Global Synthetic Fibers Market By Type (Polyester, Nylon, Acrylics, Polyolefin, Others), By Application (Clothing, Home Furnishing, Automotive, Filtration, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 141278

- Number of Pages: 346

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

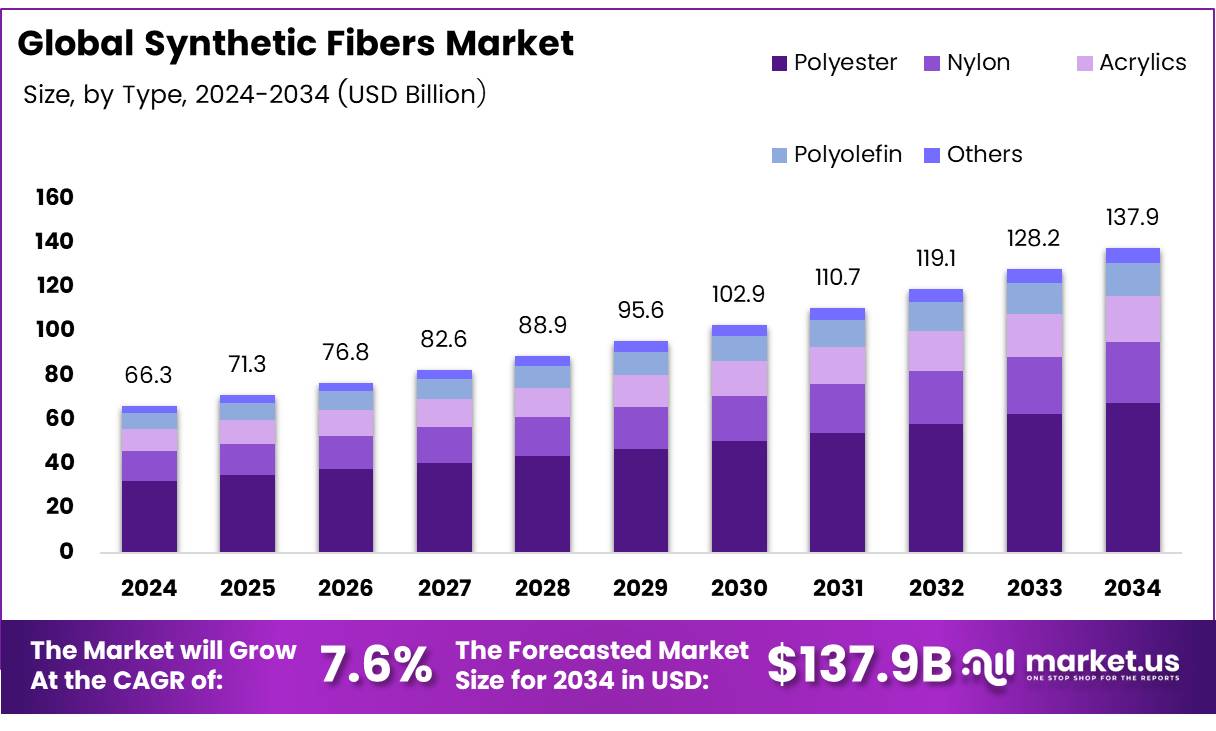

The Global Synthetic Fibers Market size is expected to be worth around USD 137.9 Billion by 2034, from USD 66.3 Billion in 2024, growing at a CAGR of 7.6% during the forecast period from 2025 to 2034.

The synthetic fibers market has established itself as a cornerstone in the textile industry, accounting for a substantial share of global textile production. According to FashionDive, synthetic fibers currently account for 69% of textile production, with expectations for this share to rise to 73% by 2030, as reported by Changing Markets. This shift highlights the growing demand for synthetic materials driven by their versatility, durability, and cost-effectiveness compared to natural fibers.

Synthetic fibers, such as polyester, nylon, and acrylic, dominate various applications, including apparel, home textiles, and industrial products, due to their high-performance qualities like resistance to moisture, heat, and abrasion.

The expansion of synthetic fiber production is particularly evident in key markets like India, where production volume in fiscal year 2023 reached nearly four million metric tons, according to Recent Study. This growth can be attributed to the increasing adoption of synthetic fibers in mass-market textiles, coupled with advances in fiber technologies that have enhanced their applications.

Furthermore, as the production of virgin fossil-based synthetic fibers increased from 67 million tonnes in 2022 to 75 million tonnes in 2023, as noted by TextileExchange, it becomes evident that synthetic fibers are poised for continued growth globally, expanding into new sectors and applications.

The synthetic fibers market is experiencing robust growth, driven by rising consumer demand for affordable, durable, and versatile fabrics. As synthetic fibers continue to penetrate a broader range of industries, opportunities emerge in both established and emerging markets.

Governments worldwide are investing in sustainable fiber technologies, aiming to reduce the environmental footprint of synthetic materials. With innovations such as bio-based and recycled synthetic fibers gaining traction, there is significant potential for new market entrants to capitalize on this transition.

Regulations also play a pivotal role in shaping the market dynamics, particularly in relation to environmental concerns surrounding plastic waste and sustainability. As global regulations tighten, manufacturers are under increasing pressure to adopt greener technologies and processes.

Several governments have introduced incentives and grants to support the development of eco-friendly synthetic fiber production methods. For instance, the rise of initiatives aimed at increasing the use of recycled polyester and bio-based materials presents an opportunity for companies to align with sustainability trends while meeting market demand.

Key Takeaways

- The global synthetic fibers market is projected to reach USD 137.9 billion by 2034, growing at a CAGR of 7.6%.

- Polyester held a dominant 48.7% share in the synthetic fibers market in 2024, driven by its versatility and cost-effectiveness.

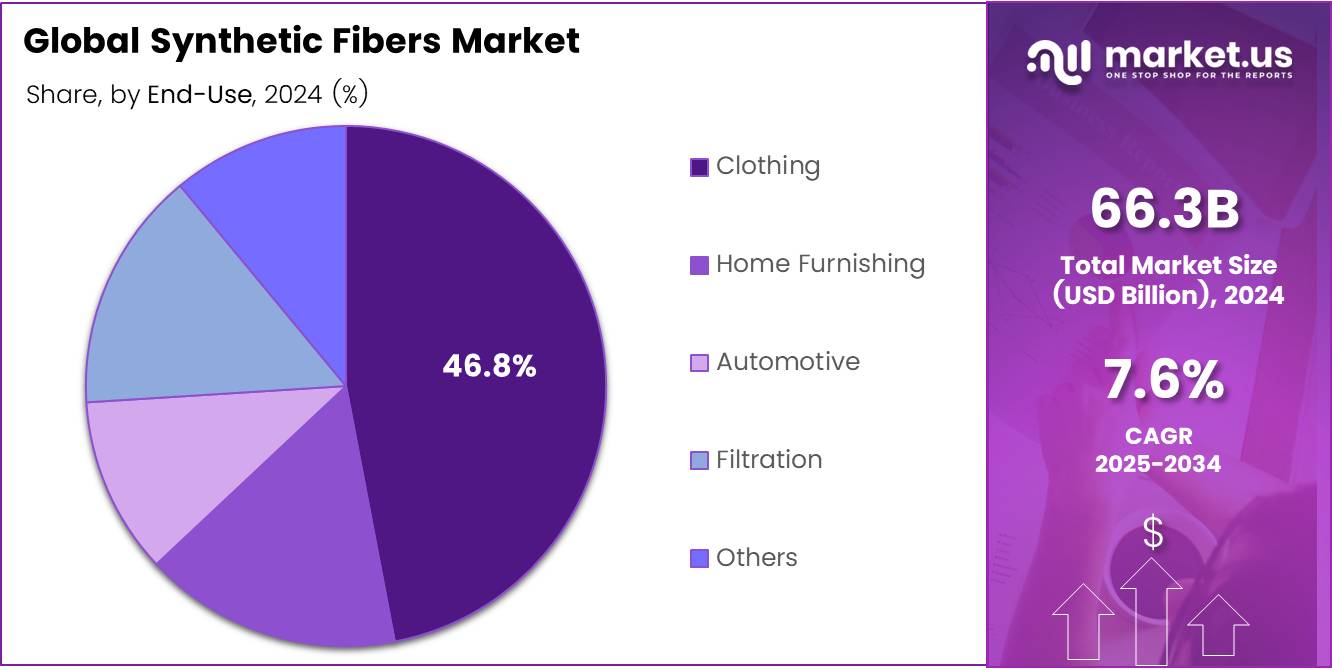

- The clothing segment accounted for 46.8% of the synthetic fibers market in 2024, driven by the extensive use of polyester, nylon, and acrylic in apparel.

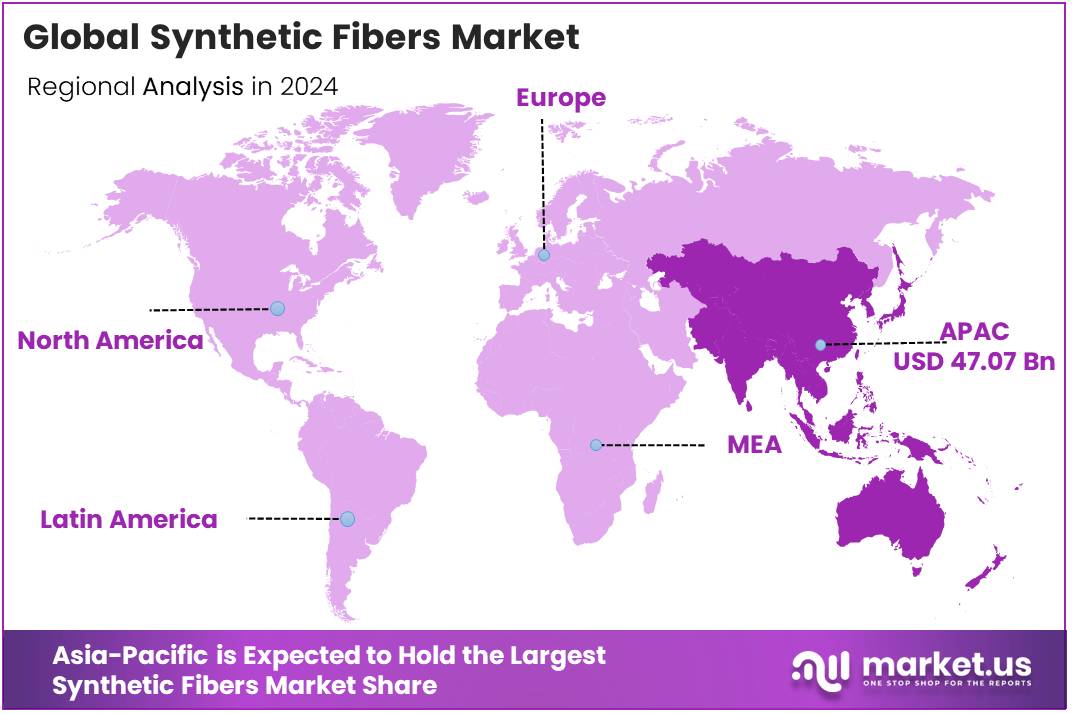

- The Asia-Pacific region dominated the market in 2024, holding 71.3% of the global share, valued at USD 47.07 billion.

Type Analysis

Polyester Leads Synthetic Fibers Market with 48.7% Share in 2024, Driven by Versatility and Cost Efficiency

In 2024, polyester maintained a dominant market position in the By Type Analysis segment of the Synthetic Fibers Market, commanding a significant 48.7% share. This dominance can be attributed to the material’s versatility, cost-effectiveness, and widespread applicability across various industries.

Polyester fibers are widely used in textiles, apparel, and home furnishings due to their durability, resistance to wrinkles, and ease of maintenance, making them a preferred choice for both manufacturers and consumers.

Nylon, while second in the segment with a notable share, holds its ground due to its strength, elasticity, and resistance to abrasion, making it suitable for high-performance applications such as industrial and automotive sectors. Acrylic fibers, contributing to a smaller portion of the market, continue to see demand in products like outdoor furniture and carpets due to their softness and color retention.

Polyolefin fibers, with applications ranging from medical textiles to geotextiles, are gaining traction for their low density and chemical resistance. The Others category includes various synthetic fibers with specialized applications, though their share remains limited compared to the major types. Overall, polyester’s consistent growth and broad utility position it as the leader in this segment.

Application Analysis

Clothing Segment Dominates Synthetic Fibers Market with 46.8% Share in 2024

In 2024, the clothing segment held a dominant position in the By Application Analysis category of the synthetic fibers market, with a significant share of 46.8%. This commanding market presence can be attributed to the widespread use of synthetic fibers such as polyester, nylon, and acrylic in the production of apparel.

The versatility of synthetic fibers in terms of cost, durability, and ease of care has led to their widespread adoption in both mass-market and high-end clothing lines. Additionally, synthetic fibers’ ability to be engineered for specific attributes such as moisture-wicking, breathability, and stretchability has enhanced their appeal in the fashion and sportswear industries.

The home furnishing segment followed closely, driven by the demand for synthetic fibers in products like upholstery, carpets, and curtains. While automotive and filtration applications are also prominent, they hold comparatively smaller market shares due to their more niche requirements.

Despite these smaller segments, the demand for synthetic fibers across these industries continues to grow steadily, driven by technological advancements and the increasing need for specialized materials.

Overall, the clothing segment remains the largest and most influential, supporting the continued growth of the synthetic fibers market.

Key Market Segments

By Type

- Polyester

- Nylon

- Acrylics

- Polyolefin

- Others

By Application

- Clothing

- Home Furnishing

- Automotive

- Filtration

- Others

Drivers

Rising Demand for Affordable and Durable Fabrics Drives Synthetic Fibers Market Growth

The growth of the synthetic fibers market is largely attributed to the increasing demand for affordable and durable fabrics. Compared to natural fibers, synthetic options like polyester, nylon, and acrylic are more cost-effective and offer superior durability, which makes them appealing to both manufacturers and consumers. This affordability combined with their ability to withstand wear and tear has made synthetic fibers the preferred material in various industries, especially the textile sector.

Moreover, advancements in fiber technology continue to fuel market expansion by introducing high-performance and multifunctional fibers that meet evolving consumer needs. Research into new synthetic fiber compositions has led to the development of materials with enhanced properties such as water resistance, flame retardancy, and greater elasticity, further boosting their appeal.

The ongoing growth of the global textile industry, particularly in emerging markets, also plays a significant role in driving the demand for synthetic fibers. Additionally, urbanization and changing consumer lifestyles, marked by a shift toward modern, low-maintenance home decor and fashion, have contributed to the rising adoption of synthetic materials. As a result, these factors collectively support the continuous growth of the synthetic fibers market, making it a key sector in the broader textile and manufacturing industries.

Restraints

Environmental Impact and Waste Management Challenges Pose Risks to Synthetic Fibers Market Growth

The synthetic fibers market faces several challenges that may hinder its growth, particularly concerning environmental concerns and waste management. Many synthetic fibers, such as polyester and nylon, are derived from non-biodegradable plastics, which contribute to long-term environmental pollution.

The production and disposal of these fibers create substantial waste, which can lead to microplastic contamination in oceans and ecosystems, causing growing concerns among consumers and environmental organizations.

These factors are likely to prompt stricter regulations around the production and disposal of synthetic fibers, potentially limiting their use. Furthermore, the volatility in raw material prices, especially petroleum, which is a key input for many synthetic fibers, adds another layer of uncertainty.

Fluctuating prices of oil can result in price instability for synthetic fibers, thereby impacting the overall production costs and availability. This price volatility may also affect the profitability of manufacturers, further contributing to the pressure on market growth.

The combined effect of environmental concerns, stricter regulations, and raw material price instability presents a complex set of challenges for the synthetic fibers market. While demand for synthetic fibers continues in various industries, these factors could reduce their appeal, particularly among environmentally-conscious consumers and industries moving toward more sustainable alternatives.

Growth Factors

Development of Biodegradable Synthetic Fibers Opens New Growth Opportunities

The synthetic fibers market is poised for significant growth through innovations in eco-friendly materials. With increasing environmental concerns, the development of biodegradable synthetic fibers presents a promising avenue for sustainable solutions.

These fibers address the rising demand for green products and respond to regulatory pressures surrounding sustainability. The growing consumer preference for eco-conscious brands and materials is driving investment in this area, particularly within industries such as fashion and packaging.

Moreover, biodegradable fibers offer potential applications in sectors where traditional fibers have faced environmental criticism, such as in textiles and medical products. Companies investing in research and development to create sustainable synthetic fibers stand to gain a competitive edge as governments and consumers alike prioritize eco-friendly alternatives.

This growth opportunity is not only environmentally responsible but also aligns with the shift toward circular economy practices, where materials are designed to be reused or safely degraded over time. As such, this emerging trend holds substantial promise for shaping the future of the synthetic fibers market, offering both commercial potential and solutions to pressing environmental issues.

Emerging Trends

Rising Demand for Smart and Wearable Technology Spurs Synthetic Fiber Innovation

The synthetic fibers market is experiencing growth driven by several key factors. One of the primary trends is the increasing use of synthetic fibers in smart textiles and wearable technology. The integration of sensors, conductive fibers, and other electronic components into textiles is fueling the demand for more advanced synthetic materials.

Additionally, the rising interest in functional textiles is pushing the market for synthetic fibers that offer specialized properties such as UV protection, anti-bacterial features, and moisture-wicking capabilities, especially for sports and activewear applications.

Another significant trend is the growing popularity of synthetic fiber blends, where fibers like polyester or nylon are combined with natural fibers such as cotton or wool to create fabrics that leverage the benefits of both materials.

This approach enhances the functionality, durability, and aesthetic appeal of the fabrics. Furthermore, the demand for lightweight and breathable materials is surging in sectors like activewear, outdoor clothing, and footwear.

These materials provide comfort and performance while maintaining a low weight, which is increasingly sought after by consumers. Collectively, these trends are shaping the future of the synthetic fibers market, with innovation and product diversification at the forefront of industry growth.

Regional Analysis

Asia-Pacific dominates the synthetic fibers market with 71.3% share and USD 47.07 billion

The synthetic fibers market is predominantly driven by the Asia-Pacific region, which holds a commanding share of 71.3%, equating to a market value of USD 47.07 billion. This dominance can be attributed to the region’s robust manufacturing base, particularly in China and India, where synthetic fiber production is significantly integrated with textile and apparel industries.

The growing demand for cost-effective, high-performance fabrics in the region has spurred the expansion of synthetic fiber production capacity, making Asia-Pacific the undisputed leader in global market share.

Regional Mentions:

In North America, the synthetic fibers market is poised for steady growth, underpinned by rising demand in industries such as automotive, textiles, and packaging. The region’s market value is bolstered by the presence of key players in the U.S. and Canada, where technological advancements in fiber production and strong industrial applications are contributing to market expansion.

Europe holds a significant share in the synthetic fibers market, with countries such as Germany, Italy, and the UK leading in terms of production and consumption. The region is experiencing steady growth, driven by demand from the automotive and home textiles sectors. Sustainability trends have prompted manufacturers in Europe to focus on eco-friendly synthetic fiber solutions, which has led to the development of biodegradable and recycled synthetic fibers, further bolstering the market in the region.

The Middle East & Africa and Latin America regions are expected to exhibit moderate growth due to emerging demand in industrial applications, with Latin America seeing increased adoption of synthetic fibers in textile production. However, these regions remain small players in the global market compared to Asia-Pacific, North America, and Europe, primarily due to a lack of extensive production infrastructure.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global synthetic fibers market is poised to witness significant growth, driven by the continued dominance of key players who are well-positioned to capitalize on evolving consumer preferences and advancements in manufacturing technologies. Among these, Bombay Dyeing, Toray Chemical Korea, and Indorama Corporation are set to play pivotal roles in shaping market dynamics.

Bombay Dyeing, with its extensive presence in India, is leveraging its established brand recognition and robust supply chain to expand its footprint in synthetic fiber production, catering to both domestic and international markets. Its focus on quality and sustainable practices aligns with the growing demand for eco-friendly synthetic fibers, which is anticipated to boost its market share in the coming years.

Toray Chemical Korea, a leader in the production of high-performance fibers, is expected to maintain a competitive edge by focusing on innovation in high-tenacity fibers and environmentally sustainable production methods. The company’s strong research and development capabilities position it well to meet the rising demand for specialized synthetic fibers in industries such as automotive, healthcare, and textiles.

Indorama Corporation, a global leader in polyester production, continues to benefit from its vast production capacity and integrated value chain. As demand for polyester-based fibers rises, driven by their cost-effectiveness and versatility, Indorama’s dominance in the market is expected to persist. Furthermore, the company’s investments in sustainability initiatives are likely to resonate with environmentally conscious consumers and stakeholders, enhancing its reputation.

Other major players, such as Reliance Industries Limited and Lenzing AG, are expected to maintain strong positions by capitalizing on their diverse product offerings and commitment to innovation in the synthetic fibers sector. Together, these key players are well-positioned to drive growth and contribute to the continued evolution of the global synthetic fibers market.

Top Key Players in the Market

- Bombay Dyeing

- Toray Chemical Korea, Inc.

- Toyobo Co., Ltd.

- E. I. du Pont de Nemours and Company

- Indorama Corporation

- Reliance Industries Limited

- China Petroleum Corporation

- Lenzing AG

- Mitsubishi Chemical Holdings Corporation

- Teijin Limited

Recent Developments

- In August 2024, Shinkong Synthetic Fibers announced a $10 million investment in the Ambercycle facility to enhance the production of sustainable fibers using innovative recycling technologies.

- In August 2024, Tandem Repeat secured a $1.5 million grant from the U.S. Department of Defense (DoD) to scale its production of protein-based fibers, advancing eco-friendly materials for military applications.

- In December 2024, London-based biotech firm Solena Materials received new grant funding to collaborate with the National Physical Laboratory (NPL) on characterizing novel materials with groundbreaking properties for industrial applications.

Report Scope

Report Features Description Market Value (2024) USD 66.3 Billion Forecast Revenue (2034) USD 137.9 Billion CAGR (2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Polyester, Nylon, Acrylics, Polyolefin, Others), By Application(Clothing, Home Furnishing, Automotive, Filtration, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bombay Dyeing, Toray Chemical Korea, Inc., Toyobo Co., Ltd., E. I. du Pont de Nemours and Company, Indorama Corporation, Reliance Industries Limited, China Petroleum Corporation, Lenzing AG, Mitsubishi Chemical Holdings Corporation, Teijin Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bombay Dyeing

- Toray Chemical Korea, Inc.

- Toyobo Co., Ltd.

- E. I. du Pont de Nemours and Company

- Indorama Corporation

- Reliance Industries Limited

- China Petroleum Corporation

- Lenzing AG

- Mitsubishi Chemical Holdings Corporation

- Teijin Limited