Global Automotive Software Market Size, Share, Statistics Analysis Report By Software Type (Application Software, Middleware, Operating Systems (OS)), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Propulsion Type (ICE, EV), By Application (ADAS & Safety Systems, Infotainment & Connectivity, Navigation, Autonomous Driving, In-car Voice Assistance, Connectivity, Others, Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Mar 25

- Report ID: 142798

- Number of Pages: 238

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Scope

- Key Takeaways

- Analyst’s Review

- Key Statistics

- Regional Analysis

- By Software Type

- By Vehicle Type

- By Propulsion Type

- By Application

- Key Market Segments

- Driving Factor

- Restraining Factor

- Growth Opportunity

- Challenging Factor

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Recent Developments

- Report Scope

Report Scope

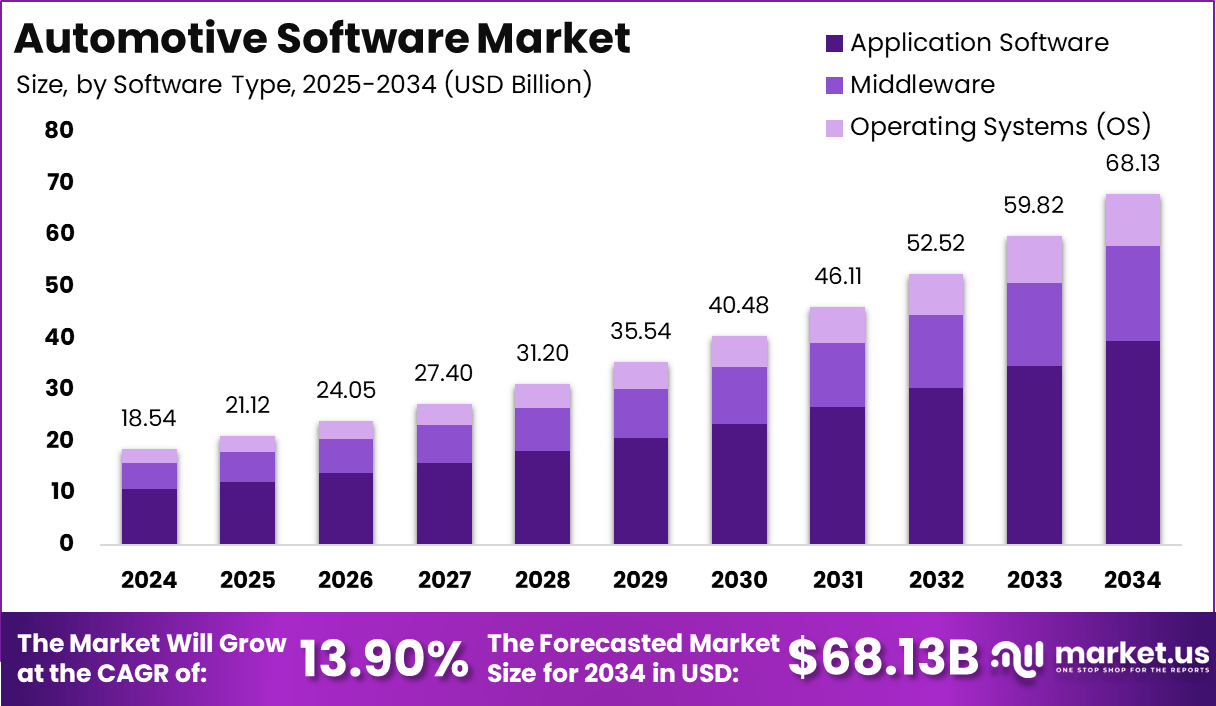

The Global Automotive Software Market is expected to be worth around USD 68.13 Billion by 2034, up from USD 18.54 Billion in 2024. It is expected to grow at a CAGR of 13.90% from 2025 to 2034.

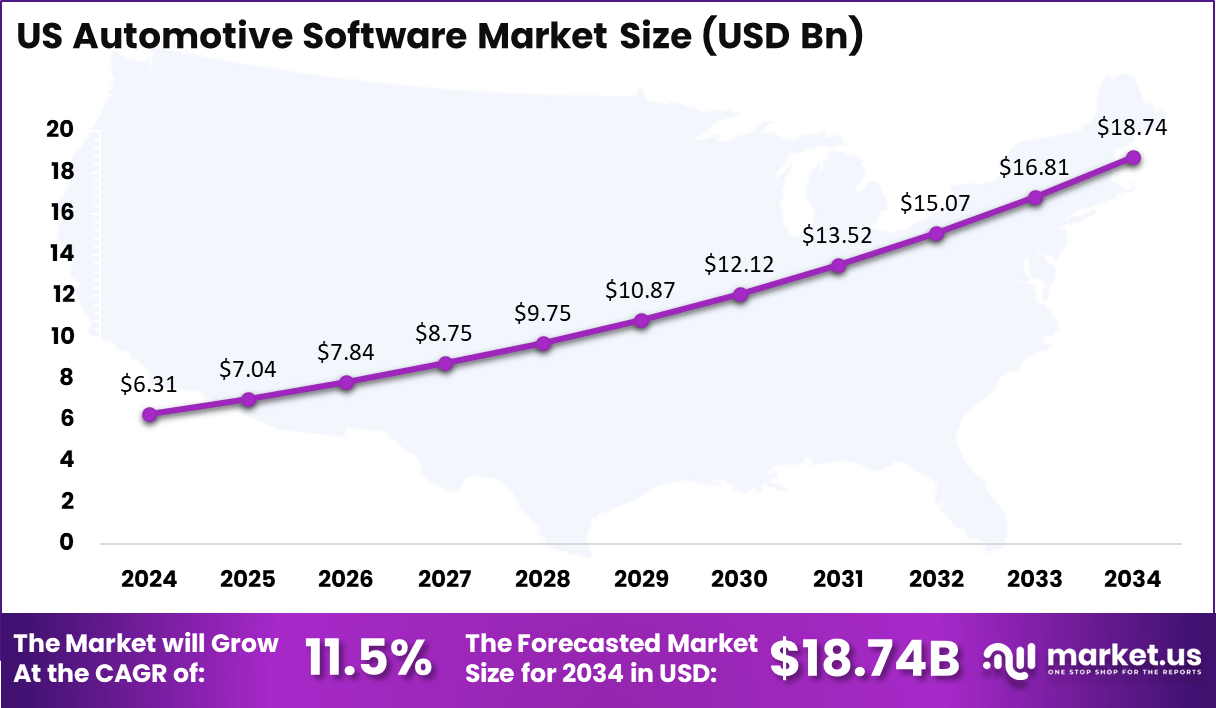

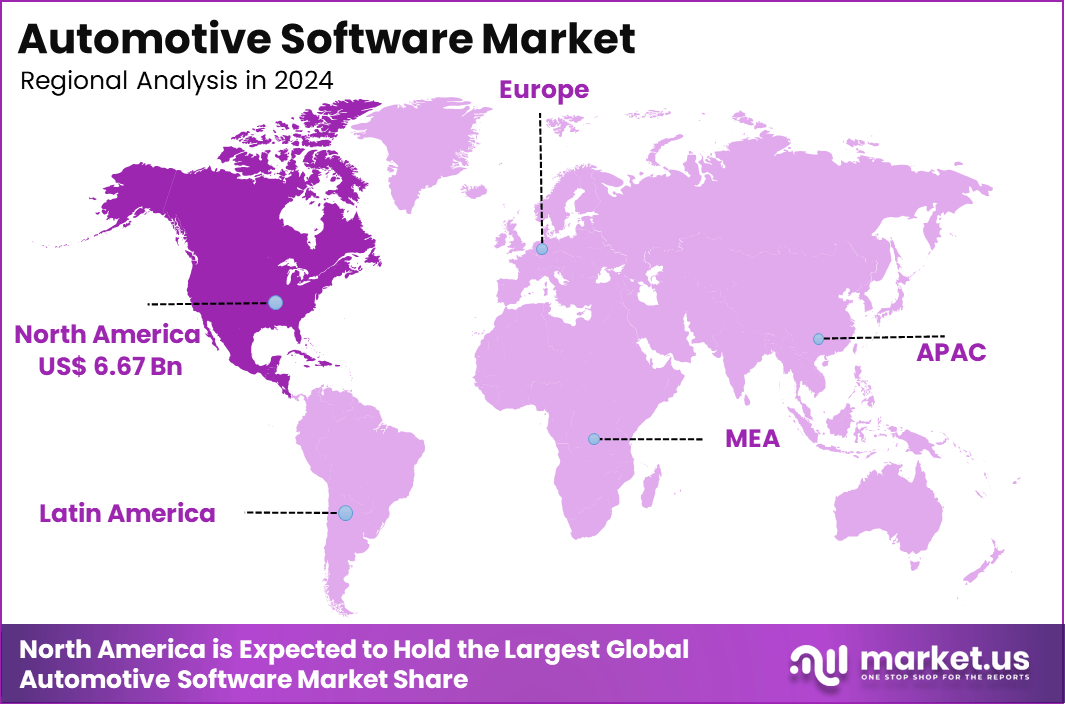

In 2024, North America held a dominant market position, capturing over a 36% share and earning USD 6.67 Billion in revenue. Further, the United States dominates the market by USD 6.31 Billion, steadily holding a strong position with a CAGR of 11.5%.

The automotive software market has become a crucial part of the automotive industry, driven by the increasing reliance on technology to improve vehicle functionality.

Modern vehicles now require sophisticated software systems to operate essential features like infotainment, navigation, advanced driver-assistance systems (ADAS), and vehicle-to-everything (V2X) communication. These software systems are vital for enhancing the driving experience, safety, and vehicle performance, making them a core component of modern automotive design.

Several factors are driving the growth of the automotive software market. One of the major drivers is the increasing demand for connected vehicles, which rely heavily on software to enable features like real-time navigation, telematics, and remote diagnostics.

Additionally, the push for autonomous vehicles has led to the need for advanced software solutions that enable vehicles to process data, make decisions, and interact with their surroundings. The adoption of electric vehicles (EVs) has also contributed to the growth of automotive software, as these vehicles require specialized software for battery management and energy optimization.

Key Takeaways

- Market Growth: The Automotive Software market is projected to grow from USD 18.54 billion in 2024 to USD 68.13 billion by 2034, reflecting substantial expansion with a CAGR of 13.90%.

- Software Type: Application Software holds the largest share of the market, accounting for 58%.

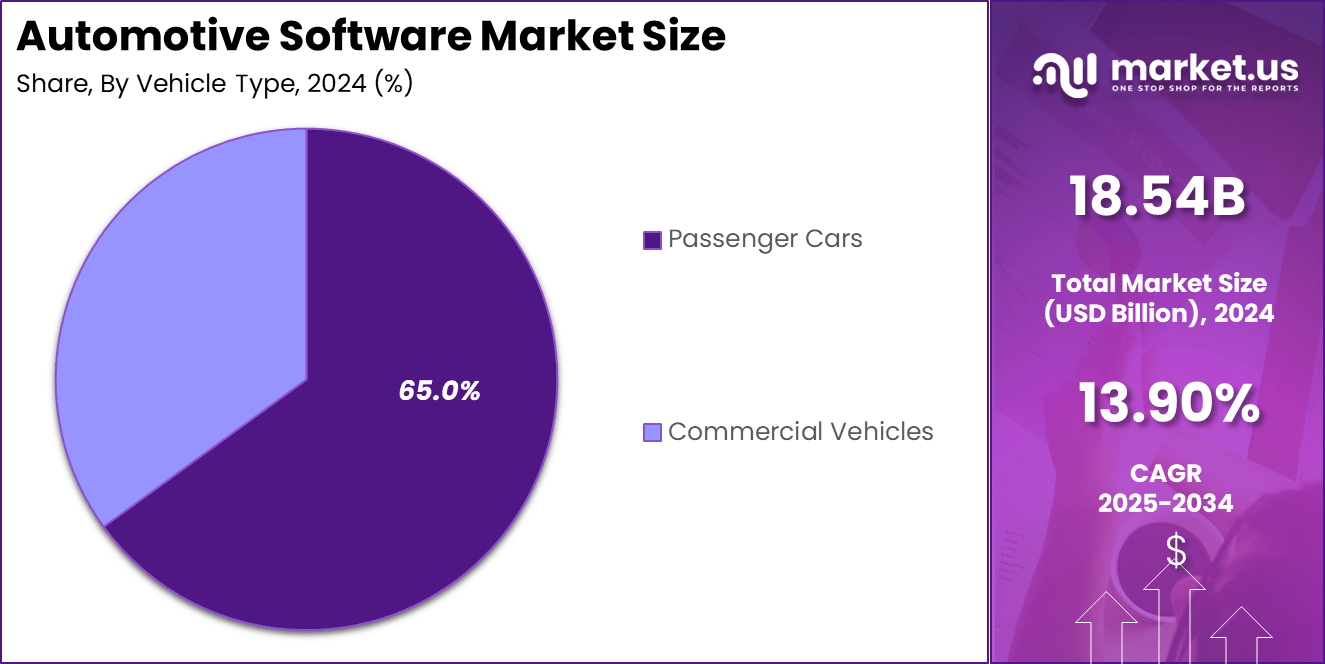

- Vehicle Type: Passenger Cars dominate the market, making up 65% of the total share.

- Propulsion Type: Internal Combustion Engine (ICE) Vehicles lead the market with 60% share.

- Application: Infotainment & Connectivity software represents 25% of the market.

- Regional Insights: North America holds a significant 36% market share, with the US contributing USD 6.31 billion.

- Regional Growth: The North American automotive software market is expected to grow at a CAGR of 11.5%.

Analyst’s Review

The demand for automotive software is being fueled by consumer expectations for more advanced, connected, and user-friendly vehicles. Drivers now expect their vehicles to offer seamless integration with smartphones, provide enhanced safety features, and improve overall driving comfort.

As automakers focus on offering vehicles with autonomous capabilities and integrated connectivity, software development plays a pivotal role in meeting these consumer needs. The need for software solutions in semi-autonomous vehicles, infotainment systems, and navigation tools is expected to continue driving demand in the coming years.

The automotive software market presents significant opportunities, particularly in the realm of autonomous vehicles, which require highly sophisticated software systems to enable self-driving capabilities. Another opportunity lies in the integration of 5G technology, which can enable faster data processing and improved vehicle-to-vehicle communication.

Furthermore, the rise of software-defined vehicles (SDVs) — where software plays an integral role in controlling vehicle functions — offers exciting possibilities for automakers to deliver personalized driving experiences and over-the-air software updates.

Technological advancements are transforming the automotive software landscape. The integration of artificial intelligence (AI) and machine learning (ML) is enabling vehicles to process large amounts of data, which is essential for features such as predictive maintenance, adaptive cruise control, and autonomous driving.

Additionally, the Internet of Things (IoT) is facilitating vehicle connectivity, allowing for features like remote diagnostics and vehicle-to-infrastructure communication. As cyber threats grow, advancements in cybersecurity are also becoming a priority, ensuring that vehicles remain secure from potential vulnerabilities and data breaches.

Key Statistics

General Overview

- Users: Automotive software is used by over 1.4 billion vehicle owners worldwide.

- Usage: The average vehicle contains about 100 million lines of code, with this number expected to increase to 300 million lines by 2026.

Key Applications

- Advanced Driver Assistance Systems (ADAS): Used in over 70% of new vehicles.

- Infotainment and Telematics: Installed in 85% of new vehicles.

- Powertrain Systems: Present in 95% of vehicles.

- Body Control and Comfort Systems: Found in 90% of vehicles.

- Vehicle-to-everything (V2X) Communication Systems: Expected to be in 30% of new vehicles by 2026.

Software Layers

- Operating Systems (OS): Over 50 different OS are used in vehicles.

- Middleware: Used in 80% of automotive software applications.

- Application Software: Accounts for 60% of the total automotive software market.

Connected Vehicles

- Quantity: By 2025, an estimated 2 billion connected vehicles will be on the roads globally.

- Penetration Rate: Connected vehicles are expected to account for 70% of all new vehicle sales by 2026.

Regional Analysis

United States Market Size

In North America, the United States dominates the market size by USD 6.31 billion, holding a strong position steadily with a robust CAGR of 11.5%. This growth is driven by increasing demand for advanced automotive technologies, including infotainment, connectivity, and autonomous driving features.

The country’s position is further strengthened by the rising adoption of connected vehicles, which rely heavily on sophisticated software to enable real-time communication, navigation, and safety features.

The automotive software market in the US is shaped by several key factors. The widespread use of passenger cars, particularly those equipped with advanced driver-assistance systems (ADAS) and infotainment solutions, continues to fuel demand for high-quality software. Additionally, the growing trend of electrification, along with advancements in electric vehicle (EV) technology, is creating new opportunities for automotive software solutions.

The US automotive sector’s commitment to innovation and investment in autonomous vehicles is also boosting the market. The integration of artificial intelligence, machine learning, and IoT technologies into vehicles is enhancing their functionality and driving software adoption.

These developments position the US as a leader in the automotive software market, ensuring sustained growth in the coming years. North America’s steady growth and technological advancements ensure that the US remains a key player in the global market.

North America Market Size

In 2024, North America held a dominant market position, capturing more than a 36% share, holding USD 6.67 billion in revenue. The region’s leadership can be attributed to the high demand for advanced automotive technologies, particularly in the United States, which leads in automotive innovation and adoption of connected vehicle solutions.

North America’s robust infrastructure for electric vehicles (EVs), coupled with the rapid growth of autonomous vehicle development, positions it as a key player in the automotive software sector. The region’s strategic investments in research and development, along with supportive government policies for clean energy and smart transportation, further boost the demand for automotive software solutions.

Europe follows closely behind, with a strong market presence driven by countries like Germany, France, and the UK, which are home to some of the world’s leading automotive manufacturers. Europe’s emphasis on vehicle electrification and sustainability, along with stringent regulatory standards regarding emissions and safety, fosters the demand for innovative software in automotive systems. The region is also witnessing a surge in electric and hybrid vehicle adoption, which in turn drives the need for specialized software solutions to optimize battery management and energy efficiency.

The Asia-Pacific (APAC) region is another significant market, experiencing rapid growth due to the expanding automotive industry in countries like China, Japan, and South Korea. China, in particular, is seeing a boom in electric vehicles and smart transportation initiatives, which creates a strong demand for automotive software. The high penetration of mobile devices and increasing urbanization in APAC also contribute to the growing demand for connected and autonomous vehicles.

Latin America, the Middle East, and Africa remain emerging markets for automotive software. While these regions lag behind North America, Europe, and APAC in terms of market size, there is a noticeable shift toward adopting advanced automotive technologies. As vehicle ownership grows and infrastructure develops, these regions are expected to witness gradual growth in automotive software demand, particularly as connectivity and vehicle safety become prioritized by governments and consumers alike.

By Software Type

In 2024, the Application Software segment held a dominant market position, capturing more than 58% of the share in the automotive software market. The primary reason for the leading position of application software lies in its essential role in enhancing the driving experience.

Application software encompasses a wide range of functions such as infotainment, navigation, advanced driver-assistance systems (ADAS), connectivity features, and telematics. These applications have become integral to modern vehicles, responding directly to the increasing consumer demand for smarter, more connected, and feature-rich driving experiences.

The growing preference for over-the-air (OTA) updates and cloud-based services further fuels the demand for application software. As automakers shift toward software-defined vehicles (SDVs), the need for application software that can be easily updated and customized over time becomes crucial.

Additionally, the rapid adoption of connected and autonomous vehicles increases the reliance on application software to ensure real-time data processing, communication, and security. Thus, the Application Software segment is poised to continue its leadership in the automotive software market, driven by these transformative trends and consumer expectations.

By Vehicle Type

In 2024, the Passenger Cars segment held a dominant market position, capturing more than 36% of the share in the automotive software market. This segment’s leadership can be attributed to the growing demand for advanced in-car technologies, such as infotainment systems, advanced driver-assistance systems (ADAS), and connectivity features.

As consumers increasingly prioritize comfort, safety, and convenience, the demand for software that enhances vehicle performance and offers seamless connectivity with smartphones and other devices has skyrocketed.

The rise of electric vehicles (EVs) and the push for autonomous driving further drive the need for sophisticated software solutions in passenger cars. These vehicles require high-performance software to manage complex systems such as battery management, energy optimization, and autonomous navigation.

The increasing adoption of connected and smart vehicles, coupled with the rising expectations for over-the-air (OTA) updates and personalized features, solidifies the Passenger Cars segment as the leader. With growing consumer preference for next-gen technologies, the segment is set to continue dominating the automotive software market for years to come.

By Propulsion Type

In 2024, the Internal Combustion Engine (ICE) Vehicles segment held a dominant market position, capturing more than 60% of the share in the automotive software market. This segment’s leadership is largely due to the established presence of ICE vehicles in the global automotive industry, which continues to represent the majority of vehicles on the road. ICE vehicles are equipped with a wide range of software solutions that enhance engine performance, fuel efficiency, emissions control, and overall vehicle safety.

Despite the growing shift toward electric vehicles (EVs), ICE vehicles still dominate due to their widespread adoption and longevity in both developed and emerging markets. The need for software to support advanced driver-assistance systems (ADAS), infotainment, and connectivity features further boosts the demand for automotive software in this segment.

Additionally, ongoing developments in hybrid vehicles, which combine both internal combustion engines and electric drivetrains, contribute to maintaining the relevance and growth of ICE vehicles in the software market. As a result, the ICE Vehicles segment remains the largest contributor to the automotive software market, and this trend is expected to persist shortly.

By Application

In 2024, the Infotainment & Connectivity segment held a dominant market position, capturing more than 25% of the share in the automotive software market. This leadership is primarily driven by the increasing consumer demand for enhanced in-car experiences, which include entertainment, navigation, and seamless connectivity with mobile devices. Infotainment systems, which integrate multimedia, voice assistants, and cloud-based services, are no longer a luxury but a standard feature in most modern vehicles.

As consumers become more connected, they expect their vehicles to offer real-time access to music, news, social media, and other digital content while on the road. Additionally, the rise of smartphone integration, such as Apple CarPlay and Android Auto, has further propelled the demand for software solutions that support these functionalities.

The growing popularity of connected vehicles, which enable features like remote diagnostics, vehicle tracking, and communication with other smart devices, has made Infotainment & Connectivity a key focus area for automotive manufacturers. With increasing emphasis on user experience and convenience, this segment is expected to continue leading the market, driven by technological advancements and evolving consumer preferences.

Key Market Segments

By Software Type

- Application Software

- Middleware

- Operating Systems (OS)

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Propulsion Type

- ICE

- EV

By Application

- ADAS & Safety Systems

- Infotainment & Connectivity

- Navigation

- Autonomous Driving

- In-car Voice Assistance

- Connectivity

- Others

Driving Factor

Integration of Advanced Driver-Assistance Systems (ADAS)

The automotive industry is experiencing a significant transformation with the integration of Advanced Driver-Assistance Systems (ADAS), which has become a pivotal driving factor in the automotive software market. ADAS encompasses a suite of safety features such as lane-keeping assist, adaptive cruise control, and automatic emergency braking, all aimed at enhancing vehicle safety and reducing human error on the road.

The growing consumer demand for vehicles equipped with enhanced safety features has led to the widespread adoption of ADAS technologies. Automakers are increasingly incorporating these systems to meet regulatory requirements and address consumer preferences for safer driving experiences. This trend has significantly contributed to the expansion of the automotive software market, with projections indicating substantial growth in the coming years.

Technological advancements in sensors, machine learning, and data analytics have bolstered the capabilities of ADAS, making them more reliable and efficient. This has intensified competition among automakers to offer state-of-the-art safety features, further driving the demand for sophisticated automotive software solutions. Companies that lead in ADAS integration are perceived as innovators, enhancing their market position and appeal to safety-conscious consumers.

Restraining Factor

High Development Costs and Cybersecurity Concerns

Despite the clear benefits, the integration of advanced automotive software, particularly in areas like ADAS and autonomous driving, presents significant challenges. High development costs are a primary concern, as creating sophisticated software requires substantial investment in research, testing, and validation. For instance, Tesla’s plans to invest heavily in automated driving technologies highlight the financial commitments involved.

Alongside financial challenges, cybersecurity risks pose a significant threat to the automotive software market. As vehicles become more connected, they are increasingly vulnerable to cyber-attacks that can compromise vehicle control systems and user data. The rise in data breaches targeting the automotive industry underscores the urgency of addressing cybersecurity in software development.

Navigating the complex web of regulatory standards and ensuring compliance with safety, emissions, and data privacy laws add layers of complexity and cost to software development. Automakers must invest in ensuring that their software solutions meet global regulatory requirements, which can vary significantly across regions.

Growth Opportunity

Embracing Artificial Intelligence (AI) and 5G Technologies

The convergence of Artificial Intelligence (AI) and 5G technologies presents a significant growth opportunity for the automotive software market. AI enables vehicles to process vast amounts of data in real-time, facilitating advancements in autonomous driving, predictive maintenance, and personalized user experiences. 5G connectivity ensures high-speed, reliable communication between vehicles and infrastructure, enhancing safety and efficiency.

The integration of AI and 5G allows for seamless vehicle-to-everything (V2X) communication, enabling vehicles to interact with each other and surrounding infrastructure. This connectivity enhances situational awareness, reduces traffic congestion, and improves safety. Autonomous vehicles equipped with AI can make real-time decisions based on data from sensors and external sources, paving the way for safer and more efficient transportation systems.

AI-powered systems can analyze driver behavior and preferences to offer personalized in-car experiences, from tailored infotainment options to adaptive climate controls. Moreover, AI can optimize route planning and energy consumption, contributing to operational efficiencies. The combination of AI and 5G holds the potential to revolutionize the automotive industry, offering new services and business models that cater to evolving consumer demands.

Challenging Factor

Navigating Regulatory Compliance and Standardization

As the automotive software market expands, navigating the complex landscape of regulatory compliance and standardization emerges as a significant challenge. The lack of uniform standards for software development and integration can lead to compatibility issues and hinder the seamless operation of advanced automotive systems.

Different regions impose varying regulations concerning vehicle safety, emissions, and data privacy. For instance, the European Commission’s proposal to grant fair access to vehicle data aims to resolve conflicts among stakeholders but also introduces new compliance requirements for automakers. Navigating these diverse regulations necessitates significant resources and expertise, posing challenges for global automotive companies.

The absence of standardized protocols for automotive software systems can lead to interoperability issues, especially as vehicles incorporate technologies from various manufacturers. This lack of standardization can result in system incompatibilities and affect the reliability of safety-critical features. Establishing industry-wide standards is crucial to ensure seamless integration and operation of automotive software systems.

Growth Factors

The adoption of ADAS features is a major growth driver in the automotive software market. These systems enhance vehicle safety and driving experience through functionalities like lane-keeping assist, adaptive cruise control, and automatic emergency braking. Technological innovations in AI and IoT are transforming automotive software capabilities.

AI enables real-time data processing, enhancing features like predictive maintenance and personalized user experiences. IoT connectivity facilitates vehicle-to-vehicle and vehicle-to-infrastructure communication, supporting the development of autonomous driving technologies.

Emerging Trends

Automakers are transitioning towards SDVs, where software dictates vehicle functionality, enabling features like over-the-air updates and customizable user experiences. This shift allows manufacturers to offer new services and functionalities post-sale, enhancing customer engagement and generating additional revenue streams. This trend highlights the industry’s move towards greater software integration.

Connected cars equipped with advanced connectivity capabilities are revolutionizing the driving experience. These vehicles offer real-time GPS, data analytics, and extensive Wi-Fi services through the Internet of Things (IoT). The connected car market is estimated to be worth hundreds of billions of euros by the end of this decade. The integration of 5G technology is expected to further enhance vehicle-to-vehicle communication and enable over-the-air software updates, improving safety, reliability, and autonomous driving capabilities.

Business Benefits

Incorporating software-driven safety features such as ADAS not only improves driver and passenger safety but also helps manufacturers comply with increasingly stringent safety regulations. For example, BYD’s decision to make ADAS a standard feature across most of its models at no additional cost challenges traditional revenue models but emphasizes the importance of safety features in consumer choice. This approach can lead to increased customer trust and brand loyalty.

Advanced software solutions enable real-time monitoring and diagnostics, leading to proactive maintenance and reduced operational costs. For instance, the integration of software that optimizes battery charging speeds can enhance the efficiency of electric vehicles, extending battery life and reducing maintenance expenses. These efficiencies contribute to improved profitability and competitiveness in the market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

BlackBerry Limited has significantly strengthened its position in the automotive software market through strategic acquisitions and product innovations. In April 2010, BlackBerry acquired QNX Software Systems, a leader in embedded software and a key player in automotive operating systems, for $200 million. This acquisition enabled BlackBerry to offer robust, secure, and reliable software solutions tailored for automotive applications.

KPIT Technologies Limited has been proactive in enhancing its automotive software offerings through strategic collaborations and product developments. The company has focused on providing integrated solutions for automotive electrification and autonomous mobility. KPIT’s collaborations with global automotive manufacturers aim to accelerate the development of next-generation vehicle technologies, emphasizing software-driven innovation to meet the evolving demands of the automotive industry.

Alphabet Inc., through its subsidiary Google, has significantly impacted the automotive software landscape by forging strategic partnerships and introducing innovative solutions. In October 2024, Google partnered with Qualcomm to offer a combination of chips and software enabling automakers to develop proprietary AI voice assistants.

Top Key Players in the Market

- BlackBerry Limited

- KPIT Technologies Limited

- Google (Alphabet Inc.)

- Airbiquity Inc.

- Wind River Systems

- Microsoft Corporation

- MontaVista Software LLC

- Robert Bosch GmbH

- Intellias Ltd

- HARMAN International

- GlobalLogic Inc.

- Other Key Players

Recent Developments

- In 2024, BlackBerry Limited launched its QNX Software Development Platform (SDP) 8.0 to enhance automotive software solutions with increased safety and security features.

- In 2024, KPIT Technologies expanded its collaboration with global automakers to accelerate the development of electrification and autonomous mobility solutions through advanced software innovations.

Report Scope

Report Features Description Market Value (2024) USD 18.54 Billion Forecast Revenue (2034) USD 68.13 Billion CAGR (2025-2034) 13.90% Largest Market North America Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Software Type (Application Software, Middleware, Operating Systems (OS)), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Propulsion Type (ICE, EV), By Application (ADAS & Safety Systems, Infotainment & Connectivity, Navigation, Autonomous Driving, In-car Voice Assistance, Connectivity, Others) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape BlackBerry Limited, KPIT Technologies Limited, Google (Alphabet Inc.), Airbiquity Inc., Wind River Systems, Microsoft Corporation, MontaVista Software LLC, Robert Bosch GmbH, Intellias Ltd, HARMAN International, GlobalLogic Inc., Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- BlackBerry Limited

- KPIT Technologies Limited

- Google (Alphabet Inc.)

- Airbiquity Inc.

- Wind River Systems

- Microsoft Corporation

- MontaVista Software LLC

- Robert Bosch GmbH

- Intellias Ltd

- HARMAN International

- GlobalLogic Inc.

- Other Key Players