Global Leather Care Products Market By Product Type (Cleaners, Conditioners, Protectants, Dyes and Colorants, Others), By Formulation Type (Spray, Liquid, Wipe, Cream, Gel), By End Use (Footwear, Apparel, Furniture, Automotive, Accessories), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 137515

- Number of Pages: 313

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

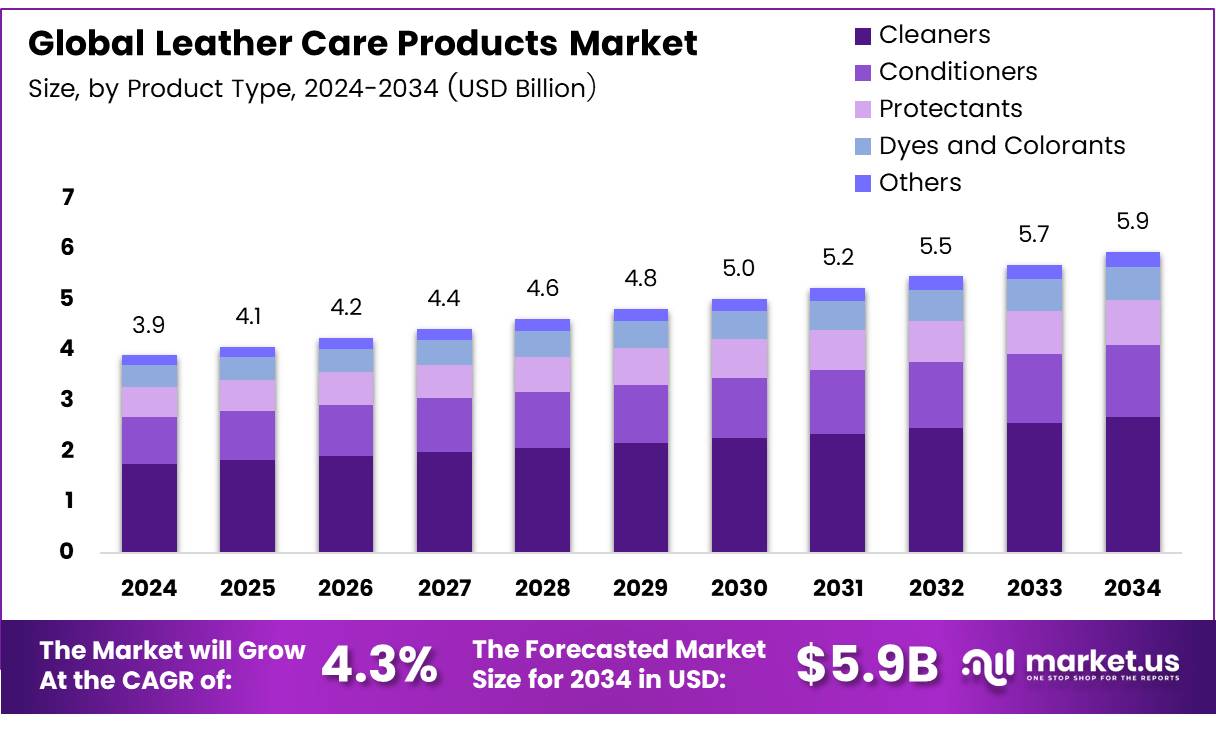

The Global Leather Care Products Market size is expected to be worth around USD 5.9 Billion by 2034, from USD 3.9 Billion in 2024, growing at a CAGR of 4.3% during the forecast period from 2025 to 2034.

Leather care products are specialized solutions designed to clean, protect, and maintain the quality and appearance of leather goods. These products include cleaners, conditioners, waterproofing sprays, and dyes that cater to various types of leather, from shoes and apparel to furniture and automotive interiors.

The importance of leather care products stems from their ability to extend the life of leather items, preserve their aesthetic appeal, and ensure durability through regular maintenance.

The leather care products market encompasses the manufacturing, distribution, and sale of leather maintenance solutions globally. This market is influenced by the dynamics of the fashion industry, automotive upholstery needs, and the luxury goods sector.

It is characterized by its responsiveness to consumer trends, such as the growing emphasis on sustainable and eco-friendly products. The rise of online retail has significantly shaped market access, making it easier for consumers to obtain high-quality leather care products irrespective of geographical boundaries.

The leather care products market is poised for substantial growth, driven by increasing consumer awareness about the long-term benefits of proper leather maintenance.

According to NCBI, online sales channels accounted for 38% of leather care product purchases in 2024, up from 29% in 2022. This shift highlights a growing preference for convenience and accessibility in purchasing these products. Furthermore, the EPA notes that a 2024 life cycle assessment study found that using proper leather care products can extend the lifespan of leather goods by up to 40%, potentially reducing waste.

This not only enhances consumer satisfaction but also aligns with global sustainability efforts. Additionally, the IBEF reported that the export of leather and leather products stood at US$ 4.6 billion in FY24, indicating robust market activity and the potential for further expansion into international markets.

Government investments and regulatory frameworks significantly impact the leather care products market. Regulations focusing on the environmental impact of leather processing and care products encourage the development of greener alternatives, thus shaping consumer preferences and industry practices.

For instance, initiatives to reduce VOC emissions in leather care products are prompting companies to innovate with water-based and organic formulations. These regulatory measures not only ensure market compliance but also foster innovation, creating opportunities for new entrants and existing players to differentiate themselves.

Key Takeaways

- Global Leather Care Products Market projected to grow from USD 3.9 Billion in 2024 to USD 5.9 Billion by 2034 at a CAGR of 4.3%.

- Cleaners dominated the Product Type segment in 2023 with a 64.3% market share, valued for their effective cleaning and preparatory qualities.

- Spray formulations led the Formulation Type segment in 2023, favored for their convenience and efficient application.

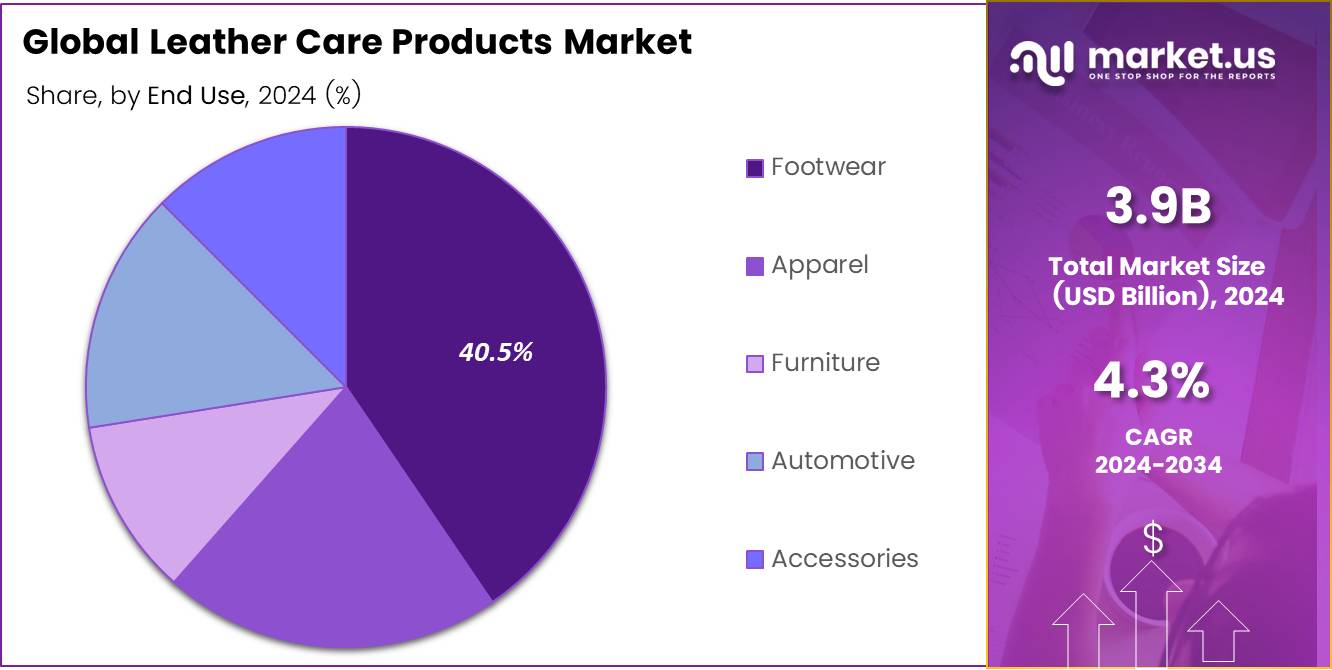

- Footwear was the leading end-use segment in 2023, holding a 40.5% market share, emphasizing the importance of specialized care for leather shoes.

- Online distribution channels dominated in 2023, reflecting a consumer shift towards digital shopping experiences.

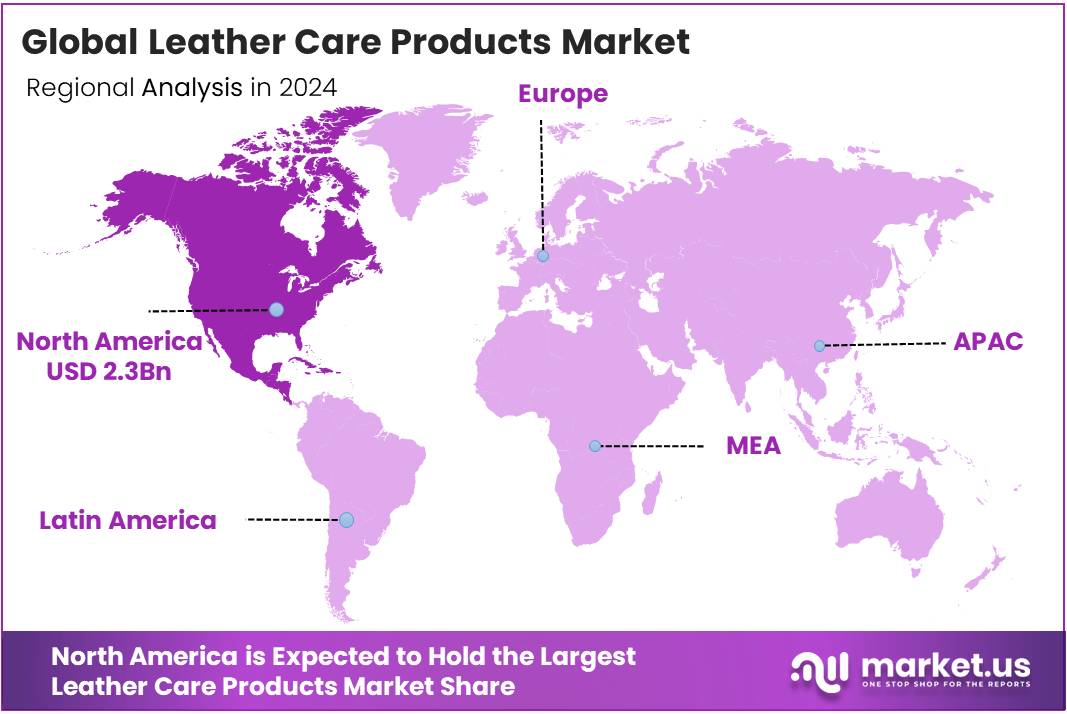

- North America was the leading region in 2023, capturing 60% of global revenue, driven by high demand for premium leather goods and strong distribution networks.

Product Type Analysis

Cleaners lead the leather care market with a 64.3% share in 2023 due to their essential role in maintaining and preparing leather goods

In 2023, Cleaners held a dominant market position in the By Product Type Analysis segment of the Leather Care Products Market, with a 64.3% share. This considerable market share underscores the critical role cleaners play in the maintenance and longevity of leather goods.

Cleaners are preferred for their effectiveness in removing dirt and stains while also preparing leather surfaces for further treatment with conditioners or protectants.

Following cleaners, conditioners captured a significant portion of the market. These products are essential for maintaining the suppleness and aesthetic appeal of leather by replenishing essential oils and ensuring the material remains durable over time.

Protectants also secured a noteworthy position in the market by offering protection against water, UV rays, and other environmental factors that can degrade leather quality.

Dyes and colorants have carved out a niche by allowing consumers to customize or restore the color of their leather products. The market segment labeled Others, which includes polishes and sprays, supports the comprehensive care approach, offering solutions for enhancing shine and providing quick touch-ups.

Collectively, these segments reflect a robust and diversified market aimed at addressing the comprehensive needs of leather product maintenance and care.

Formulation Type Analysis

Spray Leads the Charge with Consumer-Favored Convenience and Efficiency

In 2023, Spray held a dominant market position in the By Formulation Type Analysis segment of the Leather Care Products Market, offering convenience and efficiency in application.

This category stood out primarily due to consumer preference for quick and uniform application, especially in the fast-paced lifestyles of urban environments. Sprays have been particularly popular for their ability to provide a clean finish without the need for direct contact with the product, making them a go-to choice for routine leather maintenance.

Following closely, the Liquid formulation type catered to a substantial portion of the market, favored for its versatility and deep cleaning properties. It is especially preferred for more thorough cleaning tasks, where deeper penetration into the leather is required to restore its natural look and feel.

Wipes have also carved out a niche due to their portability and convenience, ideal for quick touch-ups and on-the-go maintenance. Creams, however, continue to attract consumers looking for intensive conditioning and protection, offering richer formulations that enhance the longevity and durability of leather products.

Lastly, Gels have seen steady adoption for targeted applications, providing precise control over the application process, which is particularly useful for spot treatments and detailed work on high-end accessories.

End Use Analysis

Footwear Leads the Leather Care Products Market with Over 40.5% Share

In 2023, Footwear held a dominant market position in the By End Use Analysis segment of the Leather Care Products Market, with a 40.5% share.

This substantial market share underscores the crucial role that footwear plays in the demand for leather care products. Consumers and manufacturers alike prioritize maintaining the aesthetic and functional qualities of leather shoes, which drives substantial investment in specialized care products.

Following footwear, Apparel emerges as the second largest segment. With the growing trend of sustainable and quality fashion, consumers are increasingly investing in products that extend the lifespan of leather garments.

Furniture, which includes both home and commercial furnishings, also represents a significant segment. The demand here is driven by the need to preserve the luxury appeal and comfort of leather furnishings.

The Automotive sector, though smaller, sees consistent demand driven by car owners looking to maintain the luxury aesthetic and integrity of leather interiors.

Accessories such as bags and belts make up the final segment, where the focus is on premium care products that can protect and enhance the leather’s appearance, ensuring longevity and durability. This distribution highlights a diverse yet concentrated demand within the leather care market, reflecting varied consumer priorities and usage scenarios.

Distribution Channel Analysis

Online Channels Lead in Leather Care Product Distribution

In 2023, Online held a dominant market position in the By Distribution Channel Analysis segment of the Leather Care Products Market. The rising consumer preference for shopping online has notably shaped this trend, driven by the convenience of browsing and purchasing products from the comfort of home.

Online platforms offer a broad range of leather care products, encompassing various brands and price points, which has attracted a diverse customer base. Additionally, the ability to compare prices, read customer reviews, and access detailed product information online has further boosted consumer confidence in making online purchases.

The growth of e-commerce has also been facilitated by advancements in logistics and payment security, making it easier and safer for consumers to buy leather care products online. Moreover, many manufacturers and retailers have optimized their online presence, using digital marketing strategies to reach a wider audience.

Despite the strength of online channels, the offline segment continues to hold significance, especially in regions with limited internet penetration or a strong preference for physical stores. However, the trend towards digitalization is clear, and online channels are expected to continue expanding their market share in the coming years.

Key Market Segments

By Product Type

- Cleaners

- Conditioners

- Protectants

- Dyes and Colorants

- Others (e.g., polishes, sprays)

By Formulation Type

- Spray

- Liquid

- Wipe

- Cream

- Gel

By End Use

- Footwear

- Apparel

- Furniture

- Automotive

- Accessories (bags, belts, etc.)

By Distribution Channel

- Online

- Offline

Drivers

Surging Interest in Premium Leather Goods Boosts Market

The leather care products market is experiencing significant growth, driven primarily by the increasing demand for premium leather goods. As consumers increasingly invest in high-quality leather items, from fashion accessories to luxury car interiors, there’s a corresponding rise in the need for products that maintain and extend the life of these goods.

Additionally, awareness around proper leather maintenance is growing, with more people recognizing the importance of preserving both the aesthetic and functional qualities of their leather possessions. This awareness is amplified by the expansion of the luxury goods industry, where the appeal of pristine, well-kept leather is paramount.

Moreover, the growth of e-commerce has made leather care products more accessible than ever, allowing consumers to easily find and purchase the necessary items to keep their leather in top condition. This convenience supports continued market growth, catering to the needs of leather goods enthusiasts worldwide.

Restraints

Rising Costs and Counterfeit Challenges Dampen Leather Care Market

As an analyst observing the leather care products market, a notable restraint is the high cost of premium products. These expensive options often deter budget-conscious consumers who may find the price point inaccessible.

The challenge is compounded by the availability of counterfeit products in the market. These cheaper alternatives not only draw potential customers away from authentic items but also pose a risk to the reputation and perceived value of genuine leather care products.

Such dynamics create a complex landscape for producers and sellers in this niche market, requiring strategies that balance quality, price, and consumer trust to maintain a competitive edge.

Growth Factors

Embracing Green Brings Value and Meets Eco-Friendly Expectations

The leather care products market stands at the cusp of significant growth opportunities, driven by evolving consumer preferences and demographic shifts.

Foremost, the introduction of organic and natural products represents a transformative trend. As consumers become increasingly environmentally conscious, the demand for eco-friendly, natural leather care solutions is surging. This shift not only caters to the green-minded shopper but also paves the way for brands to differentiate themselves in a crowded market.

Additionally, the expanding middle class in emerging markets like the Asia-Pacific region presents a promising avenue for growth. This demographic is rapidly acquiring more disposable income, fueling the purchase of leather goods and, subsequently, specialized care products to maintain them.

In these markets, leather is not just a purchase but an investment, necessitating products that extend durability and enhance appearance.

Emerging Trends

Eco-Friendly Products Leading the Charge in Leather Care

The leather care products market is seeing a significant transformation driven by consumer preferences for eco-friendly and sustainable solutions. As environmental concerns grow, there’s an increasing demand for leather care products made from biodegradable and sustainable ingredients, marking a major shift in industry practices.

Additionally, the rise of vegan leather has spurred the development of specialized care products tailored for synthetic leathers, addressing a new segment of conscientious consumers. This trend is further bolstered by the luxury sector’s expansion, where premium and high-end leather care lines are being introduced to cater to upscale consumers looking for superior quality and exclusivity.

Moreover, technological advancements have led to the creation of smart leather care devices, such as automated cleaners, enhancing convenience and efficiency in maintaining leather goods. These evolving dynamics underscore a market that’s rapidly adapting to meet the demands of both environmentally aware and tech-savvy consumers, ensuring sustainability and innovation remain at the forefront of industry growth.

Regional Analysis

North America leads the leather care products market with 60% share and USD 2.3 billion value driven by strong demand from automotive and luxury sectors

The global leather care products market exhibits distinct regional dynamics, with North America emerging as the dominant market, accounting for 60% of the global revenue and valued at approximately USD 2.3 billion in 2023.

This leadership is driven by the high demand for premium leather products such as automotive interiors, footwear, and furniture, coupled with consumer preferences for long-lasting quality. The presence of key players and advanced distribution channels further reinforces North America’s dominance.

Regional Mentions:

In Europe, the market is propelled by a strong cultural association with leather craftsmanship and luxury goods, particularly in countries like Italy, France, and Germany. The region’s robust automotive and fashion industries significantly contribute to the demand for leather care products. Rising sustainability concerns are also fostering innovation in eco-friendly leather care solutions, appealing to environmentally conscious consumers.

The Asia-Pacific region is experiencing rapid growth due to increasing disposable incomes, urbanization, and expanding industries like footwear, automotive, and fashion. Countries such as China, India, and Japan are key contributors to this growth, driven by heightened consumer awareness and a burgeoning middle class. The region also benefits from being a manufacturing hub for leather goods, which fuels the demand for maintenance and care products.

In the Middle East & Africa, the market is growing steadily, supported by the rising popularity of luxury leather goods and automotive leather interiors, particularly in GCC countries. However, the growth is tempered by limited local production capacities and a reliance on imports.

Latin America, while smaller in market size, is gaining momentum with a growing emphasis on leather exports, particularly from Brazil and Argentina. The rising focus on preserving leather quality for exports underpins the demand for care products.

Overall, North America leads in market share, while Asia-Pacific showcases the fastest growth, indicating a shift towards emerging markets in the near future.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global leather care products market in 2023 is characterized by a dynamic competitive landscape, with key players leveraging innovation, branding, and sustainability initiatives to differentiate themselves in a highly fragmented industry.

Chemical Guys and Lexol stand out as dominant players due to their strong brand equity and diversified product portfolios catering to automotive, furniture, and personal leather goods. Chemical Guys’ reputation for premium, eco-friendly formulations positions them as a leader in the niche segment of sustainable leather care.

Otter Wax and Saddle Soap Company capitalize on their artisanal and natural ingredient-based products, appealing to eco-conscious consumers. These companies emphasize traditional methods combined with modern sensibilities, targeting a growing segment of consumers who prioritize authenticity and environmentally friendly practices.

Weiman Products, LLC and Kiwi remain key players in the mass-market segment, offering widely accessible and competitively priced products. Their strength lies in expansive distribution networks and brand recognition, particularly in footwear and household leather care.

Specialty brands like Leather Honey, Bickmore, and Fiebing’s cater to niche markets, including equestrian and vintage leather enthusiasts. Their long-standing market presence and focus on quality have built strong customer loyalty.

Emerging players such as Trinova focus on innovative, easy-to-use solutions with multi-functional benefits, targeting younger consumers seeking convenience without compromising quality.

Lastly, Dr. Leather and Huberd’s Shoe Grease carve out their niches with tailored products for professionals, ensuring durability and high performance for demanding applications.

Top Key Players in the Market

- Chemical Guys

- Lexol

- Otter Wax

- Saddle Soap Company

- Weiman Products, LLC

- Kiwi

- Huberd’s Shoe Grease

- Dr. Leather

- Bickmore

- Leather Honey

- Fiebing’s

- Trinova

- Lexol

Recent Developments

- In July 2024, UNCAGED Innovations successfully raised $5.6 million in funding to support the development of the “world’s first” sustainable leather made from grains. This innovation aims to revolutionize the fashion industry with eco-friendly alternatives to traditional leather.

- In June 2023, a vegan leather startup secured $2 million in funding with the backing of Jaguar Land Rover. This investment is set to accelerate the development of animal-free leather for use in luxury automotive interiors and beyond.

- In January 2023, Ecovative, a leader in sustainable materials, completed an acquisition to enhance its production of leather alternatives. This strategic move strengthens its position in the growing market for mycelium-based leather products.

- In August 2023, LVMH announced the acquisition of Grupo VerdeVeleno, a company known for its innovative sustainable leather solutions. This acquisition aligns with LVMH’s commitment to integrating eco-conscious practices into its luxury brand portfolio.

Report Scope

Report Features Description Market Value (2023) USD 3.9 Billion Forecast Revenue (2033) USD 5.9 Billion CAGR (2024-2033) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Cleaners, Conditioners, Protectants, Dyes and Colorants, Others), By Formulation Type (Spray, Liquid, Wipe, Cream, Gel), By End Use (Footwear, Apparel, Furniture, Automotive, Accessories), By Distribution Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Chemical Guys, Lexol, Otter Wax, Saddle Soap Company, Weiman Products, LLC, Kiwi, Huberd’s Shoe Grease, Dr. Leather, Bickmore, Leather Honey, Fiebing’s, Trinova, Lexol Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Leather Care Products MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Leather Care Products MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Chemical Guys

- Lexol

- Otter Wax

- Saddle Soap Company

- Weiman Products, LLC

- Kiwi

- Huberd’s Shoe Grease

- Dr. Leather

- Bickmore

- Leather Honey

- Fiebing’s

- Trinova

- Lexol