Global Costume Jewelry Market Size, Share, Growth Analysis By Product Type (Necklaces and Chains, Rings, Earrings, Bracelets, Cufflinks and Studs, Others), By Material Type (Metal, Plastic, Stones, Glass, Others), By Gender (Male, Female, Unisex), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135233

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Business Environment Analysis

- Type Analysis

- Material Type Analysis

- Gender Analysis

- Distribution Channel Analysis

- Key Market Segments

- Adjacent Markets Analysis

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Emerging Trends

- Regional Analysis

- Competitive Landscape

- Recent Developments

- Report Scope

Report Overview

The Global Costume Jewelry Market size is expected to be worth around USD 63.5 Billion by 2033, from USD 30.8 Billion in 2023, growing at a CAGR of 7.5% during the forecast period from 2024 to 2033.

Costume jewelry refers to fashion accessories made from non-precious materials. Unlike fine jewelry, it uses metals like base metals, glass, and synthetic gemstones. These pieces are designed to complement outfits and trends, offering affordable and stylish options for consumers seeking variety without high costs.

The costume jewelry market encompasses the production, distribution, and sale of fashion-oriented jewelry items. It includes retailers, manufacturers, and designers who create accessible and trendy accessories.

In 2024, the costume jewelry market showcases a vibrant blend of style and affordability, making it an attractive option for consumers. For instance, Pearls have made a comeback, notably featured in high-profile collections like Giorgio Armani’s Autumn/Winter 2024/2025. Additionally, Signet Jewelers anticipates a 10% increase in sales due to a surge in wedding engagements.

Costume jewelry is marked by its accessibility and wide range of designs, which cater to diverse consumer tastes and budgets. Factors such as rising disposable incomes and fashion industry trends substantially influence market dynamics. For instance, in the U.S., a 3% annual increase in real disposable personal income has bolstered consumer purchasing power, despite ongoing inflationary challenges.

Government regulations and investment in economic stability further reinforce the costume jewelry market’s growth. For instance, the U.S. Department of Commerce reports that consistent income growth has not only supported economic stability but has also encouraged higher consumer spending levels. This environment fosters both opportunity and competition within the market, influencing local and broader scale market dynamics.

Key Takeaways

- The Costume Jewelry Market was valued at USD 30.8 billion in 2023 and is expected to reach USD 63.5 billion by 2033, with a CAGR of 7.5%.

- In 2023, Rings dominated the product type segment with 36.2% due to their high popularity and versatility across demographics.

- In 2023, Metal led the material type segment owing to its durability and aesthetic appeal in costume jewelry designs.

- In 2023, Female consumers accounted for 60.7%, showcasing strong preference and higher purchasing power in this market.

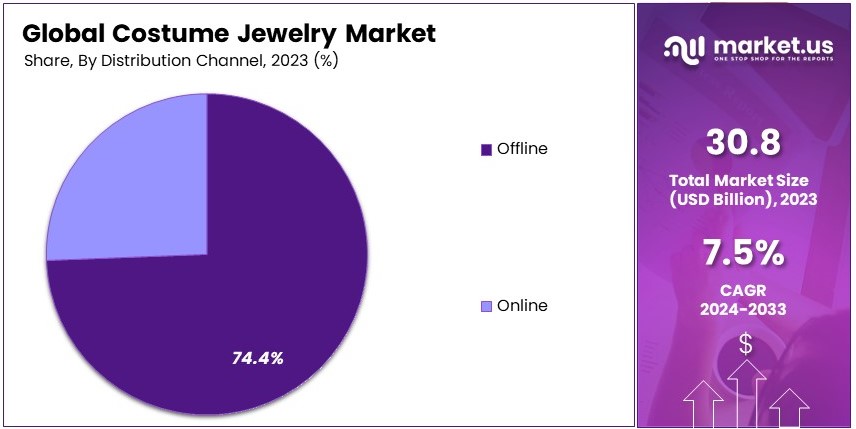

- In 2023, Offline stores captured 74.4%, highlighting the importance of physical shopping experiences in jewelry purchases.

- In 2023, Asia Pacific dominated the regional market with 33.8%, driven by a growing middle-class population and rising disposable incomes.

Business Environment Analysis

The costume jewelry market shows mixed levels of saturation depending on regions. Mature markets like the U.S. and Europe face intense competition, while emerging markets like China are expanding. For instance, according to a JP Morgan survey, China’s retail sales in jewelry grew by 48% in early 2023, signaling room for further growth.

Consumers in the costume jewelry segment largely include younger demographics and middle-income groups. These buyers prioritize affordability and trend-driven designs. Furthermore, rising disposable income across emerging economies broadens the target market. For example, China’s total retail sales increased by 17% in early 2023, reflecting stronger consumer purchasing power in this segment.

Product differentiation remains a key growth driver. Brands offering unique designs, eco-friendly materials, and collaborations with influencers stand out in this competitive market. Additionally, incorporating technological innovations like customizable jewelry or AR-based try-on solutions attracts tech-savvy consumers, fostering stronger brand loyalty and higher sales margins.

Value chain analysis highlights opportunities for optimization in production and distribution. Efficient sourcing of raw materials and streamlined logistics enhance cost competitiveness. Consequently, collaborations between manufacturers and local retailers boost market presence, particularly in price-sensitive regions. Meanwhile, global brands focus on direct-to-consumer strategies for higher profitability.

Investment opportunities are abundant, especially in markets embracing digital transformation. Online sales channels dominate in urban areas, while physical stores retain significance in smaller towns. Meanwhile, luxury costume jewelry brands tap into untapped markets, leveraging social media platforms to drive awareness and attract niche audiences globally.

Export-import dynamics play a significant role in market expansion. Countries like China and India, with established manufacturing bases, dominate global exports. Simultaneously, developed regions like Europe import significant quantities of costume jewelry, enhancing international trade flows and creating opportunities for diversified product portfolios.

Type Analysis

Rings dominate with 36.2% due to their versatility and wide consumer appeal.

In the costume jewelry market, the product type segment is crucial for understanding consumer preferences and purchasing patterns. The dominant sub-segment within this category is Rings, which account for 36.2% of the market. This prominence can be attributed to the wide range of designs that appeal to both traditional and contemporary tastes, making them suitable for various occasions, from everyday wear to special events.

Necklaces & Chains also hold a significant share of the market. They are essential for both casual and formal wear, often serving as statement pieces that define an outfit. Earrings follow closely, favored for their ability to complement facial features and hairstyles subtly.

Bracelets and cufflinks & studs, although smaller in market share, contribute to the overall diversity and richness of the costume jewelry spectrum. The ‘Others’ category includes items like brooches and anklets, which, while niche, are integral for catering to the varied tastes of consumers.

Material Type Analysis

Metal dominates with significant market share due to its durability and affordability.

The material type segment of the costume jewelry market reveals significant insights into consumer preferences regarding the substances used in jewelry manufacturing. Metal is the dominant sub-segment, favored for its durability, affordability, and versatility in crafting various jewelry designs. This preference underscores the market’s direction towards cost-effective yet stylish options.

Plastic and glass materials, used for their lightweight and colorful options, cater to a youthful demographic looking for trendy and disposable accessories. Stones, both precious and semi-precious, while not as dominant, are prized for their aesthetic appeal and use in more traditional or high-end costume jewelry pieces. The ‘Others’ category includes alternative materials like ceramics and textiles, which are gaining traction for their eco-friendly properties and unique textures.

Gender Analysis

Female consumers dominate the market with 60.7%, driven by a broader range of style options and frequent purchases.

Gender segmentation in the costume jewelry market highlights significant differences in consumption patterns. Women are the predominant consumers, holding 60.7% of the market. This dominance is largely due to the extensive variety of jewelry styles and the higher frequency of purchases among female consumers, who often seek to complement their wardrobe with matching jewelry pieces.

The market for male consumers, though smaller, is expanding as fashion trends increasingly cater to men’s accessories. Unisex jewelry is also seeing growth, supported by the rising trend towards gender-neutral fashion, which appeals to a broader audience seeking versatile and inclusive design options.

Distribution Channel Analysis

Offline stores dominate with 74.4% due to consumer preference for physical verification of product quality and instant ownership.

Distribution channels are a pivotal aspect of the costume jewelry market, with offline stores taking the lead by comprising 74.4% of sales. This significant share can be attributed to consumer preference for the tactile experience of shopping, which allows for physical verification of product quality and style. Furthermore, the immediate satisfaction of taking home a purchase continues to appeal to a large segment of consumers.

Online channels, though smaller in comparison, are rapidly growing. This growth is driven by the convenience of browsing extensive collections and the ease of purchase that online platforms offer. The expansion of online retail is expected to continue, bolstered by improvements in logistics, augmented reality apps that allow virtual try-ons, and increasingly tech-savvy consumers.

Key Market Segments

By Product Type

- Necklaces & Chains

- Rings

- Earrings

- Bracelets

- Cufflinks & Studs

- Others

By Material Type

- Metal

- Plastic

- Stones

- Glass

- Others

By Gender

- Male

- Female

- Unisex

By Distribution Channel

- Online

- Offline

Adjacent Markets Analysis

The Costume Jewelry Market is interconnected with several adjacent markets that contribute to its dynamic growth and evolution. These related sectors not only complement costume jewelry but also influence consumer trends and market expansion. Below are some key adjacent markets with their projected growth figures and driving factors:

- The Global Luxury Jewelry Market is set to expand from USD 47.6 billion in 2023 to USD 105.7 billion by 2033, achieving a CAGR of 8.3%. This surge is driven by increasing consumer demand for high-end, exclusive jewelry pieces.

- Rising from USD 14.3 billion in 2023, the Global Spiritual Jewelry Market is expected to reach USD 26.1 billion by 2033, growing at a CAGR of 6.2%. The growth is fueled by a heightened interest in wellness and spiritual practices.

- The Global Lab Grown Diamonds Market will grow from USD 14.2 billion in 2023 to USD 29.3 billion by 2033, with a CAGR of 7.5%. Advances in technology and ethical considerations are key drivers behind this expansion.

- Expanding from USD 4.4 billion in 2023, the Global Chalcedony Earrings Market is forecasted to reach USD 10.4 billion by 2033, growing at a CAGR of 9.0%. The trend towards unique and colorful designs significantly contributes to this growth.

- The Global Diamond Market is anticipated to increase from USD 101.9 billion in 2023 to USD 146.5 billion by 2033, expanding at a CAGR of 3.7%. Sustained demand for diamonds in both luxury and industrial applications supports this market’s steady growth.

The markets connected to the Costume Jewelry Market show strong growth and exciting opportunities. These related markets support the costume jewelry industry by offering new ideas, styles, and materials, creating a broader landscape of opportunities for businesses and investors.

Driving Factors

Rising Disposable Income Drives Market Growth

Rising disposable income is a major driver for the costume jewelry market. As people’s earnings increase, they are more willing to spend on non-essential items like fashion jewelry. Additionally, increasing fashion consciousness plays a significant role. Consumers today are more aware of fashion trends and seek to express their personal style through accessories.

Furthermore, the expansion of e-commerce platforms has made it easier for consumers to access a wide variety of costume jewelry. Online stores offer convenience, a broader selection, and competitive pricing, attracting more buyers.

Celebrity and influencer endorsements also boost market growth. When popular figures showcase certain jewelry pieces, their followers are likely to emulate their style, increasing demand. Consequently, these factors combined create a robust environment for the costume jewelry market to thrive.

Restraining Factors

High Competition and Market Saturation Restraints Market Growth

High competition and market saturation pose significant restraints to the costume jewelry market. With numerous brands entering the market, consumers have a vast array of choices, making it challenging for individual brands to stand out.

Moreover, fluctuating raw material prices can impact production costs and profit margins. When the cost of materials like metals and gemstones rises, manufacturers may struggle to maintain affordable pricing without compromising quality.

Concerns over quality and durability also restrain market growth. Consumers may hesitate to purchase costume jewelry if they fear it won’t last or meet their quality expectations. Additionally, rapidly changing fashion trends make it difficult for brands to keep up and consistently offer products that align with current styles. These challenges can lead to reduced consumer confidence and slower market growth.

Growth Opportunities

Emerging Markets Expansion Provides Opportunities

Emerging markets expansion offers significant opportunities for the costume jewelry market. As economies in regions like Asia-Pacific and Latin America grow, more consumers gain access to disposable income, increasing their ability to purchase fashion accessories.

Additionally, technological advancements in design allow brands to create innovative and attractive jewelry pieces that cater to diverse tastes. Customization and personalization trends also present growth opportunities. Consumers increasingly seek unique, personalized jewelry that reflects their individual style, prompting brands to offer customizable options.

Moreover, the demand for sustainable and eco-friendly products is rising. Brands that prioritize ethical sourcing and environmentally friendly materials can attract environmentally conscious consumers, further expanding their market reach. These opportunities enable costume jewelry brands to tap into new customer bases, enhance their product offerings, and differentiate themselves in a competitive market.

Emerging Trends

Minimalist and Layered Designs Are Latest Trending Factor

Minimalist and layered designs are the latest trending factors influencing the costume jewelry market. Consumers are increasingly favoring simple, elegant pieces that can be easily layered to create a personalized look. This trend reflects a broader shift towards versatile and timeless fashion accessories.

Moreover, the use of mixed materials, such as combining metals with beads or incorporating gemstones, is gaining popularity. These innovative designs appeal to consumers seeking unique and stylish jewelry that stands out.

Additionally, smart jewelry integration is becoming a trend, where technology meets fashion. Pieces that incorporate wearable tech, such as fitness trackers or smart notifications, are attracting tech-savvy consumers. Vintage and retro styles are also making a comeback, with many brands offering jewelry inspired by past decades. This resurgence appeals to those who appreciate classic designs with a modern twist.

Regional Analysis

Asia Pacific Dominates with 33.8% Market Share

Asia Pacific leads the Costume Jewelry Market with a 33.8% share and valued at USD 10.41 Bn, driven by the region’s robust economic growth, increasing disposable income, and a strong inclination towards fashion. The vast consumer base, coupled with a thriving fashion industry, supports this significant market presence.

The region’s dominance is bolstered by its extensive manufacturing capabilities and rapid urbanization, which facilitate the production and distribution of affordable fashion jewelry. Furthermore, cultural factors such as the traditional use of costume jewelry in festivals and weddings also contribute to sustained demand.

The future influence of Asia Pacific in the global Costume Jewelry Market is expected to strengthen. Increasing internet penetration and e-commerce adoption are likely to further drive growth, making the region a pivotal market for costume jewelry manufacturers.

Regional Mentions:

- North America: North America maintains a significant presence in the Costume Jewelry Market, supported by high consumer spending and a culture that embraces personal accessorizing. The region is known for its dynamic fashion trends and the presence of numerous leading jewelry brands.

- Europe: Europe is characterized by its luxury fashion heritage and strong demand for designer costume jewelry. The region benefits from the presence of major fashion capitals such as Paris and Milan, which influence global jewelry trends and market dynamics.

- Middle East & Africa: The Middle East and Africa are witnessing gradual growth in the Costume Jewelry Market, driven by increasing urbanization and a growing middle class. The region’s rich cultural heritage also plays a role in the popularity of ornate and traditional designs.

- Latin America: Latin America is seeing an uptick in costume jewelry demand, fueled by rising fashion consciousness and economic improvements. The region is embracing modern designs while maintaining a flair for traditional motifs, which resonates well with both local and international consumers.

Key Regions and Countries covered in the report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the dynamic landscape of the costume jewelry market, several key players dominate, contributing significantly to industry trends and consumer preferences. Among these, Pandora, Swarovski, Claire’s, and H&M Accessories stand out for their market presence and strategic approaches.

Pandora is renowned for its customizable charm bracelets, rings, and necklaces. Their business model focuses on high-quality, affordable jewelry accessible to a wide range of consumers. This has allowed Pandora to establish a strong global footprint, bolstered by both physical retail stores and a robust online presence, capturing a significant share of the market.

Swarovski, another major player, is distinguished by its precision-cut crystal jewelry, which has become synonymous with elegance and luxury within an accessible price range. Swarovski’s extensive product lines and collaborations with high-fashion designers continue to enhance its brand prestige and appeal to a broad consumer base.

Claire’s holds a unique position in targeting younger demographics, offering trendy, budget-friendly jewelry and accessories. Their widespread presence in malls across various countries ensures they remain a popular choice among teens and young adults, contributing to their strong performance in the costume jewelry sector.

H&M Accessories rounds out the top four with its fast-fashion approach, providing contemporary jewelry at competitive prices. Their ability to quickly translate high-fashion trends into affordable accessories makes them a key player in the market, particularly appealing to fashion-conscious consumers looking for style at a lower cost.

Each of these companies leverages distinct business strategies and brand positioning to cater to diverse customer segments, driving growth and innovation within the global costume jewelry market.

Major Companies in the Market

- Pandora

- Swarovski

- Claire’s

- H&M Accessories

- Zara Accessories

- BaubleBar

- Charming Charlie

- Forever 21 Accessories

- Topshop Jewelry

- Aldo Accessories

- Accessorize

- Icing

- Lovisa

- Bijou Brigitte

- Mango Accessories

Recent Developments

- LVMH and Platinum Investment Group: In April 2023, LVMH acquired a majority stake in Platinum Investment Group, a French jewelry manufacturing company. This strategic move aims to enhance the manufacturing capabilities of LVMH’s jewelry brands, including Tiffany & Co.

- Reliance Retail and Superdry: In October 2023, India’s Reliance Retail acquired Superdry’s licenses and brand assets in three Asian countries for £40 million. This acquisition expands Reliance’s presence in the fashion and apparel sector, potentially influencing the costume jewelry market in Asia.

- Pura Vida: On December 2024, Pura Vida introduced a new collection of affordable and customizable charm bracelets and necklaces, with prices starting at $5. This launch caters to budget-conscious consumers seeking trendy and personalized jewelry options.

Report Scope

Report Features Description Market Value (2023) USD 30.8 Billion Forecast Revenue (2033) USD 63.5 Billion CAGR (2024-2033) 7.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Necklaces and Chains, Rings, Earrings, Bracelets, Cufflinks and Studs, Others), By Material Type (Metal, Plastic, Stones, Glass, Others), By Gender (Male, Female, Unisex), By Distribution Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Pandora, Swarovski, Claire’s, H&M Accessories, Zara Accessories, BaubleBar, Charming Charlie, Forever 21 Accessories, Topshop Jewelry, Aldo Accessories, Accessorize, Icing, Lovisa, Bijou Brigitte, Mango Accessories Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Pandora

- Swarovski

- Claire's

- H&M Accessories

- Zara Accessories

- BaubleBar

- Charming Charlie

- Forever 21 Accessories

- Topshop Jewelry

- Aldo Accessories

- Accessorize

- Icing

- Lovisa

- Bijou Brigitte

- Mango Accessories