Global Activewear Market Size, Share, Growth Analysis By Product Type (Footwear, Apparel, Accessories), By Usage (Recreational activities, Yoga & pilates, Gym & fitness training, Running, Outdoor sports, Others), By Consumer Group (Female, Male, Kids), By Pricing (Medium, Low, High), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 60532

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

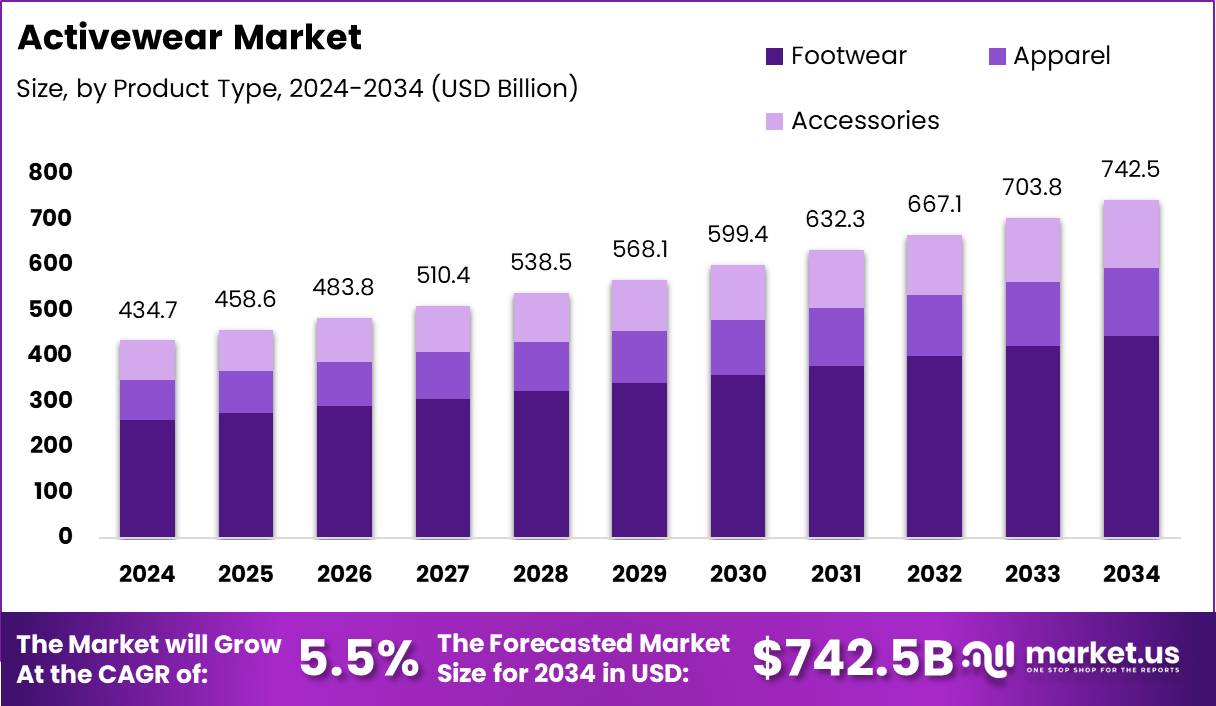

The Global Activewear Market size is expected to be worth around USD 742.5 Billion by 2034, from USD 434.7 Billion in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034.

Activewear encompasses clothing specifically crafted for physical activities like exercise, sports, or outdoor pursuits, yet versatile enough for casual, everyday wear. These garments typically feature advanced fabrics with properties such as moisture-wicking, breathability, and flexibility.

The athleisure trend, which merges functionality with fashion, has broadened activewear’s appeal, establishing it as an essential component of contemporary wardrobes.

A notable shift toward healthier lifestyles and increased fitness activity participation is fuelling demand for comfortable and functional activewear in the country.

Health and wellness are becoming top priorities, with rising awareness of physical activity’s role in overall well-being further supporting this trend. This strong commitment to physical fitness is driving activewear demand and contributing significantly to market growth.

- Data from the Health & Fitness Association shows that over 64 million Americans have gym memberships, with 23 out of every 100 people holding memberships at multiple gyms. The average membership duration is about 4.7 years, indicating a retention rate of roughly 60%.

- According to Sports Destination Management, in 2023, approximately 242 million people in the United States—representing nearly 80% of all Americans aged 6 and older—engaged in at least one sports or fitness activity.

The athleisure trend, which merges sportswear with casual wear, has greatly expanded the appeal of activewear. Advances in fabric technology and sustainable materials are attracting environmentally conscious consumers, accelerating market growth. Demand for activewear is rising across diverse demographics, fueled by lifestyle shifts toward comfort and functionality.

The post-pandemic increase in home workouts and hybrid work setups has led consumers to favor versatile clothing that balances performance with everyday comfort. Younger generations, especially millennials and Gen Z, show strong interest in stylish, performance-driven apparel, influenced by social media and influencer marketing.

Emerging markets present significant opportunities for growth in activewear, with rising disposable incomes and health awareness. Sustainability is also a key area, as brands investing in eco-friendly materials and ethical production practices can appeal to the growing base of eco-conscious consumers.

Additionally, technological advancements, including wearable tech and smart fabrics, offer pathways for differentiation and premium positioning in this competitive market.

Key Takeaways

- The Global Activewear Market is projected to reach USD 742.5 Billion by 2034, up from USD 434.7 Billion in 2024, growing at a CAGR of 5.5%.

- In 2024, Footwear dominated the product type segment with a 44.2% market share, driven by fitness trends and the rise of athleisure.

- Recreational activities led the usage segment in 2024 with an 18.6% share, reflecting demand for comfortable and casual activewear.

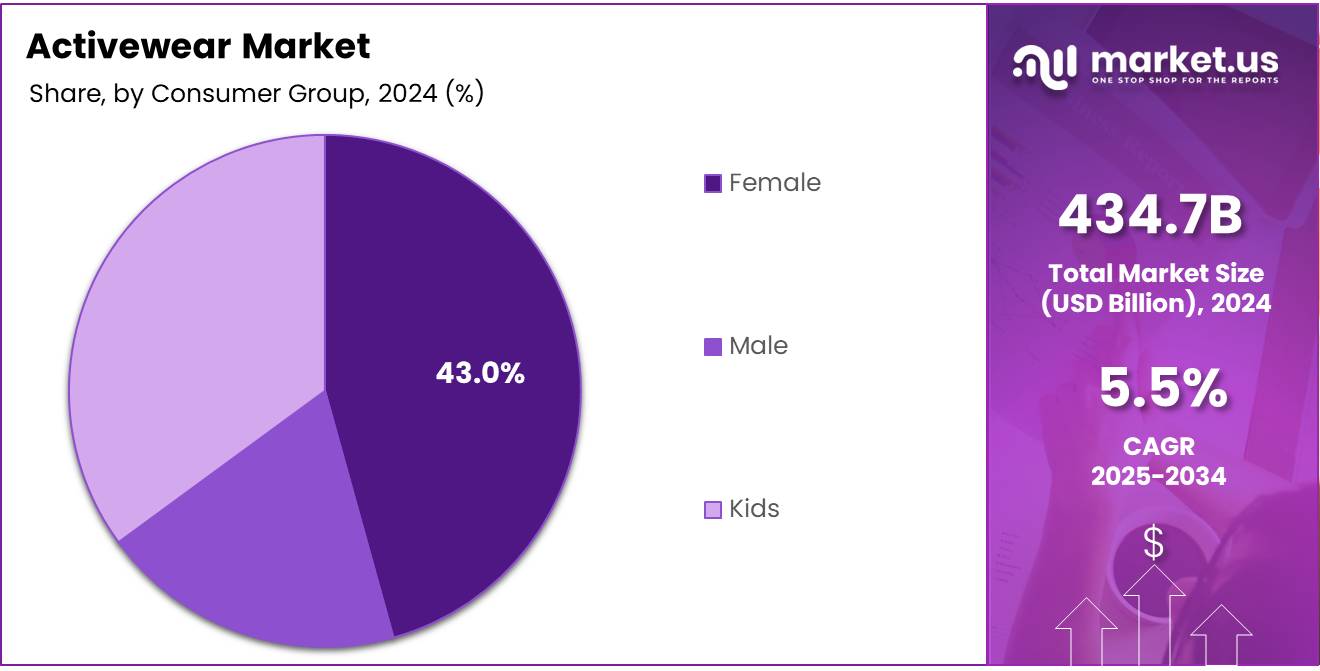

- Female consumers held a dominant 46.2% market share in 2024, fueled by wellness campaigns and inclusive fashion.

- The Medium pricing tier led in 2024 with a 37.9% share, balancing performance and affordability.

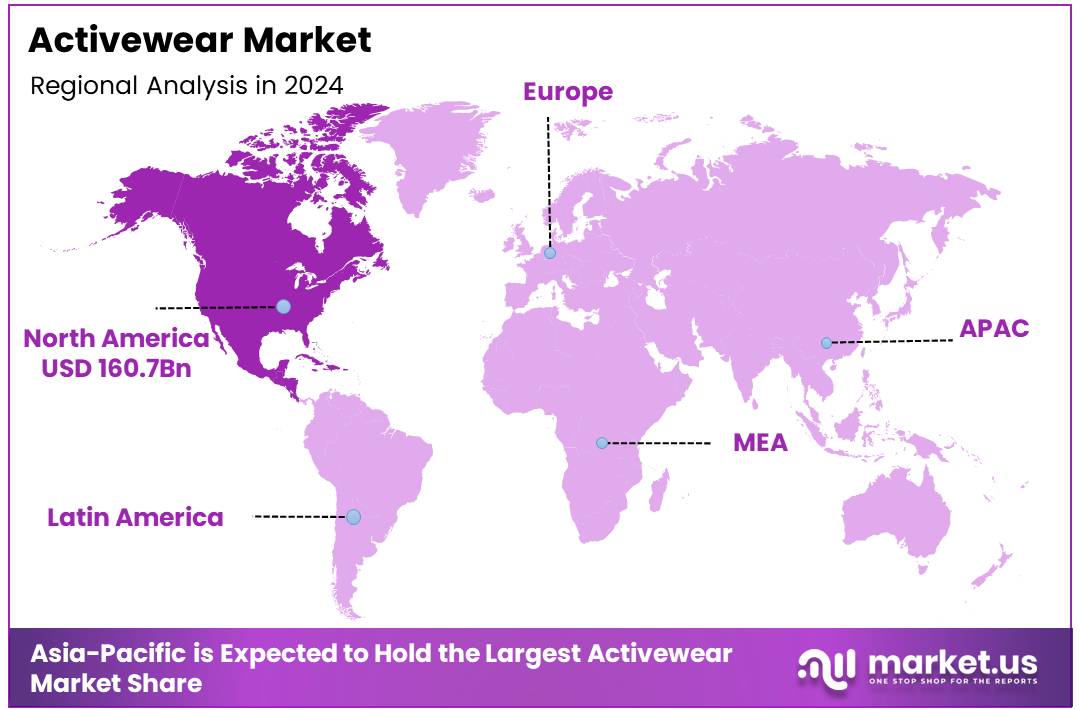

- North America was the top regional market in 2024, holding a 39.6% share valued at USD 160.7 Billion, supported by health-conscious consumers and strong retail infrastructure.

Product Type Analysis

Footwear leads with 44.2% due to high consumer demand and performance focus.

In 2024, Footwear held a dominant market position in By Product Type Analysis segment of Activewear Market, with a 44.2% share. The category’s leadership is largely attributed to increasing interest in fitness and sports-related activities, where performance-oriented and comfortable footwear is a primary requirement. The rise of athleisure culture has also driven more consumers toward stylish yet functional shoes.

Apparel continues to follow closely, with sustained demand for breathable, flexible, and durable fabrics. As consumers shift to hybrid lifestyles that blur the line between casual and active wear, brands offering multi-functional activewear are seeing growth.

Accessories represent a smaller yet steadily growing segment. Items such as fitness trackers, socks, headbands, and compression gear are gaining traction as complementary products, helping consumers enhance their performance and comfort during workouts.

Usage Analysis

Recreational activities dominate with 18.6% due to growing preference for casual movement and wellness.

In 2024, Recreational activities held a dominant market position in By Usage Analysis segment of Activewear Market, with a 18.6% share. Consumers increasingly seek comfortable, everyday activewear that supports light activities like walking, casual sports, and outdoor social events, driving this category’s growth.

Yoga & Pilates have maintained steady traction, as mindfulness practices and low-impact workouts grow in popularity. The demand for flexible and stretchable fabrics in this space has created innovation opportunities for brands.

Gym & fitness training remain key contributors, driven by urban consumers engaging in regular strength and cardio routines. However, competition within this segment is intensifying with the rise of at-home workout trends.

Running and outdoor sports also form a substantial part of the market, with growing interest in marathons, trail running, and team sports. Meanwhile, the ‘Others’ category captures a niche yet important group of varied physical activities gaining slow but steady interest.

Consumer Group Analysis

Female consumers lead with 46.2% thanks to rising focus on active lifestyles and wellness.

In 2024, Female held a dominant market position in By Consumer Group Analysis segment of Activewear Market, with a 46.2% share. The surge in women-centric wellness campaigns and inclusive fashion trends has played a key role in this dominance. Brands are catering to female consumers with collections that combine aesthetics, function, and comfort.

Male consumers follow as a significant segment, consistently contributing to demand for performance-based and durable activewear. Product lines that emphasize muscle support, breathability, and minimalistic designs remain strong within this group.

Kids’ activewear is an emerging space, gaining attention from parents focused on promoting fitness and outdoor play. Although smaller in share, this group is poised for growth with increasing availability of age-specific, comfortable, and durable options.

Pricing Analysis

Medium-priced activewear leads with 37.9% driven by balance between quality and affordability.

In 2024, Medium held a dominant market position in By Pricing Analysis segment of Activewear Market, with a 37.9% share. This tier has found a sweet spot with consumers seeking high-performance products without premium costs. The segment benefits from a wide variety of brands offering innovation, sustainability, and design at a mid-range price.

Low-priced activewear continues to appeal to budget-conscious shoppers. The segment thrives in price-sensitive markets where cost-efficiency outweighs technical features. Mass-market retailers and online platforms are major drivers in this space.

High-priced activewear caters to a more niche audience that values brand prestige, cutting-edge technology, and exclusive designs. While its share is lower, the luxury and premium segment is growing with demand from fashion-forward and fitness-focused consumers willing to invest in top-tier performance wear.

Key Market Segments

By Product Type

- Footwear

- Apparel

- Accessories

By Usage

- Recreational activities

- Yoga & pilates

- Gym & fitness training

- Running

- Outdoor sports

- Others

By Consumer Group

- Female

- Male

- Kids

By Pricing

- Medium

- Low

- High

By Distribution Channel

- Offline

- Online

Drivers

Rising Health and Fitness Awareness

The global activewear market is witnessing substantial growth, primarily fuelled by the rising awareness of health and fitness among consumers. This heightened focus on well-being has led to an increase in physical activity participation, including running, yoga, and gym workouts, driving demand for performance-driven apparel.

Consumers are increasingly seeking clothing that offers both support for their active routines and comfort in daily wear. As wellness becomes a top priority, individuals are incorporating regular exercise into their lifestyles, further propelling market growth.

Additionally, the integration of technology, such as wearable fitness devices and apps, has enhanced this trend. These technologies offer users real-time insights into their physical activities, motivating them to stay active and, in turn, elevating the demand for appropriate activewear.

The combination of growing health awareness and technological innovation is fostering a strong demand for activewear, positioning the market for sustained growth in the years ahead.

- According to American College of Sports Medicine, in 2023, there were 850 million fitness app downloads by nearly 370 million users.

- As per statistics, fewer than 5% of adults engage in 30 minutes of physical activity daily.

Restrains

Market Saturation and Intense Competition

While the activewear market is on a positive growth path, it faces notable challenges due to market saturation and intense competition. The abundance of brands offering similar products has created a crowded landscape, making it challenging for new players to establish a presence.

Established brands are constantly innovating and expanding their product lines, raising entry barriers for newcomers.

This saturation limits growth opportunities for emerging companies and puts pressure on existing ones to stand out through distinct value propositions, innovative designs, or exceptional quality.

Additionally, fierce competition has spurred aggressive pricing strategies, compressing profit margins across the industry.

Companies are increasingly investing in marketing and brand-building efforts to retain or expand their market share, which can place strain on financial resources. This competitive atmosphere demands ongoing innovation and strategic foresight to overcome challenges and drive sustainable growth in the activewear market.

Opportunities

Integration of Digital Health is Presenting Growth Opportunities

The integration of digital health technologies is opening new growth opportunities in the global activewear market. With the rise of wearable health devices, fitness apps, and smart clothing, consumers can now monitor their health metrics, including heart rate, steps, sleep quality, and more.

This trend is fuelling demand for activewear that not only offers comfort and functionality but also supports digital connectivity.

Brands are increasingly embedding sensors and other tracking features into activewear, enabling users to gain real-time insights into their physical activities and overall wellness. This synergy between fitness and technology enhances the appeal of activewear, particularly among tech-savvy and health-conscious consumers.

Additionally, the emphasis on personalized fitness regimes is driving demand for activewear tailored to individual health goals, creating opportunities for brands to differentiate and innovate. This digital integration thus represents a significant growth lever, meeting evolving consumer expectations and driving forward the activewear market.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the global activewear market. Economic conditions such as inflation, fluctuating currency rates, and shifting disposable incomes can impact consumer spending on non-essential items like activewear, particularly in price-sensitive markets.

During economic downturns, consumers may prioritize essential goods over discretionary spending, affecting activewear sales. Geopolitical events, such as trade tensions and supply chain disruptions, also play a crucial role.

For instance, tariffs or restrictions on imports from key manufacturing hubs like China or Vietnam can increase production costs for activewear brands, leading to potential price increases for consumers.

Additionally, raw material shortages or shipping delays may hinder product availability, impacting retail and e-commerce channels. These macroeconomic and geopolitical factors create uncertainties for companies in the activewear market, making it essential for brands to adopt flexible supply chains, monitor global trends closely, and consider regional diversification strategies to manage risks and maintain resilience.

Latest Trends

The global activewear market is witnessing dynamic shifts driven by evolving consumer preferences and technological advancements. One prominent trend is the rise of athleisure, where versatile clothing blurs the line between athletic and casual wear, allowing consumers to seamlessly transition from the gym to daily life.

Sustainability is also a major focus, with brands increasingly turning to eco-friendly materials and ethical production processes to attract environmentally conscious consumers.

Technological integration is enhancing product functionality, with features like moisture-wicking fabrics, UV protection, and even embedded sensors for health monitoring. Customization has become another key trend, as consumers seek personalized options tailored to fit and style preferences.

Additionally, social media platforms and influencer partnerships are shaping purchasing decisions, amplifying the impact of fitness and fashion influencers on brand visibility and consumer choices. These trends are redefining activewear, positioning it as both a lifestyle statement and a performance-driven necessity.

Regional Analysis

North America Dominates the Activewear Market with a Market Share of 39.6%, Valued at USD 160.7 Billion

North America leads the global activewear market, accounting for a substantial 39.6% market share and valued at USD 160.7 Billion. This dominance is driven by rising health awareness, a strong culture of fitness, and a well-established athleisure trend. High disposable income and the presence of advanced distribution channels further contribute to the region’s robust market performance.

Europe Activewear Market Overview

Europe remains a significant contributor to the activewear market, supported by a growing focus on wellness and sustainability in fashion. Urban consumers increasingly prefer performance-oriented yet stylish apparel for both workouts and daily wear. Additionally, initiatives promoting outdoor fitness and athletic lifestyles enhance regional demand.

Asia Pacific Activewear Market Trends

Asia Pacific is witnessing rapid growth in the activewear sector, propelled by expanding middle-class populations and rising fitness consciousness. Urbanization and the increasing popularity of home workouts and yoga are influencing activewear purchases. The market is also benefiting from digital retail expansion across emerging economies.

Middle East and Africa Activewear Market Insights

The Middle East and Africa activewear market is experiencing gradual growth, driven by increased participation in fitness activities and growing investments in sports infrastructure. Cultural shifts toward health and wellness are encouraging more consumers to adopt active lifestyles, creating opportunities for sportswear and athleisure brands.

Latin America Activewear Market Analysis

Latin America shows promising potential in the activewear industry as fitness trends continue to gain momentum. An increasing number of fitness clubs, sports events, and wellness campaigns are driving consumer interest. While still developing, the region benefits from youth-oriented fashion trends and growing online retail access.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Activewear Company Insights

In 2024, the global activewear market is witnessing strong performance from leading players who continue to drive innovation, sustainability, and brand loyalty.

Adidas AG remains a top contender with its focus on eco-friendly materials and cutting-edge design collaborations, strengthening its appeal among environmentally conscious consumers. ASICS Corporation continues to capitalize on its reputation for high-performance athletic footwear, with growing interest in its technical advancements and targeted expansion in the Asia-Pacific region.

Hanesbrands Inc. is making strides by enhancing its product lines with comfort-focused innovations and increasing its digital presence, which resonates well with the growing athleisure trend. Nike Inc. retains its dominant position through strategic marketing, athlete endorsements, and strong omnichannel retail strategies, all while pushing boundaries in innovation and inclusivity.

Other notable competitors, such as Puma SE and Under Armour, are also elevating their game, but the top four companies are setting the benchmark for growth, branding, and consumer engagement in the activewear sector. Their ability to adapt to market shifts, integrate sustainability, and invest in product development ensures they remain at the forefront of the global activewear landscape.

Top Key Players in the Market

- Adidas AG

- ASICS Corporation

- Hanesbrands Inc.

- Nike Inc.

- PUMA SE

- PVH Corp.

- Skechers U.S.A., Inc.

- The Columbia Sportswear Company

- Under Armour, Inc.

- VF Corporation

Recent Developments

- In October 2024, S&S Activewear completed the acquisition of alphabroder, forming one of the largest apparel wholesale companies in North America.

This strategic move aims to enhance their product range, distribution capabilities, and market reach. - In June 2025, activewear brand TALA secured £5 million in funding from major investors to fuel product innovation and international expansion.

The investment reflects growing confidence in sustainable fashion and TALA’s market potential. - In May 2025, BlissClub raised Rs 45 Cr in a mixed funding round led by Elevation Capital, with participation from existing investors.

The funds will be used to scale operations, expand product offerings, and strengthen the brand’s presence in India.

Report Scope

Report Features Description Market Value (2024) USD 434.7 Billion Forecast Revenue (2034) USD 742.5 Billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Footwear, Apparel, Accessories), By Usage (Recreational activities, Yoga & pilates, Gym & fitness training, Running, Outdoor sports, Others), By Consumer Group (Female, Male, Kids), By Pricing (Medium, Low, High), By Distribution Channel (Offline, Online) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Adidas AG, ASICS Corporation, Hanesbrands Inc., Nike Inc., PUMA SE, PVH Corp., Skechers U.S.A., Inc., The Columbia Sportswear Company, Under Armour, Inc., VF Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Adidas AG

- Nike Inc.

- PUMA SE

- The Columbia Sportswear Company

- VF Corporation

- PVH Corp.

- ASICS Corporation

- Skechers U.S.A., Inc.

- Under Armour, Inc.

- Hanesbrands Inc.