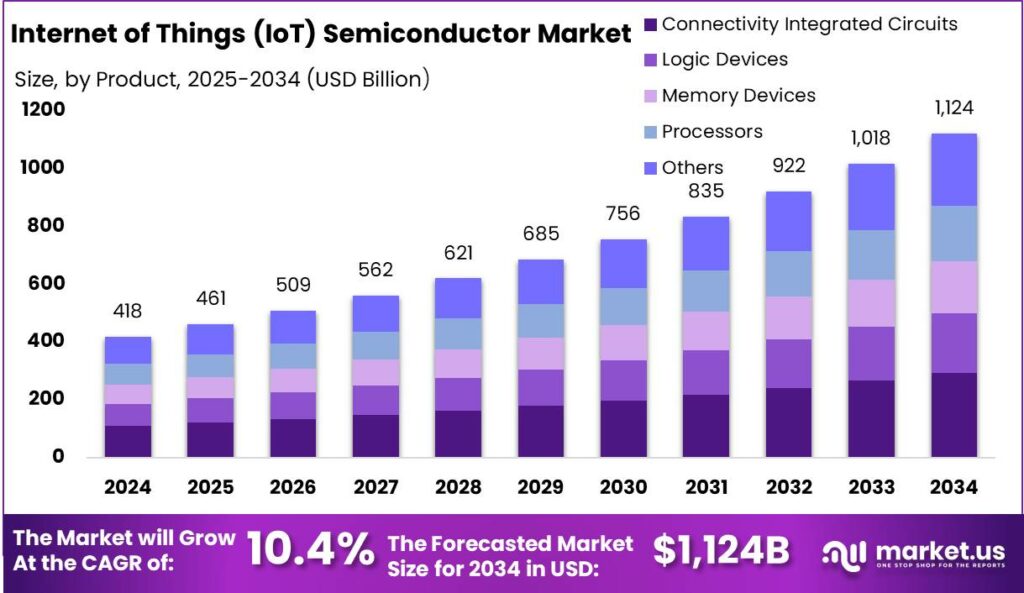

Global Internet of Things (IoT) Semiconductor Market Size, Share, Statistics Analysis Report By Product (Connectivity Integrated Circuits (ICs), Logic Devices, Memory Devices, Processors, Others), By Industry Vertical (Consumer Electronics, Wearable Devices, Automotive & Transportation, BFSI, Healthcare, Retail, Building Automation, Oil & Gas, Agriculture, Aerospace & Defense, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142340

- Number of Pages: 398

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

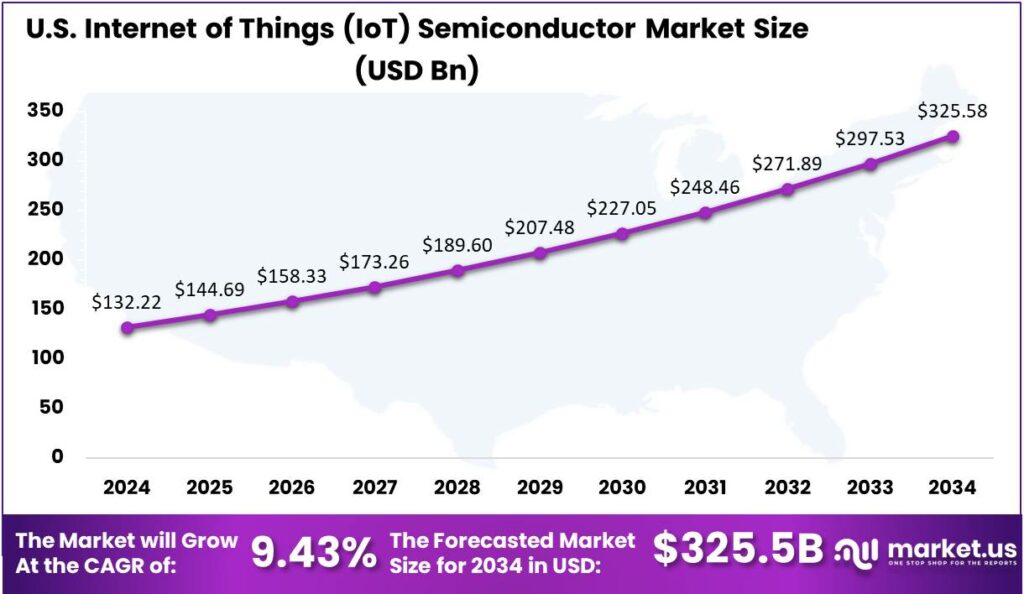

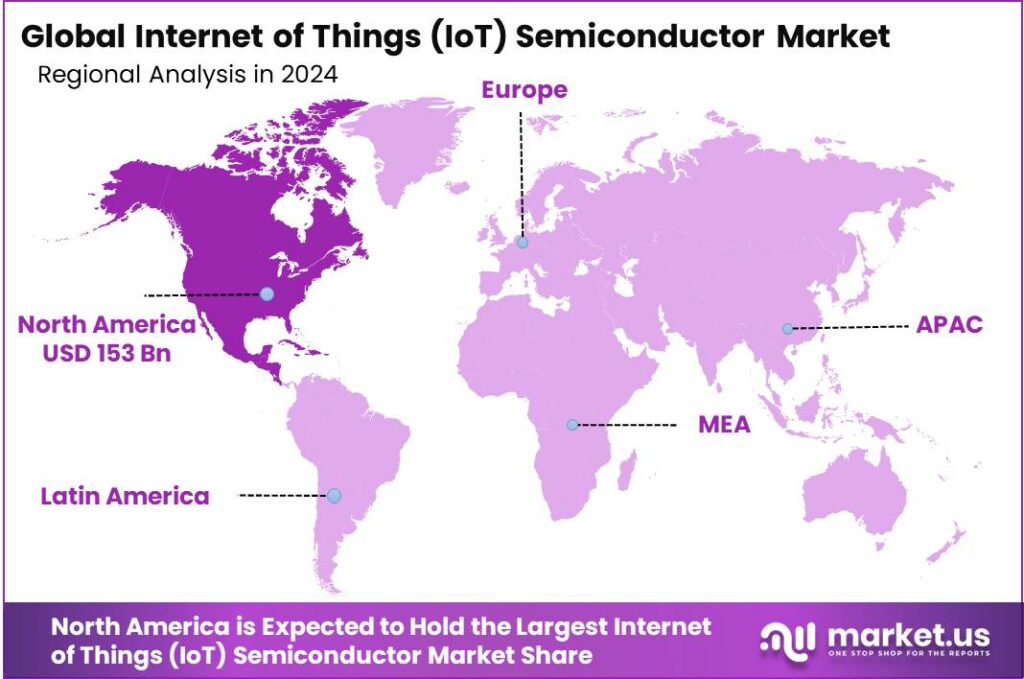

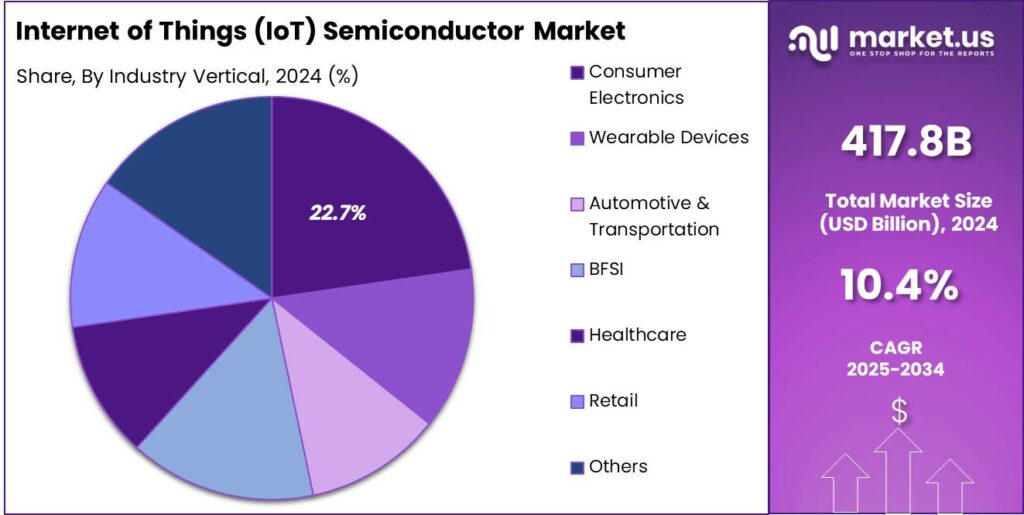

The IoT Semiconductor Market size is expected to be worth around USD 1,124 Bn By 2034, from USD 417.8 Bn in 2024, growing at a CAGR of 10.40% during the forecast period. In 2024, North America led the Market with over 36.8% share, generating USD 153 bn in revenue. The U.S. IoT Semiconductor Market was valued at USD 132.22 bn and is projected to grow at a CAGR of 9.43%.

The Internet of Things (IoT) Semiconductor market encompasses a range of microchips and integrated circuits specifically designed to support the connectivity, processing, and security requirements of IoT devices. Semiconductors enable smart devices to collect, process, and transmit data, driving seamless communication across industries like consumer electronics, healthcare, automotive and smart cities.

The IoT semiconductor market is a dynamic sector characterized by rapid growth and innovation, driven by the increasing demand for IoT devices across various industries. This market includes the design and manufacture of semiconductors that cater specifically to IoT applications. It spans several product categories such as sensors, connectivity chips, and advanced microcontrollers tailored for IoT systems.

The primary drivers for the IoT semiconductor market include the surge in demand for smart home and smart city solutions, the advancement of wireless communication technologies, and the widespread adoption of edge computing. In particular, the need for energy-efficient and miniaturized semiconductors that can perform with minimal power consumption is crucial in devices like wearables and smart meters.

According to Market.us, The global semiconductor market is set for significant growth, with its value expected to surge from USD 530 billion in 2023 to approximately USD 996 billion by 2033. This represents a compound annual growth rate (CAGR) of 6.5% over the forecast period (2024-2033).

In 2023, the Asia-Pacific (APAC) region dominated the semiconductor industry, accounting for more than 63.91% of the global market share and generating USD 388.7 billion in revenue. This dominance is largely driven by the presence of leading chip manufacturers in China, Taiwan, South Korea, and Japan, coupled with strong government support and increasing demand for advanced technologies like AI, 5G, and IoT.

The demand for IoT semiconductors is expected to escalate as industries and consumers increasingly adopt IoT solutions for improved efficiency and convenience. This adoption is creating substantial investment opportunities in areas like smart grids, autonomous vehicles, and personalized healthcare, which rely on the seamless integration of IoT technology.

Based on data from deloitte, The global semiconductor industry is set to reach $697 billion in sales, marking a new record and positioning itself for the widely anticipated $1 trillion milestone by 2030. This growth requires a 7.5% CAGR from 2025 to 2030, a realistic trajectory given the increasing demand across industries.

A key driver of this expansion is generative AI (Gen AI) chips, which have significantly outperformed earlier forecasts. Deloitte initially projected the market for these chips to exceed $50 billion in 2024. However, the actual market size was likely over $125 billion, contributing more than 20% of total chip sales for the year.

Key Takeaways

- The Global Internet of Things (IoT) Semiconductor Market is expected to grow at a CAGR of 10.40%, reaching a size of approximately USD 1,124 Billion by 2034, up from USD 417.8 Billion in 2024.

- In 2024, the Connectivity Integrated Circuits (ICs) segment dominated the IoT Semiconductor Market, capturing more than a 26.1% share.

- The Consumer Electronics segment also held a dominant position in the IoT semiconductor market in 2024, accounting for more than a 22.7% share.

- North America led the IoT Semiconductor Market in 2024, securing more than a 36.8% share. The region generated approximately USD 153 billion in revenue.

- In 2024, the U.S. IoT Semiconductor Market was valued at USD 132.22 billion and is expected to grow at a CAGR of 9.43% over the forecast period.

Analysts’ Viewpoint

The integration of IoT semiconductors brings numerous business benefits, including enhanced operational efficiency, reduced costs due to automation, and improved data collection and analytics. Technological advancements in semiconductor manufacturing, such as the development of smaller, more efficient chips and the integration of IoT functionalities directly onto the silicon, are driving these benefits.

These innovations enable businesses to deploy intelligent devices capable of complex computations and communications with minimal latency and power usage, thus opening up new avenues for data-driven decision-making and real-time monitoring.

The regulatory environment for IoT semiconductors is evolving as governments and international bodies strive to address security, privacy, and interoperability concerns. With IoT devices becoming ubiquitous in sensitive areas such as healthcare and infrastructure, ensuring the security of the data they handle and the privacy of users is paramount.

Regulations and standards are being developed to establish a secure and reliable framework for IoT deployments, which semiconductor companies must adhere to. Compliance with these standards is crucial for gaining trust and facilitating wider adoption of IoT technologies

U.S. Market Growth

In 2024, the U.S. Internet of Things (IoT) Semiconductor Market was estimated at a value of USD 132.22 billion. This market is projected to expand at a compound annual growth rate (CAGR) of 9.43% over the forecast period.

The growth of the U.S. IoT semiconductor market is driven by the widespread adoption of IoT technology in sectors like automotive, healthcare, and smart homes. Semiconductors are crucial for powering IoT devices with the necessary processing and connectivity. As IoT devices proliferate, the demand for advanced microchips with improved efficiency and features continues to rise.

Technological advancements in semiconductor manufacturing and the development of low-power, high-performance chips are driving market expansion. These innovations are essential for meeting the power efficiency and size demands of modern IoT devices. Government initiatives to promote smart technologies and improve connectivity infrastructure will also support future market growth.

In 2024, North America held a dominant position in the Internet of Things (IoT) Semiconductor Market, capturing more than a 36.8% share. This region generated significant revenue, amounting to approximately USD 153 billion. This leadership can be attributed to several key factors that uniquely position North America at the forefront of the IoT semiconductor industry.

The region benefits from a strong technological infrastructure that supports advanced IoT manufacturing and deployment. With global tech giants and startups in Silicon Valley and North America, ongoing investments in R&D drive the development and adoption of new semiconductor technologies. Government policies in North America further boost market growth by promoting IoT integration in key sectors like healthcare, automotive, and industrial automation.

The rising demand for smart home and smart city solutions in North America boosts the need for IoT semiconductors. Consumers embrace technologies offering convenience, energy efficiency, and security, all dependent on advanced IoT systems. Additionally, the push for sustainability and renewable technologies further drives the growth of the IoT semiconductor market in the region.

Product Analysis

In 2024, the Connectivity Integrated Circuits (ICs) segment held a dominant position in the IoT Semiconductor Market, capturing more than a 26.1% share. This segment includes chips like WiFi, Bluetooth, and cellular modules, vital for IoT device connectivity, driving its leading market position.

The Connectivity Integrated Circuits (ICs) segment is growing due to the increasing demand for reliable, high-speed data transfer in IoT across consumer electronics, automotive, and industrial applications. This drives the development of advanced ICs supporting multi-protocol communication, fueling market growth and technological progress.

The growth of smart cities and automated technologies has elevated the Connectivity Integrated Circuits (ICs) segment. These ICs are crucial for connecting sensors and actuators in urban infrastructure, supporting data collection for traffic, safety, and energy management, driving demand for advanced connectivity solutions.

The rollout of 5G networks has significantly boosted the Connectivity Integrated Circuits (ICs) segment by improving device-to-device and network connectivity, enabling faster and more reliable IoT functionality. As industries and consumers adopt more interconnected environments, the demand for high-performance ICs drives growth in the broader IoT Semiconductor Market.

Industry Vertical Analysis

In 2024, the Consumer Electronics segment held a dominant position in the Internet of Things (IoT) semiconductor market, capturing more than a 22.7% share.

The rapid growth of connected consumer devices, such as smart TVs, home assistants, and appliances, has driven significant demand for IoT-enabled devices. As consumers seek convenience and enhanced experiences, this surge is fueling substantial growth in semiconductor requirements for consumer electronics.

The dominance of the Consumer Electronics segment is strengthened by ongoing innovations in device functionality and interoperability. Manufacturers are incorporating advanced semiconductors to enhance performance, connectivity, and energy efficiency, meeting consumer demand for smarter products. This drives rapid product upgrades and replacements, sustaining semiconductor market growth.

While the Consumer Electronics segment leads, industries like Automotive & Transportation and Healthcare are growing more slowly due to longer development cycles and regulatory challenges. However, as technologies mature and adoption barriers are overcome, these sectors show growth potential, with Consumer Electronics remaining the most scalable and impactful segment.

Key Market Segments

By Product

- Connectivity Integrated Circuits (ICs)

- Logic Devices

- Memory Devices

- Processors

- Others

By Industry Vertical

- Consumer Electronics

- Wearable Devices

- Automotive & Transportation

- BFSI

- Healthcare

- Retail

- Building Automation

- Oil & Gas

- Agriculture

- Aerospace & Defense

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rise of Interconnected Devices

The rapid expansion of connected devices stands as a significant driver for the Internet of Things (IoT) semiconductor market. This surge encompasses various applications, including smart home devices, wearable technologies, industrial automation systems, and connected vehicles. Each application demands specific semiconductor solutions, such as microcontrollers, sensors, and connectivity modules, tailored to their unique requirements.

The automotive sector exemplifies this trend, with vehicles incorporating advanced driver-assistance systems (ADAS), infotainment platforms, and vehicle-to-everything (V2X) communication capabilities. These advancements necessitate sophisticated semiconductor components to manage complex functionalities and ensure seamless connectivity.

Restraint

Security and Privacy Concerns

Security and privacy concerns present significant restraints in the IoT semiconductor market. As IoT devices become more prevalent, the potential attack surface for cyber threats expands, raising risks related to data breaches, unauthorized access, and malicious activities. These vulnerabilities can lead to substantial financial losses, compromise user privacy, and erode trust in IoT technologies.

The semiconductor industry’s traditional focus on hardware development may not sufficiently address the complex security requirements of IoT applications. Inadequate security measures at the hardware level can render devices susceptible to attacks, as software-based solutions alone may not provide comprehensive protection.

Opportunity

AI and ML Integration

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into IoT devices presents a significant opportunity for the semiconductor industry. AI and ML enable IoT devices to process data locally, make real-time decisions, and adapt to user behaviors, enhancing functionality and user experience.

This progress requires specialized semiconductors to handle complex tasks while maintaining power efficiency and compact size. In industries, AI-powered IoT systems predict equipment failures and optimize maintenance, reducing downtime and costs. This demands semiconductors with advanced processing and energy efficiency.The growing demand for edge computing further amplifies this opportunity.

Edge computing involves processing data closer to the source, reducing latency and bandwidth usage. This shift requires semiconductors designed for efficient data processing at the edge, supporting AI and ML functionalities without relying solely on cloud-based resources.

Challenge

Market Fragmentation and Standardization

Market fragmentation and the lack of standardization pose significant challenges in the IoT semiconductor industry. The IoT ecosystem encompasses a vast array of devices, applications, and communication protocols, leading to a highly fragmented market.

This diversity complicates the development of universal semiconductor solutions that can seamlessly integrate across different platforms and use cases. The absence of standardized protocols and interoperability frameworks hinders the scalability of IoT solutions. Designing chips that cater to a wide range of standards and protocols increases complexity and costs.

Manufacturers often develop proprietary technologies to differentiate their products, resulting in compatibility issues that limit the cohesive integration of IoT systems. This fragmentation can deter consumers and businesses from adopting IoT technologies due to concerns about device compatibility and future-proofing.

Emerging Trends

The Internet of Things (IoT) is rapidly expanding, leading to significant advancements in semiconductor technology. One notable trend is the development of ultra-low-power chips that extend battery life. Morse Micro’s Wi-Fi HaLow processor delivers 10x the range of standard Wi-Fi and lasts years on a single battery.

Another trend is the integration of multiple wireless protocols into single chips, enhancing device interoperability. Companies like Silicon Labs are producing System-on-Chip (SoC) solutions that support protocols such as Bluetooth, Zigbee, Thread, and Wi-Fi. This integration simplifies the design process and reduces costs for IoT device manufacturers.

Cellular IoT connectivity is rapidly growing, especially for applications needing wide-area coverage and mobility. At the same time, security features are becoming essential in IoT semiconductors, with manufacturers adding measures like secure boot, encrypted storage, and tamper detection to defend against cyber threats.

Business Benefits

- Enhanced Operational Efficiency: By embedding IoT semiconductors into equipment, businesses can continuously monitor performance metrics, enabling predictive maintenance and reducing unplanned downtime. This proactive approach leads to increased productivity and cost savings.

- Improved Asset Tracking: IoT-enabled semiconductors facilitate real-time tracking of assets, ensuring better inventory management and reducing losses due to theft or misplacement. This enhances supply chain visibility and operational accuracy.

- Energy Management: With precise data collection from IoT-enabled semiconductor sensors, companies can monitor and optimize energy consumption, leading to significant reductions in utility costs and supporting sustainability initiatives.

- Product Quality Assurance: Continuous monitoring of production processes through IoT semiconductors allows for immediate detection of anomalies, ensuring consistent product quality and reducing waste from defective products.

- Enhanced Customer Experiences: By leveraging data collected from IoT semiconductor devices, businesses can gain insights into customer behaviors and preferences, enabling personalized services and improved customer satisfaction.

Key Player Analysis

Qualcomm Technologies Inc. is a major player in the IoT semiconductor market, known for its leadership in mobile communication technologies.Qualcomm specializes in advanced connectivity solutions like 5G, Wi-Fi, and Bluetooth for IoT applications, with chipsets designed to support faster, more reliable connectivity in devices such as smart homes, wearables, and automotive systems.

Intel Corporation, a global leader in semiconductor manufacturing, has been making significant strides in the IoT market. Intel offers powerful processors, microcontrollers, and sensors to boost performance and efficiency in IoT devices, providing end-to-end solutions that help industries like agriculture, healthcare, and manufacturing optimize operations with connected devices.

STMicroelectronics N.V. is a key player in the IoT semiconductor market, offering a broad portfolio of chips and solutions that cater to various IoT applications. STMicroelectronics leverages its expertise in sensor technologies, microcontrollers, and power management ICs to offer energy-efficient, secure, and scalable solutions for IoT development across industries like automotive, smart cities, and healthcare.

Top Key Players in the Market

- Qualcomm Technologies Inc.

- Intel Corporation

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- NXP Semiconductors N.V.

- Samsung Electronics Co. Ltd.

- Analog Devices Inc.

- MediaTek Inc.

- Microchip Technology Inc.

- Infineon Technologies AG

- Other Major Players

Top Opportunities Awaiting for Players

- Expansion in Automotive and IoT Device Integration: The increasing integration of IoT devices in the automotive sector, including electric vehicles (EVs) and autonomous driving systems, presents a significant opportunity for semiconductor companies. This trend is expected to fuel demand for advanced semiconductors that enable connectivity and enhanced performance in automotive applications.

- Advancements in AI and Machine Learning: AI and machine learning continue to drive the demand for specialized semiconductor chips like GPUs and TPUs. These technologies are critical for applications ranging from natural language processing to predictive analytics, offering semiconductor companies opportunities to lead in high-performance computing tasks.

- Growth in Asia-Pacific Markets: The Asia-Pacific region remains a crucial area for the semiconductor industry, with significant growth expected in markets like Singapore and South Korea. This region’s focus on enhancing IoT infrastructure and the adoption of advanced semiconductor technologies in smart cities and domestic automation offers lucrative prospects for market expansion.

- Sustainability and Energy Efficiency: There is a growing emphasis on sustainability within the semiconductor industry. Energy-efficient and environmentally friendly chip designs are becoming more prevalent, aligning with global environmental goals and consumer preferences for greener technology. This shift not only meets regulatory requirements but also provides a competitive edge in the market.

- Technological Innovations and R&D Investment: Continuous innovation in semiconductor technology, including the development of quantum computing and advanced packaging techniques like chiplets and 3D stacking, is creating new market opportunities. Companies that invest in research and development to push the boundaries of what’s possible will find themselves well-positioned to capitalize on these emerging trends.

Recent Developments

- In January 2024, Infosys acquired InSemi, a company specializing in semiconductor design and embedded services, to strengthen its capabilities in engineering R&D. This move is significant for Infosys’ involvement in AI and 5G chip sectors.

- Ambiq received recognition as the 2024 IoT Semiconductor Company of the Year in January 2024 for its cutting-edge ultra-low-power semiconductors, which empower AI capabilities in IoT devices.

Report Scope

Report Features Description Market Value (2024) USD 417.8 Bn Forecast Revenue (2034) USD 1,124 Bn CAGR (2025-2034) 10.40% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Internet of Things (IoT) Semiconductor Market By Product (Connectivity Integrated Circuits (ICs), Logic Devices, Memory Devices, Processors, Others), By Industry Vertical (Consumer Electronics, Wearable Devices, Automotive & Transportation, BFSI, Healthcare, Retail, Building Automation, Oil & Gas, Agriculture, Aerospace & Defense, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Qualcomm Technologies Inc., Intel Corporation, STMicroelectronics N.V., Texas Instruments Incorporated, NXP Semiconductors N.V., Samsung Electronics Co. Ltd., Analog Devices Inc., MediaTek Inc., Microchip Technology Inc., Infineon Technologies AG, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Qualcomm Technologies Inc.

- Intel Corporation

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- NXP Semiconductors N.V.

- Samsung Electronics Co. Ltd.

- Analog Devices Inc.

- MediaTek Inc.

- Microchip Technology Inc.

- Infineon Technologies AG

- Other Major Players