Global Halal Packaging Market By Type (Rigid, Flexible), By Product (Bottles and jars, Bags and pouches, Films and labels, Trays, Pails and buckets, Tubes and blisters, Others), By End-Use (Food and Beverage, Pharmaceutical, Cosmetics, Modest Fashion), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140916

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

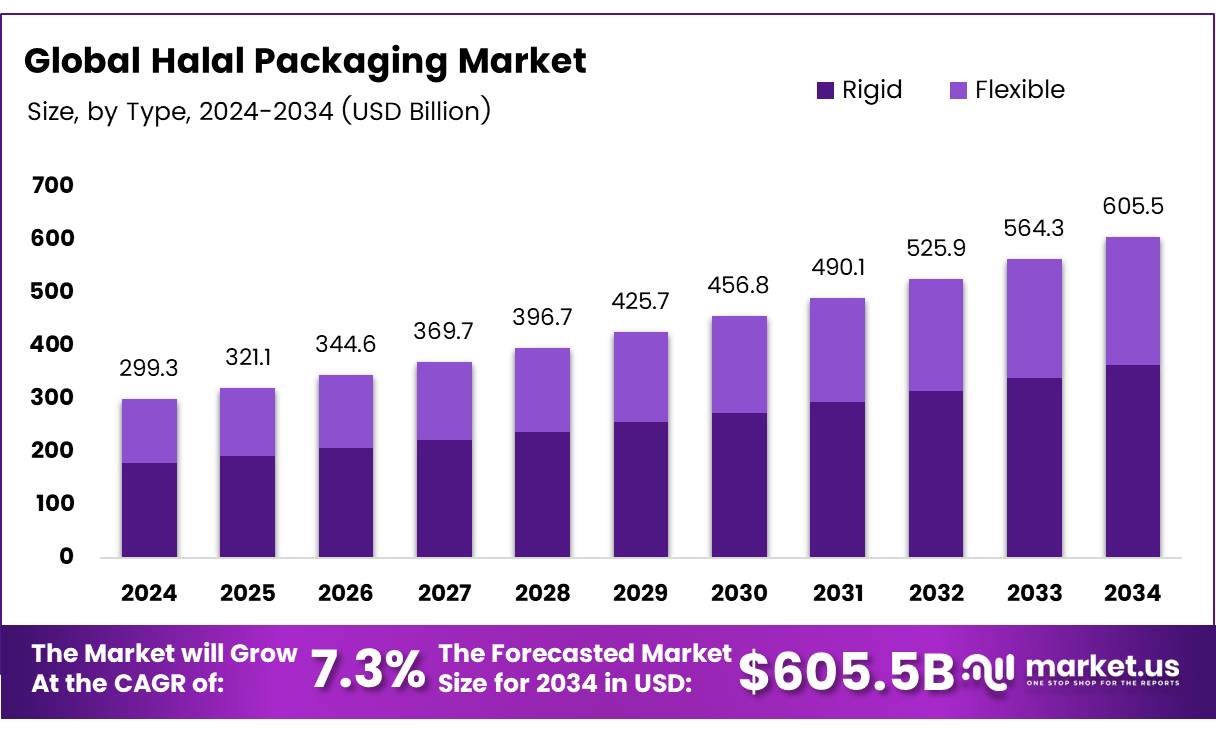

The Global Halal Packaging Market size is expected to be worth around USD 605.5 Billion by 2034, from USD 299.3 Billion in 2024, growing at a CAGR of 7.3% during the forecast period from 2025 to 2034.

The Halal Packaging market is experiencing rapid growth due to the increasing global demand for Halal-certified products, driven by Muslim consumer preferences and evolving regulations. Halal packaging refers to the materials and processes that comply with Islamic laws, ensuring that products meet strict hygiene and ethical standards.

This market segment is gaining significant traction across various industries, including food and beverages, pharmaceuticals, and cosmetics, as businesses are keen to cater to the growing Muslim consumer base.

As the global Halal market is projected to grow from over two trillion U.S. dollars to 2.8 trillion U.S. dollars in the coming years according to Study, packaging plays a crucial role in ensuring that products remain compliant with Halal standards throughout their lifecycle.

The demand for Halal packaging is not limited to Muslim-majority countries but is growing in non-Muslim markets as well. The expansion of Muslim populations in regions such as Europe and North America, along with heightened consumer awareness about Halal-certified products, is further contributing to the market’s expansion. Companies are investing in innovations such as eco-friendly packaging that adheres to Halal standards, which aligns with broader sustainability goals in global packaging trends.

The Halal Packaging market is poised for substantial growth as the Halal food sector alone is expected to reach a value of 1.67 trillion U.S. dollars by 2025, up from 1.26 trillion U.S. dollars in 2021, according to Study. This surge in spending on Halal food signals a robust demand for Halal-compliant packaging solutions.

Governments and organizations across the globe are recognizing the value of the Halal market, with increasing investments in infrastructure to support Halal certifications and packaging technologies.

Furthermore, Halal-certified brands are experiencing higher consumer loyalty, with Halal consumers being 35% more loyal to certified brands compared to the average consumer, according to Halalfoundation. This loyalty presents a prime opportunity for businesses to tap into a highly engaged consumer segment.

Moreover, government regulations and investments in Halal certification processes, as well as innovation in packaging materials, are further incentivizing companies to explore Halal packaging options.

Regulatory frameworks and certifications that ensure Halal compliance continue to evolve, with governments across key markets increasing efforts to establish clear guidelines for Halal packaging. These regulations are pivotal in maintaining the integrity of the market, ensuring that Halal products meet international standards and building trust among Muslim consumers.

As the Halal market grows, packaging companies are presented with new opportunities for collaboration and innovation, positioning them for long-term success in a rapidly expanding industry.

Key Takeaways

- The global Halal Packaging Market is expected to reach USD 605.5 billion by 2034, growing at a CAGR of 7.3%.

- Rigid packaging dominates the market with a 54.3% share in 2024 due to its durability and protective qualities.

- Bottles & Jars lead the By Product Analysis segment, holding a 27.1% share in 2024 for their versatility in packaging.

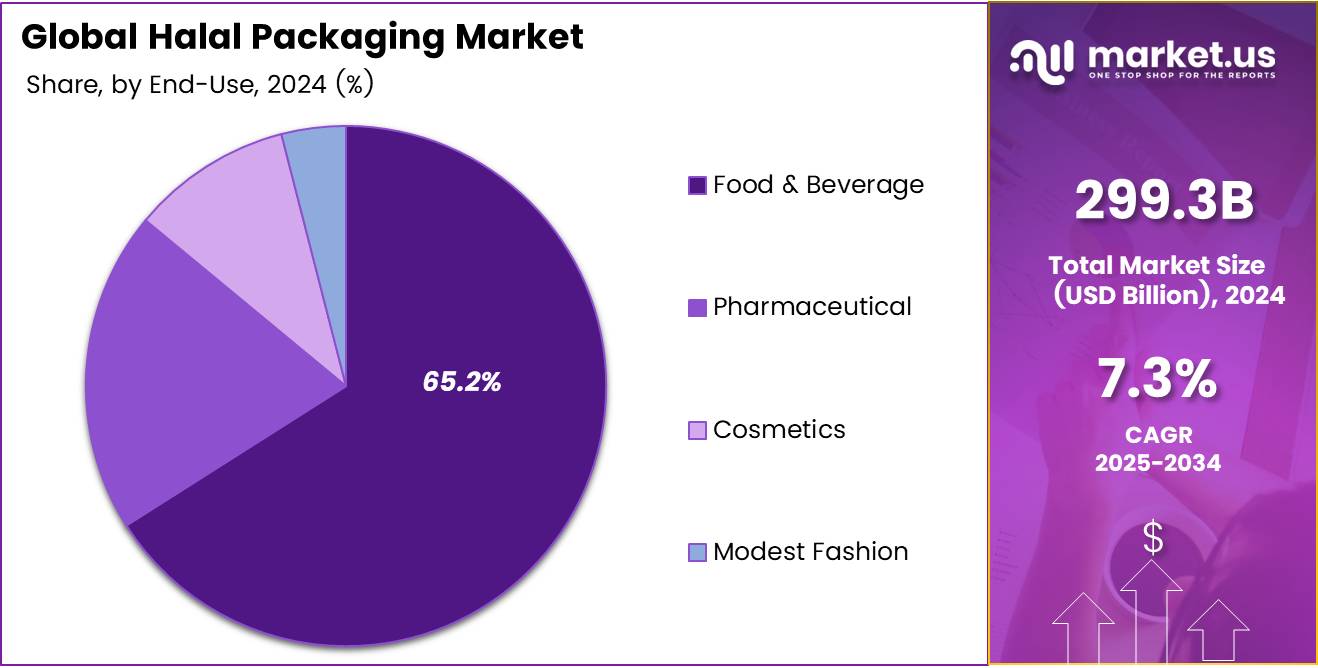

- The Food & Beverage sector holds the largest share in the By End-Use Analysis segment, accounting for 65.2% in 2024.

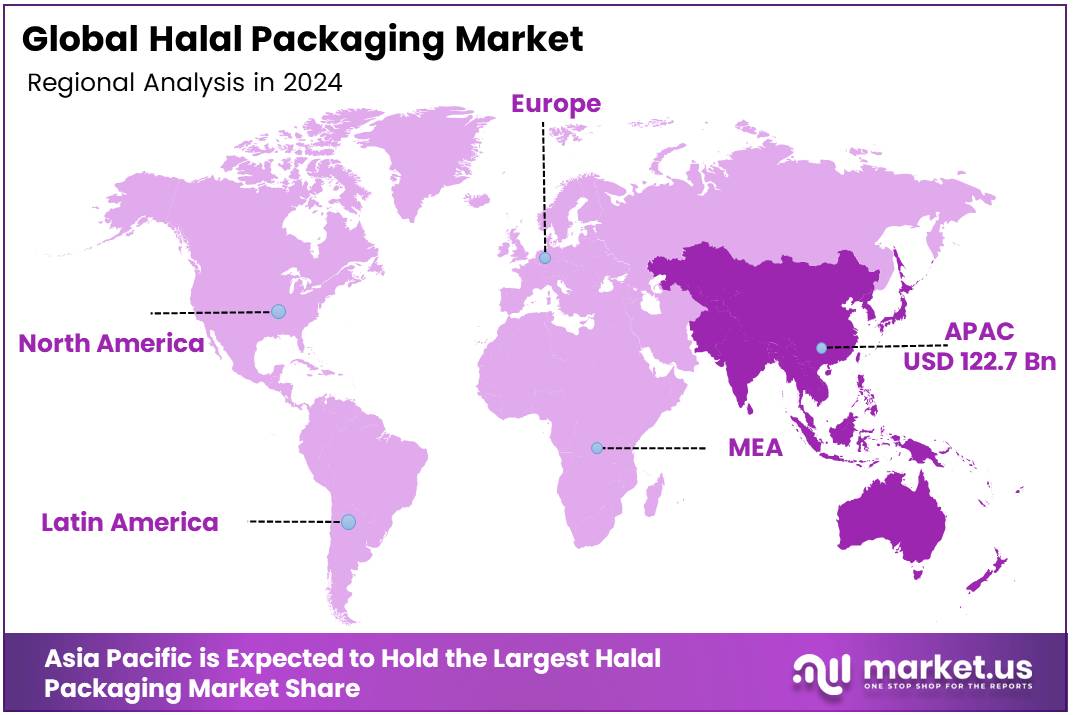

- Asia Pacific leads the Halal packaging market, with a 41.2% global share valued at approximately USD 122.7 billion.

Type Analysis

Rigid Packaging Leads Halal Packaging Market with 54.3% Share, Driven by Durability and Consumer Preference

In 2024, rigid packaging dominated the Halal Packaging Market with a 54.3% share in the By Type Analysis segment. This segment’s strong performance is attributed to rigid packaging’s superior durability, protective qualities, and ability to maintain product integrity, making it a preferred choice for halal food manufacturers and consumers.

Its widespread use across various halal-certified products, such as packaged meat, dairy, and processed foods, reinforces its position in the market. Rigid packaging offers ease of handling, enhanced shelf life, and increased consumer confidence in terms of quality and safety, aligning well with the stringent requirements of halal certification.

On the other hand, flexible packaging continues to gain ground, particularly in the halal snack and convenience food sectors. While it holds a smaller share compared to rigid packaging, its lightweight, cost-effective, and versatile nature makes it an attractive option for brands looking to optimize packaging costs and improve convenience for consumers. Flexible packaging also supports more sustainable practices, further driving its adoption in the halal market as environmentally conscious consumers seek eco-friendly alternatives.

Despite the growing preference for flexible options, rigid packaging remains the dominant force in the Halal Packaging Market, owing to its reliability and long-standing industry presence.

Product Analysis

Bottles & Jars Lead Halal Packaging Market with 27.1% Share in 2024, Driven by Versatility and Consumer Demand

In 2024, Bottles & Jars held a dominant position in the By Product Analysis segment of the Halal Packaging Market, commanding a 27.1% market share. This segment’s leading role can be attributed to its versatility in packaging a wide range of halal-certified products, including food, beverages, and cosmetics.

Bottles & jars are favored for their ability to preserve product integrity, maintain shelf life, and offer easy handling for both manufacturers and consumers. The demand for these packaging formats is particularly high in the halal food and beverage sector, where product quality and safety are critical.

Following Bottles & Jars, Bags & Pouches also held a significant portion of the market, contributing to the packaging of smaller halal food products and snacks. Films & Labels, which provide effective branding and product information, are seeing a rise in demand as more consumers seek halal certification visibility. Trays, Pails & Buckets, and Tubes & Blisters, while smaller in market share, remain integral to the packaging of bulk items and specific cosmetic applications.

Other packaging formats, though accounting for a smaller portion, are nonetheless relevant for niche products and markets within the broader halal industry.

End-Use Analysis

Food & Beverage Leads the Halal Packaging Market with a 65.2% Share in 2024

In 2024, the Food & Beverage sector commanded the largest share in the By End-Use Analysis segment of the Halal Packaging Market, accounting for an impressive 65.2% share.

The growth in this sector is primarily driven by the increasing demand for halal-certified food products globally, especially in regions with large Muslim populations. Halal packaging ensures that food products meet specific religious guidelines, further boosting consumer confidence and product accessibility.

Following the food sector, the pharmaceutical industry is expected to experience notable growth in halal packaging adoption, driven by the rising awareness and demand for halal-certified health products, including medicines, supplements, and nutraceuticals. The Cosmetics industry is also anticipated to grow as consumers increasingly seek ethically produced, halal-compliant skincare and beauty products.

Meanwhile, the modest fashion segment is gaining traction, with halal packaging playing a role in catering to the needs of consumers who prioritize religiously compliant, modest attire. The combined momentum in these sectors reflects a broader cultural shift toward halal-certified products, enhancing the market’s potential across diverse industries.

As consumer awareness of halal standards continues to rise, these end-use segments will remain integral to the Halal Packaging Market’s overall expansion.

Key Market Segments

By Type

- Rigid

- Flexible

By Product

- Bottles & jars

- Bags & pouches

- Films & labels

- Trays

- Pails & buckets

- Tubes & blisters

- Others

By End-Use

- Food & Beverage

- Pharmaceutical

- Cosmetics

- Modest Fashion

Drivers

Growing Muslim Population Fuels Demand for Halal Packaging Solutions

The Halal packaging market is experiencing significant growth, driven by several key factors. One of the primary drivers is the growing global Muslim population, which leads to an increased demand for Halal-certified products across various industries.

As more consumers seek products that comply with Halal standards, the need for specialized packaging that guarantees the product’s adherence to these requirements rises. Alongside this, rising consumer awareness of Halal certifications plays a critical role in shaping market dynamics.

People are becoming more conscious of the importance of Halal packaging, which ensures the integrity and authenticity of the product. This growing awareness, coupled with stricter government regulations in Muslim-majority countries, is further intensifying demand for Halal-compliant packaging solutions.

Governments are enforcing rigorous standards to ensure that Halal-certified products meet the required criteria, thereby boosting the need for packaging that aligns with these regulations.

Additionally, the rising popularity of Halal food products, driven by both religious and non-religious consumers seeking ethical or quality assurances, is spurring further demand for packaging that ensures products meet Halal certification.

As these trends continue, the Halal packaging market is poised for continued expansion, with manufacturers and suppliers adapting to the increasing need for safe, certified, and culturally appropriate packaging solutions.

Restraints

Limited Availability of Halal Packaging Suppliers Hampers Market Expansion

One key challenge facing the Halal packaging market is the limited availability of suppliers who offer specialized Halal-certified materials. Compared to traditional packaging solutions, Halal packaging options are relatively scarce, which restricts the market’s growth potential. This is mainly due to the fact that fewer manufacturers are equipped with the necessary certifications and processes to produce packaging that meets Halal standards.

As a result, businesses that require Halal-compliant packaging often face difficulties in sourcing these materials in large quantities or at competitive prices. Moreover, the complexity and specific regulations surrounding Halal certification can deter new suppliers from entering the market, further limiting the variety and accessibility of Halal packaging options.

Another challenge is that in some regions, especially outside of Muslim-majority countries, there is limited awareness or understanding of Halal requirements. This lack of knowledge can slow the adoption of Halal packaging, as companies in these regions may not prioritize or recognize the importance of Halal certification, ultimately impacting the market’s growth.

The combination of these factors makes it harder for the Halal packaging market to scale and expand globally, hindering its ability to meet the rising demand from the food, beverage, and cosmetic industries.

Growth Factors

Expanding Halal Packaging Solutions in Emerging Markets Presents Growth Opportunities

The Halal packaging market has significant growth potential, especially in emerging regions such as Southeast Asia, Africa, and parts of Europe, where Halal-certified products are seeing rising demand due to the growing Muslim population. As these markets become more economically active, the need for packaging that aligns with Halal standards is set to increase, presenting a clear opportunity for businesses to tap into this expanding consumer base.

Another key driver is the growing trend toward sustainability, where eco-friendly and biodegradable Halal-certified packaging solutions can cater to the environmentally-conscious consumer. This shift toward greener options presents a dual opportunity for businesses to fulfill both Halal and sustainability requirements.

Additionally, the Halal cosmetics and personal care market is on the rise, as Muslim consumers increasingly demand Halal-certified skincare and beauty products. This creates an emerging need for packaging solutions that meet both Halal and safety standards, offering room for growth in this segment.

Furthermore, advancements in packaging materials, like plant-based plastics and compostable films, provide innovative opportunities to develop Halal-compliant solutions that appeal to the modern consumer.

By leveraging these material innovations, companies can create new packaging solutions that meet both ethical and functional demands, driving market expansion. Together, these factors offer numerous opportunities for companies to capture a larger share of the Halal packaging market globally.

Emerging Trends

Smart Packaging Revolutionizes Halal Market with Real-Time Tracking and Authentication

The Halal packaging market is evolving rapidly, driven by several key trends that are shaping the way products are packaged and delivered. One of the most notable developments is the integration of smart technologies like RFID, NFC, and QR codes, enabling real-time product tracking and ensuring Halal authenticity. This innovation allows consumers to verify the Halal status of their purchases easily, creating trust in the market.

Alongside this, there is a shift toward minimalist packaging designs, which emphasize simplicity and purity, aligning with the values of Halal compliance. This trend is being complemented by the rise of convenience packaging, designed for on-the-go meals, snacks, and beverages, catering to busy lifestyles while maintaining Halal standards.

Another growing factor is the focus on health-oriented packaging, which highlights certifications like organic and preservative-free labels, attracting health-conscious consumers who want to ensure that products meet both Halal and wellness standards.

Lastly, the growth of e-commerce is driving innovations in packaging to ensure that Halal products are easier to handle, store, and ship. With more consumers shopping online, these packaging solutions are becoming a critical part of the supply chain, enhancing convenience and sustainability. Overall, these trends are positioning the Halal packaging market for significant growth, as manufacturers and brands look to meet the evolving demands of modern consumers.

Regional Analysis

Asia Pacific leads Halal Packaging Market with 41.2% share and USD 122.7 Billion

The global Halal packaging market is experiencing significant growth, driven by increasing demand for Halal-certified products across various regions. Asia Pacific dominates the market, accounting for 41.2% of the global share, with a market value of approximately USD 122.7 billion.

This dominance is largely attributed to the region’s substantial Muslim population, particularly in countries such as Indonesia, Malaysia, and India, where Halal certification is essential for both domestic and international trade. The growing consumer awareness of Halal food safety, along with government regulations promoting Halal standards, further boosts the market growth in this region.

Regional Mentions:

In North America, the Halal packaging market is expanding as a result of the increasing number of Muslim consumers in the United States and Canada. The market in this region is projected to grow steadily due to the rising demand for Halal-certified food products and the growing penetration of Halal products in mainstream retail chains.

Europe is also witnessing notable growth in the Halal packaging market. Countries such as the United Kingdom, France, and Germany, which have significant Muslim populations, are seeing rising demand for Halal food products. Additionally, the regulatory framework in the European Union encourages Halal standards and certifications, contributing to the expansion of Halal packaging solutions.

In the Middle East & Africa (MEA), the market is driven by high levels of Muslim population and significant growth in Halal food consumption. The GCC countries, particularly Saudi Arabia and the UAE, are leading in the adoption of Halal packaging, driven by both religious and health considerations. Halal certification is vital for products entering these markets, providing a stable growth trajectory for packaging solutions.

Latin America is gradually emerging as a growth market for Halal packaging, with countries like Brazil, Argentina, and Mexico witnessing increased demand due to expanding Muslim communities and trade opportunities in the region. However, the market remains smaller compared to other regions, but growth is anticipated as the Halal food industry gains momentum.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global Halal Packaging Market in 2024 is marked by a dynamic mix of established multinational corporations and regional players, each strategically positioning themselves to tap into the growing demand for Halal-certified products, particularly in the food, pharmaceutical, and cosmetic sectors.

Amcor plc and Huhtamaki Group, both global leaders in packaging, are expected to maintain their significant share due to their extensive R&D capabilities and commitment to innovation in sustainable and compliant packaging solutions.

These companies have increasingly integrated Halal certification into their portfolios, capitalizing on the rising demand in Muslim-majority regions and markets with significant Muslim populations. Amcor’s environmentally sustainable packaging technologies and Huhtamaki’s comprehensive global footprint place them in a prime position to lead.

Companies like AIE Pharmaceuticals, Inc. and Avesta Continental Pack are key players in the pharmaceutical and food sectors, where Halal certification is crucial for regulatory compliance in specific regions. Their specialized offerings ensure that sensitive products meet religious and safety requirements, further driving their relevance in the market.

Regional players such as PT Champion Pacific Indonesia Tbk and Albea Indonesia are essential in catering to Southeast Asia’s rapidly growing Halal market. These companies are capitalizing on local production and distribution advantages to meet regional consumer needs more effectively.

Tetra Pak and Sealed Air Corporation are prominent in liquid and food packaging, offering robust solutions for Halal compliance. These companies benefit from their global logistics and reputation for high-quality, durable packaging.

Top Key Players in the Market

- Amcor plc

- Pacmoore Products Inc.

- AIE Pharmaceuticals, Inc.

- Rootree

- Cardia Bioplastics

- Albea Indonesia

- Asia Pulp and Paper (APP) Indonesia

- PT Champion Pacific Indonesia Tbk

- Avesta Continental Pack

- Huhtamaki Group

- MM Karton

- Constantia Flexibles

- Novvia Group

- Tetra Pak International S.A.

- Sealed Air Corporation

Recent Developments

- In Dec 2023, Saudi Arabia and Indonesia joined forces to enhance the assurance and certification processes for halal products, aiming to boost international trade and consumer confidence in halal standards across markets.

- In Dec 2024, Indonesia’s halal product trade is projected to reach $53.73 billion, reflecting a strong growth trajectory fueled by increased global demand for halal-certified food, beverages, and lifestyle products.

- In Dec 2024, Ayan Capital successfully secured £2.8 million in funding to expand its halal finance offerings in the UK, signaling a rising interest in Sharia-compliant financial services and investment opportunities within the region.

- In Nov 2024, Brazilian meat processing giant BRF announced its plan to acquire a 26% stake in Addoha Poultry, strengthening its presence in the halal food sector and enhancing its strategic positioning in international markets.

Report Scope

Report Features Description Market Value (2024) USD 299.3 Billion Forecast Revenue (2034) USD 605.5 Billion CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Rigid, Flexible), By Product(Bottles and jars, Bags and pouches, Films and labels, Trays, Pails and buckets, Tubes and blisters, Others), By End-Use(Food and Beverage, Pharmaceutical, Cosmetics, Modest Fashion) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amcor plc, Pacmoore Products Inc., AIE Pharmaceuticals, Inc., Rootree, Cardia Bioplastics, Albea Indonesia, Asia Pulp and Paper (APP) Indonesia, PT Champion Pacific Indonesia Tbk, Avesta Continental Pack, Huhtamaki Group, MM Karton, Constantia Flexibles, Novvia Group, Tetra Pak International S.A., Sealed Air Corporation, Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amcor plc

- Pacmoore Products Inc.

- AIE Pharmaceuticals, Inc.

- Rootree

- Cardia Bioplastics

- Albea Indonesia

- Asia Pulp and Paper (APP) Indonesia

- PT Champion Pacific Indonesia Tbk

- Avesta Continental Pack

- Huhtamaki Group

- MM Karton

- Constantia Flexibles

- Novvia Group

- Tetra Pak International S.A.

- Sealed Air Corporation