Global Rehabilitation Equipment Market Analysis By Product Type [Therapy Equipment, Daily Living Aids (Medical Beds, Bathroom And Toilet Assist Devices, Reading Writing And Computer Aids, Other Daily Living Aids), Exercise Equipment (Upper Body Exercise Equipment, Lower Body Exercise Equipment), Body Support Devices (Patient Lifts, Medical Lifting Slings), Mobility Equipment (Walking Assist Devices, Wheelchairs And Scooters)], By Application (Physiotherapy, Occupational Therapy), By End Use (Hospitals & Clinics, Rehab Centers, Home Care Settings, Physiotherapy Centers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 134735

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

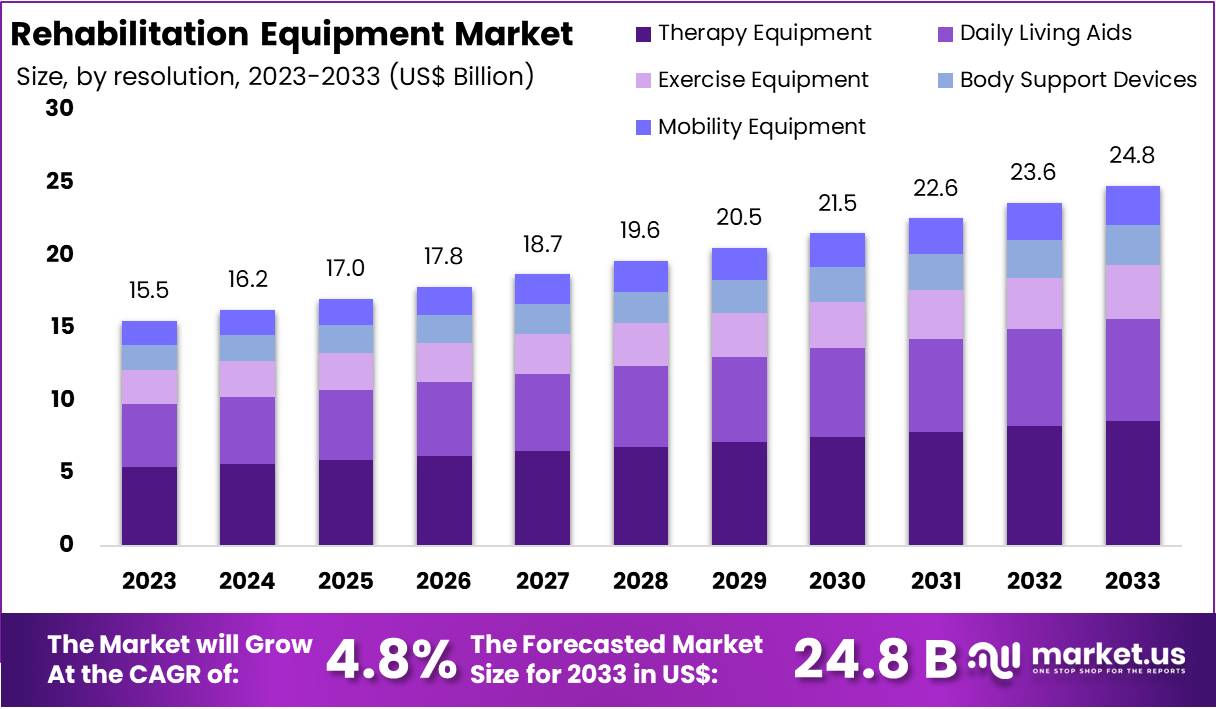

The Global Rehabilitation Equipment Market size is expected to be worth around US$ 24.8 Billion by 2033, from US$ 15.5 Billion in 2023, growing at a CAGR of 4.8% during the forecast period from 2024 to 2033.

Rehabilitation equipment includes devices like wheelchairs, prosthetics, orthotics, and therapeutic exercise tools. These assistive devices help individuals recover from physical impairments or injuries, improve mobility, and enhance independence. According to the World Health Organization, about 2.41 billion people globally could benefit from rehabilitation services – a 63% rise since 1990. This growing need is fueled by an aging population, rising chronic disease prevalence, and advancements in rehabilitation technologies.

The rehabilitation equipment market is witnessing robust growth due to increasing demand. Aging populations, especially in high-income countries, are significant contributors. For example, osteoarthritis, a leading cause of disability in the U.S., affects over 52 million individuals, with estimates suggesting 78 million could be affected by 2040 mentioned by WHO. Moreover, musculoskeletal conditions, including hip fractures, are prevalent, with nearly 50% of elderly hip fracture patients failing to regain pre-fracture mobility levels.

Government policies significantly influence the rehabilitation equipment market. In the U.S., the FDA, through its Center for Devices and Radiological Health, regulates these devices. Programs like the Breakthrough Devices Program expedite the approval of innovative solutions. Additionally, the Export Administration Regulations (EAR) guide the international trade of medical devices. Globally, initiatives like the FDA’s Digital Health Center of Excellence promote digital health technologies, fostering innovations in smart rehabilitation tools.

The rehabilitation equipment market is global, with significant trade activity. Exporters must navigate foreign import regulations to ensure compliance. In the U.S., tools like the Consolidated Screening List help verify foreign buyer eligibility. Understanding these dynamics ensures the safety and quality of exported products while boosting market accessibility. Countries worldwide are investing in healthcare infrastructure, promoting the adoption of rehabilitation devices for both clinical and home use.

Despite its benefits, rehabilitation is underutilized in some areas. According to Million Hearts, the U.S., cardiac rehabilitation (CR) programs see participation rates between 19% and 34%. Barriers include limited availability, low referrals, transportation challenges, and financial constraints. This highlights the need for greater awareness and investments in accessible rehabilitation services to bridge demographic and geographic disparities.

Technological advancements are revolutionizing the rehabilitation equipment market. Companies are integrating artificial intelligence (AI) and machine learning into devices, offering real-time feedback and personalized therapy programs. For example, smart prosthetics and mobility aids are gaining popularity due to their enhanced functionality. These innovations address the growing demand for efficient and effective rehabilitation solutions globally.

Pediatric rehabilitation is also a growing segment. For instance, cerebral palsy (CP), affecting approximately 2.1 per 1,000 live births globally, underscores the need for specialized equipment. Similarly, increasing ICU admissions among children, as reported by the JAMA Network, highlight a rising demand for post-ICU rehabilitation services. Between 2001 and 2019, pediatric ICU admissions rose from 10.6% to 15.5%, indicating a higher survival rate but increased functional impairments requiring rehabilitation.

The market is poised for expansion due to strategic investments and collaborations. Companies are prioritizing research and development to launch advanced solutions. Partnerships between healthcare providers and tech firms are driving innovations, while mergers and acquisitions help companies diversify and expand globally. With favorable demographics, proactive government policies, and cutting-edge technologies, the rehabilitation equipment market holds immense potential for growth, making rehabilitation services more accessible worldwide.

Key Takeaways

- The global rehabilitation equipment market is projected to grow to US$ 24.8 billion by 2033, from US$ 15.5 billion in 2023, at a 4.8% CAGR.

- Therapy equipment dominated the product type segment in 2023, capturing over 34.8% of the rehabilitation equipment market share.

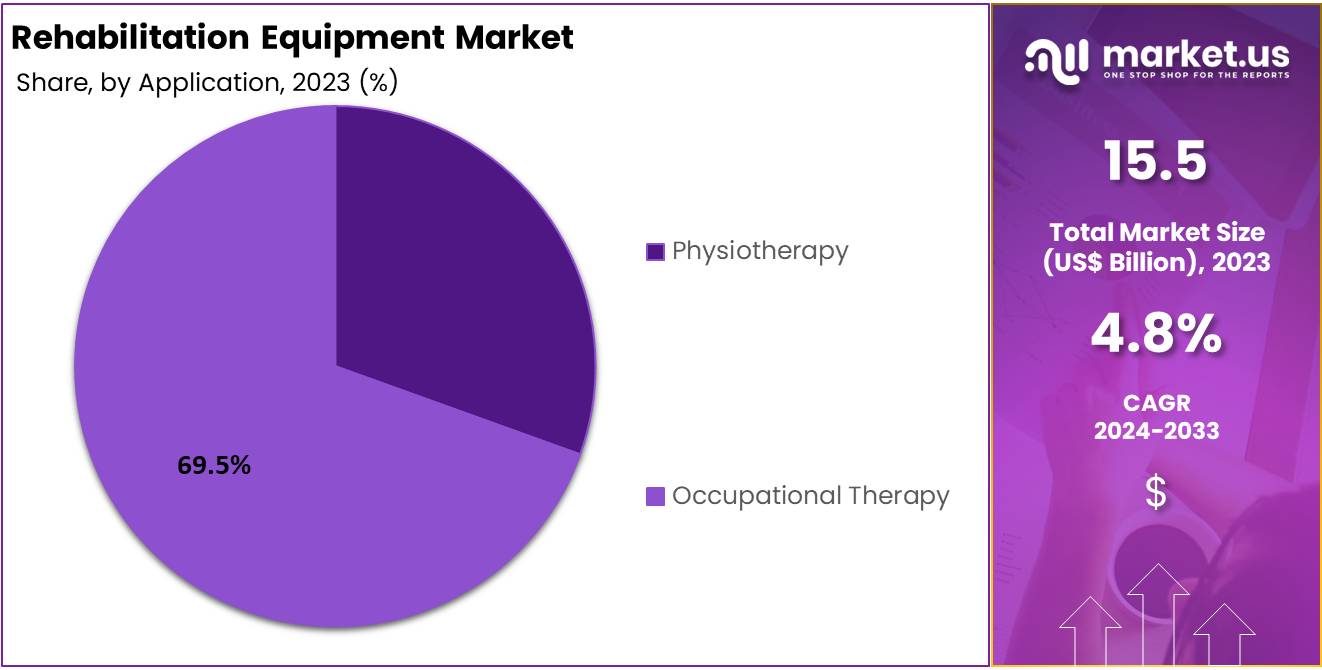

- Occupational therapy led the application segment in 2023, accounting for more than 69.5% of the total rehabilitation equipment market share.

- Hospitals and clinics emerged as the leading end-use segment in 2023, representing over 32.3% of the market share.

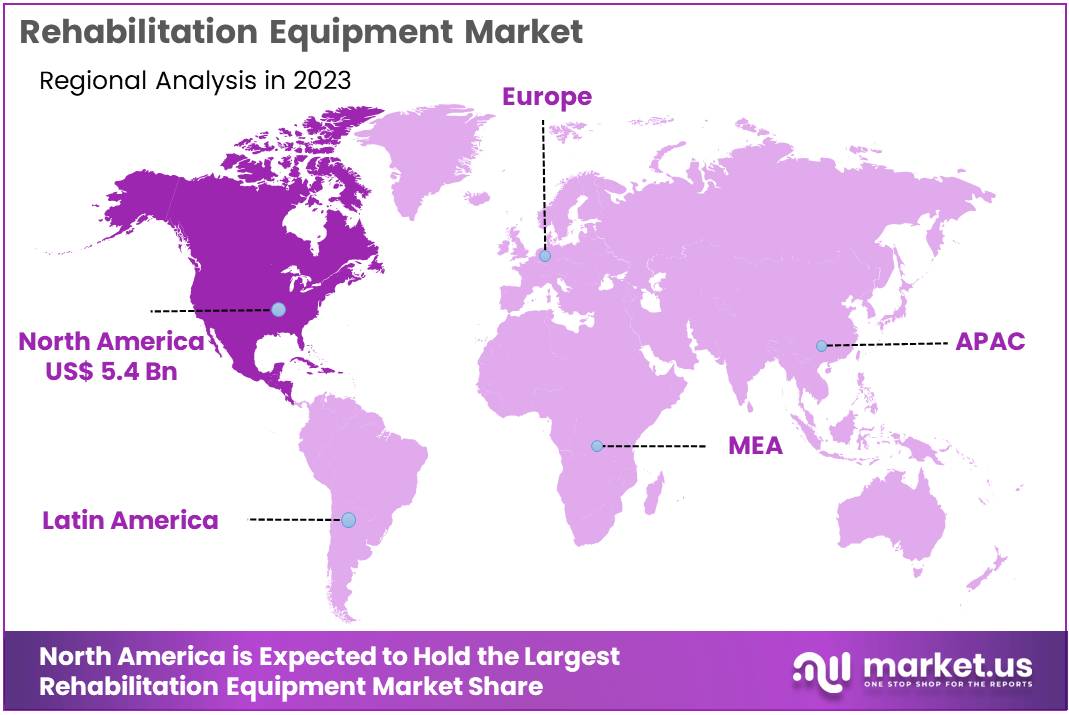

- North America held the top regional position in 2023, contributing 34.9% of the global market share, valued at US$ 5.4 billion.

Industrial Advantages For Market Key Players

The rehabilitation equipment market is experiencing robust growth due to an aging population and an increase in chronic diseases. Companies can benefit by diversifying their product lines to include various types of rehabilitation devices such as mobility aids, therapy machines, and exercise equipment. This approach not only meets the varied needs of patients but also enhances the market presence of these companies. Additionally, offering maintenance and training services can provide a steady revenue stream through repeat business.

Technological advancements offer significant industrial advantages in the rehabilitation equipment sector. Key players can enhance their products with innovative technologies like artificial intelligence, virtual reality, and robotics, thereby improving the effectiveness of their offerings and enhancing the user experience. This technological edge helps position companies as leaders in the rapidly evolving tech-driven healthcare landscape. Partnering with healthcare providers also boosts distribution channels and market penetration.

Opportunities for growth in the rehabilitation equipment market are plentiful, especially in emerging markets. These regions show rapid healthcare infrastructure development and increased healthcare spending, which are conducive to market expansion. Additionally, the trend towards personalized healthcare opens up prospects for customization and personalization of rehabilitation devices, catering to the specific needs of individual users.

The integration of rehabilitation equipment with telehealth services represents a promising opportunity. As telehealth continues to gain traction, equipment that supports remote monitoring and care becomes increasingly valuable. This integration facilitates better patient management from a distance, expanding the scope for remote rehabilitation services. Such innovations not only improve patient care but also broaden the market for rehabilitation equipment by meeting contemporary healthcare demands.

Product Type Analysis

In 2023, the Therapy Equipment segment held a dominant market position in the Product Type Segment of the Rehabilitation Equipment Market, capturing more than a 34.8% share. This segment includes devices essential for patient recovery, such as electric stimulation devices, heat therapy equipment, and cryotherapy machines. These tools are crucial for rehabilitation after surgeries, injuries, or chronic conditions, enhancing mobility and quality of life.

The Daily Living Aids segment encompasses Medical Beds, Bathroom and Toilet Assist Devices, and aids for reading, writing, and computer use. Designed for individuals with limited mobility, these aids significantly enhance independence and safety. They allow users to manage daily activities more effectively, making them indispensable in home care settings.

Exercise Equipment is divided into Upper Body and Lower Body categories. Upper Body Exercise Equipment focuses on arms and shoulders, helping patients improve strength and functionality. Conversely, Lower Body Equipment targets the legs and lower torso, playing a vital role in rehabilitation and muscle rebuilding.

Body Support Devices include Patient Lifts and Medical Lifting Slings. They are critical for safe patient handling, preventing injuries to both patients and caregivers by facilitating secure transfers. Mobility Equipment, such as Walking Assist Devices, Wheelchairs, and Scooters, significantly contributes to the autonomy of individuals with mobility challenges, continuously evolving to meet diverse needs.

Application Analysis

In 2023, the Occupational Therapy segment held a dominant market position in the Application Segment of the Rehabilitation Equipment Market, capturing more than a 69.5% share. This prominence is attributed to the increasing recognition of the benefits occupational therapy provides. It plays a crucial role in improving the quality of life for those with physical, mental, or cognitive challenges.

Occupational therapy focuses on facilitating independence by using therapeutic approaches tailored to individual needs. The segment utilizes a variety of rehabilitation equipment to enhance daily function and self-care capabilities. This approach is essential for patients’ recovery and integration into their daily lives.

The surge in demand for occupational therapy is supported by an aging population and a rise in chronic conditions that require ongoing rehabilitation. Additionally, advancements in technology, such as AI and IoT, are being integrated into rehabilitation devices. These innovations aid in monitoring and adjusting treatments to better suit patient progress and outcomes.

Occupational therapy maintains its significance across healthcare settings worldwide, including rehabilitation centers, hospitals, and clinics. This enduring demand drives the need for innovative rehabilitation equipment. As health systems increasingly focus on patient-centered and outcome-oriented treatments, the importance of the Occupational Therapy segment is expected to grow even further.

End Use Analysis

In 2023, the Hospitals & Clinics segment held a dominant market position in the Rehabilitation Equipment Market’s End-Use Segment, capturing more than a 32.3% share. This segment’s strong performance is largely due to the extensive use of rehabilitation equipment in these settings, where a broad spectrum of therapies and treatments are administered to patients recovering from illnesses, surgeries, and injuries. Hospitals and clinics are equipped with a variety of rehabilitation devices that cater to the needs of diverse patient groups, including those recovering from orthopedic, neurologic, and cardiovascular conditions.

Rehab Centers followed as another significant segment. These facilities specialize in providing intensive rehabilitation services. They use advanced equipment to help patients regain or improve physical, sensory, and mental capabilities. Rehab centers are crucial for patients needing long-term recovery support.

Home Care Settings have also seen growth in the adoption of rehabilitation equipment. This rise is driven by the aging population and the increasing preference for at-home recovery. Equipment like portable motorized treadmills and lightweight wheelchairs are popular, allowing patients to continue their rehabilitation in the comfort of their homes.

Lastly, Physiotherapy Centers are integral to the market. These centers extensively utilize rehabilitation equipment to provide targeted therapies for pain management and muscle strengthening, fostering patient recovery through personalized treatment plans. The focus on outpatient recovery and the increasing number of physiotherapy centers contribute significantly to the demand for rehabilitation equipment in this segment.

Key Market Segments

Product Type

- Therapy Equipment

- Daily Living Aids

- Medical Beds

- Bathroom And Toilet Assist Devices

- Reading Writing And Computer Aids

- Other Daily Living Aids

- Exercise Equipment

- Upper Body Exercise Equipment

- Lower Body Exercise Equipment

- Body Support Devices

- Patient Lifts

- Medical Lifting Slings

- Mobility Equipment

- Walking Assist Devices

- Wheelchairs And Scooters

Application

- Physiotherapy

- Occupational Therapy

End Use

- Hospitals & Clinics

- Rehab Centers

- Home Care Settings

- Physiotherapy Centers

Drivers

Increasing Geriatric Population

The rehabilitation equipment market is significantly influenced by the expanding global geriatric population. As the number of older adults rises, so does the prevalence of chronic diseases and the necessity for mobility aids and rehabilitation devices. Older individuals often require rehabilitation to manage chronic conditions, recover from surgeries, and maintain mobility, leading to increased demand for these products. According to the World Health Organization, approximately 1 billion people were aged 60 years or older in 2020, a number expected to grow substantially in the coming decades.

Projections indicate that the global elderly population will experience significant growth. By 2030, the number of individuals aged 60 years or older is anticipated to reach 1.4 billion, and by 2050, this figure is expected to climb to 2.1 billion. Furthermore, the number of persons aged 80 years or older is set to triple between 2020 and 2050, reaching 426 million, highlighting a rapidly aging demographic that will influence healthcare and rehabilitation needs.

The proportion of the global population aged 65 and above is also on the rise. A study by the National Institutes of Health reports that in 2019, this age group constituted 9% of the global population, with expectations to nearly double to about 17% by 2050. This translates to approximately 1.6 billion elderly individuals, underscoring a shift that will impact global healthcare demands and market dynamics for rehabilitation equipment.

Regionally, the aging population varies significantly. For instance, Japan has one of the highest proportions of elderly individuals, with nearly 30% of its population aged 65 and above. Similarly, countries like Italy and Finland also have substantial elderly populations, with shares around 24% and 23%, respectively, as reported by Visual Capitalist. These demographic trends present various economic and social challenges, necessitating comprehensive policy planning and international cooperation to ensure sustainable development amid an aging global population.

Restraints

High Cost of Rehabilitation Equipment

The high cost of rehabilitation equipment, particularly advanced technologies like robotic systems and AI-driven devices, significantly hinders market growth. These innovative tools require substantial investments in research and development, leading to higher retail prices and limiting accessibility, especially in developing regions and under-resourced healthcare settings. For instance, exoskeletons and virtual reality systems for neurological and physical therapy are crucial for enhancing patient outcomes but remain financially out of reach for many.

Furthermore, the adoption of these technologies is impeded by the scarcity of trained professionals in low-resource settings. According to studies, this lack of specialized training limits the effective utilization of high-tech rehabilitation equipment, further restraining market expansion. In areas with limited professional training, even available advanced technologies are underutilized, which impacts their potential benefits and market penetration.

Additionally, logistical and supply chain issues, particularly during global disruptions like the COVID-19 pandemic, have strained the availability and timely delivery of critical rehabilitation devices. For example, in the United States, the cost of prosthetic limbs ranges from $15,000 to $90,000, with patients typically covering 10%–50% of these costs, while insurance companies handle the rest. However, these prosthetics often require replacement every 3–4 years due to wear and tear, leading to recurring expenses and impacting market profitability and growth.

Opportunities

Technological Advancements in the Rehabilitation Equipment Market

Integrating artificial intelligence (AI) and machine learning into rehabilitation equipment presents both opportunities and challenges. According to industry analysts, the complexity and costs associated with AI technology could hinder its adoption, especially in low-resource environments. AI solutions necessitate significant investments in technology, data management, and expert personnel, limiting accessibility for some healthcare providers. Furthermore, concerns about data privacy and security are paramount, as the reliance on extensive personal health data introduces significant risks of breaches and legal issues.

The therapeutic dynamics in rehabilitation also face potential shifts due to AI integration. Studies indicate that increased automation might reduce crucial human interactions, potentially diminishing patient comfort and trust. This could undermine the essential therapeutic relationship between patients and therapists, affecting treatment outcomes and patient satisfaction. Additionally, technical challenges persist as AI systems must effectively manage highly variable patient data and adapt to unique individual needs.

Integration into clinical practice poses another layer of complexity. For instance, clinicians and healthcare facilities may resist adopting new technologies that disrupt established practices. This resistance often stems from the challenges of integrating AI with existing systems and the necessary training and adaptation for staff. Addressing these integration challenges is vital for the effective use of AI in rehabilitation, ensuring it complements rather than disrupts traditional therapeutic approaches.

Despite these challenges, the potential of AI in rehabilitation is underscored by promising results in various patient treatments. According to a Wikipedia report, about 80% of patients using virtual reality (VR) for musculoskeletal issues experienced enhanced mobility and pain relief. In stroke recovery, VR therapy has improved motor functions by 20% within four weeks. Additionally, VR-based rehabilitation has decreased fall risks by 30% in Parkinson’s disease patients, significantly improving gait speed and balance. In managing chronic pain among cancer patients, VR therapy has shown a notable decrease in pain levels, emphasizing AI’s transformative potential in enhancing rehabilitation outcomes.

Trends

Rising Demand for Home-Based Rehabilitation Products

The demand for home-based rehabilitation products is growing rapidly. This trend reflects a significant shift in healthcare preferences. Patients increasingly prefer to recover in the comfort of their homes. Home settings offer convenience and reduce the need for frequent hospital visits. This preference aligns with broader shifts toward patient-centric care. It also highlights the importance of accessibility and comfort in healthcare delivery.

Advancements in technology are further driving this trend. Portable and user-friendly rehabilitation devices are now widely available. These devices enable effective therapy at home, reducing dependency on clinical settings. They are easy to operate and designed for diverse needs, catering to patients of all ages. This innovation has made rehabilitation more accessible than ever before.

The benefits of home rehabilitation extend to both patients and healthcare providers. Patients experience fewer disruptions to daily life and greater privacy. Healthcare systems benefit from reduced demand for in-patient facilities. This shift also addresses challenges like hospital overcrowding and resource constraints. Overall, it creates a win-win situation for all stakeholders.

Market players are responding swiftly to this demand. Companies are investing in the development of cutting-edge home rehab products. Customizable solutions, tele-rehabilitation platforms, and wearable devices are entering the market. These innovations aim to provide seamless and efficient care. As the trend grows, it opens significant opportunities for businesses. The home rehabilitation segment is poised for sustained growth in the coming years.

Regional Analysis

In 2023, North America secured a dominant position in the Rehabilitation Equipment Market, boasting a 34.9% share valued at US$ 5.4 billion. This dominance is supported by a robust healthcare infrastructure, characterized by significant investments in medical facilities and services. The availability of advanced rehabilitation technologies further strengthens the region’s market leadership.

The demographic trend towards an aging population has notably increased the demand for rehabilitation services and equipment. This surge is primarily due to the growing need to manage age-related conditions and improve mobility among the elderly. Furthermore, the region faces a high prevalence of chronic diseases like cardiovascular and neurological disorders, which frequently necessitate sustained rehabilitation efforts.

Technological innovation remains a pivotal factor in North America’s market dominance. The region is at the forefront of developing cutting-edge rehabilitation equipment, including robotics and tele-rehabilitation solutions. These advancements have substantially enhanced the efficacy and accessibility of rehabilitation services, propelling market growth.

Government policies in North America actively support the rehabilitation equipment sector. Initiatives aimed at enhancing access to care for the disabled and elderly populations contribute to market expansion. Additionally, the region’s strong economic standing facilitates higher per capita healthcare spending, enabling the adoption of expensive, innovative medical technologies. This comprehensive support ensures North America’s continued leadership in the global Rehabilitation Equipment Market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Invacare Corporation stands out in the Rehabilitation Equipment Market with a robust selection of mobility and home healthcare solutions. Their product range includes manual and electric wheelchairs, tailored for long-term home care settings. Invacare emphasizes innovation and quality, aiming to enhance the living standards of those in need.

Medline Industries Inc. is renowned for supplying a comprehensive array of medical and surgical products, including diverse rehabilitation equipment. They focus on improving patient care and operational efficiency in healthcare settings. Medline’s offerings cater to a broad spectrum of rehabilitative needs, from basic mobility aids to sophisticated therapeutic devices.

Dynatronics Corporation specializes in physical therapy and rehabilitation equipment. Their portfolio includes treatment tables, ultrasound machines, and exercise equipment, designed to aid recovery and enhance physical therapy outcomes. Dynatronics is committed to high-quality, effective solutions that support both therapists and patients in rehabilitation settings.

Drive Devilbiss Healthcare and Ekso Bionics are pivotal in advancing rehabilitation technologies. Drive Devilbiss delivers durable medical equipment to increase user independence, while Ekso Bionics leads with robotic exoskeletons that help patients regain mobility. Together with other key players, they innovate and expand product offerings to meet diverse rehabilitation needs.

Market Key Players

- Invacare Corporation

- Medline Industries Inc.

- Dynatronics Corporation

- Drive Devilbiss Healthcare

- Ekso Bionics

- Caremax Rehabilitation Equipment Ltd

- GF Health Products Inc.

- Hospital Equipment Mfg. Co

- Maddak Inc.

- India Medico Instruments

Recent Developments

- In May 2023: Invacare Holdings Corporation successfully completed a financial restructuring process, emerging from Chapter 11 bankruptcy. This restructuring involved a $75 million rights offering and the establishment of an $85 million Exit Term Loan Facility, significantly enhancing the company’s financial stability and positioning it for future growth.

Report Scope

Report Features Description Market Value (2023) US$ 15.5 Bn Forecast Revenue (2033) US$ 24.8 Bn CAGR (2024-2033) 4.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type [Therapy Equipment, Daily Living Aids (Medical Beds, Bathroom And Toilet Assist Devices, Reading Writing And Computer Aids, Other Daily Living Aids), Exercise Equipment (Upper Body Exercise Equipment, Lower Body Exercise Equipment), Body Support Devices (Patient Lifts, Medical Lifting Slings), Mobility Equipment (Walking Assist Devices, Wheelchairs And Scooters)], By Application (Physiotherapy, Occupational Therapy), By End Use (Hospitals & Clinics, Rehab Centers, Home Care Settings, Physiotherapy Centers) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Invacare Corporation, Medline Industries Inc., Dynatronics Corporation, Drive Devilbiss Healthcare, Ekso Bionics, Caremax Rehabilitation Equipment Ltd, GF Health Products Inc., Hospital Equipment Mfg. Co, Maddak Inc., India Medico Instruments Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Rehabilitation Equipment MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Rehabilitation Equipment MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Invacare Corporation

- Medline Industries Inc.

- Dynatronics Corporation

- Drive Devilbiss Healthcare

- Ekso Bionics

- Caremax Rehabilitation Equipment Ltd

- GF Health Products Inc.

- Hospital Equipment Mfg. Co

- Maddak Inc.

- India Medico Instruments