Global Shrink Packaging Market By Material (Polyethylene, Polyvinyl Chloride, Polyolefin, Ethylene-vinyl Alcohol, Others), By Product Type (Films and Wraps, Sleeves and Labels, Hoods, Bags, Others), By Packaging Format (Secondary Packaging, Primary Packaging, Tertiary Packaging), By Application (Food and Beverage Packaging, Pharmaceuticals, Cosmetics and Personal Care, Industrial Goods, Consumer Goods, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140856

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

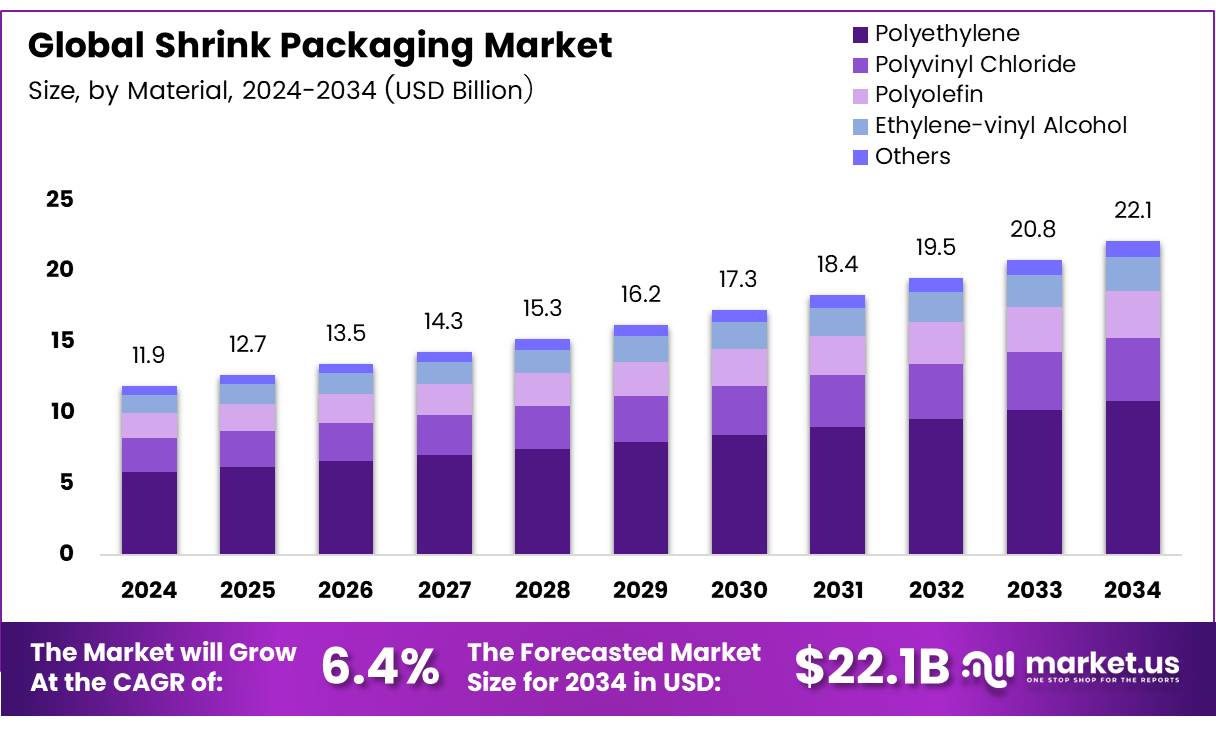

The Global Shrink Packaging Market size is expected to be worth around USD 22.1 Billion by 2034, from USD 11.9 Billion in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034.

Shrink packaging is a widely adopted method used for sealing products in a plastic film that tightly conforms to the shape of the product when heat is applied. It provides a secure, tamper-evident seal that ensures product protection, convenience, and enhanced shelf appeal.

Commonly used across industries such as food & beverage, consumer goods, and pharmaceuticals, shrink packaging offers both cost-effectiveness and environmental advantages compared to traditional packaging methods.

This flexible packaging format is particularly valued for its ability to accommodate various shapes and sizes, making it an ideal solution for diverse product types. The growing emphasis on sustainable packaging solutions and consumer demand for eco-friendly alternatives further drives the adoption of shrink packaging technologies.

The shrink packaging market has demonstrated consistent growth in recent years, driven by factors such as increased demand for protective packaging, sustainability trends, and advancements in packaging technologies. According to Study, pallet utilization accounted for 29% of the U.S. shrink film market in the current year, highlighting the increasing reliance on shrink films in large-scale applications.

Additionally, consumer preferences play a key role in shaping the market, as 72% of consumers believe that packaging design influences their purchasing decisions as per Business Dasher. As sustainability concerns rise, a significant portion of consumers are gravitating toward products with minimal and eco-friendly packaging.

According to Meyers, 49% of U.S. consumers actively avoid products with excessive packaging, which is steering the market toward more efficient and environmentally conscious shrink packaging solutions.

The shrink packaging market presents ample growth opportunities, particularly as consumer demands for more sustainable and cost-effective solutions continue to rise. The market is expected to benefit from increased investments in packaging technologies, which aim to reduce waste and improve efficiency. This presents opportunities for companies to innovate and capture a broader market share by developing advanced shrink films that offer better performance, reduced material usage, and enhanced recyclability.

Government regulations and initiatives to promote environmentally friendly packaging are also playing a critical role in shaping the market landscape. Governments worldwide are introducing stricter regulations to reduce plastic waste and promote sustainable practices.

These regulations are encouraging manufacturers to adopt eco-friendly shrink packaging materials, fostering innovation in biodegradable and recyclable shrink films. Consequently, these regulatory pressures are not only driving market growth but are also enabling the expansion of new product categories that align with both consumer expectations and regulatory requirements.

Together, these factors are propelling the shrink packaging market toward sustained growth, with both businesses and consumers increasingly prioritizing sustainability and innovation in packaging solutions. The combination of evolving consumer preferences, regulatory developments, and technological advancements offers a dynamic landscape for the shrink packaging market.

Key Takeaways

- The global shrink packaging market is projected to reach USD 22.1 billion by 2034, growing at a CAGR of 6.4% from 2025 to 2034.

- Polyethylene (PE) held 40.2% of the market share in 2024, due to its durability, flexibility, and cost-effectiveness.

- Films & Wraps dominated the market with a 50.3% share in 2024, favored for their versatility across industries like food, beverage, and pharmaceuticals.

- Secondary packaging held the largest share in 2024, with 48.1%, driven by the demand for product protection and visual appeal.

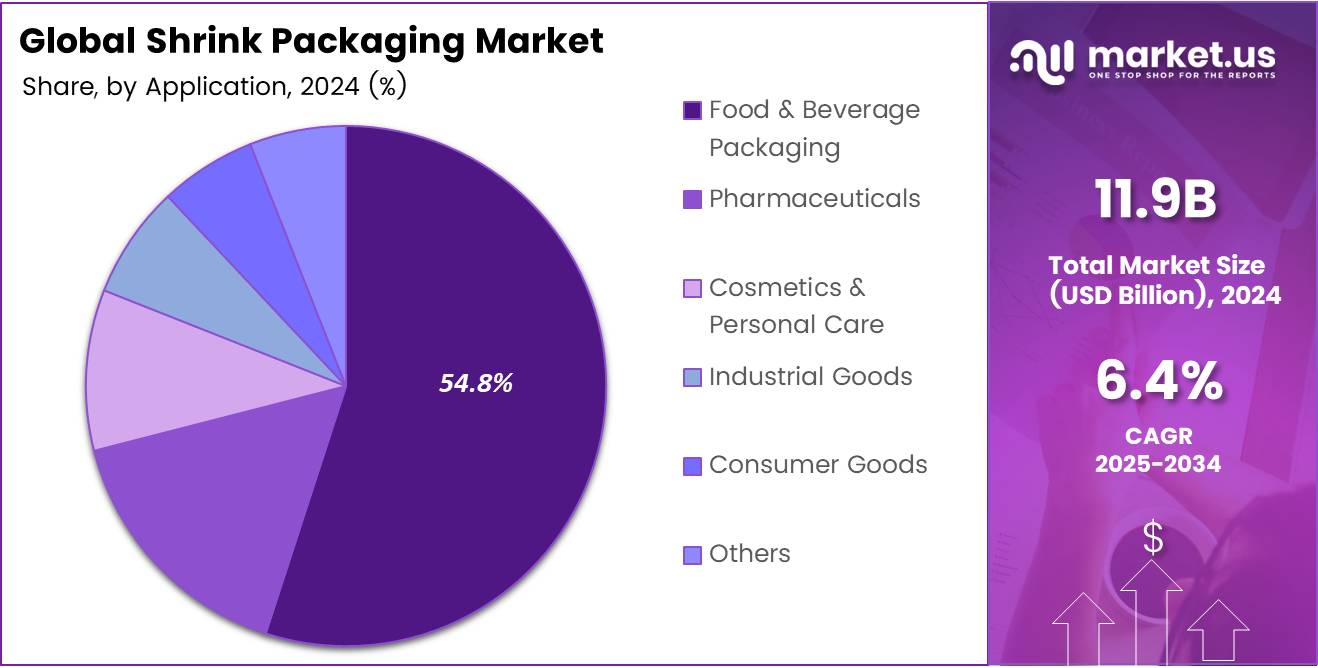

- Food & Beverage Packaging accounted for 54.8% of the market share in 2024, reflecting its prominence in shrink packaging applications.

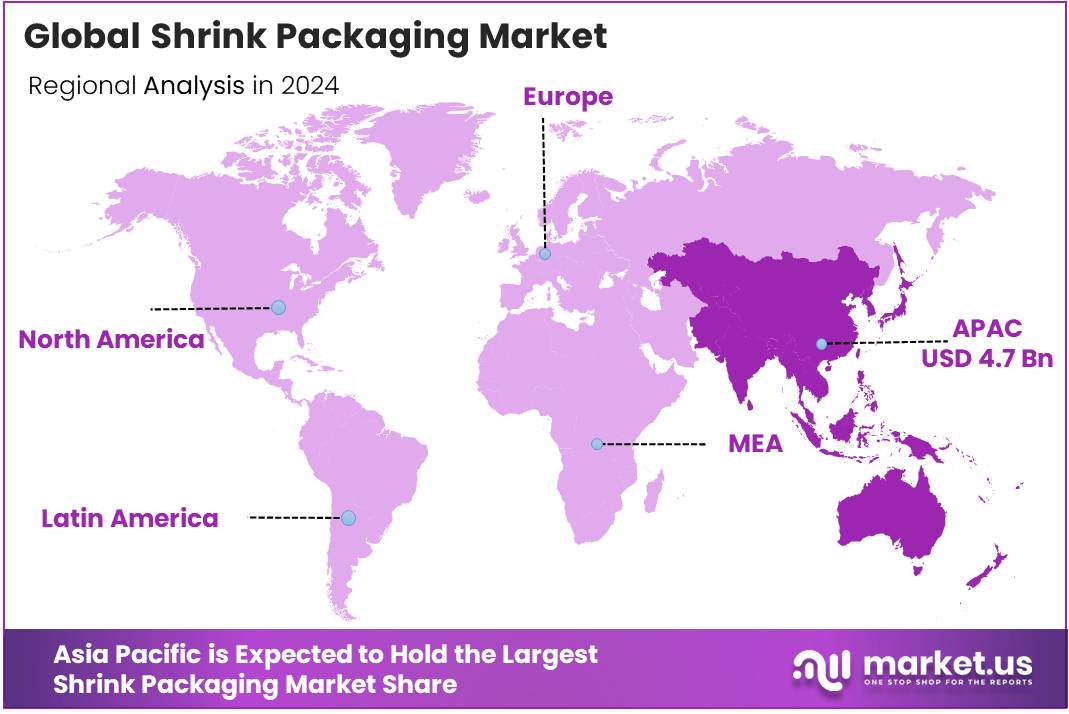

- Asia Pacific led the global market with a 40.5% share in 2024, valued at USD 4.7 billion.

Material Analysis

Polyethylene (PE) Leads Shrink Packaging Market with 40.2% Share in 2024

In 2024, Polyethylene (PE) held a dominant market position in the By Material Analysis segment of the Shrink Packaging Market, accounting for 40.2% of the total market share. This strong performance can be attributed to its versatile properties, including durability, flexibility, and cost-effectiveness, which make it a preferred material for a variety of shrink packaging applications.

PE’s low production cost, combined with its suitability for a wide range of products, has led to its widespread adoption across industries such as food and beverage, consumer goods, and pharmaceuticals.

Polyvinyl Chloride (PVC) followed as the second-largest material, contributing a significant share to the market. However, its performance is often tempered by environmental concerns associated with its production and disposal, limiting its potential growth in comparison to PE.

Polyolefin (POF) and Ethylene-vinyl Alcohol (EVOH) are also important materials within the segment, though they collectively make up a smaller portion of the market. POF’s higher strength and clarity make it a preferred choice for high-end packaging solutions, while EVOH’s barrier properties are valued in specialized applications requiring protection against oxygen and moisture.

The increasing demand for sustainable packaging solutions has driven innovation in material alternatives, but PE remains a key driver of the shrink packaging market’s growth.

Product Type Analysis

Films & Wraps Lead Shrink Packaging Market with 50.3% Share in 2024 Due to Versatility and Cost Efficiency

In 2024, Films & Wraps dominated the shrink packaging market under the By Product Type Analysis segment, accounting for 50.3% of the total market share. This significant market share can be attributed to the versatile nature of films and wraps, which are widely used across various industries such as food and beverage, pharmaceuticals, and consumer goods.

The ability of films and wraps to provide a cost-effective and reliable solution for product containment and protection is a key factor driving their widespread adoption. Their flexibility, durability, and ease of application make them ideal for both small and large-scale packaging needs.

Following films and wraps, Sleeves & Labels represented a notable portion of the market, driven by their ability to offer branding and product differentiation alongside shrinkage. Sleeves provide enhanced shelf appeal, making them a popular choice in the beverage and consumer product sectors.

Hoods and Bags, while contributing a smaller share, are increasingly being utilized for bulk packaging and larger items. The Others category, encompassing various niche products, also contributed to the overall growth of the market, although at a lower rate.

Overall, the market is expected to continue evolving with films and wraps maintaining their dominant position, driven by ongoing technological advancements and consumer demand for efficient, sustainable packaging solutions.

Packaging Format Analysis

Secondary Packaging leads with 48.1% share in Shrink Packaging Market due to demand for protective and aesthetic packaging solutions

In 2024, Secondary Packaging held a dominant market position in the By Packaging Format Analysis segment of the Shrink Packaging Market, with a 48.1% share. This segment’s growth can be attributed to the increasing demand for packaging that ensures both product protection and visual appeal, particularly in the consumer goods and retail sectors.

Secondary packaging often plays a crucial role in grouping primary packaged products, improving shelf life, and enhancing brand presentation. As the demand for visually appealing and durable packaging continues to rise, secondary packaging remains a key focus area for manufacturers.

Primary Packaging, representing the direct contact between the product and its packaging, also holds significant market share in shrink packaging, albeit at a lower percentage compared to secondary packaging. It is favored for its ability to provide product containment, safety, and branding benefits.

Tertiary Packaging, primarily utilized for logistics and bulk handling, occupies a smaller share of the market. While essential for transportation and storage, its impact in the shrink packaging market remains limited due to its functional, rather than consumer-facing, role. Overall, secondary packaging continues to be the dominant force, driving growth in the sector.

Application Analysis

Food & Beverage Packaging Dominates Shrink Packaging Market with 54.8% Share in 2024

In 2024, the Food & Beverage Packaging segment held a dominant position in the By Application Analysis of the Shrink Packaging Market, commanding a significant 54.8% share.

This large market share can be attributed to the increasing demand for packaging solutions that ensure product safety, preservation, and extended shelf life across various food categories, including fresh produce, frozen foods, dairy products, meat and seafood, and beverages. The use of shrink packaging in bottles and cans has particularly seen substantial growth due to its cost-effectiveness and the growing need for tamper-evident, attractive packaging.

The Pharmaceuticals sector also represents a significant portion of the market, driven by the demand for secure and protective packaging for medicinal products. In addition, the Cosmetics & Personal Care segment has grown steadily as consumers seek packaging that enhances product appeal and integrity.

The Industrial Goods and Consumer Goods segments have witnessed increasing adoption of shrink packaging due to its versatility and protective qualities, essential for shipping and handling. Together, these sectors contribute to the overall expansion of the shrink packaging market, with other smaller applications continuing to evolve and contribute to market growth.

Key Market Segments

By Material

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyolefin (POF)

- Ethylene-vinyl Alcohol (EVOH)

- Others

By Product Type

- Films & Wraps

- Sleeves & Labels

- Hoods, Bags

- Others

By Packaging Format

- Secondary Packaging

- Primary Packaging

- Tertiary Packaging

By Application

- Food & Beverage Packaging

- Fresh Produce

- Frozen Foods

- Dairy Products

- Meat & Seafood

- Beverages

- Bottles

- Cans

- Pharmaceuticals

- Cosmetics & Personal Care

- Industrial Goods

- Consumer Goods

- Others

Drivers

Rising Demand for Packaged Food & Beverages Drives Shrink Packaging Market Growth

The growing preference for convenience foods, such as ready-to-eat meals and packaged beverages, is a significant driver for the shrink packaging market. As consumers seek time-saving, easily accessible food options, manufacturers are increasingly turning to shrink films to ensure product freshness and ease of handling.

The rise in demand for on-the-go meals, snacks, and beverages in developed and developing regions is driving packaging innovation, with shrink packaging offering benefits such as extended shelf life and product protection. Furthermore, the increase in health-conscious consumers has led to higher demand for packaged foods with clear labeling, which shrink films can efficiently provide.

As a result, shrink packaging is becoming the preferred choice for the food and beverage industry due to its ability to provide a secure, compact, and visually appealing packaging solution. This trend is expected to continue to drive market growth in the coming years, further bolstered by the increasing demand for sustainable and eco-friendly packaging alternatives.

Restraints

Environmental Concerns and Stringent Regulations Affect Shrink Packaging Market Growth

The shrink packaging market is facing growing challenges due to increasing environmental concerns over plastic waste. Governments worldwide are implementing stricter regulations and even bans on plastic usage, especially in consumer packaging. These actions can limit the adoption of traditional shrink packaging, which predominantly relies on plastic materials.

As a result, manufacturers are under pressure to shift towards sustainable alternatives, such as biodegradable or recyclable films, which may not be as widely available or cost-effective as conventional plastic options.

Additionally, the high initial investment required for advanced shrink packaging equipment acts as another barrier to market growth. The adoption of state-of-the-art machinery can be capital-intensive, and small or mid-sized manufacturers may struggle to make such large investments. This factor further hampers market expansion, as smaller players may be unable to compete with larger, more resource-rich companies that can afford these upfront costs.

As a result, both environmental regulations and high equipment costs represent significant restraints that can hinder the growth and scalability of the shrink packaging market.

Growth Factors

Growing Demand for Sustainable Packaging Fuels Growth in Shrink Packaging Market

The shrink packaging market is experiencing significant growth, driven by several emerging opportunities. One key factor is the development of biodegradable and compostable shrink films. As environmental concerns intensify, businesses are increasingly adopting sustainable alternatives, leading to a rising demand for eco-friendly packaging solutions.

Furthermore, the adoption of high-barrier shrink films is gaining traction, as these films offer enhanced protection against moisture, oxygen, and contaminants, thereby improving product shelf life and quality. This trend is especially relevant in industries like food and pharmaceuticals.

Additionally, rapid industrialization in emerging markets, particularly in countries like India, China, and Brazil, is creating a strong demand for shrink packaging, as these regions experience increased production activities and consumer demand.

Lastly, customization and smart packaging innovations are adding value to the market. The integration of technologies such as QR codes, RFID tags, and interactive packaging elements allows brands to engage consumers and offer personalized experiences, further expanding market potential. Together, these factors suggest a promising outlook for the shrink packaging industry, with sustained growth driven by sustainability, innovation, and global industrial expansion.

Emerging Trends

Surge in Demand for Heat-Shrink Sleeves & Labels Enhances Product Aesthetics and Brand Visibility

The shrink packaging market is experiencing significant growth due to the increasing demand for heat-shrink sleeves and labels. These packaging solutions not only offer superior protection for products but also enhance their visual appeal, providing an opportunity for brands to improve their market presence. With the growing focus on aesthetics and brand recognition, companies are increasingly adopting shrink-sleeve labeling to differentiate their products on crowded retail shelves.

Moreover, the trend towards bio-based and plant-based polymers is gaining momentum as manufacturers seek sustainable alternatives to traditional plastics. This shift is supported by rising environmental awareness and regulatory pressures, prompting industry players to invest in eco-friendly material innovations.

Additionally, the rise of e-commerce has contributed to the demand for shrink packaging, particularly for tamper-evident and damage-resistant solutions. As online retail continues to expand, there is a growing emphasis on packaging that ensures product integrity during transit, thus minimizing the risk of product damage and enhancing consumer trust. These factors combined—enhanced product aesthetics, sustainability, and the need for durable packaging in e-commerce—are driving the growth and evolution of the shrink packaging market.

Regional Analysis

Asia Pacific leads the shrink packaging market with 40.5% share valued at USD 4.7 billion

The global shrink packaging market is witnessing substantial growth, driven by diverse regional dynamics. Among the key regions, Asia Pacific dominates the market, accounting for approximately 40.5% of the global market share, valued at USD 4.7 billion.

This can be attributed to the region’s robust manufacturing sector, expanding e-commerce industry, and increasing demand for packaged consumer goods. In particular, countries like China and India are major contributors, with the rising adoption of shrink packaging solutions in sectors such as food and beverages, pharmaceuticals, and personal care products.

Regional Mentions:

North America holds a significant position in the shrink packaging market, contributing to a considerable portion of the global demand. The market value in this region is bolstered by the advanced packaging infrastructure and high demand for packaged food and consumer goods. The United States, in particular, remains a leading market, driven by stringent regulatory standards, innovation in packaging technologies, and growing concerns over sustainability.

Europe also represents a prominent market for shrink packaging, with countries such as Germany, France, and the UK spearheading growth. The region’s market growth is propelled by the demand for lightweight, cost-effective packaging solutions across industries like food, beverages, and pharmaceuticals. Additionally, the growing trend towards eco-friendly and recyclable packaging materials is driving market expansion in Europe.

In the Middle East and Africa, the shrink packaging market is expanding due to rising consumer demand and infrastructural developments. The adoption of shrink packaging is gaining momentum across sectors like food & beverage, and retail, as manufacturers aim to improve shelf appeal and reduce material costs.

Latin America, while a smaller contributor to the global market, is witnessing steady growth. Countries such as Brazil and Mexico are increasingly using shrink packaging to meet the growing demand for packaged food and beverages, especially in the e-commerce sector.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global shrink packaging market in 2024 is poised to experience significant growth, driven by rising demand for efficient packaging solutions across industries such as food and beverage, pharmaceuticals, and consumer goods.

Key players in the market include Sealed Air Corporation, American Eagle Packaging Corporation, Uflex Ltd., and Berry Global Inc., each contributing to the market’s expansion through strategic innovations and product offerings.

Sealed Air Corporation continues to dominate the market with its innovative shrink packaging technologies, which offer superior product protection and sustainability. The company’s focus on eco-friendly solutions, such as recyclable shrink films, positions it as a leader in the push for sustainable packaging.

American Eagle Packaging Corporation is expanding its reach with customized shrink packaging solutions, catering to diverse industries. Its emphasis on flexibility and efficiency has made it a key player in the market, particularly in North America.

Uflex Ltd. stands out for its high-quality shrink films, which are designed to cater to the growing demand for tamper-evident and cost-effective packaging. Its global presence and manufacturing capabilities make it a formidable competitor.

Berry Global Inc. is leveraging its wide-ranging product portfolio to tap into the growing trend of consumer and environmental awareness. The company’s focus on reducing plastic waste and developing biodegradable shrink films has bolstered its market position.

Other notable companies such as Amcor Plc, Winpak Ltd., and Dow Chemical Company are also making significant strides in the market with innovative, sustainable packaging solutions. The ongoing shift towards e-commerce and demand for enhanced product presentation are expected to fuel further competition and technological advancements, making the shrink packaging market a dynamic space to watch in 2024.

Top Key Players in the Market

- Sealed Air Corporation

- American Eagle Packaging Corporation

- Uflex Ltd.

- Berry Global Inc.

- Amcor Plc

- Winpak Ltd.

- Bemis Company, Inc.

- Aakriti Packaging

- Deufol SE

- Dow Chemical Company

- Coveris Holdings S.A.

- Flexopack S.A.

- Bonset America Corporation

- Other

Recent Developments

- In June 2024, reusable pallet wrap company Bearhug secured $325,000 in funding to support its expansion into the Australian market. The investment aims to enhance Bearhug’s market presence and grow its sustainability-focused business in the region.

- In February 2024, IPG introduced ExlfilmPlus PCR, a new shrink film containing 35% post-consumer recycled (PCR) content. The product is prequalified for recycling at store drop-off locations, aligning with the company’s commitment to sustainability.

- In May 2023, Closed Loop Partners’ fund received a $10M investment to support polyethylene (PE) and polypropylene (PP) recycling initiatives. The investment is expected to drive advancements in the circular economy and enhance recycling infrastructure for these materials.

- In May 2024, Great Wrap raised $5 million to scale its compostable pallet wrap, in partnership with Opal ANZ. This funding is set to accelerate Great Wrap’s growth and expand the availability of eco-friendly packaging solutions in the Australian market.

Report Scope

Report Features Description Market Value (2024) USD 11.9 Billion Forecast Revenue (2034) USD 22.1 Billion CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Polyethylene, Polyvinyl Chloride, Polyolefin, Ethylene-vinyl Alcohol, Others), By Product Type (Films and Wraps, Sleeves and Labels, Hoods, Bags, Others), By Packaging Format (Secondary Packaging, Primary Packaging, Tertiary Packaging), By Application (Food and Beverage Packaging, Pharmaceuticals, Cosmetics and Personal Care, Industrial Goods, Consumer Goods, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sealed Air Corporation, American Eagle Packaging Corporation, Uflex Ltd., Berry Global Inc., Amcor Plc, Winpak Ltd., Bemis Company, Inc., Aakriti Packaging, Deufol SE, Dow Chemical Company, Coveris Holdings S.A., Flexopack S.A., Bonset America Corporation, Other Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sealed Air Corporation

- American Eagle Packaging Corporation

- Uflex Ltd.

- Berry Global Inc.

- Amcor Plc

- Winpak Ltd.

- Bemis Company, Inc.

- Aakriti Packaging

- Deufol SE

- Dow Chemical Company

- Coveris Holdings S.A.

- Flexopack S.A.

- Bonset America Corporation

- Other