Pet Wearables Market Report By Technology (RFID, Sensors, GPS), By Product Type (Smart Collars, Smart Camera, Training Devices, Smart Harness and Vest, Others), By Component (Memory, Processors, Batteries, Display, RFID Chips, GPS Chips, Connectivity Integrated Circuit - Cellular Chips, Wi-Fi Chips, Bluetooth Chips, Sensors), By Application, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 26311

- Number of Pages: 323

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

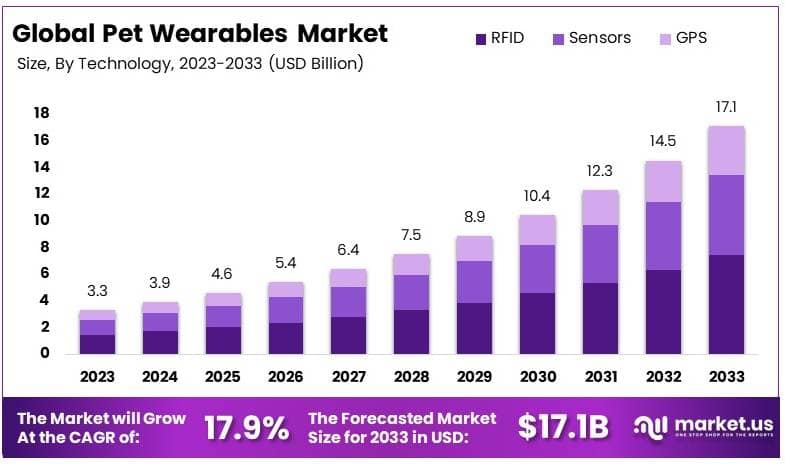

The Global Pet Wearables Market size is expected to be worth around USD 17.1 Billion by 2033, from USD 3.3 Billion in 2023, growing at a CAGR of 17.9% during the forecast period from 2024 to 2033.

Pet wearables are electronic devices designed for pets, usually worn as collars or tags. These devices track pets’ activities, monitor their health, and provide location tracking using GPS technology. Some wearables also measure vital signs like heart rate and temperature, helping pet owners manage their pets’ well-being.

The pet wearables market includes all products and services related to these devices. It covers manufacturing, distribution, and related services like data analysis and veterinary care. The market is growing due to rising pet ownership, increasing pet healthcare spending, and technological advancements in wearable technology.

This growth is supported by a rising trend in pet humanization, where pet owners increasingly view pets as family members, leading to higher spending on pet health and wellness. The American Pet Products Association (2023-2024) reports that 86.9 million U.S. households (or 66%) owned a pet, indicating steady demand for innovative pet care products.

The increasing concern for pet health, combined with technological innovation, drives the demand for advanced monitoring systems. The FitBark GPS Dog Tracker, for instance, offers features like calorie tracking, sleep analysis, and compatibility with health platforms, illustrating the evolving landscape of pet health management.

Such devices not only provide real-time data but also integrate seamlessly into broader health ecosystems, enhancing pet owners’ ability to track and manage their pets’ health comprehensively.

Demand and opportunities are particularly strong in developed markets like the United States and the United Kingdom. In the UK, for example, pet ownership rose by 9% from 2021 to 2024, increasing the pet population from 29 million to 32 million. This rise supports the growth of the pet wearables market as more pet owners seek advanced health and safety solutions.

On a local scale, the adoption of pet wearables contributes to higher standards of pet care, as owners gain insights into their pets’ health, promoting preventive care and safety measures like microchipping and GPS tracking devices.

As highlighted by the ASPCA, 15% of pet owners in the U.S. reported losing a pet in the past five years, underscoring the need for effective tracking solutions. With 93% of dogs but only 74% of cats recovered, this discrepancy indicates a significant opportunity for innovation in pet tracking systems tailored for different species.

The pet wearables market is becoming increasingly competitive, with both established brands and new entrants innovating to capture market share. While market saturation is noticeable in the U.S., emerging markets present opportunities for expansion.

The availability of different price points and product features will likely determine competitive advantage as companies seek to differentiate their offerings. Companies like FitBark have capitalized on integrating wearables with existing human health technology platforms, a strategy that may help sustain growth even in more saturated markets.

Key Takeaways

- The Pet Wearables Market was valued at USD 3.3 Billion in 2023 and is expected to reach USD 17.1 Billion by 2033, with a CAGR of 17.9%.

- In 2023, RFID technology dominated with 43.6%, essential for efficient tracking and monitoring.

- In 2023, Smart Collars led the product segment with 60.4%, emphasizing convenience and advanced functionalities.

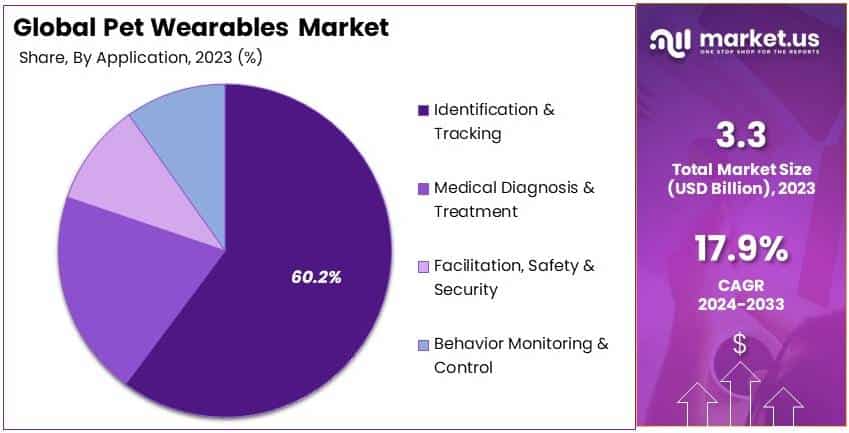

- In 2023, Identification & Tracking was the top application with 60.2%, highlighting the demand for pet safety solutions.

- In 2023, North America held the largest market share at 33.4%, valued at USD 1.10 Billion, driven by high pet ownership rates.

Technology Analysis

RFID dominates with 43.6% due to its enhanced efficiency in tracking and data accuracy.

The technology segment within the pet wearables market is highly critical, incorporating various innovative solutions aimed at enhancing pet care and management. RFID (Radio Frequency Identification) technology emerges as the dominant sub-segment, capturing 43.6% of the market.

This prominence can be attributed to RFID’s ability to provide precise and real-time tracking of pets, which is essential for efficient identification and health monitoring. The technology leverages wireless non-contact use of radio-frequency electromagnetic fields that allow for data transfer without needing a direct line of sight, enhancing the ease of tracking pets over distances.

Sensors, GPS, and other technologies also play significant roles in the market. Sensors are crucial for monitoring health parameters such as heart rate and temperature, while GPS technology offers location tracking that is more accurate over longer distances. However, RFID’s lower cost and higher reliability in proximity-based tracking scenarios give it a distinct advantage, particularly in urban settings where pets are more likely to roam near home.

The growth of RFID in the pet wearables market is supported by its integration into daily pet management solutions, from health monitoring to location tracking, making it an indispensable tool for pet owners and veterinarians alike. As technology advances, the integration of RFID with other technologies like sensors and GPS could potentially unlock new applications and drive further growth in this segment.

Product Type Analysis

Smart Collar dominates with 60.4% due to its multifunctionality and ease of use.

In the product type segment of the pet wearables market, Smart Collars stand out, accounting for 60.4% of the market. The dominance of Smart Collars is largely due to their multifunctional capabilities, which combine identification, tracking, and health monitoring all in one device that is easy for pet owners to use.

These collars often include GPS, RFID, and sensor technologies, which provide comprehensive data about the pet’s location, activity levels, and physiological parameters.

Other products in this segment include Smart Cameras, Training Devices, Smart Harnesses and Vests, and other smart wearables.

Each of these products serves specific needs: Smart Cameras for remote monitoring and interaction, Training Devices for behavior modification, and Smart Harnesses and Vests for improved control and health monitoring during physical activities. However, the convenience and all-encompassing features of Smart Collars make them more appealing to a broader audience, ensuring their market dominance.

The role of remaining products, while smaller in market share, is crucial for catering to specialized needs that Smart Collars might not fully address. For instance, Training Devices are essential for behavioral training using remote techniques, which is particularly valuable for pet owners who are often away from home.

Application Analysis

Identification & Tracking dominates with 60.2% due to its critical role in pet management and safety.

Within the application segment of the pet wearables market, Identification & Tracking is the most significant, accounting for 60.2% of the market. This dominance is driven by the increasing need for pet owners and facilities to ensure pets are easily identifiable and trackable in real-time, which is crucial for safety and management.

Other applications such as Medical Diagnosis & Treatment, Facilitation, Safety & Security, and Behavior Monitoring & Control also contribute to the market. Each of these applications uses technology to monitor using animal health and well-being of pets.

For example, Medical Diagnosis & Treatment applications are vital for early detection of health issues, while Behavior Monitoring & Control helps in managing and modifying pet behavior through continuous monitoring.

The overarching role of Identification & Tracking as a foundation for the other applications cannot be overstated. It not only ensures the basic safety and security of pets but also provides a data backbone for advanced applications like medical diagnosis and behavioral analysis, which rely on accurate tracking and identification data to function effectively.

Key Market Segments

By Technology

- RFID

- Sensors

- GPS

By Product Type

- Smart Collars

- Smart Camera

- Training Devices

- Smart Harness and Vest

- Others

By Component

- Memory

- Processors

- Batteries

- Display

- RFID Chips

- GPS Chips

- Connectivity Integrated Circuit

- Cellular Chips

- Wi-Fi Chips

- Bluetooth Chips

- Sensors

By Application

- Medical Diagnosis & Treatment

- Identification & Tracking

- Facilitation, Safety & Security

- Behavior Monitoring & Control

Drivers

Increasing Pet Ownership and Technological Advancements Drive Market Growth

The growth of the pet wearables market is largely influenced by the rise in pet ownership and spending. More people are choosing to adopt pets, leading to higher expenditures on pet care and products. This shift has created a broad customer base willing to invest in technologies that enhance their pets’ well-being.

Additionally, technological advancements in wearable devices have played a crucial role. Innovations such as GPS tracking and smart sensors have improved the functionality and efficiency of these products. Companies are integrating these features to create more accurate and user-friendly devices that attract tech-savvy pet owners.

The rising awareness of pet health and safety is another key driver. Owners are becoming more concerned about their pets’ well-being, leading to higher demand for products that offer real-time monitoring and preventive care. The focus on safety, particularly with outdoor pets, drives the use of tracking technologies that ensure pets are safe and accounted for.

Restraints

High Cost and Limited Battery Life Restraints Market Growth

Despite its growth, the pet wearables market faces some restraints. High device costs are a primary barrier, particularly for pet owners in lower-income brackets or developing regions. This price sensitivity limits the market’s reach and prevents widespread adoption, keeping some segments of potential customers out of the market.

Battery life and durability also present challenges. Many wearables need frequent charging, which can be inconvenient for users. Limited battery life may reduce the effectiveness of devices, especially those used for real-time tracking. Durability issues arise when devices are not built to withstand rough usage or environmental conditions, leading to a shorter product lifespan and additional costs for consumers.

Privacy concerns are also noteworthy. As these devices collect data about pets and, indirectly, their owners, some consumers worry about how this information is stored and used. These concerns could prevent some pet owners from embracing wearable technologies. The lack of awareness and access in developing regions limits market growth. Without proper education on the benefits of these devices, the market may struggle to expand into these areas.

Opportunity

Expansion in Emerging Markets Provides Opportunities

Emerging markets offer a promising growth avenue for the pet wearables industry. As pet ownership increases in developing countries, the demand for pet care products, including wearables, is expected to rise. Companies can capitalize on this by expanding their reach into these markets, providing more affordable solutions tailored to different income groups.

Integration with IoT and smart home systems also presents an opportunity. Connecting pet wearables with other smart devices creates a unified ecosystem, enhancing the overall user experience. As more homes adopt smart technology, integrating pet devices can boost demand and create new market segments.

Development of advanced health monitoring features is another potential area for growth. As owners become more attentive to their pets’ health, there is a growing need for devices that offer more comprehensive data, such as heart rate monitoring and stress indicators. Companies investing in such technologies can tap into this demand and establish themselves as leaders in the market.

The rising trend of pet humanization is driving pet owners to treat pets as family members. This mindset encourages spending on advanced care products, including wearable technology, offering long-term growth potential for companies that align with this sentiment.

Challenges

Technological Compatibility Issues Challenge Market Growth

Several challenges confront the pet wearables market. Technological compatibility issues are a primary concern, as different devices and operating systems may not integrate seamlessly. This lack of standardization can limit device functionality, frustrating consumers and preventing widespread adoption.

Regulatory compliance and certification also present hurdles. Different regions have varying standards for safety and data security, making it complex for manufacturers to launch products globally. Companies must invest time and resources to meet these regulations, which can slow market expansion.

Competition from low-cost manufacturers, particularly in regions with fewer regulations, challenges established brands. These low-cost alternatives may attract price-sensitive consumers, making it difficult for premium brands to maintain their market position.

Maintenance and upgradation issues are also significant. As technology evolves, wearables need updates and maintenance, which may not be easily accessible to all users. This challenge can lead to dissatisfaction among customers, who might prefer more stable, low-maintenance solutions.

Growth Factors

Increasing Healthcare Expenditure and Telehealth Services Are Growth Factors

Increasing pet healthcare expenditure is a major growth factor in the pet wearables market. Pet owners are investing more in advanced healthcare products and services, creating a robust demand for wearables that offer health monitoring features. As pets become an integral part of families, owners are willing to spend on technology that enhances pet care.

Animal telehealth services are also contributing to market growth. Wearable devices that can integrate with telehealth platforms provide veterinarians with real-time data on pets’ health, enabling quicker diagnoses and treatments. This feature increases the value of pet wearables and drives adoption, especially among tech-savvy pet owners.

Strong market penetration in developed regions is another growth driver. These regions have higher disposable incomes and greater access to technology, making it easier for companies to market and sell advanced pet wearables. Consumers in these areas are more likely to invest in premium products that offer comprehensive tracking and monitoring services.

Continuous innovations in wearable designs, such as lightweight materials and waterproof models, enhance user experience and expand the market. These new designs make wearables more comfortable for pets, encouraging wider adoption and boosting overall sales.

Emerging Trends

AI Integration and Smart Collars Are Latest Trending Factors

AI integration and smart collars are major trends shaping the pet wearables market. With AI, companies can now provide advanced behavioral monitoring and predictive analysis, giving pet owners deeper insights into their pets’ health and activities. This technology allows wearables to offer customized care recommendations, enhancing the value of these devices.

Smart collars are another emerging trend. These collars combine multiple features such as GPS tracking, activity monitoring, and health diagnostics into a single device. The convenience and multi-functionality appeal to a wide range of pet owners, especially those who seek an all-in-one solution for managing their pets’ well-being.

Sustainability in wearable products is also gaining attention. There is a growing interest in eco-friendly materials and sustainable designs, reflecting consumer demand for products that align with their environmental values. Companies that offer such solutions can appeal to this eco-conscious segment.

Pet subscription box service models are becoming popular. These models provide continuous access to data insights and premium features, creating a recurring revenue stream for companies while enhancing customer loyalty. This trend shows the market’s shift towards a service-oriented approach, focusing on long-term engagement.

Regional Analysis

North America Dominates with 33.4% Market Share

North America leads the Pet Wearables Market, capturing a 33.4% share, valued at USD 1.10 billion. This dominance is fueled by high pet ownership rates, increasing awareness of pet health, and a strong demand for pet tech products like GPS trackers and health monitors. Advanced technology adoption and disposable income levels also play a significant role.

North America’s developed technology sector and high adoption rates of smart devices positively impact the pet wearables industry. Pet owners in the region value data-driven health insights, encouraging companies to innovate and expand their offerings. Favorable regulatory policies also help in fast-tracking product development and market penetration.

North America’s influence in the Pet Wearables Market is expected to grow as pet humanization trends and technology adoption continue. Rising consumer spending on pet wellness and the development of advanced health monitoring features are likely to further increase the region’s market share and drive growth in the coming years.

Regional Mentions:

- Europe: Europe shows steady growth in the Pet Wearables Market due to high pet ownership and a strong focus on pet health. The region’s consumers prefer eco-friendly and high-quality products, encouraging local firms to develop innovative solutions for pet safety and health tracking.

- Asia Pacific: Asia Pacific is expanding rapidly, driven by increasing pet ownership in urban areas and rising disposable incomes. Countries like China and Japan are investing in smart pet technology, making the region a significant player in the market’s growth.

- Middle East & Africa: The Middle East & Africa have a growing interest in pet tech, especially for security and tracking. The rise of pet ownership and smart city initiatives create opportunities for pet wearable companies to introduce new products and services.

- Latin America: Latin America’s market is gradually growing, with pet owners increasingly adopting tech products for safety and health monitoring. Urbanization and an expanding middle class are key factors encouraging the adoption of pet wearables, particularly in Brazil and Mexico.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The pet wearables market is marked by a competitive landscape with key players focusing on innovative product solutions for pet health monitoring and activity tracking. Major companies in this space include Garmin Ltd., FitBark, Whistle Labs, Inc., and PetPace LLC, which lead in technology and market reach.

These leading firms offer a range of products that cater to the needs for pet safety, health monitoring, and activity tracking. Garmin Ltd. and FitBark are noted for their advanced activity trackers and GPS collars, which help in monitoring pet behavior and health metrics. Whistle Labs, Inc. and PetPace LLC focus on health monitoring devices that provide vital signs tracking and detailed health reports to pet owners.

These companies employ strategic partnerships and collaborations with veterinary health experts and pet care organizations to enhance their market presence and brand credibility. Their marketing strategies are heavily oriented towards emphasizing the emotional bond between pets and their owners, showcasing the utility of wearables in fostering pet health and safety.

Pricing varies significantly among the top players, with premium pricing strategies often adopted by Garmin Ltd. due to their brand reputation for quality and durability. Conversely, FitBark and Whistle Labs compete on more cost-effective pricing, making technology accessible to a broader customer base.

Garmin Ltd. boasts a robust global distribution network, whereas FitBark, Whistle Labs, and PetPace are expanding their market presence, primarily in North America and parts of Europe, focusing on affluent pet owners who prioritize pet health and well-being.

Innovation is a critical focus, with each company investing in research and development to introduce features like health trend tracking, real-time alerts, and integration with smartphones. The use of AI and data analytics to offer predictive insights into pet health conditions is a notable trend among these players.

The competitive edge in the pet wearables market lies in technological innovation, comprehensive health monitoring features, and effective market penetration strategies. Garmin Ltd. leads with robust technology and extensive geographical reach, while FitBark and Whistle Labs offer competitive pricing and innovative health monitoring features, catering to tech-savvy pet owners looking for affordable solutions. PetPace LLC differentiates itself with a focus on detailed health diagnostics, appealing to pet owners prioritizing health over tracking functionality.

Top Key Players in the Market

- Avid Identification Systems, Inc.

- Allflex USA Inc.

- Datamars

- FitBark

- Garmin Ltd.

- Invisible Fence

- Link AKC

- Loc8tor Ltd.

- PetPace LLC

- Whistle Labs, Inc.

- Voyce

- Other Key Players

Recent Developments

- PetPace: On March 2024, PetPace launched the PetPace 2.0 collar, an AI-driven device offering continuous health monitoring for dogs. It tracks vital signs such as temperature, heart rate, respiratory metrics, and activity levels, providing real-time health alerts and wellness insights.

- Tractive: On February 2024, Tractive, the largest pet wearables firm in the UK, launched its first insurance product, Tractive Pet Cover, via Ignite’s broker platform. The product offers comprehensive coverage, including vet fees, dental treatments, and 24/7 video vet services, along with a free GPS tracker for new customers.

- Whistle Labs: On January 2020, Whistle Labs introduced Whistle FIT, a pet wearable focused on monitoring health and fitness, including a new nutrition feature offering personalized food recommendations. The device collects extensive data on pet behaviors like activity and calories burned, integrating this information with its nutrition database for tailored dietary advice.

- Mars Petcare: On June 2022, Mars Petcare launched the world’s first comprehensive pet biobank, aiming to collect genetic, clinical, and lifestyle data from 20,000 pets (10,000 dogs and 10,000 cats) over a ten-year period. The biobank is designed to identify early signs of disease and develop new strategies for disease prevention, personalized nutrition, and health monitoring.

Report Scope

Report Features Description Market Value (2023) USD 3.3 Billion Forecast Revenue (2033) USD 17.1 Billion CAGR (2024-2033) 17.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (RFID, Sensors, GPS), By Product Type (Smart Collars, Smart Camera, Training Devices, Smart Harness and Vest, Others), By Component (Memory, Processors, Batteries, Display, RFID Chips, GPS Chips, Connectivity Integrated Circuit – Cellular Chips, Wi-Fi Chips, Bluetooth Chips, Sensors), By Application (Medical Diagnosis & Treatment, Identification & Tracking, Facilitation, Safety & Security, Behavior Monitoring & Control) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Avid Identification Systems, Inc., Allflex USA Inc., Datamars, FitBark, Garmin Ltd., Invisible Fence, Link AKC, Loc8tor Ltd., PetPace LLC, Whistle Labs, Inc., Voyce, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Avid Identification Systems, Inc.

- Allflex USA Inc.

- Garmin Ltd.

- FitBark Inc.

- Datamars SA

- Invisible Fence Inc.

- PetPace LLC

- Loc8tor Ltd.

- Other Key Players