Global Smart Shelves Market Size, Share, Growth Analysis By Component (Hardware, IoT Sensors, RFID Tags & Readers, Electronic Shelf Label (ESL), Cameras, Software, Services), By Application (Planogram Management, Inventory Management, Pricing Management, Content Management, Others), By Enterprise Size (Large Enterprises, SMEs), By End Use (Hypermarkets, Supermarkets, Department Stores, Warehouses, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 76792

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

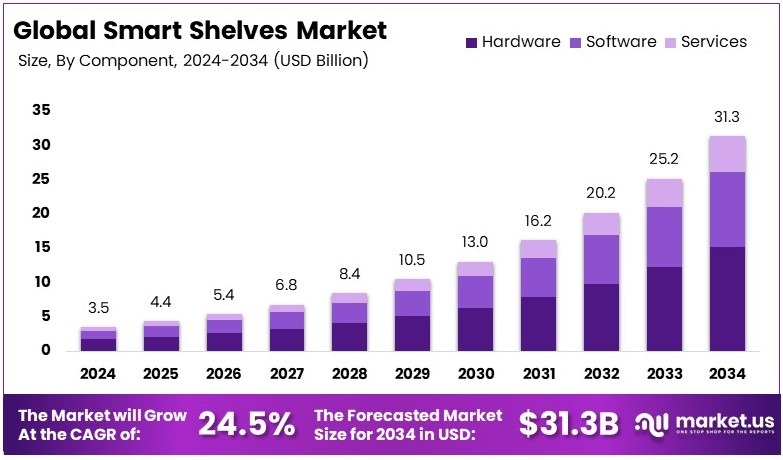

The Global Smart Shelves Market size is expected to be worth around USD 31.3 Billion by 2034, from USD 3.5 Billion in 2024, growing at a CAGR of 24.5% during the forecast period from 2025 to 2034.

Smart shelves are technologically advanced shelving units equipped with sensors and RFID tags to automatically track inventory levels and gather data on product placement and customer interaction, enhancing retail operations.

The smart shelves market refers to the sector involved in the development, production, and sale of intelligent shelving solutions. This market is integral to retail environments aiming to optimize inventory management and customer experience.

Smart shelves represent a significant advancement within the retail sector, leveraging technology to enhance inventory management and customer experience. This innovation utilizes sensors and RFID technology to automatically track stock levels, reducing out-of-stock instances and ensuring accurate inventory data.

The demand for smart shelves is driven by their ability to offer real-time insights and streamline operations, making them increasingly popular among retailers looking to optimize their operations.

Furthermore, the smart shelves market is influenced by broader trends in smart home and IoT device adoption. A survey by the National Association of Realtors indicated that 81% of homebuyers value smart home technology, underscoring the growing consumer preference for connected devices.

Additionally, the use of smart home devices in the U.S. increased to 69.91 million households in 2024, up 10.2% from 63.43 million in 2023. This widespread adoption highlights the potential for smart shelves to integrate seamlessly into the increasingly connected lives of consumers, offering enhanced convenience and personalized shopping experiences. The market’s competitive level is escalating as more companies invest in these technologies to meet consumer expectations and gain a competitive edge.

Key Takeaways

- Smart Shelves Market was valued at USD 3.5 Billion in 2024 and is projected to reach USD 31.3 Billion by 2034 with a CAGR of 24.5%.

- In 2024, Hardware leads the component segment with 48.6%, driven by demand for robust retail technology solutions globally.

- In 2024, Inventory Management dominates the application segment with 36.1%, enhancing operational efficiency across retail chains.

- In 2024, Large Enterprises dominate with 61.4% share, leveraging advanced technology and expansive operational scales for market leadership.

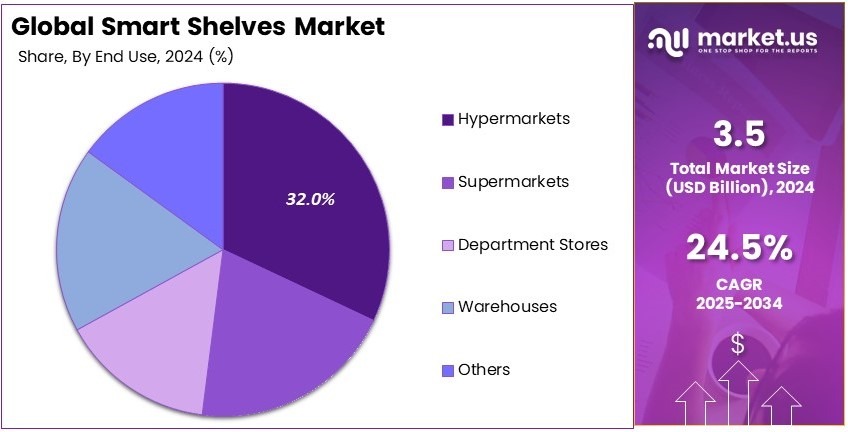

- In 2024, Hypermarkets lead end-use with 32.0%, driven by high footfall and demand for smart retail innovations.

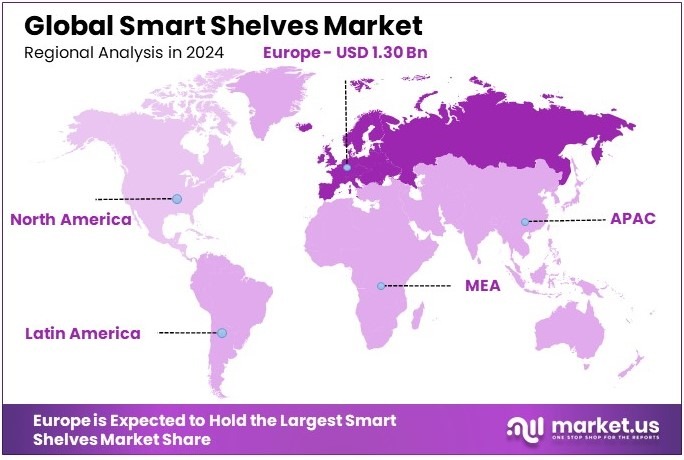

- In 2024, Europe dominates with 36.9% share, contributing approximately USD 1.30 Billion in revenues from smart shelf deployments.

Component Analysis

Hardware dominates with 48.6% due to its critical role in enabling smart shelf functionality.

The smart shelves market is divided into several key components: hardware, IoT sensors, RFID tags & readers, electronic shelf labels (ESL), cameras, software, and services. Among these, the hardware segment leads with a significant market share of 48.6%. The hardware includes the physical infrastructure required to install and maintain smart shelves, such as sensors, readers, and other electronic devices.

This component is essential because it forms the backbone of the entire system, allowing retailers to track inventory and monitor shelf conditions in real-time. Hardware solutions provide the foundational technology needed to enable IoT sensors and RFID tags, which help automate inventory management processes and enhance operational efficiency.

IoT sensors, though not as dominant, are also critical for collecting data from smart shelves. These sensors detect various environmental factors, such as temperature and humidity, and relay this information to central systems for analysis.

RFID tags and readers, which play an important role in inventory tracking, are another crucial sub-segment. These tags use radio waves to communicate item information, enabling efficient stock management.

Cameras and electronic shelf labels (ESL) are used in conjunction with these technologies to display pricing and product details, improving customer experience and operational transparency. While software and services are essential for data processing and cloud-based management, they take a secondary role compared to the physical hardware component.

Application Analysis

Inventory Management dominates with 36.1% due to its direct impact on operational efficiency.

In the smart shelves market, applications such as planogram management, inventory management, pricing management, content management, and others are key drivers of market demand. Inventory management holds the largest share at 36.1%, reflecting its importance in optimizing supply chain processes.

Retailers increasingly rely on smart shelves equipped with IoT sensors and RFID tags technology to automate inventory tracking, reducing errors and ensuring stock availability. This application helps businesses maintain real-time visibility of stock levels, preventing overstocking or stockouts, which directly impacts sales and customer satisfaction.

Pricing management, though a smaller sub-segment, also contributes to growth by enabling dynamic pricing based on demand, stock levels, and competitor pricing. Content management, another crucial aspect, involves the display of relevant product information and promotions to enhance customer engagement.

Other applications encompass a broad range of use cases, such as data collection for marketing and customer behavior analysis. These applications collectively improve efficiency, reduce costs, and enhance customer experiences, driving the adoption of smart shelf technologies across various industries.

Enterprise Size Analysis

Large Enterprises dominate with 61.4% due to their ability to invest in large-scale infrastructure.

The enterprise size segment of the smart shelves market is divided into large enterprises and SMEs (small and medium-sized enterprises). Large enterprises dominate this segment, holding a market share of 61.4%. This dominance is driven by the greater financial and technological resources of larger organizations, which are better equipped to invest in advanced smart shelf systems.

Large enterprises, particularly in sectors like retail and logistics, have the scale to deploy smart shelf solutions across multiple locations. These companies seek automation and efficiency improvements at a large scale, driving significant growth in the market. The ability to manage large volumes of data and leverage cloud-based solutions further enhances their adoption of smart shelf technologies.

SMEs, while contributing less to market share, are gradually embracing smart shelf solutions. These businesses are often more cost-conscious but are starting to realize the potential of automation in reducing operational costs and improving customer experience. The shift towards e-commerce and the growing demand for improved in-store experiences are prompting SMEs to adopt these solutions at a smaller scale.

End Use Analysis

Hypermarkets dominate with 32.0% due to their vast product range and high demand for inventory management.

The end-use segment of the smart shelves market includes hypermarkets, supermarkets, department stores, warehouses, and others. Hypermarkets lead this segment with a market share of 32.0%, driven by their large product inventories and the need for efficient inventory management. These retail giants are under constant pressure to streamline operations and improve the shopping experience for customers.

Smart shelves help hypermarkets by providing real-time inventory visibility, improving stock replenishment, and enabling better space utilization. Moreover, the integration of smart shelves in hypermarkets allows for dynamic pricing and enhanced product visibility, both of which contribute to improved sales and customer satisfaction.

Supermarkets, though smaller than hypermarkets, also benefit significantly from smart shelf solutions. These stores use smart shelves to ensure that products are always in stock and to provide pricing information on the fly.

Department stores and warehouses, on the other hand, focus more on managing large volumes of products and improving supply chain operations, which can also benefit from smart shelf technology. The “Others” category includes other types of retail establishments and logistics hubs, where the adoption of smart shelves is increasing, although at a slower pace compared to the larger retail outlets.

Key Market Segments

By Component

- Hardware

- IoT Sensors

- RFID Tags & Readers

- Electronic Shelf Label (ESL)

- Cameras

- Software

- Services

By Application

- Planogram Management

- Inventory Management

- Pricing Management

- Content Management

- Others

By Enterprise Size

- Large Enterprises

- SMEs

By End Use

- Hypermarkets

- Supermarkets

- Department Stores

- Warehouses

- Others

Driving Factors

Technological Innovations Driving Market Growth

Technological advancements are playing a key role in the growth of the Smart Shelves Market. The integration of advanced sensors and artificial intelligence (AI) has significantly improved the efficiency of inventory management. Retailers can now track stock levels in real-time, reducing the risk of overstocking or running out of popular products. This level of automation not only enhances operational efficiency but also lowers labor costs by minimizing the need for manual stock checks.

The rising demand for automation in retail is another major factor contributing to the adoption of smart shelves. As businesses strive to cut operational expenses and improve productivity, automated solutions such as smart shelves are becoming more attractive. These systems streamline restocking, optimize shelf space, and enhance product visibility, leading to increased sales and improved customer satisfaction.

The development of the Internet of Things (IoT) has further expanded the capabilities of smart shelves. With IoT-enabled connectivity, retailers can remotely monitor inventory and receive real-time alerts when stock levels are low. This reduces human intervention and enhances efficiency. The continuous improvements in sensor technology and machine learning algorithms are making smart shelves more accurate and reliable, driving their widespread adoption across retail environments.

Restraining Factors

High Initial Costs Limiting Market Expansion

Despite the benefits of smart shelves, the high initial investment required for implementation remains a significant barrier. Setting up these systems involves substantial costs, including hardware installation, software integration, and maintenance. For small and medium-sized retailers, these expenses can be overwhelming, making it difficult for them to adopt this technology.

Additionally, integrating smart shelves into existing retail operations is complex and time-consuming. Businesses must allocate resources for employee training, system upgrades, and continuous maintenance to ensure seamless functionality. These challenges can slow down the adoption rate, particularly for retailers that operate on tight budgets.

Technical difficulties also pose a major hurdle. Many retailers lack the in-house expertise needed to install and manage smart shelf systems. As a result, they may need to hire external service providers, further increasing costs. Another key concern is data security. Smart shelves often collect and store large amounts of consumer and inventory data. This raises privacy concerns and makes retailers vulnerable to cyber threats, which could discourage widespread adoption.

Growth Opportunities

Changing Consumer Preferences Creating Growth Opportunities

The evolving shopping behavior of consumers is opening up new opportunities in the Smart Shelves Market. Modern shoppers demand a seamless and personalized shopping experience, and retailers are turning to smart technologies to meet these expectations. Smart shelves enable dynamic pricing, personalized promotions, and real-time product recommendations, enhancing the overall shopping experience.

Another factor driving market opportunities is the shift toward omnichannel retailing. Customers now expect a smooth transition between online and offline shopping. Smart shelves help bridge this gap by synchronizing inventory across different sales channels. This ensures that customers can check product availability online before visiting a store, reducing frustration and improving customer loyalty.

Sustainability concerns are also influencing the market. Retailers are under pressure to reduce waste and optimize inventory usage. Smart shelves help achieve this by minimizing product spoilage, reducing stock shortages, and preventing unnecessary overstocking. With increasing awareness of environmental issues, retailers investing in smart shelf technology can gain a competitive advantage by promoting sustainable business practices.

Emerging Trends

Retail Automation Leading the Latest Market Trends

Retail automation is a major trend shaping the Smart Shelves Market. As businesses strive for greater efficiency, smart shelves are becoming an essential part of modern retail environments. These systems help automate inventory tracking and stock replenishment, reducing reliance on manual labor and improving operational efficiency.

The rapid growth of e-commerce is pushing traditional retailers to adopt smart technologies to stay competitive. With online stores offering real-time stock updates and personalized shopping experiences, brick-and-mortar retailers must adopt similar innovations. Smart shelves enable real-time tracking, interactive displays, and automated checkout processes, enhancing the shopping experience and attracting tech-savvy consumers.

Data-driven retailing is another key trend driving market demand. Smart shelves collect valuable consumer data, allowing retailers to analyze shopping patterns and adjust inventory accordingly. This data-driven approach helps retailers optimize product placement, improve marketing strategies, and boost sales. As artificial intelligence and machine learning continue to advance, smart shelves will become even more intelligent, further revolutionizing the retail sector.

Regional Analysis

Europe Dominates with 36.9% Market Share

Europe holds a dominant share of 36.9% in the Smart Shelves Market, valued at USD 1.30 billion. This strong position can be attributed to a combination of advanced retail infrastructure, high technological adoption, and a mature supply chain ecosystem. Europe’s commitment to automation in retail, coupled with its drive towards Industry 4.0, fosters the widespread implementation of smart shelf technologies.

Key factors driving this dominance include Europe’s emphasis on innovation in the retail sector, especially in countries like Germany, the UK, and France. Retailers in these regions are quick to adopt smart technologies that enhance inventory management, reduce costs, and improve customer satisfaction. Furthermore, the region’s focus on sustainability and operational efficiency aligns well with smart shelf solutions, which help businesses minimize waste and optimize stock levels.

The smart shelves market in Europe benefits from a high level of technological infrastructure and support from both public and private sectors. For example, leading retailers in Europe, such as Carrefour and Tesco, are already implementing smart shelf solutions in their stores. These innovations not only streamline operations but also offer better consumer experiences by providing real-time information on product availability and pricing.

Regional Mentions:

- North America: North America holds a significant share of the smart shelves market, driven by its advanced retail landscape and large-scale adoption of IoT solutions in major retail chains. With the presence of top players like Walmart and Target, the market is expected to continue expanding.

- Asia Pacific: Asia Pacific is emerging as a fast-growing market, particularly in countries like China and Japan, where retail modernization and smart store concepts are rapidly gaining traction. High demand for automation and efficiency drives the region’s market growth.

- Middle East & Africa: The Middle East and Africa show increasing interest in smart shelves as part of the broader trend toward smart retail technologies. Investments in retail innovation and infrastructure development, especially in countries like the UAE and South Africa, are fueling growth.

- Latin America: Latin America is witnessing gradual growth in smart shelf technology adoption, particularly in Brazil and Mexico. Retailers are adopting smart shelves to improve inventory management and enhance customer experiences amid the region’s digital transformation efforts.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Smart Shelves Market is driven by key players who provide innovative solutions in smart retail technologies, with the top four companies significantly shaping the industry landscape. Avery Dennison Corporation, AWM Smart Shelf, E Ink Holdings Inc., and Happiest Minds Technologies Limited are leading the way with their unique product offerings and strategic initiatives.

Avery Dennison Corporation is a prominent player in the market, known for its advanced RFID and electronic shelf label (ESL) solutions. The company has established itself as a leader in supply chain efficiency and retail automation, offering smart shelf solutions that enhance inventory visibility and improve customer experience. Avery Dennison’s focus on sustainability and operational efficiency positions it strongly in the growing market for smart retail technologies.

AWM Smart Shelf specializes in RFID-based smart shelf systems, providing businesses with real-time insights into inventory levels and product movement. Their products help retailers optimize stock levels, reduce shrinkage, and improve customer satisfaction by ensuring products are always available on the shelf. AWM’s emphasis on scalability and seamless integration into existing retail systems makes them a preferred choice for businesses looking to adopt smart shelf solutions.

E Ink Holdings Inc. is well known for its e-paper display technology, which is widely used in electronic shelf labels. Their technology enables retailers to display real-time pricing and product information efficiently. E Ink’s solutions offer low power consumption and high visibility, making them ideal for use in dynamic retail environments. The company’s extensive global reach and innovation in display technology provide a competitive edge in the smart shelves market.

Happiest Minds Technologies Limited is another key player providing end-to-end IoT solutions, including smart shelf technologies. The company integrates AI, machine learning, and analytics into its products, allowing retailers to enhance inventory management and deliver personalized experiences. Their focus on digital transformation and smart retail strategies positions Happiest Minds as a forward-thinking player in the industry.

These companies are well-positioned to dominate the Smart Shelves Market, contributing to the growth of automation in retail and helping businesses achieve greater efficiency and customer satisfaction.

Major Companies in the Market

- Avery Dennison Corporation

- AWM Smart Shelf

- E Ink Holdings Inc

- Happiest Minds Technologies Limited

- Honeywell International Inc.

- Huawei Technologies Co. Ltd

- Intel Corporation

- Lenovo PCCW Solutions Limited

- Samsung Electronics Co. Ltd

- Trax Retail

- Panasonic Connect

- Mirnah Technology Systems

Recent Developments

- SPAR Austria’s Implementation of Electronic Shelf Labels (August 2024): SPAR Austria announced the rollout of smart electronic shelf labels (ESLs) across its stores. The company plans to equip 200 SPAR Supermarkets, both company-owned and independently operated, with multi-coloured ESL units by the end of 2024.

- Walmart’s Expansion of Digital Shelf Labels (June 2024): Walmart announced plans to expand its digital shelf label (DSL) technology to 2,300 stores by 2026. Initially tested in Store 266 in Grapevine, Texas, these DSLs, developed by Vusion Group, enable price updates directly at the shelf via a mobile app.

- Nanoleaf’s Introduction of Modular Smart Lighting Panels (September 2024): During the IFA 2024 event in Berlin, Nanoleaf unveiled its new modular smart lighting system, known as Nanoleaf Blocks. This system includes pegboards, textured covers, and wall shelves, allowing users to create customizable, edge-to-edge smart lighting displays.

Report Scope

Report Features Description Market Value (2024) USD 3.5 Billion Forecast Revenue (2034) USD 31.3 Billion CAGR (2025-2034) 24.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, IoT Sensors, RFID Tags & Readers, Electronic Shelf Label (ESL), Cameras, Software, Services), By Application (Planogram Management, Inventory Management, Pricing Management, Content Management, Others), By Enterprise Size (Large Enterprises, SMEs), By End Use (Hypermarkets, Supermarkets, Department Stores, Warehouses, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Avery Dennison Corporation, AWM Smart Shelf, E Ink Holdings Inc, Happiest Minds Technologies Limited, Honeywell International Inc., Huawei Technologies Co. Ltd, Intel Corporation, Lenovo PCCW Solutions Limited, Samsung Electronics Co. Ltd, Trax Retail, Panasonic Connect, Mirnah Technology Systems Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Avery Dennison Corporation

- AWM Smart Shelf

- E Ink Holdings Inc

- Happiest Minds Technologies Limited

- Honeywell International Inc.

- Huawei Technologies Co. Ltd

- Intel Corporation

- Lenovo PCCW Solutions Limited

- Samsung Electronics Co. Ltd

- Trax Retail

- Panasonic Connect

- Mirnah Technology Systems