Global Surgical Rasps Market Analysis By Type (Double-ended Rasps, Single-ended Rasps), By End-User (Hospitals and Clinics, Ambulatory Surgical Centres (ASCs), Specialty Clinics), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135381

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

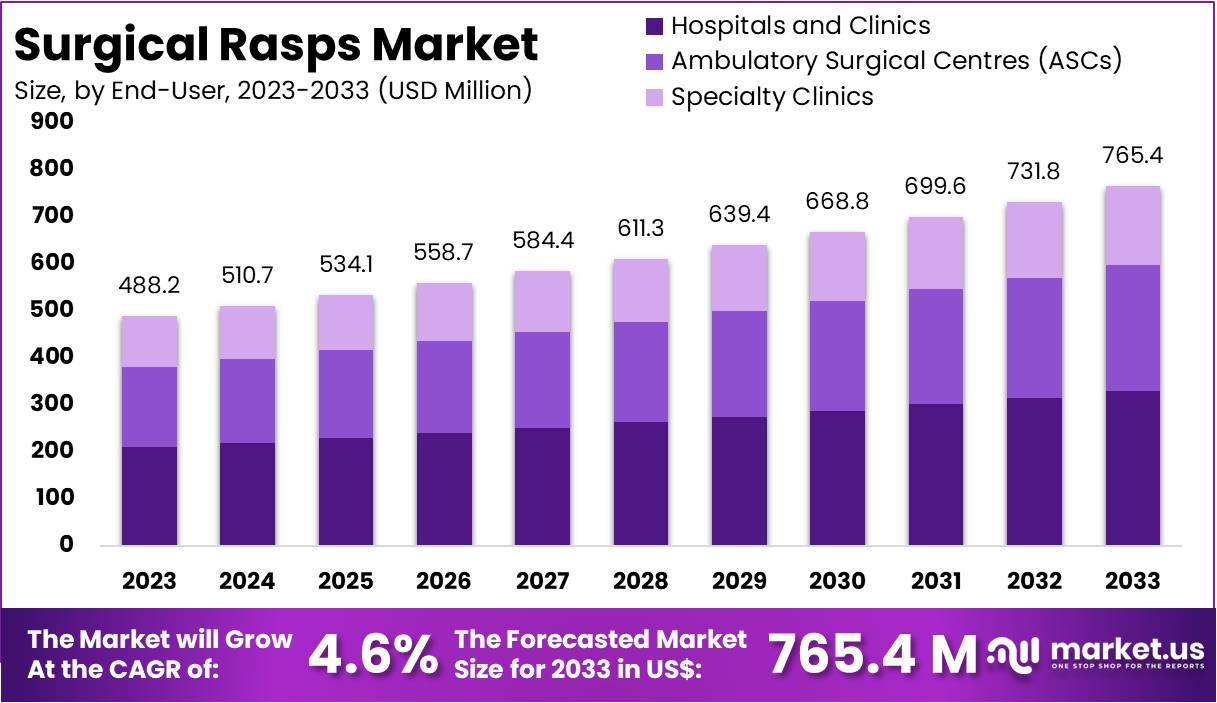

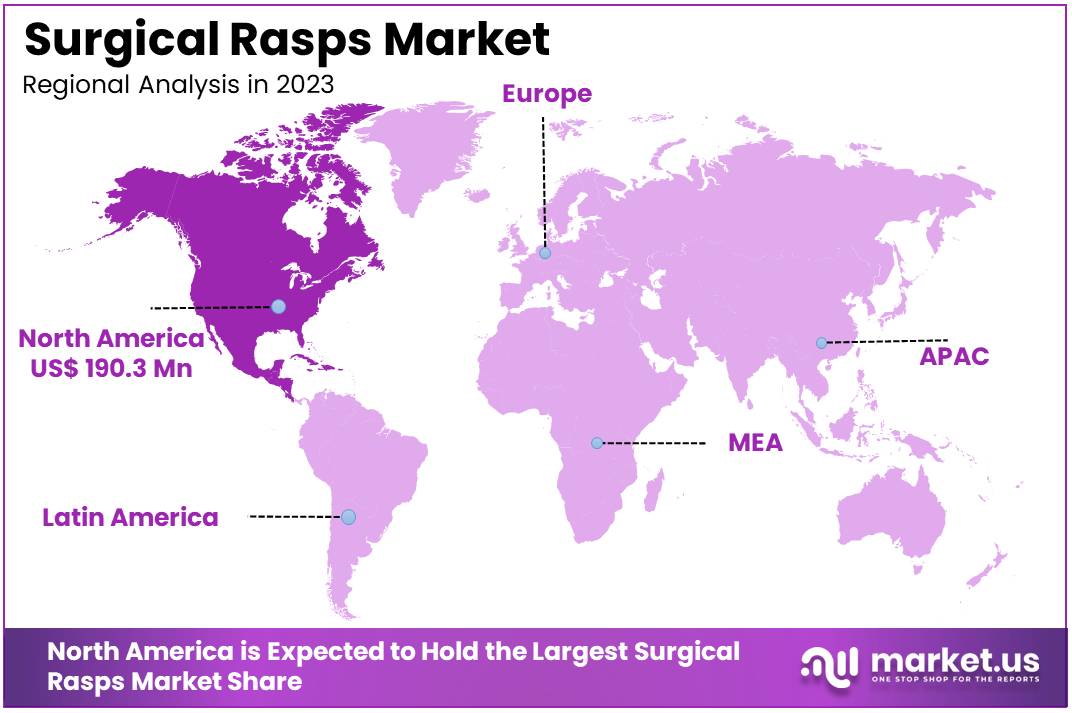

The Global Surgical Rasps Market size is expected to be worth around US$ 765.4 Million by 2033, from US$ 488.2 Million in 2023, growing at a CAGR of 4.6% during the forecast period from 2024 to 2033. North America led the Market, capturing a 39% market share with a valuation of US$ 190.3 million.

Surgical rasps are critical tools in medical procedures, designed for shaping or smoothing hard tissues such as bones and cartilage. These instruments, crafted from high-grade stainless steel, ensure precision and durability. Key applications span orthopedic, dental, plastic, reconstructive, and spinal surgeries. For example, in orthopedic surgery, surgical rasps play a significant role in joint replacements and fracture management. Their increasing adoption reflects advancements in surgical tools and growing demand for minimally invasive procedures.

The global surgical rasps market is witnessing notable growth. According to the International Osteoporosis Foundation, osteoporosis-related fractures alone account for 432,000 hospital admissions and 180,000 nursing home admissions annually in the U.S. Additionally, rising orthopedic disorders such as arthritis and sports injuries contribute significantly to market expansion. For example, the rising number of minimally invasive surgeries has fueled the demand for precision instruments like surgical rasps. Enhanced healthcare infrastructure in emerging economies is also a key growth driver.

Cosmetic surgery is another growth area for surgical rasps. According to the American Society of Plastic Surgeons (ASPS), liposuction procedures rose by 23% from 2019 to 2022, with an additional 7% increase in 2023. Similarly, rhinoplasty and facial reconstruction procedures increasingly incorporate surgical rasps for bone reshaping. In dental surgeries, these instruments assist in preparing bone for implants, reflecting a rise in dental implantology supported by publications like Clinical Oral Implants Research, which holds an SJR indicator of 1.865 and an H-index of 184.

A study by the American Association of Colleges of Podiatric Medicine (AACPM) highlights the rising interest in surgical fields. For the 2023-2024 academic year, 716 individuals applied to podiatric medical schools, with 52% of applicants being women. Concurrently, academic journals in foot and ankle research have seen a 9% rise in submissions, driven by increased contributions from countries like China, which accounted for 18% of submissions. These trends underscore the growing focus on specialized surgical instruments and their research.

The surgical rasps market benefits from consolidation and partnerships. For instance, Johnson & Johnson MedTech announced a collaboration with Responsive Arthroscopy in November 2024 to enhance soft tissue repair solutions for foot, shoulder, and ankle surgeries. Similarly, Integra LifeSciences completed its acquisition of Acclarent, Inc. in April 2024, adding $1 billion to its addressable market and expanding its ear, nose, and throat (ENT) device portfolio. Such developments highlight the industry’s emphasis on technological innovation and market expansion.

The economic burden of orthopedic conditions also drives demand for surgical tools. According to Amgen, osteoporosis-related fractures in the U.S. account for significant costs, with 20–24% mortality within the first year of a hip fracture and 40% of survivors unable to walk independently. These statistics emphasize the importance of advanced surgical instruments for improved patient outcomes. Moreover, healthcare spending on surgical and minimally invasive procedures reached $26 billion in the U.S. in 2022, reflecting a robust investment trend.

The increasing focus on surgical innovations is evident in academic journals. For example, the Journal of Foot and Ankle Research reported a 9% rise in manuscript submissions in 2023, with 266 submissions compared to 2022. Accepted articles increased from 88 to 90 within the same period, indicating rising interest in specialized surgical fields. The journal’s growing impact factor, from 2.03 in 2021 to 2.9 in 2023, underscores its relevance in promoting high-impact research.

Key Takeaways

- The Global Surgical Rasps Market is projected to grow from US$ 488.2 million in 2023 to US$ 765.4 million by 2033, at a CAGR of 4.6%.

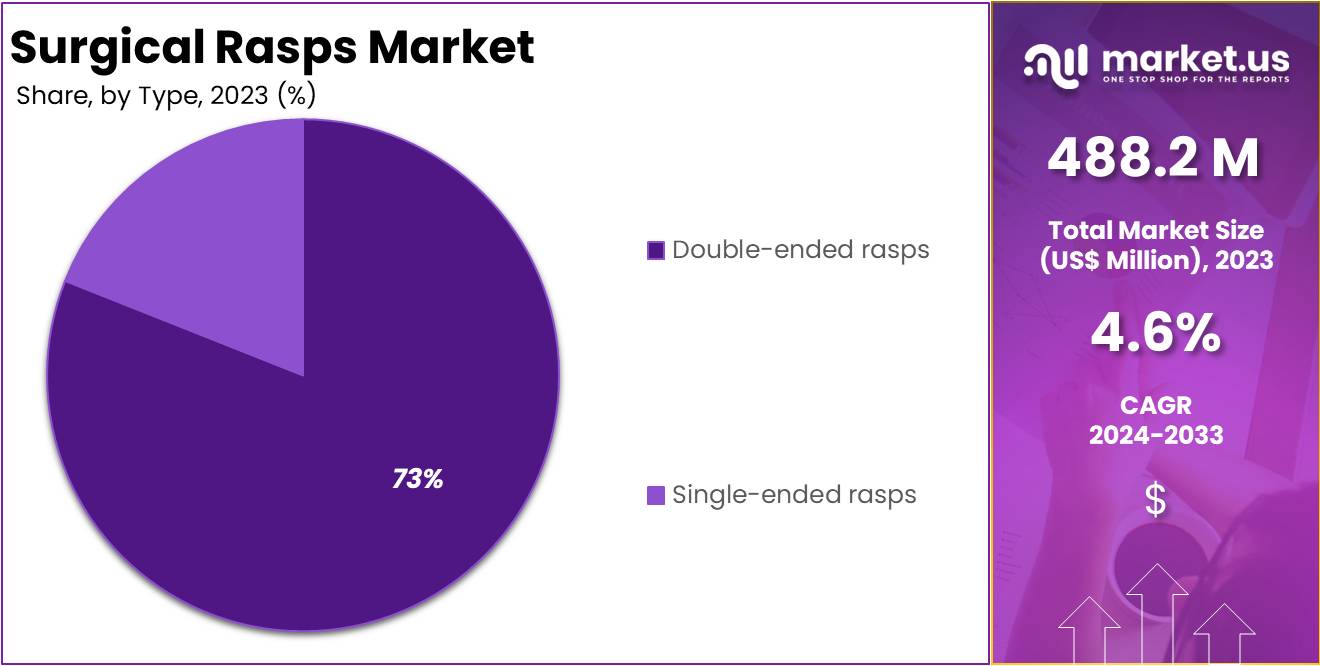

- In 2023, the Double-ended Rasps segment dominated the type category, accounting for over 73% of the market share.

- The Hospitals and Clinics segment led the end-user category in 2023, capturing more than 43% of the market share.

- North America emerged as the leading region in the Surgical Rasps Market in 2023, with a 39% share and market value of US$ 190.3 million.

Type Analysis

In 2023, the Double-ended Rasps segment held a dominant market position in the Type Segment of the Surgical Rasps Market, capturing more than a 73% share. This large share reflects widespread acceptance in the surgical community. Double-ended rasps are preferred for their versatility and efficiency, qualities that are essential in fast-paced surgical settings.

These instruments allow surgeons to switch functions quickly during operations. This flexibility reduces the need for multiple tools, potentially shortening the duration of surgical procedures. The efficiency of double-ended rasps is a key factor in their dominance in the market.

On the other hand, the Single-ended Rasps segment caters to niche applications that require precision. These tools are crucial for detailed bone shaping and fine contouring tasks in orthopedic, dental, and reconstructive surgeries. Despite holding a smaller market share, their importance remains significant for specific surgical needs.

The dynamic between double-ended and single-ended rasps illustrates a strong preference for tools that enhance operational efficiency. Yet, the steady demand for single-ended rasps highlights the varied needs within surgical practices. It suggests that both types of rasps will continue to be essential in surgical toolkits, supporting diverse procedural requirements.

End-User Analysis

In 2023, the Hospitals and Clinics segment held a dominant market position in the End-User Segment of the Surgical Rasps Market, capturing more than a 43% share. This leadership stems primarily from the extensive range of surgical operations these facilities handle. Hospitals are equipped to perform a broad array of procedures that often require specialized tools like surgical rasps.

Ambulatory Surgical Centers (ASCs) also play a significant role in this market. These centers are designed for efficiency and specialize in outpatient surgeries. They provide a setting where procedures requiring surgical rasps can be performed quickly and cost-effectively. This makes ASCs a popular choice among patients seeking convenience without an overnight hospital stay.

Specialty clinics, although smaller in market share, are vital contributors to the Surgical Rasps Market. These clinics focus on specific areas such as orthopedics or podiatry. In such specialties, the precise shaping of bones is critical, and surgical rasps are key tools for these procedures. Their specialized focus drives the demand for precision instruments.

Each segment distinctly impacts the market due to its unique healthcare service characteristics. While hospitals and clinics lead due to their comprehensive capabilities and extensive infrastructure, ASCs appeal through streamlined, cost-effective services. Specialty clinics target precise needs with specialized care, ensuring sustained demand in the Surgical Rasps Market.

Key Market Segments

By Type

- Double-ended Rasps

- Single-ended Rasps

By End-User

- Hospitals and Clinics

- Ambulatory Surgical Centres (ASCs)

- Specialty Clinics

Drivers

Technological Advancements in Surgical Procedures

Advancements in surgical technology have significantly influenced the surgical rasps market, particularly through the widespread adoption of robotic systems. These innovations enhance precision and flexibility, crucial for minimally invasive procedures. According to MDPI, robotic systems developed by Intuitive Surgical have been used in over 11 million surgeries globally, underscoring their impact on surgical practices.

Smart surgical instruments are revolutionizing surgeries by providing real-time feedback and enhanced visualization, which increases surgical accuracy and reduces complications. These instruments, equipped with advanced sensors and connectivity, allow surgeons to adjust techniques on the fly, significantly improving patient safety and surgical outcomes.

Innovations like 3D printing and augmented reality are also transforming surgical preparation and execution. These technologies enable the production of patient-specific surgical implants and provide surgeons with precise anatomical details during procedures. This personalized approach is improving the effectiveness of surgeries and, consequently, driving the demand for precision tools such as surgical rasps.

Restraints

High Cost of Surgical Procedures in the Surgical Rasps Market

The high cost of surgical procedures significantly restrains the surgical rasps market. These costs aren’t just limited to the instruments but also encompass operating room expenses and specialist staff. For instance, veterinary surgical procedures vary in cost, often reaching thousands of dollars depending on complexity, which can deter pet owners and clinics from opting for advanced surgical solutions.

A study by healthcare analysts indicates that the steep costs associated with surgical procedures can inhibit the adoption of newer and more advanced surgical technologies. This is particularly evident in under-resourced healthcare settings where budget constraints can restrict the acquisition of high-end surgical tools, thus impacting market growth.

However, there is a continued investment in surgical technologies aimed at enhancing surgery precision and effectiveness. For example, advancements in surgical techniques may lead to more efficient procedures and shorter recovery times, which could help mitigate costs over time. This ongoing investment underscores a potential pathway toward more cost-effective surgical solutions in the future.

Opportunities

Rising Geriatric Population

With an increasing elderly population globally, there is a growing need for orthopedic surgeries, such as joint replacement and bone grafting, which often require the use of surgical rasps. This demographic shift presents a significant opportunity for market expansion.

The global aging trend presents a significant opportunity for the surgical rasps market. By 2024, individuals aged 65 and over are projected to outnumber those under 15 years in the WHO European Region, signifying an increasing demand for healthcare services including orthopedic surgeries. The World Health Organization (WHO) reports that by 2030, one in six people globally will be over 60 years old, with this demographic expected to reach 2.1 billion by 2050. This age group is particularly prone to conditions requiring orthopedic interventions, such as joint replacements and bone grafting, driving demand for surgical instruments like rasps.

The ongoing shift in demographic structures, especially in low- and middle-income countries, highlights the urgent need for healthcare systems to adapt to the growing number of elderly individuals. This surge in the elderly population is anticipated to increase the prevalence of musculoskeletal disorders, thereby boosting the market for surgical rasps used in related surgeries. As such, companies in the surgical rasps sector are positioned to experience substantial growth by catering to the rising volume of orthopedic procedures worldwide.

Trends

Customization Through 3D Printing

The use of 3D printing technology in creating customized surgical rasps is a significant trend, enhancing the precision of surgeries tailored to individual patient anatomy. According to industry analysis, the demand for personalized medical tools like surgical rasps is driving advancements in 3D printing applications within healthcare. These custom tools are crucial for procedures that require precise bone shaping, leading to improved surgical outcomes and faster recovery times.

The global market for Medical 3D Printing, including surgical rasps, is on a rapid growth trajectory. For instance, the market is projected to reach US$ 4593.7 Million by 2033, growing at a compound annual growth rate (CAGR) of 19.5% from 2024 to 2029. Technologies such as Laser Powder Bed Fusion (LPBF) are pivotal in manufacturing patient-specific implants, which contribute to a better fit and enhanced comfort for patients.

Despite the benefits, the market faces regulatory challenges due to the highly customized nature of 3D printed medical devices. A study indicates that the evolving regulatory landscape is striving to keep pace with technological innovations, particularly in bioprinting and regenerative medicine. These regulations are crucial to ensure the safety and efficacy of newly introduced medical tools and implants.

Looking ahead, the integration of 3D printing at the point of care is expected to accelerate, as healthcare providers seek to enhance patient care through technology. Hospitals and surgical centers are increasingly adopting 3D printing technologies to produce surgical tools on-site, reducing costs and improving supply chain efficiency. This trend underscores the growing importance of personalized medicine and the role of advanced manufacturing technologies in its development

Regional Analysis

In 2023, North America maintained a dominant position in the Surgical Rasps Market, securing over a 39% share and reaching a market value of US$ 190.3 million. This leadership is primarily driven by the region’s advanced healthcare infrastructure, which supports the widespread adoption of innovative surgical technologies. The high level of healthcare expenditure, particularly in the United States, fuels the demand for sophisticated surgical tools that enhance precision and efficiency during operations.

The region benefits from the presence of leading surgical instrument manufacturers, which propels innovation and ensures easy access to these tools. These companies focus on developing surgical rasps that meet the high standards of performance and ergonomic design demanded by North American surgeons. Moreover, the growing number of orthopedic surgeries, driven by an aging population and increased sports injuries, further stimulates market growth.

Regulatory support for medical devices in the U.S. and Canada plays a crucial role in sustaining market dominance. This regulatory framework ensures the availability of FDA-approved, high-quality surgical instruments, guaranteeing their safety and efficacy in clinical settings. Additionally, continuous investments in medical research and development across North America encourage advancements in surgical techniques and tools, keeping healthcare providers equipped with the latest innovations in surgical rasps.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Cousin Surgery LLC is recognized for its precision-engineered surgical rasps, widely utilized in orthopedic procedures. Their commitment to high-quality manufacturing standards ensures reliable and durable instruments for surgeons. Similarly, Johnson & Johnson delivers a broad range of medical devices, including surgical rasps that are fundamental to bone shaping in various surgeries. Their focus on innovation enhances surgical outcomes and user experience.

Boston Scientific Corporation and Integra LifeSciences Holdings Corporation are prominent contributors to the surgical rasps sector. Boston Scientific integrates advanced technology in their rasps, prioritizing patient safety and tool performance. Integra LifeSciences excels in producing rasps for neurosurgery and reconstructive tasks, emphasizing precision and reliability. Their continuous improvements reflect their dedication to medical advancement.

ConMed Corporation is another key player, known for its ergonomic surgical rasps that cater to orthopedic needs. Their designs aim to reduce surgeon fatigue while optimizing procedure efficiency. The market also includes various other companies that innovate and compete to enrich their product lines. These firms collectively push the boundaries of surgical tool development, focusing on enhancing surgical precision and improving patient outcomes.

Market Key Players

- Cousin Surgery LLC

- Johnson & Johnson

- Boston Scientific Corporation

- Integra LifeSciences Holdings Corporation

- ConMed Corporation

- KLS Martin Group

- Fuhrmann GmbH

- Entrhal Medical GmbH

- Medtronic plc

- B. Braun SE

Industrial Advantages and Opportunities For Market Players

Surgical rasps offer precision and efficiency in operations, particularly orthopedic surgeries. They allow surgeons to meticulously shape bones, improving surgical outcomes and boosting patient satisfaction. This precision aids market players in expanding into the growing sector of minimally invasive surgeries. Additionally, providing high-quality, durable rasps enhances a manufacturer’s reputation for reliability, potentially increasing business from healthcare facilities.

Manufacturers that innovate in surgical rasp design and materials can set industry standards, securing a competitive edge. Adhering to strict regulatory standards allows companies to access global markets, enhancing their reach. Furthermore, optimizing the supply chain reduces operational costs and improves market responsiveness, an essential factor for maintaining industry leadership.

The integration of technologies like RFID into surgical rasps presents significant opportunities. Such advancements can improve tool tracking and usage analytics, paving the way for smarter surgical tool ecosystems. Additionally, the trend toward personalized medicine opens up prospects for customized rasps, tailored to individual surgical requirements, offering a distinct market advantage.

Expanding into emerging markets with rising healthcare investments offers new growth avenues. Developing partnerships with healthcare providers for bulk sales or exclusive supply deals can secure stable revenue streams. Moreover, creating sustainable, eco-friendly rasps aligns with the increasing demand for sustainable medical devices, meeting both environmental and regulatory expectations.

Recent Developments

- In November 2024: Integra LifeSciences updated its financial outlook for the fourth quarter of 2024, projecting revenues in the range of $441 million to $451 million, which represents a growth of 11.1% to 13.6%. This update follows the integration of Acclarent and reflects increased revenue from various operational improvements and product integrations.

- In October 2024: Johnson & Johnson completed the acquisition of V-Wave, a company specializing in heart failure treatments. This strategic acquisition, valued at potentially $1.7 billion, enhances Johnson & Johnson MedTech’s cardiovascular portfolio by adding V-Wave’s minimally invasive Ventura interatrial shunt. This move aims to bolster J&J’s presence in advanced heart failure therapies.

- In April 2023: Cousin Surgery, a French company specializing in implantable medical devices, acquired PlantTec Medical, a German firm known for its hemostatic and adhesion prevention solutions. This strategic acquisition was backed by private equity investment from Turenne Group’s Capital Santé 2 fund and several co-investors, including Nord Capital Investissement and Altur Investissement. PlantTec Medical is noted for its innovative product, 4DRYFIELD®, which has been utilized in over 350,000 surgical procedures and is distributed in more than 30 countries.

Report Scope

Report Features Description Market Value (2023) US$ 488.2 Million Forecast Revenue (2033) US$ 765.4 Million CAGR (2024-2033) 4.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Double-ended Rasps, Single-ended Rasps), By End-User (Hospitals and Clinics, Ambulatory Surgical Centres (ASCs), Specialty Clinics) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Cousin Surgery LLC, Johnson & Johnson, Boston Scientific Corporation, Integra LifeSciences Holdings Corporation, ConMed Corporation, KLS Martin Group, Fuhrmann GmbH, Entrhal Medical GmbH, Medtronic plc, B. Braun SE Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cousin Surgery LLC

- Johnson & Johnson

- Boston Scientific Corporation

- Integra LifeSciences Holdings Corporation

- ConMed Corporation

- KLS Martin Group

- Fuhrmann GmbH

- Entrhal Medical GmbH

- Medtronic plc

- B. Braun SE