Global Cosmetic Ingredients Market By Ingredient Type (Synthetic, Natural), By Product Type (Surfactant, Emollient, Polymer, Oleo-chemical, Botanical, Extract, Rheology Modifier, Preservatives, Antioxidant, Emulsifier and Stabilizer, Others), By Functionality (Cleansing Agents and Foamers, Aroma, Moisturizing, Specialty, Others), By End Use (Skin Care, Oral Care, Hair Care, Body Care), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 55034

- Number of Pages: 272

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

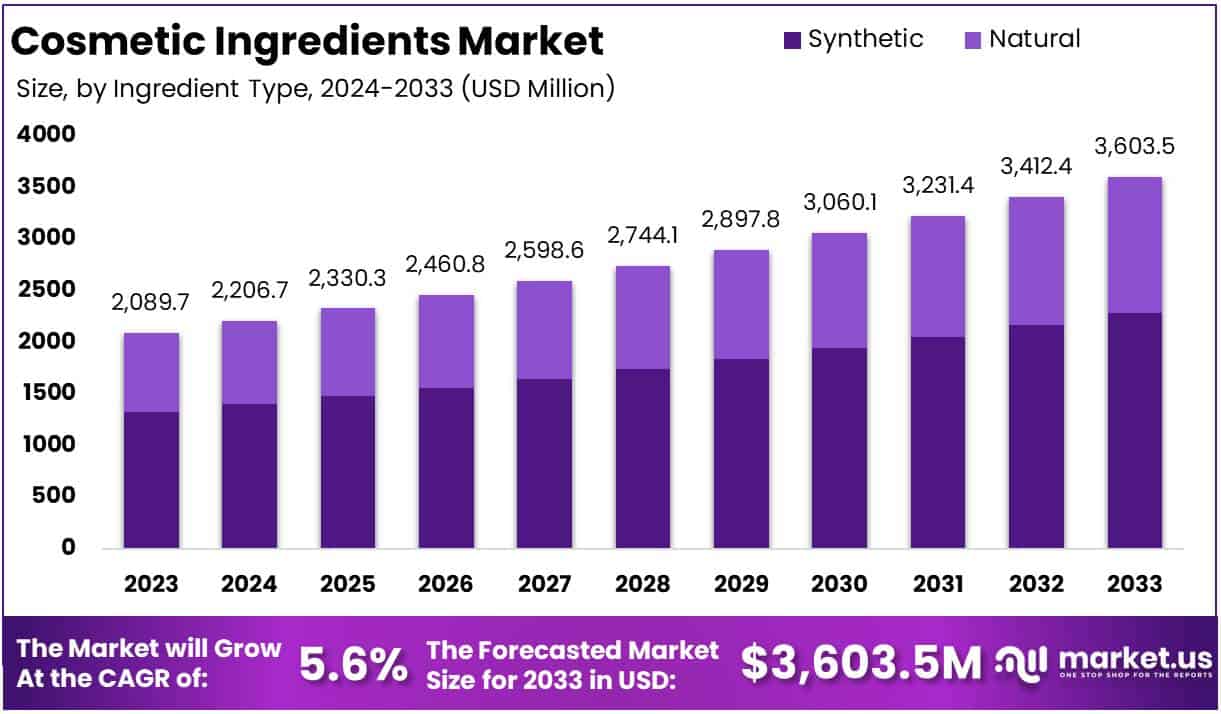

The Global Cosmetic Ingredients Market size is expected to be worth around USD 3,603.5 Million by 2033, from USD 2,089.7 Million in 2023, growing at a CAGR of 5.6% during the forecast period from 2024 to 2033.

Cosmetic ingredients are the raw materials used in the formulation of skincare, haircare, makeup, and personal care products. These components range from active ingredients, such as antioxidants, vitamins, and peptides, to functional additives like emulsifiers, preservatives, and colorants.

Cosmetic ingredients are critical to product performance, targeting specific consumer needs like anti-aging, hydration, or sun protection while ensuring safety, stability, and sensory appeal. The industry increasingly prioritizes sustainable and natural ingredients, driven by evolving consumer preferences and regulatory requirements.

The cosmetic ingredients market refers to the global industry that supplies raw materials and specialty chemicals used in cosmetic and personal care product manufacturing. This market is diverse, encompassing synthetic chemicals, natural extracts, and bio-based ingredients. It serves a wide array of downstream industries, including beauty, wellness, and pharmaceuticals.

The cosmetic ingredients market presents significant opportunities, particularly in the realms of sustainability and personalization. The growing trend toward clean and green beauty creates a fertile ground for bio-based and biodegradable ingredients. Innovations in biotechnology, such as lab-grown actives and microbial fermentation, offer a path to more sustainable solutions.

According to Mandala AI, the global cosmetic ingredients market is heavily influenced by the dynamics of key beauty markets and evolving consumer behaviors. The U.S. holds a dominant 20% market share, trailed by China at 13% and Japan at 8%. American women, on average, allocate $3,756 annually to beauty products and services, reflecting substantial consumer investment.

Despite the growing prevalence of e-commerce, 52% of consumers prefer offline purchases to test products in person. Furthermore, 78% of buyers report that social media content significantly impacts their makeup decisions, highlighting the critical intersection of digital influence and product innovation in driving market demand.

According to ADA Cosmetics, the cosmetic ingredients market is shaped by evolving regulatory frameworks and consumer preferences. Organic certifications, such as certified organic 95% organic content and made with organic ingredients 70%, highlight rising demand for transparency.

In the EU, 1,378 chemicals are banned under Annex II, with 80% never historically utilized in cosmetics. Additionally, ingredients with concentrations of 1% or less are exempt from descending order labeling, indicating flexible yet precise formulation norms. This dynamic landscape reflects innovation driven by regulatory stringency and sustainability imperatives.

Key Takeaways

- The global cosmetic ingredients market is projected to grow from USD 2,089.7 million in 2023 to USD 3,603.5 million by 2033, at a robust CAGR of 5.6% during the forecast period.

- Synthetic ingredients dominated with a 63.5% share in 2023, driven by affordability, availability, and consistent performance in formulations.

- Surfactants led the product category with a 21.4% market share in 2023, owing to their multifunctional applications in personal care formulations.

- Cleansing agents and foamers commanded a 32.5% share in functionality, highlighting their essential role in personal hygiene and skincare routines.

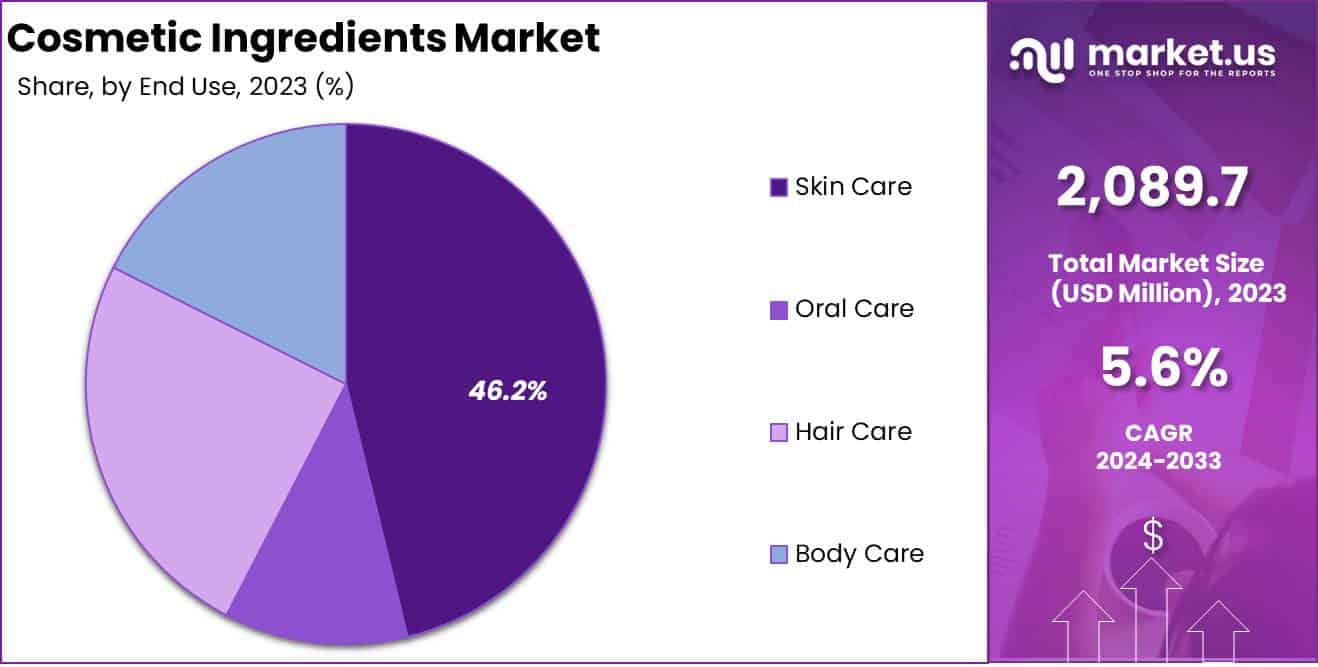

- Skin care dominated the end-use segment with a 46.2% market share, driven by rising consumer demand for anti-aging and hydration-focused products.

- Europe emerged as the leading market with a 37.2% share in 2023, supported by stringent regulatory frameworks, innovation, and sustainability-focused initiatives.

By Ingredient Analysis

Synthetic Ingredients Dominating the Cosmetic Ingredients Market with a 63.5% Share in 2023

In 2023, synthetic cosmetic ingredients held a dominant position in the global cosmetic ingredients market, capturing an impressive 63.5% share. This leadership is attributed to their affordability, ease of availability, and the ability to provide consistent performance in various cosmetic formulations.

Synthetic ingredients are widely used across skincare, haircare, and personal care products due to their stability and versatility, ensuring their continued prominence in the market.

Natural cosmetic ingredients accounted for a significant 36.5% share of the market in 2023. This segment is witnessing robust growth, fueled by the increasing consumer demand for eco-conscious and organic beauty solutions.

The shift towards clean beauty and sustainable practices is encouraging manufacturers to integrate more plant-based and natural elements into their product offerings, positioning this segment as a key growth driver in the years ahead.

By Product Analysis

Surfactants Dominating the Cosmetic Ingredients Market with 21.4% Share in 2023

In 2023, Surfactants held a dominant position in the Cosmetic Ingredients Market, capturing over 21.4% market share. These compounds are pivotal in formulations for their role in cleansing, foaming, and emulsification, driving their extensive usage in shampoos, facial cleansers, and other personal care products.

Their multifunctional properties and growing demand for advanced cleansing solutions cement their leadership in the segment.

Emollients accounted for approximately 17.4% market share in 2023, marking their significance in the market. Known for their ability to provide hydration, smoothness, and barrier repair to the skin, emollients are extensively used in moisturizers, creams, and anti-aging formulations, driven by increasing consumer demand for skincare solutions.

Polymers secured a 11.3% market share in 2023, owing to their versatility in creating texture, enhancing product stability, and delivering controlled release of active ingredients. Their application spans across hair styling products, gels, and skin care formulations, reflecting their indispensable role in modern cosmetic formulations.

The oleo-chemical segment garnered a 8.2% share in 2023, leveraging the push for sustainable and bio-based ingredients. Derived from natural oils and fats, these ingredients are widely used in soaps, creams, and other cosmetic formulations, aligning with the market’s sustainability trends.

With a 9.6% market share in 2023, botanical extracts have become a favorite among consumers seeking natural and plant-based cosmetic solutions. From antioxidants to anti-inflammatory properties, these ingredients enrich formulations across skincare and hair care segments, meeting the growing demand for clean beauty products.

Rheology modifiers accounted for a 5.1% market share in 2023, underlining their importance in enhancing the texture and stability of cosmetic products. From gels to creams, these ingredients ensure the desired consistency, making them integral to formulation science.

Preservatives retained a 8.2% share of the cosmetic ingredients market in 2023, playing a critical role in extending the shelf life of products. Their importance remains strong despite challenges surrounding consumer preferences for “preservative-free” claims, as they ensure product safety and efficacy.

With a 5.6% share in 2023, antioxidants emerged as essential ingredients due to their ability to protect formulations and skin from oxidative stress. Their inclusion in anti-aging and protective cosmetic products continues to drive their demand.

The emulsifier and stabilizer segment accounted for 7.9% market share in 2023, vital for maintaining product integrity by preventing ingredient separation. Their role in both water-in-oil and oil-in-water formulations ensures consistent product performance.

The others category, including niche and emerging ingredients, captured a modest 5.3% market share in 2023. These components serve specialized functions and represent opportunities for innovation in the evolving cosmetic industry.

By Functionality Analysis

Cleansing Agents & Foamers Lead the Cosmetic Ingredients Market with 32.5% Share in 2023

In 2023, Cleansing Agents & Foamers emerged as the largest segment by functionality in the global cosmetic ingredients market, holding a commanding 32.5% market share. This dominance is attributed to their integral role in personal care formulations such as facial cleansers, shampoos, and body washes.

The increased focus on hygiene, coupled with the demand for sulfate-free and mild surfactants, has bolstered this segment’s growth. Moisturizing Ingredients, contributing to 27.2% of the market, represent the second-largest segment.

The growth in this category is fueled by a rising consumer focus on skincare routines, particularly in regions with harsh climatic conditions, and the adoption of ingredients such as hyaluronic acid, glycerin, and ceramides for hydration-focused products.

Specialty Ingredients, with an 18.7% share, cater to advanced formulations for anti-aging, brightening, and other targeted skincare applications. The increasing preference for premium products with scientifically proven efficacy has propelled this segment’s prominence. Ingredients like peptides, antioxidants, and bioactives are key contributors to this category.

Aroma Ingredients held a 9.4% market share, driven by the enhanced appeal of cosmetics through unique and long-lasting fragrances. The inclusion of natural essential oils and the growing trend of aromatherapy-based cosmetics are key factors supporting this segment.

The Others category, comprising 12.2% of the market, includes multifunctional ingredients such as preservatives, emulsifiers, and colorants. This category is witnessing significant innovation, with the focus shifting toward eco-friendly and sustainable alternatives to meet regulatory and consumer demands.

By End Use Analysis

Skin Care Dominating the Cosmetic Ingredients Market with a 46.2% Share

In 2023, Skin Care held a dominant position in the global cosmetic ingredients market, capturing over 46.2% market share by end use. This segment’s prominence is driven by growing consumer demand for anti-aging products, moisturizers, and sun protection solutions, fueled by heightened awareness of skin health and a surge in premium product launches.

The inclusion of advanced active ingredients such as peptides, ceramides, and hyaluronic acid continues to propel growth in this category. Oral Care accounted for a significant share of the cosmetic ingredients market, driven by an increasing focus on oral hygiene and aesthetics.

The segment’s growth is underpinned by consumer preferences for whitening, sensitivity-reducing, and anti-bacterial formulations. Innovations in functional ingredients, such as fluoride alternatives and bioactive compounds, have further strengthened its market presence.

The Hair Care segment has been witnessing steady growth, supported by rising consumer interest in scalp care and damage-repair formulations. This category benefits from the incorporation of novel ingredients, including plant-based actives, biotin, and silicone alternatives, which address key concerns like hair loss, frizz, and pollution damage. Its robust position highlights the evolving needs of health-conscious consumers.

Body Care remains a niche segment but has shown consistent growth as consumers increasingly prioritize holistic skincare routines. The adoption of moisturizing, firming, and exfoliating ingredients in body care formulations is driving the demand. The trend of clean and sustainable products is further boosting the appeal of this segment, particularly among eco-conscious demographics.

Key Market Segments

By Ingredient Type

- Synthetic

- Natural

By Product Type

- Surfactant

- Emollient

- Polymer

- Oleo-chemical

- Botanical Extract

- Rheology Modifier

- Preservatives

- Antioxidant

- Emulsifier & Stabilizer

- Others

By Functionality

- Cleansing Agents & Foamers

- Aroma

- Moisturizing

- Specialty

- Others

By End Use

- Skin Care

- Oral Care

- Hair Care

- Body Care

Driver

Rising Consumer Demand for Natural and Organic Ingredients

The global cosmetic ingredients market is experiencing significant growth, primarily driven by an escalating consumer preference for natural and organic components. This shift is fueled by heightened awareness of potential adverse effects associated with synthetic chemicals and a broader movement towards health-conscious and environmentally sustainable lifestyles.

Consumers are increasingly scrutinizing product labels, seeking transparency and authenticity in the ingredients used. This trend has compelled manufacturers to reformulate products, incorporating plant-based extracts, essential oils, and bioactive compounds that align with the clean beauty movement.

The demand for such natural ingredients is not only a response to health concerns but also reflects a desire for products that are perceived as safer and more environmentally friendly.

This consumer-driven demand has a profound impact on the cosmetic ingredients market. Manufacturers are investing heavily in research and development to source and integrate natural ingredients without compromising product efficacy. This includes exploring sustainable sourcing methods and developing innovative extraction techniques to maintain the potency of natural compounds.

Additionally, the market is witnessing a surge in certifications and standards that validate the authenticity of natural and organic claims, further influencing purchasing decisions. The emphasis on natural ingredients is also leading to collaborations between cosmetic companies and agricultural sectors to ensure a steady supply of high-quality raw materials.

Overall, the consumer inclination towards natural and organic ingredients is a pivotal driver, reshaping product development strategies and propelling growth in the cosmetic ingredients market.

Restraint

Stringent Regulatory Frameworks and Compliance Challenges

The cosmetic ingredients market faces significant challenges due to stringent regulatory frameworks imposed by health and safety authorities worldwide. These regulations are designed to ensure consumer safety by controlling the use of certain chemicals and mandating rigorous testing protocols.

Compliance with such regulations often requires substantial investment in research and development, as well as modifications to existing formulations to meet safety standards.

For instance, recent restrictions on specific compounds have necessitated reformulations, leading to increased production costs and potential delays in product launches. These regulatory hurdles can impede market growth by limiting the availability of certain ingredients and increasing the complexity of bringing new products to market.

Moreover, the global nature of the cosmetic industry means that companies must navigate a complex web of regulations that vary by region. This necessitates a comprehensive understanding of international compliance requirements, adding to the operational burden.

Non-compliance can result in severe penalties, product recalls, and damage to brand reputation, further emphasizing the importance of adherence to regulatory standards.

Additionally, the dynamic nature of regulations, with frequent updates and amendments, requires companies to remain vigilant and adaptable. While these regulations are essential for ensuring consumer safety and product efficacy, they present a significant restraint on the cosmetic ingredients market by increasing operational costs and complicating the product development process.

Opportunity

Technological Advancements in Ingredient Development

Technological advancements present a substantial opportunity for growth in the cosmetic ingredients market. Innovations in biotechnology, nanotechnology, and green chemistry are enabling the development of novel ingredients with enhanced efficacy and safety profiles.

For example, biotechnology allows for the sustainable production of bioactive compounds through fermentation processes, reducing reliance on traditional extraction methods that may be resource-intensive.

Nanotechnology facilitates the creation of ingredients with improved delivery systems, enhancing the penetration and effectiveness of active compounds in cosmetic formulations. These technological innovations not only improve product performance but also align with consumer demands for sustainability and efficacy.

Furthermore, advancements in analytical techniques and computational modeling are accelerating the discovery and optimization of new cosmetic ingredients.

High-throughput screening methods enable rapid assessment of ingredient safety and functionality, while computational models predict the behavior of compounds in formulations, streamlining the development process. These technologies reduce time-to-market and allow for more targeted and effective product development.

Companies that leverage these technological advancements can gain a competitive edge by offering innovative products that meet evolving consumer preferences. Overall, embracing technological innovation is a key opportunity for stakeholders in the cosmetic ingredients market to drive growth and differentiation.

Trends

Emphasis on Sustainability and Ethical Sourcing

A prominent trend shaping the cosmetic ingredients market is the increasing emphasis on sustainability and ethical sourcing. Consumers are becoming more environmentally conscious, seeking products that not only deliver desired results but also align with their values regarding environmental stewardship and social responsibility.

This has led to a surge in demand for ingredients that are sustainably sourced, biodegradable, and produced through eco-friendly processes. Companies are responding by adopting sustainable practices, such as utilizing renewable resources, reducing carbon footprints, and ensuring fair labor practices in their supply chains.

This trend is driving innovation in the development of green chemistry solutions and the upcycling of waste materials into valuable cosmetic ingredients.

The focus on sustainability is also influencing packaging choices, with a shift towards recyclable and minimalistic designs that reduce environmental impact. Certifications and labels indicating sustainable and ethical practices are becoming important marketing tools, as consumers seek transparency and accountability from brands.

This trend not only caters to consumer preferences but also anticipates regulatory pressures as governments implement stricter environmental regulations. Companies that proactively adopt sustainable practices are likely to gain a competitive advantage, fostering brand loyalty and opening new market opportunities.

In summary, the emphasis on sustainability and ethical sourcing is a significant trend that is reshaping the cosmetic ingredients market, driving innovation, and influencing consumer purchasing decisions.

Regional Analysis

Europe Leads the Cosmetic Ingredients Market with the Largest Market Share of 37.2%

The global cosmetic ingredients market exhibits distinct regional dynamics, shaped by varying consumer demands, regulatory frameworks, and industrial advancements. Europe, the frontrunner in this market, accounted for a significant 37.2% share in 2023, with a valuation of approximately USD 777.3 million.

This stronghold is attributed to the region’s robust regulatory standards under frameworks like REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and the EU Cosmetics Regulation, which encourage the development of high-quality and sustainable ingredients.

Key markets within Europe, including Germany, France, and the UK, house some of the world’s leading cosmetic brands and R&D facilities, further solidifying the region’s dominance.

North America, holding the second-largest share, benefits from a mature cosmetics industry and increasing consumer demand for premium and multifunctional products. The U.S., a major contributor to the regional market, emphasizes the use of clean and natural ingredients, driven by growing awareness of environmental and health impacts.

According to Zippia, the U.S. cosmetics industry generates approximately $49.2 billion in annual sales, driven by growing consumer demand for innovative and sustainable cosmetic ingredients. On average, Americans spend between $244 and $313 monthly on cosmetics, with American women outspending men by 22%, at $3,756 annually compared to $2,928. The U.S. beauty and personal care market is valued at $91.4 billion, representing 22% of the global cosmetics industry.

Notably, African American shoppers contribute significantly, accounting for 86% of the ethnic beauty market and spending $1.2 trillion annually, a figure projected to rise to $1.5 trillion. With 27% of young women never leaving home without makeup, the demand for high-performing, sustainable, and inclusive cosmetic ingredients continues to drive market growth. This highlights a growing opportunity for innovation aligned with consumer preferences for quality and diversity in product offerings.

Meanwhile, the Asia-Pacific region, with a projected CAGR surpassing 6.5% during the forecast period, is rapidly expanding. Countries like China, Japan, South Korea, and India are experiencing surging demand for personal care products, fueled by rising disposable incomes and an increasing focus on grooming and wellness. The region also serves as a global manufacturing hub for cost-effective production, enabling competitive pricing.

The Middle East & Africa and Latin America, though smaller in size, are experiencing steady growth. Brazil dominates the Latin American market, driven by its vibrant beauty and personal care industry.

In the Middle East & Africa, markets such as the UAE and South Africa are witnessing growing adoption of innovative formulations, particularly halal-certified and natural ingredient-based products.

Europe’s leadership in innovation, sustainability, and regulatory compliance underscores its commanding presence in the global cosmetic ingredients market, positioning it as a benchmark for other regions to emulate.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global cosmetic ingredients market in 2024 is poised for robust growth, driven by consumer demand for sustainable, multifunctional, and clean-label products. Leading players such as Clariant AG and Croda International PLC are expected to play a pivotal role in the transition toward natural and bio-based ingredients, leveraging their R&D capabilities to address growing eco-consciousness.

Clariant AG, for instance, is likely to expand its focus on active ingredients that align with the clean beauty trend, while Croda continues to innovate in botanical extracts and green chemistry.

BASF SE and Dow Chemical Company remain dominant in the delivery of multifunctional formulations, excelling in surfactants and emulsifiers essential for high-performance cosmetic applications. Their expertise in polymer science and material innovation ensures a competitive edge in both premium and mass-market segments.

Similarly, Solvay S.A. and Eastman Chemical Company are emphasizing sustainable solutions, such as biodegradable solvents and bioengineered polymers, to meet stringent regulatory requirements and consumer expectations.

In the personal care space, Estee Lauder Companies is advancing its partnerships with ingredient suppliers to integrate cutting-edge actives into its formulations, particularly for anti-aging and hydration-focused products. Ashland Global Specialty Chemicals and Lonza Group Ltd. are leveraging their capabilities in functional ingredients like film-formers and preservatives to enhance product shelf-life and stability.

Lastly, Wacker Chemie AG continues to expand its silicone-based innovations, delivering textures and sensory enhancements crucial for premium cosmetics. Collectively, these players are shaping the industry’s innovation trajectory, with a strategic emphasis on sustainability, performance, and regulatory compliance.

Top Key Players in the Market

- Clariant AG

- Solvay S.A.

- BASF SE

- Dow Chemical Company

- Eastman Chemical Company

- Croda International PLC

- Estee Lauder Company

- Ashland Global Specialty Chemicals

- Lonza Group Ltd.

- Wacker Chemie AG

Recent Developments

- In 2024 L’Oréal Groupe acquires a 10% stake in Galderma, a global leader in dermatology and injectable aesthetics. The shares were purchased from Sunshine SwissCo AG, a consortium including EQT, ADIA, and Auba Investment Pte. Ltd., for an undisclosed amount.

- In 2024 Clariant completes the acquisition of Lucas Meyer Cosmetics, a leading supplier of premium cosmetic ingredients, for an enterprise value of USD 810 million. The deal strengthens Clariant’s focus on sustainable and high-value solutions in the personal care sector.

- In 2023 Givaudan announces the acquisition of key cosmetic ingredients from Amyris, including Neossance® Squalane, Neossance® Hemisqualane, and CleanScreen™, to expand its sustainable beauty portfolio.

- In 2023 Debut, a synthetic biology company specializing in advanced beauty ingredients, raises $34 million in Series B funding led by L’Oréal’s BOLD venture fund to accelerate innovation in high-performing active ingredients

Report Scope

Report Features Description Market Value (2023) USD 2,089.7 Million Forecast Revenue (2033) USD 3,603.5 Million CAGR (2024-2033) 5.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Ingredient Type (Synthetic, Natural), By Product Type (Surfactant, Emollient, Polymer, Oleo-chemical, Botanical Extract, Rheology Modifier, Preservatives, Antioxidant, Emulsifier & Stabilizer, Others), By Functionality (Cleansing Agents & Foamers, Aroma, Moisturizing, Specialty, Others), By End Use (Skin Care, Oral Care, Hair Care, Body Care) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Clariant AG, Solvay S.A., BASF SE, Dow Chemical Company, Eastman Chemical Company, Croda International PLC, Estee Lauder Company, Ashland Global Specialty Chemicals, Lonza Group Ltd., Wacker Chemie AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cosmetic Ingredients MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Cosmetic Ingredients MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Clariant AG

- Solvay S.A.

- BASF SE

- Dow Chemical Company

- Eastman Chemical Company

- Croda International PLC

- Estee Lauder Company

- Ashland Global Specialty Chemicals

- Lonza Group Ltd.

- Wacker Chemie AG