Global Pet Insurance Market by Coverage Type (Accident Only, Accident & Illness, and Others), By Animal Type (Dogs, Cats, and Others), By Sales Channels (Broker, Direct, Agency, Bancassurance), By Provider (Public and Private) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: April 2025

- Report ID: 32245

- Number of Pages: 364

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

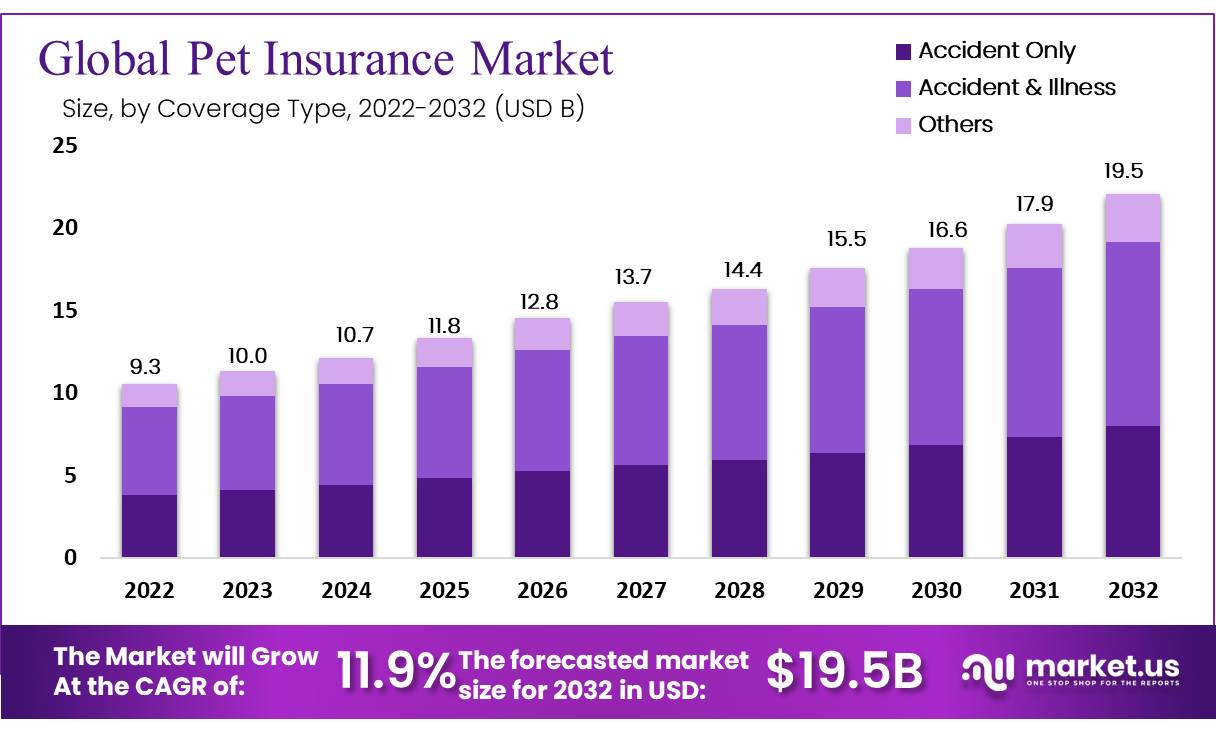

The global pet insurance market size is expected to be worth around USD 19.15 Bn by 2032 from USD 9.3 Bn in 2022, growing at a CAGR of 11.9% during the forecast period from 2022 to 2032.

Pet protection is a strategy that pays halfway or all out for the veterinary treatment of the guaranteed individual’s harmed pet. It is likewise a strategy carried by pet holders that assists with bringing down the general expense of costly veterinary bills. Some method additionally covers the pet passing or in the event of misfortune. Besides, the developing costs in veterinary medication and the holding of costly clinical strategy and medicine are helping the interest in the pet protection market.

The pet insurance market is expected to observe critical development through the gauge period attributable to the ascent in the reception pace of pets across the globe. Developing and expanding interest in pet insurance contracts and the rise deprived of financial well-being in the event of rush concerns increment the development of the worldwide pet protection market. However, the rising population awareness in developing economics about some pet insurance schemes will further drive market growth.

Additionally, a growing number of companies arriving in the pet insurance industry is another leading factor for corresponding market competition and prompting significant players to offer several concessions and profits to take a strong position in the market. High costs associated with pet insurance policies, lack of standards, customer knowledge, and government regulations are key roadblocks to market expansion.

Key Takeaways

- The pet insurance market is projected to reach USD 27.8 billion by 2032.

- The market is expected to grow at a CAGR of 11.9% from 2023 to 2032.

- The accident & illness pet insurance segment dominated the market in 2022.

- The cat segment is anticipated to dominate the market by animal type during the forecast period.

- The direct sale channel sub-segment dominated the market in 2022 by sales channel.

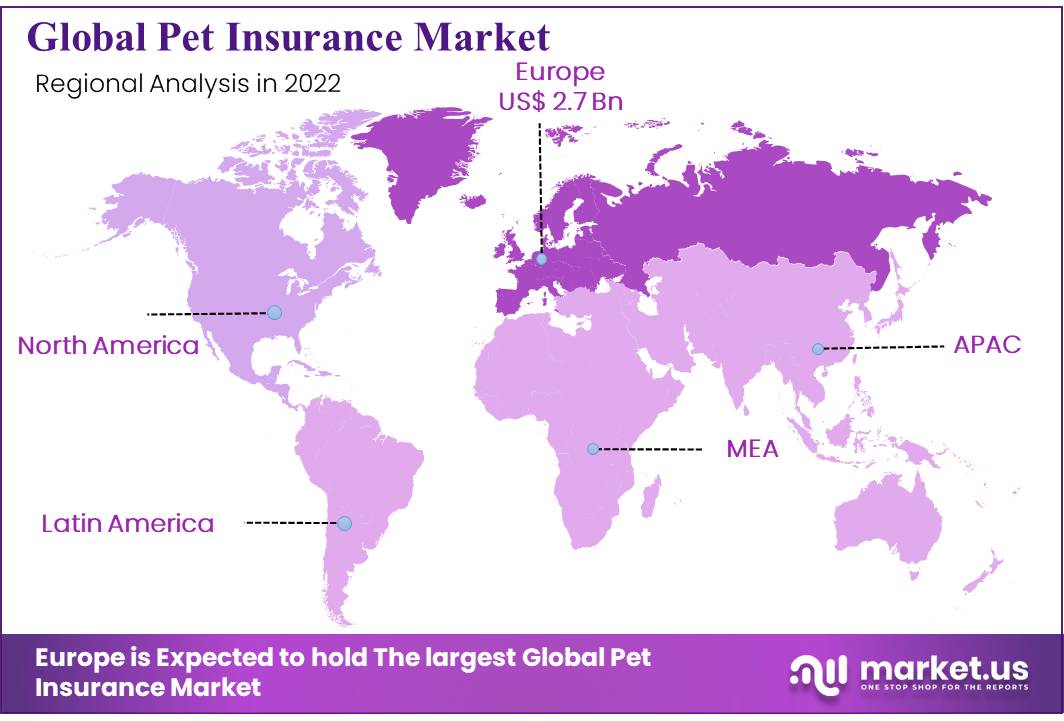

- Europe held the dominant market share in 2022, accounting for 30% of the market.

- North America is expected to have the second-largest revenue in the forecast period.

- Asia Pacific is projected to have the highest CAGR during the forecast period.

Type Analysis

Accident and Illness Segment to Dominate the Global Pet Insurance Market

On the basis of coverage type, the market for pet insurance is segmented into accident only, accident & illness, and others. The accident & illness pet insurance segment is the leading segment in the global pet insurance market. Among these types, the accident and illness segment is expected to dominate the pet insurance market share during the forecast period.

Such policies offer flexible coverage for injuries, illnesses, accidents, hospitalization, surgeries, medications, and others. In addition, the accident and illness pet insurance market might place a cost-effective way to avoid any substantial unexpected bills due to its action.

However, the other fragment is anticipated to become fundamental because of expanding enhancement in pets and improvement in pet strategies that incorporate new sorts of pets, for example, turtles and others, which is expected to give abundant opportunities to showcase development.

On the other hand, the accident policy segment is estimated to witness market growth during the forecast period. Pets that are not extended appropriately for complete accident and illness coverage and above 15 yrs. of age can benefit from the accident-only policy.

However, growing concerns among their owners about safety and health will further enhance segmental growth.

Animal Type Analysis

Cats Segment to Witness Lucrative Growth Owing to High Pet Adoption Rate

The market is further divided by animal type analysis into dogs, cats, and others. The cat segment is anticipated to observe a positive growth course through the forecast period and is owed to the increasing acceptance of cats across numerous countries.

For example, according to The American Society for The Prevention of Cruelty to Animals, more than millions of cats are owned in the US. Hence, increasing cat adoption in various developed and developing countries will significantly determine segmental growth across the forecast period.

Dogs dominate the market, accounting for maximum revenue shares across the forecast period. The increase in growth is due to the growing approval of dogs as pets in numerous regions worldwide. As Per Japan Food Association, Japan has millions of dogs. The rate is anticipated to rise during the forecast period.

Furthermore, increasing insurance for animal disorders is another significant factor for the supportive approval of pet insurance. Hence, the aforementioned factors are expected to augment dog segment growth during the forecast period.

Pet insurance companies most commonly offer accident and illness policies. Additionally, an increase in the number of companies would lead to a rise in the need for veterinary healthcare facilities.

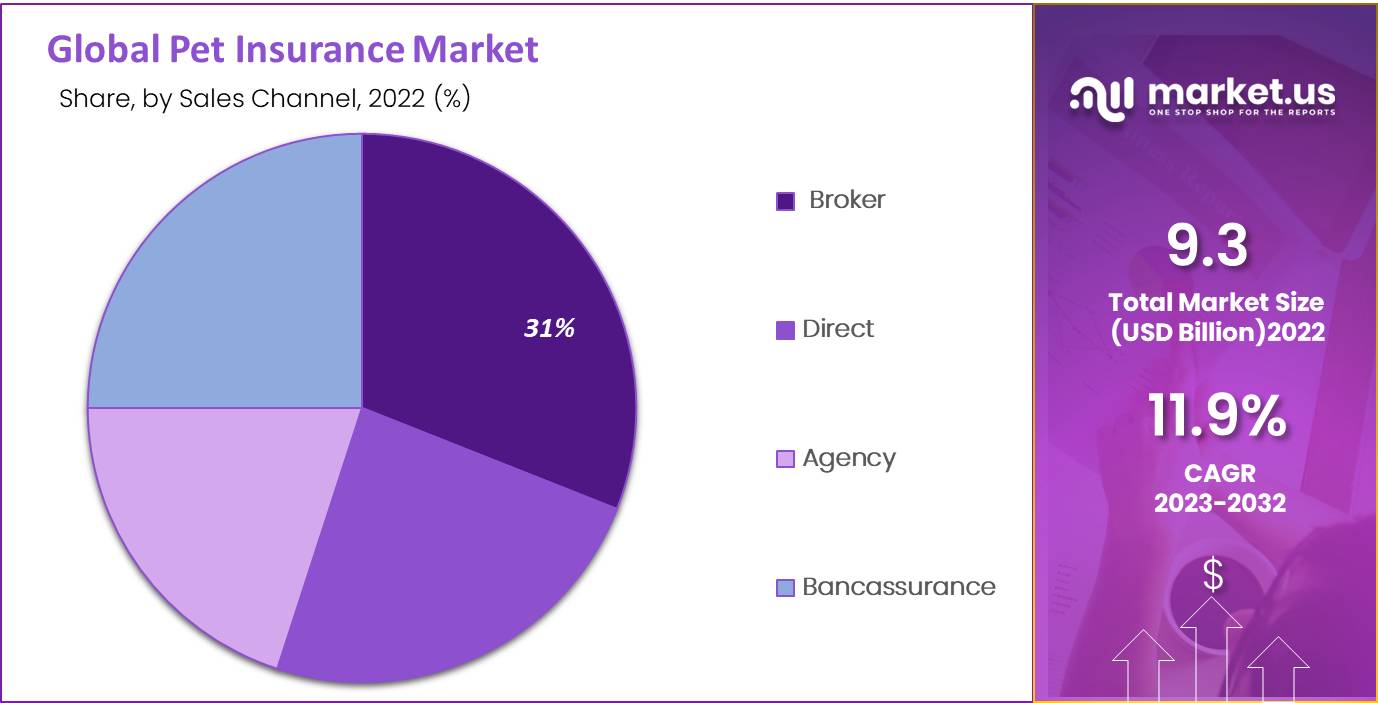

Sales Channel Analysis

Sales Channel attributed the High Sales Strategy of Pet Insurance Providers

Based on the sale channel, the market is segmented into broker, agency, direct, and bancassurance. The direct sale channel is a sub-segment that is anticipated to hold the maximum revenue in the global market during the forecast period. This is attributed to the high sales strategy of key pet insurance providers.

Key Market Segments

Based on Coverage Type

- Accident Only

- Accident & Illness

- Others

Based on Animal Type

- Dogs

- Cats

- Others

Based on Sales Channel

- Broker

- Direct

- Agency

- Bancassurance

Based on Provider

- Public

- Private

Drivers

Increasing Pet Adoption Across Various Countries Will Incentive Revenue Growth

An increase in pet adoption in various countries is one of the significant factors that promote product demand and thereby enhance market growth; for example, As Per the American Society for The Prevention to Cruelty Animals is anticipated during the forecast period.

Increase in demand for pet insurance policies due to rise in pet ownership. Hence increasing the adoption of cats in various developed countries. However, the rising permeation across different European countries is another important factor in improving product demand.

Moreover, the increasing dominance of zoonotic disease among companion animals is one of the significant reasons to approve pet insurance, thus contributing to the development of the market. The growing pet population, increasing veterinary care cost initiatives by key companies, and humanization of pets are some of the key drivers of this market.

However, rising costs in veterinary treatment and the use of expensive medical techniques and pharmaceuticals are driving the demand for pet insurance. Technological advancements have helped the pet insurance industry grow and will contribute to the industry sector’s growth at a significant rate in the near future.

Increasing government initiatives to promote pet adoption and growing animal adoption in European countries are major market drivers. Increasing pet adoption and launching novel pet insurance schemes are the key factors driving the global pet insurance market. Rising medical costs in veterinary treatment and the use of various techniques are driving the demand for pet insurance.

Major Player’s Contribution to Novel Pet Insurance Policies and Concessions to Boost Product Demand

The rise in the number of companies operating market is another important factor in expanding market growth. Increasing Competition between players to grasp a strong position in the market has managed to overview various new policy schemes for pets.

For instance, multiple companies offer different multi-insurance policies where a single policy pet can be enrolled. Furthermore, several other key players are offering offers in their pet insurance organizations to maintain customers and thereby expand market growth.

Restraints

Lack of Knowledge Regarding Pet Insurance Mainly Obstruct Market Growth

Nearly Pet Owners in developed countries are unconscious of pet insurance policies, and this is because of less knowledge of pet care and inadequate animal care facilities. Therefore, the high cost of pet care products, the absence of awareness of pet insurance, and the rise in the maximum cost decline in pet insurance sales.

Opportunities

Implementation of Technologies boosts the market growth

Developing and increasing demand for pet insurance market policies and an increase in the need for financial safety caused due to uncertainties boost the growth of the global pet insurance market. Additionally, a number of veterinary centers positively influence the growth of the market.

Implementations of technologies in existing products and government initiatives regarding pet insurance policies are anticipated to offer opportunities for the development of the market.

Regional Analysis

Europe Dominates Global Pet Insurance Market

Europe holds a maximum revenue share of 30% and is projected to dominate the market growth throughout the forecast period. Increasing government initiatives to promote pet approval of animals in European countries are limited to the main market drivers.

However, the concept of pet insurance originated in Sweden. Since it is the biggest user of pet insurance by the proportion of pets covered, the increasing number of startups entering the European market is an additional factor enhancing the pet insurance market in the UK.

In North America, the market on behalf of pet insurance holds the second-largest revenue during the forecast period. Besides, only some percent of the pets in the US are insured, thus presenting profitable growth opportunities. Moreover, the Asia-Pacific region is expected to witness exponential growth.

High growth is attributable to increasing concerns among owners about their pet health. Health improvement concerns coupled with the disposable income of these countries are the major driving factors in Asia-Pacific. The rising number of players entering the available market in Asia –the Pacific region will further drive the pet insurance market growth.

Also, increasing awareness among the population about several benefits associated with pet insurance schemes will considerably augment sales in the Middle – East and South America region, thus enhancing global market growth.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Pet insurance is a competitive and highly fragmented market. Key market players participate in various initiatives to increase their market shares, such as introducing new policies, partnerships and collaborations, mergers and acquisitions, and regional expansion.

For instance, Trupanion and Vetter Software, a provider of technology solutions for the healthcare of animals, entered into a partnership in June. Trupanion’s software, which enables payment to the veterinarian at the time of check-out, and Vetter Software’s cloud-based veterinary training organization platform were joined as part of this partnership.

It is anticipated that the level of Competition will rise even further as larger businesses enter the pet market. AXIS Insurance, a specialty insurance business section of AXIS Capital Holdings Limited, arrived on the market through a partnership with Management General Underwriter Petplan.

The company formed a planned collaboration with Petplan through its Accident and Health division to support its growth goals. Private players tend to supply insurance policies with maximum coverage plans and minimum premium offers.

Listed below are some of the most prominent pet insurance industry players.

Market Key Players

- Trupanion

- Nationwide Mutual Insurance Company

- Healthy Paws Pet Insurance, LLC

- Embrace Pet Insurance Agency, LLC

- Anicom Holdings

- Figo Pet Insurance LLC.

- Agria Pet Insurance Ltd.

- 24 Pet Watch

- Pets Best Insurance Services, LLC

- ASPCA

- Pet Plan Insurance

- MetLife Services and Solutions LLC

- Petfirst Healthcare LLC

- Ipet Insurance Co, Ltd.

- Hartville Group

- ASPCA Pet Insurance

- Animals Friends Insurance Services Limited

- Progressive Casualty Insurance Company

- Other Key Players

Recent Developments

- June 2021-Trupanion declared the idea to raise its overseas growth by transferring Wheeler from Agria Pet Insurance, Ltd. Wheeler will help grow Trupanion’s global growth through new markets in U, K Brazil, Japan, and Western Europe.

- March 2021- Waffle and Crum Foster Pet Insurance Group declared a corporation with ASPCA Pet Health Insurance to propose pet holders with customized and good exposure in the US.

Report Scope

Report Features Description Market Value (2022) USD 9.3 Bn Forecast Revenue (2032) USD 19.15 Bn CAGR (2023-2032) 11.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Coverage Type- Accident Only, Accident Illness and others; By Animal Type- Dogs and Cats; By Sales Channel- Broker, Direct Agency, and Bancassurance; By Provider- Public and Private Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Trupanion, Nationwide Mutual Insurance, Healthy Pause Pet Insurance LLC. ASPCA, Anicom Holdings, 24 Pet Watch, Pet Plan, and other players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Who are the leading players in Pet Insurance Market?The key players profiled in the report include Trupanion, Nationwide Mutual Insurance Company, Healthy Paws Pet Insurance, LLC, Embrace Pet Insurance Agency, LLC, Anicom Holdings, Figo Pet Insurance LLC., Agria Pet Insurance Ltd., 24 Pet Watch, Pets Best Insurance Services, LLC, ASPCA, Pet Plan Insurance, MetLife Services and Solutions LLC, Petfirst Healthcare LLC, Ipet Insurance Co, Ltd., Hartville Group, ASPCA Pet Insurance, Animals Friends Insurance Services Limited, Progressive Casualty Insurance Company, Other Key Players,

What will be the market value of Pet Insurance Market by the end of 2032?The Pet Insurance Market is projected to reach USD 27.8 Bn by 2032.

What was the value of the global pet insurance market in 2022?The value of the global market was USD 9.3 Bn in 2022.

-

-

- Trupanion

- Nationwide Mutual Insurance Company

- Healthy Paws Pet Insurance, LLC

- Embrace Pet Insurance Agency, LLC

- Anicom Holdings

- Figo Pet Insurance LLC.

- Agria Pet Insurance Ltd.

- 24 Pet Watch

- Pets Best Insurance Services, LLC

- ASPCA

- Pet Plan Insurance

- MetLife Services and Solutions LLC

- Petfirst Healthcare LLC

- Ipet Insurance Co, Ltd.

- Hartville Group

- ASPCA Pet Insurance

- Animals Friends Insurance Services Limited

- Progressive Casualty Insurance Company

- Other Key Players