Global Green Packaging Market By Packaging Type (Recycled Content Packaging, Reusable Packaging, Degradable Packaging), By Application (Food and Beverages, Personal care, Health care, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140203

- Number of Pages: 232

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

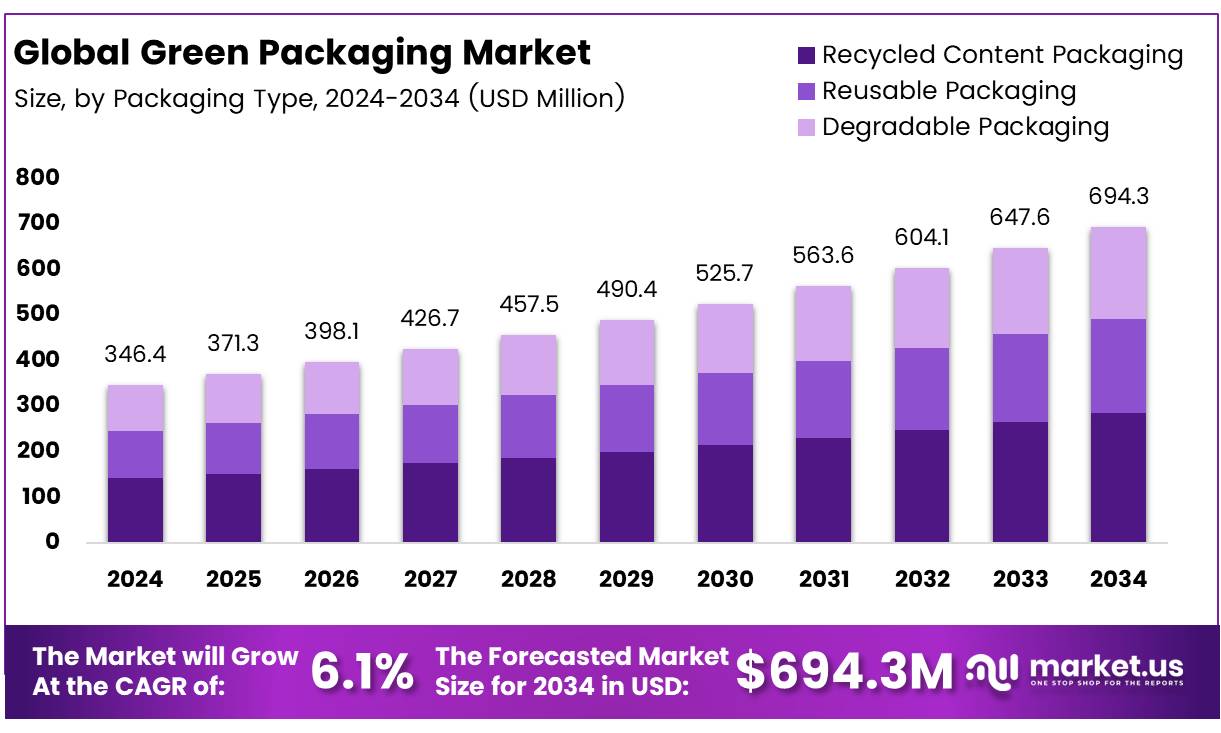

The Global Green Packaging Market size is expected to be worth around USD 694.3 Million by 2034, from USD 346.4 Million in 2024, growing at a CAGR of 7.2% during the forecast period from 2025 to 2034.

The Green Packaging market refers to packaging solutions that are designed to have a minimal environmental impact, either through the use of recyclable, biodegradable, or compostable materials. This market encompasses a wide range of packaging types, including paper-based, plant-based plastics, and packaging made from recycled materials.

The growing concern over environmental sustainability, particularly regarding the detrimental effects of traditional plastic packaging, has spurred significant demand for eco-friendly alternatives. As consumers increasingly become aware of environmental issues, the shift toward green packaging is gaining momentum, with more businesses looking to incorporate sustainable practices into their operations.

The global Green Packaging market is poised for continued growth, as both consumers and businesses recognize the need for more sustainable packaging options. According to GreenMatch, 76% of consumers in the UK, Europe, and the United States prefer paper-based packaging over plastic for environmental reasons, highlighting a clear consumer preference for eco-friendly materials.

Additionally, government regulations and growing public awareness are expected to drive further demand for green packaging solutions. The market presents an opportunity for businesses to align themselves with sustainability goals while catering to the rising demand for sustainable products.

The Green Packaging market has witnessed substantial growth in recent years, driven by changing consumer preferences and an increasing demand for sustainability. According to Ecobliss-Retail, 66% of all U.S. consumers, and 80% of adults under 34, are willing to pay a premium for sustainable products.

This shift in consumer behavior demonstrates the growing importance of eco-conscious choices in purchasing decisions, particularly among younger generations. As a result, companies are increasingly integrating green packaging solutions into their product offerings to meet consumer expectations and gain a competitive edge.

Furthermore, government regulations and investment in sustainable initiatives play a crucial role in the market’s expansion. Many countries have introduced policies to reduce plastic waste and encourage the adoption of sustainable packaging alternatives.

For example, the European Union has imposed strict regulations on plastic packaging waste, urging businesses to adopt green packaging solutions. These regulations are driving investments in research and development of new, eco-friendly materials, opening new opportunities in the market.

In addition, a recent study by MarineBiodiversity found that 73% of global consumers would definitely or probably change their consumption habits to reduce their environmental impact. This indicates a growing willingness among consumers to support businesses that prioritize sustainability, further accelerating the demand for green packaging.

Key Takeaways

- The global green packaging market is projected to reach USD 694.3 million by 2034, growing at a CAGR of 7.2% from 2025 to 2034.

- Recycled Content Packaging leads the market in 2024, holding 61.9% of the market share, driven by sustainability efforts and stricter regulations.

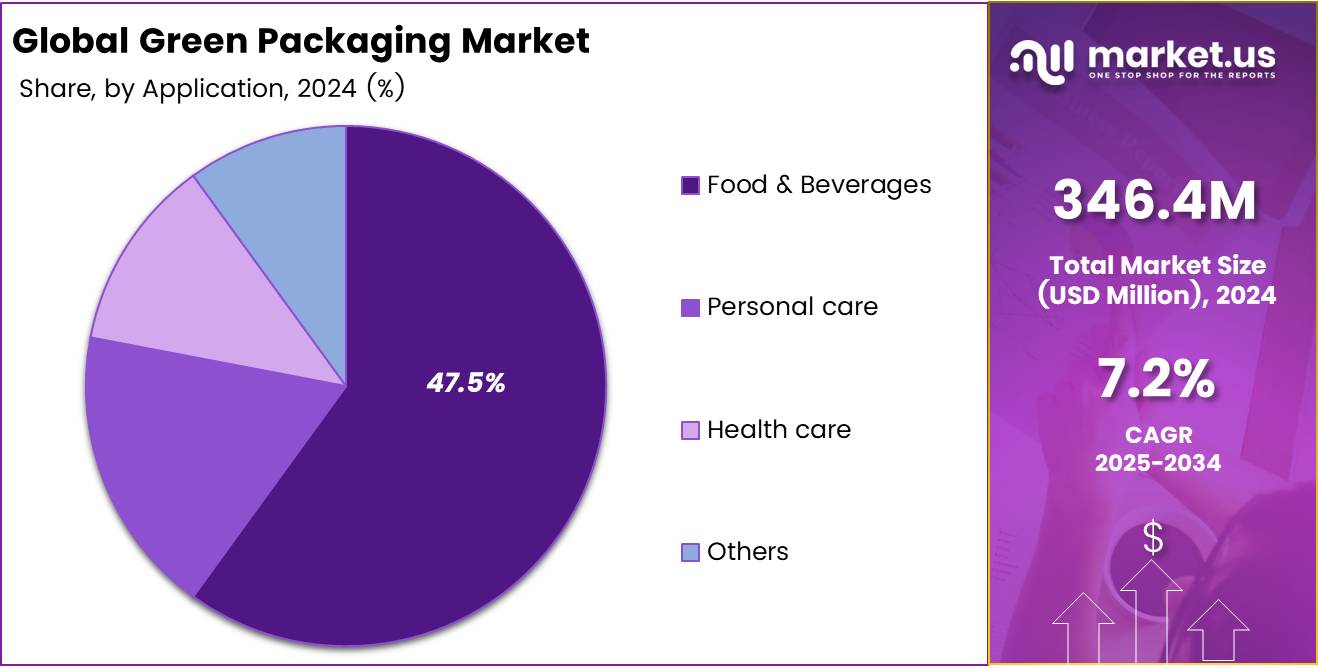

- The Food & Beverages sector dominates the green packaging market in 2024 with a 61.3% share, driven by the demand for eco-friendly packaging.

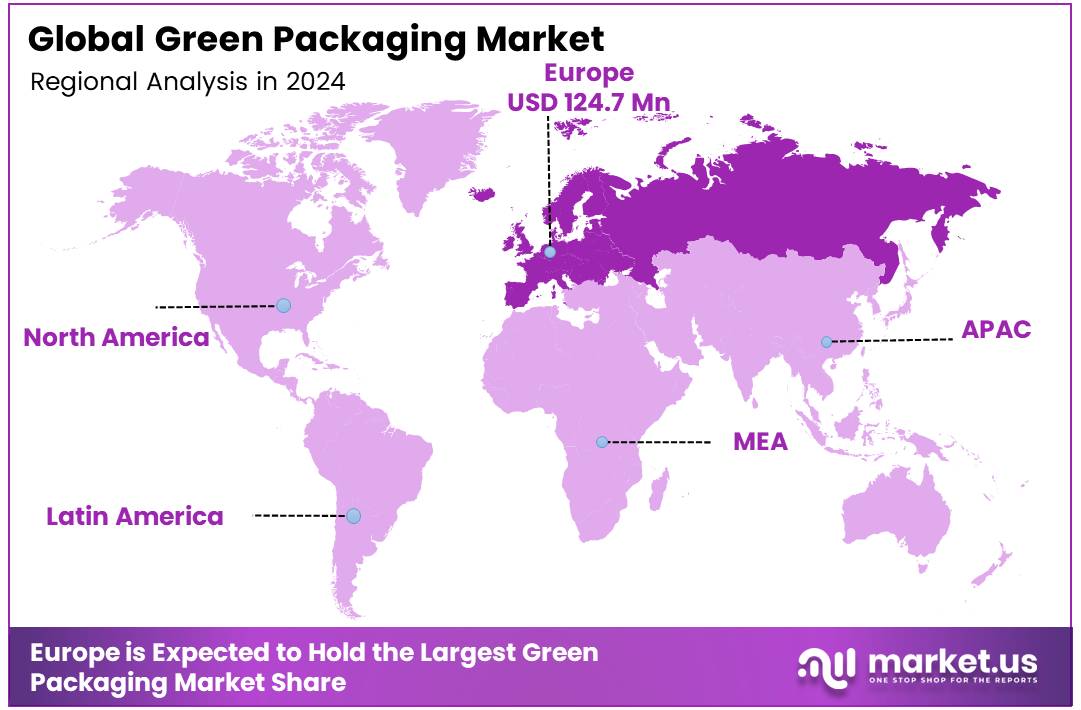

- Europe holds the largest market share at 36.8%, valued at USD 124.7 million, supported by strong regulations and consumer preference for sustainable packaging.

Packaging Type Analysis

Recycled Content Packaging Dominates with 61.9% Share in 2024, Driven by Sustainability Demands

In 2024, Recycled Content Packaging emerged as the dominant packaging type in the Green Packaging Market, commanding a substantial 61.9% market share. This growth is primarily attributed to the increasing emphasis on sustainability across industries, as companies seek to reduce their environmental footprint and comply with stricter regulations regarding waste and recycling.

Materials such as paper, plastic, metal, and glass, which are easily recyclable, continue to drive the adoption of recycled content packaging. These materials not only support circular economy principles but also offer cost-effective solutions to meet consumer demand for eco-friendly packaging options.

Following this, Reusable Packaging also demonstrated significant traction, contributing to a growing share in the market. Packaging types like drums and plastic containers are gaining popularity, especially in industries with high-volume shipping needs, due to their durability and cost-effectiveness over multiple usage cycles.

Additionally, the Degradable Packaging segment is expected to witness steady growth, as biodegradable materials continue to be favored in efforts to reduce landfill waste.

The ongoing shift toward greener alternatives is reshaping the packaging landscape, with Recycled Content Packaging leading as the top choice in 2024.

Application Analysis

Food & Beverages Lead with 61.3% Share in Green Packaging Market by Application in 2024

In 2024, the Food & Beverages sector held a dominant position in the By Application Analysis segment of the Green Packaging Market, accounting for 61.3% of the overall market share. This significant share can be attributed to the increasing consumer demand for eco-friendly and sustainable packaging solutions within the food and beverage industry.

As sustainability becomes a core consideration for consumers and businesses alike, the industry has seen a shift toward adopting materials such as biodegradable plastics, recyclable paper, and plant-based alternatives.

Personal Care and Health Care sectors also contribute notably to the growth of green packaging, albeit at smaller shares compared to Food & Beverages. The Personal Care segment benefits from the growing preference for natural and organic products, prompting a rise in the adoption of green packaging solutions that align with eco-conscious branding.

Similarly, the Health Care industry has begun incorporating sustainable packaging as part of broader environmental commitments, but its market share remains limited relative to Food & Beverages.

In conclusion, while sectors like Personal Care and Health Care continue to adopt green packaging practices, the Food & Beverages sector leads by a substantial margin, driving the demand and growth for sustainable packaging solutions.

Key Market Segments

By Packaging Type

- Recycled Content Packaging

- Paper

- Plastic

- Metal

- Glass

- Others

- Reusable Packaging

- Drum

- Plastic Container

- Others

- Degradable Packaging

By Application

- Food & Beverages

- Personal care

- Health care

- Others

Drivers

Rising Consumer Environmental Awareness Fuels Green Packaging Demand

The growing awareness of environmental issues among consumers is a major driver for the green packaging market. As more people understand the environmental impact of plastic waste and packaging waste, they increasingly demand sustainable, eco-friendly alternatives. This shift in consumer behavior is pushing companies to adopt green packaging solutions to meet these preferences.

Furthermore, many companies are aligning their packaging strategies with their corporate sustainability goals, using eco-friendly materials as part of their corporate social responsibility (CSR) initiatives.

Innovations in packaging technology, such as biodegradable plastics and compostable materials, are making green packaging both more feasible and cost-effective.

These advancements are reducing the cost barriers that once limited the widespread adoption of green packaging. Additionally, supply chain optimization efforts are encouraging companies to adopt lightweight and recyclable packaging.

This not only helps reduce transportation costs but also minimizes waste, aligning with environmental goals. As a result, the green packaging market is experiencing robust growth, driven by the convergence of consumer demand, corporate responsibility, technological innovations, and supply chain efficiency.

Restraints

High Production Costs and Raw Material Scarcity Challenge Green Packaging Adoption

One of the major restraints facing the green packaging market is the high production cost associated with eco-friendly materials. Green packaging often requires advanced materials such as biodegradable plastics, compostable films, or recycled content, which can be more expensive to produce than conventional packaging options. This price gap can create challenges for businesses, especially smaller companies with limited budgets, as it raises the overall cost of their products.

In addition to production costs, the limited availability of raw materials for green packaging poses another barrier. Materials like biodegradable plastics and recycled content may not be consistently available in all regions, leading to supply chain disruptions and further driving up costs. The scarcity of these materials also makes it harder for manufacturers to scale up production of green packaging, limiting its widespread adoption.

As a result, companies may be hesitant to transition to green packaging solutions due to these financial and logistical challenges. While the demand for sustainable packaging is growing, the affordability and accessibility of green materials remain key concerns that could slow down the market’s expansion.

Growth Factors

Government Support and Custom Solutions Drive Growth in Green Packaging Market

The green packaging market presents significant growth opportunities, largely driven by government incentives and evolving consumer preferences. Governments worldwide are offering subsidies, tax breaks, and other financial incentives to businesses that adopt eco-friendly packaging solutions. This support is especially beneficial for industries facing increasing regulatory pressure to reduce waste and carbon footprints. Additionally, advancements in packaging recycling technologies provide further growth potential.

As companies invest in more efficient recycling systems, the ability to process green packaging materials, such as biodegradable plastics and recycled content, will improve, making them more viable for widespread use.

Another key opportunity lies in the customization of green packaging for the e-commerce sector. With the rapid growth of online shopping, there is an increasing demand for sustainable packaging solutions tailored to shipping needs. Custom, eco-friendly packaging can offer companies a competitive edge while meeting consumer demands for sustainability.

Furthermore, the rising popularity of organic and natural products, particularly in the food and beverage sector, provides additional opportunities for green packaging adoption. As consumers continue to prioritize sustainability, brands in these sectors are increasingly seeking packaging that aligns with their values.

Overall, these trends suggest strong potential for growth in the green packaging market, supported by government initiatives, innovation in recycling, e-commerce needs, and a growing focus on organic products.

Emerging Trends

Integration of Smart Technologies and Sustainable Practices Shapes Green Packaging Trends

Several key trends are driving innovation and adoption in the green packaging market. One notable trend is the integration of smart technologies, such as QR codes and Near Field Communication (NFC) tags, into sustainable packaging. These technologies not only improve the traceability of products but also enhance consumer engagement by providing transparency about the sustainability of packaging and product origins.

Additionally, the beauty industry is increasingly embracing eco-friendly packaging, with brands opting for recyclable glass, refillable containers, and biodegradable materials as part of their sustainability strategies.

Another emerging trend is the zero-waste movement, which encourages businesses to adopt packaging solutions that are reusable, recyclable, or compostable, aiming for minimal or no waste generation. This movement is inspiring brands to redesign their packaging to align with consumer values focused on environmental responsibility.

Furthermore, the use of upcycled materials is gaining momentum, with companies incorporating discarded ocean plastics, post-consumer waste, and other upcycled materials into packaging. This not only reduces waste but also aligns with the growing consumer demand for sustainable products.

These trends reflect a broader shift towards innovation in green packaging, with companies increasingly looking for ways to reduce environmental impact, engage consumers, and align with global sustainability goals. As these trends continue to evolve, the green packaging market is expected to experience further growth and transformation.

Regional Analysis

Europe leads the Green Packaging Market with 36.8% share at USD 124.7 million

The global green packaging market is experiencing robust growth across different regions, with each region contributing significantly to the overall market expansion.

Europe holds the dominant position in the green packaging market, accounting for approximately 36.8% of the total market share, valued at USD 124.7 million. The region’s dominance can be attributed to strong regulatory frameworks and growing consumer demand for sustainable packaging solutions.

The European Union’s stringent environmental regulations, such as the Circular Economy Action Plan, have played a pivotal role in promoting eco-friendly packaging practices. Furthermore, the presence of major players in countries like Germany, the UK, and France contributes to the region’s market leadership.

Regional Mentions:

North America follows as a prominent player, with the United States being a key market for green packaging. The market in North America is driven by a significant shift towards sustainable practices in the retail and food sectors, coupled with increasing investments in innovative packaging solutions. The region’s growing focus on reducing plastic waste and enhancing recyclability is projected to continue to fuel market growth, with a particularly strong rise in demand for recyclable and biodegradable packaging materials.

Asia Pacific is expected to witness the highest growth rate in the coming years. The growing industrialization and urbanization, especially in countries like China, India, and Japan, contribute to increased demand for green packaging solutions. In addition, rising consumer awareness regarding environmental sustainability, coupled with government initiatives to reduce plastic usage, is driving the adoption of green packaging in this region.

Latin America and the Middle East & Africa are relatively smaller markets in comparison but are poised for steady growth. In these regions, demand is driven by emerging economies, increasing awareness about environmental impact, and government support for eco-friendly packaging initiatives. In Latin America, countries like Brazil are leading the way in green packaging adoption, while the Middle East is focusing on innovative packaging solutions to meet the growing demand from sectors such as food and beverages.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global green packaging market is experiencing significant growth, driven by increasing consumer demand for sustainable packaging solutions and stringent environmental regulations. Key players in the market, such as Amcor plc, Be Green Packaging, Ball Corporation, Sealed Air, and DuPont, are positioning themselves to capitalize on this shift toward eco-friendly alternatives.

Amcor plc stands out for its commitment to sustainability, aiming to make all of its packaging recyclable or reusable by 2025. Its strategic investments in sustainable materials, like plant-based plastics, have cemented its role as a leader in the green packaging market. Similarly, Ball Corporation is accelerating the adoption of aluminum packaging, which is highly recyclable, as part of its broader sustainability initiatives.

Sealed Air and Mondi are notable for their innovations in biodegradable packaging solutions. Sealed Air has made significant strides in reducing plastic usage through its Bubble Wrap alternative, which uses 100% recyclable material. Mondi’s efforts in paper-based solutions and its investment in sustainable production practices further strengthen its market position.

Smaller but influential players, such as Be Green Packaging and Evergreen Packaging LLC, focus on niche markets for compostable and renewable packaging solutions, while Tetra Laval and Nampak Ltd have targeted the beverage and food industries, offering carton packaging with high recyclability.

These key players are enhancing their product portfolios and strategic alliances to meet the growing demand for sustainable packaging, positioning themselves for a pivotal role in shaping the future of the global green packaging market.

Top Key Players in the Market

- Amcor plc

- Be Green Packaging

- Ball Corporation

- Sealed Air

- DS Smith Plc

- DuPont

- Evergreen Packaging LLC

- Mondi

- Nampak Ltd

- Tetra Laval

Recent Developments

- In December 2024, Movopack, a leader in sustainable eCommerce packaging solutions, successfully secured $2.5M in funding to further enhance its eco-friendly packaging innovations aimed at reducing plastic waste in the e-commerce sector.

- In November 2023, Fibmold, a startup specializing in sustainable packaging solutions, raised $10M in a funding round led by Omnivore and Accel, which will be utilized to scale their biodegradable packaging products and expand their market reach.

- In December 2024, Bpacks, the developer of the world’s first bark-based, 100% compostable packaging, secured €1M in pre-seed funding to advance its innovative approach to sustainable packaging, targeting a reduction in the environmental impact of conventional packaging materials.

- In March 2024, Bambrew, a sustainable packaging startup focused on producing eco-friendly alternatives from bamboo, raised ₹60 crore in funding to enhance its production capabilities and expand its product line into international markets.

Report Scope

Report Features Description Market Value (2024) USD 346.4 Million Forecast Revenue (2034) USD 694.3 Million CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Packaging Type(Recycled Content Packaging, Reusable Packaging, Degradable Packaging), By Application(Food & Beverages, Personal care, Health care, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amcor plc, Be Green Packaging, Ball Corporation, Sealed Air, DS Smith Plc, DuPont, Evergreen Packaging LLC, Mondi, Nampak Ltd, Tetra Laval Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amcor plc

- Be Green Packaging

- Ball Corporation

- Sealed Air

- DS Smith Plc

- DuPont

- Evergreen Packaging LLC

- Mondi

- Nampak Ltd

- Tetra Laval