Global Near Field Communication Market Size, Share, Statistics Analysis Report By Offering (Non-Auxiliary Products, Auxiliary Products, Software), By Operating Mode (Read and Write Mode, Peer-To-Peer Mode, Card Emulation Mode) By End-user Vertical (BFSI, IT & Telecom, Retail, Healthcare, Hospitality and Transportation, Other End-users), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135839

- Number of Pages: 230

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

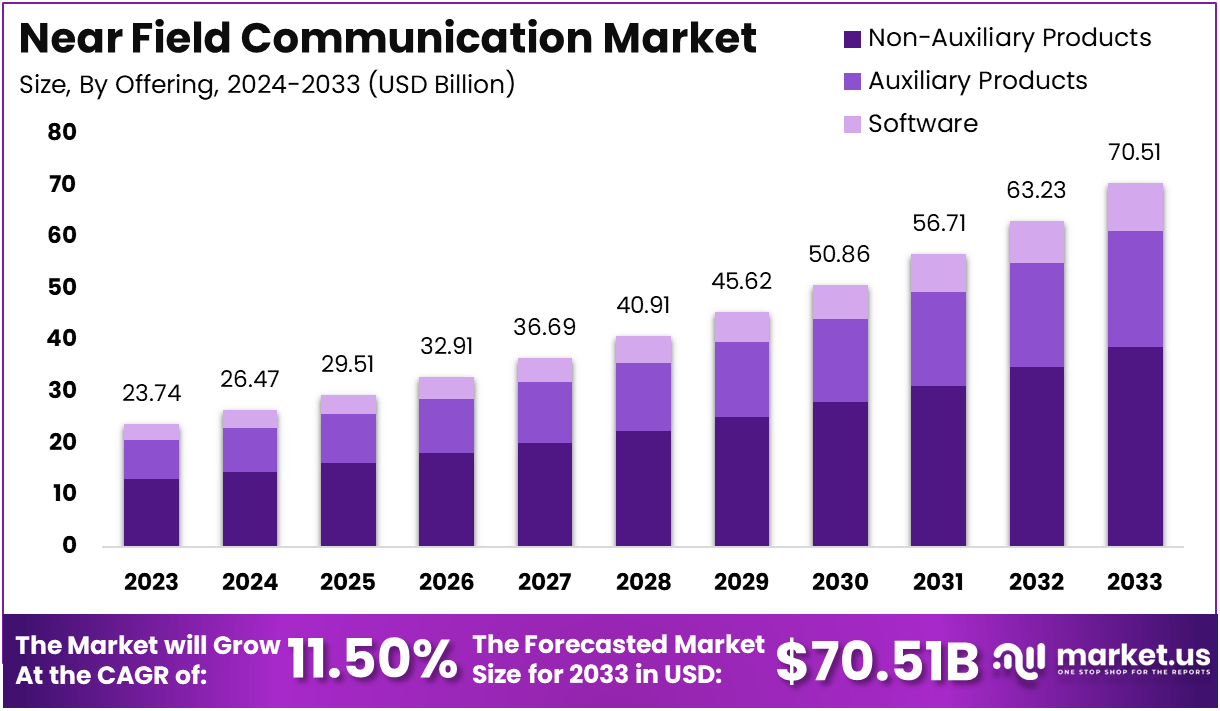

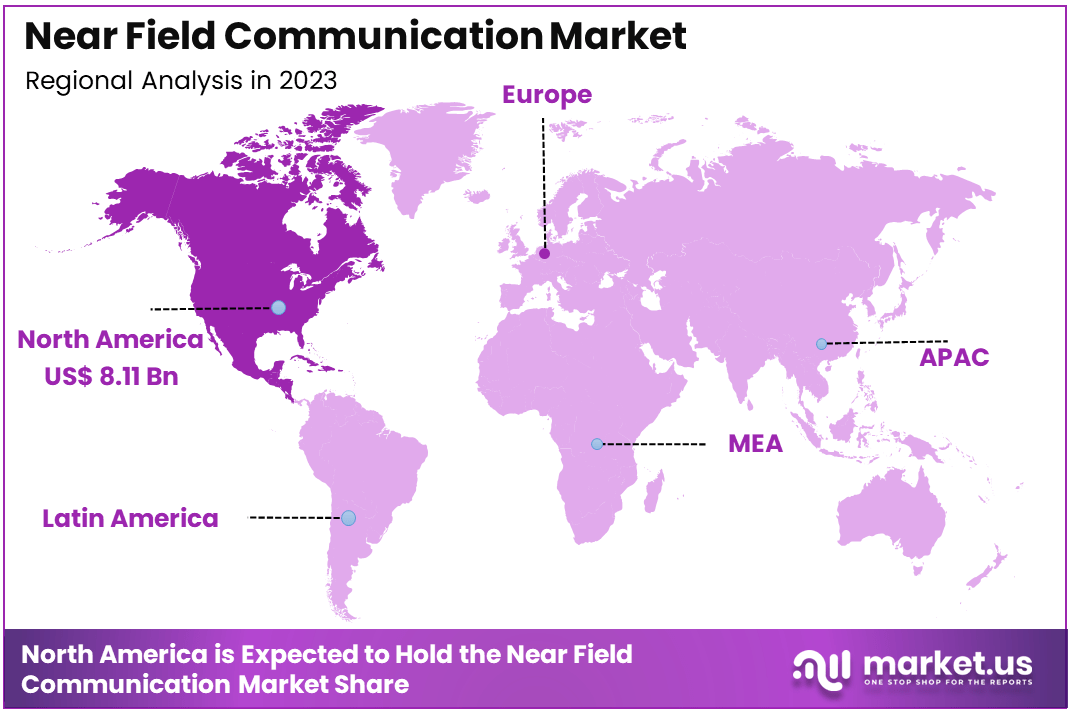

The Global Near-Field Communication Market is expected to be worth around USD 70.51 Billion By 2033, up from USD 23.74 billion in 2023. It will grow at a CAGR of 11.50% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 34.2% share and holding USD 8.11 billion in revenue.

Near Field Communication (NFC) is a short-range wireless technology that allows communication between devices over very short distances, typically within a range of 4 cm (1.6 inches) or less. NFC enables seamless data exchange by simply tapping or bringing devices close together. It is a subset of RFID (Radio Frequency Identification) technology but operates at a higher frequency.

NFC is widely used for contactless payments, where users can tap their smartphones or NFC-enabled cards at payment terminals to complete transactions. Other applications include secure access control, ticketing for public transport, file sharing, and authentication systems. NFC’s simplicity, security, and ease of use have made it a key enabler of mobile-based applications in various industries.

The global NFC market has been experiencing substantial growth as the adoption of NFC-enabled devices increases across a wide range of applications. With the rise of mobile payments, NFC technology has become central to secure and efficient transaction processes, particularly in the retail, transportation, and healthcare sectors.

The NFC market is expected to continue expanding as more consumer electronics, such as smartphones, wearables, and smart cards, incorporate NFC capabilities, providing greater opportunities for businesses to offer secure, convenient solutions to their customers.

The NFC market’s growth is primarily driven by the increasing adoption of mobile payments, which is reshaping how consumers conduct transactions. As consumers move away from cash and traditional credit cards, contactless payments have gained significant popularity due to their speed and security.

Additionally, the growth in smartphone usage globally has led to the widespread incorporation of NFC chips into these devices, further expanding the technology’s reach. The rise of digital wallets, loyalty programs, and smart ticketing has further contributed to NFC’s growth in sectors such as retail and transportation.

Moreover, as industries push for more efficient and secure methods of data exchange, NFC technology is increasingly viewed as a solution for a variety of use cases, including access control and secure identification.

The demand for NFC technology is particularly high in the consumer electronics market, with smartphones and wearable devices being the largest contributors to growth. In the retail sector, NFC-powered contactless payment systems have seen widespread adoption, with retailers incorporating NFC-enabled point-of-sale (POS) terminals to cater to the growing demand for seamless payment options.

The transportation sector is also seeing increased demand for NFC-enabled systems for ticketing and access control, providing travelers with faster and more convenient methods to access services. Moreover, NFC’s role in healthcare, where it is used for secure patient identification and data exchange, is expected to grow, further driving market demand.

The NFC market presents numerous opportunities for businesses to innovate and develop new solutions. One of the key opportunities lies in the expansion of contactless payments across emerging markets, where mobile payment adoption is growing rapidly. NFC technology also offers significant opportunities in the healthcare industry, particularly in patient management and secure data exchange, as well as in the development of smart health devices.

Another opportunity lies in the growing trend of the Internet of Things (IoT), where NFC can facilitate communication between IoT devices, creating new business models and services. NFC’s ability to enhance consumer experience through secure, convenient, and fast interactions positions it as a valuable tool across various industries. Technological advancements in NFC have focused on improving its range, security features, and integration into new devices and systems.

The development of more power-efficient NFC chips is one such advancement, enabling longer battery life for NFC-enabled devices, such as wearables and smartphones. Furthermore, the integration of NFC with other technologies, such as Bluetooth Low Energy (BLE) and Wi-Fi, is enhancing its capabilities in providing more versatile and scalable solutions for businesses.

NFC’s ability to enable peer-to-peer communication has also been expanded, allowing users to share files, media, and information seamlessly between devices. As technology continues to evolve, it is expected to become even more integrated into everyday life, creating new applications and possibilities in consumer electronics, payment systems, and beyond.

NFC technology operates over short distances, typically within 10 centimeters, facilitating secure data exchanges and transactions primarily through smartphones, laptops, and tablets. Research found that 85% of respondents across nine countries reported using NFC contactless cards or mobile payment wallets, with contactless payment card usage increasing by 30% over the past two years.

Notably, 95% of those surveyed had utilized NFC technology for payments within the last year, indicating a strong trend toward contactless transactions. Near Field Communication (NFC) technology operates at a frequency of 13.56 MHz, which is globally unlicensed, allowing for diverse applications.

It typically functions within a communication range of up to 2 centimeters (20 mm), with the NFC Forum specifying a certified compliant range of 5 mm. NFC supports multiple data transfer rates, including 106 kbit/s, 212 kbit/s, and 424 kbit/s, with certain configurations achieving rates up to 1.7 Mbit/s.

Key Takeaways

- Market Size & Growth: The Near Field Communication (NFC) market was valued at USD 23.74 Billion in 2023 and is expected to grow to USD 70.51 Billion by 2033, with a robust CAGR of 11.50%.

- By Offering: The Non-Auxiliary Products segment held the largest share, accounting for 55% of the market in 2023. This includes NFC-enabled devices such as smartphones, smart cards, and other consumer electronics that directly support NFC technology.

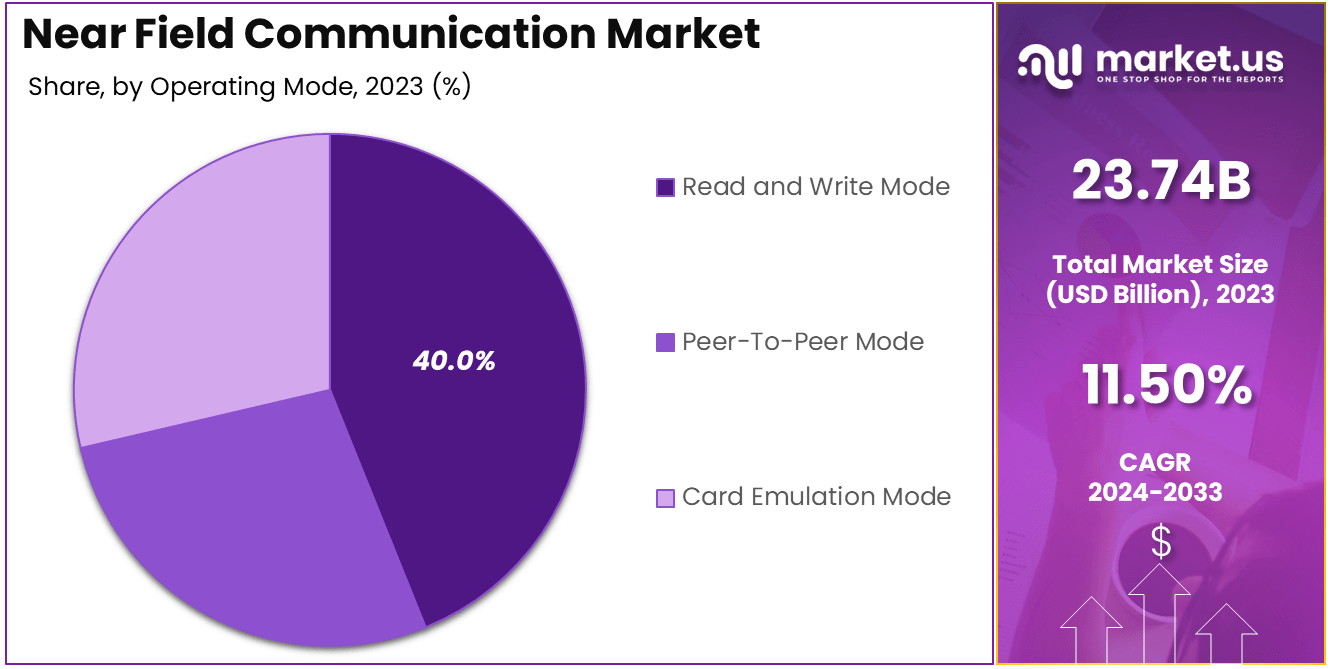

- By Operating Mode: Read and Write Mode led the operating modes in the market, capturing 40% of the share in 2023. This mode enables devices to both read and write data, making it ideal for applications like contactless payments and data sharing between devices.

- By End-User Vertical: The BFSI (Banking, Financial Services, and Insurance) sector dominated the NFC market, accounting for 30% of the market share in 2023. The demand for secure, contactless payments in the banking sector has driven the adoption of NFC technology.

- Regional Insights: North America captured 34.2% of the NFC market in 2023, leading in adoption across industries such as BFSI, retail, and healthcare, driven by technological advancements and high smartphone penetration.

By Offering

In 2023, the Non-Auxiliary Products segment held a dominant market position, capturing more than a 55% share of the Near Field Communication (NFC) market. This segment includes NFC-enabled devices such as smartphones, wearables, contactless payment cards, and other consumer electronics that directly incorporate NFC technology.

The widespread adoption of smartphones and their integration with NFC has been a key driver behind the growth of this segment. With NFC capabilities embedded in mobile devices, users can easily make contactless payments, share data, and access secure services, which has significantly contributed to the increasing market share of non-auxiliary NFC products.

The growth of mobile payment systems, such as Apple Pay, Google Pay, and other regional platforms, has further accelerated the demand for NFC-enabled smartphones. In addition, wearables like smartwatches and fitness trackers that incorporate NFC technology for seamless payments and ticketing have gained popularity.

As the market for contactless payments continues to expand, the demand for NFC-enabled devices is expected to remain strong, driving the non-auxiliary products segment forward. Moreover, industries beyond finance, such as retail, healthcare, and transportation, are increasingly integrating NFC technology into their operations, creating new opportunities for NFC-enabled products.

For instance, NFC-enabled ID cards and access systems in healthcare and corporate environments are becoming more common, further expanding the potential applications of non-auxiliary NFC products.

By Operating Mode

In 2023, the Read and Write Mode segment held a dominant market position, capturing more than a 40% share of the Near Field Communication (NFC) market. This mode allows NFC devices to exchange data by reading from or writing to an NFC tag, making it a fundamental technology in various consumer and industrial applications. The ease of use and versatility of the read-and-write mode have contributed to its widespread adoption in industries such as retail, healthcare, and logistics.

One of the primary drivers behind the growth of the read-and-write mode is the increasing demand for contactless payments and inventory management solutions. For example, NFC-enabled smartphones and point-of-sale (POS) terminals use read-and-write functionality for secure transactions.

Similarly, in logistics and supply chain management, NFC tags are often used to track goods, which improves efficiency and reduces errors. This broad range of applications ensures the continued growth and importance of the read-and-write mode in the NFC ecosystem. In addition, the growing adoption of NFC technology in everyday consumer goods like tickets, loyalty cards, and access control systems has reinforced the position of this segment.

As more businesses integrate NFC technology into their operations, the demand for NFC-enabled devices that can read and write data is expected to increase. This trend is particularly evident in retail environments, where NFC-based tags enable smooth and efficient inventory checks, product tracking, and customer interactions.

By End-user Vertical

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position in the Near Field Communication (NFC) market, capturing more than 30% of the overall market share. The BFSI sector’s significant adoption of NFC technology can be attributed to the growing demand for secure, fast, and convenient contactless payment methods.

NFC is widely used in mobile wallets, contactless debit and credit cards, and digital banking services, making it a key driver for the market’s expansion in this sector. The BFSI industry’s embrace of NFC has been propelled by the increasing preference for cashless transactions and the push towards enhancing customer experience through ease and speed.

Contactless payments, enabled by NFC, have become an integral part of the banking ecosystem due to their security and user convenience. Customers prefer the fast processing times and seamless experience that NFC-powered devices offer, which has led banks and financial institutions to integrate NFC into their payment infrastructure.

Moreover, NFC technology offers added security features, such as encryption and secure data transmission, making it highly appealing to the BFSI sector. This focus on security is crucial in an era where financial transactions are under constant threat from cybercriminals. The BFSI industry’s stringent regulatory compliance requirements and emphasis on safe and reliable payment solutions are key factors contributing to the ongoing adoption of NFC solutions.

Key Market Segments

By Offering

- Non-Auxiliary Products

- Auxiliary Products

- Software

By Operating Mode

- Read and Write Mode

- Peer-To-Peer Mode

- Card Emulation Mode

By End-user Vertical

- BFSI

- IT & Telecom

- Retail

- Healthcare

- Hospitality and Transportation

- Other End-users

Driving Factors

Increasing Adoption of Contactless Payments

The growth of the Near Field Communication (NFC) market is primarily driven by the increasing adoption of contactless payment solutions. With the rise of mobile wallets, smart cards, and wearable devices, consumers and businesses alike are increasingly relying on NFC technology to facilitate seamless, secure, and fast transactions. As cashless transactions become the norm in both developed and emerging markets, the demand for contactless payment systems continues to surge.

Contactless payments powered by NFC technology allow consumers to make transactions without physically inserting cards into payment terminals. Instead, users can simply tap their NFC-enabled smartphones or smartwatches against a point-of-sale terminal to complete payments. This convenience has been a key factor in the growing adoption of NFC-based solutions in retail, transportation, and financial services.

The shift towards digital payment solutions is not only driven by consumer convenience but also by the need for enhanced security. NFC payments are encrypted and use tokenization to protect transaction data, making them safer than traditional magnetic stripe cards.

Furthermore, the COVID-19 pandemic accelerated the demand for contactless payments as people sought ways to minimize physical contact with surfaces during transactions. The widespread preference for secure and frictionless payment methods has propelled the growth of NFC in sectors like banking, retail, and transportation, positioning NFC as a dominant player in the global payment ecosystem.

As mobile and digital wallet platforms continue to evolve, NFC technology’s role in simplifying financial transactions will remain crucial. The global trend towards cashless economies further amplifies the opportunities for NFC technology to expand its presence across various industries, driving market growth in the coming years.

Restraining Factors

Security and Privacy Concerns

Despite its many advantages, the adoption of Near Field Communication (NFC) technology faces a significant restraint due to security and privacy concerns. While NFC is generally considered a secure technology due to its use of encryption and short-range communication, there are potential risks involved, particularly with the unauthorized scanning of NFC-enabled devices.

One of the key concerns is the possibility of data breaches or unauthorized access during NFC transactions. Malicious actors could exploit vulnerabilities in the system to intercept payment information or access sensitive user data, leading to identity theft or financial fraud.

This is particularly concerning for industries like banking and retail, where the security of transactions is paramount. Additionally, the potential for contactless payment systems to be hacked, allowing attackers to steal funds or manipulate payment data, adds to consumer and business hesitations.

Another major concern is the privacy implications of NFC technology. Since NFC devices transmit data wirelessly over short distances, they could be vulnerable to unauthorized scanning from nearby devices. Consumers may feel uncomfortable knowing that their personal and financial information could be captured without their knowledge or consent. In some cases, malicious software or rogue devices may even attempt to track the location of an NFC-enabled device, raising further privacy concerns.

Growth Opportunities

Expansion of NFC in the Internet of Things (IoT)

The Internet of Things (IoT) represents a significant growth opportunity for the Near Field Communication (NFC) market. As IoT continues to gain traction across industries, NFC technology’s ability to enable secure, short-range communication between devices is becoming increasingly valuable. The integration of NFC into IoT ecosystems can open up new applications in sectors such as healthcare, logistics, and smart homes, where seamless device interaction and data transfer are critical.

In the healthcare industry, NFC can facilitate contactless identification, patient tracking, and medical data management. Hospitals and clinics can use NFC-enabled devices to securely track equipment and medications, while patients can use NFC-enabled wristbands to access their medical records. This integration not only improves operational efficiency but also enhances patient safety and security.

In the logistics and supply chain sector, NFC technology can streamline inventory management, product tracking, and authentication processes. By embedding NFC tags in products and packages, companies can instantly track the movement of goods, reducing errors and improving transparency. In smart homes, NFC can be used for automation, allowing consumers to control household devices and appliances with a simple tap on their smartphones or wearables.

Challenging Factors

Standardization and Interoperability Issues

One of the major challenges facing the Near Field Communication (NFC) market is the lack of standardized protocols and interoperability between different NFC-enabled devices and systems. While NFC technology itself is standardized, the various applications and use cases of NFC often rely on different hardware and software platforms that may not be fully compatible with each other.

This lack of uniformity can create barriers for businesses and consumers looking to implement or adopt NFC solutions. For example, different NFC devices may use varying encryption methods, communication protocols, or hardware configurations, making it difficult for these devices to work together seamlessly.

This issue is particularly prevalent in industries such as retail, where NFC-based payment terminals may not always be compatible with all types of NFC-enabled payment methods, such as mobile wallets or credit cards. Inconsistencies in NFC standards could limit the scalability of NFC solutions and hinder the broader adoption of the technology across multiple sectors.

The challenge of interoperability also extends to the software side, where NFC applications may require custom configurations or integrations with existing systems. For businesses, this can lead to higher costs and longer implementation times, as they must invest in tailored solutions that work with their current infrastructure. Furthermore, consumers may experience frustration if they find that their NFC-enabled devices do not work with certain terminals or services due to compatibility issues.

Growth Factors

The NFC market is growing rapidly, driven by increasing smartphone penetration and the widespread adoption of digital payment solutions. NFC technology allows devices to exchange data by simply being nearby, making it ideal for a wide range of applications, from payments to ticketing to access control.

As the demand for seamless, fast, and secure transactions rises, NFC is becoming a preferred choice for both consumers and businesses. Additionally, the growing shift towards cashless transactions is a major growth factor for the NFC market, particularly in industries like retail, banking, and transportation.

Emerging Trends

One of the most notable emerging trends in the NFC market is the integration of NFC technology in wearable devices, such as smartwatches and fitness bands. This allows consumers to make contactless payments directly from their wrist, enhancing convenience and offering a new level of mobility.

Another significant trend is the rise of NFC-enabled smartphones, which are making NFC payments and ticketing even more accessible. Additionally, the implementation of NFC in IoT (Internet of Things) applications is expected to revolutionize sectors such as smart homes, healthcare, and logistics.

Business Benefits

For businesses, adopting NFC technology offers a wide range of benefits, including improved customer experience, faster transactions, and enhanced security. NFC payments are not only quick and convenient but also provide a secure method of transaction, reducing fraud risks.

Moreover, NFC solutions help businesses stay ahead in the competitive digital payment landscape, attracting tech-savvy customers looking for easy-to-use and reliable payment options. As NFC technology continues to evolve, businesses in sectors like banking, retail, and transportation can leverage this technology to drive growth, improve operational efficiency, and increase customer loyalty.

Regional Analysis

In 2023, North America held a dominant market position in the Near Field Communication (NFC) market, capturing more than 34.2% of the total market share, with a revenue of USD 8.11 billion. This leadership can be attributed to a combination of factors, including the high adoption rate of NFC-enabled smartphones, widespread use of mobile payments, and the robust infrastructure for NFC applications in various industries, such as banking, retail, and healthcare.

The region’s dominance in the NFC market is largely driven by the growing demand for contactless payment solutions, particularly in the U.S. and Canada. Consumers and businesses in North America are increasingly shifting towards cashless transactions due to the convenience, speed, and security offered by NFC technology.

This trend is especially evident in major cities, where NFC-enabled point-of-sale terminals and mobile wallets are commonly used for day-to-day transactions. The growing popularity of digital wallets, such as Apple Pay and Google Pay, has further accelerated NFC adoption in the region.

Moreover, the North American market benefits from significant technological advancements, as the region continues to lead in terms of NFC innovation. Companies in the region, particularly in the tech and financial sectors, are continuously investing in research and development to expand NFC applications beyond mobile payments.

For example, NFC is increasingly being integrated into smart cards, wearables, and even IoT-enabled devices, further boosting market demand. In addition, North America’s strong regulatory environment and established digital payment infrastructure provide a conducive environment for the widespread adoption of NFC technology.

The region’s ongoing efforts to improve financial inclusion and security in digital transactions further reinforce its leadership in the global NFC market. With continued advancements in NFC technology and expanding applications, North America is expected to maintain its dominant position in the market for the foreseeable future.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

NXP Semiconductors, a leader in the NFC market, has been at the forefront of developing innovative solutions to meet the growing demand for contactless payments and IoT applications. In 2023, the company announced the acquisition of RF Micro Devices, a move aimed at enhancing its portfolio of NFC solutions with advanced radio frequency technologies.

NXP’s key focus has been on improving security features within NFC chips, particularly for mobile wallets and secure transactions. Their flagship products, such as the PN80T NFC Secure Element, enable high-speed communication and secure data transfer.

STMicroelectronics has long been a significant player in the NFC market, and in recent years, the company has made substantial progress in integrating NFC capabilities into a range of consumer electronics and automotive solutions.

In 2023, STMicroelectronics announced a strategic partnership with Qualcomm Technologies, which allows for more seamless NFC integration in smartphones and connected devices. ST’s ST25R series of NFC readers and their NFC tag solutions are widely used in industries such as logistics and healthcare.

Infineon Technologies has been strengthening its position in the NFC market through several key product launches and strategic partnerships. In 2023, Infineon announced the release of a new range of secure NFC controllers that offer enhanced data encryption for mobile payment solutions and IoT applications.

Their SLE78 and SLE88 NFC chips, which support both payment and identification applications, have been crucial for expanding NFC adoption in the BFSI and transportation sectors.

Top Key Players in the Market

- NXP Semiconductors

- STMicroelectronics N.V.

- Infineon Technologies

- Shanghai Fudan Microelectronics Group Company Limited

- Smartrac N.V.

- HID Global

- Texas Instruments Incorporated

- Toshiba Electronic Devices & Storage Corporation

- Marvell Technology Group Ltd.

- Zebra Technologies Corporation

- Other Key Players

Recent Developments

- In 2023: Visa and Mastercard further expanded their NFC payment solutions across North America, driving increased adoption of contactless payments. Both companies have focused on enhancing their mobile wallet platforms and increasing partnerships with major retailers to enable seamless NFC-enabled transactions.

- In 2023: Samsung launched a new line of smartphones equipped with enhanced NFC capabilities, aiming to make mobile payments and device interactions more seamless. The company has integrated multi-protocol NFC support in its flagship devices, which allows for improved connectivity with a range of NFC-enabled devices, including wearables and home appliances.

Report Scope

Report Features Description Market Value (2023) USD 23.74 Bn Forecast Revenue (2033) USD 70.51 Bn CAGR (2024-2033) 11.50% Largest Market North America Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Offering (Non-Auxiliary Products, Auxiliary Products, Software), By Operating Mode (Read and Write Mode, Peer-To-Peer Mode, Card Emulation Mode) By End-user Vertical (BFSI, IT & Telecom, Retail, Healthcare, Hospitality and Transportation, Other End-users) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape NXP Semiconductors, STMicroelectronics N.V., Infineon Technologies, Shanghai Fudan Microelectronics Group Company Limited, Smartrac N.V., HID Global, Texas Instruments Incorporated, Toshiba Electronic Devices & Storage Corporation, Marvell Technology Group Ltd., Zebra Technologies Corporation, Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Near Field Communication MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Near Field Communication MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- NXP Semiconductors

- STMicroelectronics N.V.

- Infineon Technologies

- Shanghai Fudan Microelectronics Group Company Limited

- Smartrac N.V.

- HID Global

- Texas Instruments Incorporated

- Toshiba Electronic Devices & Storage Corporation

- Marvell Technology Group Ltd.

- Zebra Technologies Corporation

- Other Key Players