Global Implantable Cardioverter Defibrillator Market By Type (Subcutaneous Cardioverter Defibrillator (S-ICDs), Transvenous Cardioverter Defibrillator (T-ICDs), and Other), By Application (Hospitals, Clinics, and Ambulatory Surgical Centers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 106466

- Number of Pages: 260

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

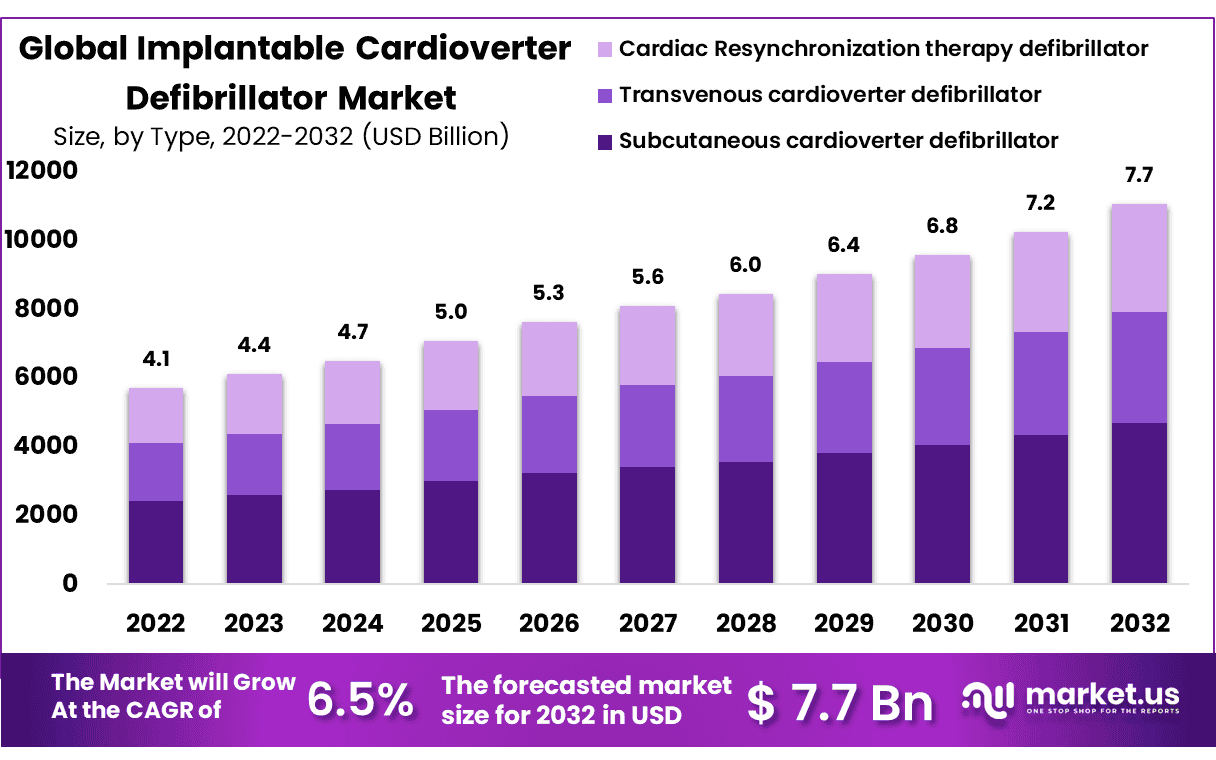

According to a recent report by Market.us, the Global Implantable Cardioverter Defibrillator Market size is expected to be worth around USD 7.7 Billion by 2032 from USD 4.1 Billion in 2022, growing at a CAGR of 6.5% during the forecast period from 2023 to 2032.

The implantable cardioverter defibrillator system is the implantation of a pacemaker in the patient’s body. It stimulates heart muscles by giving shock to the heart muscle when the heartbeat is very fast to restore heartbeats. In Bradycardia, the heartbeat is very slow; by providing a small amount of electric impulse heart rate will easily restore. The increase in the geriatric population and the growing prevalence of cardiovascular diseases are the main driving factors for market growth.

In most countries, cardiovascular disorder is the main cause of death. The growing demand and awareness of this implantable cardioverter defibrillator will likely increase market growth. The absence of complications and the availability of sensible defibrillators will help to boost the growth of the market.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- An implantable cardioverter defilbrillator is a medical device utilized to stabilize an erratic heartbeat, especially for patients who suffer from chronic arrhythmia.

- Arrhythmia poses a risk for cardiovascular diseases, which claim a considerable share of mortalities out of those caused by chroic illness. Additionally, it can cause heart failure.

- When categorized based on poduct, the subcutaneous implantable cardioverter defibrillator (S-ICDs) segment claims the largest market share, with the contribution amounting to 42.3 %.

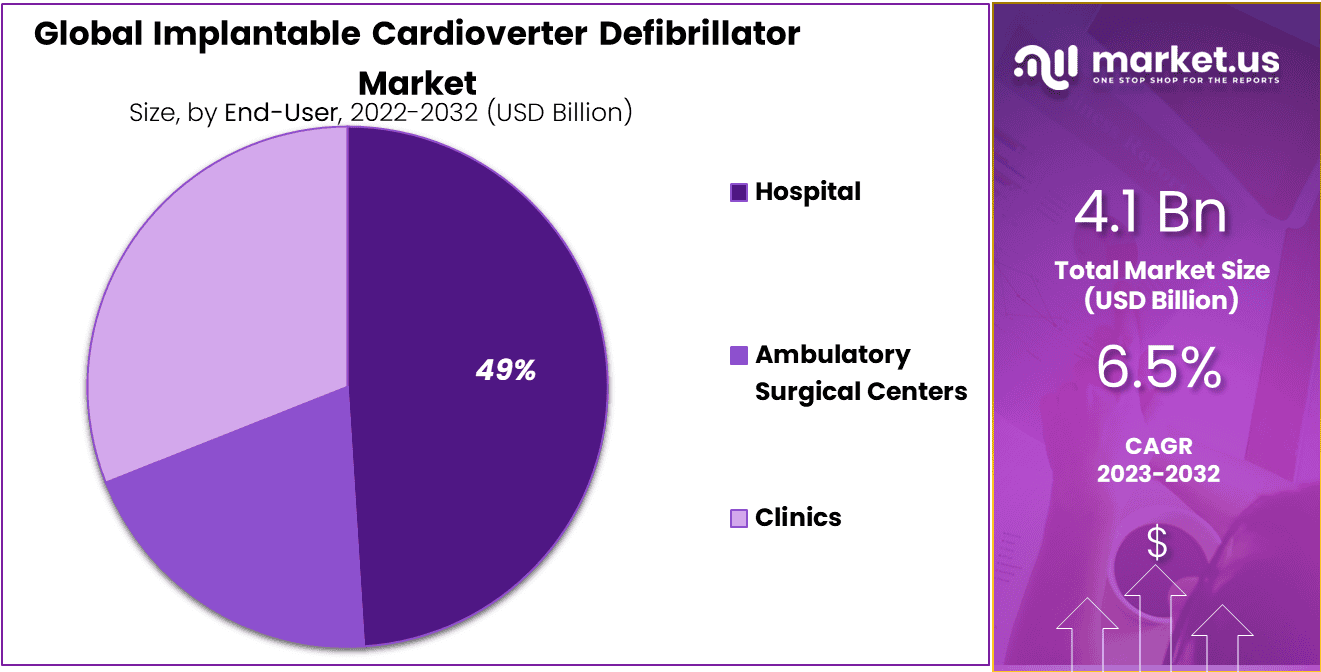

- As far as end users are considered, hospitals contributed the most and the segment is expected to grow at a CAGR of 49%.

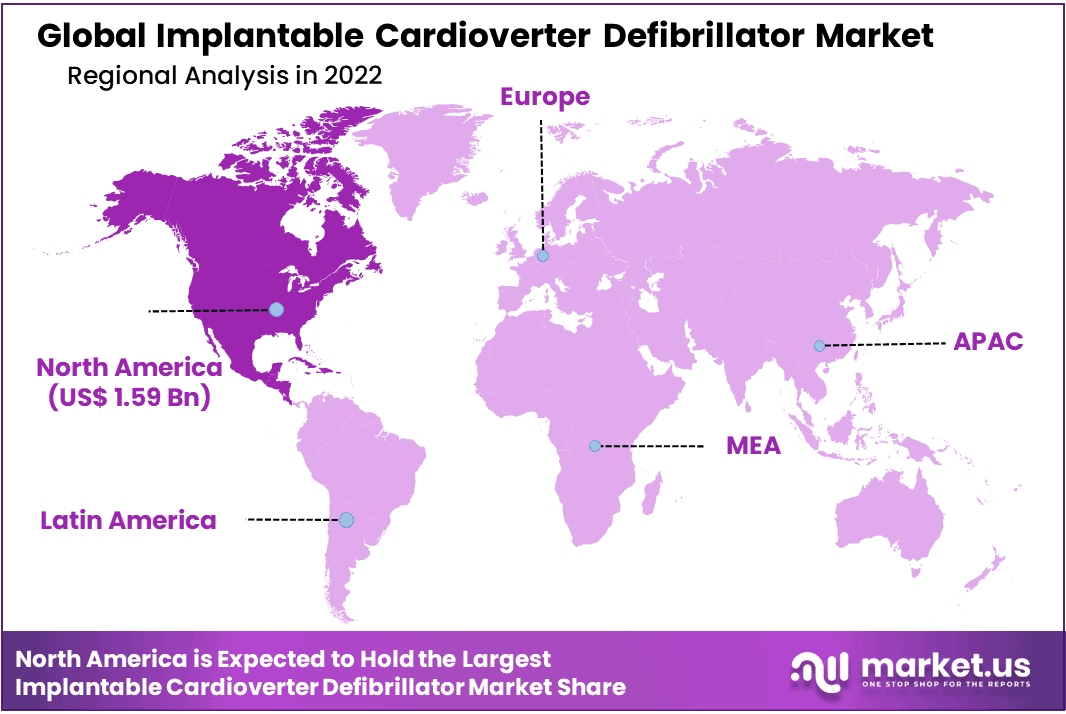

- North America remains the highest contributing geographical region in the market of implantable cardioverter defilbrillator, with a share of 39%.

- Key players in the industry include ZOLL Medical Corporation, Boston Scientific Corporation, BIOTRONIK SE & Co. KG, Medtronic PLC, Jude Medical, Koninklijke Philips N.V., Sorin Group, Nohen Kohden Corporation, LivaNova PLC, Fukuda Denshi Co. Ltd., Mediana Co. Ltd., Element Science Inc., Stryker Corporation and othes.

Product Type Analysis

Subcutaneous Implantable Cardioverter Defibrillator Dominates the Product Segment

On the basis of product type, the market is divided into subcutaneous implantable cardioverter defibrillator (S-ICDs), transvenous cardioverter defibrillator (T-ICDs), and cardiac resynchronization therapy defibrillators (CRT-D). The subcutaneous implantable cardioverter defibrillator (S-ICDs) held the largest market share, and it is anticipated to grow at the fastest rate during the forecast period. It is easily implantable and involves a less complicated procedure. Subcutaneous cardioverter defibrillator is a thin, lightweight, and small pacemaker which helps to deliver electric impulse in patients suffering from chest pain, dizziness, nausea, etc.

Transvenous cardioverter defibrillator is the second largest segment in this market. It helps to detect critical and life-threatening arrhythmias. It also detects irregular heartbeats and works on other implanted devices, such as implanted pacemaker and nerve stimulator, to keep the heartbeat regular. Cardiac resynchronization therapy defibrillator is anticipated to grow at a low rate as compared to other segments. It is used to treat heart failure. It offers effective results in reducing the death rate from a heart attack. It is significantly used in other treatments for both diastolic as well as systolic heart failure.

End-User Analysis

Hospital Segment Dominates the Market

On the basis of end-user, the market is segmented into ambulatory surgical centers, hospitals, and clinics. The hospital segment is expected to hold the largest revenue share in this market. The ICD is an electrical device that is widely used in hospitals and can be implanted into the patient’s abdomen or chest depending on the type of implantation. Ambulatory surgical centers are also growing at significant rate next to the hospital segment. The segment growth can be attributed to increase in rate of cardiac diseases patients.

Key Market Segments

Based on Product Type

- Subcutaneous cardioverter defibrillator (S-ICDs)

- Transvenous cardioverter defibrillator (T-ICDs)

- Cardiac Resynchronization therapy defibrillator(CRT-D)

Based on End-User

- Ambulatory Surgical Centers

- Hospital

- Clinics

- Other End-Users

Drivers

Increase in Geriatric Population and Technological Advancements

The market for implantable cardioverter defibrillators is estimated to grow due to technological advancements such as an increase in battery life, and the creation of MRI-safe ICDs. The emergence of subcutaneous ICD technology has revolutionized cardiac rhythm management therapy techniques which utilize these devices. Medtronic is a leading player in the market due to its diverse product offering in ICD during the forecast period. The demand for ICD is estimated to rise universally during the forecast period. An increase in demand for these devices in case of patients with no ischemic cardiometry, as it reduces the risk of mortality, is estimated to offer new opportunities for the market.

Restraints

Infection, Swelling, and Leakage of Blood at Implanted Regions Restrict the Market Growth

After the implanting procedure, there is a presence of infection in the implanted area, damage to the veins where the implantable cardioverter defibrillator is placed, and this is a key factor hindering the growth of market. The factors such as lack of awareness about the advantages of using ICD, and lack of funding policies are anticipated to restrain the market growth. After the device’s implantation, there is an infection at the implant site, causing swelling, and bleeding, which may reduce the demand for this ICD treatment. Additional damage of blood vessels by ICD may lead to blood leaking around the heart.

Opportunity

Increase in Prevalence of Cardiovascular Illness and Healthcare Facilities Helps in Market Growth

The implantable cardioverter defibrillator market is also expanding as a result of the expanding healthcare sectors in numerous emerging economies, including Brazil, India, South Africa, and China. The global increase in the incidence of healthcare infrastructure and cardiovascular disease presents significant potential prospects for industry players in the implantable defibrillator market.

The rapidly expanding per capita incomes, huge patient numbers, and increased public awareness are pushing the need to improve these countries’ healthcare industries. As a result, governments in these economies are expanding their investments in healthcare facilities and infrastructure. Because of the increased usage of implanted cardioverter defibrillators in healthcare, increased investment is expected to provide market growth possibilities.

Trends

Innovation of Advanced Technology

Cardiovascular diseases are among the most harmful diseases, with a significant share of fatalities. The growing elderly population and the high risk of cardiovascular illnesses are significant factors driving the Implantable Cardioverter Defibrillator market. However, the advancement of improved technology, advanced healthcare facilities, and an increase in demand for these treatments will lead to the spontaneous growth of the defibrillator market.

Impact Of Macroeconomic Factors On The Market

The symptoms of potentially life-threatning chronic cardiovascular diseases can be managed with the implantation of ICDs. The device itself is cost-effective, which drives up the demand. On the other hand, factos such as inflation and government taxation policies impact the growth of the market to a considerable extent. The input costs have increased significantly. This has effectively created indrances in the process of market size expansion for the implantable cardioverter defilbrillator market. Moreover, ICD implantation require longer hospital stay. This combined with inflation-adjusted costs might deter the growth of the market.

Regional Analysis

North America Region Dominates the Market

North America dominated the implantable cardioverter defibrillator market due to increasing geriatric population, the presence of advanced healthcare centers, as compared to other regions. Such factors contribute to an increase in demand for implantable defibrillators. The Asia Pacific region is expected to register high growth during the forecast period. Asia Pacific focuses on the introduction of advanced technologies with affordable prices for the patients in low-income regions.

Also, poor lifestyle, lack of exercise, unhealthy diet, smoking, and drinking leads to an increase in cholesterol levels, which results in increase in the number of cardiovascular diseases, which provides opportunities for the implantable cardioverter defibrillator market in the coming years. The increase in adoption of implantable cardioverter defibrillators in the regions is due to the introduction of advanced and modernized hospitals in developing countries is estimated to significantly increase market revenue growth during the projection period. The increase in demand for implantable cardioverter defibrillators from Japan is also boosting the market growth.

Key Regions

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Emerging main players are concentrating on a number of strategic policies in order to expand their respective operations in foreign markets. Several businesses in the Implantable Cardioverter Defibrillator market are focusing on growing their existing operations and R&D centers. Furthermore, companies in the Implantable Cardioverter Defibrillator market are creating new products and expanding their portfolios through investments, mergers, and acquisitions. These variables are having a beneficial impact on market growth.

Market Key Players

The market for implantable cardioverter defibrillator is fragmented due to the existence of numerous regional companies. Market players with strong brand recognition and extensive distribution networks are very prominent. Companies have developed numerous expansion methods, such as new product launches, collaborations, and investments, to increase their presence in the market.

Listed below are some of the most prominent Implantable Cardioverter Defibrillator industry players.

- ZOLL Medical Corporation

- Boston Scientific Corporation

- BIOTRONIK SE & Co. KG

- Medtronic PLC

- Jude Medical

- Koninklijke Philips N.V.

- Sorin Group

- Nohen Kohden Corporation

- LivaNova PLC

- Fukuda Denshi Co. Ltd.

- Mediana Co. Ltd.

- Element Science Inc.

- Stryker Corporation

- Other key players

Recent Developments

- June 2023: a strategic alliance between tech giant Philips and med-tech corporation Biotronik was annpoounced. The collaboration is intended to increase patient care acessibility.

- Augusr 2023: The cryoablation system of Boston Scientific Corporation got the approval by FDA. This system features a novel balloon catheter system which was named as POLARx FIT, it will allow the targeted delivery of cryotherapy to pulmonary vein. The system freezes the affected tissue and causes minimal damage, thus, it was proved to be revolutionary for the atrial fibrillation treatment.

Report Scope

Report Features Description Market Value (2022) USD 4.1 Bn Forecast Revenue (2032) USD 7.7 Bn CAGR (2023-2032) 6.5% Base Year for Estimation 2022 Historic Period 2016-2021 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (subcutaneous cardioverter defibrillator (S-ICDs), Transvenous cardioverter defibrillator (T-ICDs), Cardiac Resynchronization therapy defibrillator (CRT-D); By Application (Hospitals, Clinics and Ambulatory Surgical Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherland, Rest of Europe; APAC – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA. Competitive Landscape ZOLL Medical Corporation, Boston Scientific Corporation, BIOTRONIK SE & Co. KG, Medtronic PLC, Jude Medical, Koninklijke Philips N.V., Sorin Group, Nohen Kohden Corporation, LivaNova PLC, Fukuda Denshi Co. Ltd., Mediana Co. Ltd., Element Science Inc., Stryker Corporation, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is an Implantable Cardioverter Defibrillator (ICD)?An ICD is a medical device implanted in the chest to monitor and treat life-threatening arrhythmias by delivering electric shocks to restore a normal heart rhythm.

How big is the Implantable Cardioverter Defibrillator Market?The global Implantable Cardioverter Defibrillator Market size was estimated at USD 4.1 billion in 2022 and is expected to reach USD 7.7 billion in 2032.

What is the Implantable Cardioverter Defibrillator Market growth?The global Implantable Cardioverter Defibrillator Market is expected to grow at a compound annual growth rate of 6.5%. From 2023 To 2032

Who are the key companies/players in the Implantable Cardioverter Defibrillator Market?Some of the key players in the Implantable Cardioverter Defibrillator Markets are ZOLL Medical Corporation, Boston Scientific Corporation, BIOTRONIK SE & Co. KG, Medtronic PLC, Jude Medical, Koninklijke Philips N.V., Sorin Group, Nohen Kohden Corporation, LivaNova PLC, Fukuda Denshi Co. Ltd., Mediana Co. Ltd., Element Science Inc., Stryker Corporation, Other key players

Who needs an Implantable Cardioverter Defibrillator ?ICDs are typically recommended for individuals at high risk of sudden cardiac arrest due to certain heart conditions, such as ventricular arrhythmias.

How does an ICD work?It continuously monitors the heart's rhythm and delivers a shock if it detects a dangerous arrhythmia, restoring the heart's normal rhythm.

What are the key players in the ICD market?Major companies in the ICD market include Medtronic, Abbott Laboratories, Boston Scientific, and Biotronik, among others.

Implantable Cardioverter Defibrillator MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample

Implantable Cardioverter Defibrillator MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- ZOLL Medical Corporation

- Boston Scientific Corporation

- BIOTRONIK SE & Co. KG

- Medtronic PLC

- Jude Medical

- Koninklijke Philips N.V.

- Sorin Group

- Nohen Kohden Corporation

- LivaNova PLC

- Fukuda Denshi Co. Ltd.

- Mediana Co. Ltd.

- Element Science Inc.

- Stryker Corporation

- Other key players