Global Halal Cosmetics Market By Product Type (Personal Care Products, Color Cosmetics, Fragrances), By Application (Skin Care, Face Care, Hair Care, Beauty Care), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135150

- Number of Pages: 381

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

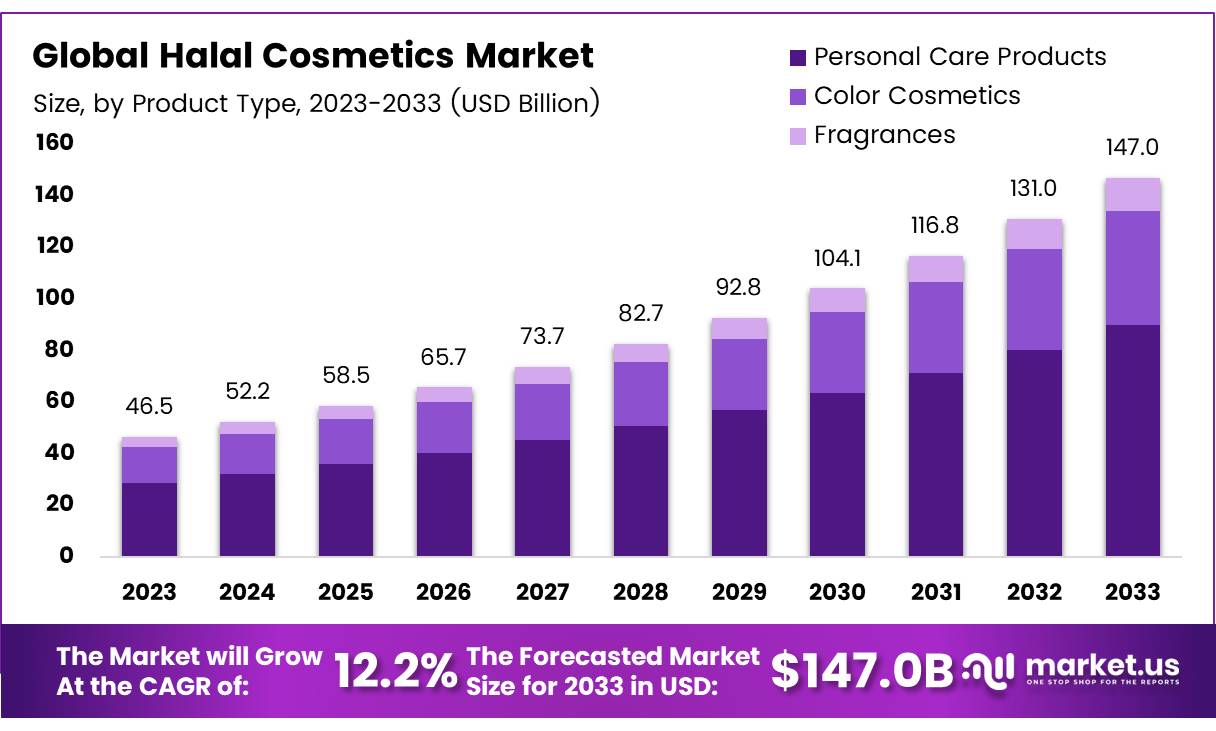

The Global Halal Cosmetics Market size is expected to be worth around USD 147.0 Billion by 2033, from USD 46.5 Billion in 2023, growing at a CAGR of 12.2% during the forecast period from 2024 to 2033.

Halal cosmetics refer to beauty and personal care products that comply with Islamic law (Sharia). These products must be free from ingredients prohibited in Islam, such as alcohol, animal-derived substances, and harmful chemicals. They also need to be produced and processed in facilities that adhere to Islamic ethical standards, ensuring that no cross-contamination occurs with non-halal items.

Halal-certified cosmetics provide Muslim consumers with a reliable alternative that aligns with their religious beliefs and ethical considerations while maintaining high standards of quality and performance.

The certification is typically verified by reputable organizations that assess the products’ ingredients, sourcing, and production processes. As a result, Halal cosmetics offer an important niche within the broader beauty industry, catering to the growing demand for ethical and clean beauty products.

The global Halal cosmetics market refers to the sector of the beauty and personal care industry dedicated to producing and selling products that are Halal-certified.

This market has experienced significant growth due to the increasing Muslim population, rising consumer awareness of ethical products, and growing demand for natural and safe alternatives in cosmetics. The market spans skincare, hair care, cosmetics, and fragrances, with skincare being the most profitable segment.

According to Statistics, skincare products alone accounted for about 12.3 billion U.S. dollars in 2023, with revenues for the entire halal cosmetics market exceeding six billion U.S. dollars as of the same year.

It is projected that this market will more than double by 2032, underscoring its strong growth trajectory. Notably, Halal-certified products are not only attractive to Muslim consumers but are also gaining popularity among non-Muslim buyers who are increasingly inclined towards ethical and natural beauty solutions.

The growth of the Halal cosmetics market can be attributed to multiple factors, including the rising awareness of ethical consumption, increasing consumer demand for natural and safe products, and the expanding Muslim middle class globally. In 2022, Muslim consumers spent approximately 84 billion U.S. dollars on cosmetics, marking a noticeable increase from the previous year.

With a large proportion of the Muslim population in regions such as Southeast Asia, the Middle East, and parts of Europe, Halal cosmetics are in high demand. In particular, Indonesia has emerged as a key market, where over 50% of consumers surveyed in March 2023 reported purchasing halal body and face care products.

Opportunities in the Halal cosmetics market extend beyond Islamic consumers, as a growing number of non-Muslim consumers are also attracted to the clean, ethical, and cruelty-free nature of these products.

Furthermore, governments in Muslim-majority countries are investing in this sector, providing incentives for the development of Halal-certified beauty products. Regulatory frameworks for Halal cosmetics are becoming more standardized, with authorities in countries like Malaysia, the UAE, and Indonesia actively promoting Halal certification for cosmetics to ensure the integrity of the products and protect consumers.

The potential for continued growth is significant. With consumer loyalty being another strong driver, Halal consumers tend to be 35% more loyal to Halal-certified brands compared to the average consumer, as reported by the Halal Foundation.

Additionally, Halal cosmetic brands are increasingly seen as premium products that meet consumer expectations for quality and ethical standards. The market’s future is bright, particularly with government support and continued innovation in Halal-certified products.

According to Statistics, the Halal cosmetics market is poised for continued expansion. In 2022, Muslim consumers worldwide spent around 84 billion U.S. dollars on cosmetics, a growth from the previous year. As of 2023, the Halal cosmetics segment generated over six billion U.S. dollars in revenue.

The skincare segment, which is the most profitable in the Halal beauty industry, accounted for 12.3 billion U.S. dollars in global revenues. It is projected that the overall Halal cosmetics market will more than double by 2032, reflecting the growing demand for such products. Furthermore, Halal consumers demonstrate a 35% higher loyalty to Halal-certified brands, offering a solid foundation for market growth and long-term brand success.

Key Takeaways

- The Global Halal Cosmetics Market is projected to reach USD 147.0 billion by 2033, growing at a CAGR of 12.2% from 2024 to 2033.

- In 2023, Personal Care Products dominated the market by product type due to growing consumer awareness of Halal-certified and ethical products.

- The Skin Care segment accounted for a 34.5% share in the application analysis, driven by demand for ethical and religiously compliant products.

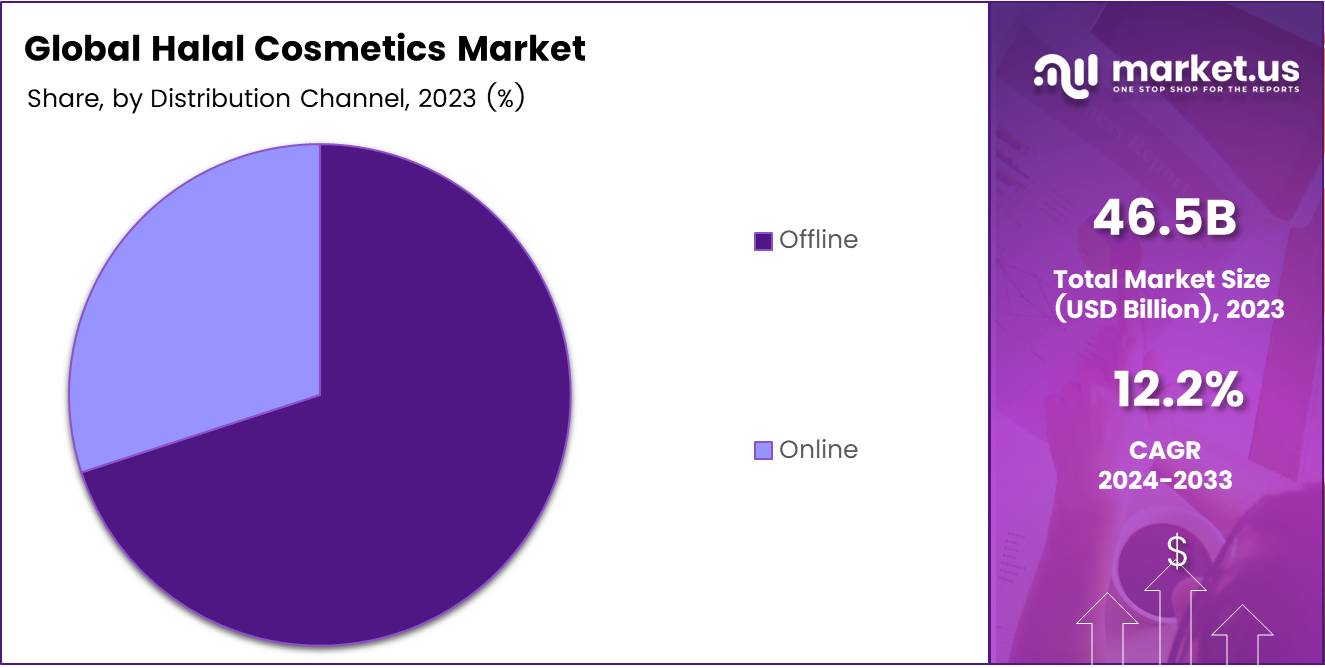

- Offline distribution channels held a dominant position in 2023, with traditional retail outlets like supermarkets and specialty stores leading the sales.

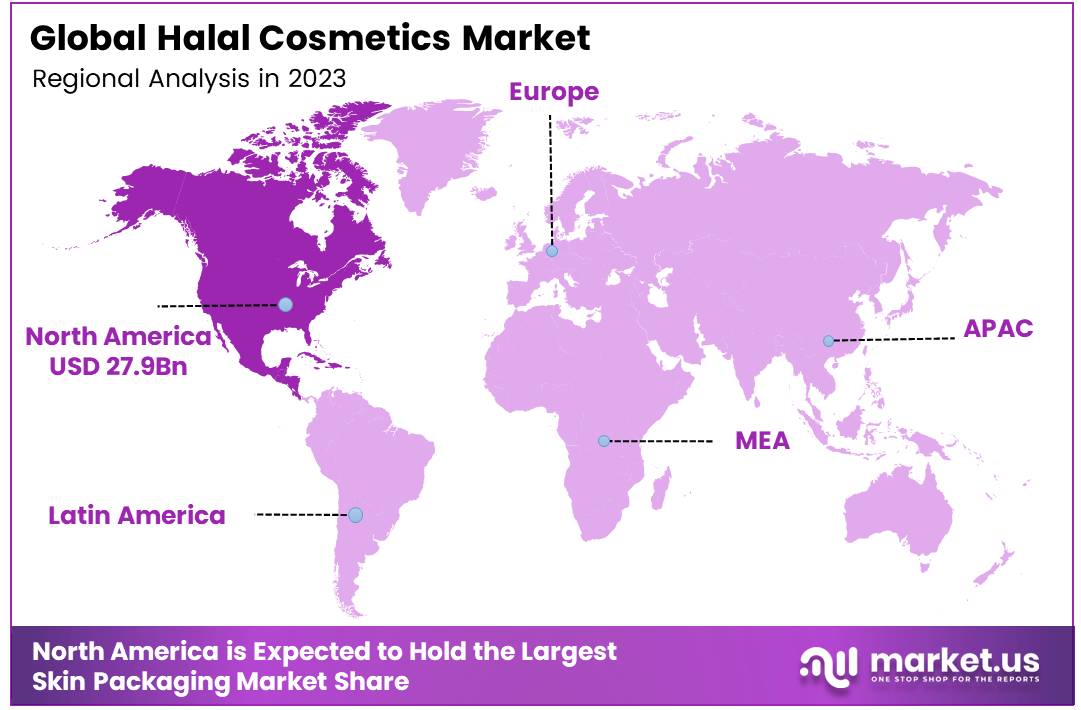

- North America led the market regionally in 2023, representing 60% of the global market share, valued at USD 27.9 billion.

Product Type Analysis

Personal Care Products Dominated the Halal Cosmetics Market in 2023, Driven by Growing Demand for Ethical and Halal-Certified Solutions

In 2023, Personal Care Products held a dominant market position in the By Product Type segment of the Halal Cosmetics Market. This category includes skincare, haircare, and body care products, all formulated to adhere to Halal standards.

The segment’s growth is driven by increasing consumer awareness of ethical and Halal-certified products. As more consumers seek beauty solutions that align with their values, the demand for personal care products has surged, strengthening its leading market position.

Color Cosmetics also represent a significant part of the market, with products like makeup gaining traction, especially among younger, beauty-conscious consumers. This segment is benefiting from trends toward inclusivity and the desire for products that are both high-quality and ethically produced.

Meanwhile, Fragrances continue to grow, with an emphasis on alcohol-free and naturally derived options. Consumers are increasingly drawn to Halal-certified perfumes, as they seek alternatives that align with both personal and religious preferences.

The Halal Cosmetics Market is thus evolving, with personal care products maintaining the largest share while color cosmetics and fragrances continue to expand in response to consumer demand.

Application Analysis

Skin Care Leads Halal Cosmetics Market with 34.5% Share in 2023 Driven by Increasing Demand for Ethical and Natural Products

In 2023, Skin Care held a dominant market position in the By Application Analysis segment of the Halal Cosmetics Market, with a 34.5% share. The widespread consumer demand for products that align with both ethical and religious guidelines has significantly fueled the growth of this category.

Skin care products, including moisturizers, cleansers, and anti-aging formulations, are increasingly sought after due to their compatibility with halal certification standards. Consumers are becoming more conscious of the ingredients used in their skincare routines, leading to a preference for natural, alcohol-free, and cruelty-free products.

Face Care followed closely in market share, accounting for a significant portion of the halal skincare segment. Products like halal-certified foundations, sunscreens, and serums have gained traction among both Muslim and non-Muslim consumers due to their inclusivity and ethical production methods.

Hair Care and Beauty Care segments, while experiencing steady growth, collectively hold a smaller share compared to skin care and face care products. As halal cosmetics continue to gain prominence, the demand for ethically produced beauty products in diverse categories is expected to further expand, with skin care maintaining its lead in the coming years.

Distribution Channel Analysis

In 2023, Offline Channels Captured the Largest Share of the Halal Cosmetics Market Due to Consumer Trust and In-Store Experience

In 2023, Offline distribution channels held a dominant market position in the By Distribution Channel Analysis segment of the Halal Cosmetics market. This segment accounted for a significant share, with traditional retail outlets such as supermarkets, specialty stores, and dedicated halal cosmetic shops playing a crucial role in consumer purchases.

The preference for offline purchasing can be attributed to the ability to physically assess product quality, availability, and the growing trust in retail outlets that cater to halal-certified goods. Additionally, cultural and regional factors further supported the prominence of offline channels, particularly in regions with established halal-conscious consumer bases, such as the Middle East, Southeast Asia, and parts of Europe.

Conversely, the Online distribution channel is experiencing robust growth, driven by the increasing convenience of e-commerce, availability of a wider product range, and the growing influence of social media marketing. Online retail platforms and direct-to-consumer models are attracting a broader audience, especially among younger, tech-savvy consumers.

As internet penetration and digital literacy continue to rise globally, the online segment is expected to capture an increasing share of the market, though offline channels are likely to retain a significant presence in the coming years due to established consumer trust and local retail dynamics.

Key Market Segments

By Product Type

- Personal Care Products

- Color Cosmetics

- Fragrances

By Application

- Skin Care

- Face Care

- Hair Care

- Beauty Care

By Distribution Channel

- Offline

- Online

Drivers

Increasing Demand for Halal Cosmetics Driven by Population Growth and Rising Health Consciousness

The increasing global Muslim population is a major factor driving the demand for halal-certified cosmetics. As the number of Muslims grows, particularly in regions like the Middle East, Southeast Asia, and parts of Europe, the need for products that align with religious and cultural beliefs has significantly risen. Halal cosmetics, which are free from alcohol and animal-derived ingredients, cater specifically to this demand.

Additionally, rising awareness about the ethical and cultural standards associated with halal products has further accelerated market growth. Consumers are becoming more informed about what goes into their cosmetics, seeking products that not only meet religious criteria but are also produced responsibly.

Alongside this, there is a growing focus on health and safety, with halal cosmetics being perceived as healthier options due to their use of natural ingredients and adherence to stringent regulations.

These products are considered safer for the skin, as they are free from harmful chemicals commonly found in conventional cosmetics. The demand is further fueled by consumers’ increasing preference for products that support their overall well-being, reflecting a wider trend towards natural and clean beauty products.

As a result, halal cosmetics are not only seen as a religious choice but also as a premium option for health-conscious consumers. Thus, these drivers collectively contribute to the continued expansion of the halal cosmetics market globally.

Restraints

Challenges in the Halal Cosmetics Market Due to Price and Awareness Factors

One of the key restraints in the halal cosmetics market is limited awareness in non-Muslim regions. In areas where the Muslim population is low, consumers may be less familiar with the concept of halal certification, which could slow the growth of demand. This lack of awareness can result in reluctance or hesitation among potential customers to explore or switch to halal-certified products.

Another significant challenge is the higher price point of halal cosmetics. Halal certification involves rigorous processes and adherence to strict ethical and religious standards, which can increase production and certification costs. These higher expenses often translate into retail prices that are significantly more expensive than non-halal alternatives.

As a result, price-sensitive consumers might opt for non-halal products, limiting the market’s growth potential, especially in competitive regions. Consequently, these barriers could hinder the widespread adoption of halal cosmetics, particularly in non-Muslim markets where both awareness and affordability are key challenges.

Growth Factors

Expanding Halal Cosmetics Market by Embracing Ethical Values and Consumer Demand for Natural Products

The halal cosmetics market is poised for significant growth, driven by multiple factors. One of the most promising opportunities lies in expanding into non-Muslim markets, especially in regions like Europe and North America. These areas are witnessing an increasing demand for natural, ethical, and cruelty-free beauty products, which align with the core values of halal cosmetics.

Another key opportunity is the innovation of product lines, particularly the development of halal-certified skincare, haircare, and perfumes, which are still underrepresented in the market. As consumers seek more holistic, non-toxic, and ethically produced beauty products, halal cosmetics provide a compelling alternative.

Additionally, partnerships with major e-commerce platforms like Amazon and Alibaba offer an effective strategy for expanding reach, particularly to younger consumers who prefer the convenience of online shopping. This partnership allows brands to tap into global markets and scale quickly. Furthermore, increasing consumer awareness about the benefits of halal cosmetics is essential. Beyond religious significance, these products are increasingly recognized for their high-quality, natural ingredients, and ethical production processes, which resonate with a broader audience.

Educating consumers through targeted marketing campaigns and influencer collaborations will foster a deeper understanding of the halal cosmetics’ benefits, driving demand and expanding market opportunities. These combined factors position the halal cosmetics market for sustained growth and long-term success.

Emerging Trends

Halal Cosmetics Market Growth Driven by Values of Purity, Sustainability, and Inclusivity

The halal cosmetics market is experiencing rapid growth, driven by several key factors. Sustainability is becoming increasingly important, with brands shifting towards eco-friendly packaging solutions such as recyclable, biodegradable, and minimalistic designs. This movement aligns with the broader consumer demand for environmentally responsible products.

Additionally, social media platforms like Instagram, TikTok, and YouTube are significantly enhancing the visibility of halal cosmetics, making them more accessible to a global audience. These platforms play a crucial role in building consumer trust and promoting awareness.

The rise of the clean beauty movement is another important driver, as consumers are becoming more conscious of the ingredients in their beauty products. Halal cosmetics, which emphasize purity and safety, naturally appeal to this demand for toxin-free, transparent products.

Furthermore, the market is expanding to cater to men’s grooming needs, with halal-certified shaving products, skincare, and fragrances gaining traction. This demographic shift is contributing to the diversification of the halal cosmetics product range, creating new opportunities in both skincare and personal care segments. These factors, combined with the growing awareness of ethical consumerism and religious inclusivity, are expected to continue driving the halal cosmetics market’s growth.

Regional Analysis

North America Leads Halal Cosmetics Market with 60% Share Worth USD 27.9 Billion

The halal cosmetics market is witnessing notable regional growth, with distinct dynamics shaping its expansion across different parts of the world. North America remains the dominant region, accounting for approximately 60% of the global market share, valued at USD 27.9 billion.

This dominance can be attributed to the region’s growing Muslim population, increased awareness of halal certification, and rising consumer demand for products that align with ethical, sustainable, and cruelty-free beauty standards. North America’s multicultural landscape further supports the growth of halal cosmetics, particularly among both Muslim and non-Muslim consumers seeking high-quality, transparent products.

Regional Mentions:

In Europe, the halal cosmetics market is gaining momentum, particularly in countries like the UK, France, and Germany. The region is experiencing a steady growth trajectory, driven by a combination of increasing Muslim consumers and growing industry demand for inclusive, natural beauty solutions. The European market is also characterized by a rising number of beauty brands obtaining halal certification to meet the demand for ethically produced and religiously compliant products.

The Asia Pacific region, with its substantial Muslim populations in countries such as Indonesia, Malaysia, and India, plays a significant role in the market. This region is expected to continue expanding rapidly due to factors such as rising disposable income, an increase in halal-certified product offerings, and heightened consumer awareness about halal standards. The region’s expanding middle class and the increasing acceptance of halal cosmetics by non-Muslim consumers also contribute to its market growth.

In Middle East & Africa, the halal cosmetics market thrives, driven by cultural and religious factors. The market’s expansion in this region is bolstered by the widespread adoption of halal standards in beauty and skincare products, with both local and international brands meeting the demand for ethical, halal-certified options.

Latin America, though smaller in comparison, is witnessing increasing interest in halal cosmetics, especially in countries like Brazil, driven by growing consumer awareness and a rising Muslim population. The region’s halal market is expected to experience robust growth in the coming years.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global halal cosmetics market continues to grow rapidly, driven by rising consumer demand for ethical, sustainable, and religiously compliant products. Key players such as IBA Halal Care, Inika, Mena Cosmetics, and others are capitalizing on this trend by offering halal-certified products that cater to a diverse consumer base, including those in Muslim-majority countries and increasingly conscientious consumers in Western markets.

IBA Halal Care stands out for its comprehensive product line across skincare, haircare, and cosmetics, maintaining a strong presence in markets like India and the Middle East. Similarly, Inika, known for its premium, organic approach, focuses on eco-conscious consumers seeking halal certification in high-end beauty products, expanding its reach globally.

Mena Cosmetics and Brataco Group are notable for their strong regional positions in the Middle East and Southeast Asia, where halal beauty products are experiencing an uptick in demand due to growing awareness of halal standards in beauty and personal care. Companies like Clara International Beauty Group and Halal Cosmetics Company leverage their long-standing industry experience and innovation to cater to evolving beauty preferences in the halal sector.

PHB Ethical Beauty and Sampure Minerals focus on cruelty-free, vegan, and halal formulations, appealing to a broader spectrum of environmentally and ethically conscious consumers. Wardah Cosmetics and Amara Cosmetics, as established regional players, have successfully bridged the gap between traditional halal beauty products and modern skincare trends, further strengthening consumer loyalty.

Overall, these companies are not only fulfilling a niche market but are also shaping the future of the halal beauty industry through innovation, quality, and a commitment to ethical beauty standards.

Top Key Players in the Market

- IBA Halal Care

- Inika

- Mena Cosmetics

- Brataco Group of Companies

- Clara International Beauty Group

- Halal Cosmetics Company

- PHB Ethical Beauty

- Sampure Minerals

- Wardah Cosmetics

- Amara Cosmetics

Recent Developments

- In March 2024, Azelis enhanced its presence in the Asia Pacific region by acquiring PT Marga Dwi Kencana in Indonesia, marking a strategic move to expand its portfolio in the Southeast Asian market. This acquisition is expected to strengthen Azelis’ distribution capabilities and foster growth in the rapidly developing cosmetics sector in Indonesia.

- In September 2024, Believe Beauty announced a significant financing round led by HPDC, aimed at scaling its operations and accelerating product innovation. This partnership is expected to provide the brand with the necessary capital to expand its market presence and enhance its product offerings in the beauty industry.

- In October 2024, ClayCo Cosmetics secured an investment of USD 2 million from Unilever Ventures to support the growth and diversification of its premium skincare product range. This funding will enable ClayCo to expand its offerings and strengthen its position in the competitive high-end skincare market.

- In June 2024, RENÉE Cosmetics raised ₹100 crore in a Series B funding round, with the capital expected to fuel its growth and enhance brand visibility in the Indian market. This investment will also help RENÉE strengthen its product development and marketing efforts, catering to the growing demand for innovative beauty solutions.

Report Scope

Report Features Description Market Value (2023) USD 46.5 Billion Forecast Revenue (2033) USD 147.0 Billion CAGR (2024-2033) 12.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Personal Care Products, Color Cosmetics, Fragrances), By Application (Skin Care, Face Care, Hair Care, Beauty Care), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBA Halal Care, Inika, Mena Cosmetics, Brataco Group of Companies, Clara International Beauty Group, Halal Cosmetics Company, PHB Ethical Beauty, Sampure Minerals, Wardah Cosmetics , Amara Cosmetics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- IBA Halal Care

- Inika

- Mena Cosmetics

- Brataco Group of Companies

- Clara International Beauty Group

- Halal Cosmetics Company

- PHB Ethical Beauty

- Sampure Minerals

- Wardah Cosmetics

- Amara Cosmetics