Global Luxury Jewelry Market By Raw Material (Gold, Platinum, Diamond, Precious Pearls, Gemstones, Others), By Product (Ring, Necklaces , Earrings, Bracelets, Others), By Application (Women, Men, Children), By Distribution channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133264

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

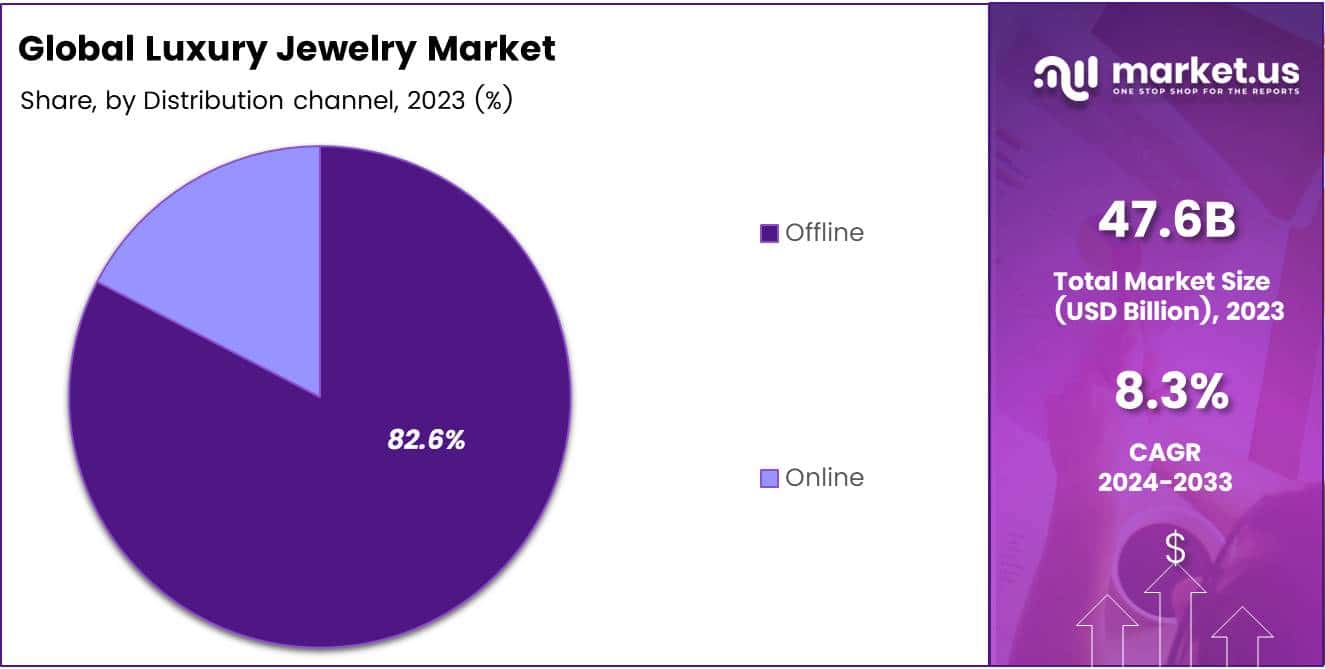

The Global Luxury Jewelry Market size is expected to be worth around USD 105.7 Billion by 2033, from USD 47.6 Billion in 2023, growing at a CAGR of 8.3% during the forecast period from 2024 to 2033.

Luxury jewelry, a symbol of status and opulence, encompasses finely crafted pieces adorned with precious metals and gemstones, such as gold, diamonds, and pearls.

These items are not merely accessories; they represent a high level of craftsmanship and exclusivity, often associated with renowned brands and heritage craftsmanship.

The luxury jewelry market refers to the commercial arena where these high-value pieces are bought, sold, and traded. It includes both primary sales from brands to customers and secondary markets where items are resold or auctioned. This market is characterized by its high price points, limited production quantities, and significant consumer investment, both financially and emotionally.

The luxury jewelry market is poised for substantial growth, driven by increasing disposable income among the affluent population and a growing appreciation for artisanal craftsmanship. This sector has seen a resurgence of interest in unique, handcrafted jewelry that offers personal expression and maintains value over time.

Government policies play a pivotal role in shaping the luxury jewelry market. Regulations concerning the sourcing and distribution of materials like diamonds and gold often governed by international agreements such as the Kimberley Process—are crucial for maintaining the market’s integrity and sustainability.

According to the World Gold Council, China emerged as the world’s largest gold producer in 2023, contributing approximately 10% to the total global production. This substantial share underscores China’s pivotal role in the luxury jewelry market, influencing global gold supply and pricing dynamics.

Furthermore, the total gold demand in 2023, inclusive of significant over-the-counter and stock flows, reached a record high at 4,899 tons. This surge in demand is reflective of gold’s enduring appeal as a key component in luxury jewelry, supporting its market growth and investment allure.

In 2023, the average gold price set a new record at US$1,940.54 per ounce, 8% higher than the previous year, indicating robust market conditions and investor confidence. Additionally, the recycled gold supply, which increased by 9% year-over-year to total 1,237 metric tons, was driven by these high gold prices, highlighting a mature recycling market that contributes to sustaining gold supply without additional mining.

On another front, the stability in global natural industrial diamond production, with Russia leading at 41% of the output, showcases the steady demand for these precious stones in luxury jewelry, supporting the industry’s supply chain resilience and continuous growth potential.

Key Takeaways

- The Global Luxury Jewelry Market is projected to grow from USD 47.6 billion in 2023 to USD 105.7 billion by 2033, with a CAGR of 8.3%.

- Gold dominates the raw material segment with a 39.2% market share in 2023, highlighting its continued preference in luxury jewelry.

- Rings are the leading product category, capturing a 32.5% share, emphasizing their central role in luxury adornment.

- Women are the primary consumers in the luxury jewelry market, holding a 69.8% share, driven by increasing purchasing power and fashion consciousness.

- The offline distribution channel remains prevalent, with an 82.6% market share, reflecting a strong consumer preference for physical buying experiences.

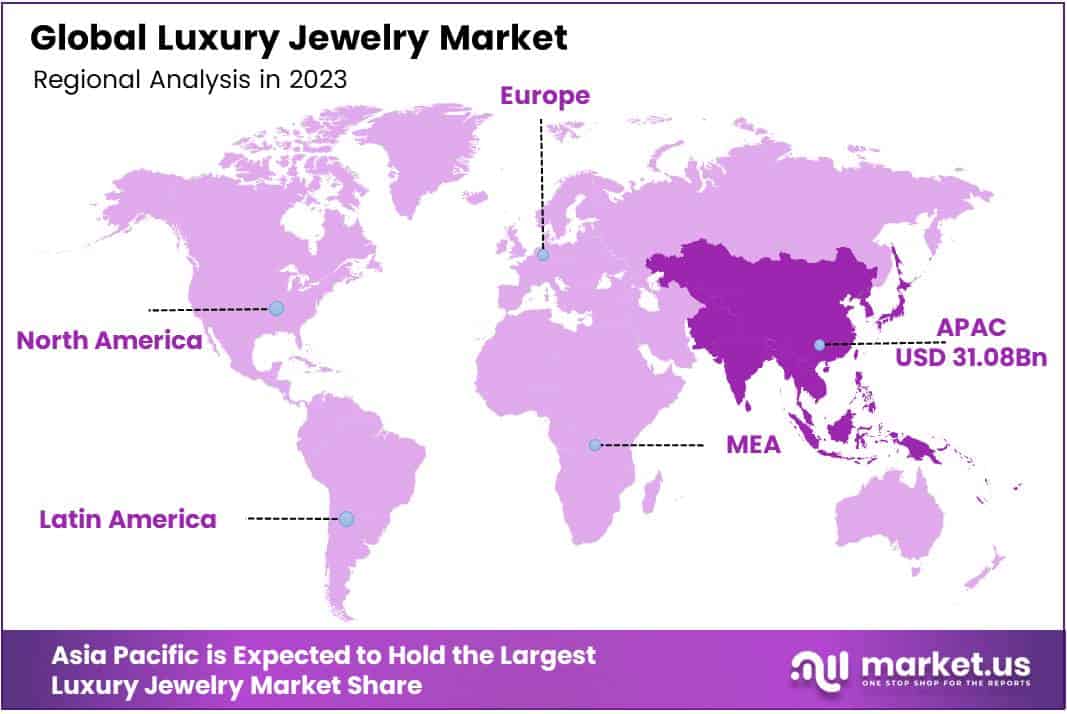

- The Asia Pacific region dominates the market, claiming a 65.3% share, fueled by rising incomes, a growing middle class, and strong local production capabilities.

Raw Material Analysis

Gold Dominates 2023 Luxury Jewelry Market with 39.2% Share

In 2023, gold held a dominant market position in the By Raw Material Analysis segment of the Luxury Jewelry Market, securing a 39.2% share.

This significant market presence reflects gold’s enduring appeal and status as a preferred material among luxury buyers. Platinum followed, appreciated for its rarity and durability, appealing to a niche segment that values its unique properties.

Diamonds, synonymous with luxury, continued to captivate consumers, emphasizing their importance in high-value jewelry. Precious pearls also maintained a notable share, favored for their natural beauty and elegance in classic jewelry designs. Gemstones saw varied interest due to their wide range of colors and types, catering to diverse consumer tastes and preferences.

The Others category, which includes materials like silver and high-end metals, captured the remaining market portion, indicating a varied consumer base with specific preferences for less traditional luxury materials. This segmentation highlights the diverse materials that luxury jewelry buyers consider, with gold leading due to its traditional appeal and substantial investment value.

Product Analysis

Rings Lead 2023 Luxury Jewelry Market with 32.5% Share

In 2023, Ring held a dominant market position in the By Product Analysis segment of the Luxury Jewelry Market, capturing a significant 32.5% share. This prominence underscores the enduring appeal and significant consumer investment in rings as a cornerstone of luxury adornment.

Following closely, necklaces commanded a robust market presence, favored for their versatility and the statement they make in both casual and formal settings.

Earrings, always a staple in personal jewelry collections, maintained a steady demand, reflecting consumer preferences for both classic and contemporary designs. Bracelets also saw appreciable traction, attributed to their increasing popularity as both standalone pieces and in combination with other jewelry types for a layered look.

The Others category, which includes items like brooches and luxury cufflinks, although smaller in market share, catered to niche consumer tastes, highlighting the diverse consumer base and the broad spectrum of products that define the luxury jewelry landscape. This segmentation reveals not only the varying consumer preferences but also highlights areas with potential growth opportunities within the luxury jewelry sector.

Application Analysis

Women Lead Luxury Jewelry Market with 69.8% Share in 2023

In 2023, women held a dominant market position in the By Application Analysis segment of the Luxury Jewelry Market, accounting for a 69.8% share. This significant majority is attributed to the increasing purchasing power of women and the growing fashion consciousness that drives demand for luxury jewelry.

Contrastingly, men’s participation in the luxury jewelry market has been gradually increasing, driven by a rise in fashion trends that include luxury watches and branded jewelry. However, men’s share remains considerably lower than that of women, reflecting more traditional purchasing patterns in luxury goods.

The children’s segment of the luxury jewelry market is relatively small but is beginning to gain traction. This growth is spurred by the trend of gifting expensive, keepsake jewelry to mark significant life events such as birthdays and graduations. While this segment represents a niche market, it is expected to grow as parents and family members increasingly view high-quality jewelry as a long-term investment for children.

Distribution Channel Analysis

Offline Dominates Luxury Jewelry Distribution with 82.6% Market Share

In 2023, Offline held a dominant market position in the By Distribution Channel Analysis segment of the Luxury Jewelry Market, with an 82.6% share. This segment’s substantial market share can be attributed to consumer preferences for a tactile buying experience, where they can physically inspect and try on high-value items before purchasing.

The tactile aspect is crucial in the luxury market, where the feel, fit, and immediate gratification of luxury goods play a significant role in the buying decision. Furthermore, offline channels offer personalized services and expert advice, enhancing consumer confidence in expensive purchases.

Conversely, the Online segment, although smaller, is growing as technology improves and consumer habits shift. Online platforms are increasingly incorporating augmented reality (AR) and high-definition visualization tools to mimic the in-store experience, making them more appealing, especially to tech-savvy younger demographics.

However, despite these advancements, the need for physical interaction in luxury jewelry shopping keeps the Offline segment in the lead. As digital tools evolve and consumer trust increases, the online segment is expected to gradually capture more market share, introducing a dynamic shift in consumer buying patterns in the luxury jewelry sector.

Key Market Segments

By Raw Material

- Gold

- Platinum

- Diamond

- Precious Pearls

- Gemstones

- Others

By Product

- Ring

- Necklaces

- Earrings

- Bracelets

- Others

By Application

- Women

- Men

- Children

By Distribution channel

- Offline

- Online

Drivers

Brands Drive Jewelry Desires

The luxury jewelry market is propelled by several key factors that contribute to its ongoing growth and appeal. Firstly, consumer preference for branded and exclusive jewelry as a status symbol continues to rise, reflecting an increasing emphasis on brand aspirations that align with personal identity and social status.

Additionally, jewelry holds enduring cultural and religious significance, especially in regions like South Asia, where it plays a crucial role in ceremonies and rituals, thus maintaining its demand across diverse demographics. Technological advancements are also pivotal, as the integration of 3D printing and computer-aided design (CAD) technologies allows for the creation of intricate and customizable designs.

These technologies not only enhance the aesthetic appeal of luxury jewelry but also enable manufacturers to meet specific consumer preferences, thereby broadening the market’s scope and accessibility. This combination of brand prestige, cultural depth, and technological innovation forms a robust foundation for the market’s expansion.

Restraints

Counterfeit Jewelry Impacting Market

The luxury jewelry market faces significant challenges, primarily due to the widespread issue of counterfeiting. Counterfeit luxury jewelry significantly damages brand reputation and reduces revenue for authentic manufacturers.

As counterfeit pieces become more sophisticated, it becomes increasingly difficult for consumers to distinguish them from genuine articles, undermining consumer trust and loyalty.

Additionally, changing consumer preferences pose a notable restraint. Today’s consumers are increasingly drawn to minimalistic or alternative jewelry styles, which diverges from traditional luxury offerings. This shift could lead to a decrease in demand for classic luxury jewelry pieces, as consumers opt for simpler, often less expensive options that resonate more with contemporary fashion trends.

Together, these factors create a challenging environment for luxury jewelry brands, compelling them to innovate and adapt to maintain relevance and market share.

Growth Factors

Personalized Jewelry Drives Consumer Engagement

The luxury jewelry market is poised for significant growth, driven by evolving consumer preferences and strategic industry movements. A primary opportunity lies in personalized jewelry, catering to a rising demand for unique, custom-made pieces that reflect individual styles and stories. This trend not only enhances consumer engagement but also elevates brand loyalty and perceived value.

Furthermore, collaborations with renowned fashion brands present a lucrative avenue for introducing exclusive, trend-setting collections that merge the allure of high fashion with the prestige of luxury jewelry. Additionally, the expanding interest in men’s luxury jewelry opens a new demographic frontier, offering diverse designs that resonate with modern male consumers seeking sophistication and statement pieces.

These opportunities collectively underscore a dynamic shift towards more personalized, diverse, and fashion-forward offerings in the luxury jewelry sector.

Emerging Trends

Minimalism Elevates Luxury Jewelry Appeal

In the evolving landscape of the luxury jewelry market, minimalist designs are becoming increasingly popular, aligning with consumer preferences for understated elegance and lightweight accessories. This shift highlights a broader trend towards simplicity in luxury aesthetics, allowing for versatile and timeless pieces that blend seamlessly with various styles.

Additionally, there is a resurgent interest in vintage and antique jewelry, with consumers drawn to heirloom-inspired collections that embody historical significance and craftsmanship. Another significant trend is the rise of lab-grown diamonds, which are gaining traction as sustainable alternatives to traditional mined diamonds.

These lab-created gems cater to the growing consumer demand for eco-friendly and ethically sourced luxury products, providing a blend of modern technology and classic allure that appeals to environmentally conscious buyers. Together, these trends are shaping a new era in the luxury jewelry market, where sustainability, heritage, and minimalism converge to redefine consumer preferences and market dynamics.

Regional Analysis

Asia Pacific region dominant in the luxury jewelry market

The Asia Pacific region, now the dominant force in the luxury jewelry market, claims a staggering 65.3% market share, amounting to USD 31.08 billion.

This dominance is fueled by rising disposable incomes, expanding middle-class populations, and growing brand awareness among consumers. Countries like China and India not only lead in consumption but are also significant producers of luxury jewelry, leveraging centuries-old crafts combined with modern designs.

Regional Mentions:

The Luxury Jewelry Market exhibits dynamic growth trajectories across the globe, influenced by regional economic conditions, cultural preferences, and consumer behavior.

In North America, the market is characterized by a steady demand for high-end luxury pieces, with consumers showing a strong preference for personalized and bespoke jewelry. This region, while mature, continues to innovate through the integration of technology and sustainable practices in jewelry making.

Europe stands as a historical hub for luxury jewelry, home to many of the world’s renowned luxury brands and artisans. The market here is driven by a rich heritage of craftsmanship and a robust presence of luxury houses, which cater to a well-established consumer base that values heritage and quality craftsmanship. The region’s market is buoyed by high tourist inflows and a strong export orientation.

Middle East & Africa region reflects a market driven by high purchasing power and a preference for opulent, statement pieces, which are often integrated with traditional attire. The luxury jewelry market here is also supported by strong cultural ties to gold and precious gemstones, making it a significant market for high-value items.

Latin America, though smaller in scale compared to other regions, shows potential for growth with increasing brand penetration and consumer awareness about international luxury jewelry brands. This region benefits from improving economic indicators and a growing affluent segment that is keen on investing in luxury goods, including jewelry.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the global Luxury Jewelry Market, Louis Vuitton SE emerges as a formidable leader in 2023, demonstrating robust market strategies and a strong brand heritage.

Known for its iconic designs and high-quality craftsmanship, Louis Vuitton has successfully expanded its jewelry segment, offering exclusive pieces that resonate with luxury consumers globally. The company’s strategic focus on integrating contemporary art with traditional jewelry-making techniques has fortified its brand presence and appeal among affluent buyers.

MIKIMOTO, another significant player, continues to leverage its expertise in cultured pearls to captivate a niche market that values both tradition and the allure of fine pearls. Their commitment to sustainability and the sourcing of ethical pearls further strengthens their market position, appealing to environmentally conscious consumers.

Guccio Gucci S.p.A., with its distinctive Italian craftsmanship and bold designs, has also made notable strides. The brand’s ability to blend modern trends with classic elements appeals to a diverse clientele, boosting its visibility and sales in the luxury jewelry segment.

The Swatch Group Ltd. and Signet Jewelers Limited play crucial roles in the market by diversifying their product offerings and adapting to digital sales platforms. Their ability to cater to a broader audience through accessible luxury pieces signifies a strategic pivot that aligns with evolving consumer purchasing behaviors.

Lastly, companies like Chopard International SA and Tiffany & Co. continue to exemplify excellence in luxury jewelry. Chopard’s commitment to ethical jewelry production and Tiffany’s innovative designs underpin their strong reputations and contribute significantly to their sustained market success.

Top Key Players in the Market

- Louis Vuitton SE

- MIKIMOTO

- Guccio Gucci S.p.A.

- The Swatch Group Ltd.

- Signet Jewelers Limited

- Chopard International SA

- Richemont

- Tiffany & Co.

- GRAFF

- Pandora Jewelry, LLC

Recent Developments

- In August 2024, Fireside made a significant investment of $3.2 million in Aukera, a pioneering lab-grown jewelry brand, aiming to boost its innovative approach to sustainable jewelry production.

- In November 2024, Nivoda, the premier digital marketplace for diamonds, secured a substantial $51 million in funding to enhance its global supply chain and expand its market reach.

- In May 2024, Nivoda successfully raised $30 million in a Series B funding round, aimed at accelerating growth and expanding its diamond and gemstone marketplace capabilities.

- In September 2024, Finemater, a London-based jewelry platform run by women and supported by world-leading jewelers, concluded a second seed funding round of 2.6 million euros to promote a sustainable, circular jewelry economy.

Report Scope

Report Features Description Market Value (2023) USD 47.6 Billion Forecast Revenue (2033) USD 105.7 Billion CAGR (2024-2033) 8.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Raw Material (Gold, Platinum, Diamond, Precious Pearls, Gemstones, Others), By Product (Ring, Necklaces , Earrings, Bracelets, Others), By Application (Women, Men, Children), By Distribution channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Louis Vuitton SE, MIKIMOTO, Guccio Gucci S.p.A., The Swatch Group Ltd., Signet Jewelers Limited, Chopard International SA, Richemont, Tiffany & Co., GRAFF, Pandora Jewelry, LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Louis Vuitton SE

- MIKIMOTO

- Guccio Gucci S.p.A.

- The Swatch Group Ltd.

- Signet Jewelers Limited

- Chopard International SA

- Richemont

- Tiffany & Co.

- GRAFF

- Pandora Jewelry, LLC