Global Luxury Pet Accessories Market By Pet Type (Dogs, Cats, Other Pet Types), By Product Type (Apparel, Collars, Harnesses, and Leashes, Beds and Furniture, Toys, Feeding Accessories, Grooming Products, Other Product Types), By Distribution Channel (Specialty Pet Stores, Online Retail Stores, Department Stores, Supermarkets and Hypermarkets, Other Distribution Channels), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 105444

- Number of Pages: 362

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

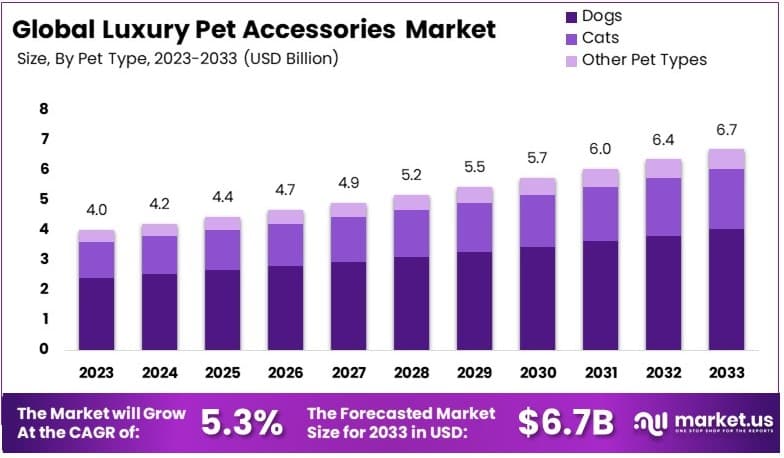

The Global Luxury Pet Accessories Market size is expected to be worth around USD 6.7 Billion by 2033, from USD 4.0 Billion in 2023, growing at a CAGR of 5.3% during the forecast period from 2024 to 2033.

Luxury pet accessories are high-end products designed for pets, offering superior quality, unique designs, and premium materials. Items include designer beds, collars, clothing, and carriers that cater to fashion-conscious owners. These accessories combine functionality and luxury, appealing to pet owners who view their pets as part of the family.

The luxury pet accessories market involves brands and designers creating exclusive products for pets. This market is driven by high-income pet owners and the growing trend of pets as family members. Premium brands offer items with stylish designs and quality materials, elevating pet accessories to a luxury category with strong demand.

In Europe, demand is significant, with 88 million households owning pets, creating a large market for luxury pet items. The non-food luxury accessories segment alone is valued at approximately 21.2 billion euros annually, according to FEDIAF. High-quality, stylish products appeal strongly to fashion-forward pet owners across these markets.

Luxury goods brands like Prada, Versace, and Louis Vuitton have entered the market, offering designer items such as collars priced around $300 and pet beds over 1,000 euros. These premium products add value by combining high-end aesthetics with functionality, marking a strong trend among affluent pet owners.

Brand collaborations have further boosted this market. For example, Milan-based Poldo Dog Couture has teamed with brands like Moncler and Dsquared2 to create exclusive pet apparel. These partnerships expand the visibility of luxury pet products, enhancing the premium appeal and market position of these accessories.

According to research about 71% of pet owners globally consider pets as family members. This trend increases demand for luxury pet products, from designer beds to health-focused items, as pet owners invest in premium products that mirror the human market for quality and care.

Key Takeaways

- The Luxury Pet Accessories Market was valued at USD 4.0 billion in 2023 and is expected to reach USD 6.7 billion by 2033, with a CAGR of 5.3%.

- In 2023, Dogs dominated the pet type segment with 60%, reflecting higher consumer spending on premium products for dogs.

- In 2023, Toys led the product type segment, driven by the rising trend of interactive and enriching products for pets.

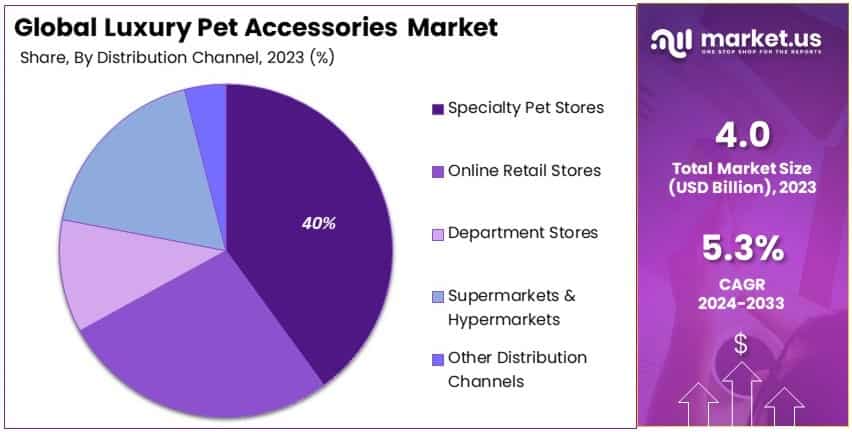

- In 2023, Specialty Pet Stores dominated with 40%, offering a more curated shopping experience for luxury pet accessories.

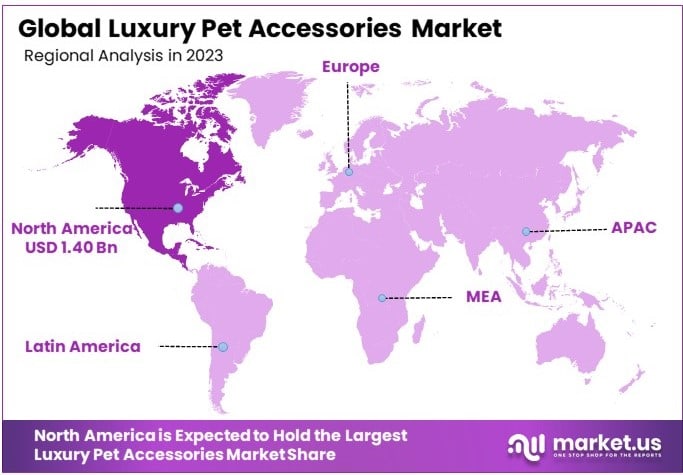

- In 2023, North America held 35.0% of the market, supported by high pet ownership rates and premiumization trends.

Pet Type Analysis

Dogs dominate with 60% in 2023 due to their popularity as pets and the wide variety of products tailored for them.

Dogs are the leading segment, holding a 60% market share in 2023. The primary reason for this dominance is the high popularity of dogs as pets, combined with the vast array of luxury accessories available for them.

Owners are increasingly seeking high-quality, stylish, and functional items for their dogs, ranging from designer apparel to bespoke beds and premium toys. This trend is driven by the humanization of pets, where owners treat their pets as family members and are willing to invest in high-end products for their comfort and style.

Cats are the second-largest segment in the luxury pet accessories market. While not as dominant as dogs, luxury products for cats, including intricate play structures and luxury pet grooming products, are becoming increasingly popular as cat ownership rises and owners seek to provide similar levels of comfort and luxury for their feline companions.

Other Pet Types include animals like birds, reptiles, and small mammals. Although this segment is smaller, there is a growing niche market for luxury accessories tailored to these pets, reflecting a broader trend of pet humanization across all pet types.

Product Type Analysis

Toys dominate the product type segment due to their appeal in enhancing pet engagement and owner interaction.

Toys are the most dominant product type, as they play a crucial role in pet development and the bonding process between pets and their owners. Luxury pet toys, which often feature durable materials and innovative designs, appeal to owners looking to provide their pets with entertainment and stimulation.

The growth in this sub-segment is driven by the increasing recognition of the benefits of mentally and physically stimulating toys, which can contribute to a pet’s overall well-being.

Apparel for pets, including luxury items like coats and themed costumes, allows pet owners to express their pet’s personality and their own aesthetic preferences. The market for pet apparel is expanding as fashion becomes a more prominent part of the pet industry.

Collars, Harnesses, and Leashes are essential for pet safety and comfort but are also fashion statements. Luxury versions often feature high-end materials and custom designs, catering to consumers looking for both style and functionality.

Beds and Furniture not only provide comfort for pets but also integrate seamlessly into home decor. Luxury beds and furniture are designed with both aesthetics and the pet’s comfort in mind, attracting owners interested in premium products.

Feeding Accessories and Grooming Products are segments that include items made from high-quality materials that offer functionality and style. These products often incorporate ergonomic designs and sustainable materials, appealing to environmentally conscious pet owners.

The Other Product Types category includes items like pet cameras, luxury travel accessories, and customized products that cater to niche interests within the pet owner community.

Distribution Channel Analysis

Specialty Pet Stores dominate with 40% in 2023 due to their focused product offerings and expertise in high-quality pet products.

Specialty Pet Stores are the leading distribution channel, accounting for 40% of the market in 2023. These stores are preferred by consumers for their wide range of specialized products and knowledgeable staff who can provide advice on the best luxury accessories for different types of pets.

The trust established by these stores through expert recommendations and high product standards is crucial for maintaining their market dominance.

Online Retail Stores are increasingly popular due to the convenience they offer. These platforms make it easy for consumers to access a broad range of products from around the world, often at competitive prices, and are especially appealing for hard-to-find luxury items.

Department Stores and Supermarkets & Hypermarkets are expanding their pet product ranges to include luxury items, catering to convenience-driven shoppers who prefer to buy pet accessories while shopping for other household items.

The Other Distribution Channels segment includes direct-to-consumer sales and boutique shops that offer exclusive, often handmade, luxury pet products. This channel is growing as consumers seek unique items that are not available in mainstream retail outlets.

Key Market Segments

By Pet Type

- Dogs

- Cats

- Other Pet Types

By Product Type

- Apparel

- Collars, Harnesses, and Leashes

- Beds & Furniture

- Toys

- Feeding Accessories

- Grooming Products

- Other Product Types

By Distribution Channel

- Specialty Pet Stores

- Online Retail Stores

- Department Stores

- Supermarkets & Hypermarkets

- Other Distribution Channels

Drivers

Pet Humanization and E-Commerce Drives Market Growth

The Luxury Pet Accessories Market is primarily driven by the increasing trend of pet humanization. More pet owners are treating their pets as family members, which drives demand for high-quality and luxurious pet accessories. As pets become an integral part of families, owners are willing to spend more on premium products, including luxury apparel, luxury bedding, and custom-made accessories.

Growing disposable incomes among pet owners further fuel the market. With rising incomes, consumers are more inclined to purchase luxury items not only for themselves but also for their pets.

The premiumization of pet products is another significant driving factor. Pet owners are increasingly opting for premium brands that offer exclusive, high-quality products. This shift is evident in various categories, such as luxury collars, gourmet pet food, and designer pet carriers, contributing to the market’s expansion.

Lastly, the expansion of e-commerce and online retail platforms is transforming the market. Luxury pet accessories are becoming more accessible to a global audience through online stores. E-commerce platforms provide a convenient way for pet owners to explore and purchase high-end products, driving growth in the luxury pet accessories sector.

Restraints

High Costs and Economic Uncertainty Restraint Market Growth

One of the primary barriers is the high cost of luxury pet accessories. These products are often significantly more expensive than standard pet products, limiting their appeal to a niche audience with higher disposable incomes. This makes it difficult for luxury brands to attract a wider customer base.

Limited awareness in emerging markets is another challenge. In regions where luxury pet products are less common, consumers may not be familiar with the concept of premium accessories for pets, slowing the adoption of such products.

Additionally, economic uncertainties can affect consumer spending on non-essential items like luxury pet products. When faced with financial constraints, many pet owners may prioritize basic necessities over luxury accessories.

Furthermore, there is a preference for traditional, non-luxury pet products among certain segments of consumers. Many pet owners are satisfied with standard, functional accessories and do not see the need to invest in expensive alternatives, further restraining market growth in this category.

Opportunity

Personalized Products and Eco-Friendly Options Provide Opportunities

The Luxury Pet Accessories Market presents several growth opportunities, particularly with the rising demand for personalized and custom-made pet products. Pet owners increasingly seek unique items that reflect their pet’s personality, driving the demand for bespoke collars, beds, and apparel tailored to individual pets.

Expansion into emerging markets offers another opportunity. As pet ownership increases in regions like Asia-Pacific and Latin America, there is a growing appetite for premium products, including luxury pet accessories. Companies that can successfully market their products in these regions stand to gain a substantial customer base.

The development of eco-friendly and sustainable luxury accessories is a major growth area. Consumers are becoming more environmentally conscious and prefer brands that offer sustainable products. This trend is leading to the creation of luxury pet accessories made from eco-friendly materials, providing a competitive edge to brands that align with these values.

Collaboration with luxury fashion brands offers another avenue for growth. By partnering with established luxury brands, pet accessory companies can enhance their appeal and reach a broader audience, capitalizing on the existing brand loyalty of fashion-conscious consumers.

Challenges

Competition and Supply Chain Disruptions Challenge Market Growth

The Luxury Pet Accessories Market faces several challenges that could hinder its growth. High competition among luxury pet product brands is a significant challenge, as numerous companies are vying for market share. This intense competition makes it difficult for new entrants to establish themselves and for existing players to maintain their market position.

Another challenge is the difficulty in maintaining product differentiation. As the market becomes more saturated, brands must innovate continually to stand out from competitors, which can be costly and resource-intensive. Without distinct product features, it becomes harder for brands to justify premium pricing.

Supply chain disruptions, particularly those affecting the availability of raw materials, also present challenges. Delays in sourcing high-quality materials can lead to production slowdowns, affecting a brand’s ability to meet market demand.

Additionally, creating global brand recognition in a competitive market is challenging. Many luxury pet accessory brands struggle to build a strong international presence due to cultural differences and varying consumer preferences, limiting their global reach.

Growth Factors

Pet Adoption and Fashion Are Growth Factors

The growth of the Luxury Pet Accessories Market is closely linked to rising pet adoption rates globally. As more people bring pets into their homes, the demand for accessories, including high-end options, continues to grow. New pet owners are more likely to splurge on luxury products, particularly in affluent markets.

The increasing focus on pet fashion is another key growth factor. Many pet owners view their pets as an extension of their personal style, leading to a surge in demand for fashionable accessories such as designer pet clothing, collars, and carriers.

The demand for premium pet care services is also contributing to market growth. As pet owners invest in luxury grooming and pet spa services, they are more likely to purchase high-end accessories to complement these services, further driving the market.

Finally, the expansion of pet-friendly travel and hospitality services is fueling the demand for luxury pet accessories. As more hotels and airlines cater to pets, there is a growing need for stylish, functional travel gear for pets, such as luxury pet carriers and travel beds. This trend is boosting the demand for premium accessories in the market.

Emerging Trends

Tech-Enabled and Eco-Friendly Accessories Are Latest Trending Factor

Several trends are shaping the Luxury Pet Accessories Market, with the increasing focus on pet wellness being a major factor. Consumers are prioritizing their pets’ health and well-being, driving demand for wellness-focused accessories such as orthopedic pet beds, ergonomic harnesses, and health-monitoring devices.

Tech-enabled pet accessories, such as smart collars with GPS tracking and fitness monitoring, are also trending. These products offer added functionality and convenience for pet owners, making them highly attractive in the luxury segment.

There is also a rising demand for eco-friendly and ethically sourced pet products. Pet owners are becoming more conscious of the environmental impact of their purchases, leading to increased demand for sustainable luxury accessories made from recyclable or biodegradable materials.

Lastly, social media and celebrity pets are having a significant influence on the market. The growing visibility of luxury pet products on platforms like Instagram, driven by celebrity endorsements and pet influencers, is helping to popularize high-end accessories, further boosting market growth.

Regional Analysis

North America Dominates with 35.0% Market Share

North America leads the Luxury Pet Accessories Market with a 35.0% share, valued at USD 1.40 billion. This dominance is driven by high disposable incomes, the increasing trend of pet humanization, and strong consumer demand for premium pet products. The region’s focus on pet wellness, fashion, and personalized items further boosts its market leadership.

North America’s performance in the luxury pet accessories market is enhanced by its well-developed retail sector, with numerous high-end pet boutiques and online platforms. The growing influence of celebrity pets and social media trends also plays a key role in driving consumer interest in luxury pet items. Additionally, the region benefits from advanced e-commerce infrastructure, making it easy for customers to access a wide range of luxury pet products.

Regional Mentions:

- Europe: Europe is a strong player in the luxury pet accessories market, driven by its focus on eco-friendly products and personalized pet items. The region’s strict regulations on product safety and quality support its market growth.

- Asia Pacific: Asia Pacific is witnessing rapid growth in the luxury pet accessories market due to increasing pet ownership, particularly in countries like China and Japan. The region’s rising disposable incomes and interest in premium pet products fuel demand.

- Middle East & Africa: The Middle East & Africa region is gradually entering the luxury pet accessories market, driven by rising demand for premium pet products among affluent consumers. Pet fashion and wellness trends are emerging in key markets.

- Latin America: Latin America is seeing steady growth in the luxury pet accessories market, supported by increasing pet adoption and a growing middle class. The region’s expanding e-commerce platforms are also helping to boost sales of high-end pet items.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Luxury Pet Accessories Market is driven by companies like K&H Pet Products, Moshiqa, and Ruffwear. These brands cater to pet owners seeking premium products, offering high-quality, stylish, and functional accessories for pets. The market has grown significantly due to increased pet humanization and higher spending on pet wellness and comfort.

Product offerings include luxury collars, pet beds, clothing, and tech-based accessories like smart collars and pet cameras. Companies like Mungo & Maud and Canine Styles focus on fashionable and high-end designs, while brands like Furbo and Wild One offer innovative and practical solutions for modern pet owners.

Market strategies center around premiumization and branding, with many companies collaborating with luxury fashion brands and influencers to enhance their positioning. Pricing strategies typically target affluent consumers, with products ranging from mid to high-end price points, often seen as status symbols.

Geographically, North America and Europe dominate the market, with expanding interest in Asia-Pacific, where pet ownership and spending are on the rise.

Innovation in design and materials is a key focus, with companies investing in sustainable and eco-friendly products. Many brands also incorporate technology into their offerings to appeal to tech-savvy pet owners.

Their competitive edge lies in delivering unique, high-quality products that cater to the emotional and practical needs of pet owners, combined with strong brand recognition in the luxury market.

Top Key Players in the Market

- K&H Pet Products

- Puppia

- Moshiqa

- Buddy Belts

- FitFurLife

- Wild One

- Hartman & Rose

- Mungo & Maud

- Pet Interiors

- Ruffwear

- Wolfgang Man & Beast

- For The Furry

- LoveThyBeast

- Canine Styles

- Furbo

- Other Key Players

Recent Developments

- Dolce & Gabbana: In August 2024, Dolce & Gabbana launched Fefé, a luxury dog perfume inspired by the founders’ pet. Marketed to upscale dog owners, this product enters the luxury pet market amidst discussions by the RSPCA regarding its potential sensory impact on dogs.

- Jaxx Fontaine D’Eau: In October 2024, Tiana Barron introduced Jaxx Fontaine D’Eau, a premium bottled water for dogs, addressing concerns over environmental pollutants. Each sale supports dog rescues, blending luxury with philanthropy in the pet care market.

- Alpine Dog Co.: In July 2024, Alpine Dog Co. launched the Tactik collar line for large breeds, featuring a handle and customizable options such as colors and fonts. Made from durable nylon, these collars are designed to cater to pet owners’ desires for both functionality and style.

Report Scope

Report Features Description Market Value (2023) USD 4.0 Billion Forecast Revenue (2033) USD 6.7 Billion CAGR (2024-2033) 5.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Pet Type (Dogs, Cats, Other Pet Types), By Product Type (Apparel, Collars, Harnesses, and Leashes, Beds and Furniture, Toys, Feeding Accessories, Grooming Products, Other Product Types), By Distribution Channel (Specialty Pet Stores, Online Retail Stores, Department Stores, Supermarkets and Hypermarkets, Other Distribution Channels) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape K&H Pet Products, Puppia, Moshiqa, Buddy Belts, FitFurLife, Wild One, Hartman & Rose, Mungo & Maud, Pet Interiors, Ruffwear, Wolfgang Man & Beast, For The Furry, LoveThyBeast, Canine Styles, Furbo, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Luxury Pet Accessories MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Luxury Pet Accessories MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- K&H Pet Products

- Puppia

- Moshiqa

- Buddy Belts

- FitFurLife

- Wild One

- Hartman & Rose

- Mungo & Maud

- Pet Interiors

- Ruffwear

- Wolfgang Man & Beast

- For The Furry

- LoveThyBeast

- Canine Styles

- Furbo

- Other Key Players