Global Automotive Chip Market Size, Share Analysis By Type (Analog ICs, Microcontrollers & Microprocessors, Logic ICs), By Vehicle (Passenger Vehicles, Commercial Vehicles (Light Commercial Vehicle, Heavy Commercial vehicle), By Application (Chassis, Powertrain, Safety, Telematics & Infotainment, Body Electronics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142580

- Number of Pages: 372

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- China Automotive Chip Market

- Impact of AI on Automotive Chip

- By Type Analysis

- By Vehicle Analysis

- By Application Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Regions and Countries

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

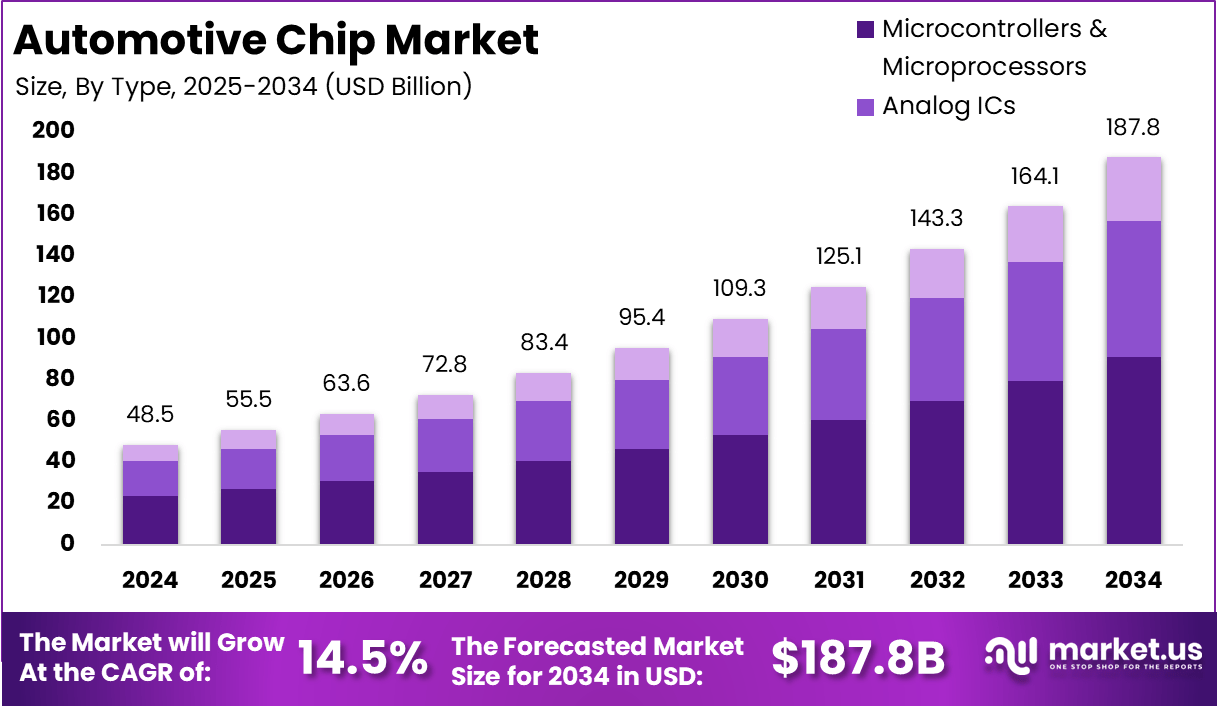

The Automotive Chip Market size is expected to be worth around USD 187.8 Billion By 2034, from USD 48.5 billion in 2024, growing at a CAGR of 14.5% during the forecast period from 2025 to 2034. In 2024, APAC held a dominant market position, capturing more than a 40.5% share, holding USD 19.64 Billion revenue.

Automotive chips, also known as automotive semiconductors, are specialized integrated circuits designed specifically for use in vehicles. These chips are crucial for a multitude of vehicle functions ranging from basic engine management and safety systems to advanced driver assistance and infotainment systems.

Automotive chips are engineered to withstand the harsh conditions typical in automotive environments, such as extreme temperatures, vibrations, and electromagnetic interference. The automotive chip market is experiencing significant growth driven by the increasing electrification of vehicles, the advancement of autonomous driving technologies, and heightened demand for vehicle connectivity.

As modern vehicles incorporate more electronic components to improve safety, efficiency, and user experience, the demand for automotive chips continues to expand. This market is further propelled by the ongoing innovation in semiconductor technology, which is enabling more powerful and efficient chips.

The primary drivers of the automotive chip market include the surge in adoption of electric vehicles (EVs), the expansion of advanced driver assistance systems (ADAS), and the global shift towards more connected and autonomous vehicles.

The integration of high-performance semiconductors enables enhanced vehicle functionalities and supports the transition to green energy by improving the efficiency of electric and hybrid vehicles. The demand for automotive chips is robust, with a particular emphasis on microcontrollers, sensors, and power semiconductors.

These components are essential for developing more autonomous, connected, and energy-efficient vehicles. The market is also seeing a rising demand for chips that support vehicle-to-everything (V2X) communication and advanced infotainment systems, which are becoming standard features in new vehicles.

Key Takeaways

- Strong Market Growth: The global Automotive Chip Market is projected to reach USD 187.8 billion by 2034, rising from USD 48.5 billion in 2024, with a CAGR of 14.5% from 2025 to 2034.

- APAC Leading the Market: In 2024, Asia-Pacific (APAC) dominated the market, securing more than 40.5% of the total share and generating USD 19.64 billion in revenue.

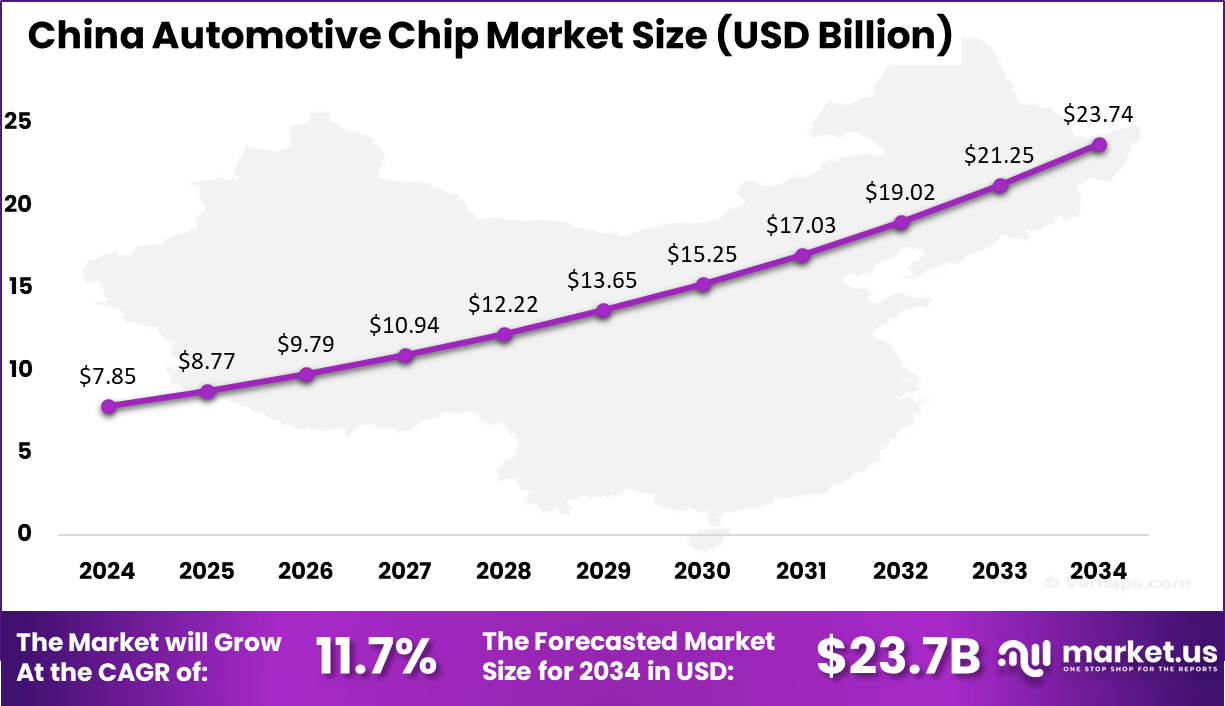

- China’s Market Growth: The China Automotive Chip Market alone was valued at USD 7.85 billion in 2024, with an expected CAGR of 11.7%, highlighting its strong position in the global automotive chip industry.

- Microcontrollers & Microprocessors in Demand: The microcontrollers and microprocessors segment accounted for a significant 48.5% share of the automotive chip market in 2024, reflecting their critical role in vehicle electronics.

- Passenger Vehicles Driving Demand: Passenger vehicles represented the largest segment by vehicle type, contributing 65.6% of the total market in 2024, driven by increasing electrification and automation trends.

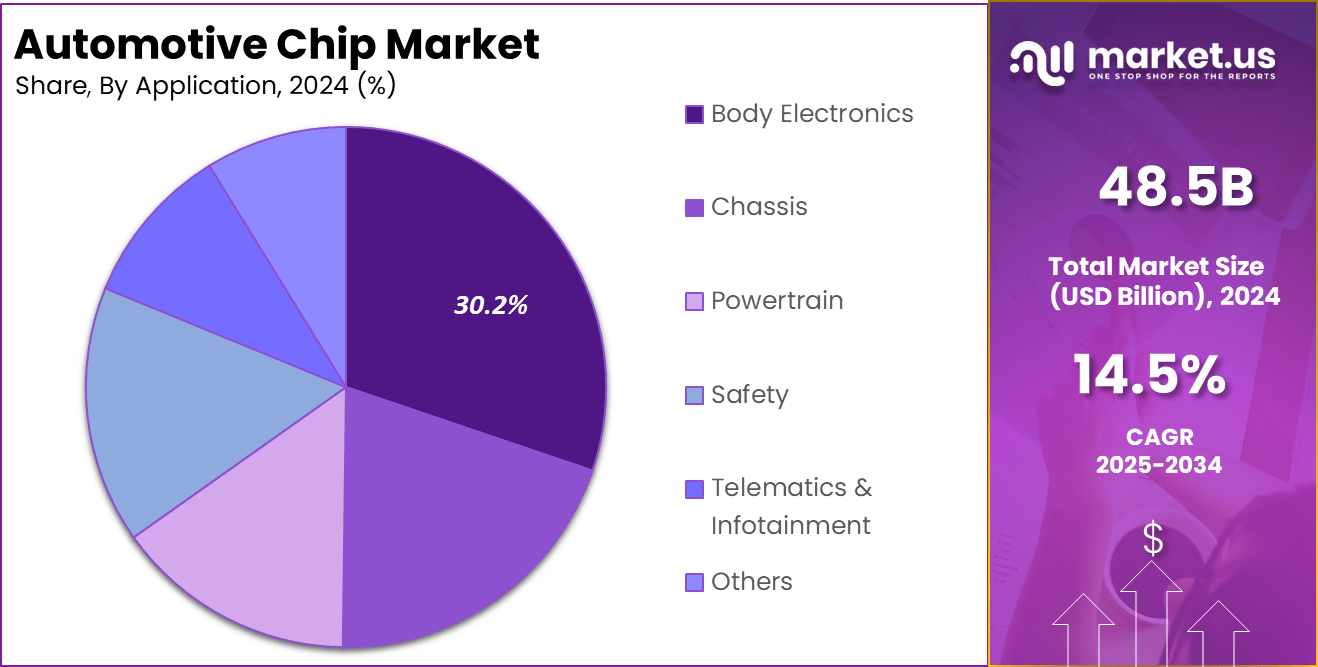

- Body Electronics as a Key Application: The body electronics application held a 30.2% share in 2024, underscoring its importance in modern vehicle designs, including smart lighting, power windows, and digital dashboards.

Analysts’ Viewpoint

Investment opportunities in the automotive chip market are huge due to the sector’s rapid expansion and technological innovations. Areas particularly ripe for investment include companies developing SiC and GaN semiconductors, which are critical for power management in electric vehicles, as well as firms focused on sensor technology and AI chips for autonomous driving.

Key factors impacting the automotive chip market include the global semiconductor supply chain’s vulnerabilities, as recently highlighted by widespread chip shortages that affected production across the automotive industry. Additionally, ongoing technological advancements and regulatory changes regarding vehicle safety and emissions are significantly influencing market dynamics.

Adopting advanced automotive chips offers numerous business benefits, including enhanced vehicle performance, improved safety features, and increased fuel efficiency. These advancements not only meet consumer expectations but also comply with stringent environmental and safety regulations, giving manufacturers a competitive edge in the market.

The automotive chip industry is tightly regulated, with standards such as ISO 26262 for functional safety and various Automotive Safety Integrity Levels (ASIL) guiding the development and integration of electronic systems in vehicles. These regulations ensure that automotive chips meet the highest safety standards to handle the critical functions they perform.

China Automotive Chip Market

The China Automotive Chip Market was valued at USD 7.85 billion in 2024, exhibiting a compound annual growth rate (CAGR) of 11.7%. This significant growth trajectory is underpinned by China’s aggressive expansion in the automotive sector, particularly in electric vehicles (EVs), which necessitate a higher utilization of semiconductor chips compared to traditional vehicles.

Despite this rapid growth, the dominance of U.S. companies in China’s automotive chip market is profound and multifaceted. U.S. firms have established a strong foothold due to their advanced technological capabilities, extensive intellectual property portfolios, and strategic control over essential semiconductor manufacturing equipment and software.

As reported by ijiwei, a notable 95% of Semiconductor Intellectual Property (IP) cores crucial for chip design are controlled by American and European companies, and around 96% of Electronic Design Automation (EDA) software, vital for developing these chips, is under U.S. control.

The Chinese government has been actively promoting the industrialization and quality improvement of domestic automotive-grade chips through various programs and standards. For instance, in 2023, a significant investment was made by SAIC and its subsidiaries to focus on semiconductor supply chain and key technologies.

In 2024, APAC held a dominant market position within the global automotive chip sector, capturing more than a 40.5% share, which equates to USD 19.64 billion in revenue. This prominence can be attributed to several strategic and market-driven factors.

Firstly, the region benefits from a robust automotive manufacturing base, with countries like China, Japan, South Korea, and India not only leading in production volumes but also in technological integrations in vehicles.

This extensive production base provides a significant demand for automotive chips, which are crucial for various vehicle functionalities, ranging from basic control systems to advanced driver-assistance systems (ADAS) and connectivity solutions. Moreover, APAC’s lead in the electric vehicle (EV) market significantly contributes to its dominance.

The region’s aggressive environmental policies and government incentives supporting EV adoption have resulted in a higher demand for semiconductor chips, as EVs typically require more chips than conventional vehicles. For example, China, as the world’s largest EV market, has implemented numerous subsidies and policies that encourage both manufacturers and consumers to shift towards electric mobility.

Additionally, APAC benefits from having a substantial semiconductor manufacturing footprint. Countries like Taiwan and South Korea are global leaders in semiconductor production, possessing advanced technological capabilities and substantial investments in R&D. These capabilities not only support the automotive chip demand locally but also cater to global needs, thereby reinforcing the region’s market position.

Impact of AI on Automotive Chip

The impact of AI on the automotive chip market is profound and multifaceted, reflecting a shift towards more intelligent, efficient, and safe automotive technologies. Here are key points that encapsulate the current trends and future prospects:

- Enhanced Vehicle Safety and Efficiency: AI chips are integral to developing advanced driver-assistance systems (ADAS) like pedestrian detection, lane-change assistance, and automated braking. These technologies not only enhance vehicle safety but also improve fuel efficiency and driving comfort by optimizing various operational parameters of the vehicle in real-time.

- Growth in Autonomous Vehicles: The automotive industry’s pivot towards AI is largely driven by the rise of autonomous vehicles. AI chips enable these vehicles to perceive their environment and make decisions with minimal human input, thereby increasing the reliability and safety of autonomous operations.

- Market Expansion and Innovation: The AI automotive market is expected to witness substantial growth, attributed to technological innovations and increasing demand for connected cars and personalized driving experiences. Companies are investing heavily in AI to remain competitive, leading to rapid advancements in computer vision and machine learning that further drive the market growth.

- Operational Optimization: AI is playing a crucial role in streamlining operations across the automotive industry, from supply chain management to after-sales services. By leveraging AI for predictive maintenance and inventory management, automotive companies are able to enhance operational efficiency and reduce costs.

By Type Analysis

In 2024, microcontrollers and microprocessors held a significant 48.5% share in the automotive chip market. This dominance is driven by the critical role these chips play in both traditional and modern automotive architectures.

Microcontrollers and microprocessors are essential for processing and executing commands in various vehicle systems, including engine management, transmission control, and increasingly, in autonomous and semi-autonomous driving technologies.

The demand for these components has surged with the rise of more digitally integrated and smart vehicles, which require robust computing power to manage complex algorithms and real-time data. The automotive industry’s shift towards electric and autonomous vehicles has particularly accentuated the need for powerful microcontrollers and microprocessors.

These vehicles rely heavily on advanced chipsets to handle electrification and automated driving functionalities, from battery management to sensor data integration for navigation and safety systems. As manufacturers continue to innovate and push the boundaries of what vehicles can do, the microcontrollers and microprocessors segment is expected to grow, supported by ongoing advancements in semiconductor technology.

Additionally, the integration of connectivity features such as V2X (vehicle-to-everything) communications further propels the importance of microcontrollers and microprocessors. These technologies require high-performance processing capabilities to ensure that vehicles can communicate effectively with each other and with infrastructure, enhancing safety and driving efficiencies.

By Vehicle Analysis

Passenger vehicles accounted for 65.6% of the automotive chip market in 2024, marking them as the largest segment by vehicle type. This predominance is primarily due to the increasing incorporation of electronic components in passenger cars, catering to consumer demands for safety, efficiency, and infotainment features.

As the automotive industry evolves, passenger vehicles are becoming more like mobile computing platforms, requiring a wide range of chips to support everything from dashboard displays and navigation systems to autonomous driving aids and electric powertrains.

The rise in safety regulations and the push for greener transportation options have also played pivotal roles in shaping the demand within this segment. For instance, regulatory bodies across the globe are mandating the inclusion of advanced safety systems, which rely heavily on sensors and chips for their operation.

Furthermore, the technological convergence between consumer electronics and automotive manufacturing has led to increased expectations for connectivity and multimedia features, which in turn boosts the chip content in passenger vehicles.

As automakers strive to differentiate themselves through technology, the demand for automotive chips in this segment is expected to maintain a strong growth trajectory, supported by continuous innovations in vehicle technology.

By Application Analysis

The body electronics application commanded a 30.2% share of the automotive chip market in 2024, underscoring its importance in modern vehicles. Body electronics encompass a wide array of vehicle functionalities including lighting, electric windows, seating, HVAC systems, and security features, all of which have become standard in new vehicles.

The increasing consumer expectations for a comfortable, convenient, and safe driving experience are major drivers behind the growth in this segment. Advancements in vehicle technology have expanded the scope of body electronics, integrating more sophisticated electronic controls to enhance vehicle usability and passenger comfort.

For example, ambient lighting, advanced climate control systems, and electronically adjustable seats are becoming common features that rely on sophisticated chip-based control systems to operate. These enhancements not only improve the user experience but also add to the overall safety and energy efficiency of the vehicle.

Moreover, as vehicles become more connected, the role of chips in body electronics extends to include connectivity modules that support smartphone integration and in-vehicle internet access. This integration is part of a broader trend towards the Internet of Things (IoT) within the automotive sector, which sees vehicles as nodes in a larger network, capable of communicating with other devices both inside and outside the vehicle.

Key Market Segments

By Type

- Analog ICs

- Microcontrollers & Microprocessors

- Logic ICs

By Vehicle

- Passenger Vehicles

- Commercial Vehicles

- Light Commercial Vehicle

- Heavy Commercial vehicle

By Application

- Body Electronics

- Chassis

- Powertrain

- Safety

- Telematics & Infotainment

- Others

Driver

Increasing Demand for Advanced Automotive Technologies

The automotive chip market is experiencing significant growth, primarily driven by the escalating demand for advanced automotive technologies such as safety features, infotainment systems, and advanced driver assistance systems (ADAS).

The integration of these technologies necessitates sophisticated compute units capable of managing complex algorithms and real-time data processing. Infotainment systems alone are expected to grow to ~$46 billion by 2030. This growth underscores the critical role of automotive chips in enhancing vehicle functionality and user experience, making them indispensable for modern vehicles.

Restraint

Semiconductor Supply Shortages

One of the primary restraints facing the automotive chip market is the persistent shortage of semiconductor chips. This challenge is compounded by geopolitical tensions and supply chain disruptions, which have affected key regions such as China, South Korea, and Taiwan—critical hubs in semiconductor manufacturing.

The shortage is exacerbated by the growing competition and strategic partnerships that often prioritize large-scale orders, leaving smaller manufacturers struggling to secure their supplies. This situation highlights the vulnerability of the global supply chain and the urgent need for diversified sourcing strategies to mitigate such risks in the future.

Opportunity

Expansion in Electric Vehicles (EVs) and Autonomous Driving

The shift towards electric vehicles (EVs) and the advancement of autonomous driving technologies present substantial opportunities for the automotive chip market. As the automotive industry continues to innovate, the demand for chips capable of supporting these technologies is surging.

Chips that manage power efficiency, battery management, and enhanced connectivity are particularly in demand. The growth is particularly pronounced in regions with strong EV adoption rates and supportive government policies aimed at reducing emissions and promoting sustainable transportation.

This trend is expected to drive further innovations and investments in the automotive chip sector, particularly in high-performance semiconductor technologies.

Challenge

Rapid Technological Evolution and Market Saturation

A significant challenge within the automotive chip market is the rapid pace of technological evolution, which requires continuous research and development efforts to keep up. Additionally, the market is approaching saturation in mature markets where the high volume of vehicle production has plateaued.

Companies face the dual challenge of innovating at speed while managing the lifecycle of existing products in a highly competitive market. This scenario demands substantial investments in next-generation technologies and strategic alignments with automotive manufacturers to stay relevant and competitive.

The need for high capital investment and the risk of obsolescence add layers of complexity to strategic planning and operational efficiency in the automotive chip industry.

Growth Factors

The automotive chip market is witnessing substantial growth, influenced primarily by the rapid advancements in automotive technologies and the increasing integration of electronics in vehicles. This growth is driven by several factors:

- Electrification of Vehicles: The surge in demand for electric vehicles (EVs) and hybrid electric vehicles (HEVs) plays a crucial role. As these vehicles rely heavily on advanced electronic systems for operation, they require a higher quantity and variety of semiconductor chips. This demand is a direct response to global initiatives aimed at reducing vehicle emissions and promoting sustainable transportation.

- Advanced Driver-Assistance Systems (ADAS): The automotive industry’s shift towards autonomous driving technologies has significantly increased the need for high-performance chips. These chips are central to the functionality of ADAS, providing vehicles with the necessary computational power to perform complex tasks such as image processing and real-time decision making.

- Government Regulations and Safety Requirements: Stringent safety and emission regulations worldwide compel automakers to incorporate advanced safety features such as anti-lock braking systems and airbags, as well as emission control technologies. This regulatory environment is pushing the automotive sector towards more sophisticated electronic components.

Emerging Trends

Several emerging trends are shaping the future of the automotive chip industry:

- Silicon Carbide (SiC) and Gallium Nitride (GaN) Technologies: These materials are increasingly preferred for their ability to improve the efficiency of electronic devices significantly. In the automotive sector, SiC and GaN are being utilized to enhance the performance of power electronics, especially in EVs, where they contribute to longer driving ranges and faster charging times.

- Integration of AI and IoT: The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) in automotive chips is another prominent trend. These technologies enable enhanced connectivity and smarter features in vehicles, such as predictive maintenance and advanced user interfaces.

- Focus on Cybersecurity: With the rise of connected vehicles, cybersecurity has become a critical concern. Automotive chips now increasingly incorporate security features to protect against hacking and other cyber threats, ensuring the safety and privacy of vehicle data and functionality.

Business Benefits

The evolution of automotive chips offers numerous business benefits:

- Enhanced Vehicle Performance: Modern chips improve the overall performance of vehicles, enabling more efficient power management, better fuel efficiency, and improved handling and stability.

- Cost Efficiency: Advances in chip technology can also lead to cost savings for automotive manufacturers by reducing the energy consumption of vehicles and lowering the costs associated with emissions compliance.

- Competitive Advantage: Automakers that leverage the latest chip technologies can differentiate their products in the market with advanced features and better performance, appealing to a broader customer base.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia

-Pacific - China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East

& Africa - South Africa

- Saudi Arabia

- United Arab Emirates

- Rest of Middle East & Africa

Key Player Analysis

The automotive chip market is highly competitive, with key players such as Qualcomm Technologies, Inc., STMicroelectronics, Texas Instruments Incorporated, NXP Semiconductors, and Renesas Electronics Corporation driving innovation. As demand for advanced vehicle electronics, autonomous driving, and electric mobility continues to rise, manufacturers are adopting strategic approaches to stay ahead.

Companies are investing in continuous research and development (R&D), technology innovation, and product enhancements to improve semiconductor performance. Additionally, mergers, acquisitions, collaborations, and partnerships are being pursued to expand market presence, strengthen supply chains, and accelerate technological advancements.

Key Automotive Chip Companies

- Qualcomm Technologies, Inc.

- Renesas Electronics Corporation

- Infineon Technologies AG

- STMicroelectronics

- Texas Instruments Incorporated

- NXP Semiconductors

- Broadcom

- Micron Technology, Inc.

- Intel Corporation

- ROHM CO., LTD.

- Others

Recent Developments

- In January 2025, NXP Semiconductors announced its agreement to acquire Austria’s TTTech Auto for $625 million. This acquisition aims to enhance NXP’s automotive operations by integrating TTTech Auto’s safety-focused middleware, which ensures critical car functions remain unaffected during system updates.

- In November 2024, Infineon announced a strategic collaboration with automotive manufacturer Stellantis to develop power architectures for next-generation vehicles. This partnership includes the use of Infineon’s smart power switches and silicon carbide semiconductors to enhance vehicle performance and efficiency.

- In January 2024, Texas Instruments Incorporated introduced a new line of semiconductors designed to improve automotive safety and intelligence. These advanced chips focus on battery management functions, ensuring efficient and safe control of power flow in electric and hybrid vehicles.

Report Scope

Report Features Description Market Value (2024) USD 48.5 Bn Forecast Revenue (2034) USD 187.8 Bn CAGR (2025-2034) 14.5% Largest Market Asia Pacific: 40.5%, China: USD 7.85 Billion, CAGR: 11.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Analog ICs, Microcontrollers & Microprocessors, Logic ICs), By Vehicle (Passenger Vehicles, Commercial Vehicles (Light Commercial Vehicle, Heavy Commercial vehicle), By Application (Chassis, Powertrain, Safety, Telematics & Infotainment, Body Electronics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Qualcomm Technologies Inc., Renesas Electronics Corporation, Infineon Technologies AG, STMicroelectronics, Texas Instruments Incorporated, NXP Semiconductors, Broadcom, Micron Technology Inc., Intel Corporation, ROHM CO. LTD., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Qualcomm Technologies, Inc.

- Renesas Electronics Corporation

- Infineon Technologies AG

- STMicroelectronics

- Texas Instruments Incorporated

- NXP Semiconductors

- Broadcom

- Micron Technology, Inc.

- Intel Corporation

- ROHM CO., LTD.

- Others