Global Foot Care Products Market Size, Share, Growth Analysis By Product Type (Foot Creams, Foot Cleansing Lotions, Foot Scrubs, Foot Masks, Others), By Application (Skin Conditions, Pain Relief, Odor Control, Others), By Distribution Channel (Online Retail, Supermarkets or Hypermarkets, Specialty Stores, Pharmacies or Drugstores), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 137167

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

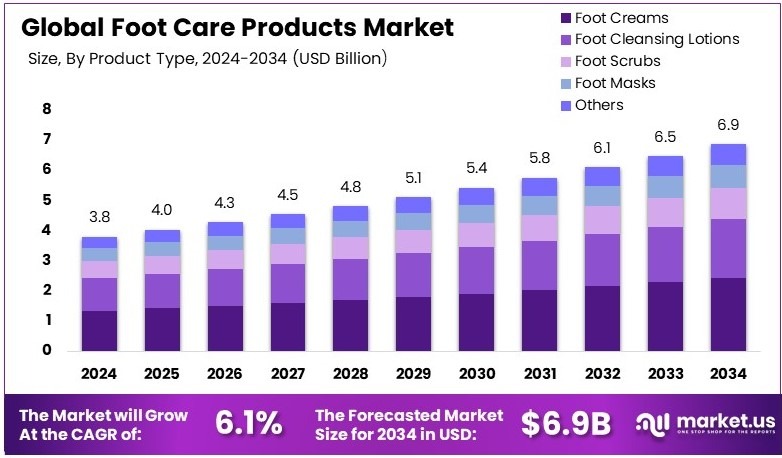

The Global Foot Care Products Market size is expected to be worth around USD 6.9 Billion by 2034, from USD 3.8 Billion in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034.

Foot care products include items designed to improve foot hygiene, comfort, and health. These products range from creams and lotions for moisturizing to tools for removing calluses and specialized footwear for support and protection.

The foot care products market includes companies that manufacture and sell products for foot health and wellness. It serves a broad customer base, addressing issues such as dryness, discomfort, and foot-related medical conditions.

The foot care products market caters to diverse needs, including moisturizing creams, antifungal sprays, and orthopedic implants and insoles. According to the American Podiatric Medical Association, over 80% of individuals experience foot pain, driving demand for these products. Seniors are a key demographic, with more than 70% of elderly patients reporting foot issues.

Foot disorders affect a broad population. The CDC states that foot pain impacts 13% to 36% of adults, with women and older individuals more affected. This prevalence creates consistent demand for targeted solutions. Additionally, athletes frequently require products like antifungal sprays due to conditions like athlete’s foot, enhancing product diversity.

Retailers play a significant role in distribution. The U.S. cosmetic and beauty retail industry, comprising over 184,000 establishments, ensures wide availability of foot care products. Pharmacies and beauty clinics are major channels. This vast network supports accessibility, making it easier for consumers to address foot health concerns efficiently.

Governments are encouraging the use of medical-grade foot care products to prevent chronic foot issues. Regulatory standards ensure safe and effective formulations, boosting consumer trust. Awareness campaigns highlighting foot health’s importance also drive growth. This dual focus on safety and education supports long-term market development.

Key Takeaways

- The Foot Care Products Market was valued at USD 3.8 Billion in 2024 and is expected to reach USD 6.9 Billion by 2034, with a CAGR of 6.1%.

- In 2024, Foot Creams dominated the product type segment with 45.3%, driven by their popularity for hydration and therapeutic benefits.

- In 2024, Skin Conditions led the application segment with 38.6%, reflecting high demand for targeted skin care solutions.

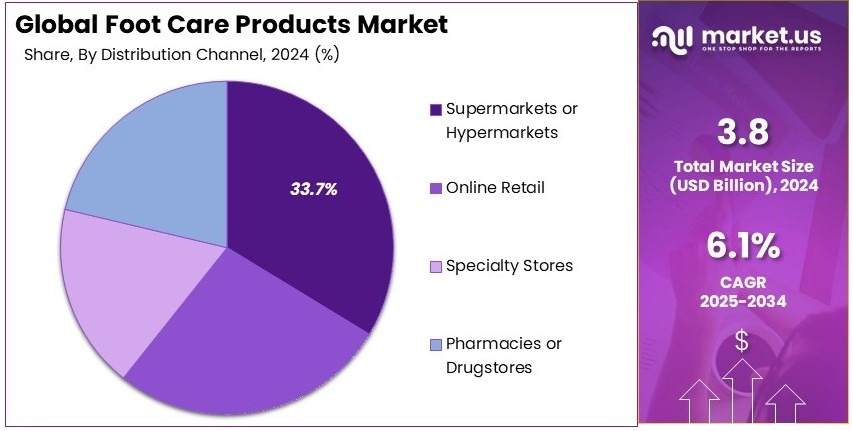

- In 2024, Supermarkets/Hypermarkets accounted for 33.7% of distribution channel sales, benefiting from convenience and widespread availability.

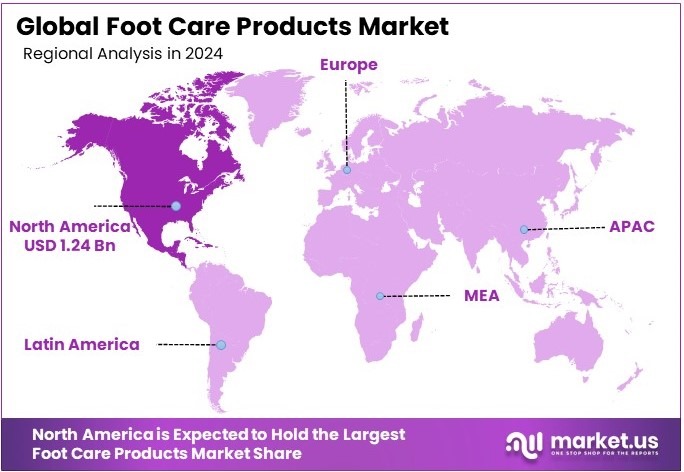

- In 2024, North America led the regional market with 32.5%, contributing USD 1.24 Billion, driven by established retail networks and awareness.

Business Environment Analysis

The foot care products market shows varying levels of saturation across regions. Developed markets like North America and Europe are mature, with steady demand for advanced solutions. On the other hand, emerging markets in Asia-Pacific offer untapped potential due to increasing urbanization and growing awareness of foot health.

The target demographic primarily includes seniors, athletes, and individuals with chronic conditions like diabetes or plantar fasciitis. Additionally, younger consumers are becoming proactive about foot care, seeking preventative solutions. Consequently, brands are broadening their product lines to cater to these diverse groups.

Product differentiation is a key competitive strategy. For example, brands are introducing specialized insoles, antifungal sprays, and therapeutic creams. Additionally, natural and organic skincare options are gaining popularity, reflecting consumer demand for sustainable and safe products.

Value chain analysis reveals opportunities to enhance efficiency. For instance, sourcing cost-effective raw materials and investing in automated manufacturing improve profit margins. Furthermore, leveraging e-commerce and direct-to-consumer models enhances distribution and reduces reliance on traditional retail networks.

Investment opportunities include research and development of targeted solutions for conditions like diabetic foot ulcers and sports injuries. Moreover, companies focusing on sustainable packaging and eco-friendly formulations gain traction among conscious consumers. As a result, these investments drive innovation and market growth.

Product Type Analysis

Foot Creams dominate with 45.3% due to their effectiveness in treating dry skin and preventing foot ailments.

In the foot care products market, Foot Creams emerge as the dominant sub-segment, holding a 45.3% market share. This prominence is primarily due to their essential role in moisturizing and treating dry skin, which are common foot issues among all age groups. Foot creams are particularly valued for their ability to prevent further skin problems, which makes them a staple in daily foot care routines.

Other product types like Foot Cleansing Lotions, Foot Scrubs, and Foot Masks also contribute to the market’s diversity. Foot Cleansing Lotions are important for maintaining daily hygiene and preventing infections, while Foot Scrubs are used for their ability to exfoliate and rejuvenate the skin, enhancing the overall health and appearance of feet.

Foot Masks provide intensive care and deep moisturization, especially beneficial for severely dry or cracked feet. Each product plays a crucial role in comprehensive foot care, driving the market’s growth by meeting various consumer needs.

Application Analysis

Skin Conditions lead with 38.6% due to the high prevalence of skin-related issues in the foot care market.

The application segment of the foot care products market is predominantly driven by products aimed at treating Skin Conditions, accounting for 38.6% of the segment.

This leading position is fueled by the widespread incidence of skin ailments such as athlete’s foot, psoriasis, and eczema, which require specialized care products to manage and treat effectively.

Other applications include Pain Relief and Odor Control. Products targeting Pain Relief are essential for consumers dealing with foot discomfort and ailments such as heel spurs or plantar fasciitis.

Odor Control products are increasingly popular, particularly among athletes and individuals with active lifestyles, as they help maintain foot hygiene and comfort. These applications are crucial for addressing specific, everyday foot care needs, further supporting the growth and diversification of the market.

Distribution Channel Analysis

Supermarkets/Hypermarkets dominate with 33.7% due to their convenience and wide range of available foot care products.

Distribution channels for foot care products are led by Supermarkets/Hypermarkets, which hold a 33.7% share of the market. This dominance is attributed to the convenience these outlets offer, allowing consumers to inspect products firsthand and make informed decisions based on variety and price.

Supermarkets and hypermarkets typically offer a wide range of foot care products under one roof, making them a preferred choice for busy shoppers.

Other significant channels include Online Retail, Specialty Stores, and Pharmacies/Drugstores. Online Retail is growing rapidly, providing easy access to a broad spectrum of foot care products with the convenience of home delivery.

Specialty Stores offer specialized products often not available in general retail outlets, catering to specific needs such as diabetic foot care. Pharmacies/Drugstores are essential for distributing medicated products and providing consumer guidance on foot care issues. Each channel plays a vital role in making foot care products accessible to a diverse consumer base, thus driving market growth and accessibility.

Key Market Segments

By Product Type

- Foot Creams

- Foot Cleansing Lotions

- Foot Scrubs

- Foot Masks

- Others

By Application

- Skin Conditions

- Pain Relief

- Odor Control

- Others

By Distribution Channel

- Online Retail

- Supermarkets/Hypermarkets

- Specialty Stores

- Pharmacies/Drugstores

Driving Factors

Increasing Awareness and Specialized Needs Drives Market Growth

The Foot Care Products Market is influenced by several driving factors. Rising prevalence of foot disorders and skin conditions often leads to increased demand. Conditions like plantar fasciitis or athlete’s foot prompt consumers to seek reliable solutions.

Increasing awareness about personal hygiene and foot care also spurs growth. As people learn about proper foot health, they opt for preventive and corrective products. Growth in the geriatric population requiring specialized foot care products is another key factor. Older adults often need extra care due to reduced mobility or circulation issues.

Expansion of sports and fitness activities increases demand for foot care. Athletes and active individuals look for products that prevent injuries and support recovery. These combined factors encourage innovation and expansion in the market.

For example, companies like Dr. Scholl’s and O’Keeffe’s design products targeting specific foot problems and fitness needs. The focus on preventive care, ease of use, and specialized solutions drives market expansion. As consumer demand grows, companies are likely to invest more in research and development.

Restraining Factors

Limited Awareness and Market Saturation Restraints Market Growth

The Foot Care Products Market faces several restraining factors that can slow its progress. Limited awareness about foot care in developing regions restricts market reach. Many consumers do not realize the importance of proper foot hygiene and care.

High competition from generic and low-cost alternatives also poses a challenge. These products can undercut prices and reduce profit margins for established brands. Additionally, challenges in differentiating products in a crowded market make it hard for new entrants to stand out. With so many similar options, consumers may find it difficult to choose the best product for their needs.

Side effects associated with certain medicated foot care products raise health concerns among potential users. For example, some antifungal creams might cause skin irritation or allergic reactions. These factors slow adoption and reduce consumer trust.

Companies must invest in education, product development, and safety testing to overcome these barriers. Effective marketing, clear communication of benefits, and assurance of quality are essential strategies. Addressing awareness and differentiation challenges can gradually open new opportunities.

Growth Opportunities

Eco-Friendly Innovations Provides Opportunites

Opportunities in the Foot Care Products Market emerge from evolving consumer demands and technological advancements. Development of eco-friendly and biodegradable foot care products meets consumer desires for sustainable solutions. As environmental concerns grow, green products gain popularity.

Rising demand for products targeting diabetic foot issues opens specialized market segments. Diabetic consumers need gentle, effective care to prevent complications. Expansion of foot care solutions for active and sports enthusiasts targets a growing demographic. This group seeks products that offer enhanced support and recovery.

Growth in subscription-based foot care product services presents recurring revenue opportunities. For instance, a company providing monthly foot care kits can build customer loyalty. These trends encourage companies to innovate.

Brands like Burt’s Bees and Himalaya emphasize natural, eco-friendly ingredients. They cater to consumers seeking sustainable, effective foot care solutions. By investing in research, sustainable practices, and targeted formulations, companies can capitalize on these opportunities. This approach not only satisfies existing demand but also attracts new customers.

Emerging Trends

Vegan Trends and Herbal Solutions Is Latest Trending Factor

Trending factors in the Foot Care Products Market highlight new consumer preferences and product development. The rising popularity of vegan and cruelty-free foot care products shows a shift towards ethical consumption. Consumers increasingly seek products that align with their values while maintaining quality.

Growth in foot care solutions with herbal and Ayurvedic formulations is also notable. Such products appeal to those seeking natural remedies with a long tradition of use. Additionally, the focus on foot moisturizers with long-lasting hydration meets the demand for effective daily care.

The increasing use of probiotics and microbiome-friendly ingredients reflects a scientific approach to skin health. These innovative formulations cater to consumers prioritizing advanced and personalized solutions for foot care.

These trends reflect changes in consumer behavior and market offerings. For example, brands like Plantur and The Body Shop integrate vegan, herbal, and sustainable practices into their product lines. This creates a competitive edge by attracting eco-conscious and health-focused customers.

Regional Analysis

North America Dominates with 32.5% Market Share

North America leads the Foot Care Products Market with a 32.5% share, translating to USD 1.24 billion. This dominance is primarily due to high consumer awareness about foot health and the availability of a wide range of foot care products across well-established retail channels.

The region’s strong performance in the market is bolstered by a robust healthcare infrastructure and a significant focus on preventative care, which includes foot health as a key component. Additionally, North America benefits from the presence of major foot care brands that are consistently innovating and expanding their product lines.

The future influence of North America in the global Foot Care Products Market is expected to grow, driven by trends such as an increasing elderly population susceptible to foot ailments and the continuous introduction of advanced product formulations. These factors are likely to further enhance North America’s position in the market.

Regional Mentions:

- Europe: Europe maintains a solid market share in the Foot Care Products Market, supported by advanced healthcare systems and high consumer spending power. The market is driven by a strong preference for quality and specialized foot care products.

- Asia Pacific: The Asia Pacific region is experiencing rapid growth in the Foot Care Products Market, fueled by increasing health awareness and improvements in healthcare access. Economic growth and rising consumer incomes are enabling more people to invest in foot health.

- Middle East & Africa: The Middle East and Africa are emerging in the Foot Care Products Market, with increased consumer awareness and growing healthcare infrastructure. The market is developing through urbanization and increased access to quality healthcare products.

- Latin America: Latin America’s Foot Care Products Market is expanding due to growing health consciousness and the gradual improvement of healthcare facilities. The region is adopting more specialized foot care products, driven by an increasing focus on overall health and wellness.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Foot Care Products Market is driven by established players that offer a wide range of solutions catering to diverse consumer needs. The top companies include Reckitt Benckiser Group plc, Johnson & Johnson, GlaxoSmithKline plc, and Bayer AG, which dominate through product innovation, extensive distribution networks, and strong brand loyalty.

Reckitt Benckiser leads with its Scholl brand, offering specialized solutions for foot hygiene, comfort, and protection. The company’s products target both therapeutic and preventive care segments, appealing to a broad audience. Johnson & Johnson, through brands like Band-Aid and Neutrogena, provides medicated foot care solutions that combine efficacy with consumer trust. GlaxoSmithKline plc focuses on antifungal and therapeutic products under its Lamisil and Lotrimin brands, addressing common foot health issues like infections. Bayer AG, with its Dr. Scholl’s Wellness Company, emphasizes comfort and innovation, offering insoles and skin care products tailored for active lifestyles.

These companies benefit from strong brand presence, strategic partnerships with retailers, and omnichannel distribution. Their focus on product diversification and R&D drives market leadership. They also capitalize on trends such as eco-friendly packaging and natural ingredients, enhancing consumer appeal. Collectively, these players shape the Foot Care Products Market by prioritizing consumer needs and setting quality benchmarks.

Major Companies in the Market

- Reckitt Benckiser Group plc

- Johnson & Johnson

- GlaxoSmithKline plc

- Bayer AG

- Blistex Inc.

- Chattem, Inc.

- PediFix Inc.

- Alva-Amco Pharmacal Companies, Inc.

- Aetrex Worldwide, Inc.

- Superfeet Worldwide Inc.

- Scholl’s Wellness Company

- Footlogix

- ProFoot Inc.

Recent Developments

- Birkenstock: On November 2024, Birkenstock launched the Care Essentials Range, a foot care line featuring six products, including Relaxing Bath Salts and Nourishing Foot Balm, to relax, exfoliate, and nourish the feet. These vegan, COSMOS Natural certified products are fragranced with essential oils and packaged using 100% recycled materials.

- Ipca Laboratories Ltd.: On December 2024, Ipca Laboratories Ltd. introduced ‘Diulcus,’ a new treatment for diabetic foot ulcers (DFU) in India, addressing a common and serious complication among diabetic patients. This launch highlights the company’s commitment to improving diabetic care and patient outcomes in the region.

- Medline: On September 2024, Medline announced the launch of its Minimally Invasive Surgery (MIS) Foot Recon System at the AOFAS 2024 Annual Scientific Conference. The system includes six screw families and two plate families, designed to support percutaneous bunion correction and other MIS foot surgeries.

Report Scope

Report Features Description Market Value (2024) USD 3.8 Billion Forecast Revenue (2034) USD 6.9 Billlion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Foot Creams, Foot Cleansing Lotions, Foot Scrubs, Foot Masks, Others), By Application (Skin Conditions, Pain Relief, Odor Control, Others), By Distribution Channel (Online Retail, Supermarkets or Hypermarkets, Specialty Stores, Pharmacies or Drugstores) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Reckitt Benckiser Group plc, Johnson & Johnson, GlaxoSmithKline plc, Bayer AG, Blistex Inc., Chattem, Inc., PediFix Inc., Alva-Amco Pharmacal Companies, Inc., Aetrex Worldwide, Inc., Superfeet Worldwide Inc., Scholl’s Wellness Company, Footlogix, ProFoot Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Reckitt Benckiser Group plc

- Johnson & Johnson

- GlaxoSmithKline plc

- Bayer AG

- Blistex Inc.

- Chattem, Inc.

- PediFix Inc.

- Alva-Amco Pharmacal Companies, Inc.

- Aetrex Worldwide, Inc.

- Superfeet Worldwide Inc.

- Scholl's Wellness Company

- Footlogix

- ProFoot Inc.