Global 5G Chipset Market By Type (Modems, RFICs, Other Types), By Operating Frequency (Sub-6 GHz, 24-39 Ghz, Above 39 Ghz), By Deployment Type (Telecom Base Station Equipment, Smartphones/Tablets, Connected Vehicles, Connected Devices, Broadband Access Gateway Devices, Other Deployment Types), By Industry Vertical (Manufacturing, Media & Entertainment, Energy & Utilities, IT & Telecom, Healthcare, Transportation & Logistics, Other Verticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb. 2024

- Report ID: 65622

- Number of Pages: 272

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

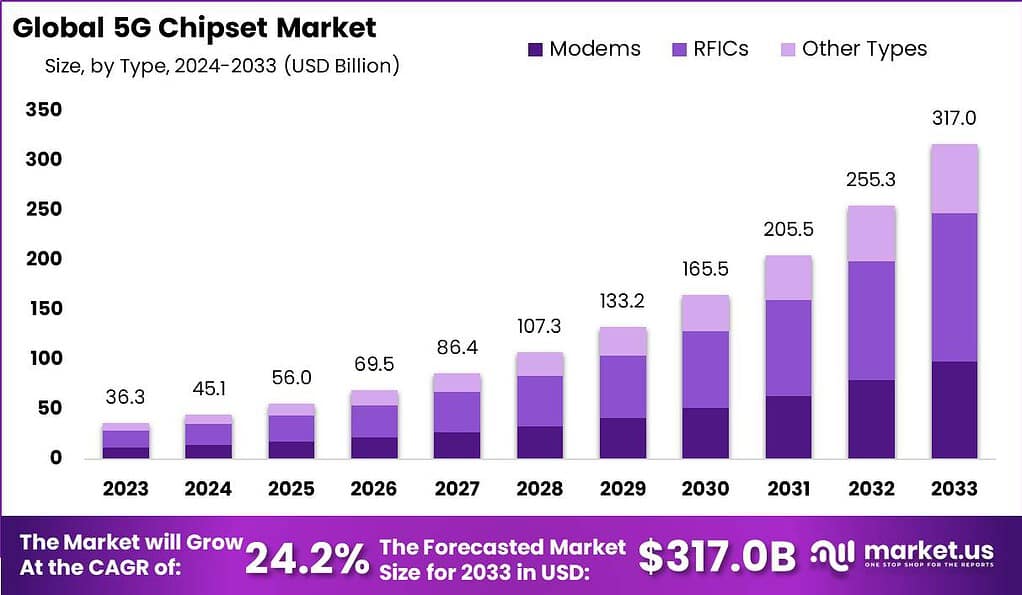

The Global 5G Chipset Market size is expected to be worth around USD 317.0 Billion by 2033, from USD 36.3 Billion in 2023, growing at a CAGR of 24.2% during the forecast period from 2024 to 2033.

A 5G chipset refers to the integrated circuit that enables the transmission and reception of 5G signals in electronic devices such as smartphones, tablets, routers, and other connected devices. It serves as the core component that enables the device to connect to 5G networks and leverage the benefits of high-speed data transfer, low latency, and enhanced network capacity offered by 5G technology.

The 5G chipset market is experiencing rapid growth driven by the global rollout of 5G networks and the increasing adoption of 5G-enabled devices. With telecommunications operators investing heavily in 5G infrastructure deployment, there is a growing demand for chipsets that can power the next generation of mobile networks. Additionally, the proliferation of 5G-compatible smartphones, tablets, and IoT devices is driving demand for 5G chipsets among device manufacturers seeking to capitalize on the benefits of 5G connectivity.

Analyst Viewpoint

The global rollout of 5G networks is accelerating, leading to an increased demand for devices equipped with 5G chipsets, including smartphones, tablets, and a wide array of Internet of Things (IoT) devices. This surge in demand is a direct consequence of consumers’ growing appetite for higher data speeds, lower latency, and more reliable network connections that 5G technology promises.

In the competitive landscape of the 5G chipset market, Qualcomm leads with a significant market share of 44%, generating revenue of USD 31.5 billion. This leadership position is supported by a robust investment in research and development (R&D), with spending reaching USD 6.6 billion, underscoring the company’s commitment to innovation and technology advancement. MediaTek follows as a strong contender, holding a 26% market share with revenues amounting to USD 15.8 billion and an R&D expenditure of USD 2.3 billion.

Opportunities within the 5G chipset market is the increased demand for enhanced mobile broadband (eMBB) services opens up opportunities for 5G chipset manufacturers. eMBB applications require high data speeds and low latency, enabling seamless streaming of high-definition videos, immersive virtual reality experiences, and real-time gaming.

To support these applications, 5G chipsets need to offer higher performance, improved power efficiency, and advanced connectivity features. Manufacturers that can deliver chipsets with these capabilities have the potential to capture a significant market share.

Key Takeaways

- The global 5G chipset market is anticipated to witness substantial growth, with a projected worth of USD 317.0 billion by 2033, expanding at a remarkable CAGR of 24.2% from 2024 to 2033.

- Qualcomm leads the 5G chipset market with a significant market share of 44%, generating revenue of USD 31.5 billion. It is closely followed by MediaTek, holding a 26% market share with revenues amounting to USD 15.8 billion.

- RFICs segment dominated the market in 2023, capturing over 47% share, attributed to their crucial role in handling complex radio frequency requirements of 5G networks.

- Sub-6 GHz segment emerged as the dominant market segment in 2023, capturing more than 58% share, offering a balance between coverage and capacity.

- Smartphones/Tablets segment instruct a significant market share of over 35% in 2023, driven by the proliferation of smartphones and tablets globally.

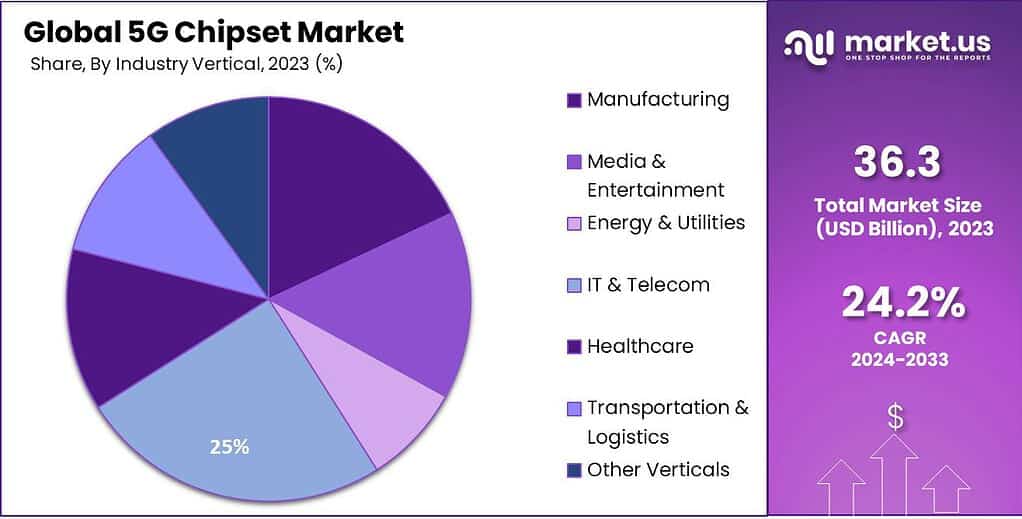

- IT & Telecom segment emerged as the leader in 2023, capturing a significant market share of over 25%, owing to the industry’s forefront adoption of advanced technologies like 5G.

- North America emerged as the leader in 2023, capturing a significant market share of over 30%, attributed to early investments in infrastructure and proactive adoption of advanced technologies.

Type Analysis

In 2023, the RFICs (Radio Frequency Integrated Circuits) segment held a dominant market position in the 5G chipset market, capturing more than a 47% share. RFICs are a crucial component of 5G chipsets as they enable the transmission and reception of high-frequency signals in wireless communication systems. They are specifically designed to handle the complex radio frequency requirements of 5G networks, including the ability to operate at higher frequencies and support wider bandwidths.

The dominance of the RFICs segment can be attributed to several factors. Firstly, the increasing demand for high-speed data transfer and low-latency communication in 5G networks necessitates robust RFICs capable of delivering efficient and reliable wireless connectivity.

RFICs play a vital role in amplifying, filtering, and modulating signals, ensuring the seamless transmission of data across the 5G network. Secondly, advancements in RFIC technology have led to improved performance, power efficiency, and miniaturization, making them suitable for integration into various devices, including smartphones, tablets, and IoT devices.

The compact size and enhanced capabilities of RFICs have made them a preferred choice for 5G chipset manufacturers. Additionally, the expanding deployment of 5G networks globally and the increasing adoption of 5G-enabled devices have further fueled the demand for RFICs. As a result, the RFICs segment has witnessed significant growth and is expected to continue its dominance in the 5G chipset market in the coming years.

Operating Frequency Analysis

In 2023, the Sub-6 GHz segment emerged as the dominant market segment in the 5G Chipset market, capturing more than a 58% share. This segment refers to the operating frequency range below 6 GHz, which includes frequencies such as 600 MHz, 2.5 GHz, and 3.5 GHz. The Sub-6 GHz segment’s leadership position can be attributed to several key factors.

Firstly, the Sub-6 GHz frequency range offers a balance between coverage and capacity. These lower frequencies provide wider coverage areas and better penetration through obstacles like walls and buildings, making them suitable for delivering 5G services in both urban and rural environments. The Sub-6 GHz segment enables network operators to provide wide-area coverage and expand the reach of 5G networks, ensuring a more inclusive and accessible deployment.

Secondly, the Sub-6 GHz segment offers compatibility with existing network infrastructure and devices. Many countries and operators have adopted frequency bands within the Sub-6 GHz range for their initial 5G deployments. This compatibility allows for a smooth transition from previous generations of wireless technology, facilitating the integration of 5G networks into the existing communication ecosystem. It also enables a seamless user experience, as users can leverage 5G services with their current devices without requiring additional hardware upgrades.

Furthermore, the Sub-6 GHz segment supports a variety of use cases and applications. The lower frequencies excel in providing stable and reliable connections for applications such as voice calls, streaming services, and Internet of Things (IoT) devices. The Sub-6 GHz segment’s capabilities make it suitable for applications that prioritize coverage, latency, and reliability over ultra-high data speeds, including critical communications, smart cities, and industrial automation.

Deployment Type Analysis

In 2023, the Smartphones/Tablets segment emerged as the frontrunner in the 5G chipset market, commanding a significant market share of over 35%. This segment’s dominance can be attributed to several key factors. Firstly, the proliferation of smartphones and tablets globally has been remarkable, with these devices becoming an integral part of everyday life for a vast majority of the population. As consumers increasingly demand faster data speeds and seamless connectivity, the adoption of 5G-enabled smartphones and tablets has surged.

Moreover, the growing popularity of advanced features such as high-definition video streaming, augmented reality (AR), and virtual reality (VR) applications has further fueled the demand for 5G chipsets in these devices. Furthermore, smartphone manufacturers have been actively integrating 5G capabilities into their latest models to stay competitive in the market.

The availability of a wide range of affordable 5G-enabled smartphones and tablets has also played a crucial role in driving the growth of this segment. Additionally, the ongoing expansion of 5G network infrastructure across various regions has facilitated the widespread adoption of 5G-enabled devices, further bolstering the demand for 5G chipsets in smartphones and tablets.

The Smartphones/Tablets segment is expected to continue its dominance in the coming years as the market for 5G chipsets evolves. With the increasing availability of low-cost 5G smartphones and tablets and the continuous advancements in network infrastructure, the adoption of 5G technology is anticipated to become even more widespread. As a result, the demand for 5G chipsets in smartphones and tablets is projected to witness substantial growth, driving the market forward.

Industry Vertical Analysis

In 2023, the IT & Telecom segment emerged as the leader in the 5G chipset market, capturing a significant market share of over 25%.

Several factors contributed to the dominant position of this segment. Firstly, the IT & Telecom industry has been at the forefront of adopting and implementing advanced technologies, and 5G is no exception. The telecom sector, in particular, has been a key driver in the deployment of 5G networks, owing to its ability to deliver faster speeds, lower latency, and increased network capacity. As a result, there has been a substantial demand for 5G chipsets from telecom operators and network equipment manufacturers.

Additionally, the IT industry has witnessed a rapid digital transformation, with an increasing reliance on cloud computing, IoT devices, and data-intensive applications. 5G technology plays a crucial role in supporting these advancements by providing the necessary connectivity and bandwidth. With the rising demand for high-speed data transmission, low latency, and improved network performance, the adoption of 5G chipsets by IT companies has gained significant momentum.

Moreover, the proliferation of smartphones, laptops, and other connected devices within the IT & Telecom industry has further fueled the demand for 5G chipsets. As these devices increasingly incorporate 5G capabilities, the need for efficient and powerful chipsets becomes paramount. The IT & Telecom segment has been quick to recognize the potential of 5G technology in enhancing communication networks and enabling innovative services, leading to its dominant position in the market.

Key Market Segments

Type

- Modems

- RFICs

- Other Types

Operating Frequency

- Sub-6 GHz

- 24-39 Ghz

- Above 39 Ghz

Deployment Type

- Telecom Base Station Equipment

- Smartphones/Tablets

- Connected Vehicles

- Connected Devices

- Broadband Access Gateway Devices

- Other Deployment Types

Industry Vertical

- Manufacturing

- Media & Entertainment

- Energy & Utilities

- IT & Telecom

- Healthcare

- Transportation & Logistics

- Other Verticals

Driver

Increasing demand for high-speed internet connectivity

The acceleration in the demand for high-speed internet connectivity serves as a primary driver for the global 5G chipset market. This surge is attributed to the escalating consumption of online content, including streaming services, cloud-based applications, and the proliferation of remote work and learning environments. The need for faster data transfer rates, lower latency, and more reliable connections to support these bandwidth-intensive applications has become critical.

Consequently, the deployment of 5G technology is seen as essential in meeting these requirements, driving advancements in 5G chipset development to enable the next generation of wireless communication. This technological push is facilitating a transformative shift in various sectors, including telecommunications, automotive, and smart cities, further propelling the demand for 5G chipsets.

Restraint

Regulatory challenges and spectrum allocation issues

Regulatory challenges and spectrum allocation issues present significant restraints to the growth of the 5G chipset market. The allocation of radio frequencies is a complex and contentious process, involving stringent regulatory frameworks to manage spectrum rights and avoid interference between different services.

Countries vary in their approach to spectrum allocation, leading to inconsistencies in available bandwidth and the potential for cross-border interference. These regulatory hurdles can delay the rollout of 5G networks, impacting the demand for 5G chipsets. Furthermore, the high cost of spectrum licenses can deter investment in 5G infrastructure, posing an additional challenge to market growth. Addressing these regulatory and spectrum allocation issues is crucial for the seamless global deployment of 5G technology.

Opportunity

Emergence of Internet of Things (IoT) applications

The emergence of Internet of Things (IoT) applications represents a significant opportunity for the 5G chipset market. IoT technology, which connects billions of devices and sensors to the internet, requires robust, high-speed, and low-latency communication networks to function effectively.

5G technology, with its superior speed and connectivity capabilities, is uniquely positioned to meet these requirements, enabling more efficient and reliable IoT applications. This symbiosis between 5G and IoT paves the way for transformative applications across industries such as healthcare, agriculture, smart cities, and manufacturing, driving the demand for advanced 5G chipsets. The proliferation of IoT devices, coupled with the capabilities of 5G, is set to unlock immense market potential and foster innovation in the digital ecosystem.

Challenge

Addressing concerns related to cybersecurity and privacy

Addressing concerns related to cybersecurity and privacy poses a significant challenge for the 5G chipset market. The deployment of 5G networks introduces new vulnerabilities and attack vectors, given the increased number of connected devices and the reliance on software-defined networking. The complexity of the 5G network architecture, along with the vast data volumes transmitted, exacerbates the risk of data breaches and cyber-attacks, undermining user trust and adoption rates.

Ensuring robust security measures and privacy protections in 5G chipsets and infrastructure is paramount to mitigating these risks. Manufacturers and stakeholders must prioritize the development of secure 5G technologies and collaborate with regulatory bodies to establish comprehensive cybersecurity frameworks, safeguarding the ecosystem against potential threats.

Regional Analysis

In 2023, the 5G chipset market in North America emerged as the leader, capturing a significant market share of over 30%. This dominant position can be attributed to several key factors. Firstly, North America has been at the forefront of 5G deployment, with early investments in infrastructure and a proactive approach towards adopting advanced technologies. The region has witnessed widespread commercial availability of 5G networks, enabling various industries to leverage the benefits of high-speed connectivity and low latency.

The presence of key market players, including chipset manufacturers, telecom operators, and device vendors, has further fueled the growth of the 5G chipset market in North America. These companies have actively collaborated to drive innovation and accelerate the adoption of 5G technology, resulting in a robust ecosystem for 5G chipsets.

Moreover, North America boasts a strong demand for high-end smartphones, tablets, and other connected devices that rely on 5G technology. The region’s tech-savvy population and their inclination towards the latest technological advancements have been instrumental in driving the demand for 5G chipsets. Additionally, industries such as automotive, healthcare, and manufacturing have also embraced 5G technology in North America, further contributing to the market’s growth.

Looking ahead, North America is expected to maintain its dominant position in the 5G chipset market. The region’s continued investments in 5G infrastructure, ongoing research and development activities, and the launch of new applications and services are anticipated to drive the demand for 5G chipsets. Furthermore, the deployment of advanced technologies such as autonomous vehicles, smart cities, and industrial automation will further propel the market growth in North America.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the 5G chipset market, key players play a pivotal role in shaping industry dynamics and driving technological advancements. Major companies such as Qualcomm Technologies, Inc., MediaTek Inc., and Huawei Technologies Co., Ltd., are at the forefront of chipset development, leveraging their expertise in semiconductor design and wireless communications. These industry leaders invest heavily in research and development to enhance the performance, efficiency, and compatibility of their 5G chipsets, catering to the diverse needs of mobile device manufacturers and network operators worldwide.

Additionally, collaborations with telecommunications equipment vendors and participation in standardization efforts further strengthen their market presence and influence. Alongside these giants, emerging players like Samsung Electronics Co., Ltd., and Intel Corporation are making significant strides in the 5G chipset space, intensifying competition and fostering innovation.

Moreover, strategic partnerships, mergers, and acquisitions are prevalent strategies employed by key players to expand their product portfolios, gain market share, and maintain a competitive edge in the evolving 5G landscape. As the demand for high-speed connectivity continues to rise, the role of key players in driving the proliferation of 5G technology is poised to become increasingly significant, shaping the future of wireless communications.

Top Market Leaders

- Qualcomm Incorporated

- MediaTek Inc.

- Samsung Electronics Co., Ltd.

- Huawei Technologies Co., Ltd.

- Intel Corporation

- NVIDIA Corporation

- Ericsson

- Nokia Corporation

- Xilinx, Inc.

- Analog Devices, Inc.

- Marvell Technology Group Ltd.

- Qorvo, Inc.

- Other Key Players

Recent Developments

1. Qualcomm Incorporated:

- January 2023: Launched the Snapdragon 8 Gen 2 mobile platform, the company’s most advanced 5G chipset yet, featuring improved performance and power efficiency.

- April 2023: Announced the Snapdragon X70 modem, offering faster 5G speeds and support for new features like satellite connectivity.

- July 2023: Partnered with Samsung to develop next-generation AI chips for future mobile devices.

2. MediaTek Inc.:

- March 2023: Announced the Dimensity 9000 series, its flagship 5G chipset for high-end smartphones, competing directly with Qualcomm’s offerings.

- August 2023: Partnered with Google to launch the Pixel 7 and Pixel 7 Pro smartphones powered by the custom-designed Tensor 2 chip with MediaTek technology.

- November 2023: Launched the Dimensity 8200, a mid-range 5G chipset offering improved performance and battery life.

3. Samsung Electronics Co., Ltd.:

- February 2023: Launched the Exynos 2300, its new flagship 5G chipset for the Galaxy S23 series smartphones.

- June 2023: Announced plans to invest heavily in chip development, aiming to challenge Qualcomm and MediaTek in the high-end segment.

- October 2023:

Report Scope

Report Features Description Market Value (2023) US$ 36.3 Bn Forecast Revenue (2033) US$ 317.0 Bn CAGR (2024-2033) 24.2% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Modems, RFICs, Other Types), By Operating Frequency (Sub-6 GHz, 24-39 Ghz, Above 39 Ghz), By Deployment Type (Telecom Base Station Equipment, Smartphones/Tablets, Connected Vehicles, Connected Devices, Broadband Access Gateway Devices, Other Deployment Types), By Industry Vertical (Manufacturing, Media & Entertainment, Energy & Utilities, IT & Telecom, Healthcare, Transportation & Logistics, Other Verticals) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Qualcomm Incorporated, MediaTek Inc., Samsung Electronics Co. Ltd., Huawei Technologies Co. Ltd., Intel Corporation, NVIDIA Corporation, Ericsson, Nokia Corporation, Xilinx, Inc., Analog Devices Inc., Marvell Technology Group Ltd., Qorvo Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a 5G chipset?A 5G chipset is a crucial component in devices such as smartphones, base stations, and IoT devices, enabling them to connect to 5G networks.

How big is the 5G Chipset Industry?The Global 5G Chipset Market size is expected to be worth around USD 317.0 Billion by 2033, from USD 36.3 Billion in 2023, growing at a CAGR of 24.2% during the forecast period from 2024 to 2033.

Which Operating Frequency type held the largest share in the 5G chipset market?In 2023, the Sub-6 GHz segment emerged as the dominant market segment in the 5G Chipset market, capturing more than a 58% share.

Which deployment type led the global 5G chipset market?In 2023, the Smartphones/Tablets segment emerged as the frontrunner in the 5G chipset market, commanding a significant market share of over 35%.

Which region will lead the global 5G chipsets market?In 2023, the 5G chipset market in North America emerged as the leader, capturing a significant market share of over 30%.

-

-

- Qualcomm Incorporated

- MediaTek Inc.

- Samsung Electronics Co., Ltd.

- Huawei Technologies Co., Ltd.

- Intel Corporation

- NVIDIA Corporation

- Ericsson

- Nokia Corporation

- Xilinx, Inc.

- Analog Devices, Inc.

- Marvell Technology Group Ltd.

- Qorvo, Inc.

- Other Key Players