Global Luxury Resale Market By Product (Apparel and Accessories, Watches, Fine Jewelry, Leather Goods), By Demographic (Affluent Consumers, Millennials, Generation Z), By Distribution Channel (Online Platforms, Brick-and-Mortar Stores, Consignment Stores), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 138097

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

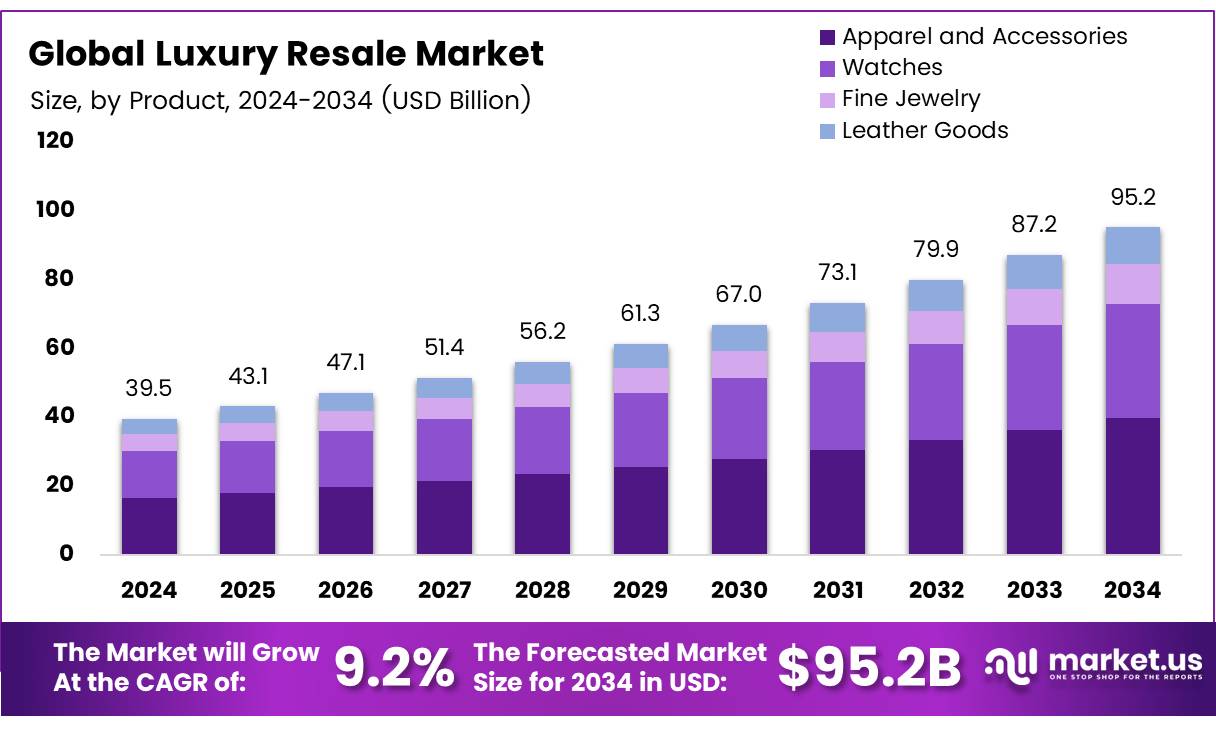

The Global Luxury Resale Market size is expected to be worth around USD 95.2 Billion by 2034, from USD 39.5 Billion in 2024, growing at a CAGR of 9.2% during the forecast period from 2025 to 2034.

Luxury resale involves the buying and selling of pre-owned luxury goods, which can include a range of items from high-end fashion and accessories to jewelry and watches. This market segment appeals particularly to eco-conscious consumers and those looking to access luxury brands at a more accessible price point.

The luxury resale market is a burgeoning sector within the broader luxury goods industry, characterized by the commercial exchange of pre-owned high-end products through various platforms including boutique consignment stores and expansive online marketplaces.

This market’s growth is driven by a consumer shift towards sustainability and value for money, coupled with an increasing acceptance of purchasing secondhand items. As digital platforms become more prevalent, the accessibility and popularity of luxury resale continue to soar, making high-end products more accessible to a wider audience.

The luxury resale market is witnessing exponential growth, propelled by evolving consumer attitudes and the increasing value proposition of pre-owned luxury goods. In 2023, the market size reached approximately $49.3 billion globally, as estimated by Bain & Company.

This substantial figure underscores the lucrative potential within this sector, reflecting a consumer base that is both expanding and becoming increasingly sophisticated in its purchasing behaviors. Notably, with 83% of Gen Z consumers either already engaging in or showing openness to shopping secondhand for apparel, the demographic foundation for sustained growth is robust.

Online resale platforms are forecasted to grow by an average of 21% annually over the next five years. This growth trajectory suggests a promising horizon for businesses investing in digital capabilities and innovative customer engagement strategies.

Additionally, the luxury resale market benefits significantly from the high price elasticity observed in luxury goods. For instance, the U.S. Bureau of Labor Statistics highlighted a 99.13% price increase in jewelry and watches from 1986 to 2024, which enhances the attractiveness of the resale market for consumers seeking value in these high-ticket categories.

Government regulations and investments play a crucial role in shaping the luxury resale market. Policies aimed at promoting sustainability can encourage the growth of the resale sector by providing incentives for businesses that contribute to waste reduction and offer sustainable consumer options.

Additionally, stringent authenticity and quality controls enforced by regulatory bodies ensure consumer trust and market stability, which are vital for the sector’s growth. Governments are increasingly recognizing the economic and environmental benefits of supporting such markets, leading to potential subsidies and favorable regulations for businesses operating within this space.

Key Takeaways

- The global luxury resale market is projected to grow from USD 39.5 billion in 2024 to USD 95.2 billion by 2034, with a CAGR of 9.2%.

- Apparel and accessories lead the product segment, accounting for over 50.2% of the market in 2024.

- Affluent consumers dominate the demographic segment with a 50% market share in 2024.

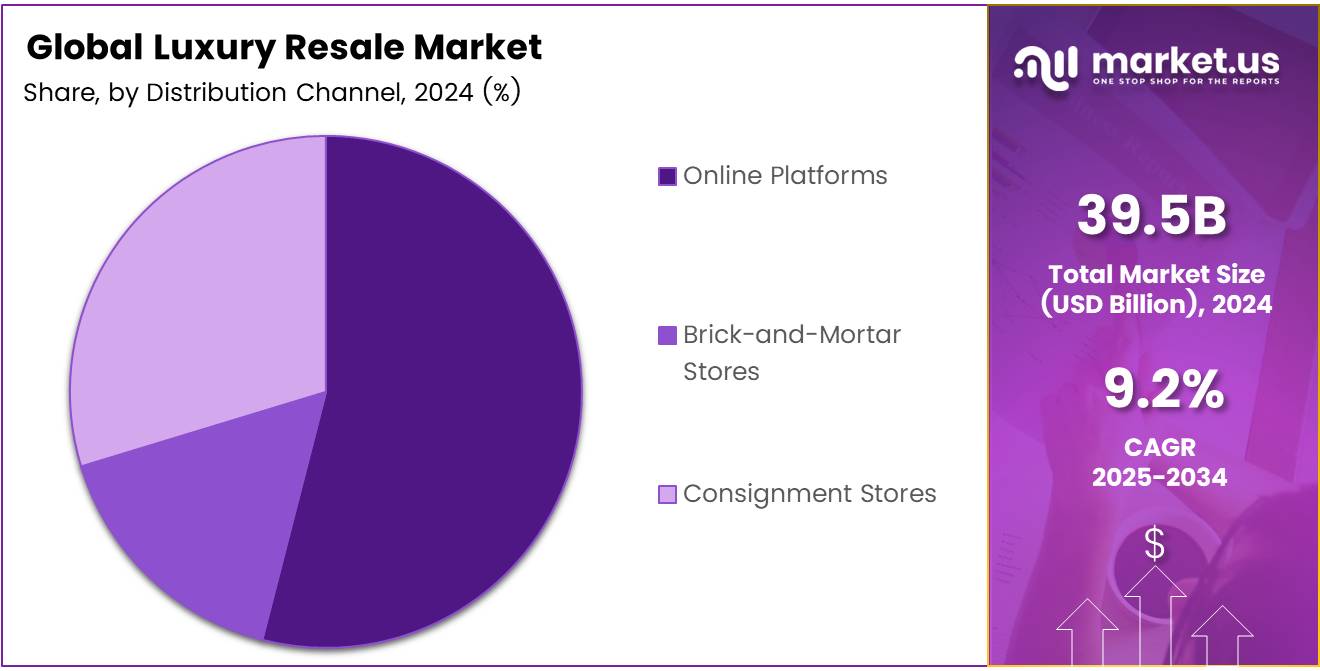

- Online platforms are the leading distribution channel, holding a 60% share in 2024, favored for their convenience and variety.

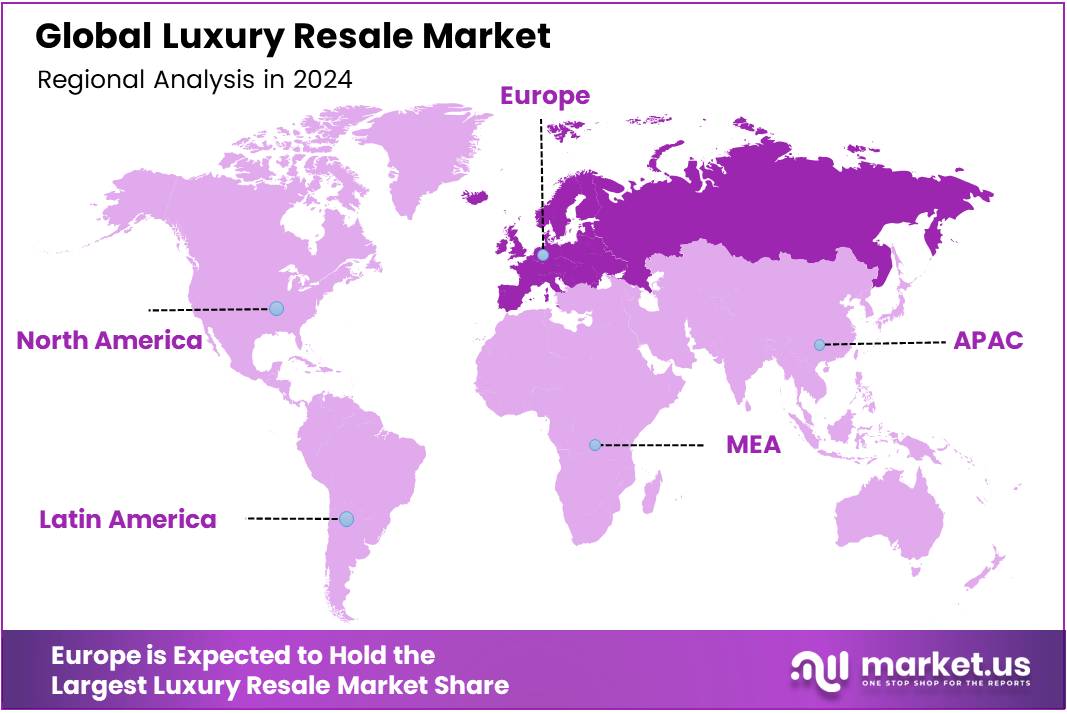

- Europe is the leading region in the luxury resale market due to its luxury heritage and consumer interest in pre-owned luxury goods.

Product Analysis

Apparel and Accessories Lead with 50.2 of Luxury Resale Market in 2024

In 2024, the By Product Analysis segment of the Luxury Resale Market saw Apparel and Accessories retain a commanding lead, accounting for 50.2% of the market.

This segment’s dominance is attributed to the sustained popularity and versatile range of products that appeal to a broad demographic of consumers seeking both classic and contemporary styles. The allure of high-quality materials and craftsmanship continues to drive consumer preference towards luxury apparel, supporting a robust resale value and a vibrant secondary market.

Watches and Fine Jewelry also demonstrated strong market performances, indicative of a growing consumer interest in long-lasting value and timeless design. Watches, known for their craftsmanship and prestige, captured a significant market share, underscoring their desirability among collectors and fashion aficionados alike.

Leather Goods, which include a variety of products from high-end handbags to designer belts, maintained a steady grip on the market. The durability and brand prestige associated with luxury leather goods fuel their demand in the resale market, reflecting a consumer shift towards investment in quality over quantity.

Overall, the Luxury Resale Market in 2024 emphasized the consumer’s pivot towards sustainability and value retention in luxury segments, with Apparel and Accessories leading the trend.

Demographic Analysis

Affluent Consumers Lead with 50% the Market Share in Luxury Resale Demographics

In 2024, affluent consumers maintained a dominant position in the By Demographic Analysis segment of the luxury resale market, commanding a significant 50% share.

This segment primarily thrives on the purchasing power and brand loyalty of high-income individuals who value premium quality and exclusivity. These consumers often seek out luxury resale items as a means to access rare, discontinued, or limited-edition products, thereby driving sustained growth in this market sector.

Following affluent consumers, Millennials represent a critical demographic, contributing substantially to market dynamics with their preference for sustainable and ethical fashion choices. This group’s growing interest in luxury resale platforms underscores a shift towards more conscious consumption, further energized by digital engagement and social media influence.

Generation Z emerges as an influential force as well, albeit with distinct purchasing behaviors compared to previous generations. Focused heavily on authenticity and individuality, Gen Z buyers are less brand-loyal but highly value the uniqueness and sustainability that the luxury resale market offers. Their increasing financial independence and digital nativity propel them as pivotal contributors to the market’s expansion.

Overall, these demographic segments collectively shape the evolving landscape of the luxury resale market, each adding unique value and perspectives that drive forward the industry’s growth.

Distribution Channel Analysis

Online Platforms Lead Luxury Resale Market with Commanding 60% Market Share

In 2024, online platforms maintained a dominant position in the luxury resale market, commanding a 60% share within the By Distribution Channel Analysis segment. This significant market presence is attributed to the digital-first approach that resonates with contemporary consumers who prioritize convenience, variety, and accessibility.

Online platforms have revolutionized the way luxury goods are resold, offering seamless user experiences and broader geographic reach, which brick-and-mortar and consignment stores struggle to match.

Brick-and-mortar stores, holding the second-largest share, capitalize on the tactile buying experience that some consumers still prefer, especially in the luxury segment where the feel and authenticity of the product play crucial roles in the purchasing decision. These stores provide a sense of security and immediate gratification that online platforms cannot offer, despite their smaller market share.

Consignment stores continue to hold a niche but vital part of the market. These stores are often celebrated for their curated collections and the ability to provide unique, often rare luxury items. Although they have the smallest share, consignment stores maintain a loyal customer base that values personalized service and the thrill of the hunt for distinctive pieces.

Overall, the distribution channel landscape in the luxury resale market is shaped significantly by the dominance of online platforms, reflecting changing consumer behaviors and technological advancements in e-commerce.

Key Market Segments

By Product

- Apparel and Accessories

- Watches

- Fine Jewelry

- Leather Goods

By Demographic

- Affluent Consumers

- Millennials

- Generation Z

By Distribution Channel

- Online Platforms

- Brick-and-Mortar Stores

- Consignment Stores

Drivers

Consumer Mindset Shift Fuels Growth in Luxury Resale Market

As an analyst observing the luxury resale sector, a significant driver of market expansion is the evolving consumer perception towards second-hand luxury goods. This shift has effectively diminished the stigma once associated with used items, catalyzing broader acceptance and participation across various demographics.

Particularly influential in this trend are Millennials and Generation Z, whose preferences for affordability dovetail with a strong commitment to sustainability, propelling the demand for pre-owned luxury items. These younger consumers are not only motivated by cost savings but also by the desire to reduce environmental impact, aligning ethical considerations with their purchasing decisions.

Furthermore, the proliferation of e-commerce on a global scale has made luxury resale items more accessible, connecting sellers and buyers worldwide and creating a seamless shopping experience. This digital expansion ensures that luxury resale markets are not confined to geographic boundaries, thereby enhancing customer reach and facilitating the continuous growth of the sector.

Restraints

Fear of Counterfeits Dampens Enthusiasm in Luxury Resale Market

As a market analyst, it’s crucial to acknowledge that the luxury resale market faces significant restraints that hinder its growth. Primary among these concerns is the pervasive fear of counterfeit products.

Many potential buyers remain cautious, worried about the authenticity of high-value items, which can often look remarkably similar to their genuine counterparts. This fear is compounded by limited trust in online platforms, where much of the luxury resale transactions occur.

Customers frequently question the reliability and transparency of these digital marketplaces, making them hesitant to engage. Without stringent verification processes and clear, trust-building measures from resale platforms, both of these factors severely restrict consumer participation and ultimately, the market’s potential expansion. These barriers need to be addressed with robust authentication methods and improved transparency to reassure consumers and enhance market growth.

Growth Factors

Collaborating with Luxury Brands Boosts Market Credibility

In the flourishing luxury resale market, strategic collaborations with original luxury brands present a significant growth opportunity. By partnering with these brands to create certified pre-owned programs, resale platforms can enhance their credibility and attract customers seeking authenticity and quality assurance.

This alliance benefits both parties; brands maintain influence over their products’ lifecycle, while resellers gain access to a broader inventory of authenticated goods, reassuring buyers and potentially commanding higher prices. Additionally, incorporating augmented reality (AR) can revolutionize customer engagement by enabling virtual try-ons, thereby enriching the online shopping experience and reducing return rates.

Furthermore, adopting luxury resale subscription models can secure a steady income stream by offering members exclusive access to a curated selection of high-end items. This model not only fosters customer loyalty but also caters to an eco-conscious clientele eager to participate in a sustainable fashion cycle, thereby expanding the market base.

Emerging Trends

Increasing Demand for Limited-Edition Items Fuels Luxury Resale Market Growth

As an analyst, it’s clear that the luxury resale market is significantly propelled by the rising demand for rare and exclusive products. Limited-edition items have become a crucial factor in driving consumer interest and higher price points in the resale sector.

Additionally, the market is experiencing a surge due to the popularity of luxury streetwear brands like Supreme and Off-White. These brands have carved out a niche, attracting a dedicated following willing to pay premiums for pre-owned pieces that often sell out quickly upon release.

Another pivotal trend is the increasing use of sustainability as a marketing strategy. Today’s socially conscious buyers are more likely to engage with brands that emphasize eco-friendly practices.

This shift not only appeals to environmental concerns but also adds a layer of value to the items, enhancing their appeal in the resale market. These factors together are shaping a robust and dynamic market landscape, where value appreciation and consumer loyalty go hand in hand with sustainable luxury shopping experiences.

Regional Analysis

Europe leads the luxury resale market

Europe stands as the dominant region in the luxury resale market. This prominence is bolstered by a rich heritage in luxury fashion and a high consumer propensity to engage with pre-owned luxury goods.

Countries such as France, Italy, and the UK are pivotal, significantly influenced by their longstanding luxury sectors that traditionally support a circular economy through upscale consignment stores and sophisticated online platforms.

Regional Mentions:

In North America, the market is driven by heightened consumer awareness and acceptance of sustainable fashion practices, with a substantial portion of growth facilitated by digital innovation. The region is home to significant players like The RealReal and Poshmark, which are instrumental in advancing the luxury resale segment.

The Asia Pacific region is witnessing the fastest growth in luxury resale, catalyzed by expanding economic affluence and increasing environmental consciousness among consumers. China and Japan, in particular, are leading this surge, supported by a burgeoning middle class and enhanced digital connectivity that facilitates online transactions in the luxury resale space.

The Middle East & Africa are rapidly emerging as significant players in the luxury resale market, with the UAE and Saudi Arabia driving regional growth. These markets are characterized by high disposable incomes and a burgeoning recognition of the value offered by pre-owned luxury goods, aligning with global trends towards sustainability.

Latin America, though still developing in the luxury resale market, is experiencing growth driven by economic variability and a shift towards sustainable consumption practices. Countries like Brazil and Mexico are beginning to embrace luxury resale, recognizing its potential to deliver value and sustainability in consumer choices.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The luxury resale market is expanding rapidly, driven by sustainability concerns and a shifting consumer preference towards eco-friendly and economically viable luxury options. As we look towards 2024, several key players are shaping the industry landscape, each contributing uniquely to this growing sector.

Coupang Inc., with its robust e-commerce infrastructure, is poised to further enhance its luxury resale segment, capitalizing on its vast logistics network and customer base. The company’s technology-driven approach could streamline the authentication process, a critical factor in luxury resale.

YOOX Net-a-Porter Group S.p.A. stands out for its blend of high fashion credibility and extensive online retail experience. The group’s established luxury audience provides a solid foundation for expanding into curated resale offerings, potentially setting trends in the circular fashion economy.

The RealReal Inc. remains a pivotal force, with its consignment-based model attracting both buyers and sellers seeking transparency and authenticity. Its emphasis on expert authentication and high-quality inventory makes it a trusted name for consumers looking to invest in secondhand luxury.

Newer platforms like Poshmark Inc. and Depop Limited are democratizing luxury resale, appealing to younger consumers through social media integration and user-friendly mobile experiences. Their community-centric approaches are vital for engaging Gen Z consumers who favor sustainability.

In contrast, niche players like Timepiece 360 Ltd. and Fashionphile Group LLC specialize in specific categories such as luxury watches and handbags, respectively. Their specialized knowledge and dedicated customer base offer significant competitive advantages in their segments.

As we move into 2024, these companies, along with others like Vestiaire Collective and Luxury Promise Ltd., will need to focus on scaling their operations while maintaining authenticity and quality to capitalize on the growing consumer interest in sustainable luxury. The ability to integrate advanced data analytics and an enhanced customer experience will likely be key differentiators in this increasingly crowded marketplace.

Top Key Players in the Market

- Coupang Inc.

- YOOX Net-a-Porter Group S.p.A.

- The RealReal Inc.

- Poshmark Inc.

- Timepiece 360 Ltd.

- Yoogi’s Closet Inc.

- ThredUp Inc.

- Vestiaire Collective

- Couture Designer Resale Boutique

- Luxury Promise Ltd

- Cudoni

- Depop Limited

- Rebag

- Fashionphile Group LLC

- Luxepolis Retail Services Pvt Ltd

- Grailed Inc.

- Luxury Closet Inc.

- Luxury Garage Sale LLC

- The Closet Inc.

- LePrix Inc.

Recent Developments

- In March 2023, Kream successfully secured $168 million in funding, marking the most successful year for investment in the secondhand retail sector to date.

- In April 2024, Carousell Group expanded its presence in the secondhand luxury bag market by acquiring LuxLexicon, Singapore’s top reseller of luxury bags, enhancing its market strength.

- In August 2024, Trove, a key player in branded resale, broadened its market reach by acquiring Recurate, further consolidating its position in the competitive secondhand market.

- In December 2024, Bureau Veritas strengthened its expertise in the luxury and fashion sectors by acquiring LBS Group, enhancing its service offerings and market footprint.

Report Scope

Report Features Description Market Value (2024) USD 39.5 Billion Forecast Revenue (2034) USD 95.2 Billion CAGR (2025-2034) 9.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Apparel and Accessories, Watches, Fine Jewelry, Leather Goods), By Demographic (Affluent Consumers, Millennials, Generation Z), By Distribution Channel (Online Platforms, Brick-and-Mortar Stores, Consignment Stores) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Coupang Inc., YOOX Net-a-Porter Group S.p.A., The RealReal Inc., Poshmark Inc., Timepiece 360 Ltd., Yoogi’s Closet Inc., ThredUp Inc., Vestiaire Collective, Couture Designer Resale Boutique, Luxury Promise Ltd, Cudoni, Depop Limited, Rebag, Fashionphile Group LLC, Luxepolis Retail Services Pvt Ltd, Grailed Inc., Luxury Closet Inc., Luxury Garage Sale LLC, The Closet Inc., LePrix Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Coupang Inc.

- YOOX Net-a-Porter Group S.p.A.

- The RealReal Inc.

- Poshmark Inc.

- Timepiece 360 Ltd.

- Yoogi’s Closet Inc.

- ThredUp Inc.

- Vestiaire Collective

- Couture Designer Resale Boutique

- Luxury Promise Ltd

- Cudoni

- Depop Limited

- Rebag

- Fashionphile Group LLC

- Luxepolis Retail Services Pvt Ltd

- Grailed Inc.

- Luxury Closet Inc.

- Luxury Garage Sale LLC

- The Closet Inc.

- LePrix Inc.