Global Lingerie Market Report By Type (Brassiere, Knickers & Briefs, Shapewear, Others), By Distribution Channel (Specialty Stores, Multi-Brand Stores, Online Channel), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 20788

- Number of Pages: 297

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

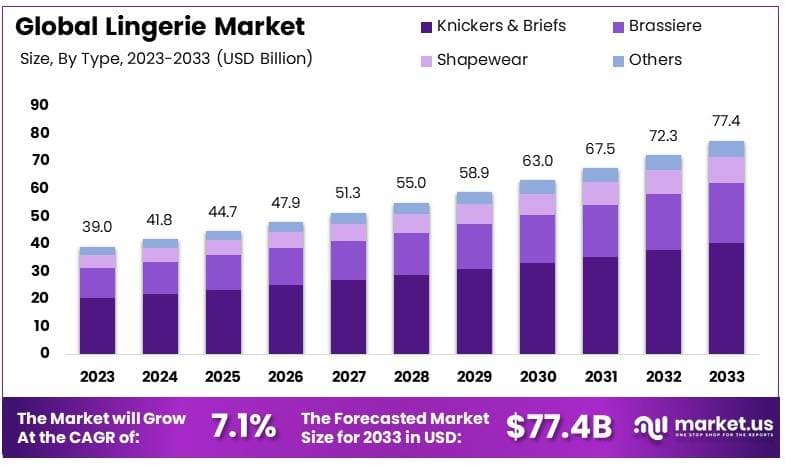

The Global Lingerie Market size is expected to be worth around USD 77.4 Billion by 2033, from USD 39.0 Billion in 2023, growing at a CAGR of 7.1% during the forecast period from 2024 to 2033.

Lingerie refers to women’s undergarments and intimate apparel. These items are designed for comfort, functionality, and fashion. They include bras, panties, camisoles, sleepwear, and shapewear. The industry focuses on fabric quality, design, and fit to enhance both comfort and aesthetics.

The lingerie market is a segment within the broader fashion and apparel industry. It encompasses the production, distribution, and retail of various intimate apparel products. The market is expanding due to rising fashion trends, increased purchasing power, and growing consumer focus on comfort and body positivity.

The lingerie market is expanding, driven by evolving consumer preferences and increasing demand for comfort-oriented and sustainable products. Comfort remains a key driver, with 23% of women preferring full briefs and 37% choosing bikini panties, according to Shyaway.

This preference shift indicates an opportunity for brands to innovate and cater to comfort-first consumers. Additionally, the market shows diverse preferences, as 19% opt for G-strings while 10% prefer other styles like hi-cuts and French cuts.

Growth in the lingerie market is propelled by the rising awareness of diverse body types and inclusivity. However, challenges remain. A Vogue Business report shows that only 3.8% of models on global runways are mid-size (UK size 10-16) and just 0.6% are plus-size (UK size 18 or above). This data highlights a gap between industry representation and consumer diversity, suggesting opportunities for brands that promote body inclusivity and diverse sizing options.

According to the Global Web Index, while 60% of consumers believe fashion retailers have improved in offering diverse sizes, only 50% feel the industry is genuinely inclusive. This gap reflects an unmet demand and space for further development.

Additionally, sustainability remains a crucial factor in market dynamics. According to Genomatica, 86% of U.S. consumers view sustainability as a good goal, yet 48% are unsure of where to find sustainable options, and 42% remain confused about what constitutes sustainable fashion. This represents a significant market opportunity for brands that can clearly communicate and deliver on sustainability promises.

The lingerie market exhibits moderate saturation levels, particularly among established brands. High competition from well-known companies like Victoria’s Secret, Aerie, and emerging D2C (Direct-to-Consumer) brands has intensified market rivalry. However, the shift towards sustainability and body inclusivity presents opportunities for new entrants and existing brands to differentiate themselves.

On a broader scale, the global lingerie market is evolving with a focus on eco-friendly initiatives, as demonstrated by Victoria’s Secret’s move to incorporate recyclable materials. This trend may influence other brands to follow suit, contributing to global sustainability goals and reshaping supply chains.

Key Takeaways

- The Lingerie Market was valued at USD 39.0 billion in 2023, and is expected to reach USD 77.4 billion by 2033, with a CAGR of 7.1%.

- In 2023, Briefs dominated the type segment with 52.3%, driven by comfort and widespread consumer preference.

- In 2023, Multi-Brand Stores led the distribution channel with 62.0%, benefiting from variety and consumer accessibility.

- In 2023, Online Channel was projected to grow at a rate of 6.7%, due to increasing digital retail adoption.

- In 2023, APAC dominated with 35.0% market share and USD 13.65 billion, highlighting robust regional demand.

Type Analysis

Brassieres dominate with 52.3% due to comprehensive product offerings and high consumer demand.

The lingerie market is broadly categorized into several types, including brassieres, knickers & briefs, shapewear, and others. The brassiere segment currently leads, accounting for 52.3% of the market. This dominance can be attributed to a variety of factors including innovation in design, growing fashion consciousness among consumers, and an increasing emphasis on comfort coupled with aesthetics.

Manufacturers have focused on enhancing the aesthetic appeal of brassieres while ensuring functionality, which has led to a diversification of products ranging from sports bras to maternity innerwear, each catering to specific needs and preferences. The evolving consumer demand for variety in design, coupled with the functionality that modern brassieres provide, has significantly driven the growth of this segment.

Moreover, the increasing participation of women in sports and fitness activities has propelled the demand for sportswear and sports bras, which are a sub-category within this segment. The health and wellness trend continues to influence consumer preferences, leading to increased demand for products that offer both comfort and support.

Additionally, advancements in fabric technology and the integration of smart textiles have contributed to the growth of this segment. Fabrics that offer better stretch, moisture management, and temperature control have made brassieres more appealing to a diverse consumer base, from teenagers to older women.

The other types within the lingerie market—knickers & briefs, shapewear, and others—also play critical roles in the market’s expansion. Knickers and briefs remain essential staples, with innovations in materials and designs that prioritize comfort and functionality.

Shapewear has seen growth due to the rising popularity of body-contouring garments that offer a sculpted appearance, catering to the beauty standards promoted in media and fashion. The ‘others’ category, which includes items such as loungewear and lingerie accessories, complements the main product types by enhancing consumer choices and experiences.

Distribution Channel Analysis

Multi-brand stores dominate with 62.0% due to their extensive reach and variety of options.

In the distribution of lingerie, multi-brand stores take the lead, capturing 62.0% of the market. This predominance is largely due to their widespread presence and ability to offer a wide range of brands under one roof, providing convenience and a comparative shopping experience for consumers.

These stores typically benefit from strategic locations in shopping centers or commercial districts, drawing a high footfall and offering consumers the tactile shopping experience they value when purchasing intimate apparel.

The ability of multi-brand stores to provide personal customer service, such as fitting advice and immediate product availability, further bolsters their position in the market. Moreover, these stores often host a variety of brands, ranging from luxury apparels to budget, catering to a broad spectrum of consumers.

The online channel, although a smaller segment compared to brick-and-mortar stores, is projected to grow at a significant rate of 6.7%. This growth is driven by the convenience of shopping from home, the increasing penetration of internet and mobile devices, and a shift in consumer shopping behaviors favoring online purchases.

Online retailers have been enhancing their customer experience through improved logistics, easy return policies, and innovative marketing strategies such as virtual fitting rooms and personalized shopping experiences.

Specialty stores, while smaller in market share, specialize in offering an extensive range of products and personalized services. They typically focus on a specific category within lingerie, such as bridal lingerie or plus-size options, providing expert guidance and specialized products not widely available in generalist stores.

Key Market Segments

By Type

- Brassiere

- Knickers

- Shapewear

- Others

By Distribution Channel

- Specialty Stores

- Multi-Brand Stores

- Online Channel

Drivers

Inclusivity, E-commerce Growth, and Disposable Income Drive Market Growth

The lingerie market is experiencing significant growth driven by several key factors. Firstly, the increasing emphasis on body positivity and inclusivity has broadened the consumer base, encouraging brands to offer a diverse range of sizes and styles that cater to all body types. This shift not only enhances customer satisfaction but also fosters brand loyalty.

Additionally, the rapid expansion of e-commerce platforms have made lingerie more accessible to a global audience. Online platforms provide convenience, a wider selection, and personalized shopping experiences, which are highly valued by modern consumers.

Moreover, rising disposable incomes have enabled consumers to spend more on premium and luxury lingerie products. As people have more financial flexibility, they are willing to invest in higher-quality items that offer better comfort and style. Innovations in fabric and design also play a crucial role in driving market growth. Advanced materials that provide better fit, comfort, and functionality meet the evolving demands of consumers seeking both aesthetics and practicality.

Restraints

High Competition and Regulatory Challenges Restrain Market Growth

Despite the positive growth drivers, the lingerie market faces several restraining factors that hinder its expansion. One of the primary challenges is the intense competition within the market. Numerous brands, ranging from established names to new entrants, vie for market share, making it difficult for companies to differentiate themselves and maintain profitability.

Additionally, fluctuating raw material prices pose a significant threat to market stability. Variations in the cost of fabrics, elastics, and other essential materials can lead to increased production costs, which may not always be transferable to consumers without affecting sales volumes.

Stringent regulatory standards also act as a barrier to growth. Compliance with various international and local regulations regarding product safety, labeling, and sustainability requires substantial investment and can delay market entry for new products.

Furthermore, cultural taboos and stigmas surrounding lingerie in certain regions limit market penetration and acceptance. These societal attitudes can restrict marketing efforts and reduce the overall demand in specific areas.

Opportunity

Expansion in Emerging Markets and Sustainability Provide Opportunities

The lingerie market is ripe with growth opportunities, particularly through strategic expansion and innovation. One significant opportunity lies in the expansion into emerging markets, where rising incomes and changing lifestyles are increasing the demand for lingerie products. These regions present untapped potential for brands to establish a strong presence and capture new customer segments.

Additionally, the trend towards personalized and customized lingerie offers a unique avenue for differentiation. By leveraging data and technology, companies can provide tailored products that meet individual preferences, enhancing customer satisfaction and loyalty.

Technological advancements, such as smart lingerie with integrated health monitoring features, further expand the market by introducing innovative products that cater to modern consumer needs. These opportunities enable lingerie brands to diversify their offerings, enhance their value proposition, and drive long-term growth in a competitive marketplace.

Challenges

Supply Chain Issues and High Return Rates Challenge Market Growth

The lingerie market faces several challenging factors that complicate its growth trajectory. Supply chain disruptions, often caused by geopolitical tensions, natural disasters, or logistical inefficiencies, can lead to delays in production and distribution. These interruptions not only affect inventory levels but also increase costs and reduce the ability to meet consumer demand promptly.

Additionally, rapidly changing consumer preferences pose a significant challenge for brands. As fashion trends evolve and consumer tastes shift towards new styles and functionalities, companies must continuously adapt their product lines to stay relevant. This requires agility in design and production processes, which can strain resources and increase operational complexities.

High return rates, particularly prevalent in online sales, also present a major hurdle. The intimate nature of lingerie means that fit and comfort are critical, and dissatisfaction with these aspects can lead to frequent returns. Managing these returns incurs additional costs and can negatively impact profit margins.

Growth Factors

Product Diversification, Strategic Partnerships, and Enhanced Customer Experience Are Growth Factors

Growth in the lingerie market is supported by several key factors that enable brands to expand and strengthen their market position. Product diversification is a critical growth factor, allowing companies to offer a wider range of products that cater to different consumer needs and preferences.

Strategic partnerships and collaborations also play a vital role in driving market growth. Collaborating with other brands, designers, or influencers can enhance brand visibility, introduce new design perspectives, and access new market segments. These partnerships can lead to innovative product offerings and co-branded collections that appeal to diverse consumer groups.

Additionally, enhancing the customer experience is essential for fostering loyalty and encouraging repeat purchases. Investing in user-friendly online platforms, personalized shopping experiences, and excellent customer service can significantly improve customer satisfaction and retention.

Implementing advanced technologies, such as virtual fitting rooms and AI-driven recommendations, further enriches the shopping experience by providing tailored solutions that meet individual needs.

Emerging Trends

Athleisure, Minimalist Designs, and Social Media Trends Are Latest Trending Factors

The lingerie market is currently influenced by several trending factors that shape consumer preferences and drive innovation. The integration of athleisure into lingerie collections has become a prominent trend, blending comfort with style to meet the demands of active lifestyles.

Minimalist designs are also gaining popularity, characterized by their simplicity, clean lines, and understated elegance. These designs cater to consumers who prefer timeless and versatile pieces that can be easily incorporated into any wardrobe.

Additionally, the use of social media influencers has become a crucial trend in marketing lingerie. Influencers leverage their online presence to showcase products, provide authentic reviews, and engage with followers, significantly impacting brand visibility and consumer trust.

Gender-neutral lingerie is another emerging trend, reflecting a broader shift towards inclusivity and diversity. By offering products that cater to all genders, brands can tap into a more extensive and diverse customer base.

Regional Analysis

Asia Pacific Dominates with 35.0% Market Share

Asia Pacific (APAC) leads the global lingerie market with a 35.0% share, amounting to USD 13.65 billion. This dominance is driven by a large and growing consumer base, rising disposable incomes, and increasing fashion awareness. Rapid urbanization and changing lifestyles, particularly in countries like China, India, and Japan, further fuel demand for a variety of lingerie products.

The market benefits from a strong manufacturing base, which allows for cost-effective production and distribution across the region. Additionally, a surge in e-commerce platforms and social media influences consumers’ purchasing behavior, making lingerie brands more accessible. Local and international brands are capitalizing on these dynamics by expanding their presence and catering to diverse consumer preferences.

The future influence of APAC is projected to strengthen as the region’s middle-class population grows, and as online retail becomes even more prevalent. Increased focus on product innovation, sustainability, and premium offerings is expected to sustain APAC’s leading position and potentially expand its market share further in the coming years.

Regional Mentions:

- North America: North America represents a stable market with a preference for premium and functional lingerie. The focus on inclusive sizing and body positivity campaigns boosts demand. The region shows steady growth driven by established brands and the expansion of online retail channels.

- Europe: Europe’s lingerie market thrives on fashion-forward designs and luxury segments. The region’s emphasis on sustainable and eco-friendly products influences purchasing decisions. Innovation in fabrics and a strong retail network contribute to its solid market presence.

- Middle East & Africa: The Middle East & Africa sees a rise in lingerie demand due to increasing urbanization and changing social norms. The market is expanding, supported by growth in retail infrastructure and the increasing purchasing power of women in these regions.

- Latin America: Latin America is witnessing moderate growth in the lingerie market, with a focus on comfort and affordability. Urbanization and a growing middle class drive demand, while local brands gain prominence through regional production and distribution networks.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The lingerie market is competitive, with several global and regional players. Major companies include Jockey International Inc., Zivame, Victoria’s Secret, Hanesbrands Inc., Gap Inc., Hunkemoller, Triumph International Ltd., Calvin Klein, and Fashion Nova Inc. These companies dominate the market with strong brand recognition and diverse offerings.

Key players provide a variety of lingerie products such as bras, panties, shapewear, sleepwear, and loungewear. Some focus on luxury items, while others target affordable, everyday essentials. Online and offline retail options are common.

Brands like Victoria’s Secret and Calvin Klein position themselves as premium brands, focusing on luxury and fashion-forward products. In contrast, companies like Hanesbrands Inc. and Zivame emphasize affordability and comfort, appealing to the mass market. Many companies use social media and influencer marketing for greater reach.

Global brands like Victoria’s Secret and Triumph International Ltd. have a strong international presence. Regional players like Zivame and Hunkemoller dominate local markets, particularly in India and Europe.

Innovation is key in product development, with many companies investing in sustainable materials, comfort-focused designs, and inclusive sizing options. Digital fitting technologies and personalized online shopping experiences are also growing trends.

The competitive edge of these companies lies in their brand loyalty, diverse product lines, and adaptation to consumer preferences. Market leaders invest in innovation and digital strategies to maintain relevance and expand their customer base.

Top Key Players in the Market

- Jockey International Inc.

- Zivame

- Victoria’s Secret

- Hanesbrands Inc.

- Gap Inc.

- Hunkemoller

- Triumph International Ltd.

- Calvin Klein

- Fashion Nova Inc.

- Other Key Players

Recent Developments

- Bold & Bae Fashion Launch: On February 2024, Bold & Bae Fashion, a Mumbai-based startup, launched a premium lingerie and casual wear line, aiming to cater to modern women aged 14-44. The collection, which includes lingerie, loungewear, and athleisure, is available on major Indian e-commerce platforms, targeting the growing female innerwear market projected to reach $12 billion by 2025.

- Bali Launches Bali Breathe: On October 2024, Bali, America’s number one bra brand, introduced the Bali Breathe line, focusing on comfort and elegance. This collection is made with breathable, lightweight fabrics designed to enhance comfort, marking a new era in the brand’s innovation in innerwear.

- Temperley London Expands: On January 2024, Temperley London launched its first-ever lingerie and sleepwear collection. Known for luxury fashion, the brand’s new line includes delicate silk and lace pieces, expanding into intimate apparel as a natural extension of its elegant aesthetic.

- Bravissimo Acquired by Wacoal Europe: On September 2024, Bravissimo, a UK-based lingerie brand catering to women with larger busts, was acquired by Wacoal Europe. This acquisition aims to strengthen Wacoal’s position in the UK market by expanding its product range for fuller busts.

Report Scope

Report Features Description Market Value (2023) USD 39.0 Billion Forecast Revenue (2033) USD 77.4 Billion CAGR (2024-2033) 7.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Brassiere, Knickers & Briefs, Shapewear, Others), By Distribution Channel (Specialty Stores, Multi-Brand Stores, Online Channel) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Jockey International Inc., Zivame, Victoria’s Secret, Hanesbrands Inc., Gap Inc., Hunkemoller, Triumph International Ltd., Calvin Klein, Fashion Nova Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Jockey International Inc.

- Zivame

- Victoria's Secret

- Hanesbrands Inc.

- Gap Inc.

- Hunkemoller

- Triumph International Ltd.

- Calvin Klein

- Fashion Nova Inc.

- Other Key Players