend to under £9, according to YouGov.

According to Study, the global consumption of paper and paperboard reached 420 million tons in 2023, with projections indicating a rise to 476 million tons by 2032. The containerboard sector, the largest paper type, accounted for 185 million tons in 2023 and is anticipated to surpass 220 million tons by 2030. This growth reflects the ongoing demand for stationery products, driven by both consumer and industrial usage, indicating a robust outlook for the stationery market in the coming years.

Key Takeaways

- The global stationery products market is projected to grow from USD 117.1 billion in 2024 to USD 180.1 billion by 2034, achieving a compound annual growth rate (CAGR) of 4.4% during the forecast period.

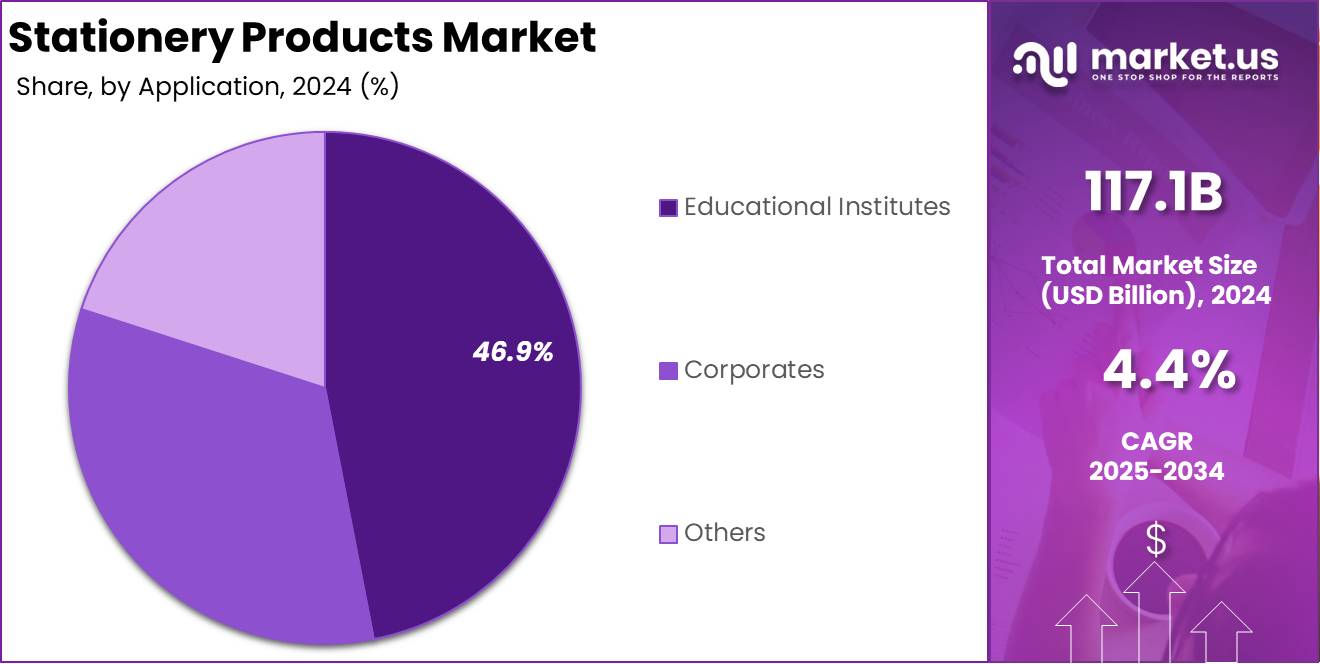

- Educational institutes dominate the stationery products market by application, accounting for 46.9% of the market share.

- The economy segment leads the stationery products market by price range, commanding 48.1% of the market share.

- Offline distribution channels dominate the stationery products market, holding a substantial 66.2% market share.

- North America is expected to maintain the largest regional share in the stationery products market, with an anticipated market share of 33.8% in 2024.

By Product Analysis

Paper Products Dominates Stationery Products Market with Market Share of 38.8%

In 2024, Paper Products maintained a dominant market position in the Stationery Products sector, capturing more than 38.8% of the overall market share. This segment’s strong performance can be attributed to the ongoing demand for traditional stationery items such as notebooks, copy paper, and envelopes, which continue to be essential in educational, corporate, and administrative settings.

The segment’s growth is further supported by the rising consumption of premium paper products, particularly in the retail and e-commerce sectors, which cater to consumers seeking high-quality materials for personal and professional use.

The Writing Instruments segment follows closely behind, comprising a significant portion of the stationery market. This segment includes pens, pencils, markers, and highlighters, which remain indispensable in everyday activities.

The segment’s growth is bolstered by product innovations, such as eco-friendly writing tools and ergonomically designed products, which cater to both environmental concerns and user comfort. Furthermore, the rising popularity of digital learning tools has not significantly hindered the demand for traditional writing instruments, especially in educational institutions and offices.

The Art & Craft segment has shown consistent growth, driven by increasing interest in DIY activities, home-based crafts, and art education. The availability of a wide range of products, including paints, brushes, drawing tools, and craft kits, has helped cater to a growing base of creative consumers.

Furthermore, the increasing focus on creative and recreational hobbies, particularly among millennials and Generation Z, has contributed to the segment’s steady rise.

The Others category encompasses a variety of products such as adhesives, paper clips, binders, and other miscellaneous office supplies. While this segment holds a smaller share of the overall market, it remains crucial in supporting the functionality of offices, schools, and home environments.

Innovations in organizational tools and the growing demand for multi-functional products continue to drive modest but steady growth within this segment.

By Application Analysis

Educational Institutes Dominates Stationery Products Market by Application with Market Share of 46.9%

In 2024, Educational Institutes held a dominant market position in the Stationery Products sector by application, capturing more than 46.9% of the overall market share. This significant share is driven by the consistent and high-volume demand for essential stationery items such as notebooks, pens, papers, and organizational tools used in schools, colleges, and universities.

The strong educational framework in developed and emerging markets continues to support the growth of this segment, with increasing enrollment rates and higher education participation. Furthermore, the growing emphasis on stationery products for e-learning environments, such as digital notebooks and customizable school supplies, has further reinforced the sector’s market leadership.

The Corporates segment, while not as large as the Educational Institutes segment, represents a critical portion of the stationery products market. This segment includes a wide range of items used in professional environments, such as office supplies, pens, paper, and organizational tools. Corporate demand is fueled by the steady requirement for daily office supplies, with particular growth observed in personalized products, high-quality paper, and specialized writing instruments.

The increasing trend of remote working and hybrid work models has driven demand for stationery products that cater to home-office setups and small businesses. Additionally, the corporate segment’s reliance on premium and branded products, such as high-end pens and organizers, has contributed to a steady rise in this application’s market share.

The Others category includes various applications for stationery products in sectors such as hospitality, retail, and government institutions. While this segment represents a smaller share of the overall market, it remains relevant in supporting a wide range of functional and professional requirements. Demand in this category is driven by the need for administrative and organizational tools in non-educational and non-corporate environments.

Growth in this segment is tied to the expanding use of stationery products in government offices, retail chains, and other service-oriented sectors, where items such as office supplies, labels, and packaging materials play a crucial role in daily operations.

By Price Range Analysis

Economy Segment Dominates Stationery Products Market by Price Range with Market Share of 48.1%

In 2024, the Economy segment held a dominant position in the Stationery Products market by price range, capturing more than 48.1% of the overall market share. This segment’s leadership is largely attributed to the widespread demand for affordable and functional stationery items that cater to a broad consumer base.

The economic accessibility of products such as basic pens, notebooks, and paper continues to drive this segment’s growth, particularly in developing regions and educational institutions where cost-effective solutions are a priority. The Economy segment also benefits from bulk purchasing in schools, offices, and retail environments, further solidifying its position in the market.

The Mid-Range segment represents a significant portion of the stationery products market, offering products that balance quality and price. This segment captures the demand from consumers seeking reliable, durable, and moderately priced stationery items. Mid-range products, such as mid-tier pens, notebooks, and art supplies, are widely used in corporate environments, educational institutions, and home offices.

The segment’s growth is driven by the increasing preference for products that offer a combination of quality and affordability. As consumers continue to seek products with enhanced features such as ergonomic designs or eco-friendly materials mid-range options have become increasingly popular, offering both value and performance.

The Premium segment, while comprising a smaller share of the overall market, continues to experience steady growth, driven by consumer preference for high-quality, specialized products. Premium stationery items, including luxury pens, high-grade paper, and designer organizers, are targeted at consumers who prioritize quality, design, and brand prestige.

This segment is particularly strong in corporate settings, where personalized and high-end stationery is often used for branding and executive gifts. Additionally, growing interest in premium, sustainable, and eco-conscious stationery products has contributed to a shift toward premium offerings, especially in developed markets. The segment’s niche appeal and higher price points position it as a key player in the evolving stationery landscape.

By Distribution Channel Analysis

Offline Distribution Channel Dominates Stationery Products Market with Market Share of 66.2%

In 2024, the Offline distribution channel held a dominant position in the Stationery Products market, capturing more than 66.2% of the overall market share. This segment’s continued leadership is largely driven by the widespread presence of brick-and-mortar retail outlets, including supermarkets, hypermarkets, office supply stores, and specialty stationery retailers.

The tactile nature of stationery products, such as paper, writing instruments, and art supplies, makes them particularly suited to offline purchasing, where consumers can assess the quality and feel of the products before making a purchase.

Additionally, convenience factors, including immediate product availability and in-person assistance, remain significant drivers of offline sales, particularly in regions with strong retail infrastructure. The Online distribution channel, while accounting for a smaller portion of the overall market, has demonstrated rapid growth and increasing consumer adoption.

Online sales of stationery products have expanded due to the rise of e-commerce platforms, where consumers can easily access a wide variety of products from the comfort of their homes. The convenience of doorstep delivery, coupled with the ability to compare prices and browse a broader range of products, has made online shopping an increasingly attractive option for many buyers.

This trend has been particularly evident in urban areas, where online penetration is high, and among consumers seeking niche or premium products that may not be readily available in physical stores. E-commerce platforms also cater to bulk-buying needs, particularly in the corporate and educational sectors, where larger quantities of stationery are required.

According to Study, the global consumption of paper and paperboard reached 420 million tons in 2023, with expectations to rise to 476 million tons by 2032. Containerboard, the most widely consumed type, accounted for 185 million tons in 2023, with demand projected to surpass 220 million tons by 2030. This increase in paper consumption is expected to fuel growth in the stationery products market, as paper remains a critical component.

Key Market Segments

By Product

- Paper Products

- Writing Instruments

- Art & Craft

- Others

By Application

- Educational Institutes

- Corporates

- Others

By Price Range

- Economy

- Mid-Range

- Premium

By Distribution Channel

- Offline

- Online

Driver

Increased Demand for Eco-Friendly Stationery

The stationery products market has seen a notable shift toward sustainability, driven by growing consumer demand for eco-friendly and environmentally responsible products. This trend has been fueled by increasing awareness about climate change and the negative environmental impacts of non-biodegradable products.

Consumers are becoming more conscious of their purchasing choices, preferring brands that prioritize sustainable practices such as using recycled materials, biodegradable packaging, and reducing carbon footprints during manufacturing processes. As a result, eco-friendly stationery products, including recycled paper, bamboo pens, and non-toxic inks, have gained significant popularity.

This shift toward sustainability is not only a consumer-driven trend but also a response to stricter environmental regulations imposed by governments and regulatory bodies across the globe. These regulations incentivize manufacturers to adopt sustainable production methods, which in turn drives innovation in the development of new eco-friendly stationery products.

The increasing availability of sustainable materials and the growing importance of corporate social responsibility (CSR) have positioned the eco-friendly segment as one of the major drivers of growth in the global stationery products market. As the demand for such products continues to rise, it is expected that more companies will focus on integrating sustainability into their product lines, further fueling market expansion.

Restraint

Volatility in Raw Material Prices

One of the significant restraints facing the global stationery products market is the volatility in raw material prices. Many stationery items, including paper, ink, and plastics, rely on materials such as wood pulp, petroleum-based products, and chemical derivatives.

Fluctuations in the prices of these raw materials, driven by global supply chain disruptions, geopolitical tensions, and unpredictable weather events, can create substantial price volatility. When raw material costs rise unexpectedly, manufacturers often face increased production expenses, which can lead to higher retail prices for end consumers. This, in turn, can dampen demand for certain types of stationery products, especially in price-sensitive markets.

Moreover, the fluctuating cost of raw materials can have a ripple effect across the supply chain, from procurement and production to distribution. For manufacturers, this unpredictability complicates long-term planning and forecasting, making it difficult to maintain profit margins.

While some companies may attempt to mitigate these challenges by optimizing their supply chains or switching to alternative materials, the impact of raw material price volatility remains a significant restraint. In an environment where consumers are increasingly value-conscious, any price increase can lead to reduced consumption, hindering overall market growth.

Opportunity

Growing Demand for Digital Stationery Solutions

An emerging opportunity in the global stationery products market is the growing demand for digital stationery solutions. As technology continues to advance, digital tools for note-taking, drawing, and organizing have become increasingly popular, especially among younger generations who are more tech-savvy.

Products such as digital pens, smart notebooks, and electronic planners are bridging the gap between traditional stationery and modern technology. These digital solutions not only cater to the preferences of digital natives but also offer added benefits such as cloud synchronization, improved organization, and environmental sustainability through reduced paper usage.

The convergence of stationery and technology presents manufacturers with a unique opportunity to innovate and capture a new customer base. By developing products that combine the tactile feel of traditional stationery with the convenience of digital tools, companies can cater to the evolving needs of modern consumers.

Moreover, the expansion of e-learning, remote work, and digital collaboration tools in both personal and professional settings has further fueled the demand for digital stationery products. As the global digital transformation continues, the opportunity for growth in the digital stationery segment is poised to accelerate, contributing to the overall expansion of the market.

Trends

Personalization and Customization

Personalization and customization have emerged as key trends in the stationery products market, as consumers increasingly seek products that reflect their unique identity and preferences. The desire for personalized stationery, such as monogrammed notebooks, custom-designed pens, and tailored planners, is rising across various demographics.

This trend is particularly prevalent among students, professionals, and gift-givers, who view personalized stationery items as a reflection of their individual style or as thoughtful, bespoke gifts. The ability to personalize products through online platforms has made these custom stationery options more accessible than ever, leading to a surge in demand for personalized stationery solutions.

Moreover, customization goes beyond just aesthetics; it extends to functionality as well. Consumers are increasingly looking for stationery products that can be tailored to their specific needs. For instance, customizable planners and notebooks that allow users to choose layouts, paper types, and page designs are gaining popularity. This trend reflects a broader consumer preference for products that can be adapted to personal workflows, lifestyles, and goals.

As this demand for personalization grows, manufacturers are investing in new technologies such as advanced printing techniques and online configurators to offer a wide range of customizable options. Consequently, personalization and customization are becoming integral to the growth trajectory of the stationery products market, appealing to a diverse customer base seeking unique, functional, and tailored products.

Regional Analysis

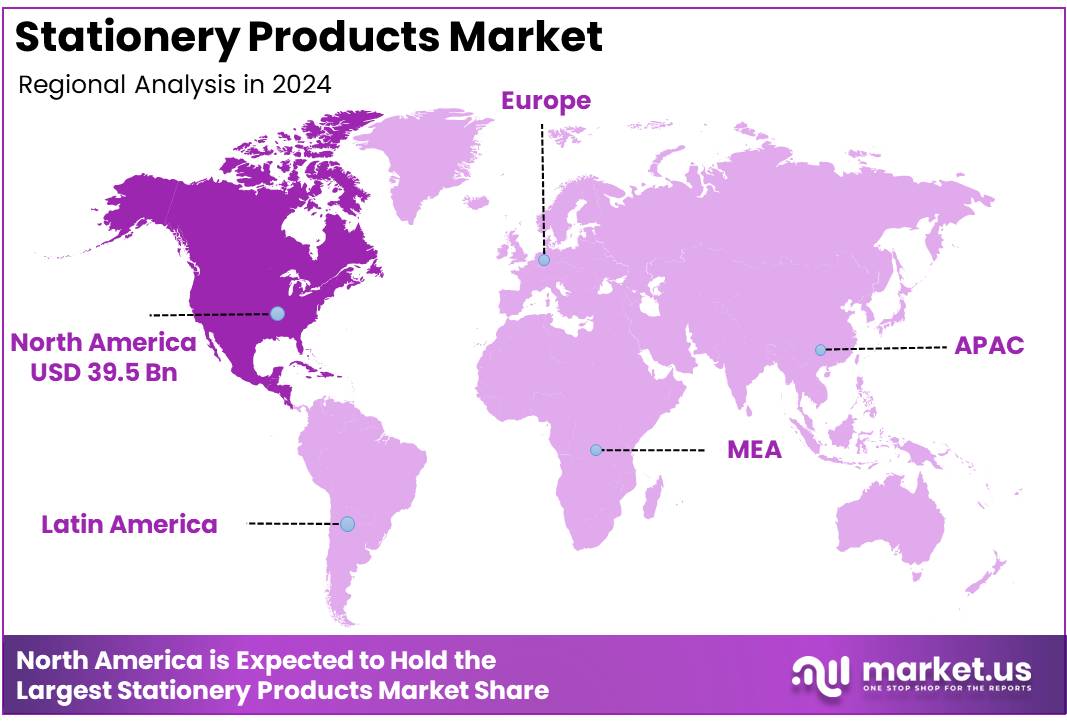

North America Stationery Products Market with Largest Market Share 33.8% in 2024

The stationery products market exhibits significant regional variation, with North America commanding the largest market share. In 2024, North America is expected to capture 33.8% of the global market, equating to a market value of USD 39.5 billion.

This dominance can be attributed to high consumer demand, robust educational and office sectors, and increased disposable income, particularly in the United States and Canada. The region’s well-established retail networks and increasing trend towards personalized and premium stationery items further contribute to its strong position.

Europe follows as a key market for stationery products, accounting for a substantial portion of global sales. The region’s market dynamics are driven by a mix of traditional demand from the education sector and a growing inclination toward sustainable and eco-friendly products. The presence of multiple local and international manufacturers, along with heightened environmental awareness among consumers, continues to shape the market landscape.

Asia Pacific is poised for considerable growth, largely driven by the expanding middle-class population, rapid urbanization, and rising disposable income in countries like China, India, and Japan. While the region is not the largest market by value, it is projected to experience the fastest growth, with significant increases in both demand for stationery products in educational institutions and the burgeoning corporate sector.

The Middle East & Africa, though smaller in market size compared to North America and Europe, is witnessing steady growth. The region’s growth is largely attributed to the expansion of educational infrastructure and office-based industries, particularly in countries such as the UAE and Saudi Arabia. However, the market remains heavily dependent on imports, limiting the region’s growth potential relative to more established markets.

Latin America, while showing moderate demand for stationery products, is expected to maintain a steady market trajectory. Economic fluctuations and political instability in several key countries, such as Brazil and Argentina, have led to some market challenges. Nevertheless, steady demand for stationery items in schools, offices, and government sectors contributes to the region’s overall growth.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

In 2024, the global stationery products market is poised for growth, driven by key players whose strategic innovations and strong brand recognition continue to shape industry trends. Leading the charge are companies like BIC and Pilot Corporation, known for their broad product portfolios and global reach, dominating the writing instrument segment.

Faber-Castell and Staedtler maintain a significant presence in the premium and artistic segments, capitalizing on the growing demand for high-quality, eco-friendly products. Meanwhile, Kokuyo Camlin and Linc Pens & Plastics Ltd. are notable for their emphasis on affordability and accessibility in emerging markets, leveraging extensive distribution networks.

Maped and Schwan Stabilo continue to innovate with specialized products that cater to both educational and professional needs, while 3M expands its stationery offerings by integrating office supplies with its well-established brand in the industrial sector.

Muji and Rifle Paper Co. capitalize on the intersection of design and functionality, offering minimalist and aesthetically appealing products that resonate with contemporary consumers. Mead and Navneet focus on the educational market, offering value-driven solutions that appeal to students and parents.

As consumer preferences evolve toward sustainability, players like Fullmark and Reynolds Pens are stepping up with eco-conscious product lines, positioning themselves as leaders in green innovation. With diverse strategies and targeted segments, these players are expected to drive competitive dynamics and sustained growth in the global stationery market throughout 2024.

Top Key Players in the Market

- Artline

- BIC

- Faber-Castell

- Fullmark

- Kokuyo Camlin

- Linc Pens & Plastics Ltd.

- Maped

- Mead

- Muji

- Navneet

- Paper Mate

- Pilot Corporation

- Reynolds Pens

- Rifle Paper Co.

- Schwan Stabilo

- Staedtler

- 3M

Recent Developments

- In March 2023, Elmer’s® introduced a new addition to its craft collection with the launch of Elmer’s Squishies. Designed to foster creativity in children, this DIY kit provides all the necessary components to create a personalized squishy toy. Users can mix colorful glue with other ingredients, pour the mixture into a mold, and after 60 minutes, reveal and play with a surprise squishy character.

- In September 2023, Lotus commemorated its 75th anniversary by forming an exclusive partnership with Onoto, the luxury British fountain pen manufacturer. This collaboration honors Lotus’s rich history in the automotive industry, reflecting on its legacy of innovation and success that has significantly impacted the global motoring and motorsport sectors.

- On February 28, 2024, Mitsubishi Pencil Co. Ltd., based in Japan, acquired C. Josef Lamy GmbH, the esteemed manufacturer of LAMY writing instruments. Founded in 1930, LAMY’s family-owned business was seeking a new owner capable of guiding the brand into the future. With this acquisition, Mitsubishi Pencil, known for its flagship uni brand, aims to expand its influence in the stationery market, leveraging its substantial financial capacity to further strengthen LAMY’s legacy.

- In 2023, Sun-Star Stationery, a leading Japanese company, introduced an innovative eraser inspired by the art of origami. This unique eraser features a flat top for erasing larger mistakes and edges for finer corrections, showcasing a clever combination of functionality and design aimed at enhancing user experience in the stationery market.

Report Scope

Report Features Description Market Value (2024) USD 117.1 Billion Forecast Revenue (2034) USD 180.1 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Product (Paper Products, Writing Instruments, Art and Craft, Others), Application (Educational Institutes, Corporates, Others), Price Range (Economy, Mid-Range, Premium), Distribution Channel (Offline, Online), Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Artline, BIC, Faber-Castell, Fullmark, Kokuyo Camlin, Linc Pens & Plastics Ltd., Maped, Mead, Muji, Navneet, Paper Mate, Pilot Corporation, Reynolds Pens, Rifle Paper Co., Schwan Stabilo, Staedtler, 3M Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Artline

- BIC

- Faber-Castell

- Fullmark

- Kokuyo Camlin

- Linc Pens & Plastics Ltd.

- Maped

- Mead

- Muji

- Navneet

- Paper Mate

- Pilot Corporation

- Reynolds Pens

- Rifle Paper Co.

- Schwan Stabilo

- Staedtler

- 3M