Global Wool Worsted Yarn Market Size, Share, Growth Analysis By Product Type (Merino Wool, Cashmere Wool, Peruvian Highland Wool, Shetland Wool, Others), By Application (Apparel, Upholstery, Blankets, Others), By Distribution Channel (Offline Stores, Online Stores), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 14374

- Number of Pages: 217

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

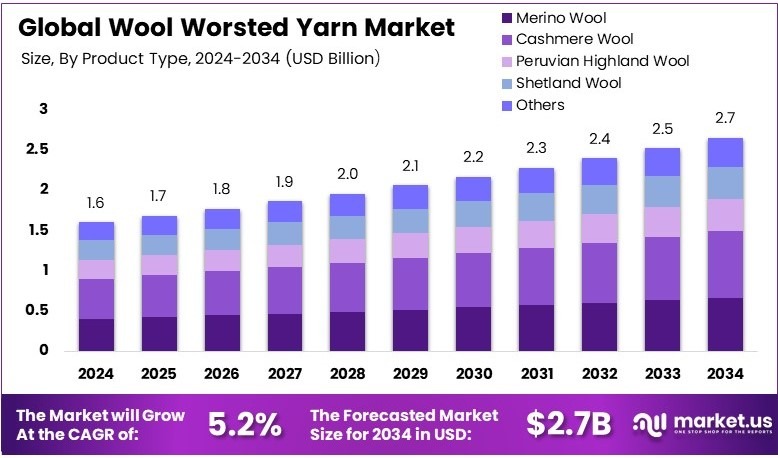

The Global Wool Worsted Yarn Market size is expected to be worth around USD 2.7 Billion by 2034, from USD 1.6 Billion in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034.

Wool Worsted Yarn is a type of yarn made from wool that is combed to align the fibers, making it smoother and more durable. This process produces a fine yarn used extensively in the manufacturing of high-quality textiles and garments.

The Wool Worsted Yarn Market refers to the industry involved in the production and distribution of worsted yarn. It encompasses the activities of manufacturers, distributors, and retailers who supply this yarn globally, catering to sectors like fashion and home furnishings.

The Wool Worsted Yarn market is thriving due to its renowned durability and quality. Demand for this yarn is bolstered by the increasing interest in sustainable fashion and natural fabrics. Globally, approximately one million tons of wool are produced annually, showcasing the extensive scale of wool production driven by one billion sheep. This underlines the substantial market size and the continuous need for worsted yarn products.

Furthermore, the market’s competitiveness is on the rise, with numerous players vying for leadership in quality and sustainability. This competition contributes to innovation and improvement in yarn production techniques. Additionally, on a local scale, wool yarn industries support numerous communities by providing jobs and preserving crafting traditions.

In addition, government regulations and investments in sustainable practices are enhancing this market. For example, initiatives encouraging the use of natural fibers are pushing the industry towards more eco-friendly processes. This reflects a broader movement towards sustainability in textiles, impacting global and local markets positively.

Key Takeaways

- The Wool Worsted Yarn Market was valued at USD 1.6 billion in 2024 and is expected to reach USD 2.7 billion by 2034, with a CAGR of 5.2%.

- In 2024, Cashmere Wool led the Product Type segment with 31.0%, driven by its premium quality and growing demand in luxury textiles.

- In 2024, Apparel dominated the Application segment with 48.7%, owing to increasing fashion industry consumption.

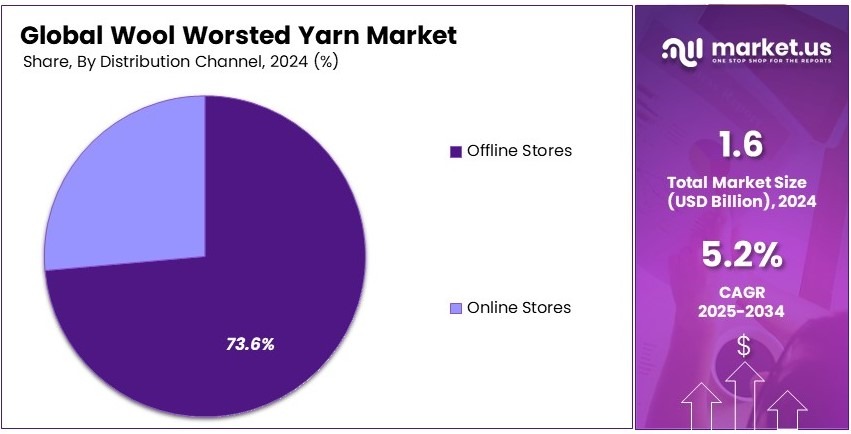

- In 2024, Offline Stores led the Distribution Channel segment with 73.6%, due to consumer preference for fabric quality verification.

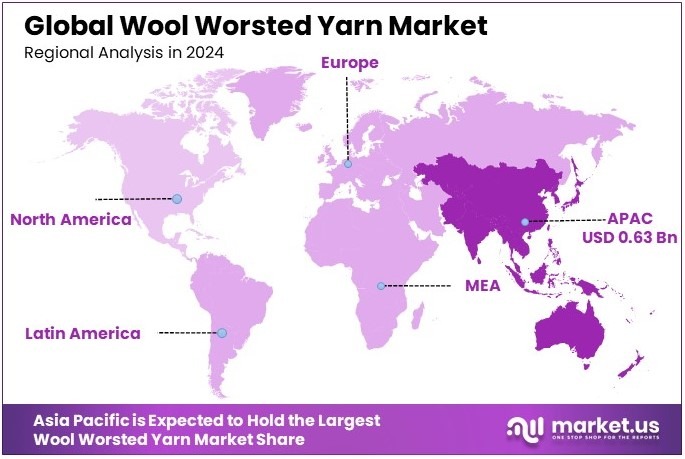

- In 2024, APAC held the largest regional share at 39.5%, valued at USD 0.63 billion, fueled by strong textile manufacturing hubs.

Product Type Analysis

Cashmere Wool dominates with 31.0% due to its luxurious qualities and high demand in premium products.

Cashmere wool holds the largest share in the Wool Worsted Yarn market, commanding 31.0% of the market. The dominance of cashmere wool can be attributed to its superior quality, softness, and warmth, which make it highly desirable for luxury apparel. This wool is often used in high-end fashion, including fine knitwear, scarves, and sweaters.

Cashmere is not only known for its luxurious feel but also for its durability and insulating properties, making it a premium product in both fashion and home textiles. The growing consumer preference for premium and sustainable fabrics is driving cashmere wool demand. As a result, brands are increasingly using cashmere in their high-quality woolen products.

Merino wool, which is also highly valued for its softness and breathability, is another significant segment. It is widely used in both casual and formal clothing. Peruvian Highland wool is known for its strength and resilience, making it ideal for robust apparel like jackets and coats.

Shetland wool, although smaller in share, has a unique market appeal due to its heritage and use in traditional garments. The “others” category includes wool types that are less commonly used but still important, such as alpaca and lamb’s wool, each playing a specialized role in the market. Cashmere wool, however, continues to dominate due to its unmatched luxury appeal and growing consumer demand.

Application Analysis

Apparel dominates with 48.7% due to the increasing global demand for wool-based clothing.

Apparel is the leading application in the Wool Worsted Yarn market, representing 48.7% of the total market share. The high demand for wool-based garments, driven by consumer preferences for comfort and natural fibers, is a key factor behind this segment’s dominance.

Wool is known for its warmth, moisture-wicking properties, and durability, making it a popular choice for both seasonal and all-season clothing. The growing trend for sustainable and eco-friendly fashion has also increased the demand for wool yarns in the apparel sector, particularly for sweaters, coats, and scarves. In addition, wool’s versatility in both men’s, women’s, and kids’ clothing has further strengthened its market presence.

Men’s clothing is a major driver within the apparel segment, with wool often used in formal wear such as suits and coats. Women’s clothing, which includes everything from outerwear to knitwear, is another important sub-segment. Kids’ clothing, while smaller in share, has shown steady growth due to the increasing popularity of woolen garments for their warmth and comfort.

Upholstery, although a smaller segment, remains significant, especially in high-end furniture. Wool is a preferred material for upholstery due to its durability and aesthetic appeal. Blankets, another key application, benefit from wool’s insulating properties, making them ideal for both luxury and practical use. The “others” category includes niche applications like crafts and textile arts, contributing to the diversity of the wool market.

Distribution Channel Analysis

Offline Stores dominate with 73.6% due to traditional shopping preferences and physical product experience.

Offline stores lead the distribution channels in the Wool Worsted Yarn market, accounting for 73.6% of total sales. This segment’s dominance can be attributed to the strong preference for in-person shopping, where consumers can feel the quality and texture of wool products.

Physical stores offer a direct experience, allowing customers to inspect and touch woolen items before making a purchase. The presence of well-established retail chains and boutiques specializing in woolen garments further supports offline sales. Additionally, many luxury and high-end brands prefer to showcase their wool products in-store to offer a premium shopping experience.

On the flip side, online stores are growing but still account for a smaller portion of the market. With the increasing convenience of online shopping, more consumers are turning to e-commerce platforms for purchasing woolen garments and yarn.

However, buying wool-based products online presents challenges in assessing quality, which limits some consumers’ willingness to purchase without first seeing the product. Despite this, the rise of online marketplaces and brand-specific e-commerce sites is gradually boosting online sales. The “others” category includes direct-to-consumer and subscription-based sales models, which are niche but gaining traction as consumers seek personalized, sustainable shopping options.

Key Market Segments

By Product Type

- Merino Wool

- Cashmere Wool

- Peruvian Highland Wool

- Shetland Wool

- Others

By Application

- Apparel

- Men’s Clothing

- Women’s Clothing

- Kids’ Clothing

- Upholstery

- Blankets

- Others

By Distribution Channel

- Offline Stores

- Online Stores

Driving Factors

Growing Demand for Sustainable Textiles Drives Market Growth

The growing demand for sustainable and eco-friendly textiles is a major factor driving the wool worsted yarn market. As consumers become more environmentally conscious, they are increasingly seeking textiles made from natural, renewable fibers. Wool, known for its sustainability and biodegradability, is well-positioned to meet these demands.

Expanding applications in luxury apparel and high-end fabrics further contribute to the market growth. Wool’s premium quality makes it a favored choice for luxury garments, such as suits, coats, and scarves. As more designers and brands incorporate wool into their collections, the demand for wool worsted yarn continues to rise.

Additionally, the increase in consumer preference for natural fibers also supports this trend. Many consumers are opting for wool over synthetic alternatives due to its natural properties, such as breathability, moisture-wicking, and comfort. These factors collectively enhance the appeal of wool in the textile market.

Technological advancements in yarn spinning and dyeing processes have also played a key role. New innovations in production methods have improved the efficiency, color consistency, and quality of wool yarn, making it even more attractive to manufacturers. These developments contribute significantly to the growing demand for wool worsted yarn in the textile industry.

Restraining Factors

High Costs and Competition Restrain Market Growth

The wool worsted yarn market faces several challenges that may hinder its growth. A primary constraint is the high cost of raw wool and production processes. Wool is a premium fiber, and the cost of raw wool, along with processing expenses, is relatively high compared to synthetic fibers. This can make wool yarn more expensive for consumers and manufacturers, limiting its widespread adoption.

Competition from synthetic fibers and blends also poses a threat to the wool yarn market. While wool offers many natural benefits, synthetic fibers such as polyester and nylon are often cheaper and more readily available. As a result, some consumers and brands may opt for these alternatives, especially when cost is a major consideration.

Seasonal fluctuations in wool supply further complicate the situation. Wool production is subject to seasonal variations, which can lead to shortages or price volatility. This uncertainty can disrupt supply chains and hinder manufacturers’ ability to meet market demand.

Finally, the limited availability of a skilled workforce in traditional yarn manufacturing is another challenge. Many yarn manufacturers face difficulty in finding workers with the expertise needed to produce high-quality wool yarn, which can impact production efficiency and quality.

Growth Opportunities

Rising Demand in Emerging Economies Provides Opportunities

The wool worsted yarn market presents several promising growth opportunities. Rising demand from emerging economies in the Asia-Pacific region is a significant factor. As these economies develop, there is an increasing need for high-quality textiles in industries like fashion and interior design, boosting the demand for wool yarn.

The expansion of eco-conscious consumer segments further enhances growth prospects. As consumers worldwide become more focused on sustainability, the demand for wool yarn, which is both natural and eco-friendly, continues to rise. Brands that position themselves as eco-conscious are likely to experience increased customer loyalty.

Additionally, the integration of smart textiles and functional yarn solutions provides new opportunities. The development of wool-based yarns with integrated smart features, such as temperature regulation or moisture-wicking properties, caters to the growing demand for innovative textile products.

An increased focus on high-performance wool yarns for sportswear also creates opportunities. Wool’s natural properties, such as moisture management and insulation, make it an ideal choice for activewear. As sportswear brands prioritize performance and sustainability, the demand for wool yarn in this segment is expected to rise.

Emerging Trends

Sustainable Practices and Ethical Sourcing Is Latest Trending Factor

Several emerging trends are shaping the wool worsted yarn market. One notable trend is the surge in interest for wool’s natural insulating properties. Wool’s ability to provide warmth without excessive bulk is gaining recognition, particularly in the production of outerwear and performance garments.

The adoption of circular economy practices in wool yarn production is another key trend. As sustainability becomes more important, many manufacturers are turning to circular production models, focusing on recycling and reusing wool fibers to minimize waste and reduce environmental impact.

Collaboration between fashion designers and sustainable yarn manufacturers is also on the rise. Many designers are actively seeking partnerships with yarn producers who prioritize ethical sourcing and sustainable practices, ensuring their collections align with eco-conscious values.

Finally, the focus on traceability and ethical sourcing of wool is gaining traction. Consumers and brands alike are becoming more concerned with the origins of their materials. Companies that can demonstrate transparency in sourcing wool from responsible and ethical sources will likely gain a competitive advantage in the market.

Regional Analysis

APAC Dominates with 39.5% Market Share

The Asia-Pacific (APAC) region holds a dominant share of 39.5% in the global Wool Worsted Yarn Market, valued at approximately USD 0.63 billion. This leadership is driven by strong demand for wool products, particularly in key markets like China, India, and Japan, where woolen fabrics are central to traditional clothing and emerging textile industries.

APAC’s dominance is primarily due to its large textile manufacturing base and a growing consumer preference for woolen fabrics, especially in colder regions. Countries like China and India are major producers and consumers of wool, which supports the regional market’s growth. Additionally, the increasing demand for high-quality wool in luxury apparel boosts regional sales.

The region’s textile industry is a key driver, with countries like China and India contributing significantly to global wool yarn production. The increasing urbanization and changing fashion trends also fuel demand for woolen products. In particular, APAC’s strong manufacturing infrastructure allows for cost-effective production of high-quality wool yarn, which strengthens its market position.

Regional Mentions:

-

North America: North America holds a notable market share, led by the U.S., where there is strong demand for premium wool yarn products in high-end fashion. The region benefits from a well-developed textile industry and a rising trend for sustainable and eco-friendly fashion.

-

Europe: Europe commands a significant portion of the market, with countries like Italy and the UK leading the demand for high-quality wool yarn in the fashion and textiles industry. European manufacturers focus on luxury wool yarns, catering to a high-end consumer base.

-

Middle East & Africa: The Middle East & Africa represent a smaller but growing segment. The demand is driven by a mix of traditional wool garments and a growing interest in premium textiles among the expanding middle class.

-

Latin America: Latin America holds a presence in the Wool Worsted Yarn Market. Brazil and Argentina are key players in the region, with a focus on both local production and international exports, especially to other regions in the Americas.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the highly competitive Wool Worsted Yarn Market, Laxtons Limited, SuedWolle Group Italia S.p.A., Indorama Ventures Public Company Limited, and Suripi Textiles Pvt. emerge as the top players driving innovation and growth.

Laxtons Limited is a key player, renowned for its high-quality worsted yarn production. The company focuses on manufacturing premium wool yarns used in a wide range of textile applications, from fashion to home furnishings. Laxtons is recognized for its sustainable practices and commitment to producing eco-friendly products, meeting the growing consumer demand for sustainable textiles.

SuedWolle Group Italia S.p.A. is one of the world’s largest suppliers of wool yarns and is known for its high-quality worsted yarns. SuedWolle’s extensive product range includes yarns used in both fashion and industrial textiles, making it a go-to player in the market. The company is well-regarded for its innovation in blending natural wool fibers with other materials, ensuring high durability and versatility in its yarn products.

Indorama Ventures Public Company Limited is a major global player in the fiber and yarn industry. The company offers a broad range of wool worsted yarn products, with a focus on producing high-strength, premium-quality yarns. Indorama’s commitment to technological advancements and sustainability allows it to meet diverse customer needs across various industries, including fashion and upholstery.

Suripi Textiles Pvt. is another key player, specializing in the production of high-quality worsted wool yarns for both domestic and international markets. Suripi’s expertise in yarn manufacturing and focus on customer satisfaction has helped it establish a strong reputation. The company is known for its ability to produce customized yarn products, catering to niche markets in the textile industry.

Together, these companies represent a powerful presence in the global Wool Worsted Yarn Market, driving both quality and innovation. Their ability to adapt to market trends, such as sustainability and custom yarn solutions, places them at the forefront of the industry.

Major Companies in the Market

- Laxtons Limited

- SuedWolle Group Italia S.p.A.

- Indorama Ventures Public Company Limited

- Suripi Textiles Pvt.

- Sharman Woollen Mills Ltd.

- Jainson Hosiery Industries

- Shanghai Kunlei Wool Textile Co. Ltd.

- Rosy Woollen Mills Pvt. Ltd.

- AUTEFA Solutions Germany GmbH

- BSL Limited

Recent Developments

- Swedish Wool Initiative: On March 2024, the Swedish Wool Initiative, led by Axfoundation, announced the development of premium worsted yarn made from previously discarded Swedish wool. Traditionally, over 50% of Sweden’s annual wool production, approximately 1,000 metric tons, was wasted due to excessive vegetable matter like straw.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Billion Forecast Revenue (2034) USD 2.7 Billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Merino Wool, Cashmere Wool, Peruvian Highland Wool, Shetland Wool, Others), By Application (Apparel, Upholstery, Blankets, Others), By Distribution Channel (Offline Stores, Online Stores) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Laxtons Limited, SuedWolle group Italia S.p.A., Indorama Ventures Public Company Limited, Suripi Textiles Pvt., Sharman Woollen Mills Ltd., Jainson Hosiery Industries, Shanghai Kunlei Wool Textile Co. Ltd., Rosy Woollen Mills Pvt. Ltd., AUTEFA Solutions Germany GmbH, BSL Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Indorama Ventures Public Company Limited

- Grasim Industries Limited

- Südwolle Group

- Shandong Hengtai Textile Co. Ltd.

- Novita Oy

- Oswal Woollen Mills Limited

- Laxtons Limited

- Brown Sheep Company Inc.

- The Fibre Co

- Kapotex Industries Pvt. Ltd.

- Brooklyn Tweed

- other key players.