Global Exoskeleton Market By Mobility (Mobile and Fixed/Stationary) By (Technology, Powered and Non-powered) By Extremity (Upper Body, Lower Body and Full Body) By End-use (Healthcare, Military and Industry), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast: 2023-2033

- Published date: Nov 2023

- Report ID: 12588

- Number of Pages: 269

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

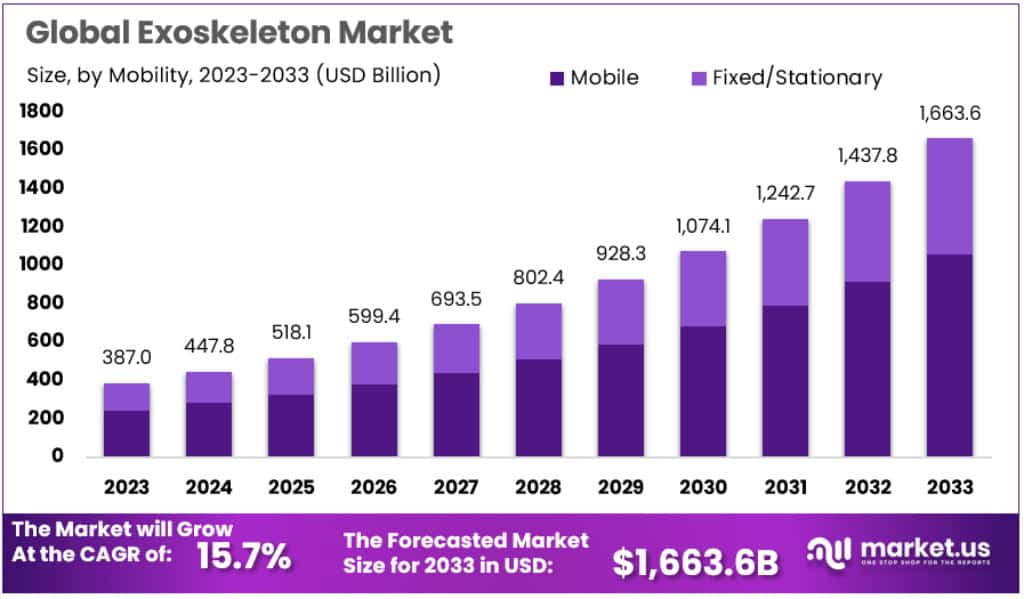

The Global Exoskeleton Market size is expected to be worth around USD 1663 Billion by 2033, from USD 387 Billion in 2023, growing at a CAGR of 15.7% during the forecast period from 2023 to 2033.

This market’s growth has been driven by booming global geriatric populations and the increasing adoption rates of medical equipment across various industries like the automobile, defense, and construction sectors. Additionally, there is also an increasing incidence rate of strokes being indexed across the globe.

Global markets are expected to register an increase in the number of Spinal Cord Injuries (SCI). According to National Spinal Cord Injury Statistical Center, (NSCISC), the number of SCI cases for 2019, 2020, and 2021 was 17,730, 17,810, and 10,9000, respectively. A further 296,000 Americans have suffered from SCIs.

Key Takeaways

- Market Growth: Exoskeleton market to reach USD 1663 Billion by 2033, growing at 15.7% CAGR from 2023, driven by aging population and medical equipment adoption.

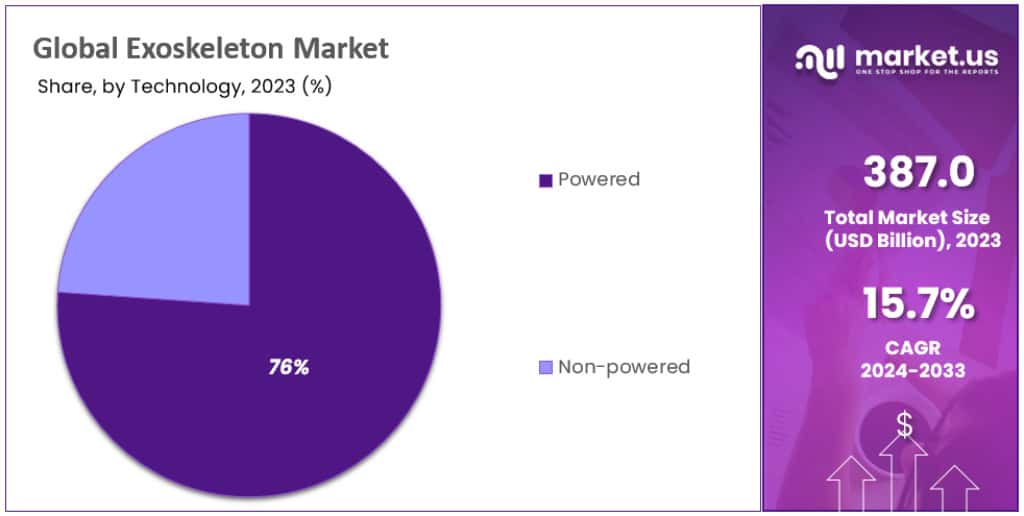

- Segment Dominance: Mobile exoskeletons hold 63.56% market share, favored for versatility, while powered technology captures 76.1% share for advanced capabilities.

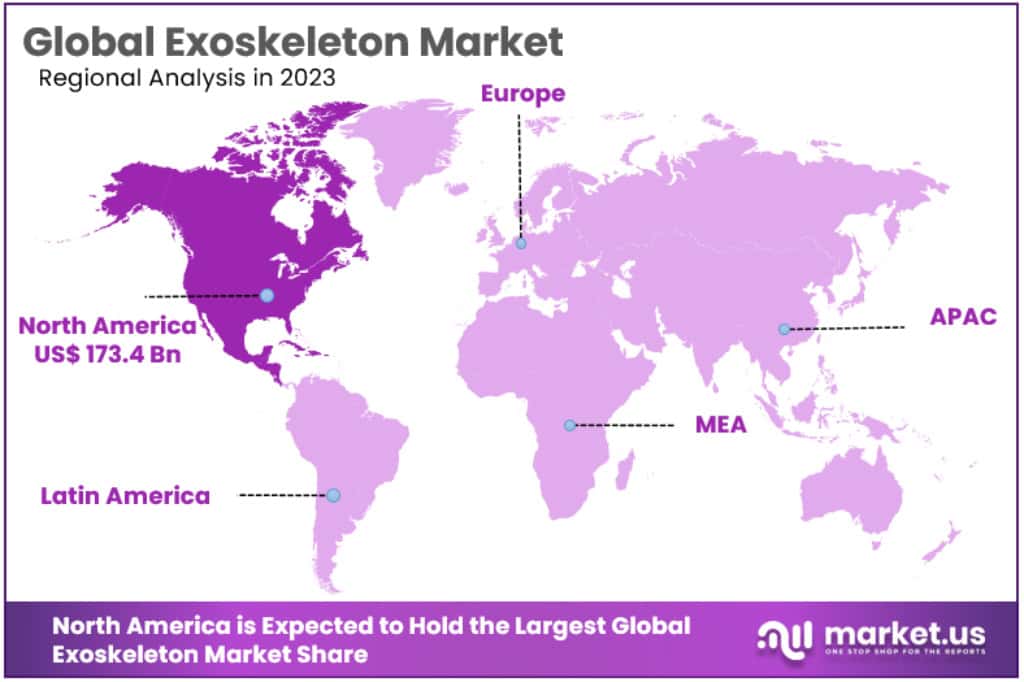

- End-use Focus: Healthcare sector leads with 51.7% market share, driven by rehabilitation needs, while North America dominates with 44.8% share.

- Regional Trends: North America leads with USD 173.4 billion market in 2023, supported by collaborations and investments, while Asia Pacific anticipates highest growth.

- Technological Advancements: Robotics innovations propel market growth, enabling efficient and portable exoskeleton designs for diverse applications.

- Regulatory Hurdles: Stricter approvals challenge powered exoskeletons, particularly on uneven surfaces, necessitating stringent safety measures for user protection.

- Insurance Coverage: Growing insurance support increases accessibility, particularly in healthcare, enhancing adoption rates and market expansion.

- Cost Barriers: High equipment costs hinder widespread adoption, especially in low-income regions, prompting exploration of cost-effective alternatives.

- Opportunities in Emerging Economies: Favorable funding environments in regions like Asia Pacific drive market growth, fostering technological advancements and adoption rates.

Mobility Analysis

In 2023, the exoskeleton market was significantly led by the mobile segment, which held a dominant position with over 63.56% market share. This segment’s growth can be attributed to its versatility and wide range of applications in various industries including healthcare, military, and industrial sectors. Mobile exoskeletons offer enhanced mobility and physical support to users, leading to increased adoption in tasks that require extensive physical labor or assistance in movement.

On the other hand, the fixed or stationary segment, while smaller in comparison, plays a crucial role in specific applications where mobility is not a primary requirement. These types of exoskeletons are primarily used in rehabilitation centers and medical facilities for patient support and therapy. Despite its smaller market share, this segment benefits from technological advancements and increasing investments in healthcare infrastructure, contributing to its steady growth.

Both segments are influenced by factors such as technological innovations, rising demand for automation, and the growing prevalence of physical disabilities and aging populations. The mobile segment, however, exhibits a more dynamic growth pattern due to its broader application scope and continuous development in wearable technology. The fixed/stationary segment, while more niche, is expected to see incremental growth with advancements in medical technologies and increasing focus on patient care and rehabilitation.

Technology Analysis

The exoskeleton market witnessed a significant dominance of powered technology, capturing more than a 76.1% share in 2023. This substantial market share can be attributed to the advanced capabilities of powered exoskeletons, such as enhanced strength, endurance, and precision, which are highly valued in various sectors including healthcare, military, and industrial applications. The powered exoskeletons, equipped with motors, actuators, and advanced control systems, provide substantial assistance and augmentation of human capabilities, leading to their widespread adoption.

Conversely, the non-powered segment, while holding a smaller portion of the market, remains vital in scenarios where simplicity, cost-effectiveness, and lower maintenance are key considerations. Non-powered exoskeletons, often relying on mechanical components like springs and dampers, are predominantly used in applications requiring basic support and mobility assistance. This technology is particularly relevant in rehabilitation and geriatric care, where the need for powered assistance may be less critical.

Extremity Analysis

In 2023, the lower body segment held a dominant position in the exoskeleton market, capturing more than a 43.6% share. This segment’s prominence is primarily due to the high demand for lower body exoskeletons in applications such as mobility assistance, rehabilitation, and labor-intensive industries. These exoskeletons are designed to support and enhance the strength and endurance of the legs and lower back, making them ideal for tasks that involve lifting, walking, or standing for extended periods.

The upper body segment, while holding a smaller market share, is crucial in applications requiring arm and shoulder support. These exoskeletons are widely used in rehabilitation for patients with upper limb disabilities and in industries where workers engage in repetitive upper body tasks. The focus on reducing workplace injuries and enhancing productivity drives the demand for upper body exoskeletons.

The full body segment, encompassing both upper and lower extremities, represents a niche but growing market. These exoskeletons offer comprehensive support and are particularly beneficial in extreme environments, such as military and heavy industry applications. Although they currently hold a smaller market share, advancements in technology and design are likely to boost their adoption in the future.

Overall, each segment addresses specific needs across various applications, with lower body exoskeletons leading due to their broad applicability in both medical and industrial fields. The market for each segment is influenced by factors such as technological advancements, an aging population, and increasing focus on workplace safety and efficiency.

End-use Analysis

The healthcare sector held a dominant position in the exoskeleton market, capturing more than a 51.7% share in 2023. This significant market share is a result of the increasing adoption of exoskeletons in rehabilitation, assisting patients with mobility issues, and aiding elderly individuals. The healthcare industry’s focus on providing advanced care and improving patient quality of life drives the demand for these devices, with applications ranging from physical therapy to assistance in daily activities.

- Companies using exoskeletons in healthcare: Some of the major companies that operate in the medical exoskeleton market include CYBERDYNE INC., Ekso Bionics, Ergosanté, B-Temia, ExoAtlet, ReWalk Robotics., Ottobock SE & Co. KGaA (suit X), DIH medical Hocoma., Human Motion Technologies LLC., and Wearable Robotics srl.

- Exoskeleton use in patient handling: Exoskeletons can help reduce the risk of musculoskeletal disorders (MSDs) in healthcare workers, particularly those involved in patient handling. The Rehabilitation Institute of Michigan (RIM) uses exoskeleton suits to help patients with spinal cord injuries and other mobility impairments.

- Exoskeleton use in rehabilitation: Ekso Bionics is a company that produces exoskeletons for rehabilitation purposes, helping patients with mobility impairments such as spinal cord injuries or other brain injuries.

- Exoskeleton use in stroke rehabilitation: ReWalk Robotics produces exoskeletons that are highly recommended by doctors for stroke rehabilitation

The military segment, while holding a smaller share, plays a vital role in the exoskeleton market. Exoskeletons in the military are used for enhancing soldier endurance, strength, and load-carrying capabilities. This technology is critical in augmenting the physical abilities of soldiers in challenging environments, leading to its steady adoption in various military applications.

- Top companies in the military exoskeleton market: Some of the major companies operating in the military exoskeleton market include BAE Systems, Lockheed Martin Corporation, General Atomics, Raytheon Company, Bionic Power Inc., and SRI International.

- Lower body exoskeletons: Military exoskeletons for the lower body accounted for 41.9% of overall sales in 2022.

- Partial-body exoskeletons: Sales of partial-body exoskeletons are projected to rise at a CAGR of 16.9%.

- Exoskeletons for dismounted soldiers: The focus on increasing the safety and efficiency of dismounted soldiers has led to the military investing in exoskeletons, as they reduce fatigue and provide an extra layer of protection from the outside.

Industry, as an end-use segment, also represents a significant portion of the market. In industrial settings, exoskeletons are increasingly used to prevent workplace injuries and improve productivity. These devices are particularly beneficial in manufacturing, construction, and warehousing, where they assist workers in lifting heavy objects and performing repetitive tasks.

- Exoskeleton companies in the industry: Some of the major companies operating in the industrial exoskeleton market include BAE Systems, Lockheed Martin Corporation, General Atomics, Raytheon Company, Bionic Power Inc., and SRI International.

- Exoskeletons for construction and manufacturing: Exoskeletons for work and industry can be used at construction sites, dry-docks, factories, warehouses, and even surgical rooms.

- Exoskeletons for lifting and carrying: Companies like Ekso Bionics and Honda Motor Co., Ltd. have developed exoskeletons for lifting and carrying heavy objects, reducing the risk of work-related injuries and increasing worker productivity.

- Exoskeletons for rehabilitation and assistive devices: Companies like Cyberdyne Inc. and ReWalk Robotics have developed exoskeletons for rehabilitation and assistive devices, helping individuals with mobility impairments regain their independence and improve their quality of life.

Each end-use segment reflects the diverse applications of exoskeletons, with healthcare leading due to its wide-ranging implications in patient care and rehabilitation. The military and industrial segments, though smaller, are poised for growth, driven by technological advancements and a growing emphasis on enhancing human capabilities and workplace safety.

Key Market Segments

Mobility

- Fixed/Stationary

- Mobile

Technology

- Non-Powered

- Powered

Extremity

- Lower Body

- Upper Body

- Full Body

End-use

- Healthcare

- Industry

- Military

Type

- Soft Exoskeleton

- Rigid Exoskeleton

Market Dynamics

To improve employee productivity and health, exoskeleton solutions have been widely adopted in a host of industries. There are several startups that specialize in exoskeleton technology, as well as rehabilitation solutions. In order to improve this market’s share in the coming years, industry players have been developing innovative product strategies due to the ever-changing nature of the exoskeleton industry. In June 2021, SuitX introduced shieldX. It is designed for health workers who have neck or back-related issues and wear heavy anti-radiation aprons. Roam Robotics, a robotic partial-knee orthosis, launched Ascend in May 2021. It is designed to help wearers reduce knee pain and improve mobility.

Cumulative Trauma Disorders (CTD), Occupational Overuse Syndrome (OOS), and Repetitive Strain Injury (RSI) are three of the most common musculoskeletal conditions and injuries that affect individuals in the construction industry. According to data published by the WHO in February 2021 about 1,710 million people suffer from musculoskeletal diseases. According to the Health and Safety Executive’s (HSE) November 2020 data, 480,000 British workers suffer from occupational-related musculoskeletal system disorders. These are some of the most prominent reasons why exoskeleton technology is being adopted. The benefits of exoskeleton technology include enhancing or assisting users’ ability or physical activity, improving productivity, as well as reducing fatigue.

The market for exoskeletons has been hindered by a lack of technological developments and low per capita incomes in developing nations and emerging economies. In developing countries, companies face numerous challenges due to a lack of funding and inaccessibility to the latest technologies. A lack of adequate healthcare services in emerging economies has limited access to rehabilitation treatments for those individuals with disabilities. Additionally, these countries are heavily dependent upon medical device imports. This makes devices more expensive and limits access in general. This factor is limiting the potential for the further development and growth of the exoskeleton market.

The COVID-19 outbreak has had a detrimental impact on the global economy. It raised unemployment rates and sparked economic instability while disrupting supply and demand systems. EksoBionics 2020’s annual report stated that there was a 36.0% decline in revenue earnings for FY2020 compared to FY2019. This is due to a substantial decline in the sales of medical equipment. According to the annual report, 38.0% of exoskeleton sales declined over the course of the pandemic. This led to a booking of 61 units in 2020, as opposed to 98 units in 2019.

Driver

Advancements in Robotic Technologies

Technological progress in robotics has greatly impacted the exoskeleton market. Developments in electrical and electronic engineering have led to better materials, sensors, actuators, control systems, and software. These innovations have enabled the creation of exoskeletons that are more efficient, self-powered, lightweight, simple, and portable. These advancements are vital for producing exoskeletons that are easy to use and can perform a variety of tasks more effectively.

Restraint

Regulatory Challenges in Medical Approvals

Although powered lower-limb exoskeletons have advanced significantly, they still struggle on sloping or slippery surfaces and with twisting movements. This limitation can lead to fatigue and even serious injuries like skin damage and bone fractures. Consequently, regulatory bodies have imposed strict approval processes for these devices to ensure the safety of the users, particularly considering the high power of the actuators involved.

Opportunity

Growing Insurance Coverage for Exoskeletons

In the healthcare sector, there’s an increasing trend of insurance providers covering robotic devices, including exoskeletons. For example, in Germany, the ReWalk 6.0 personal exoskeleton system was listed in the Medical Device Directory, making it eligible for insurance procurement. This growing support from insurance companies is a significant opportunity for the exoskeleton market, making these devices more accessible to those who need them.

Challenge

High Equipment Cost

Despite their benefits, exoskeletons face the challenge of high costs. Not only is the purchase price steep, but there are also additional expenses for maintenance, service, and training. This high cost of ownership makes exoskeletons less accessible, especially in low-income countries, and often leads to a preference for powered wheelchairs which are simpler and cheaper. This cost barrier is a major challenge for the industry, limiting the adoption of exoskeletons for rehabilitation purposes.

Regional Analysis

North America is dominating Exoskeleton Market with 44.8% share, with USD 173.4 Billion in 2023. This was due to the increasing prevalence of disabilities, growing public and private support, greater collaborations between key industry players, and a greater number of partnerships and collaborations.

According to CDC data, nearly 61 million Americans have some form of disability. In addition, 13.7% suffer from mobility disabilities. This growth is being driven by a rapidly increasing geriatric population, the availability of private and public investors, surging disposable incomes, a greater number of market players present here, and growing human augmentation in both military and industrial verticals.

Sarcos, for example, raised USD 40 million in a Series B round by Rotor Capital in September 2020. The funding will be used to expand the commercial production of Guardian XO. The Asia Pacific, on the other hand, is expected to experience the highest growth rate over the next few years due to a growing number of individuals who require rehabilitation support. The Asia Pacific’s exoskeleton market is growing due to the expansion and development of healthcare infrastructure and the availability of adequate funding. Expect to see steady economic growth in emerging economies like India and Japan as well as favorable public and privately funded support.

Additionally, APAC serves as a hub for several sectors’ manufacturing, therefore the region’s rapidly increasing industrial automation will result in big demand for exoskeletons.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

In order to grow their product range and expand their respective business, key participants focus on formulating new product development strategies. Ekso Bionics, for example, received FDA approval in June 2020 to use its EksoNR robotic exoskeleton in clinical trials. This exoskeleton is used by patients with Acquired Brain Injuries. This market will register a surge in technological collaborations and partnerships, geographical expansion prospects, as well as mergers and acquisitions over the next few years.

In order to commercialize rehabilitative robot devices created in Switzerland, Germany, and the United States, Hocomo’s parent company, DIH International Limited, joined up with Reha Technology in 2021.

The first sale of Bionik Laboratories’ InMotion arm robotic technology by its exclusive distributor in South Korea was announced in January 2020, following regulatory approval.

Key Market Players

- Hocoma

- Ekso Bionics

- Suit X (U.S. Bionics Inc.)

- Lockheed Martin Corporation

- RB3D

- Rex Bionics Plc.

- Cyberdyne Inc.

- Atoun Inc.

- Wearable Robotics Srl

- ReWalk Robotics Ltd.

- Bionik Laboratories Corp.

- ActiveLink (Panasonic Corporation)

- Other Key Players

Recent Development

- October 2023: Ekso Bionics launches the EksoNR, a new exoskeleton for rehabilitation and gait training. The EksoNR is designed to be more affordable and accessible than previous Ekso exoskeletons.

- September 2023: ReWalk Robotics launches the ReWalk ONE, a new exoskeleton for paraplegics. The ReWalk ONE is designed to be more lightweight and comfortable than previous ReWalk exoskeletons.

- August 2023: Bionic Power Systems launches the C-Leg 7, a new exoskeleton for amputees. The C-Leg 7 is designed to be more responsive and intelligent than previous C-Leg exoskeletons.

- July 2023: Ottobock launches the Paexo, a new exoskeleton for industrial workers. The Paexo is designed to reduce fatigue and improve productivity in industrial workers.

- June 2023: Sarcos Robotics launches the Guardian XO Max, a new exoskeleton for military and first responders. The Guardian XO Max is designed to provide superhuman strength and endurance to users.

Report Scope

Report Features Description Market Value (2023) USD 387 Billion Forecast Revenue (2033) USD 1663 Billion CAGR (2023-2032) 15.7% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Mobility (Mobile and Fixed/Stationary) By (Technology, Powered and Non-powered) By Extremity (Upper Body, Lower Body and Full Body) By End-use (Healthcare, Military and Industry) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Hocoma, Ekso Bionics, Suit X (U.S. Bionics Inc.), Lockheed Martin Corporation, RB3D, Rex Bionics Plc., Cyberdyne Inc., Atoun Inc., Wearable Robotics Srl, ReWalk Robotics Ltd., Bionik Laboratories Corp., ActiveLink (Panasonic Corporation) and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the exoskeleton market size?The exoskeleton market is valued at USD 387 Billion in 2023 and is projected to reach USD 1663 Billion by 2033; it is expected to grow at a CAGR of 15.7% from 2023 to 2033.

Who are the leading players in the global exoskeleton market?Companies such as Hocoma, Ekso Bionics, Suit X (U.S. Bionics Inc.), Lockheed Martin Corporation, RB3D, Rex Bionics Plc., Cyberdyne Inc., Atoun Inc., Wearable Robotics Srl, ReWalk Robotics Ltd., Bionik Laboratories Corp., ActiveLink (Panasonic Corporation) and Other Key Players are the leading players in the market. Moreover, these companies rely on strategies that include new product launches and developments, partnerships and collaborations, and contracts. Such advantages give these companies an edge over other companies in the market.

What are the factors driving the exoskeleton market?Key factors that are driving the market growth include the huge demand for exoskeletons, the growing adoption of exoskeletons in healthcare and non-healthcare settings, reimbursement coverage offered on these systems, and the increasing prevalence of spinal cord injuries (SCIs).

-

-

- Hocoma

- Ekso Bionics

- Suit X (U.S. Bionics Inc.)

- Lockheed Martin Corporation

- RB3D

- Rex Bionics Plc.

- Cyberdyne Inc.

- Atoun Inc.

- Wearable Robotics Srl

- ReWalk Robotics Ltd.

- Bionik Laboratories Corp.

- ActiveLink (Panasonic Corporation)

- Other Key Players