Alzheimer’s Disease Therapeutics Market By Product Type (Biocides & Disinfectants, Personal Protective Equipment (PPE), Detection & Monitoring Equipment, Decontamination Systems, and Others), by Application (Agriculture, Healthcare, Food Industry, Defense & Military, and Others), By End-User (Government & Regulatory Bodies, Healthcare Institutions, Agricultural Sector, Research & Academia, and Private & Commercial Sectors), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 105553

- Number of Pages: 275

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

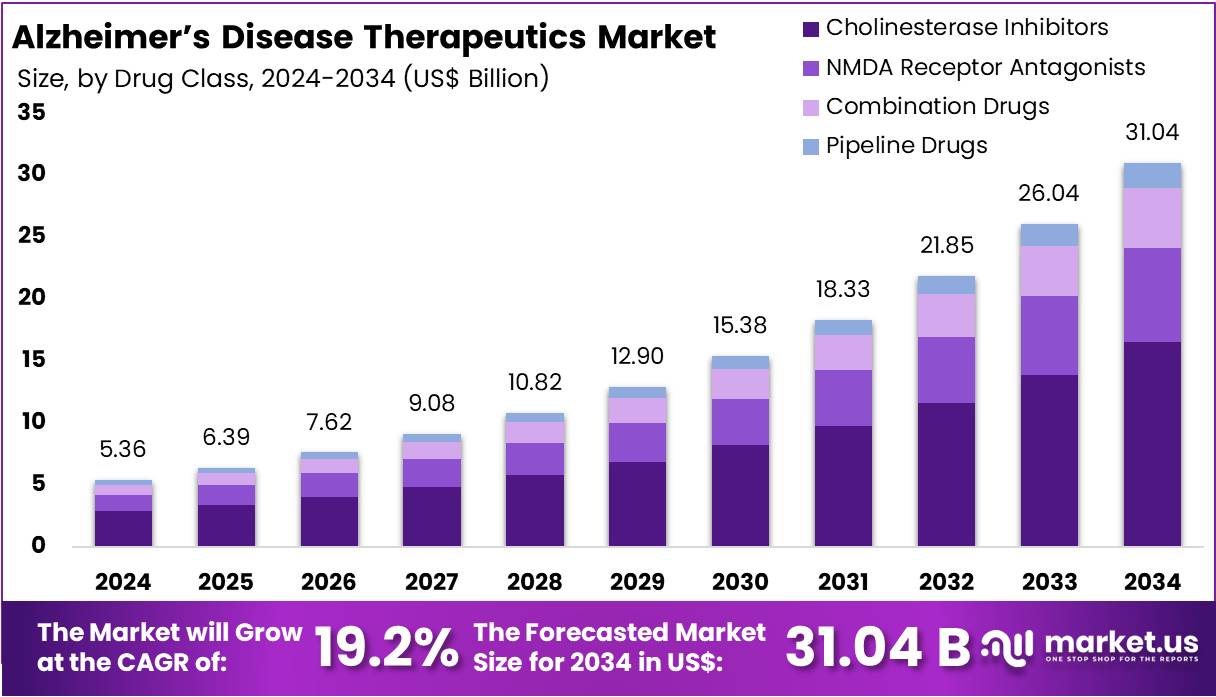

The Alzheimer’s Disease Therapeutics Market size is expected to be worth around US$ 31.04 billion by 2034 from US$ 5.36 billion in 2024, growing at a CAGR of 19.2% during the forecast period 2025 to 2034.

In 2021, around 6.2 million individuals aged 65 and older in the United States were diagnosed with Alzheimer’s disease, a number projected to rise to approximately 13.8 million by 2060, according to the NCBI. Women are more susceptible to developing Alzheimer’s due to their longer life expectancy compared to men. Alzheimer’s has become the leading cause of death among neurodegenerative diseases and a significant factor contributing to physical disability, necessitating urgent medical intervention.

Alzheimer’s disease is a chronic brain condition that frequently leads to dementia in older individuals. It affects memory, cognitive function, and disrupts daily routines. The likelihood of developing Alzheimer’s increases significantly with age. Certain genes, particularly the APOE-e4 allele, have been strongly associated with the disease. Other contributing risk factors include cardiovascular diseases, high blood pressure, diabetes, stroke, and conditions related to vascular health. Currently, there is no single test available for diagnosing Alzheimer’s disease.

The COVID-19 pandemic negatively impacted the Alzheimer’s treatment market. Government-imposed restrictions, including lockdowns aimed at controlling the virus, resulted in fewer patient visits to healthcare facilities. This led to a decline in the prescription of Alzheimer’s medications, further hindering market growth as patients were reluctant to seek treatment out of fear of contracting COVID-19.

However, the advent of advanced cloud-based cognitive assessment systems has the potential to transform the market. These systems offer pharmaceutical companies a more precise method of evaluating drug effects on patients, improving the assessment of cognitive efficacy and safety for drugs in development. For example, Cambridge Cognition’s Cantab Connect product has been designed specifically to assess the effectiveness of drugs for mild, moderate, and prodromal Alzheimer’s disease. The widespread adoption of such innovative technologies is expected to improve approval rates for new treatments, fueling market growth.

Key Takeaways

- In 2024, the market for Alzheimer’s Disease Therapeutics generated a revenue of US$ 36 billion, with a CAGR of 19.2%, and is expected to reach US$ 31.04 billion by the year 2034.

- The Drug Class segment is divided into Cholinesterase Inhibitors, NMDA Receptor Antagonists, Combination Drugs, and Pipeline Drugs with Cholinesterase Inhibitors taking the lead in 2023 with a market share of 53.2%.

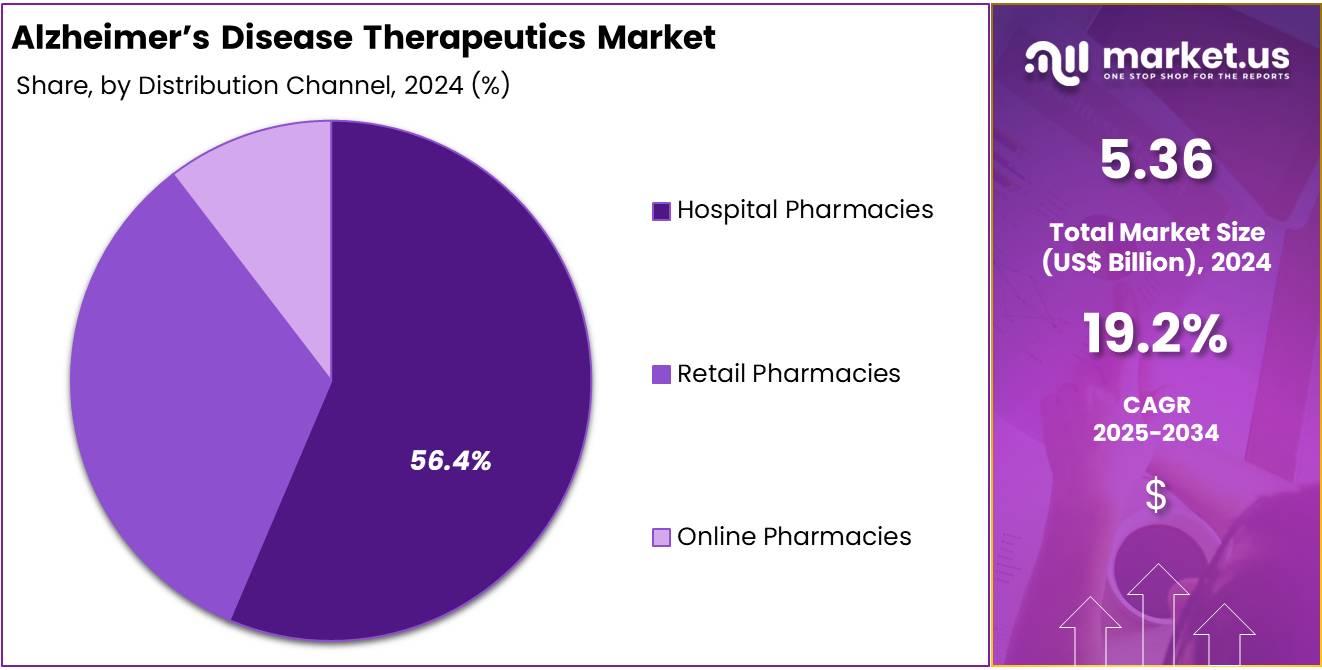

- Furthermore, concerning the Distribution Channel segment, the market is segregated into Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies. The Hospital Pharmacies out as the dominant segment, holding the largest revenue share of 56.4% in the Alzheimer’s Disease Therapeutics market.

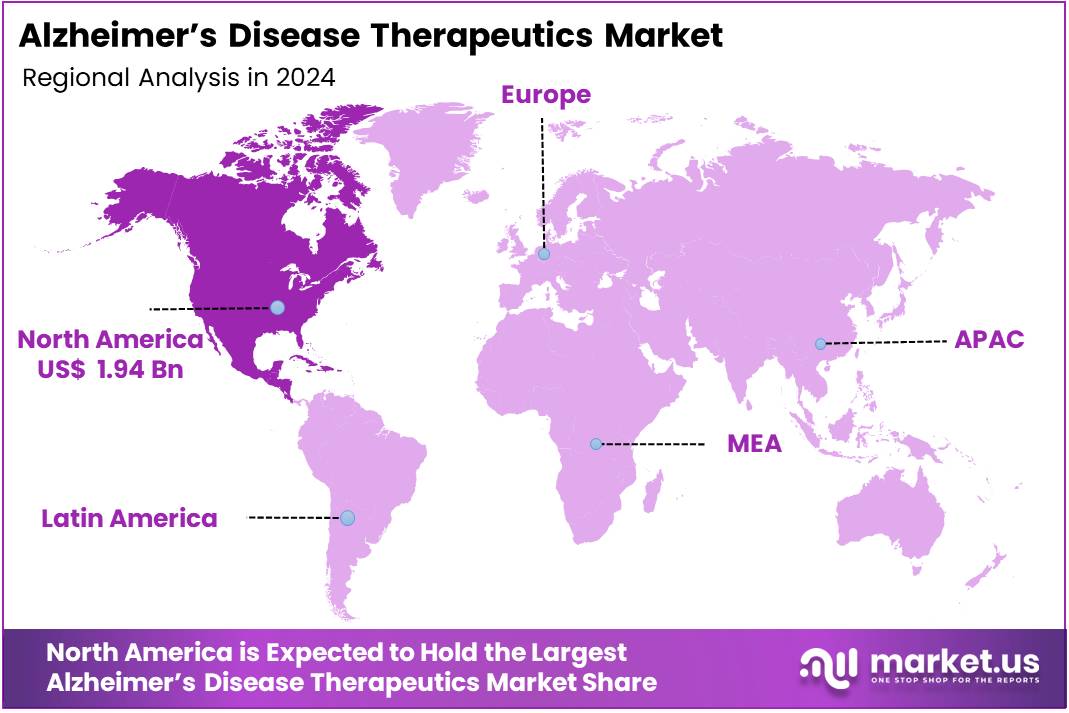

- North America led the market by securing a market share of 36.2% in 2023.

Drug Class Analysis

Cholinesterase inhibitors are the dominant drug class in the Alzheimer’s disease therapeutics market which accounted for 53.2% market share. These drugs, including Donepezil, Galantamine, and Rivastigmine, are primarily used in the early to moderate stages of Alzheimer’s disease to help alleviate symptoms. They work by inhibiting the enzyme acetylcholinesterase, which breaks down acetylcholine, a neurotransmitter crucial for memory and cognitive functions.

In Alzheimer’s patients, acetylcholine levels are typically low, and cholinesterase inhibitors help sustain cognitive function by increasing acetylcholine availability. Due to their proven efficacy and long-standing use, cholinesterase inhibitors are widely prescribed and hold a significant market share. The dominance of this drug class is also attributed to the absence of many alternative treatments in the market, particularly for early-stage Alzheimer’s, where cholinesterase inhibitors provide the most effective symptomatic relief.

As the Alzheimer’s population continues to grow globally, the demand for cholinesterase inhibitors is projected to remain high, maintaining their dominant position in the therapeutic market. In July 2024, FDA approved Alpha Cognition’s ALPHA-1062 (Zunveyl), a prodrug of the acetylcholinesterase inhibitor (AChEI) galantamine, as a treatment for patients with mild-to-moderate Alzheimer’s disease (AD), according to an official announcement.

Distribution Channel Analysis

Hospital pharmacies dominated the distribution channels in the Alzheimer’s disease therapeutics market with 56.4% market share. Hospital pharmacies are crucial in dispensing specialized treatments, including high-cost and advanced therapies, such as disease-modifying drugs that may require close monitoring or complex administration. These pharmacies are particularly important for patients in the moderate to severe stages of Alzheimer’s disease, where treatment regimens are more intensive and personalized.

Hospital pharmacies also play a significant role in clinical trials, allowing for access to the latest experimental therapies. Furthermore, they provide an essential support system for patients who require additional care and consultation while starting new therapies. Online pharmacies are an emerging and growing distribution channel in the Alzheimer’s disease therapeutics market.

These platforms provide convenient access to medications, particularly for patients who may face mobility challenges or reside in remote areas. The ease of home delivery and the ability to order medications online have made online pharmacies increasingly popular, particularly among elderly patients and their caregivers.

Key Market Segments

By Drug Class

- Cholinesterase Inhibitors

- NMDA Receptor Antagonists

- Combination Drugs

- Pipeline Drugs

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Drivers

Increasing Prevalence of Alzheimer’s Disease

The rising global prevalence of Alzheimer’s disease is a significant driver for the therapeutics market. As populations age, especially in regions like North America, Europe, and Asia-Pacific, the incidence of Alzheimer’s and other dementias is expected to grow significantly. According to NCBI, Alzheimer’s disease is a major public health concern, particularly in older adults. Approximately 6.9 million people in the United States age 65 and older are living with Alzheimer’s.

Globally, it’s the most common form of dementia, contributing to 60-70% of cases. The risk of developing Alzheimer’s increases with age, with 5% of people aged 65-74, 13.1% of those 75-84, and 33.3% of those 85 and older affected. In 2020, there were an estimated 50 million people living with dementia worldwide, with this number projected to double by 2050. This demographic shift is creating a larger patient pool, which is pushing the demand for more effective treatment options.

Advances in the understanding of the disease’s pathology, particularly in amyloid plaques and tau tangles, are leading to novel drug candidates entering the pipeline. Additionally, public awareness campaigns and increasing support from healthcare systems are encouraging earlier diagnoses, further increasing the need for therapeutics. The need for disease-modifying treatments to slow or halt disease progression has never been greater, which is driving investments and innovations in Alzheimer’s therapeutics.

Restraints

High Treatment Costs

The high costs of Alzheimer’s disease therapeutics pose a major restraint in the market. Currently, disease-modifying drugs, such as aducanumab (Aduhelm) and lecanemab, have sparked controversy due to their substantial pricing. Aduhelm, for instance, costs approximately US$56,000 per year, which creates financial burdens for healthcare systems and patients alike. These high prices limit patient access, especially in low-income and developing countries where healthcare budgets are constrained.

Furthermore, the lack of consensus regarding the efficacy of some treatments has raised concerns about the value for money. With many Alzheimer’s therapies still in the trial phase, the potential for high-cost treatments with unclear long-term benefits could create significant barriers to widespread adoption. This financial challenge slows market expansion, especially when insurers may not fully cover the treatment costs, leading to limited patient access.

Opportunities

Advancements in Personalized Medicine

Personalized medicine is emerging as a key opportunity in the Alzheimer’s disease therapeutics market. Traditional treatments often follow a one-size-fits-all model, which has shown limited success in altering the course of the disease. In contrast, personalized therapies are designed using genetic, biomarker, and individual patient data. This approach allows for better-targeted treatments, tailored to a patient’s specific disease profile. As a result, patient outcomes can be improved, and the effectiveness of treatments may increase. This shift is reshaping how Alzheimer’s therapies are developed and delivered.

In March 2021, the National Institutes of Health (NIH) launched the next phase of the Accelerating Medicines Partnership Alzheimer’s Disease program, called AMP AD 2.0. This initiative builds on an open science and big data strategy. The goal is to discover new biological targets for therapy. AMP AD 2.0 supports the development of tools such as advanced single-cell profiling and computational modeling. These technologies are critical for enabling precision medicine in Alzheimer’s drug development. This move reflects a strong commitment to more targeted, data-driven interventions.

New therapies are being developed to target amyloid and tau pathways or to align with a patient’s immune response. These personalized drugs offer the potential for greater treatment success. Advances in biomarker discovery are also enabling earlier and more accurate diagnoses. Early diagnosis is essential for timely intervention and better results. The personalized approach improves treatment responses, limits side effects, and supports sustainable care. As Alzheimer’s cases rise, this model is expected to play a vital role in reducing the disease burden and improving patient quality of life.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly impact the Alzheimer’s disease therapeutics market, influencing everything from healthcare budgets to drug pricing and market access. The growing global economic pressures, including inflation and fluctuating healthcare expenditures, can strain healthcare systems, particularly in low- and middle-income countries.

As Alzheimer’s treatments, especially disease-modifying drugs like Aduhelm and Leqembi, carry high price tags, economic conditions directly affect affordability and access. Governments facing budget constraints may prioritize other healthcare needs over Alzheimer’s treatments, potentially limiting patient access to newer therapies.

Geopolitical factors, including trade policies and tariffs, also play a pivotal role in the Alzheimer’s therapeutics market. For instance, the cost of raw materials and active pharmaceutical ingredients (APIs) used in drug manufacturing can increase due to international trade tensions or tariffs. This could lead to higher production costs, which may ultimately result in higher prices for medications.

Furthermore, political stability and regulatory frameworks in different regions can either facilitate or hinder the approval and distribution of Alzheimer’s therapeutics. For example, regulatory approval processes in the United States and Europe are relatively well-defined, whereas markets in developing regions may face slower drug access due to regulatory challenges, impacting global market expansion. In summary, both macroeconomic and geopolitical dynamics influence the pricing, accessibility, and availability of Alzheimer’s disease treatments.

Latest Trends

Rise of Biologic Therapies

The Alzheimer’s disease therapeutics market is shifting towards biologic therapies. These include monoclonal antibodies and gene therapies. Unlike traditional drugs, biologics target the root causes of the disease. Aducanumab (Aduhelm) and lecanemab are examples of such drugs. They work by reducing amyloid plaques in the brain. This marks a change from simply treating symptoms. The growing interest in disease-modifying therapies is shaping market development. As a result, biologics are becoming key players in the evolving Alzheimer’s treatment landscape.

Biologics offer a more precise treatment approach. They focus on specific biological mechanisms involved in Alzheimer’s. This is different from small-molecule drugs, which act more broadly. The development of biologics is supported by deeper knowledge of the disease. Understanding its molecular and genetic basis helps researchers create targeted therapies. This is leading to more biologics entering clinical trials. Early-stage candidates are also showing promise. As clinical results improve, the market is expected to favor biologics even more.

This trend reflects a broader shift in neurology. The focus is moving toward innovation and personalized care. In January 2025, Eisai Co., Ltd. and Biogen Inc. reported FDA acceptance of their Biologics License Application (BLA). It was for the subcutaneous autoinjector of lecanemab (LEQEMBI®) for weekly maintenance dosing. LEQEMBI is approved for early-stage Alzheimer’s, including Mild Cognitive Impairment (MCI). This regulatory progress strengthens confidence in biologic treatments. It shows that the Alzheimer’s therapeutics market is aligning with precision medicine trends.

Regional Analysis

North America is leading the Alzheimer’s Disease Therapeutics Market

The global Alzheimer’s disease therapeutics market is segmented by region into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America emerged as the leading region, capturing the largest revenue share of 36.2% in 2024.

This dominant market position can be attributed to the robust research and development efforts focused on Alzheimer’s disease treatment within the region. Additionally, the growth in North America is further fueled by increased government initiatives and funding dedicated to tackling Alzheimer’s disease.

In June 2021 when the U.S. FDA granted Breakthrough Therapy designation to lecanemab (BAN2401), an anti-amyloid beta protofibril antibody. Developed by Eisai Co., Ltd. and Biogen, lecanemab represents a promising treatment for Alzheimer’s disease, reinforcing the ongoing advancements in the region’s therapeutic landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Alzheimer’s Disease Therapeutics market includes Novartis, AbbVie, Inc., Johnson & Johnson, Eli Lilly and Company, Pfizer Inc., Biogen Inc., Amgen Inc., Roche Holding AG, AstraZeneca PLC, Merck & Co., Inc., Sanofi S.A., Otsuka Pharmaceutical Co., Ltd., H. Lundbeck A/S, GSK plc (GlaxoSmithKline), Takeda Pharmaceutical Company, and Others.

Novartis is a key player in Alzheimer’s therapeutics, focusing on both symptomatic treatments and disease-modifying therapies. It is involved in developing innovative drugs like Lecanemab for early Alzheimer’s treatment, targeting amyloid plaques, and advancing its pipeline to address the growing unmet needs of Alzheimer’s patients. AbbVie is actively engaged in Alzheimer’s disease research, with a strong focus on developing innovative therapies. It is investing in monoclonal antibody treatments like Aducanumab (Aduhelm), which aims to target amyloid plaques, a hallmark of Alzheimer’s.

AbbVie continues to explore new treatment pathways to address the disease’s progression. Eli Lilly is a leader in Alzheimer’s therapeutics, known for its Donanemab treatment, designed to target and clear amyloid plaques. Lilly’s ongoing research in Alzheimer’s aims to slow or halt disease progression, making it a key player in developing novel therapies and advancing the understanding of Alzheimer’s pathophysiology.

Top Key Players in the Alzheimer’s Disease Therapeutics Market

- Novartis

- AbbVie, Inc.

- Johnson & Johnson

- Eli Lilly and Company

- Pfizer Inc.

- Biogen Inc.

- Amgen Inc.

- Roche Holding AG

- AstraZeneca PLC

- Merck & Co., Inc.

- Sanofi S.A.

- Otsuka Pharmaceutical Co., Ltd.

- Lundbeck A/S

- GSK plc (GlaxoSmithKline)

- Takeda Pharmaceutical Company

- Other Prominent Players

Recent Developments

- In May 2025, Sanofi announced that it has reached an agreement to acquire Vigil Neuroscience, Inc., a publicly traded biotechnology company in the clinical stage, specializing in developing innovative treatments for neurodegenerative diseases. This acquisition strengthens Sanofi’s neurology division, one of its four key strategic focus areas, and bolsters its early-stage pipeline. The acquisition includes VG-3927, a promising therapy that will be tested in a phase 2 clinical trial for Alzheimer’s disease.

- In April 2025, Eisai Co., Ltd. and Biogen Inc. announced that the European Commission (EC) has granted Marketing Authorization (MA) for Leqembi® (lecanemab), an amyloid-beta (Aβ) monoclonal antibody, in the European Union (EU). This marks Leqembi as the first therapy targeting the underlying cause of Alzheimer’s disease (AD) to receive MA approval in the EU.

- In July 2024, the U.S. Food and Drug Administration (FDA) has approved Kisunla (donanemab-azbt, 350 mg/20 mL once-monthly injection for IV infusion), an Alzheimer’s treatment developed by Eli Lilly and Company. This approval is for adults with early symptomatic Alzheimer’s disease (AD), including those with mild cognitive impairment (MCI) and individuals in the mild dementia stage of AD, who have confirmed amyloid pathology.

Report Scope

Report Features Description Market Value (2024) US$ 5.36 billion Forecast Revenue (2034) US$ 31.04 billion CAGR (2025-2034) 19.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug Class (Cholinesterase Inhibitors, NMDA Receptor Antagonists, Combination Drugs and Pipeline Drugs), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Novartis, AbbVie, Inc., Johnson & Johnson, Eli Lilly and Company, Pfizer Inc., Biogen Inc., Amgen Inc., Roche Holding AG, AstraZeneca PLC, Merck & Co., Inc., Sanofi S.A., Otsuka Pharmaceutical Co., Ltd., H. Lundbeck A/S, GSK plc (GlaxoSmithKline), Takeda Pharmaceutical Company, and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Alzheimer’s Disease Therapeutics MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Alzheimer’s Disease Therapeutics MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Novartis

- AbbVie, Inc.

- Johnson & Johnson

- Eli Lilly and Company

- Pfizer Inc.

- Biogen Inc.

- Amgen Inc.

- Roche Holding AG

- AstraZeneca PLC

- Merck & Co., Inc.

- Sanofi S.A.

- Otsuka Pharmaceutical Co., Ltd.

- Lundbeck A/S

- GSK plc (GlaxoSmithKline)

- Takeda Pharmaceutical Company

- Other Prominent Players