Global Semiconductor Market Size, Share, Industry Analysis Report By Component (Discrete Semiconductors, Optoelectronics, Sensors, ICs (Analog, Micro, Logic, Memory, MPU, MCU, Others)), By Application (Networking & Communications (Ethernet Controllers, Adapters & Switches, & Routers & Others), Data Centers, Industrial (Power Controls & Motor Drives, Intelligent Systems, & Industrial Automation & Others), Consumer Electronics (Home Appliances, Personal Devices, & Other Devices), Automotive (Telematics & Infotainment, Safety Electronics, Chassis, and Others), & Government), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 105940

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Semiconductor Statistics

- Impact of AI on Semiconductor Industry

- Semiconductor Industry : Production, Manufacturing & Investment Data

- Global Landscape of Semiconductor Support

- Key Investments and Collaborations

- China Semiconductor Market Size

- Component Analysis

- Application Analysis

- Key Market Segments

- Regional Insight

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

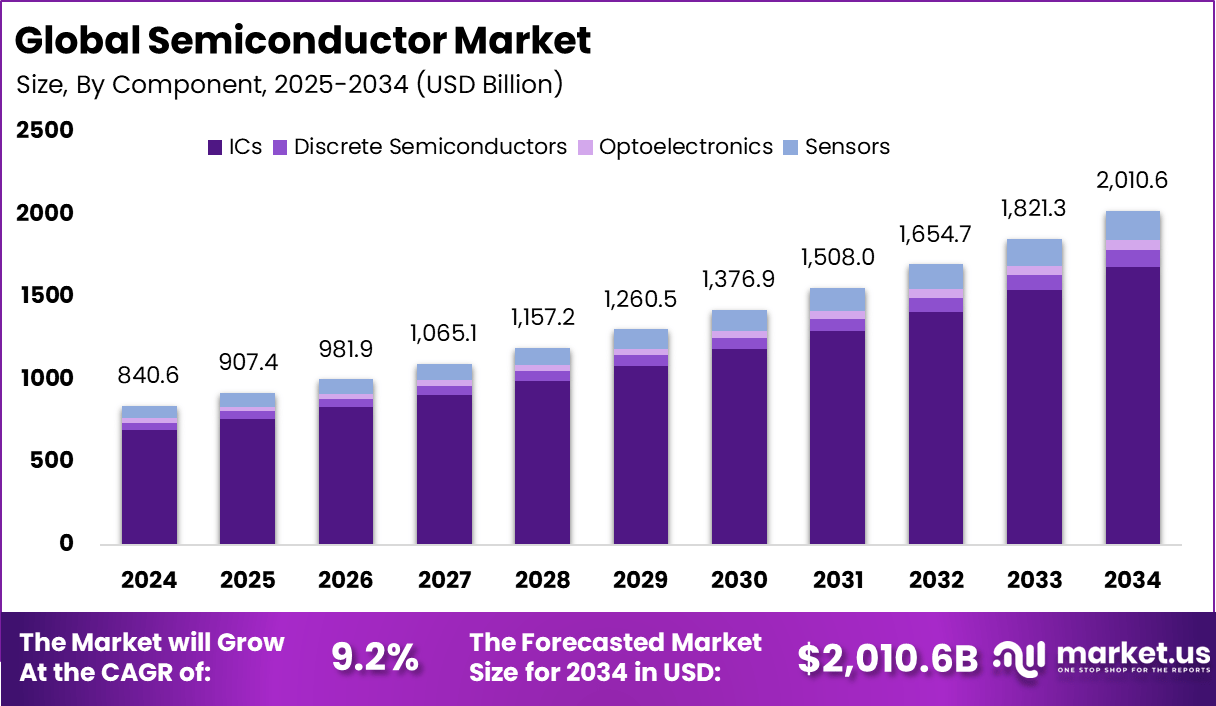

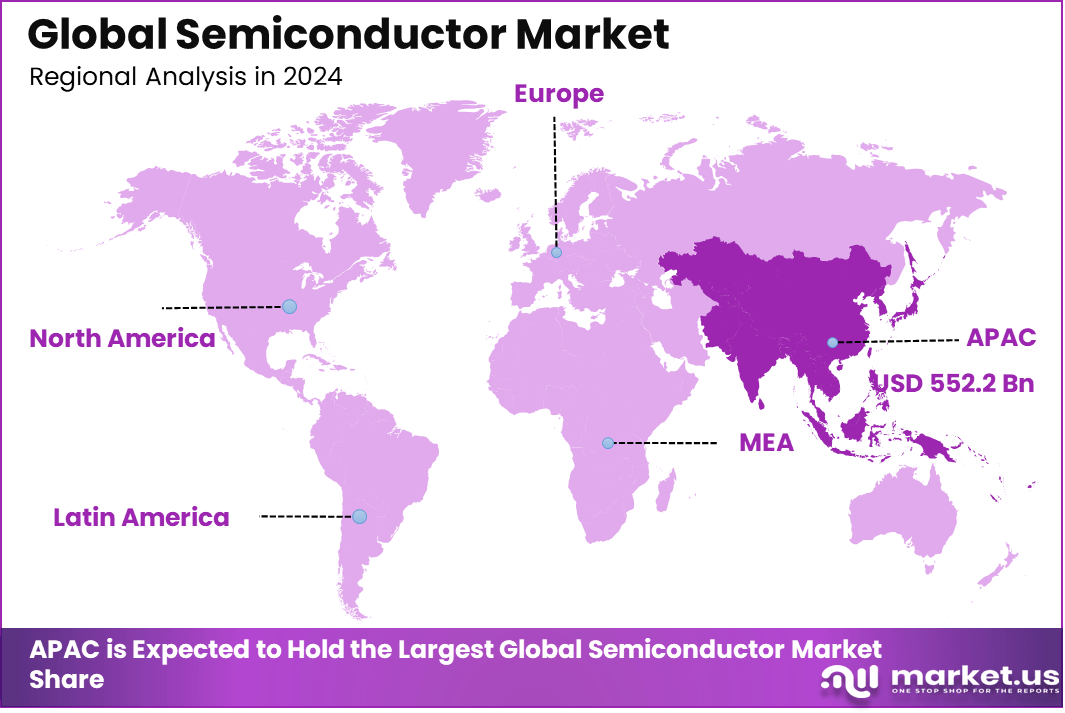

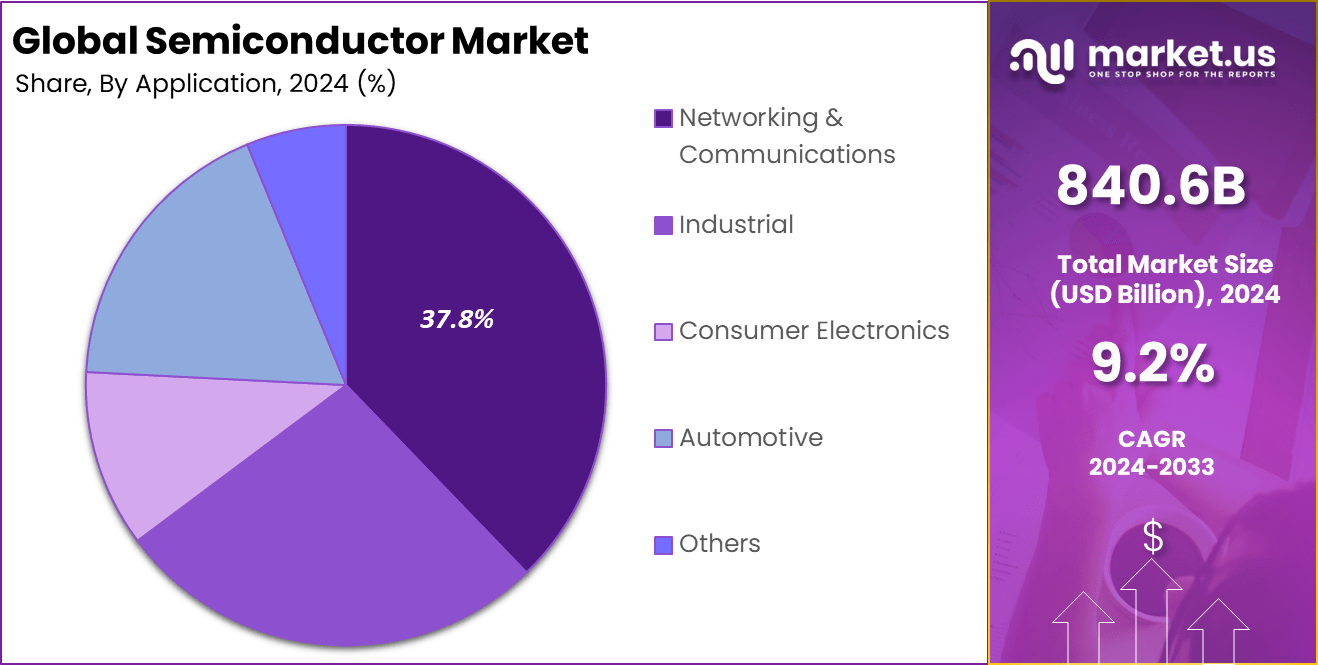

The global Semiconductor market size accounted for USD 840.60 billion in 2024 and is predicted to increase from USD 907.4 billion in 2025 to approximately USD 2,010.6 billion by 2034, expanding at a CAGR of 9.20% from 2025 to 2034. In 2024, APAC held a dominan market position, capturing more than a 65.7% share, holding USD 552.2 Billion revenue.

The Semiconductor Market covers the production and supply of electronic components made from materials such as silicon, gallium arsenide, and others that conduct electricity in controlled ways. These components include integrated circuits, microprocessors, memory chips, analog devices, sensors, and power semiconductors. They are essential for consumer electronics, automotive, telecommunications, industrial machinery, medical devices, and emerging digital infrastructure.

The market is driven by rising demand for consumer electronics such as smartphones, laptops, and tablets. Growth in cloud computing, data centers, and artificial intelligence also increases the need for high performance chips. Automotive applications, including electric vehicles and advanced driver assistance systems, add further demand. Expansion of 5G networks, smart devices, and renewable energy systems are additional contributors to semiconductor adoption.

Key Takeaways

- In 2024, the ICs segment held a dominant market position, capturing more than a 83.1% share of the Global Semiconductor Market.

- In 2024, Networking & Communications held a dominant market position, capturing more than a 37.8% share of the Global Semiconductor Market.

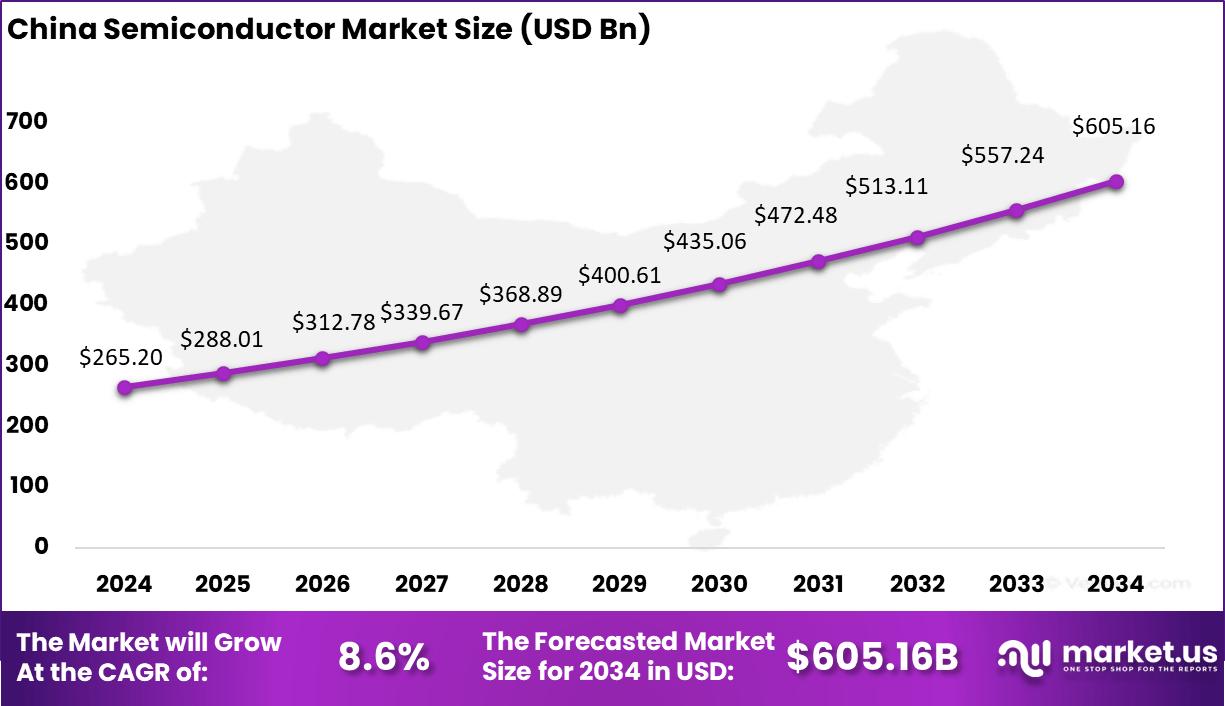

- The China Semiconductor Market was valued at USD 265.2 Billion in 2024, with a robust CAGR of 8.6%.

- In 2024, Asia Pacific held a dominant market position in the global Semiconductor Market, capturing more than a 65.7% share

Global sales have surged significantly, with the market showing an 18.9% increase year-over-year in the first half of 2025. This expansion is fueled largely by demand for chips in data centers, AI applications, and advanced logic and memory segments. The industry’s manufacturing capacity is expanding by about 7% globally in 2025, indicating robust investment to meet increasing chip requirements.

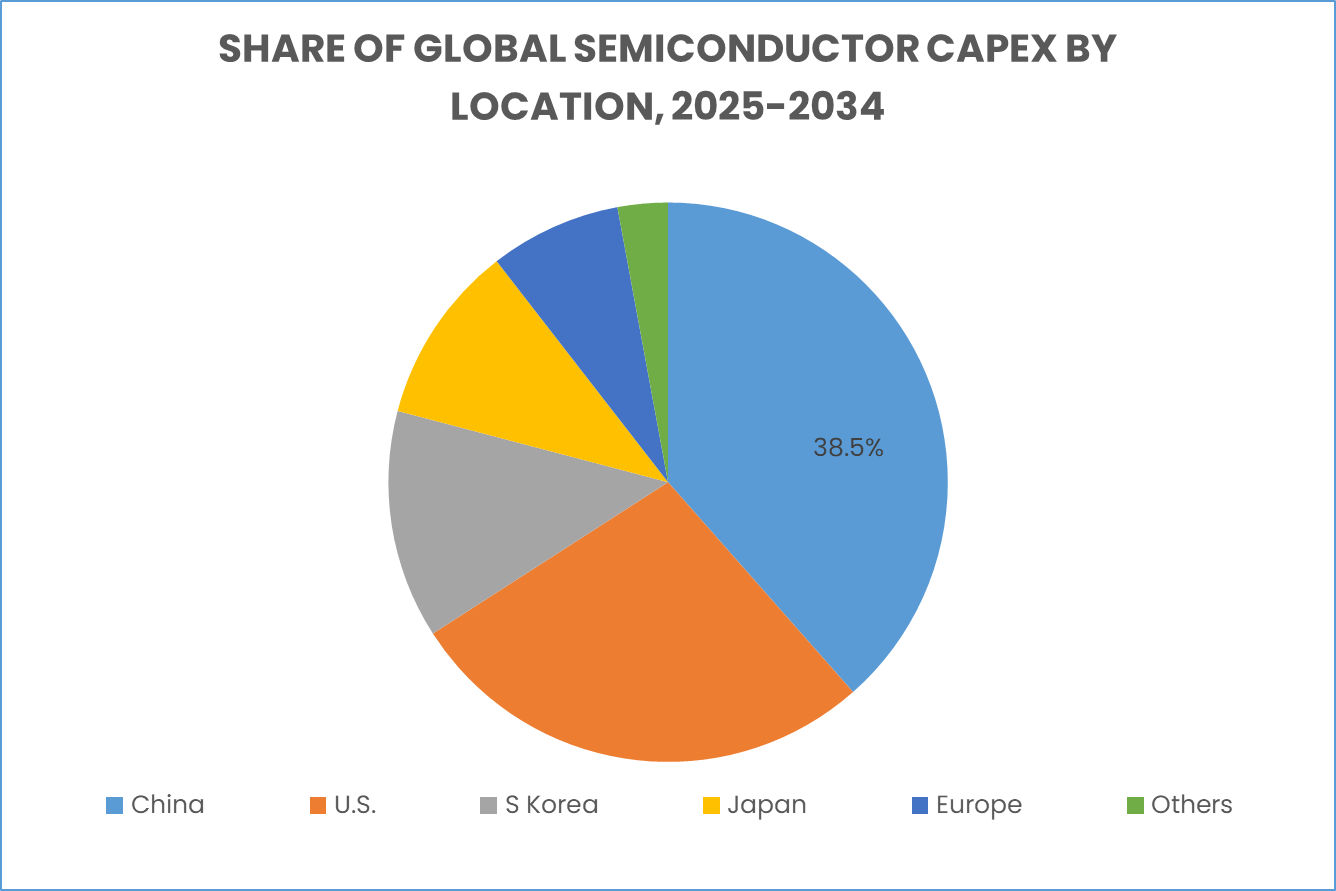

Semiconductor companies are responding with projected capital expenditures of approximately $185 billion in 2025 to expand capacity and innovate. Additionally, the push for domestic chip production in key regions like the U.S. has led to over $600 billion in private-sector investments and efforts to triple national chip manufacturing capacity by 2032, enhancing supply chain resilience.

According to the latest report from the Semiconductor Industry Association (SIA), the global semiconductor market has shown robust growth. In the third quarter of 2024, sales reached a notable $166.0 billion, marking a significant 23.2% increase from the same period last year. This growth also represents a 10.7% rise over the previous quarter in 2024. September alone saw sales of $55.3 billion, up 4.1% from August’s $53.1 billion.

Regionally, The Americas led with a striking 46.3% increase compared to the previous year, followed by a notable rise in China at 22.9%. The Asia Pacific region also saw a healthy uptick of 18.4%, while Japan experienced a modest growth of 7.7%. However, Europe bucked the positive trend with a slight decline of -8.2%. On a month-to-month basis, Japan topped the chart with a growth of 5.3%, closely trailed by the Asia Pacific at 4.5%, the Americas at 4.1%, Europe at 4.0%, and China at 3.6%.

For instance, significant investments have been planned or are underway across various regions to bolster domestic semiconductor capacities. This includes a $40 billion state fund by China to boost its chip industry, and efforts in the United States following the CHIPS Act which earmarked $39 billion over five years to encourage domestic semiconductor manufacturing.

Manufacturing capabilities are also expanding, with new facilities expected to still be operational by 2030 and beyond. This expansion is part of a broader strategy of diversifying manufacturing bases and supply chains to include a mix of onshoring, nearshoring, and offshoring depending on regional strategic needs and economic feasibility.

The semiconductor industry’s production and investment trends are thus characterized by a short-term contraction followed by a predicted recovery, underpinned by substantial investments in R&D and manufacturing infrastructure aimed at enhancing regional self-sufficiency and global competitiveness.

Semiconductor Statistics

- The semiconductor industry in the Americas observed a year-to-year growth with sales up 21.6% in China and 12.7% in the Asia Pacific/All Other regions. However, there was a decline in Japan (-5.0%) and Europe (-11.2%).

- On a month-to-month basis, June sales showed an increase in the Americas (6.3%), Japan (1.8%), and China (0.8%), but a decrease in Europe (-1.0%) and Asia Pacific/All Other (-1.4%).

- In 2024, the semiconductor market is expected to recover with both PC and smartphone sales projected to grow by 4%, following declines in 2023 of 14% and 3.5%, respectively.

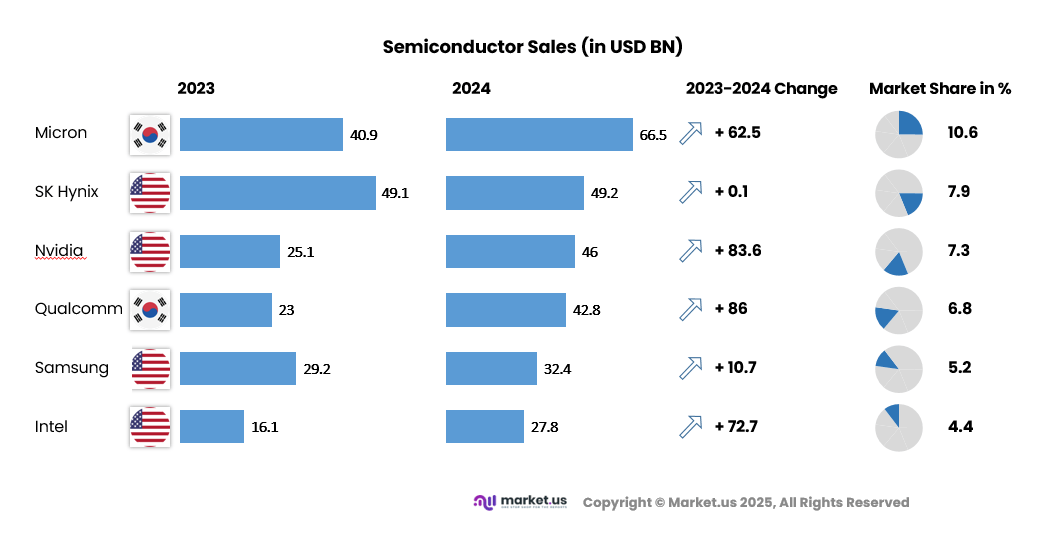

- According to the latest SemiWiki study, memory companies exhibited substantial growth. SK Hynix and Kioxia each surged by over 30%, Samsung Semiconductor increased by 23%, and Micron Technology rose by 17%.

- The weighted average growth of the top fifteen companies from the first to the second quarter of 2024 was 8%, with memory companies specifically up by 22% and non-memory companies by 3%.

- Nvidia maintained its position as the largest semiconductor company, forecasting $28 billion in revenue for Q2 2024. Samsung ranked second with projected revenues of $20.7 billion.

- Although Broadcom has yet to report its Q2 2024 results, it is estimated to achieve revenues of $13.0 billion, surpassing Intel, which is expected to post $12.8 billion.

Impact of AI on Semiconductor Industry

The integration of Artificial Intelligence (AI) in the semiconductor industry has catalyzed substantial advancements and financial opportunities, reshaping the landscape of technology. AI has escalated the demand for high-performance semiconductors due to the intensive computational requirements of AI workloads.

In 2023, AI-specific semiconductor revenues are projected to hit $53.4 billion, marking a significant 20.9% increase from the previous year. This growth trajectory is expected to continue, with revenues potentially reaching $119.4 billion by 2027. Technological innovations such as AI-driven chip design are revolutionizing the sector. AI applications in chip design can dramatically shorten design cycles, enhance chip performance, and optimize manufacturing processes.

This has not only streamlined operations but has also spurred significant market growth and investment in AI-specific Integrated Circuits (ICs). For instance, the market for AI ICs is expected to escalate to $110 billion in 2024, accounting for 18% of the total semiconductor market, with an anticipated compound annual growth rate of 20% over the next five years.

Semiconductor companies are also pivoting towards advanced technologies like hybrid bonding, which facilitates the integration of various chip types into a single package, enhancing performance and efficiency. This technology is pivotal in addressing the enhanced performance demands of AI systems, offering advantages in terms of input-output density, thermal performance, and overall system integration.

Moreover, companies like Synopsys are at the forefront of leveraging AI for semiconductor design, demonstrating over threefold productivity gains and up to 20% better results in chip quality through their AI-driven tools. This not only underscores the transformative impact of AI on the industry but also highlights the potential for future advancements that can further elevate the capabilities of semiconductor technologies.

Semiconductor Industry : Production, Manufacturing & Investment Data

The global semiconductor market has experienced a notable downturn in 2023, with a forecasted contraction of 9.4% bringing the market valuation down to approximately $520 billion. This downturn reflects broader economic pressures such as inflation and weak demand in key consumer markets.

However, a rebound is expected in 2024 with an anticipated growth of 13.1%, elevating the market value to around $588 billion. This recovery is expected to be driven largely by the Memory sector, which might see growth exceeding 40% from the previous year. Investment in semiconductor manufacturing remains robust despite these fluctuations.

For instance, significant investments have been planned or are underway across various regions to bolster domestic semiconductor capacities. This includes a $40 billion state fund by China to boost its chip industry, and efforts in the United States following the CHIPS Act which earmarked $39 billion over five years to encourage domestic semiconductor manufacturing.

Manufacturing capabilities are also expanding, with new facilities expected to still be operational by 2030 and beyond. This expansion is part of a broader strategy of diversifying manufacturing bases and supply chains to include a mix of onshoring, nearshoring, and offshoring depending on regional strategic needs and economic feasibility.

The semiconductor industry’s production and investment trends are thus characterized by a short-term contraction followed by a predicted recovery, underpinned by substantial investments in R&D and manufacturing infrastructure aimed at enhancing regional self-sufficiency and global competitiveness.

Global Landscape of Semiconductor Support

United States Initiatives

The $53 billion CHIPS and Science Act, passed in 2022, marks a major step in boosting the U.S. semiconductor industry. This funding aims to strengthen domestic manufacturing, enhance economic security, and reduce reliance on foreign supply chains, particularly given rising tensions with China.

The U.S. Department of Commerce is managing $52.7 billion in grants focused on advancing semiconductor research and production. This act positions the U.S. as a leader in cutting-edge chip development while addressing national security concerns tied to the global chip supply chain.

India’s Ambitious Plans

India is also making bold moves in the semiconductor space. The government has introduced the Semicon India Program, with an investment of $10 billion to build a complete semiconductor ecosystem. This program covers everything from chip design to fabrication and packaging.

Additionally, INR 11-12 billion (roughly $134-146 million) has been set aside specifically to support semiconductor design startups. This highlights India’s focus on nurturing domestic innovation and talent to reduce its dependency on imports.

Investment Opportunities

India’s semiconductor industry is poised for explosive growth. Valued at approximately $23.2 billion in 2023, the market is projected to hit $80.3 billion by 2028, growing at a robust CAGR of over 25%. This makes India an attractive destination for global and domestic investors alike. For example, Micron Technology recently committed $2.75 billion to establish a semiconductor testing facility in Gujarat, signaling strong international interest in India’s growing semiconductor capabilities.

Key Components of Government Support

- Financial Incentives: Both the U.S. and India offer substantial financial support for semiconductor projects. India, for instance, is providing fiscal support of up to 30% of project costs for setting up fabrication units.

- Regulatory Support: Governments are introducing streamlined regulations, such as single-window clearances, to simplify the setup process for companies entering the semiconductor space.

- R&D Funding: Investments in research and development are key to fostering innovation. The U.S. has allocated $100 million specifically for AI-driven research to advance semiconductor manufacturing processes.

Key Investments and Collaborations

Based on data from Wright Research, Lam Research, a global leader in semiconductor equipment manufacturing, has taken a significant step to boost India’s semiconductor talent pool. The company has committed to training up to 60,000 Indian engineers through its Semiverse Solutions platform.

Additionally, it is investing $25 million in a state-of-the-art lab in Karnataka, showcasing its focus on innovation and talent development in the region. In Gujarat, Tata’s foundry in Dholera, in partnership with Taiwan’s PSMC, will manufacture 28nm chips, a critical node for various applications including automotive and industrial devices. This collaboration highlights India’s potential to emerge as a significant player in the global semiconductor supply chain.

Applied Materials, a leading semiconductor toolmaker, has announced an ambitious $400 million investment over the next four years. This funding will establish a new engineering center in India, supporting over $2 billion in planned investments and creating 500 new jobs. This move underscores India’s growing importance in semiconductor equipment design and manufacturing.

Further bolstering the ecosystem, Micron Technology is setting up an ATMP (Assembly, Testing, Marking, and Packaging) facility in Gujarat. This facility will focus on assembling and testing DRAM and NAND flash modules, critical components in the global semiconductor supply chain. This investment positions India as a crucial link in ensuring supply chain resilience.

MD (Micron Design) has also committed $400 million to establish a new R&D and engineering design center in Karnataka, emphasizing India’s role as a hub for innovation and advanced semiconductor research.

China Semiconductor Market Size

The China Semiconductor Market was valued at USD 265.2 Billion in 2024, with a robust CAGR of 8.6%. China’s semiconductor market is one of the largest and fastest-growing in the world, driven by strong domestic demand for consumer electronics, automotive applications, and telecommunications infrastructure.

Despite being a global leader in semiconductor consumption, China relies heavily on foreign imports, particularly from the U.S. and Taiwan. In response, the Chinese government has made significant investments to boost domestic production, aiming for self-sufficiency in semiconductor manufacturing. The country is focusing on expanding its research and development in advanced chip technologies and enhancing domestic capabilities.

In 2024, APAC held a dominant market position in the global Semiconductor Market, capturing more than a 65.7% share. This substantial market share can primarily be attributed to the region’s robust manufacturing capabilities and the heavy concentration of semiconductor fabrication plants, particularly in countries such as Taiwan, South Korea, and China.

These nations have become pivotal in the global supply chain for semiconductors, driven by substantial investments from both government and private sectors in technological advancements and production capacity expansion. The leadership of APAC in the semiconductor sector is further reinforced by its integration into the global electronics value chain.

Semiconductor Market Share by country (%), 2020-2024

By Country 2020 2021 2022 2023 2024 China 49.8% 49.3% 48.9% 48.5% 48.0% Japan 15.1% 15.2% 15.2% 15.3% 15.3% South Korea 8.8% 8.7% 8.7% 8.7% 8.6% India 9.8% 10.2% 10.5% 10.9% 11.2% Australia 3.8% 3.7% 3.7% 3.7% 3.6% Singapore 3.9% 4.0% 4.1% 4.2% 4.3% Thailand 2.3% 2.4% 2.4% 2.4% 2.4% Vietnam 2.9% 3.2% 3.4% 3.2% 3.1% Rest of Asia Pacific 3.6% 3.6% 3.5% 3.4% 3.4% For instance, In 2022, the European Semiconductor Industry Association (ESIA) reported record-breaking sales of ~$53.9 billion in the European market, marking an impressive 12.3% year-on-year growth. This milestone, achieved by February 6, 2023, reflects strong demand and a thriving semiconductor sector, despite global economic uncertainties. The sharp increase highlights Europe’s growing role in the tech supply chain, signaling confidence in the region’s innovation and production capabilities.

The region’s extensive infrastructure for electronics manufacturing, coupled with a skilled workforce and technological expertise, positions it as a critical hub for producing a wide array of semiconductor components. These range from simple chips used in consumer electronics to complex systems-on-a-chip that power advanced computing systems.

Component Analysis

Integrated circuits (ICs) represented 83.1% of the semiconductor market in 2024, making them the most dominant component category. Their widespread adoption comes from their role as the backbone of almost all modern electronic devices, from everyday consumer gadgets to large-scale enterprise hardware. By combining multiple functions into a compact and energy-efficient architecture, ICs help manufacturers design advanced products at a lower cost and with greater performance reliability.

Semiconductor Market Share by Component (%), 2020-2024

By Component 2020 2021 2022 2023 2024 Discrete Semiconductors 5.6% 5.5% 5.4% 5.3% 5.2% Optoelectronics 9.2% 9.0% 8.7% 8.4% 8.2% Sensors 3.6% 3.6% 3.6% 3.6% 3.5% ICs 81.5% 81.9% 82.3% 82.7% 83.1% Analog 14.8% 14.6% 14.5% 14.3% 14.1% Logic 32.8% 33.1% 33.4% 33.7% 34.0% Memory 32.6% 32.6% 32.6% 32.6% 32.6% MPU 14.6% 14.5% 14.4% 14.2% 14.3% MCU 4.2% 4.2% 4.1% 4.1% 4.0% Others 1.0% 1.0% 1.0% 1.0% 0.9% The growth in this segment is also driven by rising demand in high-compute areas such as artificial intelligence, automotive electronics, and next-generation industrial automation. ICs are becoming more complex, moving from traditional logic and memory designs to highly specialized architectures optimized for performance and power efficiency. This focus has reinforced their position as the essential building blocks of current and emerging technologies.

Application Analysis

Networking and communications accounted for 37.8% of the semiconductor applications in 2024. The demand in this area reflects the surging reliance on advanced communication systems, including 5G rollouts, cloud data centers, and high-speed enterprise networks. Semiconductors used in this segment ensure reliable connectivity, improved bandwidth, and lower latency, which are crucial for handling today’s data-heavy workloads and real-time communication needs.

Semiconductor Market Share by Application (%), 2020-2024

By Application 2020 2021 2022 2023 2024 Networking & Communications 36.5% 36.8% 37.2% 37.5% 37.8% Smartphones 73.3% 73.6% 73.9% 74.2% 74.5% Data Centers 8.6% 8.6% 8.6% 8.5% 8.4% Ethernet Controllers 4.1% 4.0% 3.9% 3.8% 3.7% Adapters & Switches 6.2% 6.1% 6.0% 5.8% 5.7% Routers 5.2% 5.1% 5.0% 4.9% 4.8% Others 2.7% 2.6% 2.6% 2.6% 2.6% Industrial 13.8% 13.6% 13.5% 13.3% 13.2% Power Controls & Motor Drives 19.1% 19.0% 18.9% 18.8% 18.7% Intelligent Systems 30.9% 31.0% 31.0% 31.0% 31.1% Industrial Automation 39.1% 39.1% 39.2% 39.2% 39.2% Others 10.8% 10.8% 10.9% 10.9% 10.9% Consumer Electronics 31.8% 31.7% 31.6% 31.5% 31.4% Home Appliances 11.2% 11.2% 11.1% 11.1% 11.1% PC/Laptops/Tablets 71.5% 71.7% 71.9% 72.0% 72.4% Other Devices 17.3% 17.1% 17.0% 16.9% 16.5% Automotive 13.1% 12.9% 12.7% 12.6% 12.3% Telematics & Infotainment 47.6% 47.6% 47.5% 47.5% 47.5% Safety Electronics 31.0% 31.2% 31.4% 31.6% 31.7% Chassis 9.9% 9.8% 9.7% 9.6% 9.5% Others 11.5% 11.4% 11.4% 11.4% 11.3% Others 4.8% 4.7% 4.6% 4.5% 4.3% Expanding digital infrastructures around the world are further strengthening this segment. Semiconductors are enabling the development of advanced network switches, routers, and processors that can support increasingly complex communication ecosystems. As connected devices multiply and data traffic continues to grow, semiconductors will remain central to managing the future of communications infrastructure.

Key Market Segments

By Component Analysis

- Discrete Semiconductors

- Optoelectronics

- Sensors

- ICs

- Analog

- Micro

- Logic

- Memory

- MPU

- MCU

- Others

By Application

- Networking & Communications

- Ethernet Controllers

- Adapters & Switches

- Routers

- Others

- Data Centers

- Industrial

- Power Controls & Motor Drives

- Intelligent Systems

- Industrial Automation

- Others

- Consumer Electronics

- Home Appliances

- Personal Devices

- Other Devices

- Automotive

- Telematics & Infotainment

- Safety Electronics

- Chassis

- Others

- Others

Regional Insight

The semiconductor market shows a clear regional imbalance, with Asia Pacific steadily strengthening its dominance while other regions experience marginal declines. North America continues to hold the second-largest share, though its position has softened slightly, moving from 19.5% in 2020 to 19.2% by 2024.

Europe’s share has remained relatively stable yet modest, declining marginally to 10.5% in 2024. Structural reliance on imports and slower expansion of local manufacturing capacity have limited Europe’s market weight despite strong demand from its automotive and industrial sectors.

Meanwhile, Latin America and the Middle East & Africa collectively represent only a small portion of global revenue, accounting for 2.7% and 1.9% respectively in 2024, both reflecting a slow decline of about 0.1–0.2 percentage points since 2020.

Semiconductor Market Share by region, 2020-2024 (%)

By Region 2020 2021 2022 2023 2024 North America 19.5% 19.4% 19.3% 19.3% 19.2% Europe 10.9% 10.8% 10.7% 10.6% 10.5% Latin America 2.9% 2.9% 2.8% 2.8% 2.7% Middle East & Africa 2.1% 2.1% 2.0% 2.0% 1.9% Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Growing Demand from AI and Data Centers

One of the strongest drivers for the semiconductor market is the surging demand driven by artificial intelligence (AI) and data center expansion. As companies invest heavily in AI applications and cloud infrastructure, the need for high-performance chips has increased sharply. These chips power everything from AI model training and inference to large-scale data storage and processing in data centers.

For instance, logic and memory chips, which are crucial for AI and server workloads, have shown growth rates of 29% and 17% respectively in 2025. This growth pushes semiconductor manufacturers to increase production capacity and invest in cutting-edge technology to meet these demands.

The rise of advanced technologies like generative AI further accelerates chip consumption, leading to sustained market growth despite fluctuations in consumer devices like PCs and smartphones. Capital expenditure by semiconductor companies is projected around $185 billion in 2025 to expand manufacturing capacity by 7%.

Restraint Analysis

Geopolitical and Trade Restrictions

A significant restraint on semiconductor market growth comes from geopolitical tensions and trade restrictions, especially between major countries. Export controls and tariffs on semiconductor manufacturing equipment and advanced technologies have complicated supply chains and disrupted global trade.

For example, U.S. export controls targeting semiconductor technologies and related equipment have reduced accessible markets for companies and forced many to diversify or reshape their supply strategies. These restrictions increase operational costs and reduce market size potential for certain semiconductor segments.

This environment pressures companies to consider reshoring or “friendshoring” manufacturing closer to home regions to avoid vulnerable supply chains. While this approach may enhance control and security, it typically leads to higher manufacturing costs. Such geopolitical uncertainty hampers smooth supply chain functioning and investment, making it harder for businesses to plan long-term and manage costs effectively.

Opportunity Analysis

Expansion in Emerging Markets like India

Emerging markets present a significant growth opportunity for the semiconductor industry. India, for instance, is rapidly becoming a key market with projections valuing its semiconductor demand at $39.5 billion in 2025 and a robust compound annual growth rate of 16% through 2033.

The growth is fueled by government initiatives like the Production Linked Incentive (PLI) scheme, which supports domestic electronics manufacturing and semiconductor production. This domestic push helps offset some of the global supply chain challenges by boosting local capabilities.

Additionally, growing sectors such as telecommunications, automotive, and consumer electronics in India, along with increasing digitalization across various industries, continue to raise semiconductor demand. For instance, integrated circuits dominate the device segment due to their critical role in multiple applications.

Challenge Analysis

Supply Chain Pressure and Talent Shortage

The semiconductor industry faces ongoing challenges in managing volatile supply chains and securing skilled talent. Despite rising demand, shortages of materials, equipment, and human resources remain major hurdles.

Supply chain disruptions caused by complex logistics, geopolitical issues, and increasing demand create bottlenecks that restrict production and escalate costs. For example, global supply chain pressure directly impacts the availability of key components needed for semiconductor fabrication.

Moreover, the industry struggles with a shortage of qualified workers, including engineers and technicians with expertise in semiconductor manufacturing and design. This talent gap restricts the pace of innovation and capacity expansion. Companies with strong talent pipelines and effective supply chain management are better positioned to overcome these operational difficulties and maintain competitiveness in a fast-evolving market.

Growth Factors

The semiconductor industry’s growth is propelled by several factors, one of the most significant being the increasing demand from the automotive sector. As vehicles become more technologically advanced, incorporating features such as advanced driver-assistance systems (ADAS) and electrification, the demand for semiconductors in this sector is predicted to continue its robust growth, with automotive semiconductor revenue potentially reaching $200 billion annually by the mid-2030s.

Another key growth driver is the widespread adoption of Internet of Things (IoT) devices and the expansion of 5G technology. These technologies demand high-performance semiconductors to manage increased data processing and connectivity needs. IoT and 5G are revolutionizing how data is collected and processed, pushing the semiconductor industry to innovate and meet these new demands.

Additionally, the integration of Artificial Intelligence (AI) in various industries is creating a surge in demand for advanced AI chips, which are necessary for powering AI applications ranging from data centers to consumer electronics. This demand for AI-enabled chips is fostering growth and innovation within the semiconductor industry.

Emerging Trends

Several trends are shaping the future of the semiconductor industry. One of the most influential is the shift towards smart manufacturing practices, which incorporate AI and machine learning to optimize production processes, reduce waste, and improve product quality. These technologies are not only transforming how semiconductors are manufactured but also enhancing the efficiency of the operations.

Another trend is the nationalization of semiconductor technology, with governments increasingly investing in local semiconductor manufacturing to secure supply chains and boost domestic capabilities. This trend is exemplified by initiatives like the proposed European Chips Act, which aims to strengthen the EU’s semiconductor production and research capabilities.

For instance, In January 2023, U.S. based Ceremorphic Inc. launched an innovative 5 nm silicon chipset designed to deliver top-notch energy efficiency and high-performance capabilities. What sets this chip apart is its advanced security features, addressing growing concerns in today’s tech landscape. This breakthrough not only strengthens Ceremorphic’s position in the market but also signals a significant leap forward in chip technology, catering to industries prioritizing power savings and robust data protection.

Furthermore, the development of advanced materials like gallium nitride (GaN) and silicon carbide (SiC) is paving the way for more efficient semiconductor devices. These materials allow for semiconductors that can operate at higher voltages and temperatures, which are crucial for power electronics and renewable energy applications.

Business Benefits

The advancements in semiconductor technology are yielding substantial business benefits. For instance, the reduction in power consumption and the increase in processing power of modern semiconductors enhance the performance and extend the battery life of mobile devices and other electronic products, thus improving consumer satisfaction and driving sales.

In the automotive industry, semiconductors are playing a crucial role in the transition towards electric vehicles and the implementation of autonomous driving technologies, opening new revenue streams and markets for chip manufacturers.

Moreover, the adoption of smart manufacturing techniques is leading to cost reductions and improved yields in semiconductor production, which are crucial for maintaining profitability in the highly competitive semiconductor market.

Key Players Analysis

In the semiconductor market, Taiwan Semiconductor Manufacturing Co. Ltd. (TSMC) and Samsung play a central role as leading foundries. TSMC dominates global chip manufacturing with advanced process nodes, serving industries from consumer electronics to automotive. Samsung continues to strengthen its position with memory and logic solutions, offering integrated capabilities across different verticals.

The competitive landscape is further shaped by Intel, NVIDIA, and AMD. Intel is pursuing growth through advancements in processor technologies and investments in fabrication capabilities. NVIDIA has gained momentum with its dominance in graphics processing units, which have become essential for artificial intelligence, gaming, and data center applications.

AMD competes strongly in both CPUs and GPUs, capturing share with innovative product launches. These players are influencing the future of high-performance computing and reshaping the balance of power across data-intensive industries. Other significant contributors include Broadcom, Qualcomm, SK Hynix, Micron, and Applied Materials.

Broadcom and Qualcomm lead in connectivity and communication chipsets, driving adoption in mobile and networking markets. SK Hynix and Micron are important in memory technologies, supporting cloud, mobile, and enterprise computing. Applied Materials provides the essential equipment for semiconductor fabrication, ensuring technology progression across the value chain.

Semiconductor Market Companies

- Taiwan Semiconductor Manufacturing Co. Ltd. (TSM)

- Samsung

- NVIDIA

- Intel Corp.

- Broadcom Inc.

- Qualcomm Inc.

- SK Hynix

- Applied Materials, Inc.

- Advanced Micro Devices (AMD)

- Micron

- Other key players

Recent Development

- January 2024: TSMC announced plans to expand its advanced packaging capacity in Japan. This includes building new facilities in partnership with Sony and Toyota, with a total investment expected to exceed $20 billion. These efforts are part of Japan’s broader strategy to rejuvenate its semiconductor manufacturing ecosystem.

- February 2024: Samsung Electronics is setting up an advanced packaging facility in Yokohama, Japan. This initiative is supported by the Japanese government and aims to bolster Samsung’s capabilities in semiconductor manufacturing.

- February 2024: Intel introduced its new sustainable systems foundry business, Intel Foundry, designed for the AI era. This launch included an extended process roadmap aimed at maintaining leadership in semiconductor manufacturing.

Report Scope

Report Features Description Market Value (2024) USD 840.6 Bn Forecast Revenue (2034) USD 2,010.6 Bn CAGR (2025-2034) 9.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Discrete Semiconductors, Optoelectronics, Sensors, ICs (Analog, Micro, Logic, Memory, MPU, MCU, Others)), By Application (Networking & Communications(Ethernet Controllers, Adapters & Switches, & Routers & Others), Data Centers, Industrial (Power Controls & Motor Drives, Intelligent Systems, & Industrial Automation & Others), Consumer Electronics (Home Appliances, Personal Devices, & Other Devices), Automotive (Telematics & Infotainment, Safety Electronics, Chassis, and Others), & Government) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Taiwan Semiconductor Manufacturing Co. Ltd. (TSM), Samsung, NVIDIA, Intel Corp., Broadcom Inc., Qualcomm Inc., SK Hynix, Applied Materials, Inc., Advanced Micro Devices (AMD), Micron, and `Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the current market size of the semiconductor industry?The global Semiconductor market size accounted for USD 840.60 billion in 2024 and is predicted to increase from USD 907.4 billion in 2025 to approximately USD 2,010.6 billion by 2034, expanding at a CAGR of 9.20% from 2025 to 2034. In 2024, APAC held a dominan market position, capturing more than a 65.7% share, holding USD 552.2 Billion revenue.

What is the role of semiconductors in modern technology?Semiconductors are the foundational components enabling modern electronics, including smartphones, computers, servers, IoT devices, wearable technology, and robotics. They power CPUs, GPUs, memory devices, sensors, and communication chips, facilitating data processing, connectivity, automation, and smart functionality.

What are the major players in the semiconductor industry?The leading companies include Taiwan Semiconductor Manufacturing Co. Ltd. (TSM), Samsung, NVIDIA, Intel Corp., Broadcom Inc., Qualcomm Inc., SK Hynix, Applied Materials, Inc., Advanced Micro Devices (AMD), Micron, and `Other Key Players

What is the global market share of the semiconductor industry?Asia Pacific holds the largest market share globally, attributed to dominant fabrication hubs in Taiwan and South Korea and significant consumption in China and India. North America and Europe follow, with strong design and manufacturing ecosystems. The market distribution is shaped by advanced technology capabilities and regional supply chain factors.

What are the future trends in the semiconductor industry?Future trends include the rise of AI and machine learning integration in chip design and manufacturing, advanced materials like silicon carbide for power semiconductors, heterogeneous integration and 3D packaging technologies, smart manufacturing with digital twins and AI-driven process control, and reshoring efforts for supply chain resilience. Demand is expected to be fueled by automotive semiconductors, generative AI chips, 5G expansion, and sustainability initiatives

-

-

- Taiwan Semiconductor Manufacturing Co. Ltd. (TSM)

- Samsung

- NVIDIA

- Intel Corp.

- Broadcom Inc.

- Qualcomm Inc.

- SK Hynix

- Applied Materials, Inc.

- Advanced Micro Devices (AMD)

- Micron

- Other key players