Global Elastomeric Infusion Pumps Market Analysis By Product Type (Continuous Rate Elastomeric Infusion Pumps, Variable Rate Elastomeric Infusion Pumps), By Application (Pain Management, Chemotherapy, Chelation Therapy, Others), By End User (Hospitals, Ambulatory Surgical Centers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 24796

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

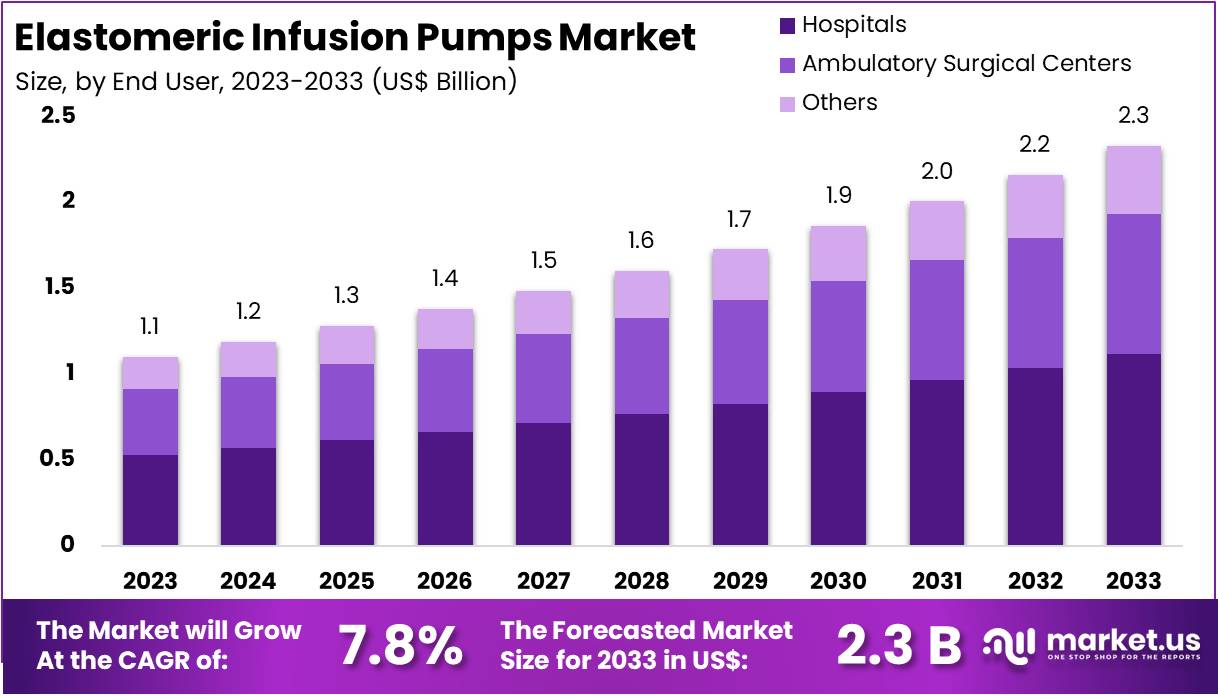

The Global Elastomeric Infusion Pumps Market size is expected to be worth around US$ 2.3 Billion by 2033, from US$ 1.1 Billion in 2023, growing at a CAGR of 7.8% during the forecast period from 2024 to 2033.

The global elastomeric infusion pumps market is witnessing remarkable growth, driven by the increasing demand for efficient and portable drug delivery solutions. These compact, disposable medical devices are designed to provide continuous and controlled delivery of medications such as antibiotics, analgesics, and chemotherapy drugs. They utilize an elastomeric balloon reservoir to maintain consistent pressure, ensuring a predetermined infusion rate. Their lightweight and electricity-free operation make them ideal for home care, ambulatory settings, and mobile healthcare applications.

One of the key market drivers is the rising prevalence of chronic diseases and the growing need for home healthcare solutions. According to industry reports, advancements in infusion technologies and the increasing geriatric population are further boosting demand. The market is segmented based on product type (continuous flow and variable flow pumps), applications (pain management, chemotherapy, and antibiotic administration), and end-users (hospitals, home care settings, and ambulatory surgical centers).

For instance, a 2022 study published in the Journal of Hospital Oncology Practice evaluated the effectiveness of SMARTeZ elastomeric pumps for continuous 5-fluorouracil (5-FU) infusions over 46 hours in gastrointestinal cancer patients. The findings revealed that 95.7% of patients received over 90% of the expected dose, with an average delivery accuracy of 94.9%. These results underscore the reliability of elastomeric pumps in chemotherapy administration, making them a dependable choice for continuous infusion therapies.

In outpatient parenteral antimicrobial therapy (OPAT), elastomeric pumps have demonstrated significant clinical benefits. A study by White Rose ePrints assessed 432 patient episodes involving continuous antimicrobial infusion over five years, concluding in December 2022. The study found an 84% success rate in curing or improving conditions and a minimal 0.2% incidence of line-related infections. These findings highlight the safety and effectiveness of elastomeric pumps in managing infections outside hospital settings.

From an economic perspective, elastomeric pumps offer cost-saving advantages. A 2024 economic analysis published in BMC Health Services Research compared these devices to conventional IV infusion for administering immune checkpoint inhibitors. Results indicated that elastomeric pumps reduced total chair time by 78% and nurse time by 55%, translating to average cost savings of €25.48 per administration. Such findings emphasize the pumps’ efficiency in reducing operational costs in oncology and other therapeutic areas.

Technological advancements have further enhanced the market potential of elastomeric pumps. For example, a 2022 study in Perioperative Medicine introduced a dual-channel elastomeric infusion pump for patient-controlled analgesia (PCA). This innovative design allows one channel for continuous basal infusion and another for bolus doses. The study concluded that the dual-channel pump effectively improved analgesia and patient satisfaction compared to single-channel devices, demonstrating its potential in pain management applications.

Moreover, elastomeric pumps are increasingly used in home IV therapy, enabling patients to receive treatment outside hospital settings. A 2023 report by the Nipro Group highlighted the safety and reliability of these devices in home care environments. The report also noted that their use significantly reduces hospital stays while improving patient mobility and quality of life. These factors contribute to their growing popularity in home healthcare.

Key Takeaways

- The Elastomeric Infusion Pumps Market is forecasted to double from US$ 1.1 billion in 2023 to US$ 2.3 billion by 2033, growing at a 7.8% CAGR.

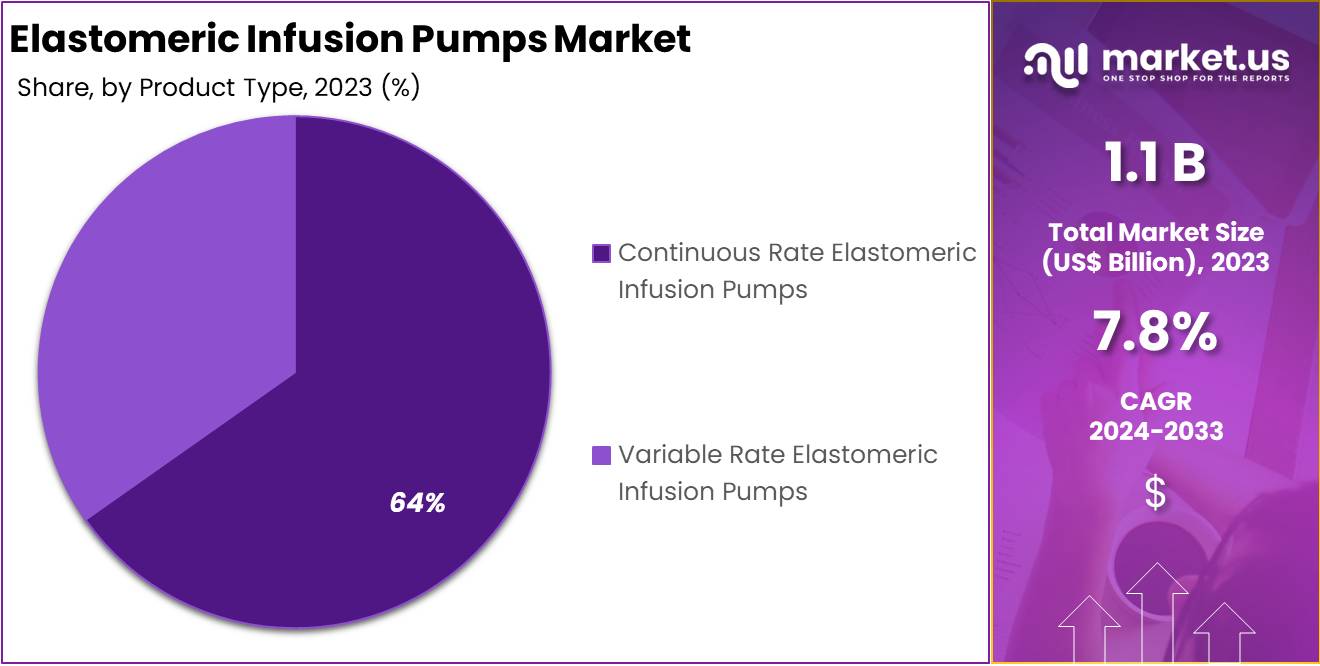

- Continuous Rate Elastomeric Infusion Pumps led the product type segment in 2023, holding over 64% of the market share.

- Pain Management applications dominated the market in 2023, with a significant 38% market share.

- Hospitals were the primary end-users in 2023, accounting for more than 48% of the market.

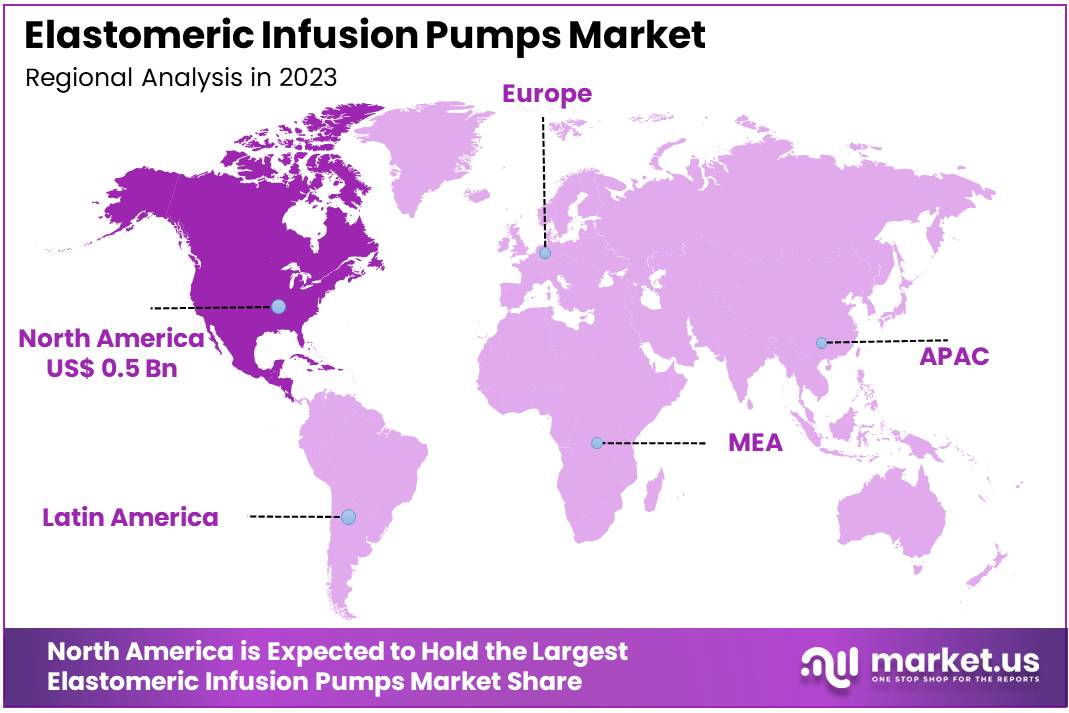

- North America was the leading region, possessing a 48% market share and valued at US$ 0.5 billion in 2023.

Product Type Analysis

In 2023, Continuous Rate Elastomeric Infusion Pumps held a dominant market position in the Product Type Segment of the Elastomeric Infusion Pumps Market. They captured more than a 64% share. These pumps are favored for their reliability and simplicity in maintaining a constant medication flow rate. Healthcare providers often choose them for their cost-effectiveness and ease of use in both hospital and home care settings.

On the other hand, Variable Rate Elastomeric Infusion Pumps also play a critical role in the market. These devices allow for adjustable flow rates, accommodating specific patient needs. This flexibility supports varied treatment requirements and can be particularly useful in complex therapy regimens. Although they hold a smaller market share, their importance grows as personalized medicine advances.

Both product types are essential in providing effective patient care. Their development continues to focus on enhancing patient comfort and treatment accuracy. As the market evolves, innovations in elastomeric pump technology are expected to drive further growth and adoption across different healthcare scenarios.

Application Analysis

In 2023, Pain Management held a dominant market position in the Application Segment of the Elastomeric Infusion Pumps Market, capturing more than a 38% share. This segment benefits significantly from the use of these pumps for post-operative and chronic pain management. The devices offer consistent, controlled medication delivery, which is crucial for patient comfort and recovery without frequent medical intervention.

Chemotherapy represents another vital segment. Elastomeric pumps maintain steady medication levels essential for cancer treatment. This consistent delivery helps avoid the usual highs and lows of drug concentrations, enhancing patient outcomes and comfort during therapy.

Chelation therapy makes up a smaller portion of the market. It employs elastomeric pumps to administer chelating agents for heavy metal poisoning treatment. These pumps are valued for their ability to deliver precise doses over extended periods, crucial for the effectiveness of this therapy.

The category labeled Others includes varied applications like antibiotic delivery and hormonal therapy. The flexibility of elastomeric pumps to serve diverse medical needs suggests potential for growth. As healthcare technologies evolve, the market is likely to see an expansion in applications and increased demand for these versatile devices.

End User Analysis

In 2023, hospitals held a dominant market position in the End User Segment of the Elastomeric Infusion Pumps Market, capturing more than a 48% share. They are favored in hospitals for their critical role in managing pain and delivering antibiotics post-surgery. The devices are noted for their portability and ease of use, features that enhance patient comfort and mobility during recovery.

Ambulatory Surgical Centers (ASCs) form another key user group. These centers are adopting elastomeric pumps at a growing rate to facilitate outpatient care. The pumps allow for effective drug delivery in settings that promote shorter hospital stays, making them a cost-effective solution for both healthcare providers and patients.

Other end-users, including home care settings and specialty clinics, have begun to incorporate these pumps more frequently. The increase is linked to the rising demand for at-home healthcare solutions. As more treatments become available for home administration, these devices are becoming more common in non-hospital settings.

The trend across all segments points to an expanding use of elastomeric infusion pumps beyond traditional hospital environments. This shift is largely driven by the benefits of patient-centered care that these pumps offer, allowing for continuous medical treatment in various settings.

Key Market Segments

By Product Type

- Continuous Rate Elastomeric Infusion Pumps

- Variable Rate Elastomeric Infusion Pumps

By Application

- Pain Management

- Chemotherapy

- Chelation Therapy

- Others

By End User

- Hospitals

- Ambulatory Surgical Centers

- Others

Drivers

Rising Incidence Of Chronic Diseases

The rising incidence of chronic diseases like cancer and diabetes significantly boosts the demand for elastomeric infusion pumps. These medical devices are pivotal for administering long-term therapies efficiently. Their design allows for continuous medication delivery, which is essential for managing complex health conditions. This mechanism supports the treatment of chronic diseases by ensuring a steady flow of medication, critical for patient care and management.

Elastomeric infusion pumps are increasingly favored for their convenience and cost-effectiveness. They facilitate home-based treatment, markedly enhancing patient quality of life. By allowing patients to receive therapy in the comfort of their homes, these pumps minimize the need for frequent hospital visits. This not only reduces healthcare costs but also supports a better quality of life, making these devices a preferred choice for continuous medical care.

Restraints

Risk Of Dosage Errors And Complications

Elastomeric infusion pumps, though beneficial for continuous drug delivery, are not without their challenges. A major restraint in their adoption is the potential for dosage errors. Incorrect configuration of these pumps can lead to significant risks, including under-dosing or over-dosing. Such dosage discrepancies can compromise patient safety, making precision in pump settings crucial.

Complications arising from device failure further limit the widespread use of elastomeric pumps. Failures may cause interruptions in drug delivery, posing serious health risks. This reliability concern can deter healthcare providers from utilizing these devices extensively, affecting their market acceptance.

Opportunities

Technological Advancements

The elastomeric infusion pump market is poised for significant growth, driven by technological advancements aimed at improving pump precision and patient safety. Innovations in this field focus on enhancing the accuracy of drug delivery systems, which is crucial for patient care. As these pumps become more reliable, they can better meet the needs of diverse medical settings, contributing to their increased adoption in healthcare facilities worldwide.

Moreover, the integration of elastomeric pumps with digital health records represents a substantial opportunity for market expansion. This integration facilitates better patient data management and supports healthcare providers in monitoring treatment efficacy. Particularly in developing regions, where healthcare investments are on the rise, the demand for advanced, integrated medical devices is expected to surge. This trend underscores the potential for these pumps to play a pivotal role in improving healthcare outcomes in underserved areas.

Trends

Rising Popularity of Disposable Elastomeric Infusion Pumps

Disposable elastomeric infusion pumps are increasingly favored in the healthcare market. Their convenience makes them ideal for both hospitals and home care settings. These pumps eliminate the need for cleaning and sterilization, reducing operational complexity. Additionally, the single-use design minimizes the risk of cross-contamination, enhancing patient safety. This feature is particularly valuable in settings where infection control is critical.

Cost-effectiveness is another driving factor behind this trend. Disposable pumps lower overall healthcare costs by reducing maintenance and labor requirements. Their ease of use also improves patient compliance, further boosting demand. This shift aligns with the growing focus on efficient and patient-friendly medical devices.

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 48% share, with a market value of US$ 0.5 billion. This dominance is supported by a robust healthcare infrastructure that promotes the use of advanced medical devices, including elastomeric infusion pumps. These devices are increasingly utilized in home care settings, aligning with the region’s growing preference for cost-effective treatment options outside hospitals.

The region’s regulatory environment also plays a critical role. The FDA’s streamlined processes for medical device approval have hastened the introduction of innovative infusion systems. This regulatory support accelerates the availability and adoption of new technologies, ensuring that advanced infusion systems reach the market swiftly and safely.

North America is home to leading healthcare technology companies that drive innovation and improve device availability. These companies are dedicated to R&D, focusing on developing elastomeric pumps that offer precise dosing and enhanced portability. Such innovations cater to the evolving needs of both healthcare providers and patients, reinforcing the region’s market leadership.

Furthermore, the focus on patient-centric healthcare solutions in North America boosts the popularity of elastomeric pumps. These devices, which allow for medication administration without constant supervision, are well-suited to the region’s healthcare approach. Coupled with increasing healthcare expenditure and favorable insurance coverage, the demand for these pumps is set to remain strong.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The elastomeric infusion pumps market is highly competitive, with key players like Baxter International Inc., B. Braun Melsungen AG, and Avanos Medical Inc. holding significant shares. These companies leverage innovation, strong distribution networks, and product differentiation to maintain their dominance. Ambu A/S and Werfenlife SA (LeVenton SAU) are gaining traction with niche products and focused strategies. The market also includes regional players contributing to a fragmented competitive landscape. Increased demand for home-based care and ambulatory solutions further drives competition.

Baxter International Inc. and B. Braun Melsungen AG lead with diversified portfolios and global presence. They focus on enhancing product offerings and expanding into emerging markets. Companies like Avanos Medical Inc. emphasize innovation in pain management devices, strengthening their market position. Ambu A/S excels in single-use device innovation, while Werfenlife SA targets specific applications. Key strategies include partnerships, R&D investments, and new product launches to address unmet needs and meet regulatory standards.

The competitive landscape reveals opportunities for both established and emerging players. Expansion into underserved markets and advancements in pump technologies create growth potential. Major players focus on sustainability and integration of digital health solutions. Smaller firms target niche segments with innovative offerings to establish market presence. Despite challenges like regulatory compliance and price pressures, the market outlook remains positive. Increasing healthcare needs and a shift toward ambulatory care solutions are expected to fuel long-term growth.

Market Key Players

- Ambu A/s

- Avanos Medical Inc

- Baxter International Inc

- B. Braun Melsungen AG

- Werfenlife SA (LeVenton SAU)

- Nipro Corporation

- Woo Young Medical Co

- Epic Medical Pte Ltd

- Daiken Medical Co. Ltd

- Smiths Medical Inc.

Recent Developments

- In October 2024: Werfen acquired Omixon, a company based in Budapest, Hungary, for about US$25 million, paid in cash. Omixon specializes in Next Generation Sequencing (NGS) technologies for transplant diagnostics. This acquisition aims to enhance Werfen’s diagnostic solutions and expand its footprint in the transplant diagnostics sector, reflecting the company’s ongoing commitment to enriching its product offerings in specialized diagnostics.

- In January 2024: Avanos Medical reported preliminary financial results for the fourth quarter and the full year of 2023, indicating a decrease in net sales due to underperformance in its hyaluronic acid pain relief products, attributed to Medicare reimbursement changes. The sales for this product line were approximately $4 million lower than anticipated. This financial performance led Avanos to revise its 2024 revenue outlook, projecting an increase in net sales ranging from $685 million to $705 million.

Report Scope

Report Features Description Market Value (2023) US$ 1.1 Billion Forecast Revenue (2033) US$ 2.3 Billion CAGR (2024-2033) 7.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Continuous Rate Elastomeric Infusion Pumps, Variable Rate Elastomeric Infusion Pumps), By Application (Pain Management, Chemotherapy, Chelation Therapy, Others), By End User (Hospitals, Ambulatory Surgical Centers, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Ambu A/s, Avanos Medical Inc, Baxter International Inc, B. Braun Melsungen AG, Werfenlife SA (LeVenton SAU), Nipro Corporation, Woo Young Medical Co, Epic Medical Pte Ltd, Daiken Medical Co. Ltd, Smiths Medical Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Elastomeric Infusion Pumps MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Elastomeric Infusion Pumps MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Ambu A/s

- Avanos Medical Inc

- Baxter International Inc

- B. Braun Melsungen AG

- Werfenlife SA (LeVenton SAU)

- Nipro Corporation

- Woo Young Medical Co

- Epic Medical Pte Ltd

- Daiken Medical Co. Ltd

- Smiths Medical Inc.