Global Pickleball Clothing And Apparel Market Size, Share, Growth Analysis By Product Type (Tops, Bottoms, Outerwear, Accessories), By Gender (Men’s Apparel, Women’s Apparel, Unisex Apparel), By Standard (General Standard, Professional Standard), By Distribution Channel (Online Retail, Offline Retail), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143179

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

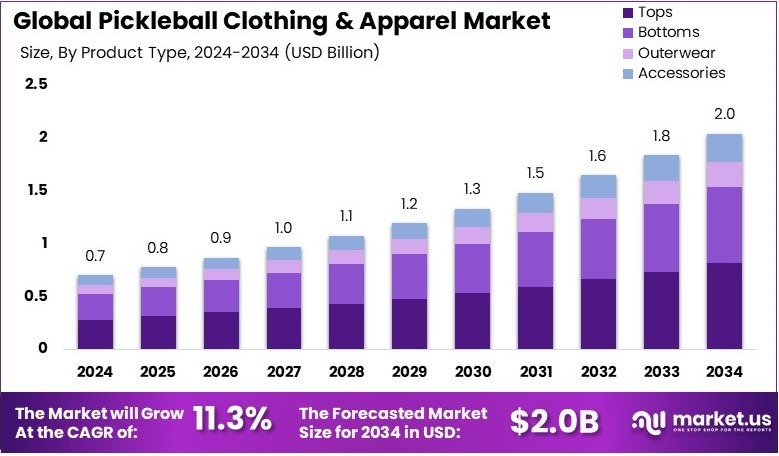

The Global Pickleball Clothing And Apparel Market size is expected to be worth around USD 2.0 Billion by 2034, from USD 0.7 Billion in 2024, growing at a CAGR of 11.3% during the forecast period from 2025 to 2034.

Pickleball clothing and apparel consist of garments specifically made for pickleball players. These items are designed for comfort and functionality, featuring breathable fabrics and flexible designs that accommodate the dynamic movements of the sport.

The pickleball clothing and apparel market encompasses the business activities involved in the design, manufacture, and sale of clothing tailored to pickleball players. This market segment aims to meet the demands of an expanding base of players seeking sport-specific attire that offers both performance benefits and fashion.

According to Market.us, the global pickleball market is projected to reach USD 9.1 billion by 2034, up from USD 2.2 billion in 2024, demonstrating a robust compound annual growth rate (CAGR) of 15.3%. This significant growth is primarily fueled by the sport’s increasing global popularity and its accessibility, which attracts a diverse player base. As pickleball continues to be recognized as a mainstream sport, the demand for specialized clothing and apparel that caters to players’ needs is rapidly expanding.

Additionally, the market for pickleball clothing and apparel is not only driven by the rising number of players but also by evolving fashion trends that influence sportswear. In regions like the United States, where there are currently 4.8 million active players and nearly 8,500 playing locations, the demand for stylish, comfortable, and functional pickleball attire is particularly strong.

This demand is further supported by legislative actions such as Washington State declaring pickleball its official sport, which helps promote the sport and, consequently, the apparel associated with it.

Emerging markets such as Australia and Canada also present significant opportunities for the pickleball apparel sector. In Australia, where interest in pickleball doubled in 2023, the potential customer base for pickleball clothing is expanding rapidly, with membership numbers growing from 4,000 to 9,000 in a single year.

Similarly, in Canada, the number of pickleball players increased from 1 million to 1.37 million from 2022 to 2023. These markets exhibit lower levels of market saturation compared to the U.S., offering new avenues for apparel brands to introduce innovative products.

The impact of pickleball extends beyond individual players to the broader economy, with local communities benefiting from the influx of tournaments and the associated spending on sportswear and related products. Moreover, the relatively light regulatory environment in these markets allows for easier introduction and distribution of new apparel lines, fostering a competitive and diverse marketplace.

Key Takeaways

- Pickleball Clothing and Apparel Market was valued at USD 0.7 Billion in 2024 and is expected to reach USD 2.0 Billion by 2034, with a CAGR of 11.3%.

- In 2024, Tops led the product type segment with 42.6%, attributed to their essential role in sportswear collections.

- In 2024, Women’s Apparel dominated the gender segment with 48.9%, reflecting the growing participation of women in pickleball.

- In 2024, Professional Standard apparel held 57.1%, driven by the rising demand for high-performance gear.

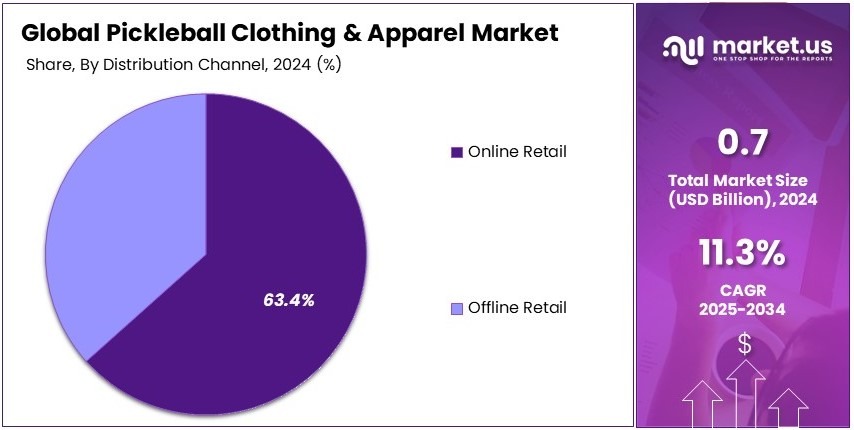

- In 2024, Online Retail led the distribution channel with 63.4%, benefiting from ease of purchase and diverse options.

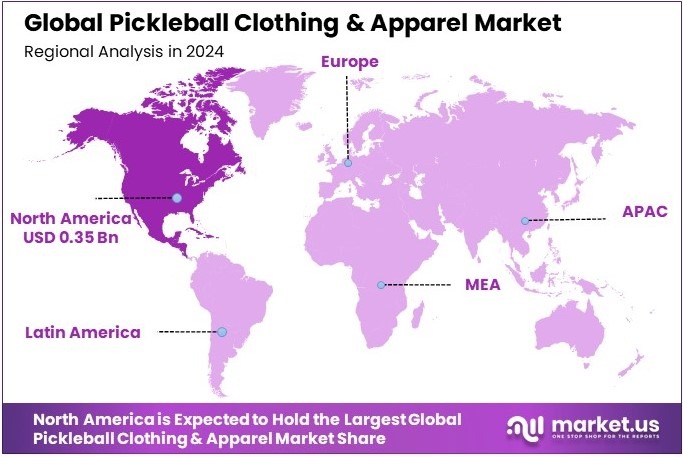

- In 2024, North America dominated the market with 50.6% and a value of USD 0.35 Bn, driven by strong sports culture and apparel innovation.

Product Type Analysis

Tops sub-segment dominates with 42.6% due to their essential functionality and frequent innovation in designs.

The Pickleball Clothing and Apparel Market’s Product Type segment features Tops, Bottoms, Outerwear, and Accessories. Tops lead with a 42.6% share, primarily because they are essential for players of all levels. The demand for tops is driven by the need for comfort, flexibility, and breathability during play, which encourages manufacturers to regularly innovate with new fabrics and designs to attract consumers.

Bottoms and Outerwear also play significant roles in the segment. Bottoms are tailored to allow ease of movement and durability, important for the rigorous physical activity in pickleball. Outerwear is increasingly sought after for its functionality in different weather conditions, supporting year-round play. Accessories, though smaller in comparison, enhance the player’s comfort and performance through items like hats, wristbands, and socks, adding depth to the market’s product offerings.

Gender Analysis

Women’s Apparel sub-segment dominates with 48.9% due to growing participation and tailored marketing strategies.

Gender segmentation in the Pickleball Clothing and Apparel Market reveals that Women’s Apparel is the largest, holding a 48.9% share. This dominance is linked to increasing female participation in sports and targeted marketing that focuses on women’s specific athletic wear needs, such as style and fit, which resonate well with this demographic.

Men’s Apparel and Unisex Apparel are also important to the market. Men’s apparel caters to comfort and performance with gender-specific designs, while Unisex Apparel offers inclusivity, covering a broad range of sizes and styles that appeal to all genders, simplifying production and inventory management for manufacturers.

Standard Analysis

Professional Standard sub-segment dominates with 57.1% due to high demand among competitive players.

Standards in the Pickleball Clothing and Apparel Market are categorized into General and Professional Standards. The Professional Standard dominates with a 57.1% market share. This is primarily because competitive players, who are increasing in number, prefer apparel that enhances performance and meets specific athletic standards.

General Standard apparel, while less prevalent, still contributes significantly to the market. These garments are suitable for casual players and beginners, offering affordability and accessibility, which are important for growing the sport’s popularity among new entrants.

Distribution Channel Analysis

Online Retail sub-segment dominates with 63.4% due to the convenience of shopping and breadth of available options.

Distribution Channels for pickleball clothing and apparel show a clear preference for Online Retail, which accounts for 63.4% of the market. This segment’s dominance stems from the convenience of shopping from home and the wide range of products that consumers can compare and purchase at competitive prices.

Offline Retail remains vital, providing tactile shopping experiences where customers can try on apparel before buying, which is particularly valued by those who are unsure of their sizing or the feel of the fabric. This segment includes brick-and-mortar stores like sporting goods stores and specialty shops that cater to local customer bases and offer immediate product availability.

Key Market Segments

By Product Type

- Tops

- Bottoms

- Outerwear

- Accessories

By Gender

- Men’s Apparel

- Women’s Apparel

- Unisex Apparel

By Standard

- General Standard

- Professional Standard

By Distribution Channel

- Online Retail

- Offline Retail

Driving Factors

Performance-Enhancing Fabrics Drive Market Growth

The demand for moisture-wicking and breathable fabrics is rising as pickleball players seek apparel that enhances comfort and performance. Sweat-resistant materials help players stay dry during long matches, improving endurance and preventing discomfort. Lightweight and stretchable fabrics also allow for greater mobility, supporting quick movements on the court.

Another key factor driving market growth is the increasing number of pickleball tournaments. More players are competing at professional and amateur levels, leading to higher demand for specialized apparel. Tournament participation requires high-quality clothing that withstands intense gameplay while maintaining a professional look.

Additionally, the growing popularity of athleisure is influencing pickleball fashion trends. Players now prefer apparel and shoes that blends performance with style, making it suitable for both sports and casual wear. This shift is attracting a broader consumer base, including younger audiences.

The expansion of women’s pickleball apparel is also boosting the market. As female participation grows, brands are offering more stylish and functional designs tailored to women’s needs. This diversification increases sales and strengthens brand loyalty among female athletes.

Restraining Factors

High Costs and Market Limitations Restrain Growth

The high production costs of performance-enhancing fabric technologies pose a challenge for manufacturers. Advanced materials, such as UV-protective and sweat-resistant fabrics, require specialized production processes, increasing the overall cost of apparel. This makes premium pickleball clothing less affordable for budget-conscious consumers.

Another challenge is the limited market penetration in regions where pickleball is not widely played. While the sport is growing, awareness remains low in certain areas, restricting apparel sales. Without strong promotional efforts, brands struggle to reach new customers outside core markets.

Competition from general sports apparel brands also restrains market expansion. Many players opt for multipurpose athletic wear from established brands rather than investing in pickleball-specific clothing. Larger companies have strong brand recognition and extensive distribution networks, making it difficul for niche brands to compete.

Balancing style and functionality is another hurdle for manufacturers. While players want fashionable designs, apparel must also meet performance requirements. Striking the right balance between aesthetics and practicality remains a challenge in product development.

Growth Opportunities

Innovation and Global Expansion Provide Opportunities

The development of UV-protective and anti-bacterial fabrics presents a major growth opportunity. Many pickleball matches take place outdoors, exposing players to sun and sweat-related issues. Apparel with built-in UV protection and odor-resistant properties appeals to athletes looking for extra comfort and safety.

Customization and personalization options are also gaining traction. Players and teams increasingly seek unique designs, logos, and colors for their apparel. Brands that offer personalized clothing stand out in the market and attract loyal customers.

Expanding into international markets with strong sports enthusiasm is another promising avenue. Countries with a growing interest in racket sports provide new sales opportunities for pickleball apparel brands. By entering these markets early, companies can establish a strong presence before competition increases.

The integration of smart fabrics and wearable technology in smart pickleball further enhances growth potential. Some brands are experimenting with clothing that tracks player movements and body temperature. These innovations offer valuable insights to athletes, making performance monitoring more accessible.

Emerging Trends

Sustainability and Celebrity Influence Are Latest Trending Factors

Minimalist and lightweight designs are becoming a popular trend in the pickleball apparel market. Players prefer clothing that feels light and non-restrictive, improving movement and overall comfort. Simple yet functional designs appeal to both amateur and professional players.

Sustainability is another key trend shaping the market. More consumers prefer eco-friendly materials, such as recycled polyester and organic cotton. Brands that focus on sustainability gain favor among environmentally conscious buyers and strengthen their market reputation.

Celebrity and influencer collaborations are also on the rise. High-profile athletes and social media personalities are promoting pickleball apparel, increasing brand visibility. Endorsements from well-known figures drive sales and encourage new players to invest in specialized clothing.

Additionally, pickleball-themed casual wear is gaining popularity beyond the court. Hoodies, t-shirts, and accessories featuring pickleball graphics are being adopted as everyday fashion. This trend expands the market by attracting consumers who may not actively play the sport but enjoy its culture.

Regional Analysis

North America Dominates with 50.6% Market Share

North America leads the Pickleball Clothing and Apparel Market with a commanding 50.6% share with a valuation of USD 0.35 Billion, underpinned by the sport’s surging popularity and supportive sports culture. The market benefits significantly from extensive grassroots programs and local leagues, which increase the sport’s visibility and participation.

The region boasts a mature retail landscape and strong e-commerce adoption, which makes pickleball clothing and apparel readily available to a broad audience. Moreover, the presence of major sporting brands and startups that focus on pickleball-specific gear continually fuels interest and sales.

The future looks promising for North America’s market share in pickleball apparel. With the sport’s integration into school curriculums and community sports programs, more individuals are likely to participate, further boosting demand for clothing and accessories tailored to pickleball.

Regional Mentions:

- Europe: Europe’s market is expanding, supported by increasing awareness of pickleball. The region benefits from strong government support for sports and a growing trend towards adopting new and alternative sports.

- Asia Pacific: Asia Pacific is witnessing growth in pickleball participation, driven by urban population increases and rising health consciousness. The region’s young demographic is particularly keen on adopting new sports.

- Middle East & Africa: Middle East & Africa are slowly entering the pickleball market, with the sport primarily introduced through expatriate communities and private sports clubs.

- Latin America: Latin America is seeing a nascent interest in pickleball, with efforts to promote the sport through sports festivals and local community events gradually increasing awareness and participation.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Pickleball Clothing and Apparel Market is led by Franklin Sports, Adidas, Nike, and Under Armour. These top players contribute significantly to shaping the market dynamics through their comprehensive product lines that include everything from performance wear to casual apparel designed specifically for pickleball.

Franklin Sports specializes in sporting goods, including pickleball apparel, and is known for offering functional yet stylish clothing that enhances player performance and comfort on the court. Adidas and Nike, both leaders in sports apparel, bring their expertise in athletic wear to the pickleball apparel sector, providing high-quality, durable clothing that supports mobility and comfort during play.

Under Armour completes the top four with its focus on innovation in sports performance apparel. Known for moisture-wicking and heat-regulation technologies, Under Armour’s clothing is particularly suited to the rigorous physical demands of pickleball, helping players maintain optimal performance levels.

These companies excel in the market by continuously evolving their product offerings and utilizing aggressive marketing strategies to reach a broad audience. Their strong brand reputations and extensive distribution channels enable them to maintain a significant presence in the growing pickleball apparel industry.

Major Companies in the Market

- Franklin Sports

- Adidas

- Nike

- Under Armour

- ASICS

- Wilson Sporting Goods

- Puma

- Fila

- Gamma Sports

- New Balance

- Selkirk Sport

- Onix Sports

- Champion Sports

Recent Developments

- Skechers: On March 2025, Skechers announced its entry into the pickleball market with a collection of footwear, apparel, and equipment developed in collaboration with professional players Tyson McGuffin and Catherine Parenteau, featuring products such as the Viper Court Pro 2.0 sneaker, Courtside Performance Tank, and Pickleball Inspire 12mm Paddle.

- Lululemon and Life Time: On May 2024, Lululemon was designated as the official apparel partner for Life Time’s pickleball and tennis programs, involving co-branded apparel offerings and joint events at Life Time’s athletic country clubs.

Report Scope

Report Features Description Market Value (2024) USD 0.7 Billion Forecast Revenue (2034) USD 2.0 Billion CAGR (2025-2034) 11.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Tops, Bottoms, Outerwear, Accessories), By Gender (Men’s Apparel, Women’s Apparel, Unisex Apparel), By Standard (General Standard, Professional Standard), By Distribution Channel (Online Retail, Offline Retail) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Franklin Sports, Adidas, Nike, Under Armour, ASICS, Wilson Sporting Goods, Puma, Fila, Gamma Sports, New Balance, Selkirk Sport, Onix Sports, Champion Sports Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pickleball Clothing And Apparel MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Pickleball Clothing And Apparel MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Franklin Sports

- Adidas

- Nike

- Under Armour

- ASICS

- Wilson Sporting Goods

- Puma

- Fila

- Gamma Sports

- New Balance

- Selkirk Sport

- Onix Sports

- Champion Sports